Navigating the complex world of business insurance can feel overwhelming. However, understanding the benefits of an “all lines” policy can significantly simplify risk management and provide crucial financial protection. This comprehensive coverage bundles various essential insurance types into a single, streamlined package, offering peace of mind for businesses of all sizes. We’ll explore the intricacies of all lines insurance, outlining its components, advantages, and crucial considerations for selection and claims processes.

From defining the scope of all lines coverage and detailing its constituent parts to examining the selection process and potential coverage gaps, this guide provides a clear and concise overview. We’ll also delve into practical examples, demonstrating the real-world value of this comprehensive insurance solution and offering insights into mitigating potential risks.

Defining “All Lines Insurance”

All lines insurance represents a comprehensive package of insurance coverage designed to protect businesses from a wide array of potential risks. Unlike policies that focus on a single type of risk, all lines insurance bundles multiple coverages into one convenient policy, simplifying administration and potentially reducing overall costs. This broad protection is particularly valuable for businesses with diverse operations or exposure to multiple liability scenarios.

All lines insurance policies typically encompass several key types of coverage, providing a holistic approach to risk management. The specific coverages included can vary depending on the insurer and the needs of the business, but a comprehensive policy will often address a significant portion of a company’s potential liabilities.

Types of Insurance Included in All Lines Policies

The components of an all lines insurance policy are designed to offer protection across various potential loss scenarios. Common types of coverage frequently included are commercial general liability (CGL), commercial auto insurance, workers’ compensation, professional liability (errors and omissions), and property insurance. CGL protects against bodily injury or property damage caused by the business’s operations, while commercial auto insurance covers accidents involving company vehicles. Workers’ compensation covers employee injuries or illnesses related to their work, and professional liability protects against claims of negligence or errors in professional services. Property insurance safeguards the business’s physical assets, such as buildings and equipment, against damage or loss. Other potential inclusions might be business interruption insurance, cyber liability insurance, and umbrella liability insurance, providing even broader protection.

Businesses that Utilize All Lines Insurance

A wide range of businesses find all lines insurance to be a valuable tool for managing risk. Companies with diverse operations, such as construction firms, often face a higher level of exposure across multiple liability categories. Similarly, businesses providing professional services, such as consulting firms or medical practices, frequently need protection against professional liability claims. Retail establishments, restaurants, and manufacturing companies all benefit from the comprehensive coverage offered by an all lines policy, mitigating potential financial losses from various unforeseen events. Essentially, any business facing multiple potential risks will find value in this type of bundled coverage.

Comparison of All Lines Insurance with Other Insurance Types

| Insurance Type | Coverage Scope | Typical Policyholders | Cost Considerations |

|---|---|---|---|

| All Lines Insurance | Broad, encompassing multiple types of coverage (e.g., general liability, auto, workers’ compensation, property) | Businesses with diverse operations and exposure to multiple risks | Potentially higher upfront cost, but can offer cost savings compared to purchasing individual policies |

| Commercial Auto Insurance | Covers accidents and damages involving company vehicles | Businesses that own or operate vehicles | Cost varies based on factors such as vehicle type, driver history, and mileage |

| General Liability Insurance | Protects against claims of bodily injury or property damage caused by the business’s operations | Most businesses, regardless of size or industry | Cost depends on factors such as business type, revenue, and risk profile |

| Workers’ Compensation Insurance | Covers medical expenses and lost wages for employees injured on the job | Businesses with employees | Cost is based on industry classification, payroll, and claims history |

Benefits of All Lines Insurance

All lines insurance offers significant advantages to businesses by providing comprehensive coverage across various risks. This holistic approach simplifies risk management, reduces potential financial burdens, and fosters greater peace of mind, allowing businesses to focus on their core operations. The benefits extend beyond simple protection; they contribute directly to the overall financial health and stability of the organization.

All lines insurance streamlines risk management by consolidating multiple insurance policies into a single, comprehensive package. This simplification reduces administrative burdens, such as managing multiple policy renewals, dealing with separate claims processes, and coordinating coverage across different insurers. The single point of contact provided by an all-lines insurer simplifies communication and ensures consistent application of coverage across all insured risks. This unified approach facilitates a more efficient and effective risk management strategy.

