Planning a trip often involves careful consideration of various factors, and securing adequate travel insurance is paramount. Amex offers travel medical insurance plans designed to provide peace of mind during your adventures abroad. This guide delves into the specifics of Amex’s offerings, outlining coverage details, the claims process, and crucial considerations to ensure a smooth and protected travel experience. We’ll explore different plan levels, compare Amex to competitors, and address common concerns to empower you with the knowledge needed to make an informed decision.

Understanding the nuances of travel insurance is crucial for mitigating potential risks. This guide aims to clarify the complexities of Amex’s travel medical insurance, providing a clear and comprehensive overview to help you navigate the process effectively. We’ll examine the benefits, limitations, and customer experiences associated with Amex’s plans, enabling you to choose the right level of coverage for your individual needs and travel style.

Amex Travel Medical Insurance

American Express offers various travel medical insurance plans designed to provide peace of mind while you’re exploring the world. The level of coverage you need will depend on the length and nature of your trip, as well as your personal risk tolerance. Understanding the different plans available is crucial for selecting the right protection for your travel needs.

Amex Travel Medical Insurance Coverage Levels

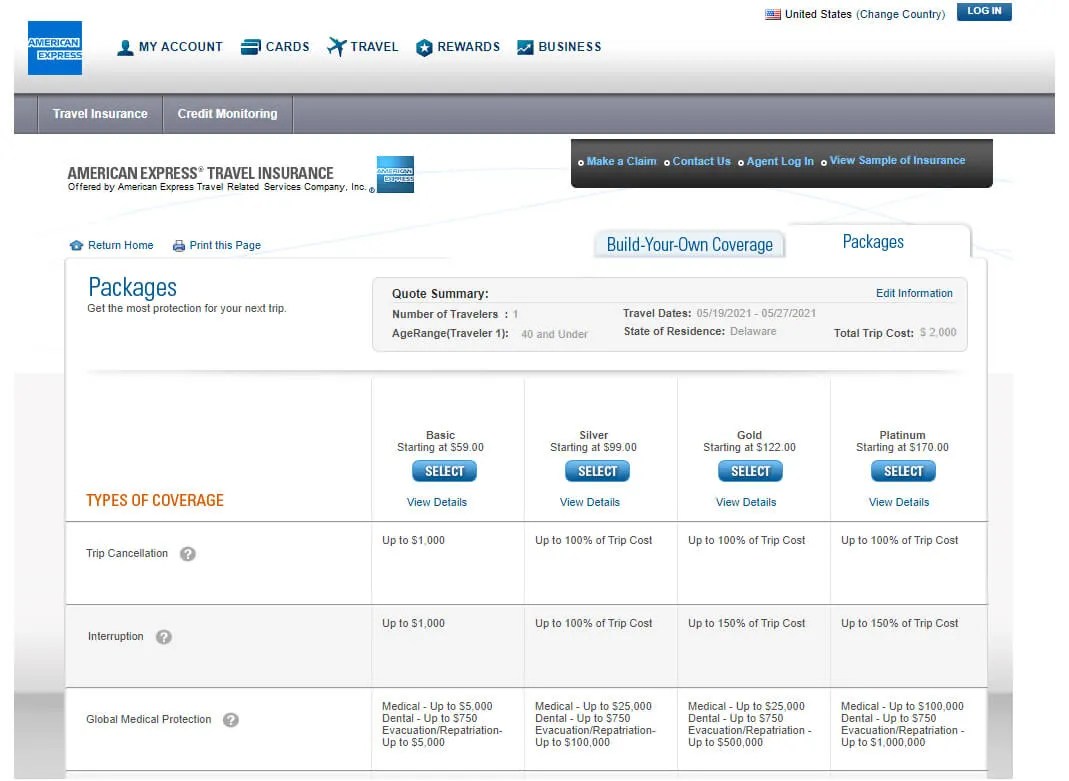

Amex typically offers several tiers of travel medical insurance, each providing varying levels of coverage for medical emergencies, evacuations, and other unforeseen circumstances. While specific plan details and names might change, the general structure usually includes options ranging from basic to comprehensive protection. A basic plan might cover only essential medical expenses, while a comprehensive plan offers broader protection, including trip interruptions and lost luggage. It’s important to review the specific policy wording for details on what is and isn’t covered.

Examples of Coverage Applicability

Consider these scenarios to illustrate how different coverage levels might apply:

- Basic Plan: A short weekend trip to a neighboring city. This plan might suffice for covering minor medical emergencies, such as a visit to an urgent care clinic for a minor injury.

