Securing your home is a significant investment, and choosing the right home insurance is crucial. This guide delves into Allstate Home Insurance, providing a detailed analysis of its coverage options, pricing factors, customer service, and claims process. We’ll explore the nuances of Allstate’s policies, comparing them to competitors and highlighting key features that set them apart. Understanding these aspects empowers you to make an informed decision about protecting your most valuable asset.

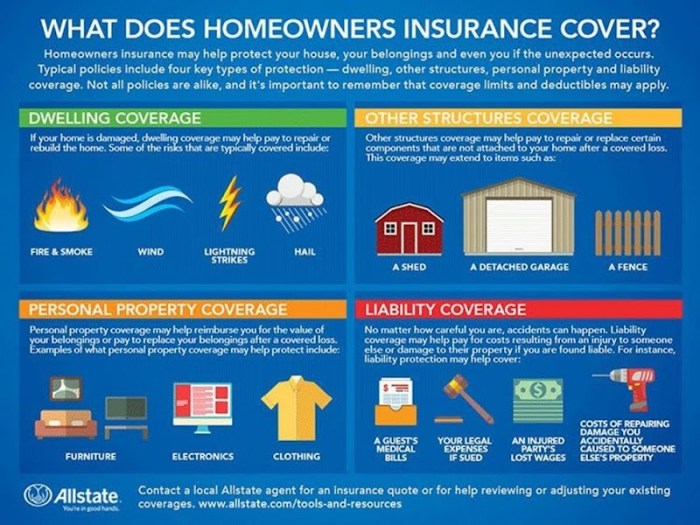

From understanding the different types of coverage available – dwelling, personal property, liability, and additional living expenses – to navigating the claims process and exploring available discounts, this guide aims to provide a comprehensive overview. We’ll also examine how factors like location, home value, and credit score impact premiums, offering practical insights to help you budget effectively and secure the best possible coverage for your needs.

Allstate Home Insurance Pricing and Factors

Understanding the cost of Allstate home insurance involves considering several key factors. The premium you pay is a reflection of the risk Allstate assesses based on your specific circumstances. This ensures that premiums are fair and accurately reflect the potential cost of covering claims.

Several elements contribute to determining your Allstate home insurance premium. These factors are carefully weighed to create a personalized quote that balances affordability with comprehensive coverage.

Factors Influencing Allstate Home Insurance Premiums

A variety of factors influence the price of your Allstate home insurance policy. These factors are carefully considered to provide accurate and fair pricing. Understanding these factors can help you better understand your premium.

- Location: Your home’s location significantly impacts your premium. Areas prone to natural disasters like hurricanes, earthquakes, wildfires, or floods will generally have higher premiums due to the increased risk of claims.

- Home Value: The replacement cost of your home is a major factor. A more expensive home will require a higher premium to cover potential damages.

- Coverage Level: The amount of coverage you choose impacts your premium. Higher coverage limits mean higher premiums, but also greater protection in case of significant damage or loss.

- Credit Score: In many states, your credit score is a factor in determining your premium. A good credit score often translates to lower premiums, reflecting a lower perceived risk.

- Home Features: Features like security systems, fire alarms, and updated plumbing or electrical systems can influence your premium. These features often qualify for discounts.

- Claim History: Your past claim history significantly impacts your premium. Frequent claims indicate a higher risk, potentially leading to higher premiums.

Hypothetical Scenario Illustrating Premium Impact

Let’s consider two hypothetical homeowners: Sarah and John. Both want Allstate home insurance, but their circumstances differ, leading to different premiums.

Sarah lives in a low-risk area with a home valued at $300,000, has excellent credit, and has never filed a claim. She opts for standard coverage. John, on the other hand, lives in a high-risk hurricane zone, has a home valued at $500,000, has a fair credit score, and has filed one claim in the past. He also selects comprehensive coverage. It’s reasonable to expect John’s premium to be significantly higher than Sarah’s due to the increased risk factors.

Allstate Home Insurance Discounts

Allstate offers various discounts to help policyholders save money on their premiums. Taking advantage of these discounts can significantly reduce your overall cost.

- Bundling Discounts: Bundling your home and auto insurance with Allstate often results in a significant discount.

- Home Security Discounts: Installing and maintaining security systems like burglar alarms and fire alarms can qualify you for a discount.

- Claim-Free Discounts: Maintaining a clean claim history usually results in discounts over time.