Simplified Risk Management for Businesses

The complexity of modern business operations often exposes companies to a wide range of potential risks, including property damage, liability claims, and business interruption. Managing these risks individually can be time-consuming and costly. All lines insurance consolidates these risks under a single policy, providing a streamlined approach to risk mitigation. This allows businesses to focus their resources on their core competencies rather than on the administrative complexities of managing diverse insurance policies. A comprehensive policy helps businesses identify potential vulnerabilities and develop proactive risk management strategies, ultimately improving their resilience to unforeseen events. For example, a manufacturing company could have its property, liability, and equipment covered under one policy, simplifying its insurance management.

Case Studies Demonstrating Loss Mitigation

Consider a hypothetical scenario involving a small bakery. Without all-lines insurance, a fire could result in separate claims for building damage, equipment loss, and business interruption. Processing these claims individually would be complex and time-consuming. With all-lines insurance, the bakery would file a single claim, simplifying the process and potentially speeding up recovery. The insurer would handle all aspects of the claim, coordinating with contractors for repairs and providing financial support for lost income during the rebuilding period. Similarly, a retail store facing a liability claim due to a customer injury would benefit from the consolidated coverage, simplifying the claims process and reducing the overall administrative burden. The claim would be handled efficiently under the umbrella of the all-lines policy.

Key Financial Benefits of an All Lines Policy

The financial benefits of an all-lines policy are substantial and contribute significantly to a business’s overall financial health. Understanding these advantages is crucial for businesses seeking to optimize their risk management strategies and protect their financial stability.

- Reduced Premiums: While seemingly counterintuitive, consolidating multiple policies into one can sometimes lead to lower overall premiums due to economies of scale and the reduced administrative costs for the insurer.

- Simplified Budgeting: A single premium payment simplifies budgeting and financial forecasting, eliminating the need to track and manage multiple policy payments.

- Faster Claims Processing: A single point of contact for claims typically results in quicker processing times, minimizing disruptions to business operations.

- Comprehensive Coverage: The breadth of coverage offered by an all-lines policy ensures that a wider range of potential risks are protected, reducing the likelihood of significant uninsured losses.

- Improved Cash Flow: Faster claim settlements can improve cash flow, particularly crucial during periods of business interruption or unexpected events.

Components of an All Lines Insurance Policy

An all-lines insurance policy bundles various types of coverage, offering comprehensive protection for businesses and individuals. Understanding its components is crucial for maximizing its benefits and ensuring adequate risk mitigation. This section details the core coverages, factors influencing cost, and a hierarchical structure illustrating the relationship between different coverage options.

Core Coverages in an All Lines Policy

A typical all-lines insurance policy encompasses a range of coverages, tailored to the specific needs of the insured. These core components usually include property insurance, liability insurance, and potentially other specialized coverages depending on the policy and the insured’s needs. Property insurance protects against damage or loss to physical assets, while liability insurance covers financial losses resulting from injuries or damages caused to third parties. Additional coverages might encompass business interruption, professional liability (errors and omissions), or workers’ compensation.

Factors Influencing the Cost of an All Lines Insurance Policy

Several factors contribute to the overall cost of an all-lines insurance policy. These factors are interconnected and influence the premium calculation process. The primary factors include the types and amounts of coverage selected, the insured’s risk profile (including claims history), the location of the insured property or business, and the specific industry or occupation. For example, a business operating in a high-risk area will likely face higher premiums compared to a similar business in a low-risk area. The value of the assets being insured also significantly impacts the premium. Furthermore, the insurer’s underwriting standards and market conditions play a role in determining the final cost.

Hierarchical Structure of Coverage Options

The various coverage options within an all-lines policy can be organized hierarchically, reflecting their interdependencies. At the top level, we have the overarching policy itself, encompassing all the different coverages. Below this, we find major categories like Property Insurance and Liability Insurance. Property Insurance further branches into sub-categories such as building coverage, contents coverage, and business personal property coverage. Similarly, Liability Insurance can be divided into General Liability, Product Liability, and Professional Liability. Each of these sub-categories may have further specialized options based on specific needs and risk assessments.

