Navigating the world of Airbnb rentals often involves questions about insurance—both for hosts protecting their property and guests seeking peace of mind. This comprehensive guide unravels the complexities of Airbnb insurance policies, clarifying coverage for hosts and guests alike. We’ll explore the various types of insurance available, compare provider offerings, and highlight crucial terms and conditions to ensure you’re fully protected during your Airbnb experience.

From understanding liability coverage for accidental damages to navigating cancellation policies and claims processes, we aim to provide a clear and concise overview of the insurance landscape within the Airbnb ecosystem. Whether you’re a seasoned host or a first-time guest, this guide offers invaluable insights to help you make informed decisions and avoid potential pitfalls.

Airbnb Host Insurance Coverage

Protecting your property and your livelihood as an Airbnb host is crucial. Understanding the intricacies of Airbnb host insurance is vital for mitigating potential risks and ensuring financial security. This section details the various types of coverage, common exclusions, and a comparison of leading providers.

Types of Airbnb Host Insurance Coverage

Several insurance options cater specifically to the needs of Airbnb hosts, offering varying levels of protection. These typically fall under the umbrella of either a standard homeowner’s or renter’s insurance policy with added endorsements, or a specialized short-term rental insurance policy. Standard policies might offer limited coverage for short-term rentals, often with exclusions or limitations. Specialized policies, however, are designed to address the unique risks associated with hosting guests. They usually provide broader coverage for liability, property damage, and other potential issues specific to short-term rentals. Some policies may even include coverage for lost income due to unforeseen circumstances.

Common Exclusions in Airbnb Host Insurance Policies

While policies aim to provide comprehensive protection, certain events or circumstances are typically excluded from coverage. Common exclusions include intentional acts of damage by the host or guest, damage caused by pre-existing conditions not disclosed, acts of terrorism, and damage resulting from naturally occurring events that are already covered under a separate policy (e.g., flood insurance). Specific exclusions vary depending on the provider and the policy details. It’s essential to carefully review the policy wording to understand what is and isn’t covered.

Comparison of Airbnb Host Insurance Providers

Different insurance providers offer varying levels of coverage and pricing. For instance, one provider might offer higher liability limits but may have stricter requirements for property security. Another provider may offer more comprehensive coverage for property damage but at a higher premium. Choosing the right provider depends on the individual host’s needs and risk tolerance. Factors such as the location of the property, the type of property, and the frequency of bookings all influence the appropriate level of coverage and the cost of the insurance.

Comparison of Three Common Airbnb Host Insurance Plans

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Liability Coverage | $1,000,000 | $500,000 | $2,000,000 |

| Property Damage Coverage | $100,000 | $75,000 | $150,000 |

| Guest Medical Expenses | Included | Included (up to $10,000) | Included (up to $25,000) |

| Lost Income Coverage | Optional Add-on | Not Offered | Included (with limitations) |

*Note: These are hypothetical examples and actual coverage amounts and features will vary by provider and policy. Always refer to the specific policy documents for accurate details.*

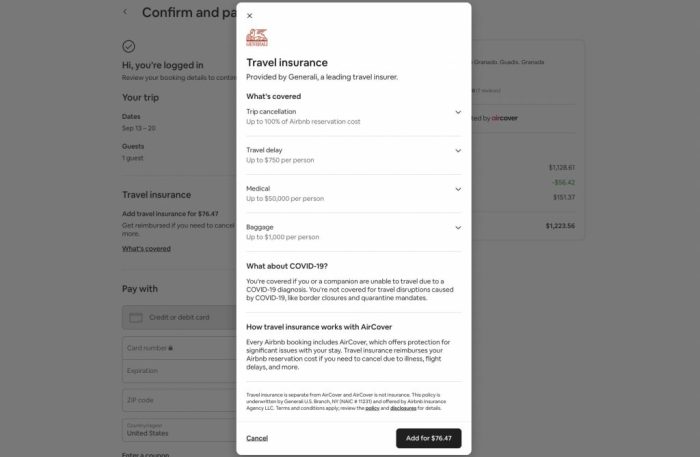

Airbnb Guest Insurance Protection

While Airbnb provides a degree of protection for guests, it’s crucial to understand its limitations and consider supplemental travel insurance. Airbnb’s Host Guarantee program offers reimbursement for certain damages or losses caused by a guest, but this doesn’t cover all potential issues a guest might face during their stay. It’s essential to know the extent of Airbnb’s coverage and when personal travel insurance becomes a necessary safeguard.

