Navigating the world of home insurance can feel overwhelming, especially when faced with the task of securing the right coverage at the right price. This guide delves into the specifics of obtaining an Allstate insurance quote for your home, providing a clear understanding of the factors that influence the final cost and empowering you to make informed decisions. We’ll explore Allstate’s online quoting system, compare coverage options, analyze customer experiences, and benchmark Allstate against its competitors. By the end, you’ll be well-equipped to confidently navigate the process and secure the ideal home insurance policy.

From understanding the intricacies of coverage levels and add-ons to comparing Allstate’s offerings with those of other major insurers, this comprehensive guide aims to demystify the process of obtaining a home insurance quote. We’ll examine the various factors influencing premium costs, including location, home features, and coverage choices, providing practical examples and illustrative scenarios to clarify key concepts. This guide is designed to be both informative and practical, equipping you with the knowledge you need to make informed decisions about protecting your most valuable asset.

Understanding Allstate Home Insurance Quotes

Obtaining an accurate Allstate home insurance quote involves understanding the numerous factors influencing the final price. This understanding allows homeowners to make informed decisions about coverage and potentially reduce their premiums. Several key elements contribute to the variability of quotes.

Factors Influencing Allstate Home Insurance Quote Variations

Numerous factors determine the cost of your Allstate home insurance. These factors are carefully assessed to provide a personalized quote reflecting your specific risk profile. The primary factors include the age and condition of your home, its location, the coverage levels you select, and your claims history. For instance, a newer home with updated safety features will generally command a lower premium than an older home requiring significant repairs. Similarly, a home in a high-risk area prone to natural disasters will typically have a higher premium than one in a low-risk area.

Impact of Coverage Options on Home Insurance Quotes

Different coverage options significantly impact the final quote. Choosing higher coverage limits for dwelling, personal property, or liability will naturally increase your premium. Conversely, opting for lower coverage limits can result in lower premiums, but it also increases your out-of-pocket expenses in the event of a claim. For example, selecting a higher deductible will reduce your premium, as you are accepting more financial responsibility in the event of a claim. Conversely, a lower deductible will lead to a higher premium but lower out-of-pocket costs if a claim arises. Additional coverages, such as flood or earthquake insurance (often purchased separately), will also add to the overall cost.

Role of Location in Determining Insurance Premiums

Location plays a crucial role in determining home insurance premiums. Areas with a higher frequency of natural disasters, such as hurricanes, earthquakes, wildfires, or floods, will generally have higher premiums. Furthermore, crime rates and the prevalence of certain types of damage (e.g., hail damage) within a specific area also influence premiums. A home located in a high-crime area might have a higher premium due to an increased risk of theft or vandalism. Conversely, a home in a quiet, low-risk neighborhood might receive a lower premium. Allstate utilizes sophisticated actuarial models that consider these location-specific risks to determine accurate premiums.

Comparison of Allstate and State Farm Home Insurance Quote Processes

The following table compares the home insurance quote processes of Allstate and State Farm, highlighting key differences in their approach:

| Company | Quote Process Steps | Factors Considered | Estimated Time |

|---|---|---|---|

| Allstate | Online quote request, property information input, coverage selection, review and purchase. | Home value, location, age, construction, coverage limits, deductible, claims history, credit score (in some states). | 15-30 minutes online; longer for phone quotes. |

| State Farm | Online quote request, property information input, coverage selection, agent consultation (often required), review and purchase. | Home value, location, age, construction, coverage limits, deductible, claims history, credit score (in some states), potentially neighborhood characteristics. | 30-60 minutes online; longer for phone quotes and agent consultations. |

Exploring Allstate’s Online Quoting System

Obtaining a home insurance quote through Allstate’s online platform is generally a straightforward process, allowing potential customers to quickly receive an estimate of their premiums. However, understanding the steps involved and anticipating potential challenges can greatly improve the user experience. This section details the process, common difficulties, and provides a step-by-step guide for a smoother quote acquisition.

Allstate’s online quoting system aims for user-friendliness, guiding customers through a series of questions to generate a personalized quote. However, the system’s complexity, coupled with the varying nature of home insurance needs, can lead to some challenges. Understanding these potential hurdles allows for proactive problem-solving and a more efficient quoting experience.

Steps Involved in Obtaining an Allstate Home Insurance Quote Online

The online quoting process typically involves providing specific information about your property and your desired coverage. This data is used by Allstate’s algorithms to calculate a preliminary insurance premium. While the exact steps might vary slightly depending on updates to the website, the general flow remains consistent. The process usually includes initial information gathering, detailed property description, coverage selection, and finally, review and submission.

Potential Challenges During the Online Quoting Process

Several challenges can arise during the online quoting process. These might include difficulties accurately describing your property, choosing the right coverage levels, or encountering technical glitches on the website. Incomplete or inaccurate information can lead to inaccurate quotes, while website issues can disrupt the process altogether. For example, an outdated browser or slow internet connection can hinder the smooth functioning of the online system. Additionally, the sheer number of options for coverage can be overwhelming for some users, leading to uncertainty in their selections.

Step-by-Step Guide to Obtaining an Allstate Home Insurance Quote

This guide Artikels a typical process. Always refer to the current Allstate website for the most up-to-date instructions.

- Navigate to the Allstate Website: Begin by visiting the official Allstate website. Look for a prominent link or button usually labeled “Get a Quote” or something similar. This will initiate the quoting process.

- Select Home Insurance: Once on the quoting page, you’ll likely see options for various insurance types (auto, life, etc.). Select “Home Insurance” to proceed.

- Enter Basic Information: The system will ask for basic information such as your zip code, address, and the type of home you own (single-family, condo, etc.).