Visual Representation of Coverage Areas

Imagine a concentric circle diagram. The outermost circle represents the overall All-Lines Insurance Policy. The next inner circle is divided into two major sections: Property Insurance and Liability Insurance. Each of these sections is further subdivided into smaller, concentric circles representing specific coverage types. For example, the Property Insurance section might contain circles representing Building Coverage, Contents Coverage, and Business Personal Property Coverage. Similarly, the Liability Insurance section could have circles representing General Liability, Product Liability, and Professional Liability. These inner circles could even be further subdivided to represent specific aspects within each coverage type. This visual representation clearly shows how the different coverages are nested within the overall policy, highlighting their relationships and interdependencies.

Choosing the Right All Lines Insurance Provider

Selecting the appropriate all lines insurance provider is crucial for securing comprehensive protection and ensuring a smooth claims process. The market offers a diverse range of insurers, each with its own strengths and weaknesses. Careful consideration of several key factors will help you make an informed decision that best suits your specific needs and risk profile.

Comparing All Lines Insurance Provider Services

Different all lines insurance providers offer varying levels of coverage, policy options, and customer service. Some may specialize in certain industries or types of risks, while others offer a broader range of services. For example, one provider might excel in providing liability coverage for large corporations, while another might focus on comprehensive packages for small businesses. A thorough comparison should involve analyzing the specific coverages offered, the ease of policy management (online portals, app availability), and the responsiveness and helpfulness of their customer service teams. This comparative analysis allows you to identify providers whose services align with your operational needs and risk management strategies.

Checklist for Selecting an All Lines Insurance Provider

Choosing the right provider involves a systematic evaluation. This checklist highlights critical factors to consider:

- Financial Stability: Assess the insurer’s financial strength ratings from reputable agencies like A.M. Best or Moody’s. A high rating indicates a lower risk of insolvency.

- Coverage Options: Examine the breadth and depth of coverage offered. Ensure the policy adequately protects against all potential risks relevant to your business operations.

- Policy Exclusions and Limitations: Carefully review policy exclusions and limitations to understand what is not covered. This prevents unpleasant surprises during a claim.

- Premium Costs: Compare premiums from different providers, but avoid solely focusing on price. A lower premium may reflect limited coverage.

- Customer Service: Evaluate the responsiveness and helpfulness of the insurer’s customer service team. Check online reviews and testimonials.

- Claims Process: Understand the insurer’s claims process, including the documentation required and the typical processing time.

- Reputation and Track Record: Research the insurer’s reputation within the industry. Look for reviews and testimonials from other clients.

Questions to Ask Potential Insurers

Proactive inquiry is essential for a suitable fit. These examples illustrate pertinent questions transformed into informative statements:

- Financial Strength: The insurer’s financial strength ratings from A.M. Best and Moody’s are readily available for review.

- Claims Handling Procedures: The insurer’s claims process involves a detailed explanation of required documentation and typical processing timelines.

- Policy Customization: The insurer offers various policy customization options to tailor coverage to specific business needs.

- Customer Support Channels: The insurer provides multiple customer support channels, including phone, email, and online chat.

- Technological Capabilities: The insurer offers online tools and resources for managing policies and filing claims.

Evaluating Financial Stability and Reputation

Assessing an insurer’s financial health and reputation is paramount. This involves checking their financial strength ratings from independent rating agencies like A.M. Best, Standard & Poor’s, and Moody’s. Higher ratings indicate greater financial stability and a lower risk of insolvency. Additionally, researching online reviews and testimonials from other clients can provide valuable insights into their reputation for customer service and claims handling. For instance, a consistently high rating from A.M. Best, coupled with overwhelmingly positive client reviews, would suggest a reliable and reputable insurer. Conversely, a low rating or numerous negative reviews should raise concerns.

