Securing your family’s financial future is a significant responsibility, and life insurance plays a crucial role in achieving this. Understanding the various types of life insurance policies, the application process, and the financial implications is key to making an informed decision. This guide will walk you through the essential steps, helping you navigate the complexities of applying for life insurance and choosing the best coverage for your needs.

From determining your coverage needs based on your financial obligations and goals to understanding the medical underwriting process and comparing policy quotes from different insurers, we aim to provide a comprehensive overview. We’ll also address common concerns regarding affordability and payment options, empowering you to make a confident choice that aligns with your budget and long-term financial strategy.

Understanding Life Insurance Needs

Choosing the right life insurance policy is a crucial step in securing your family’s financial future. Understanding the different types of policies and their associated costs is essential to making an informed decision. This section will explore the various options available and guide you through the process of determining your appropriate coverage amount.

Life Insurance Policy Types

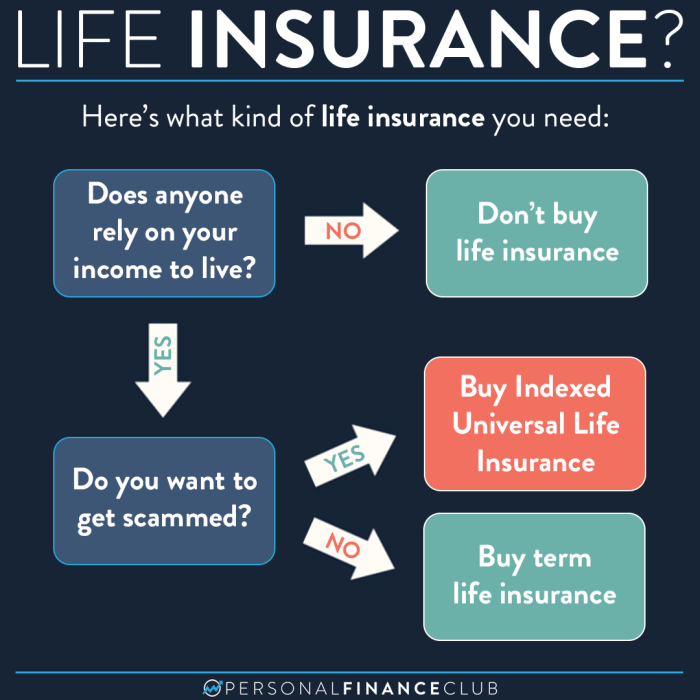

Several types of life insurance policies cater to diverse needs and financial situations. Each policy offers a unique combination of coverage duration, premium structure, and cash value accumulation. Careful consideration of these factors is vital in selecting the most suitable policy.

| Policy Type | Coverage Duration | Premium Characteristics | Cash Value |

|---|---|---|---|

| Term Life Insurance | Fixed period (e.g., 10, 20, 30 years) | Generally lower premiums than permanent policies | None |

| Whole Life Insurance | Lifelong coverage | Higher premiums than term life insurance | Builds cash value over time, which grows tax-deferred |

| Universal Life Insurance | Lifelong coverage | Flexible premiums, allowing adjustments based on financial circumstances | Builds cash value, though growth rate may vary |

| Variable Universal Life Insurance | Lifelong coverage | Flexible premiums; investment options influence cash value growth | Cash value growth depends on investment performance |

Factors Influencing Life Insurance Costs

The cost of life insurance is influenced by several key factors. Understanding these factors can help you anticipate the premium you might pay and make informed choices.

Several interconnected factors determine the cost of life insurance. Your age significantly impacts premiums, as older individuals generally face higher risks. Health status plays a crucial role, with pre-existing conditions or unhealthy lifestyles often leading to higher premiums. Lifestyle choices such as smoking, excessive alcohol consumption, and risky hobbies can also affect your insurance rate. Finally, the coverage amount you select directly impacts the premium; higher coverage amounts naturally result in higher premiums. For example, a 30-year-old non-smoker in excellent health will likely receive a significantly lower premium than a 55-year-old smoker with a pre-existing condition, both seeking the same coverage amount.

Determining Appropriate Coverage Amount

Calculating the appropriate life insurance coverage amount involves considering your financial obligations and future goals. A systematic approach ensures you secure adequate protection for your loved ones.

