Securing your home is a significant investment, and understanding your homeowners insurance is crucial. This guide delves into Allstate homeowners insurance, exploring its coverage options, claims process, customer experiences, pricing factors, and potential savings through discounts and bundling. We’ll equip you with the knowledge to make informed decisions about protecting your most valuable asset.

From navigating the complexities of policy details to understanding the claims process, we aim to provide a clear and concise overview of Allstate’s homeowners insurance offerings. We’ll also examine customer reviews to provide a balanced perspective and explore how various factors, such as location and coverage level, influence premium costs. Ultimately, our goal is to empower you with the information needed to confidently choose the right coverage for your needs.

Allstate Homeowners Insurance

Allstate offers a range of homeowners insurance policies designed to protect your home and belongings from various perils. Understanding the specifics of coverage is crucial to ensuring you have adequate protection. This section details Allstate’s standard coverage, additional options, and plan differences.

Standard Homeowners Insurance Coverage

Allstate’s standard homeowners insurance policies typically cover dwelling coverage (damage to the structure of your home), other structures (like detached garages or sheds), personal property (your belongings inside and outside your home), loss of use (additional living expenses if your home becomes uninhabitable), and liability coverage (protecting you from lawsuits if someone is injured on your property). The specific amounts of coverage are determined by factors such as the value of your home, its location, and the chosen coverage limits. For example, dwelling coverage might cover repairs or rebuilding costs after a fire, while personal property coverage would compensate for stolen or damaged items. Liability coverage would help pay for medical bills or legal fees if someone were injured on your property.

Additional Coverage Options

Beyond the standard coverage, Allstate offers several optional add-ons to customize your policy. These include things like flood insurance (essential in flood-prone areas, as it’s typically not included in standard policies), earthquake insurance (important in seismically active regions), personal liability umbrella insurance (increases your liability coverage limits significantly, providing greater protection against large lawsuits), and valuable items coverage (for items like jewelry or artwork that exceed standard personal property limits). For instance, someone with valuable antique furniture might consider supplemental coverage to ensure adequate protection beyond the standard policy limits.

Allstate Homeowners Insurance Packages: A Comparison

Allstate offers various homeowners insurance packages, often categorized by the level of coverage and included features. While the exact names and details might vary by location and availability, generally, you’ll find options that range from basic coverage to more comprehensive plans. These packages often differ in the amount of coverage provided for each aspect of your home and belongings, the included optional coverages, and the overall premium cost. Choosing the right package depends on your individual needs and risk tolerance.

| Plan Name (Example) | Dwelling Coverage (Example) | Personal Property Coverage (Example) | Estimated Price Range (Annual) |

|---|---|---|---|

| Basic Protection | $250,000 | $125,000 | $800 – $1200 |

| Enhanced Protection | $500,000 | $250,000 | $1200 – $1800 |

| Premier Protection | $750,000 | $375,000 | $1800 – $2500 |

Note: The price ranges provided are examples and will vary significantly based on individual factors such as location, home value, credit score, and selected coverage limits. Contact Allstate directly for an accurate quote.

Allstate Homeowners Insurance

Allstate is a major provider of homeowners insurance, offering a range of coverage options to protect your property and belongings. Understanding their claims process is crucial for policyholders who experience covered damage or loss. This section details the steps involved in filing a claim, the necessary documentation, and communication with Allstate adjusters.

Filing a Homeowners Insurance Claim with Allstate

The process begins with promptly reporting the incident to Allstate. This should be done as soon as reasonably possible after the damage occurs, to initiate the claims process efficiently. Failure to report promptly could affect your claim. Allstate offers multiple avenues for reporting, including online portals, phone calls, and mobile apps. Choosing the method most convenient for you is recommended.

Required Documentation for a Typical Claim

Gathering the necessary documentation before contacting Allstate can expedite the claims process significantly. Typically, you’ll need proof of ownership (such as your deed), photos and videos documenting the damage, a detailed description of the incident, and any relevant repair estimates. Providing complete documentation upfront minimizes delays and back-and-forth communication. In some cases, police reports or other official documentation might also be required, particularly for events like theft or vandalism.