Airbnb’s platform offers a basic level of protection for guests. This primarily focuses on reimbursement for certain damages or losses, typically up to a specific limit, in the event of specific circumstances, such as property damage caused by the guest. However, this protection is limited and does not cover a wide range of potential travel disruptions or emergencies. For example, it generally won’t cover medical emergencies, trip cancellations due to unforeseen circumstances, lost luggage, or personal liability issues.

Situations Requiring Additional Travel Insurance

Many situations beyond the scope of Airbnb’s protection can significantly impact a guest’s trip. These situations highlight the importance of comprehensive travel insurance. Purchasing a separate travel insurance policy acts as a safety net, providing financial protection against unforeseen events that could otherwise lead to substantial financial losses.

Benefits of Separate Travel Insurance for Airbnb Stays

Separate travel insurance offers several key benefits that complement, rather than replace, Airbnb’s limited guest protection. It provides broader coverage for a wider range of events, including medical emergencies, trip cancellations, lost or stolen belongings, and flight delays. Furthermore, it offers peace of mind, knowing that unexpected events won’t derail a carefully planned vacation and cause significant financial strain. The financial protection provided can alleviate stress and allow for a more enjoyable travel experience.

Examples of Beneficial Scenarios for Guest Travel Insurance

Consider these scenarios where guest travel insurance would be invaluable:

- Medical Emergency: A guest suffers a serious illness or injury requiring hospitalization during their stay. Travel insurance would cover medical expenses, evacuation costs, and potentially lost trip costs.

- Trip Cancellation: A sudden family emergency or severe weather forces a guest to cancel their trip. Travel insurance can reimburse for non-refundable flights, accommodation, and other prepaid expenses.

- Lost or Stolen Belongings: A guest’s luggage is lost or stolen, resulting in the loss of valuable items. Travel insurance can compensate for the value of these lost possessions.

- Flight Delays or Cancellations: Unexpected flight disruptions cause significant delays or cancellations. Travel insurance can cover expenses related to accommodation, meals, and transportation during the delay.

- Personal Liability: A guest accidentally causes damage to the Airbnb property beyond the scope of Airbnb’s Host Guarantee. Travel insurance can help cover these additional costs.

Understanding Policy Terms and Conditions

Understanding the terms and conditions of your Airbnb insurance policy is crucial for both hosts and guests. This section clarifies key aspects to ensure you’re protected and know how to proceed in case of unforeseen circumstances. Familiarizing yourself with these details will empower you to navigate any issues confidently and efficiently.

Key Terms and Conditions for Airbnb Hosts

Airbnb host insurance policies typically cover liability for property damage caused by guests, accidental injuries occurring on the property, and in some cases, loss of personal belongings. However, specific coverages and exclusions vary widely depending on the chosen policy and provider. It’s vital to thoroughly review your policy document for detailed information about your specific coverage. Pay close attention to clauses regarding liability limits, deductibles, and exclusions. For instance, some policies may exclude coverage for certain types of damage, such as those resulting from pre-existing conditions or intentional acts. Understanding these limitations is essential for effective risk management.

The Airbnb Host Claim Filing Process

Filing a claim typically involves contacting your insurance provider directly, either via phone or through their online portal. You will need to provide details of the incident, including dates, times, and a detailed description of the damage or injury. Many providers require photos and/or videos as supporting evidence. The provider will then assess the claim, potentially requesting further documentation or conducting an investigation. The timeframe for claim resolution varies depending on the complexity of the case and the provider’s processing speed. Remember to retain all relevant communication and documentation throughout the process.