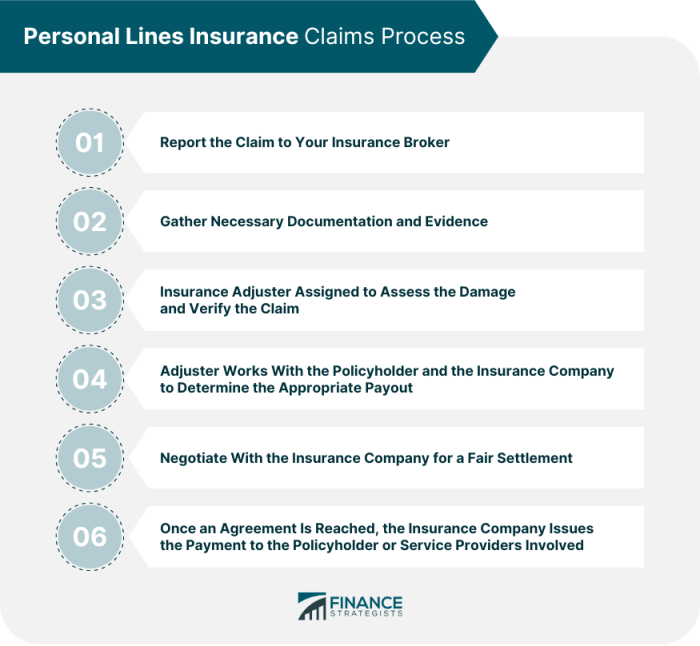

Claims Process for All Lines Insurance

Filing a claim under an all-lines insurance policy involves several steps, designed to ensure a fair and efficient resolution. The process can vary slightly depending on the specific insurer and the nature of the claim, but the fundamental steps remain consistent. Understanding this process can significantly ease the burden during a stressful time.

The claims process typically begins with immediate notification to your insurer. This is crucial for initiating the investigation and preserving evidence. Following notification, a thorough investigation is undertaken to verify the details of the incident and assess the extent of the damage or loss. The insurer will request documentation to support your claim and may also conduct their own independent investigation. Finally, once the investigation is complete, the insurer will make a determination on your claim, potentially resulting in payment or denial, with an explanation provided in case of denial.

Documentation Required for Claim Submission

Providing complete and accurate documentation is vital for a smooth and timely claims process. Missing or incomplete documentation can significantly delay the settlement of your claim. Generally, you’ll need to provide information such as the date, time, and location of the incident; a detailed description of the event, including the circumstances leading to the loss or damage; and any relevant police reports or other official documentation. Depending on the type of claim, additional documents might be necessary, such as repair estimates, medical bills, or photographs of the damaged property. It is recommended to keep detailed records of all communication with your insurer.

Common Claim Scenarios and Procedures

Different types of claims require different procedures. For instance, a car accident claim will involve providing details of the accident, police reports (if applicable), and vehicle repair estimates. A homeowner’s claim for damage due to a storm might require photographs of the damage, contractor estimates for repairs, and proof of ownership. A liability claim arising from an accident on your property would necessitate documentation related to the incident, including witness statements, medical reports (if injuries occurred), and police reports. Each claim scenario requires specific evidence to support the validity and extent of the loss.

Claims Process Flowchart

The claims process can be visualized as a flowchart:

1. Incident Occurs: The insured event happens (e.g., car accident, fire, theft).

2. Immediate Notification: The insured immediately contacts their insurance provider to report the incident.

3. Claim Filed: The insured submits a formal claim, providing initial information and details.

4. Documentation Request: The insurer requests supporting documentation (police reports, medical records, repair estimates, etc.).

5. Investigation: The insurer investigates the claim, possibly including an on-site inspection or interviews.

6. Claim Assessment: The insurer assesses the validity and extent of the claim based on the provided information and investigation.

7. Claim Decision: The insurer makes a decision to approve or deny the claim. If approved, the insurer determines the payout amount.

8. Payment (if approved): If the claim is approved, the insurer processes the payment according to the policy terms.

9. Claim Denial (if applicable): If denied, the insurer provides a detailed explanation of the reasons for denial.

10. Appeal (if applicable): The insured may have the option to appeal the denial decision, following the insurer’s established appeal process.

Potential Gaps in All Lines Insurance Coverage

While all-lines insurance provides comprehensive coverage across various business risks, it’s crucial to understand that no policy offers absolute protection against every conceivable event. Certain situations and exposures might fall outside the scope of standard policies, leaving businesses vulnerable to significant financial losses. A thorough understanding of these potential gaps and proactive strategies to mitigate them is essential for effective risk management.