Communicating with Allstate Adjusters

After filing your claim, Allstate will assign an adjuster to investigate the damage. The adjuster will contact you to schedule an inspection of your property. It’s essential to cooperate fully with the adjuster, providing access to the damaged area and answering their questions honestly and completely. Maintaining clear and consistent communication throughout the process is crucial for a smooth resolution. Keep records of all communications, including dates, times, and the names of the individuals you speak with.

Step-by-Step Guide to the Allstate Claims Process

- Report the incident to Allstate immediately through your preferred method (online, phone, or app).

- Gather necessary documentation: photos/videos of damage, proof of ownership, repair estimates, police reports (if applicable).

- An Allstate adjuster will contact you to schedule an inspection of the damaged property.

- Cooperate fully with the adjuster, providing access and answering questions accurately.

- The adjuster will assess the damage and determine the extent of coverage under your policy.

- Allstate will issue a settlement offer based on the adjuster’s assessment.

- Review the settlement offer carefully and discuss any questions or concerns with Allstate.

- Once you accept the offer, Allstate will process the payment according to your chosen method.

Allstate Homeowners Insurance

Allstate is a major player in the homeowners insurance market, offering a range of coverage options to suit diverse needs. Understanding customer experiences is crucial for prospective homeowners considering Allstate. This section examines customer reviews and ratings, comparing Allstate’s performance to its competitors and identifying key trends in customer feedback.

Customer Review Analysis: Positive and Negative Experiences

Analyzing customer reviews from various sources, including independent review sites like J.D. Power and ConsumerAffairs, reveals a mixed bag of experiences with Allstate homeowners insurance. Positive feedback frequently highlights the company’s strong financial stability, wide network of agents, and generally responsive claims process. Conversely, negative reviews often cite difficulties in navigating the claims process, long wait times for claim settlements, and perceived lack of customer service responsiveness in certain situations. The overall sentiment appears to be somewhat polarized, with strong positive and negative opinions coexisting.

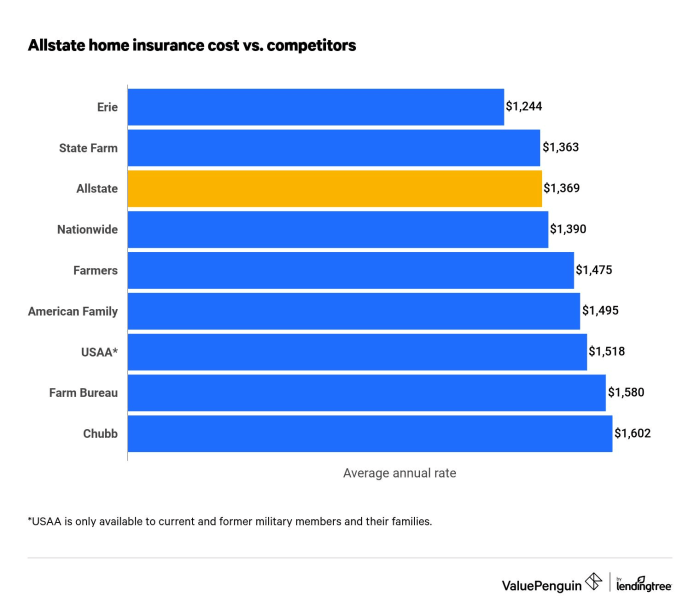

Comparison of Customer Satisfaction Ratings

Allstate’s customer satisfaction ratings vary depending on the source and methodology used. While Allstate often ranks well in terms of financial strength and claims-paying ability, its scores on customer service satisfaction are sometimes lower than those of competitors like State Farm or USAA. For instance, J.D. Power’s annual customer satisfaction surveys frequently place Allstate in the middle of the pack compared to other major national insurers. These discrepancies highlight the importance of considering multiple rating sources and individual customer experiences when making a decision.

Common Themes and Trends in Customer Feedback

Several common themes emerge from customer reviews. A significant number of positive reviews praise Allstate’s robust financial strength and ability to handle large claims effectively. Conversely, a recurring negative theme centers around the complexity of the claims process and communication challenges with adjusters. Some customers report lengthy delays in receiving claim settlements, while others describe frustrating experiences trying to reach customer service representatives. These experiences underscore the importance of clear communication and a streamlined claims process.