- Mid-Tier Plan: A two-week vacation to Europe. This plan would offer more extensive coverage, potentially including emergency medical transport within the country and repatriation if necessary, along with coverage for lost luggage or trip interruptions due to unforeseen circumstances like severe weather.

- Comprehensive Plan: A year-long backpacking trip around the world. This level of coverage is crucial for extended travel, providing extensive medical coverage, including potential medical evacuations by air ambulance, comprehensive trip interruption coverage, and potentially even coverage for lost or stolen belongings.

Comparison of Amex Travel Insurance Plans

The following table provides a general comparison of potential Amex travel insurance plans. Note that specific benefits and prices are subject to change and should be verified directly with American Express. This table is for illustrative purposes only and does not constitute a complete policy description.

| Plan Name (Example) | Medical Expense Coverage | Emergency Evacuation | Trip Interruption |

|---|---|---|---|

| Basic Travel Protection | Up to $50,000 | Limited coverage, ground transport only | Not included |

| Preferred Travel Protection | Up to $250,000 | Ground and air ambulance coverage | Up to $5,000 |

| Premium Travel Protection | Unlimited | Worldwide air ambulance coverage | Unlimited |

Amex Travel Medical Insurance

Amex Travel Medical Insurance provides valuable protection for unforeseen medical emergencies while traveling abroad. Understanding the claims process is crucial to ensuring a smooth reimbursement experience should you need to utilize your coverage. This section Artikels the steps involved in filing a claim and the necessary documentation.

Amex Travel Medical Insurance Claim Process

Filing a claim with Amex Travel Medical Insurance generally involves several key steps. First, you’ll need to seek necessary medical attention and obtain all relevant documentation from your healthcare provider. This includes bills, receipts, and any diagnostic reports. Next, you’ll need to submit your claim through the Amex website or designated claims portal, usually within a specified timeframe Artikeld in your policy documents. This online submission often involves uploading the required documents and completing a claim form. Amex will then review your claim, potentially contacting you for further information if needed. Finally, once approved, the reimbursement will be processed and credited to your account. Remember to carefully retain copies of all submitted documents for your records.

Required Documentation for a Successful Claim

To ensure a swift and successful claim process, you must provide comprehensive documentation. This typically includes the original medical bills and receipts detailing all expenses incurred, a completed claim form provided by Amex, a copy of your Amex travel medical insurance policy, your passport or other valid identification, and any relevant diagnostic reports, such as X-rays or lab results. Detailed descriptions of the medical incident and the treatment received should also be included. Failure to provide complete and accurate documentation can lead to delays or rejection of your claim.

Potential Claim Rejection Reasons and Avoidance Strategies

It is important to understand why claims might be rejected to avoid such outcomes.

- Incomplete Documentation: Failing to submit all required documents, such as medical bills or the claim form, is a common reason for rejection. Avoidance: Ensure you gather all necessary documents before submitting your claim and meticulously check the checklist provided by Amex.

- Failure to Meet Policy Requirements: Claims may be denied if the medical event doesn’t fall under the coverage specified in your policy. For instance, pre-existing conditions might not be covered. Avoidance: Carefully review your policy document before your trip to understand the extent of your coverage and any exclusions.

- Untimely Claim Submission: Most insurance policies have deadlines for submitting claims. Missing these deadlines can result in rejection. Avoidance: Submit your claim as soon as possible after receiving medical treatment and within the timeframe specified in your policy.

- Inaccurate Information: Providing false or misleading information on the claim form can lead to rejection. Avoidance: Ensure all information provided is accurate and truthful.

- Lack of Medical Necessity: If the medical treatment received is deemed unnecessary by Amex’s medical review team, the claim may be rejected. Avoidance: Ensure that all medical treatments received were deemed necessary by a qualified medical professional and are well-documented.

Amex Travel Medical Insurance

Amex Travel Medical Insurance provides valuable protection for unexpected medical emergencies while traveling abroad. However, it’s crucial to understand that this insurance, like all insurance policies, has limitations and exclusions. Knowing these limitations will help you make informed decisions about your travel plans and supplemental insurance needs.

Exclusions and Limitations of Amex Travel Medical Insurance

Understanding the specific situations and medical conditions not covered by Amex Travel Medical Insurance is essential for responsible travel planning. These exclusions are detailed in the policy documents and can vary depending on the specific plan purchased. Failure to review your policy thoroughly could result in unexpected financial burdens during a medical emergency.

