Understanding aleatory contracts in insurance is crucial for both insurers and the insured. These contracts, fundamentally characterized by unequal exchange of value and inherent uncertainty, form the bedrock of many insurance policies. This exploration delves into the intricacies of aleatory contracts, examining their defining features, legal implications, and practical applications across various insurance sectors.

We will explore how risk is allocated, the role of uncertainty in determining outcomes, and the legal frameworks governing these agreements. We’ll also analyze real-world examples, highlighting the impact of aleatory contracts on both insurers and insureds, and consider the influence of these contracts on the broader insurance market’s stability and efficiency. This examination aims to provide a comprehensive understanding of this pivotal aspect of insurance.

Definition and Characteristics of Aleatory Contracts in Insurance

Aleatory contracts form the bedrock of the insurance industry. Understanding their unique characteristics is crucial to grasping the fundamental principles governing insurance agreements. These contracts differ significantly from other contractual arrangements due to the inherent uncertainty surrounding their performance and the unequal exchange of value between parties.

Aleatory contracts are agreements where the performance of one or both parties is contingent upon the occurrence of an uncertain event. The value exchanged by each party is not necessarily equal, and one party might receive significantly more than the other, depending on whether the uncertain event occurs. This contrasts sharply with commutative contracts, where the exchange of value is roughly equal at the time of the agreement.

Fundamental Principles of Aleatory Contracts

The core principle of an aleatory contract is the element of chance or risk. The outcome is uncertain, and the obligations of the parties are dependent on the occurrence or non-occurrence of a future event, often beyond the control of either party. This inherent uncertainty is what distinguishes aleatory contracts from other types of agreements. A key aspect is that the contract is valid and binding even if the uncertain event never happens. The insured pays premiums for the potential protection, not a guaranteed return.

Key Distinguishing Elements of Aleatory Contracts

Several key elements distinguish aleatory contracts from other contract types. Firstly, the element of chance is paramount. Secondly, the performance of the contract is conditional upon the occurrence of a specified uncertain event. Thirdly, the consideration exchanged by the parties is often unequal. Finally, the contract remains valid and binding regardless of whether the uncertain event materializes.

Examples of Aleatory Contracts in Insurance

Numerous insurance policies perfectly illustrate the aleatory nature of insurance contracts. A simple example is a standard homeowner’s insurance policy. The homeowner pays premiums regularly, but the insurance company only pays out if a covered event, such as a fire or theft, occurs. Similarly, life insurance policies are quintessential aleatory contracts. The insured pays premiums throughout their life, but the beneficiary only receives a payout upon the insured’s death. Auto insurance policies function similarly; premiums are paid regardless of whether an accident occurs.

Comparison of Aleatory and Commutative Contracts in Insurance

Aleatory and commutative contracts represent contrasting approaches to contractual agreements. Commutative contracts involve a relatively equal exchange of value between parties at the time of the agreement. In contrast, aleatory contracts involve an unequal exchange of value, contingent upon the occurrence of a future uncertain event. The uncertainty inherent in aleatory contracts is the defining difference.

Comparison Table: Aleatory vs. Commutative Contracts in Insurance

| Feature | Aleatory Contract | Commutative Contract |

|---|---|---|

| Exchange of Value | Unequal; dependent on uncertain event | Roughly equal at the time of agreement |

| Uncertainty | High; outcome uncertain | Low; outcome predictable |

| Risk | Significant risk for one or both parties | Minimal risk for both parties |

| Examples | Life insurance, auto insurance, homeowner’s insurance | Purchase of goods or services |

Risk Allocation and Uncertainty in Aleatory Insurance Contracts

Aleatory contracts, a cornerstone of the insurance industry, are characterized by a fundamental imbalance in the exchange of value between the parties involved. This imbalance stems from the inherent uncertainty surrounding the occurrence of the insured event, creating a unique dynamic in risk allocation and the overall contract outcome. Understanding this dynamic is crucial to comprehending the nature of insurance itself.

The core principle of an aleatory insurance contract is the transfer of risk from the insured to the insurer. The insured pays a premium, a relatively certain payment, in exchange for the insurer’s promise to pay a potentially much larger sum if a specific, uncertain event occurs. This transfer hinges on the principle of indemnity, ensuring the insured is not unjustly enriched, and the insurer’s ability to spread the risk across a large pool of policyholders. The contract’s outcome, therefore, is contingent upon the occurrence (or non-occurrence) of a future event that is inherently unpredictable.

