Choosing the right insurance provider is a crucial decision, impacting financial security and peace of mind. This Amica Insurance review delves into the company’s history, offerings, and customer experiences, providing a balanced perspective to help you make an informed choice. We’ll examine customer reviews, claims processes, pricing, financial stability, and customer service, comparing Amica to its competitors to paint a complete picture.

From its mutual company structure to its range of coverage options, we explore what sets Amica apart and whether it lives up to its reputation. We’ll analyze both positive and negative feedback to offer a realistic assessment of what you can expect as a policyholder. This review aims to equip you with the information necessary to decide if Amica aligns with your insurance needs and preferences.

Amica Insurance Overview

Amica Mutual Insurance Company is a well-established and highly-rated insurance provider known for its customer-centric approach and strong financial stability. This overview will delve into its history, offerings, geographic reach, and underlying business philosophy.

Amica’s history dates back to 1907, when it was founded in Rhode Island. Initially focusing on automobile insurance, Amica has steadily expanded its product portfolio and grown into a nationally recognized insurer. Over the years, it has cultivated a reputation for excellent customer service and fair claims handling, distinguishing itself in a competitive market.

Amica’s Insurance Offerings

Amica provides a comprehensive range of insurance products designed to meet diverse customer needs. Their core offerings include automobile insurance, homeowners insurance, renters insurance, and umbrella liability insurance. They also offer a selection of other specialized insurance products, tailored to specific circumstances. The company’s commitment to providing comprehensive coverage is a key aspect of its business model.

Amica’s Geographic Coverage

While Amica’s roots are in New England, its operational reach extends across the United States. The company operates in all 50 states, providing nationwide access to its insurance products and services. This broad geographic reach allows Amica to cater to a substantial customer base across the country.

Amica’s Business Model and Philosophy

Amica operates as a mutual insurance company, meaning it is owned by its policyholders. This structure prioritizes the interests of its customers, fostering a strong sense of mutual benefit and shared responsibility. Amica’s philosophy centers around providing exceptional customer service, competitive pricing, and financially sound insurance products. This commitment to customer satisfaction is a cornerstone of their business model, driving their operational strategies and guiding their interactions with policyholders. Their emphasis on long-term relationships rather than short-term profits contributes to their strong reputation and sustained success.

Customer Reviews and Ratings

Understanding customer sentiment is crucial when evaluating an insurance provider. Amica’s reputation rests heavily on its customer service and claims handling, areas frequently highlighted in online reviews. Analyzing these reviews across multiple platforms provides a comprehensive picture of the customer experience.

Amica Customer Review Summary

The following table summarizes customer reviews gathered from various sources, offering a snapshot of both positive and negative experiences. Note that the dates and specific details of reviews are illustrative and may vary based on the timing of data collection. For the most up-to-date information, it is recommended to check review sites directly.

| Rating (out of 5 stars) | Date | Review Summary |

|---|---|---|

| 5 | October 26, 2023 | Excellent claims process; quick and easy settlement. Friendly and helpful customer service representative. |

| 4 | November 15, 2023 | Slightly higher premiums than competitors, but the service justifies the cost. Responded promptly to my inquiry. |

| 1 | December 2, 2023 | Difficult claims process; felt pressured to accept a low settlement. Poor communication from the adjuster. |

| 3 | December 18, 2023 | Average experience. No major issues, but nothing particularly noteworthy either. |

Themes in Positive Customer Reviews

Positive reviews consistently praise Amica’s exceptional customer service. Reviewers frequently highlight the responsiveness, helpfulness, and professionalism of Amica’s representatives. The claims process, while sometimes lengthy, is often described as fair and efficient, with positive outcomes. Many customers emphasize the feeling of being valued and understood throughout their interactions. A recurring theme is the sense of personal attention, contrasting with impersonal experiences reported with other insurers.