- Pre-existing Conditions: Generally, pre-existing conditions are not covered. This refers to any medical condition diagnosed or treated before your policy’s effective date. For example, if you have a history of heart disease and experience a heart attack while traveling, the expenses related to this event might not be covered. The definition of “pre-existing condition” is explicitly defined within your policy document and should be reviewed carefully.

- Adventure Activities: Many policies exclude or limit coverage for injuries sustained during high-risk activities such as scuba diving, bungee jumping, or mountaineering. The specific activities excluded will vary depending on the policy. If you plan to participate in such activities, you may need to purchase supplemental insurance.

- Routine Medical Care: Amex Travel Medical Insurance typically doesn’t cover routine checkups, vaccinations, or non-emergency medical care that could have been obtained before your trip. This focuses the coverage on unexpected medical emergencies while traveling.

- Mental Health Conditions: Coverage for pre-existing mental health conditions is often limited or excluded. Specific exclusions and limitations will be Artikeld in your policy documents. Travelers with pre-existing mental health concerns should consult their policy carefully or consider supplemental insurance.

- Maximum Payout Amounts: There’s usually a maximum amount the insurance will pay out for medical expenses. This limit is clearly stated in your policy. It’s important to understand this limit to avoid potentially significant out-of-pocket expenses in case of a serious medical emergency exceeding the coverage limit. For example, a policy might have a maximum payout of $500,000, meaning expenses beyond that amount would be the traveler’s responsibility.

- Alcohol or Drug-Related Illnesses: Medical expenses resulting from alcohol or drug abuse are typically not covered. This exclusion is common across most travel insurance policies.

- War or Civil Unrest: Coverage is usually excluded for medical emergencies arising from war, civil unrest, or terrorism. Travel to high-risk areas should be carefully considered, and alternative insurance solutions may be necessary.

It is strongly recommended to carefully review your specific Amex Travel Medical Insurance policy document for a complete and accurate understanding of its exclusions and limitations. Contact Amex directly if you have any questions or require clarification.

Amex Travel Medical Insurance

Amex offers travel medical insurance as part of its broader suite of travel-related services. Understanding its strengths and weaknesses requires a comparison with competing providers to determine if it represents the best value for your specific travel needs. This comparison will highlight key differences in coverage, pricing, and benefits.

Amex Travel Medical Insurance Compared to Competitors

Several major players offer travel medical insurance, each with its own approach to coverage and pricing. Direct comparison reveals important distinctions in what is included and excluded, and the overall cost. Understanding these differences is crucial for making an informed decision. We will focus on three key competitors: Allianz Global Assistance, Travel Guard, and World Nomads.

| Feature | Amex Travel Medical Insurance | Allianz Global Assistance | Travel Guard | World Nomads |

|---|---|---|---|---|

| Pricing (Example: 7-day trip for a 35-year-old) | $50 – $150 (depending on destination and coverage level) | $40 – $120 (depending on destination and coverage level) | $60 – $180 (depending on destination and coverage level) | $35 – $100 (depending on destination and coverage level) |

| Emergency Medical Evacuation | Covered up to a specified limit, typically hundreds of thousands of dollars. | Covered up to a specified limit, varying by plan. | Covered up to a specified limit, varying by plan. | Covered up to a specified limit, varying by plan. |

| Trip Cancellation/Interruption | May be included depending on the chosen plan, with specific conditions for eligibility. | Offered as an add-on or included in comprehensive plans. | Offered as an add-on or included in comprehensive plans. | Offered as an add-on or included in comprehensive plans. |

| Baggage Loss/Delay | Often included, with limitations on coverage amounts and eligible items. | Generally included, with varying coverage limits. | Generally included, with varying coverage limits. | Generally included, with varying coverage limits. |

| 24/7 Assistance Services | Offered, providing access to medical advice, emergency assistance, and other support. | Offered, with varying levels of support depending on the plan. | Offered, with varying levels of support depending on the plan. | Offered, with varying levels of support depending on the plan. |

Note: The pricing examples are illustrative and may vary based on factors such as age, trip length, destination, and chosen coverage level. Always check the provider’s website for the most up-to-date pricing information.

Specific Coverage Differences

Amex’s coverage often emphasizes its integration with existing Amex card benefits. For instance, cardholders might receive enhanced benefits or discounts when purchasing Amex travel insurance. Competitors, like Allianz, might offer more specialized plans targeting specific traveler demographics (e.g., adventure travelers, families). Travel Guard may excel in specific areas like trip cancellation coverage, while World Nomads might cater more to independent travelers with robust adventure sports coverage. These nuanced differences necessitate careful consideration of individual travel plans and risk profiles.