- Protective Device Discounts: Discounts may be available for installing devices like smoke detectors or water leak detectors.

- Multi-Policy Discounts: Discounts are often available if you insure multiple properties with Allstate.

Allstate Home Insurance and Disaster Preparedness

Allstate home insurance policies are designed not only to provide financial protection after a disaster but also to assist homeowners in preparing for and recovering from such events. Understanding the resources and support available through Allstate is crucial for minimizing the impact of natural disasters on your property and your life. This section details how Allstate’s offerings can help navigate the challenges posed by unforeseen circumstances.

Allstate home insurance policies offer various coverages that can help homeowners prepare for and recover from natural disasters, such as hurricanes, earthquakes, wildfires, and floods. The specific coverages depend on the policy and the location of the property. For example, a policyholder in a hurricane-prone area might have coverage for wind damage, while a policyholder in an earthquake zone might have coverage for seismic activity. Beyond the basic coverage, Allstate also offers supplemental options to enhance protection against specific perils. These supplemental policies can significantly reduce the financial burden after a disaster. Understanding your policy’s specifics is vital in navigating the claims process effectively.

Allstate’s Response to Major Disasters

In the event of a major disaster affecting a large number of Allstate policyholders, the company activates its comprehensive disaster response plan. This plan involves a multi-faceted approach, including rapid claims assessment, expedited payouts, and temporary housing assistance. For example, imagine a scenario where a major hurricane devastates a coastal region, impacting thousands of Allstate policyholders. Allstate would immediately deploy a team of adjusters to the affected area to assess damages and begin processing claims. The company would also establish temporary claims processing centers to expedite the claims process and provide immediate financial assistance to those in need. Furthermore, Allstate would partner with local organizations to provide temporary housing, food, and other essential services to affected policyholders. The goal is to provide swift and effective support, minimizing disruption and helping policyholders rebuild their lives.

Resources for Disaster Risk Mitigation

Allstate offers various resources to help homeowners mitigate risks and protect their homes from damage. These resources are designed to empower homeowners to proactively safeguard their property and reduce the potential for future losses.

Allstate provides valuable resources to help homeowners proactively protect their homes. These resources are designed to enhance preparedness and reduce potential damage from natural disasters.

- Disaster preparedness guides: These guides offer practical advice on how to prepare for various types of natural disasters, including creating emergency plans, securing your home, and assembling emergency kits. They often include checklists and step-by-step instructions to simplify the process.

- Home safety inspections: Allstate may offer or partner with organizations that provide home safety inspections. These inspections identify potential vulnerabilities in a home’s structure and recommend improvements to enhance its resilience against natural disasters. This proactive approach helps to prevent future damage.

- Online resources and tools: Allstate’s website and mobile app provide access to various online resources and tools, including interactive maps showing areas prone to specific natural hazards, and educational materials on disaster preparedness. This readily accessible information empowers homeowners to make informed decisions.

- Expert advice and consultations: Allstate may offer or connect policyholders with experts who can provide advice on home improvements to increase its resistance to natural disasters. This could include consultations with structural engineers or contractors specialized in disaster-resistant construction.

Final Conclusion

Protecting your home requires careful consideration of various factors, and Allstate Home Insurance offers a range of options to meet diverse needs. This guide has explored the key aspects of Allstate’s offerings, from coverage details and pricing influences to customer service experiences and disaster preparedness resources. By understanding these elements, you can confidently assess whether Allstate aligns with your specific requirements and make an informed decision about safeguarding your investment.

Popular Questions

What types of disasters are covered by Allstate Home Insurance?

Allstate typically covers damage from common perils such as fire, wind, hail, and theft. Specific coverage for natural disasters like earthquakes or floods often requires separate endorsements or riders, and availability varies by location.

How does Allstate determine my home insurance premium?

Allstate considers several factors, including your home’s location, value, age, construction materials, coverage level, claims history, and your credit score. A higher credit score often correlates with lower premiums.

What is Allstate’s claims process like?

The process generally involves reporting the claim promptly, providing necessary documentation, and cooperating with Allstate’s adjusters. The speed and efficiency of the process can vary depending on the claim’s complexity and circumstances.

Does Allstate offer any discounts?

Yes, Allstate offers various discounts, including those for bundling insurance policies (home and auto), having security systems, and maintaining a good claims history. Specific discounts vary by location and policy.