Risk Allocation Between Insurer and Insured

The allocation of risk is unequal and conditional. The insured assumes the risk of paying premiums without receiving a payout, while the insurer assumes the risk of potentially substantial payouts if the insured event occurs. The insurer mitigates this risk through diversification, careful underwriting, and actuarial modeling to predict the likelihood of claims and set appropriate premiums. The insured, on the other hand, mitigates their risk by transferring it, accepting the certainty of premium payments for the potential uncertainty of a large claim.

The Role of Uncertainty in Determining Contract Outcome

Uncertainty is the defining feature of an aleatory contract. The contract’s value to both parties is heavily dependent on future events that are inherently uncertain. The insurer’s profit depends on the infrequency of claims, while the insured’s benefit lies in the potential for a large payout in the event of a covered loss. This uncertainty is addressed through statistical analysis and risk assessment techniques that allow insurers to price policies appropriately and manage their overall exposure. Without uncertainty, the contract would be a simple exchange of equal value, lacking the core characteristic of an aleatory agreement.

Types of Risks Covered by Aleatory Insurance Contracts

Aleatory insurance contracts cover a wide range of risks, broadly categorized as property, liability, and life risks. Property insurance covers losses to physical assets like homes and vehicles. Liability insurance protects against financial losses arising from legal liability, such as car accidents or professional negligence. Life insurance provides a death benefit to beneficiaries upon the insured’s death. Each type of insurance involves a different level of risk and uncertainty, impacting premium calculations and contract design.

Examples of Disparate Payment Outcomes

In many instances, the insured’s payment significantly outweighs the insurer’s payment. For example, a homeowner pays premiums for years without experiencing a fire. Conversely, situations exist where the insurer’s payment far surpasses the insured’s total premium payments. A major house fire resulting in a total loss would be such a case, where the insurance payout could be hundreds of thousands of dollars, far exceeding the total premiums paid over many years. Similarly, a large liability claim arising from a serious accident could far outweigh the premiums paid for liability insurance.

Scenarios Illustrating High-Risk/Low-Premium vs. Low-Risk/High-Premium Contracts

A high-risk, low-premium aleatory contract could be a flood insurance policy in a high-risk flood zone. The probability of a significant flood event is high, resulting in a higher potential payout for the insurer. Consequently, the premium is relatively high to offset this risk. Conversely, a low-risk, high-premium contract might be a term life insurance policy for a young, healthy individual. The probability of death within the policy term is low, thus the potential payout for the insurer is low, resulting in a lower premium. However, the policy might offer a substantial death benefit, leading to a relatively high premium for the guaranteed protection.

Legal and Regulatory Aspects of Aleatory Insurance Contracts

The aleatory nature of insurance contracts—where the exchange of values is unequal and contingent upon a future uncertain event—introduces unique legal complexities. Understanding these complexities is crucial for both insurers and policyholders, impacting contract formation, interpretation, and enforcement. This section explores the legal and regulatory landscape surrounding these contracts, highlighting key principles and potential disputes.

Legal Implications of Aleatory Nature

The fundamental characteristic of aleatory contracts, the inherent uncertainty of outcome, significantly influences their legal treatment. Courts must carefully balance the principles of freedom of contract with the potential for unfairness arising from unforeseen events. For instance, the doctrine of utmost good faith, a cornerstone of insurance law, necessitates a higher level of disclosure and honesty from the insured compared to typical contracts. Breach of this duty, even unintentional misrepresentation, can void the policy. Furthermore, the principle of indemnity, aiming to restore the insured to their pre-loss position, often requires careful assessment of damages and the potential for over-compensation. The unequal exchange of premiums for potential future benefits means courts must scrutinize the contract’s terms for potential ambiguities or unfairness, particularly regarding exclusions and limitations of liability.