Amex Travel Medical Insurance

Amex Travel Medical Insurance offers a range of plans designed to provide coverage for medical emergencies and related expenses while traveling internationally. Understanding customer experiences is crucial for assessing the effectiveness and value of this insurance product. This section examines customer reviews to highlight both positive and negative aspects of the service.

Customer Review Summary

Analysis of online reviews reveals a mixed bag of experiences with Amex Travel Medical Insurance. While many customers praise the ease of claims processing and the comprehensiveness of coverage, others express frustration with lengthy wait times, difficulties in contacting customer service, and ambiguities in policy details. A recurring theme is the importance of carefully reviewing the policy details before purchasing to ensure it meets individual needs and travel plans. The overall sentiment is a blend of positive and negative feedback, indicating areas for improvement.

Positive Customer Experiences

Several customers have shared positive experiences highlighting the promptness and efficiency of claim reimbursements. For example, one traveler described a situation where they required emergency medical attention overseas. Their claim was processed swiftly, and they received reimbursement for their medical bills within a reasonable timeframe, alleviating significant financial stress during a challenging situation. Another positive aspect frequently mentioned is the readily available customer support, with some users reporting helpful and responsive agents who addressed their queries effectively. This positive experience contributes to overall customer satisfaction.

Negative Customer Experiences

Conversely, some customers have expressed negative experiences, primarily related to customer service responsiveness and policy clarity. One common complaint involved difficulties in reaching customer service representatives, with reports of long wait times and unclear instructions on filing claims. In some cases, customers reported discrepancies between their understanding of the policy coverage and the actual reimbursement received, leading to dissatisfaction. For instance, one review detailed a situation where a pre-existing condition, believed to be covered, was ultimately excluded from reimbursement, causing significant financial burden. These experiences underscore the need for improved communication and clarity.

Recommendations for Amex

To enhance customer satisfaction and address the concerns highlighted in customer reviews, the following recommendations are suggested:

- Improve customer service response times and accessibility. Implement strategies to reduce wait times and ensure agents are readily available to answer customer inquiries efficiently.

- Enhance policy clarity. Simplify policy language and provide clear, concise explanations of coverage details, including specific examples and scenarios. This will minimize misunderstandings and potential disputes.

- Streamline the claims process. Develop a user-friendly online claims portal that allows for easy submission and tracking of claims. Provide regular updates to customers on the status of their claims.

- Invest in comprehensive training for customer service agents. Ensure agents possess the knowledge and skills necessary to address customer concerns effectively and empathetically.

- Proactively address negative reviews. Respond to negative reviews online and offer solutions to resolve customer issues promptly. This demonstrates a commitment to customer satisfaction and can help mitigate negative publicity.

Amex Travel Medical Insurance

Planning a trip is exciting, but ensuring your well-being while abroad requires careful preparation. Amex Travel Medical Insurance can provide valuable peace of mind, but maximizing its benefits hinges on understanding your policy and taking proactive steps before, during, and after your journey. This section Artikels the crucial pre-trip preparations to ensure comprehensive coverage.

Understanding Your Amex Travel Medical Insurance Policy

Before you even pack your bags, thoroughly review your Amex Travel Medical Insurance policy. Familiarize yourself with the coverage details, including what medical emergencies are covered, geographical limitations, and any exclusions. Pay close attention to the definition of “medical emergency,” as this will dictate what situations are eligible for reimbursement. Note the claim process, including required documentation and deadlines. Understanding your policy terms and conditions is paramount to avoiding unexpected costs and complications. Misunderstandings can lead to delays in receiving reimbursements or even denial of claims. Take the time to read it carefully and, if anything is unclear, contact Amex directly for clarification.

Pre-Trip Checklist for Maximizing Insurance Benefits

A well-organized pre-trip checklist can significantly enhance your travel experience and ensure smooth claim processing should the need arise. This includes administrative tasks, health preparations, and securing necessary documentation.

- Confirm Coverage: Verify your policy’s effective dates and ensure your trip falls within the coverage period.

- Note Policy Number and Contact Information: Keep your policy number and Amex’s 24/7 assistance contact information readily accessible, ideally both digitally and in a physical copy stored separately from your other travel documents.

- Document Existing Medical Conditions: If you have pre-existing medical conditions, inform Amex and obtain clarification on their coverage. This might involve submitting additional forms or documentation.