A comprehensive approach to determining your necessary coverage should involve several steps. First, list all your current financial obligations, including mortgage payments, outstanding loans, and credit card debts. Second, estimate future expenses such as your children’s education costs, and any planned retirement expenses. Third, add these amounts together to determine your total financial needs. Fourth, factor in any existing assets, such as savings and investments, that could help offset these expenses. Finally, subtract your assets from your total financial needs to determine your required life insurance coverage. For example, if your total financial obligations are $750,000, and you have $200,000 in savings, your required life insurance coverage would be $550,000. This method provides a structured approach to ensure your family is financially protected in the event of your passing.

The Application Process

Applying for life insurance might seem daunting, but the process is generally straightforward. It involves several key steps, from your initial contact with an insurer to the final issuance of your policy. Understanding these steps will help you navigate the process efficiently and ensure a smooth experience.

The application process typically begins with contacting an insurance provider, either directly or through a broker. You’ll then discuss your needs and the different types of life insurance policies available. Following this initial consultation, you’ll complete a formal application form, providing detailed personal and health information. This information is crucial for the insurer to assess your risk and determine the appropriate premium. After submitting your application, the insurer may request additional information, such as medical records or further details about your lifestyle. A medical examination may also be required, depending on the policy and your health profile. Once the insurer has reviewed all the necessary information, they will make a decision on your application, and if approved, you will receive your policy.

Information Requested on Life Insurance Applications

Life insurance applications require comprehensive information to accurately assess risk. This information allows the insurer to determine the appropriate premium and coverage level. Examples of commonly requested information include personal details such as your full name, date of birth, address, and contact information. You will also be asked about your occupation, income, and family details, including beneficiaries. Crucially, you’ll need to provide detailed information about your health history, including any existing medical conditions, surgeries, hospitalizations, and medications. Lifestyle factors such as smoking, alcohol consumption, and other risky behaviors will also be considered. The level of detail required varies depending on the policy type and the amount of coverage sought.

Importance of Accurate and Complete Information

Providing accurate and complete information is paramount throughout the application process. Inaccurate or incomplete information can lead to delays, policy rejection, or even the denial of a claim in the future. Insurance companies rely on the information provided to assess risk accurately. Misrepresenting or withholding information can be considered fraud and have serious consequences. It’s crucial to be thorough and honest in your responses, ensuring that all questions are answered accurately and completely. If you are unsure about any aspect of the application, it’s best to seek clarification from the insurer or your broker.

Sample Life Insurance Application Form

Below is a simplified example of a life insurance application form highlighting key fields. Remember, actual application forms may be more extensive and include additional sections.

Applicant Name:_________________________

Date of Birth:_________________________

Address:_________________________

Phone Number:_________________________

Email Address:_________________________

Occupation:_________________________

Annual Income:_________________________

Smoker (Yes/No):_________________________

Height:_________________________

Weight:_________________________

Beneficiary Name:_________________________

Beneficiary Relationship:_________________________

Health History (Please describe any medical conditions, surgeries, or hospitalizations):_________________________

Current Medications:_________________________

Amount of Life Insurance Coverage Desired:_________________________

Medical Underwriting and Health Questions

Medical underwriting is a crucial part of the life insurance application process. It’s the process by which the insurance company assesses your health risks to determine your eligibility for coverage and, if approved, the premium you’ll pay. Essentially, it’s how the insurer determines how likely you are to make a claim on your policy. The more risk you represent, the higher your premium will be, or in some cases, you may be declined coverage altogether.

The underwriting process involves a thorough review of your health history and current health status. This assessment helps the insurance company accurately price the policy to reflect the level of risk they are assuming. Accurate and complete information is therefore essential for a smooth and efficient application process.

Common Health Questions

Insurers ask a range of questions to gather a comprehensive picture of your health. These questions typically cover your medical history, family history, lifestyle habits, and current health conditions. Providing accurate answers is paramount to a successful application. Inaccurate or incomplete information can lead to delays or even denial of coverage.

The relevance of these questions stems from the need to accurately assess your risk profile. For example, a history of heart disease increases the likelihood of a future claim, justifying a higher premium or even a denial of coverage. Similarly, details about current medications and treatments provide valuable insight into your overall health status. Specific questions might include those about your height and weight, as these factors are related to potential health risks such as diabetes and heart disease.

Medical Exams and Information Gathering

Depending on the policy amount and your answers to the application questions, you may be required to undergo a medical examination. This exam is typically conducted by a physician or a paramedical professional designated by the insurance company. The purpose of this exam is to obtain objective medical data to supplement the information provided in your application.