Regulatory Frameworks Governing Aleatory Insurance Contracts

Insurance regulation varies significantly across jurisdictions. Many countries have dedicated insurance regulatory bodies that oversee insurers’ solvency, the fairness of their policies, and the handling of claims. For example, in the United States, state-level insurance departments play a crucial role, setting minimum capital requirements, approving policy forms, and mediating disputes. The European Union has a more harmonized approach, with directives aimed at promoting consumer protection and market stability across member states. These regulations often include specific provisions addressing the unique challenges posed by aleatory contracts, such as requirements for clear and unambiguous policy language, standardized policy forms, and dispute resolution mechanisms. In many jurisdictions, regulators also impose restrictions on the types of risks insurers can underwrite and the terms they can include in their policies, aiming to prevent the exploitation of consumers.

Examples of Legal Disputes Arising from Aleatory Insurance Contracts

Numerous legal disputes arise from the interpretation and enforcement of aleatory insurance contracts. Common areas of contention include determining whether a covered event occurred, the extent of the insurer’s liability, and the validity of policy exclusions. For example, a dispute might arise over whether a specific loss falls under the definition of “accident” or “injury” in a liability policy, or whether a pre-existing condition excludes coverage for a subsequent illness. Another common dispute involves the interpretation of policy exclusions, particularly those relating to acts of God or intentional acts. These disputes often necessitate expert testimony and detailed examination of the policy language, the circumstances surrounding the loss, and the relevant case law. The outcome can significantly impact both the insurer’s and the insured’s financial positions.

Legal Treatment in Common Law and Civil Law Systems

Common law and civil law systems approach the interpretation and enforcement of aleatory insurance contracts differently. Common law systems, such as those in the United States and England, rely heavily on precedent and judicial interpretation of individual contracts. The emphasis is on the specific terms of the policy and the intent of the parties at the time of contract formation. Civil law systems, prevalent in many European countries, often have codified insurance laws that provide a more structured framework for resolving disputes. The interpretation of contracts tends to be more literal, with less emphasis on the parties’ subjective intent. Despite these differences, both systems recognize the unique nature of aleatory contracts and strive to balance the interests of insurers and insureds while ensuring fair and efficient dispute resolution.

Key Legal Principles Related to Aleatory Insurance Contracts

Several key legal principles underpin the formation, interpretation, and enforcement of aleatory insurance contracts. These include the principles of offer and acceptance, consideration, capacity, and legality. The doctrine of utmost good faith, as previously mentioned, is paramount. This requires both the insurer and the insured to act with complete honesty and transparency in all aspects of the insurance relationship. Furthermore, the principle of indemnity ensures that the insured is not compensated beyond their actual loss. Subrogation, where the insurer steps into the shoes of the insured to recover losses from a third party, is another crucial principle. Finally, the rules of contract interpretation, focusing on the plain meaning of the policy language and the context in which it was written, are essential for resolving disputes arising from ambiguities or uncertainties.

Practical Applications and Examples of Aleatory Contracts in Insurance

Aleatory contracts form the bedrock of the insurance industry. Their inherent uncertainty, where the exchange of values is unequal and contingent upon a future event, is precisely what makes insurance possible. This section will explore various practical applications of aleatory contracts within the insurance sector, demonstrating their impact on both insurers and insureds.

The aleatory nature of insurance contracts fundamentally shapes how insurers price policies and manage risk. Because the outcome is uncertain, insurers rely on statistical analysis and actuarial science to predict the likelihood of claims and set premiums accordingly. This process balances the potential for large payouts with the need to maintain profitability.

Types of Insurance Policies as Aleatory Contracts

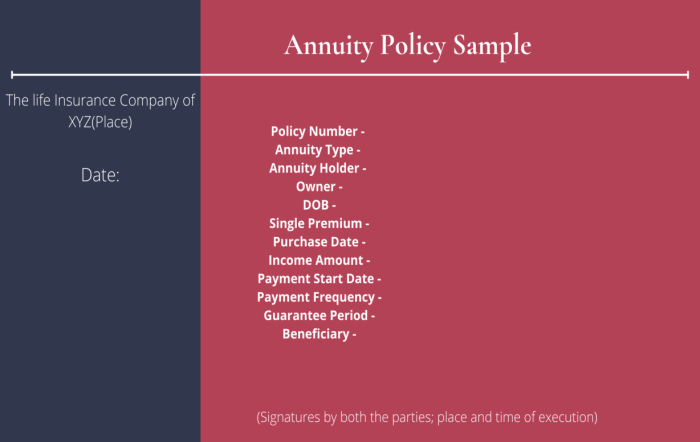

Several common insurance policies perfectly illustrate the aleatory principle. Life insurance, for instance, involves the insured paying premiums over time, with the insurer only paying out a death benefit if the insured passes away. The insured may pay premiums for decades without ever receiving a payout. Similarly, health insurance policies involve premium payments in exchange for coverage of medical expenses, which may or may not be incurred. Property insurance policies, protecting against damage or loss to property, follow the same pattern; premiums are paid, and the insurer only pays if a covered event occurs. The uncertainty inherent in each of these scenarios is a defining characteristic of an aleatory contract.