- Provide Detailed Property Information: This is a crucial step. You will need to provide details about your home’s features, including square footage, year built, construction materials, and any security systems installed. Accuracy is critical for an accurate quote.

- Choose Coverage Options: Allstate will present various coverage options, such as dwelling coverage, liability coverage, and personal property coverage. Carefully review and select the levels that best suit your needs and budget.

- Review and Submit: Before submitting your request, thoroughly review all the information you’ve provided to ensure its accuracy. Once you are satisfied, submit your request. You should receive a quote almost immediately.

Information Required to Complete the Online Quote Request

To complete the online quote request, you will generally need the following information:

- Your address

- Your zip code

- The type of home you own (e.g., single-family home, condo, townhouse)

- The year your home was built

- The square footage of your home

- The construction materials of your home (e.g., brick, wood, stucco)

- Details about any security systems you have installed

- Information about any previous insurance claims

- Your desired coverage amounts

Comparison with Other Insurers

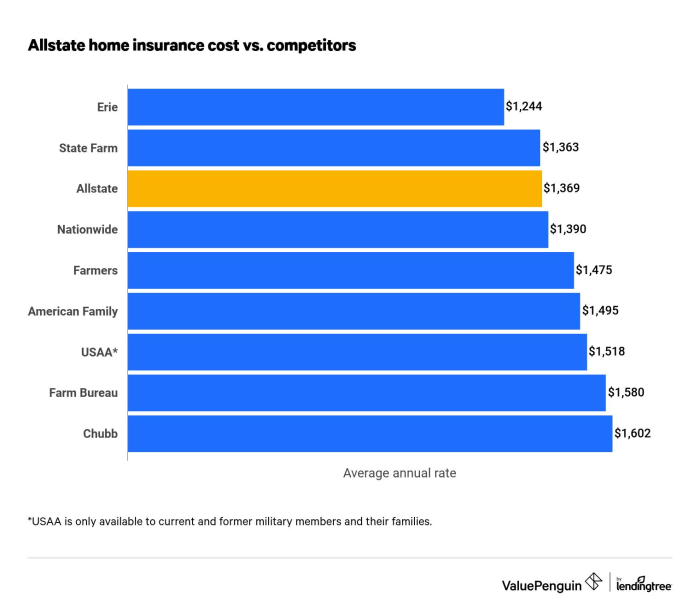

Choosing the right home insurance provider involves careful consideration of various factors beyond just price. Comparing Allstate with other major insurers helps illustrate the nuances in coverage, pricing structures, and overall customer experience. This comparison will focus on key differences to inform your decision-making process.

Several factors contribute to the variations in home insurance quotes across different providers. These include the insurer’s risk assessment model, which considers factors like your home’s location, age, construction materials, security features, and your personal claims history. Competition within the market also plays a significant role, with insurers adjusting their pricing strategies to remain competitive. Finally, the specific coverage options selected by the policyholder will directly impact the final premium cost. A policy with broader coverage will naturally be more expensive than a more basic policy.

Pricing and Coverage Differences

To illustrate these differences, let’s compare Allstate with two other prominent insurers: State Farm and Nationwide. While precise quotes vary significantly based on individual circumstances, a general comparison can highlight key trends. It’s important to remember that these are illustrative examples and actual quotes may differ based on your specific needs and location.

| Insurer | Premium Cost (Illustrative Example) | Coverage Highlights | Customer Rating (Based on Publicly Available Data) |

|---|---|---|---|

| Allstate | $1,200 annually | Standard coverage, options for additional endorsements like flood and earthquake, various discounts available. | 4.0 out of 5 stars (based on aggregated reviews from independent sources) |

| State Farm | $1,100 annually | Competitive pricing, strong reputation for claims handling, various bundled discount options. | 4.2 out of 5 stars (based on aggregated reviews from independent sources) |

| Nationwide | $1,300 annually | Broad range of coverage options, known for personalized service, may offer higher deductibles for lower premiums. | 4.1 out of 5 stars (based on aggregated reviews from independent sources) |

The table above presents illustrative premium costs. Actual premiums will vary considerably based on individual risk profiles and selected coverage levels. For example, a home located in a high-risk area for natural disasters will command a higher premium regardless of the insurer. Similarly, choosing higher coverage limits will increase the premium cost.

Customer Service Considerations

Customer service is another crucial factor in choosing a home insurance provider. While customer ratings offer a general sense of customer satisfaction, individual experiences can vary. Factors such as ease of filing claims, responsiveness of customer service representatives, and the overall claims settlement process are important considerations. Reading online reviews and seeking recommendations from friends and family can provide valuable insights into the customer service experience of different insurers.

End of Discussion

Securing adequate home insurance is a crucial step in protecting your investment and ensuring peace of mind. This guide has provided a detailed exploration of obtaining an Allstate home insurance quote, covering everything from understanding the factors influencing premiums to comparing Allstate with its competitors. By carefully considering the information presented, you can confidently navigate the quoting process, choose the coverage that best suits your needs, and secure the best possible value for your home insurance policy. Remember to thoroughly review all policy details and ask clarifying questions before finalizing your decision.

FAQ Insights

What factors significantly impact my Allstate home insurance quote?

Several factors influence your quote, including your home’s location, age, size, construction materials, security features, coverage level, and your claims history.

Can I get a quote without providing my personal information?

While some basic information is usually required for an initial quote, the level of detail needed varies by insurer. Check Allstate’s website for specifics.

What if I need to make changes to my Allstate home insurance policy after receiving a quote?

Contact Allstate directly to discuss changes. They can help adjust your coverage and recalculate your premium accordingly.

How long does it typically take to receive a quote from Allstate?

Online quotes are usually generated instantly, while quotes obtained through an agent may take a little longer.