During the medical exam, several key pieces of information are gathered. This typically includes a review of your medical history, vital signs (blood pressure, heart rate, weight, and height), blood and urine samples for laboratory analysis, and sometimes an electrocardiogram (ECG) to assess your heart’s electrical activity. The results of these tests help the underwriter to make a more informed decision regarding your eligibility and the appropriate premium. The information gathered during the medical exam provides an independent verification of the information you have provided in your application and allows the underwriter to identify any potential health concerns that might not have been disclosed. For example, the blood tests may reveal high cholesterol or other indicators of potential health problems that would otherwise not be apparent.

Financial Considerations and Affordability

Securing life insurance is a significant financial decision. Understanding the various costs involved and how they fit within your budget is crucial to choosing a policy that provides adequate coverage without causing undue financial strain. This section will explore premium payment options and strategies for managing life insurance expenses.

Choosing the right life insurance policy involves careful consideration of not only the coverage amount but also the ongoing cost. Premium payments, the regular amounts you pay to maintain your policy, can vary significantly depending on several factors, including the type of policy, your age, health, and the chosen payment frequency.

Premium Payment Options

Different payment frequencies offer varying levels of convenience and potential cost savings. Annual payments generally result in the lowest overall cost due to reduced administrative fees. However, paying annually might present a cash flow challenge for some. Semi-annual, quarterly, and monthly payments offer greater flexibility but typically come with slightly higher overall costs due to the added administrative burden for the insurance company. The exact difference in cost will vary between insurance providers and policy types.

Long-Term Costs of Different Policy Types and Payment Schedules

The following table illustrates the potential long-term cost differences between various policy types and payment frequencies. These figures are illustrative examples and actual costs will vary based on individual circumstances, insurer, and policy details. It’s crucial to obtain personalized quotes from insurance providers to determine the precise cost for your specific situation.

| Policy Type | Payment Frequency | Total Premium over 10 years | Average Monthly Cost |

|---|---|---|---|

| Term Life (20-year, $500,000 coverage) | Annual | $12,000 | $100 |

| Term Life (20-year, $500,000 coverage) | Monthly | $12,600 | $105 |

| Whole Life ($250,000 coverage) | Annual | $30,000 | $250 |

| Whole Life ($250,000 coverage) | Monthly | $31,800 | $265 |

Strategies for Managing Life Insurance Costs

Effective budget management is key to affording life insurance. Several strategies can help mitigate costs. Consider comparing quotes from multiple insurers to find the most competitive rates. Choosing a policy with a longer payment term can lower your monthly payments, although you’ll pay more overall. Exploring options like increasing your deductible or opting for a higher copay on health insurance can potentially lower your life insurance premiums. Finally, maintaining a healthy lifestyle can improve your eligibility for lower premiums. Regular exercise, a balanced diet, and avoiding risky behaviors can significantly impact your insurance costs.

Choosing the Right Insurer

Selecting the right life insurance provider is a crucial decision, impacting both the cost and the coverage you receive. A thorough evaluation of several key factors will help ensure you find a company that aligns with your needs and provides long-term security. This involves careful consideration of financial stability, customer service reputation, and the specific features offered within their policies.

Choosing a life insurance provider requires careful consideration of several key factors. The long-term implications of your choice underscore the importance of a thorough evaluation process.

Financial Stability of Insurers

Assessing an insurer’s financial strength is paramount. A financially sound company is more likely to be able to pay out claims when needed. You can research an insurer’s financial ratings through independent agencies like A.M. Best, Moody’s, and Standard & Poor’s. These agencies assign ratings based on factors such as the insurer’s reserves, investment performance, and overall financial health. A higher rating generally indicates greater financial stability. For example, an A++ rating from A.M. Best signifies exceptional financial strength, while a lower rating may indicate increased risk. Checking these ratings provides a valuable measure of the insurer’s ability to fulfill its obligations.

Customer Service Ratings and Reviews

Excellent customer service is crucial, especially during the claims process. Researching customer reviews and ratings from independent sources like the Better Business Bureau (BBB) or online review platforms can provide insights into an insurer’s responsiveness and helpfulness. Look for consistent positive feedback regarding ease of communication, claim processing speed, and overall customer satisfaction. Negative reviews, particularly those related to claim denials or slow response times, should be carefully considered. A company with a history of excellent customer service will provide peace of mind, knowing that support will be readily available when needed.