Impact of Aleatory Nature on Pricing and Risk Management

The aleatory nature significantly impacts how insurance companies price their policies and manage their risk. Insurers utilize actuarial science, employing sophisticated statistical models to analyze historical data on claims, mortality rates (in the case of life insurance), and property damage frequency. This analysis helps determine the probability of different outcomes and allows insurers to set premiums that cover expected payouts, administrative costs, and a profit margin. The uncertainty necessitates a careful balancing act: premiums must be sufficiently high to cover potential losses, but not so high as to deter customers. Risk management strategies, including diversification of policy portfolios and reinsurance (purchasing insurance for their own risk), are crucial in mitigating the impact of unpredictable events.

Real-World Case Studies

Consider a scenario where a homeowner pays premiums for property insurance for ten years without filing a claim. This represents the classic aleatory nature: a consistent outlay with a potential, but uncertain, significant payout. Conversely, a major hurricane could lead to numerous claims on property insurance policies, resulting in substantial payouts for insurers. This demonstrates the potential for significant financial swings based on the unpredictable occurrence of insured events. Similarly, a life insurance policy where the insured dies unexpectedly early leads to a significant payout, while a long lifespan might mean the premiums far outweigh the eventual payout to beneficiaries. These examples highlight the potential for both significant losses and gains within the aleatory framework.

The Role of Actuarial Science

Actuarial science is integral to managing risk within aleatory insurance contracts. Actuaries use statistical methods to model the probability of future events, allowing insurers to accurately assess risk and price policies accordingly. This includes analyzing mortality rates, morbidity rates (for health insurance), property damage statistics, and other relevant data. By employing sophisticated models and incorporating various factors, actuaries help insurers strike a balance between profitability and the provision of adequate coverage. The accuracy of these actuarial models directly influences the insurer’s financial stability and the affordability of insurance premiums for consumers.

Advantages and Disadvantages of Aleatory Contracts

The following points Artikel the advantages and disadvantages of aleatory contracts for both insurers and insureds:

For Insurers:

- Advantage: Potential for profit through careful risk assessment and premium setting.

- Advantage: Spreads risk across a large pool of policyholders, mitigating the impact of individual claims.

- Disadvantage: Exposure to significant losses due to unforeseen events or catastrophic occurrences.

- Disadvantage: The need for sophisticated risk management strategies and actuarial expertise.

For Insureds:

- Advantage: Protection against financial losses due to unforeseen events.

- Advantage: Peace of mind knowing that potential risks are transferred to the insurer.

- Disadvantage: Premiums must be paid regardless of whether a claim is ever filed.

- Disadvantage: Potential for disputes over coverage or claim payouts.

The Impact of Aleatory Contracts on Insurance Markets

Aleatory contracts form the bedrock of the insurance industry, fundamentally shaping its structure, stability, and efficiency. Their inherent uncertainty, where the exchange of value is unequal depending on the occurrence of a future event, profoundly impacts how risk is managed and transferred within the market. Understanding this impact is crucial for comprehending the functioning and future development of insurance systems.

The influence of aleatory contracts on the overall stability and efficiency of insurance markets is multifaceted. They enable the efficient transfer of risk from individuals and businesses to insurers, allowing economic activity to flourish without the crippling burden of potential catastrophic losses. This risk transfer mechanism, inherent in the unequal exchange of premiums and potential payouts, underpins the entire insurance ecosystem. Moreover, the pooling of risks, a direct consequence of numerous aleatory contracts, allows insurers to predict and manage aggregate losses more effectively, leading to greater market stability and competitive pricing.