Documentation Required for Airbnb Host Claims

The specific documentation needed will vary depending on the nature of the claim. However, generally, you should expect to provide the following: a copy of your insurance policy, detailed descriptions of the incident, including dates and times, photographic or video evidence of the damage or injury, any police reports filed, guest communication records (messages, booking details, etc.), and repair estimates or invoices for any necessary repairs or replacements. The more comprehensive your documentation, the smoother and faster the claim process will be.

Understanding Airbnb Guest Protection Policies

Airbnb’s guest protection policies offer varying levels of coverage depending on the specific circumstances. These policies are designed to provide guests with a degree of security and financial protection during their stay. It’s important to note that these policies are not travel insurance and do not cover everything.

A Step-by-Step Guide for Guests Filing a Claim

First, thoroughly review the Airbnb Guest Protection policy details available on the Airbnb website or within your booking confirmation. Second, carefully document the incident, including dates, times, and a detailed description of what happened. Gather any supporting evidence, such as photos, videos, or receipts. Third, contact Airbnb’s customer support team immediately to report the incident and initiate the claims process. They will guide you through the necessary steps and provide further instructions. Fourth, provide all the requested documentation to Airbnb promptly. Finally, maintain clear communication with Airbnb throughout the claim process to ensure a smooth resolution.

Liability and Damage Coverage

Airbnb hosts face potential liability for guest injuries or property damage. Understanding the extent of your coverage is crucial for peace of mind and financial protection. This section details the liability coverage offered by various Airbnb insurance providers and highlights situations where standard homeowner’s or renter’s insurance may fall short.

Liability coverage protects you from financial losses resulting from accidents or damage caused by your guests while they are on your property. This typically includes medical expenses for guest injuries, costs associated with repairing or replacing damaged property, and legal fees if a lawsuit arises. The specific details and limits of this coverage vary depending on the insurance provider and the type of policy you have. It’s vital to carefully review the policy documents to understand exactly what is and isn’t covered.

Liability Limits Offered by Airbnb Insurance Providers

Different Airbnb insurance providers offer varying liability limits. Some policies may offer a base level of coverage, while others offer higher limits for an additional premium. For example, one provider might offer $1 million in liability coverage, while another might offer $2 million or even more. The cost of increasing your coverage limit will depend on various factors, including the location of your property, the type of property, and the history of claims. It is crucial to compare policies and choose a level of coverage that aligns with your risk tolerance and the value of your property. It’s important to note that these limits apply to the total amount paid out for any one incident, not per guest or per claim.

Situations Where Personal Liability Insurance May Be Insufficient

A host’s personal liability insurance policy, such as a homeowner’s or renter’s insurance policy, may not adequately cover the unique risks associated with hosting guests through Airbnb. Standard policies often have limitations or exclusions related to business activities, and renting out a property is considered a business activity by many insurers. This means that a claim arising from a guest injury or property damage could be denied, or the payout could be significantly less than expected. Additionally, personal liability policies may not cover all types of damages, such as those caused by intentional acts of guests. Therefore, supplemental Airbnb-specific insurance is often recommended.

Common Scenarios Requiring Liability Coverage

It’s important to understand the types of situations where liability coverage could be essential. Here are some common scenarios:

- A guest slips and falls on your property, resulting in medical expenses and potential legal action.

- A guest damages your property, either intentionally or accidentally, requiring costly repairs or replacements.

- A guest’s belongings are stolen or damaged while on your property, leading to a claim against you.

- A guest is injured while using a defective appliance or piece of equipment on your property.

- A guest causes damage to a neighbor’s property while on your property.

These are just a few examples; many other unforeseen events could occur, highlighting the importance of adequate liability protection for Airbnb hosts.