Examples of Customer Testimonials

“Allstate handled my recent hail damage claim efficiently and professionally. The adjuster was prompt, thorough, and kept me informed throughout the process. I’m very satisfied with their service.” – John S., ConsumerAffairs

“I’ve been an Allstate customer for years, but my recent experience with a minor claim was incredibly frustrating. The claims process was overly complicated, and it took weeks to get a resolution. I’m considering switching providers.” – Sarah M., Yelp

These testimonials, while anecdotal, illustrate the range of experiences reported by Allstate homeowners insurance customers. The variation in experiences emphasizes the need for thorough research and consideration of individual circumstances before selecting an insurance provider.

Allstate Homeowners Insurance

Securing adequate homeowners insurance is a crucial step in protecting one of your most valuable assets. Allstate, a well-established name in the insurance industry, offers homeowners insurance policies designed to safeguard your property and belongings against various risks. Understanding the pricing structure and the factors influencing the cost of your Allstate homeowners insurance policy is essential for making informed decisions and obtaining the best coverage at a price that suits your budget.

Factors Influencing Allstate Homeowners Insurance Premiums

Several key factors contribute to the final premium calculation for Allstate homeowners insurance. These factors are carefully assessed by Allstate’s underwriting process to determine the level of risk associated with insuring a particular property and its owner. A comprehensive understanding of these factors empowers homeowners to make choices that could potentially lower their premiums.

Location’s Impact on Insurance Costs

Your home’s location significantly impacts your insurance premium. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, generally command higher premiums due to the increased risk of claims. For example, a home situated in a coastal region susceptible to hurricanes will likely have a higher premium than a similar home located inland. Similarly, homes in areas with high crime rates might also see increased premiums due to the elevated risk of theft or vandalism. Allstate uses sophisticated risk assessment models that incorporate historical claims data and geographic information to determine location-based risk.

Home Value and Coverage Level’s Influence on Premiums

The value of your home directly correlates with your insurance premium. A higher-valued home requires a larger payout in case of damage, leading to a higher premium. The level of coverage you choose also impacts the cost. Comprehensive coverage offering broader protection against various perils will naturally cost more than a basic policy with limited coverage. For instance, insuring a $500,000 home with full replacement cost coverage will be more expensive than insuring a $250,000 home with a lower coverage limit.

Illustrative Examples of Premium Calculation

Consider two homeowners, both with Allstate policies. Homeowner A lives in a low-risk area with a $300,000 home and chooses a standard coverage level. Homeowner B lives in a high-risk hurricane zone with a $400,000 home and opts for comprehensive coverage including flood insurance. Homeowner B’s premium will undoubtedly be significantly higher than Homeowner A’s due to the higher home value, higher risk location, and broader coverage.

Impact of Deductible Amount on Overall Cost

Choosing a higher deductible amount can lead to lower premiums. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Opting for a higher deductible means you’ll pay more in the event of a claim, but your premiums will be lower. For example, selecting a $1,000 deductible instead of a $500 deductible could result in a noticeable reduction in your monthly premium, although it will increase your out-of-pocket expenses in the case of a claim. A hypothetical scenario could involve a homeowner comparing a $1000 deductible with a $2000 deductible. The higher deductible will likely result in a 10-15% reduction in the annual premium. However, the homeowner must weigh the cost savings against the potential financial burden of a higher out-of-pocket expense in case of a claim.

Allstate Homeowners Insurance

Protecting your home is a significant investment, and choosing the right homeowners insurance is crucial. Allstate offers comprehensive coverage tailored to your needs, but understanding the available discounts and bundling options can significantly impact your overall cost. This section details the various ways you can potentially save money on your Allstate homeowners insurance policy.

Allstate Homeowners Insurance Discounts

Allstate provides a range of discounts to reward responsible homeowners and encourage proactive risk management. These discounts can vary by location and specific policy details, so it’s always best to contact an Allstate agent for personalized information. However, some commonly offered discounts include:

- Protective Devices Discount: Installing security systems, such as alarms and smoke detectors, often qualifies for a discount. These devices demonstrate a commitment to home safety and reduce the insurer’s risk.

- Claims-Free Discount: Maintaining a clean claims history demonstrates responsible homeownership and can result in lower premiums. The longer you go without filing a claim, the greater the potential discount.