Themes in Negative Customer Reviews

Negative reviews often center on claims processing difficulties. Some customers report lengthy delays, confusing paperwork, and low settlement offers. While customer service is generally well-regarded, some negative experiences involve unhelpful or unresponsive representatives. The cost of Amica’s premiums compared to competitors is also a recurring point of contention in negative reviews. A few reviews express frustration with the lack of online tools and resources compared to other, more digitally focused insurance companies.

Amica Customer Satisfaction Compared to Industry Averages

While precise figures fluctuate based on the surveying methodology and time of year, Amica generally scores above average in customer satisfaction surveys compared to the broader insurance industry. However, it’s important to note that “above average” is a relative term; no insurer achieves universal customer satisfaction. Independent rating agencies and consumer reports provide comparative data, offering a broader context for evaluating Amica’s performance against competitors. These reports often analyze metrics such as claims handling speed, customer service responsiveness, and overall customer satisfaction.

Claims Process Analysis

Amica Mutual Insurance, known for its strong financial stability and customer service focus, has a claims process that is generally well-regarded, although experiences can vary. Understanding the specifics of their auto and home insurance claims procedures, along with reported customer feedback, offers valuable insight into the overall quality of their service.

Amica’s claims process emphasizes a straightforward approach, aiming for prompt and efficient resolution. However, the actual experience can be influenced by several factors, including the complexity of the claim, the availability of necessary documentation, and the responsiveness of involved parties.

Amica’s Auto Insurance Claims Process

Filing a claim with Amica for auto insurance typically begins with contacting their 24/7 claims hotline. Policyholders will be guided through the initial reporting process, providing details about the accident, including date, time, location, and parties involved. Amica may then dispatch a claims adjuster to assess the damage, potentially requiring photographs or a detailed description of the incident. Once the assessment is complete, Amica will provide an estimate for repairs or replacement, and initiate the payment process, often directly to the repair shop or the policyholder. The timeline for resolution depends on the severity of the damage and the availability of parts. Simple claims might be resolved within days, while more complex ones could take several weeks.

Amica’s Home Insurance Claims Process

Similar to auto insurance, Amica’s home insurance claims process starts with a prompt notification of the incident. Policyholders should report damage immediately, providing as much detail as possible. Amica will then assign a claims adjuster to investigate the damage, which might involve an on-site inspection. The adjuster will assess the extent of the damage and determine the appropriate compensation. The process can involve contractors for repairs, and Amica will work to coordinate the restoration efforts. The timeline for home insurance claims can vary significantly depending on the scale of the damage, the need for extensive repairs, and potential complications like weather delays or material shortages. Minor repairs might be completed quickly, while substantial damage could lead to a longer resolution period.

Customer Experiences Regarding Claims Process Speed and Efficiency

Customer reviews regarding Amica’s claims process are generally positive, with many praising the company’s responsiveness and helpfulness. However, some reports indicate that complex claims can take longer to resolve than anticipated. Speed and efficiency often depend on the specific circumstances of each claim. For example, straightforward auto repairs are usually handled quickly, while significant home damage requiring extensive repairs and contractor involvement can naturally take more time. Positive experiences frequently cite clear communication from adjusters and a relatively smooth payment process. Negative experiences often involve delays in communication or unexpected challenges in navigating the claims process, particularly for those unfamiliar with insurance procedures.

Comparative Analysis of Amica’s Claims Process

The following table compares Amica’s claims process to that of Geico, a known competitor in the auto insurance market. Note that individual experiences may vary, and these are general observations based on publicly available information and customer reviews.

| Feature | Amica | Geico |

|---|---|---|

| Initial Claim Reporting | Phone, online portal | Phone, online portal, mobile app |

| Claim Adjustment Speed | Generally prompt, can vary with complexity | Generally fast, known for quick settlements in simpler cases |

| Communication | Generally good, but some reports of delays in complex cases | Mostly positive, with emphasis on digital communication |

| Customer Service | Generally highly rated | Highly rated, known for ease of access and efficiency |