Insurance Options and Costs

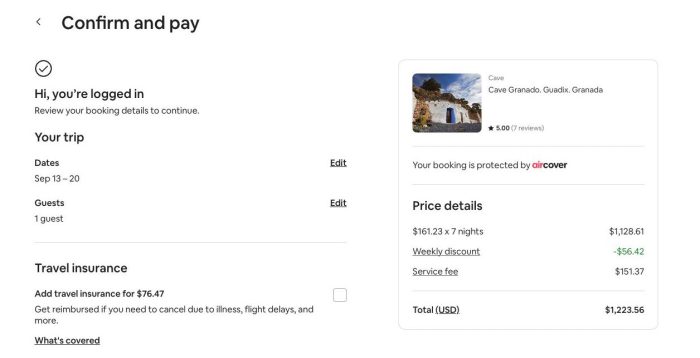

Choosing the right Airbnb insurance plan involves carefully weighing coverage levels against the associated costs. Several factors influence the final premium, making it crucial to understand the nuances of different options available to both hosts and guests. This section details the typical cost structures and helps you compare the value proposition of various plans.

The cost of Airbnb insurance varies significantly depending on several key factors. These include the type of coverage sought (host or guest), the location of the property (urban areas tend to be more expensive), the property type (a large house will cost more to insure than a small apartment), and the level of coverage selected (higher coverage equates to higher premiums). Additionally, the insurer’s own risk assessment plays a role, considering factors such as claims history and security features of the property.

Airbnb Host Insurance Costs

Host insurance premiums are influenced by the value of the property, its location, and the level of liability coverage desired. For instance, a host insuring a luxury home in a high-risk area will pay considerably more than a host insuring a small apartment in a low-crime neighborhood. Basic liability coverage might start around $100 annually, while comprehensive plans, including property damage and loss of income, could range from $500 to $1500 or more per year. Factors like the inclusion of additional coverages, such as accidental damage caused by guests or specific liability protections, further affect the cost.

Airbnb Guest Insurance Costs

Guest insurance is typically less expensive than host insurance because it focuses on personal liability and trip interruption. Plans may range from $10 to $50 per trip, depending on the length of stay and the level of coverage. For example, a basic plan might cover lost luggage, while a more comprehensive plan might also include medical expenses and trip cancellation due to unforeseen circumstances. Many travel insurance providers offer policies specifically designed for Airbnb stays, often integrated into existing travel insurance policies, which might offer a slight discount.

Cost-Effectiveness Comparison

A cost-effectiveness comparison requires a careful evaluation of the potential risks versus the insurance premiums. A visual representation, in the form of a scatter plot, could effectively illustrate this. The x-axis would represent the annual insurance premium, and the y-axis would represent the level of coverage (represented as a percentage of potential losses covered). Data points would represent different insurance plans. Plans offering high coverage at a relatively low premium would be positioned in the bottom-right quadrant, indicating high cost-effectiveness. Conversely, plans with low coverage and high premiums would be in the top-left quadrant, indicating low cost-effectiveness. The scatter plot would allow for a quick visual comparison of the various plans, allowing hosts and guests to identify options that best align with their risk tolerance and budget. For example, a point far to the right and high up on the graph would show a plan with very high coverage but also a very high premium. A point closer to the bottom right would indicate a plan that provides substantial coverage for a relatively lower premium, demonstrating better value.

Cancellation Policies and Insurance

Airbnb’s cancellation policies and your separate insurance coverage are distinct but can interact in significant ways. Understanding this interplay is crucial for protecting your financial interests as either a host or a guest. Your Airbnb booking is subject to the specific cancellation policy selected by the host, ranging from flexible to strict. However, separate travel or homeowner’s insurance may offer additional protection beyond what Airbnb provides.

Cancellation policies Artikel the financial consequences of cancelling a reservation. They dictate the percentage of the booking cost you may lose depending on the timing of the cancellation. This is often presented as a refund percentage or a schedule showing refunds based on notice period. Your personal insurance policies, however, might cover certain unforeseen circumstances that lead to cancellation, potentially reimbursing you for the losses incurred due to the Airbnb cancellation policy.