- Home Safety Features Discount: Features like impact-resistant windows or reinforced doors can significantly reduce the risk of damage, leading to potential premium reductions. This incentivizes homeowners to invest in home improvements that enhance safety.

- Bundling Discount: This is a significant discount available when you bundle your homeowners insurance with other Allstate products, as discussed in the next section.

- Loyalty Discount: Long-term customers with a history of consistent payments often qualify for loyalty discounts, rewarding their commitment to Allstate.

Bundling Allstate Homeowners and Auto Insurance

Bundling your Allstate homeowners insurance with your auto insurance, or other Allstate products like renters or umbrella insurance, offers substantial financial advantages. This strategy simplifies your insurance management and often leads to significant cost savings.

The primary benefit of bundling is the combined discount. Allstate typically offers a substantial percentage discount on both your homeowners and auto premiums when you purchase both policies through them. This discount reflects the reduced administrative costs and risk assessment for the insurer when managing multiple policies for a single customer.

| Policy Type | Estimated Annual Cost (Individual) | Estimated Annual Cost (Bundled) | Savings |

|---|---|---|---|

| Homeowners Insurance | $1200 | $1000 | $200 |

| Auto Insurance | $800 | $650 | $150 |

| Total | $2000 | $1650 | $350 |

Note: These are estimated costs and actual savings may vary depending on your specific coverage, location, and risk profile. Contact Allstate for a personalized quote.

Allstate Homeowners Insurance

Allstate homeowners insurance, like most insurance policies, offers comprehensive coverage but also includes exclusions and limitations. Understanding these is crucial for policyholders to avoid unexpected gaps in protection. It’s important to carefully review your specific policy documents for the most accurate and up-to-date information, as coverage details can vary.

Policy Exclusions

Certain events and types of damage are explicitly excluded from Allstate homeowners insurance coverage. These exclusions are typically designed to manage risk and prevent the insurance company from covering events that are considered uninsurable or outside the scope of typical homeowner risks. Understanding these exclusions can help you better prepare for potential losses.

- Earth Movement: This commonly excludes damage caused by earthquakes, landslides, mudslides, and sinkholes. While some policies may offer earthquake coverage as an add-on, it’s usually purchased separately.

- Flooding: Flood damage is typically not covered under standard homeowners insurance policies. Separate flood insurance, often provided by the National Flood Insurance Program (NFIP), is necessary for protection against flooding.

- Acts of War or Terrorism: Damage resulting from war, acts of terrorism, or nuclear incidents is usually excluded.

- Neglect or Intentional Damage: Damage caused by the homeowner’s intentional actions or willful neglect is not covered.

- Normal Wear and Tear: Gradual deterioration of property due to age or normal use is not covered. For example, the gradual fading of paint is not considered a covered event.

- Insect or Rodent Infestation: Damage caused by insects, rodents, or other pests is generally excluded unless the damage results from a sudden and accidental event, such as a roof collapse due to a termite infestation.

Coverage Limitations and Restrictions

Allstate, like other insurers, places limitations on the amount of coverage provided. These limitations can affect the maximum payout for specific types of losses or the overall coverage limits of the policy. Knowing these limitations helps in assessing the adequacy of your coverage.

For example, there may be limits on the coverage for personal property, liability, or additional living expenses in the event of a covered loss. The specific limits will be detailed in your policy documents. Furthermore, deductibles, the amount you pay out-of-pocket before insurance coverage begins, will significantly impact your overall payout. A higher deductible typically results in lower premiums but means you’ll pay more in the event of a claim.

Examples of Denied or Limited Coverage

Understanding scenarios where coverage might be denied or limited is critical for informed decision-making.

For instance, if a homeowner fails to maintain their property adequately, leading to damage that could have been prevented with reasonable upkeep, the claim might be partially or fully denied. Similarly, if a homeowner’s actions contribute to the loss, such as leaving a window open during a hurricane, coverage could be reduced or denied. If a valuable item, like a piece of jewelry, is not properly inventoried and appraised, a claim for its loss may be limited to a lower value.