- Make Copies of Important Documents: Create copies of your passport, visa, itinerary, insurance policy, and other essential travel documents. Store these copies separately from the originals.

- Consult Your Doctor: Schedule a checkup with your physician to ensure you are fit for travel and obtain any necessary vaccinations or prescriptions. Discuss any potential health risks associated with your destination.

During and After Trip Actions for Optimal Claim Processing

Maintaining meticulous records throughout your trip is crucial for a successful claim. This involves documenting medical expenses and preserving supporting documentation.

- Retain All Medical Receipts and Documentation: Keep all medical bills, receipts for medications, and any other related documents carefully organized. These will be necessary to support your claim.

- Report Incidents Promptly: If a medical emergency occurs, contact Amex immediately to report the incident and follow their instructions for filing a claim. Timely reporting is vital for efficient processing.

- Submit a Complete Claim: Ensure your claim is complete and includes all necessary documentation to avoid delays. Follow Amex’s instructions carefully.

- Keep Track of Claim Status: After submitting your claim, follow up to check on its status and address any inquiries promptly.

Amex Travel Medical Insurance

Amex Travel Medical Insurance provides comprehensive coverage for unexpected medical emergencies while traveling internationally. Beyond the medical expense coverage itself, the emergency assistance services are a crucial component, offering vital support and coordination during stressful and often unfamiliar circumstances. These services are designed to help policyholders navigate the complexities of receiving medical care abroad and ensure a smoother return home.

Emergency Assistance Services Offered

Amex Travel Medical Insurance’s emergency assistance services encompass a wide range of support, designed to address various aspects of a medical emergency abroad. This includes 24/7 access to trained professionals who can provide immediate assistance with medical referrals, arranging emergency medical transportation (including air ambulance if necessary), coordinating with local hospitals and doctors, and facilitating communication with family and friends back home. Further assistance can include help with lost or stolen belongings, legal referrals, and even emergency cash transfers if needed.

Utilizing Emergency Assistance Services in Different Situations

The utility of these services extends across a broad spectrum of medical emergencies. For instance, imagine a sudden illness while backpacking through Southeast Asia. The assistance service could arrange for immediate medical evaluation at a reputable local hospital, translate medical reports, and communicate with the policyholder’s family to update them on the situation. Similarly, a skiing accident in the Alps could necessitate emergency helicopter evacuation to a specialized trauma center; Amex’s assistance service would coordinate this complex process, ensuring the best possible care. In a less severe but still disruptive situation, a traveler experiencing a severe allergic reaction in a foreign city could rely on the service to locate the nearest pharmacy carrying appropriate medication and even arrange for delivery.

Contacting Emergency Assistance and Required Information

To access emergency assistance, policyholders should contact the designated 24/7 emergency assistance hotline, the number for which is clearly stated on the insurance policy documents. When calling, be prepared to provide the following information: your policy number, your full name, your current location (including specific address or GPS coordinates if possible), a detailed description of the medical emergency, and the name and contact information of an emergency contact person back home. The representative will then work to assess the situation, determine the best course of action, and begin coordinating the necessary assistance. It is advisable to keep your policy information readily accessible at all times while traveling. Detailed instructions, including alternative contact methods, will be provided within your policy documentation.

Closing Notes

Ultimately, choosing the right travel medical insurance is a personal decision dependent on individual needs and travel plans. While Amex offers a range of plans with varying levels of coverage, careful consideration of your specific circumstances and a thorough understanding of the policy details are essential. By weighing the benefits, limitations, and customer experiences detailed in this guide, you can make an informed choice to ensure your travels are protected and stress-free. Remember to compare options and consider your specific needs before purchasing any travel insurance policy.

Question & Answer Hub

What happens if I need medical evacuation?

Amex’s plans typically cover medical evacuation, but the specific details depend on your chosen plan. Check your policy documents for coverage limits and procedures.

Are pre-existing conditions covered?

Generally, pre-existing conditions are not covered unless you purchase supplemental coverage. Review the policy’s exclusions carefully.

What is the process for submitting a claim after a trip?

The claim process usually involves submitting required documentation, such as medical bills and receipts, within a specified timeframe. Consult your policy for detailed instructions.

Can I add coverage after purchasing my policy?

This depends on the specific policy and Amex’s terms and conditions. Contact Amex directly to inquire about adding coverage after purchase.

What types of activities are typically excluded from coverage?

Policies often exclude coverage for activities considered high-risk, such as extreme sports. Refer to your policy for a complete list of exclusions.