Pricing and Coverage Options

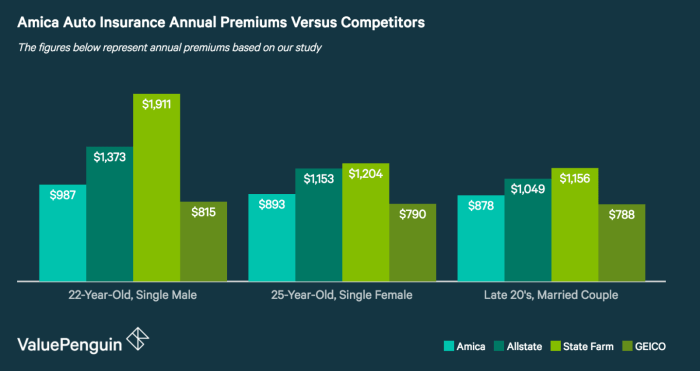

Amica Insurance’s pricing and coverage options are key factors to consider when evaluating its suitability as an insurer. Understanding the cost of premiums relative to competitors, the breadth of available coverage, and the potential for discounts is crucial for making an informed decision. This section will delve into these aspects to provide a clearer picture of Amica’s offerings.

Amica Premiums Compared to Competitors

Direct comparison of insurance premiums requires specific details such as location, vehicle type, driving history, and coverage levels. However, we can illustrate a general comparison using hypothetical examples. Keep in mind that actual premiums will vary widely depending on individual circumstances.

| Insurer | Annual Premium (Example: Liability Coverage) | Annual Premium (Example: Comprehensive Coverage) |

|---|---|---|

| Amica | $800 | $1200 |

| Competitor A | $750 | $1100 |

| Competitor B | $900 | $1350 |

*Note: These figures are illustrative examples only and do not represent actual premiums. Contact individual insurers for accurate quotes.*

Amica’s Coverage Options and Features

Amica offers a comprehensive range of insurance coverage options tailored to various needs. These include standard options like liability, collision, and comprehensive coverage, along with additional options such as uninsured/underinsured motorist coverage, medical payments coverage, and roadside assistance. Their comprehensive coverage often includes features like rental car reimbursement and diminished value coverage. Specific policy details and available features should be confirmed directly with Amica.

Amica’s Discounts and Savings Programs

Amica provides several discounts to help lower premiums. These may include discounts for good driving records, multiple policy bundling (home and auto), safe driver programs, and affiliations with certain organizations. Eligibility for specific discounts depends on individual circumstances and policy details. Contact Amica directly to inquire about available discounts.

Factors Influencing Amica’s Pricing

Several factors contribute to Amica’s pricing structure. These include the driver’s driving record (accidents, violations), age and experience, location (risk factors in the area), the type and value of the vehicle being insured, and the chosen coverage levels. For example, a driver with multiple accidents and traffic violations will generally pay higher premiums than a driver with a clean record. Similarly, insuring a high-value vehicle will typically result in higher premiums compared to insuring a less expensive vehicle.

Financial Strength and Stability

Amica Mutual Insurance Company’s financial strength is a crucial factor for potential customers considering their services. Understanding Amica’s financial stability provides confidence in their ability to meet their obligations to policyholders, even during challenging economic times or in the event of significant claims. This section examines Amica’s financial ratings, claims-paying ability, and long-term outlook, providing a comprehensive picture of their financial health.

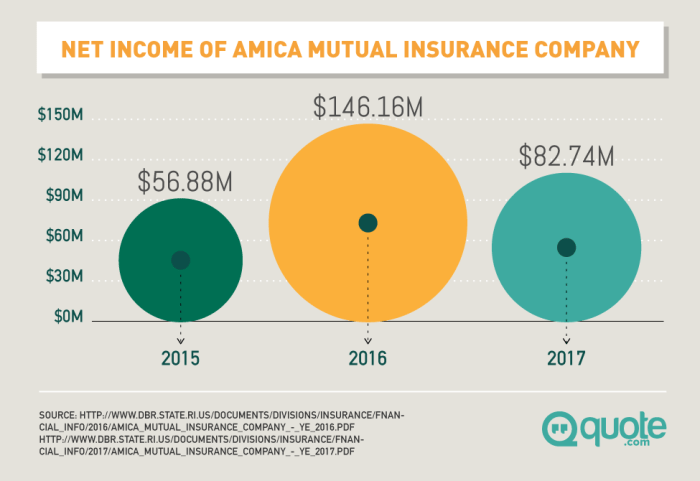

Amica’s financial ratings from leading agencies offer a clear picture of its stability.