Interaction Between Airbnb Cancellation Policies and Separate Insurance

Airbnb’s cancellation policies determine the refund you receive directly from the platform. These policies are set by hosts and are typically categorized as flexible, moderate, or strict. They detail the refund amounts available depending on when the cancellation occurs. Separate travel insurance or homeowner’s insurance (for hosts) can act as a secondary layer of protection. If a covered event, such as a sudden illness or a covered disaster, necessitates a cancellation, your insurance might reimburse you for the non-refundable portion of your Airbnb booking as Artikeld in your policy. It’s important to review both your Airbnb cancellation policy and your insurance policy to understand the coverage limits and exclusions.

Situations Where Insurance Might Cover Cancellation Fees

Insurance might cover cancellation fees if the cancellation is due to unforeseen and covered circumstances. For example, a comprehensive travel insurance policy may cover cancellations due to:

- Serious illness or injury requiring medical attention.

- Unexpected death of a family member.

- Severe weather events rendering travel unsafe or impossible (provided it’s a covered event in your policy).

- Job loss (depending on the specific policy wording).

Similarly, a homeowner’s insurance policy for hosts might offer coverage for cancellations necessitated by unforeseen circumstances impacting the property’s habitability, such as a burst pipe causing significant damage. It is crucial to check the specific terms and conditions of your insurance policy as coverage varies greatly.

Potential Gaps in Coverage Related to Cancellations

While insurance can offer valuable protection, it’s important to acknowledge potential gaps in coverage. Many policies exclude cancellations due to:

- Simple changes of plans or personal convenience.

- Pre-existing medical conditions (unless specifically covered with a pre-existing condition waiver).

- Events that were foreseeable at the time of booking.

Furthermore, some policies may have limitations on the amount of reimbursement, and may require you to exhaust all other avenues of recourse (such as claiming a refund from Airbnb under their cancellation policy) before filing a claim.

Examples Where Cancellation Insurance is Particularly Important

Cancellation insurance is especially valuable in situations involving high financial risk or significant unforeseen events. Consider these scenarios:

- Expensive Bookings: For expensive or non-refundable bookings (like a luxury villa rental or a multi-week stay), cancellation insurance provides a financial safety net against unexpected events. Imagine losing thousands of dollars due to a sudden illness preventing you from traveling.

- Non-Refundable Flights/Transportation: If your Airbnb booking is tied to non-refundable flights or other transportation, cancellation insurance can help mitigate the losses if your trip is disrupted.

- Events and Conferences: Booking an Airbnb for a conference or event requires careful consideration. Cancellation insurance is especially beneficial as the cost of the accommodation is often linked to the event itself.

- High-Risk Destinations: If you’re traveling to a region prone to natural disasters or political instability, cancellation insurance can protect you against potential losses due to unforeseen circumstances.

Conclusion

Understanding Airbnb insurance is crucial for both hosts and guests to mitigate risks and ensure a smooth and secure experience. By carefully considering the different coverage options, comparing providers, and understanding the policy terms and conditions, you can significantly reduce potential financial burdens and safeguard your interests. Remember to always review your specific policy details and seek additional insurance if necessary to complement Airbnb’s offerings. A well-informed approach to insurance guarantees a more confident and enjoyable Airbnb journey for everyone.

FAQ Compilation

What if my Airbnb host cancels my booking?

Airbnb’s cancellation policy dictates the refund process. However, additional travel insurance may cover non-refundable expenses incurred due to the cancellation.

Does Airbnb insurance cover lost or stolen belongings?

Airbnb’s host liability insurance may cover some guest property damage, but not necessarily lost or stolen items. Guests should consider purchasing travel insurance for personal belongings.

What type of incidents are usually covered under host liability insurance?

Typical coverage includes accidental injuries to guests on the property and damages to the property caused by guests, subject to policy terms and exclusions.

How much does Airbnb host insurance typically cost?

Costs vary greatly depending on factors like location, property type, and coverage level. It’s best to obtain quotes from different providers for comparison.

Can I file a claim directly with Airbnb or do I need to go through an insurance provider?

The claims process depends on the specific insurance policy. Some claims may be handled directly through Airbnb, while others require contacting the insurance provider.