Allstate Homeowners Insurance

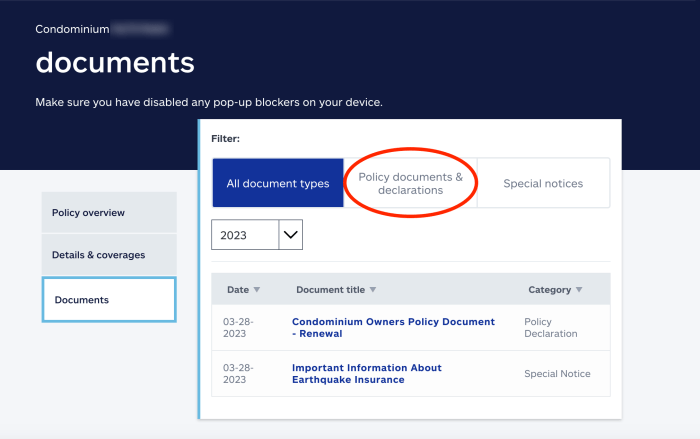

Understanding your Allstate homeowners insurance policy is crucial for protecting your most valuable asset: your home. A thorough understanding of the policy document ensures you’re adequately covered in the event of unforeseen circumstances and prevents costly misunderstandings later. This guide will help you navigate the key sections and terms, empowering you to make informed decisions about your coverage.

Key Sections of an Allstate Homeowners Policy

The Allstate homeowners insurance policy is a comprehensive document, but it’s generally organized into distinct sections. Familiarizing yourself with these sections will allow you to quickly locate specific information when needed. Each section details a different aspect of your coverage, outlining what’s protected and under what circumstances. For example, you’ll find sections dedicated to dwelling coverage, personal property coverage, liability coverage, and additional living expenses. These sections provide detailed explanations of the coverage limits and any exclusions that apply.

Interpreting Policy Language and Implications

Insurance policies often use specific terminology. Understanding this language is paramount to comprehending your coverage. Terms like “actual cash value” (ACV), which considers depreciation, and “replacement cost,” which covers the cost of replacing damaged property without considering depreciation, are crucial distinctions. Similarly, understanding deductibles – the amount you pay out-of-pocket before your insurance coverage kicks in – is essential. The policy will clearly state the deductible amount for different types of claims. Carefully review any exclusions – situations or types of damage not covered by the policy – as these can significantly impact your coverage. For example, flood damage often requires separate flood insurance.

Importance of Reading the Policy Before Signing

Before signing your Allstate homeowners insurance policy, take the time to read it thoroughly. Don’t just skim it; carefully review each section to ensure you understand the terms, conditions, and limitations of your coverage. If anything is unclear, don’t hesitate to seek clarification. Signing a policy without understanding its contents could leave you vulnerable in the event of a claim. Consider using a highlighter to mark key sections, such as coverage limits, deductibles, and exclusions. This will make it easier to reference important information later.

Contacting Allstate for Clarification

If you encounter any terms or sections that are confusing, Allstate provides various avenues for clarification. You can contact your insurance agent directly, who can explain the policy’s intricacies and answer your questions. Alternatively, Allstate’s customer service department is readily available via phone or online. Don’t be afraid to ask questions; clarifying your understanding now will prevent potential issues later. Keeping detailed notes of your conversations and any written clarifications you receive is a prudent practice.

Ending Remarks

Protecting your home requires careful consideration of your insurance needs. This exploration of Allstate homeowners insurance has highlighted the importance of understanding coverage details, the claims process, customer feedback, and the impact of various factors on pricing. By carefully weighing these aspects and considering your individual circumstances, you can confidently select a policy that provides adequate protection and peace of mind. Remember to always read your policy documents thoroughly and contact Allstate directly with any questions or concerns.

FAQ Section

What types of disasters are typically covered by Allstate homeowners insurance?

Allstate typically covers damage from fire, wind, hail, lightning, and vandalism. Specific coverage varies by policy, so review your policy details for complete information.

How does Allstate determine my premium?

Premiums are calculated based on several factors, including your home’s location, value, age, construction materials, coverage level, and your claims history.

What is the process for increasing my coverage limits?

Contact your Allstate agent or representative to discuss increasing your coverage limits. They will guide you through the necessary steps and inform you of any associated premium adjustments.

Can I file a claim online?

Allstate offers online claim filing options for certain types of claims. Check their website for details and eligibility requirements.