Policy Features and Coverage Options

Different insurers offer various policy features and coverage options. Carefully compare the types of policies available (term life, whole life, universal life, etc.), the benefit amounts, riders (additional coverage options), and any limitations or exclusions. Consider your specific needs and choose a policy that provides the appropriate level of coverage and flexibility. For instance, a term life insurance policy may be suitable for temporary coverage needs, while a whole life policy offers lifelong coverage with a cash value component. Understanding these differences is vital in selecting the right policy to meet your long-term goals.

Comparison of Hypothetical Insurers

To illustrate the comparison process, let’s examine three hypothetical insurers: Insurer A, Insurer B, and Insurer C.

| Insurer | Strengths | Weaknesses |

|---|---|---|

| Insurer A | High financial rating (A++), competitive premiums, wide range of policy options. | Customer service ratings are average; some complaints about claim processing delays. |

| Insurer B | Excellent customer service ratings, quick claim processing. | Slightly higher premiums than Insurer A, fewer policy options. |

| Insurer C | Offers unique policy riders and flexible payment options. | Lower financial rating (A-), higher premiums, mixed customer service reviews. |

Comparing Policy Quotes

When comparing quotes, focus on the annual premium cost, the death benefit amount, the policy term (if applicable), and any additional fees or charges. Don’t solely focus on the lowest premium; consider the overall value proposition. For example, a slightly higher premium may be justified if it comes with superior customer service, a higher financial rating, or valuable additional features. Ensure you understand all aspects of the policy before making a decision. Use a comparison tool or spreadsheet to organize the information and facilitate a clear comparison of the various options. Remember that the “best value” will depend on your individual needs and financial situation.

Understanding Policy Documents

Receiving your life insurance policy document marks a significant step in securing your family’s financial future. However, the document itself can seem dense and complex. Understanding its key components is crucial to ensuring you have the coverage you expect and to avoid any unpleasant surprises down the line. Taking the time to carefully review the policy is an investment in your peace of mind.

A standard life insurance policy contains several key sections, each playing a vital role in defining your coverage and the insurer’s responsibilities. These sections work together to create a legally binding contract between you and the insurance company. Familiarizing yourself with these sections empowers you to make informed decisions and to fully understand the terms of your protection.

Policy Summary

This section provides a concise overview of the policy’s main features. It typically includes the policy number, the insured’s name, the type of policy (term, whole life, etc.), the death benefit amount, the premium amount, and the policy’s effective date. This is a helpful starting point for quickly grasping the essentials of your coverage.

Definitions

The definitions section clarifies the meaning of key terms used throughout the policy. This is important because insurance policies often use specialized terminology. Understanding these terms is crucial for interpreting the policy’s conditions and exclusions accurately. For example, the policy might define “accidental death” or “total disability” in specific ways that differ from common understanding.

Coverage Details

This section Artikels the specific benefits provided by the policy. It details the circumstances under which the death benefit will be paid, including any specific conditions or exclusions. This might include information on accidental death benefits, additional riders (such as those for critical illness or disability), and the payout options available to your beneficiaries. Carefully examining this section will help you verify that the policy aligns with your protection goals.

Exclusions and Limitations

This critical section specifies circumstances where the insurance company is not obligated to pay the death benefit. Common exclusions might include death resulting from suicide within a specified period (often one or two years), death caused by pre-existing conditions that were not disclosed during the application process, or death resulting from participation in illegal activities. Understanding these limitations is vital to managing expectations and ensuring you are adequately covered. For example, a policy might exclude coverage for death resulting from participation in dangerous sports or activities without prior approval.

Premium Payment Terms

This section details the payment schedule for your premiums. It specifies the amount of each premium, the frequency of payments (monthly, quarterly, annually), and the methods of payment accepted by the insurer. It also often Artikels the grace period, which is the timeframe after the due date that you have to pay your premium without penalty. Understanding these terms ensures that you can manage your payments effectively and avoid lapses in coverage.

Beneficiary Designation

This section specifies who will receive the death benefit upon your death. You can name one or more beneficiaries, and you can designate how the death benefit will be paid (e.g., lump sum, installments). It’s crucial to review and update this section regularly to reflect any changes in your personal circumstances, such as marriage, divorce, or the birth of a child. Failure to do so could result in unintended consequences for your loved ones.