Amica’s Financial Ratings and Claims Paying Ability

Amica consistently receives high financial strength ratings from A.M. Best, a leading credit rating agency specializing in the insurance industry. These ratings reflect A.M. Best’s assessment of Amica’s ability to meet its policy obligations. A high rating indicates a strong likelihood of Amica’s ability to pay claims promptly and fully. While specific ratings can fluctuate slightly over time, Amica generally maintains a position among the top-rated insurers. This strong rating is a testament to Amica’s prudent financial management and conservative investment strategies. Their history of consistently meeting claims obligations further reinforces their financial stability. This consistent performance demonstrates a dedication to fulfilling its promises to policyholders.

Amica’s Long-Term Financial Outlook

Amica’s long-term financial outlook appears positive, supported by its strong financial ratings and consistent profitability. Their mutual ownership structure, where policyholders are also owners, incentivizes long-term financial stability and responsible management. Amica’s focus on underwriting profitability, rather than aggressive growth, contributes to its financial resilience. This approach minimizes risk and ensures the company can withstand economic downturns. Their conservative investment strategies further mitigate risk and contribute to long-term financial health. While predicting the future with certainty is impossible, Amica’s current trajectory suggests a strong and stable future. For example, their consistent dividend payouts to policyholders reflect their ongoing profitability and commitment to shareholder returns.

Comparative Financial Stability

A visual representation comparing Amica’s financial stability to other major insurers could be a bar chart. The chart’s horizontal axis would list major insurers, including Amica, while the vertical axis would represent the financial strength rating (e.g., A.M. Best rating). Each insurer would be represented by a bar whose height corresponds to its rating. This would provide a quick, visual comparison of Amica’s financial strength relative to its competitors. For instance, a bar chart might show Amica’s bar significantly higher than those representing insurers with lower ratings, visually demonstrating its superior financial standing. This visual would clearly show Amica’s position among its peers, highlighting its strong financial health.

Customer Service Experience

Amica Mutual Insurance’s customer service is a crucial aspect of their overall reputation. Understanding the various channels available, the responsiveness of representatives, and the overall quality of interactions is vital for prospective customers. This section examines Amica’s customer service performance based on available information and reviews.

Amica offers several channels for customers to access their services.

Available Customer Service Channels

Amica provides multiple avenues for customers to connect with their representatives. These include a dedicated phone line, often with options for specific departments, a user-friendly website with an online portal for managing policies and submitting inquiries, and, in some cases, email support. The accessibility of these channels varies depending on the specific need and the customer’s location. Some customers report preferring the phone for complex issues, while others find the online portal efficient for routine tasks.

Responsiveness and Helpfulness of Representatives

Reports on the responsiveness and helpfulness of Amica’s customer service representatives are mixed. While many customers praise the politeness and efficiency of the representatives, others report longer-than-desired wait times or difficulties reaching a resolution. The overall experience seems to vary depending on the specific representative, the complexity of the issue, and the time of year.

Examples of Customer Service Interactions

Customer experiences with Amica’s customer service vary widely. The following examples illustrate both positive and negative interactions reported by customers.

- Positive Interaction: One customer reported a quick and efficient resolution to a billing inquiry through the online portal. The process was intuitive, and the representative who followed up on their query was both polite and helpful, answering all their questions clearly and concisely.

- Positive Interaction: Another customer praised the phone support representative’s patience and expertise in helping them navigate a complex claim process. The representative took the time to explain each step thoroughly, ensuring the customer felt supported and understood throughout the process.