Many standard all-lines insurance policies have exclusions or limitations that could leave businesses exposed. For instance, specific types of pollution or environmental damage, intentional acts by employees, or certain types of cyberattacks might not be fully covered. Similarly, the policy’s limits of liability might be insufficient to cover the full extent of a major loss. Regular review and updating of the policy is therefore paramount to ensure adequate protection as the business evolves and the risk landscape changes.

Coverage Gaps and Mitigation Strategies

Understanding potential coverage gaps is the first step towards effective risk management. The following table Artikels common areas where all-lines insurance might fall short and suggests practical strategies to address these vulnerabilities.

| Potential Coverage Gap | Description | Suggested Solution | Example |

|---|---|---|---|

| Insufficient Limits of Liability | The policy’s coverage limits may not be high enough to cover the total cost of a significant loss, such as a major product liability lawsuit or a catastrophic event. | Increase policy limits or secure excess liability insurance (umbrella coverage). | A small manufacturing company experiences a product defect resulting in widespread injuries. Their existing liability limits are quickly exhausted, leading to significant financial strain. Umbrella coverage could have bridged this gap. |

| Specific Exclusions (e.g., Pollution, Cyberattacks) | Many policies exclude coverage for certain types of events, such as environmental pollution or cyberattacks, even if they cause substantial damage. | Purchase separate pollution liability insurance or cyber liability insurance. Review the policy exclusions carefully and negotiate broader coverage if possible. | A data breach resulting from a cyberattack could lead to significant legal fees, regulatory fines, and reputational damage, none of which might be covered under a standard all-lines policy. A specialized cyber liability policy would be needed. |

| Emerging Risks | New and evolving risks, such as those related to artificial intelligence or drone technology, might not be adequately addressed in existing policies. | Regularly review and update the policy to ensure it addresses emerging risks and technological advancements. Consult with an insurance broker to discuss relevant coverage options. | A company utilizing AI in its operations faces a lawsuit related to an AI-driven decision. The existing all-lines policy might not provide adequate coverage for this novel type of liability. |

| Employee Dishonesty or Fraud | Standard policies may have limits on coverage for losses caused by employee dishonesty or fraud. | Consider supplemental crime insurance to enhance coverage for employee dishonesty and other fraudulent activities. | An employee embezzles a substantial amount of company funds. While some coverage might exist, supplemental crime insurance could ensure complete recovery of losses. |

Regular Policy Review and Updates

Regularly reviewing and updating an all-lines insurance policy is not merely a formality; it’s a critical component of proactive risk management. As a business grows, changes its operations, or enters new markets, its risk profile inevitably shifts. A policy that adequately protected the business a year ago might be insufficient today. Annual reviews, at minimum, are essential to ensure the policy continues to provide the appropriate level of coverage and protection. This review should include a thorough examination of the policy’s terms, conditions, exclusions, and limits of liability, as well as a reassessment of the business’s current risk profile. Working with an experienced insurance broker can help identify potential gaps and ensure the policy remains tailored to the business’s evolving needs.

Outcome Summary

Securing comprehensive business protection is paramount for sustained success. All lines insurance offers a powerful solution, consolidating diverse coverage needs into a single, manageable policy. By carefully considering the factors Artikeld—from selecting a reputable provider to understanding potential coverage gaps and proactively addressing them—businesses can confidently mitigate risks and safeguard their future. This streamlined approach to risk management not only simplifies operations but also provides crucial financial security, allowing businesses to focus on growth and innovation.

User Queries

What types of businesses benefit most from all lines insurance?

Businesses with diverse operations or exposure to multiple risks, such as contractors, retailers, and restaurants, often find all lines insurance particularly beneficial.

Can I customize an all lines policy to fit my specific needs?

Yes, most insurers offer customizable options to tailor coverage to your business’s unique requirements and risk profile.

How often should I review my all lines insurance policy?

It’s recommended to review your policy annually, or more frequently if your business experiences significant changes (e.g., expansion, new equipment).

What happens if my insurer goes bankrupt?

Most jurisdictions have guaranty associations that protect policyholders in the event of insurer insolvency, ensuring continued coverage or reimbursement.