Risk Transfer and Risk Pooling through Aleatory Contracts

Aleatory contracts are the primary mechanism for risk transfer in insurance. Individuals and businesses pay premiums (a relatively certain cost) to transfer the risk of unpredictable losses to insurers. In return, the insurer agrees to compensate the insured for covered losses should they occur. This transfer is inherently unequal because the insurer’s payout is contingent on a future uncertain event. The pooling of numerous similar risks, all bound by aleatory contracts, allows insurers to leverage the law of large numbers. This law suggests that the more similar risks an insurer pools, the more accurately they can predict the overall likelihood and magnitude of losses, leading to more stable and predictable financial outcomes for the insurer. This stability, in turn, allows insurers to offer competitive premiums and maintain financial solvency. For example, a homeowner’s insurance company pools risks from thousands of homeowners, allowing them to accurately estimate the aggregate cost of potential property damage from events like fire or storms.

Challenges and Risks Associated with Aleatory Contracts

While aleatory contracts are essential, their widespread use presents certain challenges. Adverse selection, where individuals with a higher risk of loss are more likely to purchase insurance, can destabilize the market if not adequately managed through underwriting processes and risk assessment. Moral hazard, where insured individuals may engage in riskier behavior knowing they are protected, is another concern. Insurers mitigate these challenges through careful underwriting, risk assessment models, and the incorporation of deductibles and co-insurance provisions into the contracts. Furthermore, the inherent uncertainty in aleatory contracts necessitates sophisticated actuarial models and robust capital reserves to ensure the insurer’s ability to meet its obligations, even in the face of unexpected large-scale losses. The failure to accurately assess and manage these risks can lead to insurer insolvency and disruption to the insurance market. For instance, an insurer failing to account for the increasing frequency of severe weather events could face significant financial losses, impacting their ability to pay claims and potentially causing market instability.

Aleatory Contracts in Different Insurance Sectors

The application of aleatory contracts varies across different insurance sectors. In personal lines insurance (e.g., auto, home, health), contracts often involve relatively standardized terms and conditions, focusing on protecting individuals against common risks. Commercial lines insurance (e.g., liability, property, workers’ compensation), on the other hand, often involves more customized contracts tailored to the specific risks faced by businesses. The complexity of risks and the higher potential for significant losses in commercial lines lead to more sophisticated underwriting and risk management strategies compared to personal lines. The degree of uncertainty inherent in the aleatory contract also differs; for example, the probability of a car accident is statistically more predictable than the likelihood of a major industrial accident.

Technological Advancements and Aleatory Insurance Contracts

Technological advancements significantly impact the design and implementation of aleatory insurance contracts. The use of big data analytics, machine learning, and artificial intelligence allows insurers to better assess and price risk, leading to more accurate premiums and improved risk management. Telematics in auto insurance, for example, provide real-time data on driving behavior, enabling insurers to offer customized premiums based on individual risk profiles. Blockchain technology has the potential to enhance transparency and efficiency in claims processing and contract management. Furthermore, InsurTech innovations are leading to the development of new types of insurance products and distribution channels, further shaping the landscape of aleatory contracts within the insurance industry. For example, the use of drone technology for property inspections allows for quicker and more efficient risk assessments, directly influencing the pricing and terms of homeowner’s insurance policies.

Final Thoughts

Aleatory contracts are the lifeblood of the insurance industry, facilitating risk transfer and pooling in a way that benefits both parties, albeit with inherent uncertainties. Understanding the legal and practical implications of these contracts, from risk allocation to market stability, is essential for navigating the complexities of the insurance landscape. This exploration has highlighted the critical role of aleatory contracts in managing and mitigating risk, emphasizing the importance of clear understanding for all stakeholders.

User Queries

What is the difference between an aleatory and a commutative contract?

In a commutative contract, the value exchanged by each party is roughly equal. An aleatory contract involves unequal exchange, where the outcome is uncertain at the time of agreement.

Can an aleatory contract be voided?

Yes, like any contract, an aleatory contract can be voided due to misrepresentation, fraud, or lack of capacity. Specific legal grounds for voiding will vary by jurisdiction.

How does actuarial science relate to aleatory contracts?

Actuaries use statistical methods to assess and manage the risks inherent in aleatory contracts, helping insurers set premiums and manage their exposure.

Are all insurance policies aleatory contracts?

Most insurance policies are aleatory, but some aspects might involve elements of commutative contracts. The core principle of unequal exchange and uncertainty generally defines them as aleatory.