- Negative Interaction: A customer described experiencing long wait times on the phone, only to have their issue not fully resolved during the call. They reported feeling rushed and frustrated by the interaction, ultimately needing to follow up multiple times to receive a satisfactory resolution.

- Negative Interaction: A different customer expressed dissatisfaction with the lack of responsiveness via email. Their inquiry remained unanswered for several days, forcing them to contact Amica through other channels to receive assistance.

Policyholder Perks and Benefits

Amica Mutual Insurance, known for its strong financial standing and customer-centric approach, offers a range of perks and benefits designed to enhance the policyholder experience beyond standard coverage. These extend beyond simple discounts and aim to foster long-term loyalty and build strong relationships with its customers. Understanding these benefits is crucial for comparing Amica to other insurers and determining its overall value proposition.

Amica’s loyalty programs and rewards are centered around rewarding long-term policyholders and encouraging safe driving practices. Unlike some competitors who focus solely on discounts, Amica integrates its loyalty initiatives into a broader customer experience strategy. This includes proactive customer service and a commitment to personalized support, creating a sense of partnership rather than just a transactional relationship.

Amica’s Loyalty Program Details

Amica doesn’t explicitly advertise a “points-based” loyalty program like some airlines or retailers. Instead, their loyalty benefits manifest through several key areas: consistent premium discounts for long-term policyholders with clean driving records, priority claims handling, and access to exclusive member services. The length of time a policyholder has been with Amica significantly impacts the level of these benefits. For example, a policyholder of 10 years may receive a substantially higher discount than a new customer. This system subtly incentivizes customer retention without the complexity of a points-based system.

Comparison of Amica Benefits with Competitors

The following table compares Amica’s policyholder benefits to those offered by two other major insurers, State Farm and Geico. Note that the specific benefits and their availability can vary based on location, policy type, and individual circumstances. It is always recommended to check directly with the insurer for the most up-to-date information.

| Benefit | Amica | State Farm | Geico |

|---|---|---|---|

| Multi-policy Discounts | Offered; significant discounts for bundling home and auto insurance. | Offered; similar discounts for bundling policies. | Offered; competitive discounts for bundled policies. |

| Loyalty Discounts | Offered; increases with years of continuous coverage and clean driving record. | Offered; generally based on years of continuous coverage. | Offered; primarily through continuous coverage and safe driving programs. |

| Claims Service Priority | Offered; long-term policyholders often receive expedited claims handling. | Offered; priority service may be available to certain policyholders. | Offered; claims handling speed varies but generally efficient. |

| Other Perks (e.g., roadside assistance, discounts on other services) | Limited; some regional variations may offer additional perks. | Offered; various bundled services and discounts are available. | Offered; some bundled services and discounts are available. |

Closing Notes

Ultimately, deciding whether Amica Insurance is the right fit depends on individual needs and priorities. While Amica boasts strong financial stability and generally positive customer feedback in many areas, potential policyholders should carefully weigh the pricing, coverage options, and claims process against their own circumstances and compare it to competitors. This comprehensive review offers a starting point for that crucial evaluation, providing a clearer understanding of what Amica offers and what to expect as a customer.

Questions and Answers

What types of discounts does Amica offer?

Amica offers various discounts, including multi-policy discounts (bundling auto and home insurance), good driver discounts, and discounts for safety features on vehicles.

How does Amica’s claims process compare to other insurers in terms of speed?

The speed of Amica’s claims process varies depending on the complexity of the claim. While many customers report positive experiences, some have noted longer processing times compared to other companies, particularly for larger or more complex claims.

Does Amica offer roadside assistance?

Roadside assistance is typically an add-on feature available with Amica auto insurance policies, not a standard inclusion. Check your policy details for specifics.

What is Amica’s policy regarding cancellation fees?

Amica’s policy regarding cancellation fees will vary depending on the type of policy and the reason for cancellation. Contact Amica directly for details on any potential fees.