Policy Changes and Termination

This section Artikels the procedures for making changes to the policy or terminating it. It details how to request changes to the beneficiary designation, increase or decrease coverage, or surrender the policy. It also describes the circumstances under which the insurer may terminate the policy, such as non-payment of premiums. Understanding these procedures is important for maintaining control over your policy and ensuring its ongoing effectiveness.

Beneficiary Designation and Estate Planning

Choosing the right beneficiaries for your life insurance policy is a crucial step in ensuring your loved ones are financially protected after your passing. Proper beneficiary designation is not merely a formality; it directly impacts how and to whom your death benefit will be distributed, and it plays a significant role in your overall estate plan. Failing to plan carefully can lead to unintended consequences and complications for your heirs.

Beneficiary designations dictate who receives the death benefit. Understanding the different types of designations is essential for ensuring your wishes are carried out. The implications of each choice can significantly affect the distribution of your assets and the tax implications for your beneficiaries. Careful consideration should be given to your family structure, financial situation, and potential future changes in circumstances.

Types of Beneficiary Designations

Several types of beneficiary designations exist, each with its own implications. Selecting the appropriate designation depends on your individual circumstances and goals. Consider factors such as the number of beneficiaries, their ages, and your desire for control over the distribution of funds.

Primary Beneficiary: This individual or entity is the first to receive the death benefit. If the primary beneficiary is deceased, the policy proceeds move to the contingent beneficiary. For example, you might name your spouse as the primary beneficiary.

Contingent Beneficiary: This person or entity receives the death benefit if the primary beneficiary predeceases you. For example, you might name your children as contingent beneficiaries, should your spouse pass away before you.

Revocable Beneficiary: You retain the right to change the beneficiary designation at any time without the beneficiary’s consent. This offers flexibility, allowing adjustments to your plan as your circumstances change (e.g., marriage, divorce, birth of a child).

Irrevocable Beneficiary: Once designated, you cannot change the beneficiary without their consent. This designation provides a high degree of certainty for the beneficiary, but limits your flexibility to alter the plan later. This is often used in trust arrangements to protect assets for minors.

Life Insurance in Estate Planning

Life insurance serves a vital role in a comprehensive estate plan. It can provide liquidity to cover estate taxes, debts, and other expenses, ensuring a smooth transition for your heirs. It can also provide funds for specific purposes, such as your children’s education or a surviving spouse’s income. Incorporating life insurance into your estate plan helps to mitigate potential financial burdens on your family and ensures your legacy is protected.

For example, a high-net-worth individual might use life insurance to cover estate taxes, preventing the forced sale of assets to meet tax obligations. This preserves the family’s wealth and minimizes disruption. Alternatively, a young family might use a term life insurance policy to ensure their children are financially secure should something happen to one or both parents. The death benefit can provide income for daily living expenses, childcare, and education.

Considerations for Beneficiary Designation

Careful consideration should be given to various factors when designating beneficiaries. Understanding the tax implications of different beneficiary designations is critical. For example, choosing a trust as a beneficiary can offer significant tax advantages, especially for larger death benefits. Furthermore, you should regularly review and update your beneficiary designations to reflect changes in your personal circumstances. This ensures your life insurance policy continues to effectively support your family’s needs throughout your life.

Final Conclusion

Applying for life insurance can seem daunting, but with careful planning and a clear understanding of the process, it becomes a manageable task. By understanding your needs, comparing policy options, and selecting a reputable insurer, you can secure a policy that provides peace of mind knowing your loved ones are financially protected. Remember to thoroughly review policy documents and seek professional advice if needed to ensure a smooth and successful application process.

Frequently Asked Questions

How long does the application process take?

The application process varies depending on the insurer and your individual circumstances, but it can generally take anywhere from a few weeks to several months.

What if I have pre-existing health conditions?

Pre-existing health conditions will be considered during the underwriting process. It may affect your eligibility for certain policies or result in higher premiums.

Can I change my beneficiary after the policy is issued?

Yes, you can typically change your beneficiary at any time, but the process may vary depending on your policy and insurer. You should consult your policy documents or contact your insurer for specific instructions.

What happens if I don’t pass the medical exam?

Failing a medical exam doesn’t automatically disqualify you from obtaining life insurance. The insurer may offer you a policy with adjusted premiums or different coverage terms.