Navigating the world of car insurance can feel like driving through a maze, especially in a state as diverse as Georgia. Premiums vary wildly based on factors ranging from your driving history and the type of vehicle you own to your location and even your age. This guide cuts through the complexity, offering practical strategies to find affordable car insurance in Georgia without sacrificing necessary coverage. We’ll explore the state’s regulatory landscape, compare insurance providers, and uncover valuable discounts to help you secure the best possible rates.

Understanding Georgia’s insurance requirements is the first step. We’ll delve into the minimum coverage mandated by the state and then explore the benefits of opting for more comprehensive protection. We’ll also examine how various factors influence your premium, empowering you to make informed decisions and potentially save hundreds of dollars annually. This guide is your roadmap to securing reliable, affordable car insurance that fits your individual needs and budget.

Understanding Georgia’s Car Insurance Market

Georgia’s car insurance market operates within a framework of state regulations designed to protect both drivers and insurance companies. Understanding this regulatory landscape and the factors influencing costs is crucial for securing affordable and appropriate coverage. This section will explore the key aspects of Georgia’s car insurance market, enabling consumers to make informed decisions.

Georgia’s Car Insurance Regulatory Landscape

The Georgia Department of Insurance (DOI) oversees the state’s car insurance industry, setting minimum coverage requirements, regulating insurance company practices, and addressing consumer complaints. The DOI’s role is to ensure fair and competitive pricing while maintaining solvency within the insurance market. This regulatory framework includes guidelines on policy wording, claims handling, and rate filings, aiming to protect consumers from unfair practices. Companies must adhere to these regulations to operate legally within the state.

Factors Influencing Georgia Car Insurance Costs

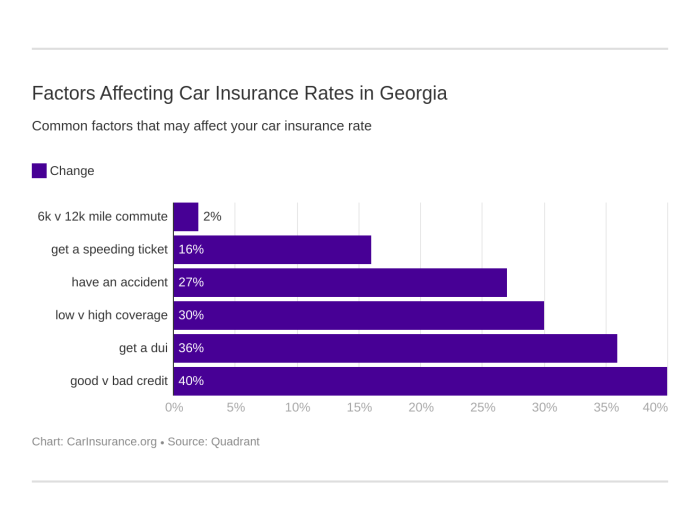

Several factors significantly influence the cost of car insurance in Georgia. Demographics play a role, with age and location significantly impacting premiums. Younger drivers, for example, statistically have higher accident rates, leading to higher premiums. Geographic location also matters; areas with higher crime rates or more frequent accidents generally have higher insurance costs. Driving history is paramount; individuals with a history of accidents, speeding tickets, or DUI convictions will typically pay more. The type of vehicle also affects premiums; high-performance cars or those with a history of theft are often more expensive to insure. Finally, the level of coverage chosen directly impacts the cost; higher coverage limits naturally result in higher premiums.

Types of Car Insurance Coverage in Georgia

Georgia offers various car insurance coverage options, each designed to address different risks. Liability coverage is the most basic and legally required, protecting you financially if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage from events other than collisions, such as theft, vandalism, or weather-related incidents. Uninsured/Underinsured Motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance. Personal Injury Protection (PIP) coverage covers medical expenses and lost wages for you and your passengers, regardless of fault. Medical Payments coverage is similar to PIP but often provides more limited benefits.

Minimum vs. Recommended Car Insurance Coverage in Georgia

It’s important to understand the difference between the minimum legally required coverage and the recommended coverage levels for comprehensive protection. While the minimum protects you from the most basic liabilities, higher coverage limits offer greater financial security in the event of a serious accident.

| Coverage Type | Minimum Required | Recommended | Description |

|---|---|---|---|

| Bodily Injury Liability | 25/50 | 100/300 or higher | Covers injuries to others in an accident you cause. (25/50 means $25,000 per person, $50,000 per accident) |

| Property Damage Liability | 25,000 | 100,000 or higher | Covers damage to others’ property in an accident you cause. |

| Uninsured/Underinsured Motorist | 25/50 | 100/300 or higher | Covers injuries if hit by an uninsured or underinsured driver. |

| Collision | Not Required | Recommended | Covers damage to your vehicle in an accident, regardless of fault. |

Finding Affordable Insurance Options

Securing affordable car insurance in Georgia requires a strategic approach. By understanding the factors influencing your premiums and employing effective strategies, you can significantly reduce your annual costs. This section Artikels various methods to achieve lower insurance rates and navigate the Georgia car insurance market effectively.

Finding the best car insurance rates involves a multi-pronged strategy. It’s not just about comparing prices; it’s about understanding what drives those prices and proactively managing the factors within your control.

Factors Affecting Car Insurance Rates

Insurance companies in Georgia, like those nationwide, use a complex algorithm to determine your premiums. Several key factors contribute to this calculation. These factors are carefully weighed to assess your risk profile as a driver. Understanding these factors allows you to make informed decisions to potentially lower your premiums.

- Driving History: Your driving record is paramount. Accidents, speeding tickets, and DUI convictions significantly increase your rates. A clean driving record is your best asset.

- Age and Gender: Statistically, younger drivers and males tend to have higher accident rates, resulting in higher premiums. This is a factor outside of individual control, but choosing a safe vehicle and defensive driving practices can help mitigate this.

- Vehicle Type: The make, model, and year of your vehicle influence your premiums. Sports cars and luxury vehicles are generally more expensive to insure due to higher repair costs and a higher theft risk. Choosing a vehicle with good safety ratings can sometimes offset this.

- Location: Your address matters. Areas with higher crime rates and more frequent accidents typically have higher insurance rates due to increased risk.

- Credit Score: In many states, including Georgia, your credit score can be a factor in determining your insurance rates. A good credit score often correlates with responsible behavior, leading to lower premiums.

- Coverage Levels: The amount of coverage you choose (liability, collision, comprehensive) directly impacts your premium. Higher coverage levels mean higher premiums, but offer greater protection.

Strategies for Lowering Premiums

Several proactive steps can help lower your car insurance costs. These strategies focus on mitigating the risk factors insurance companies consider.

- Maintain a Clean Driving Record: This is arguably the most effective way to lower your premiums. Avoid speeding tickets, accidents, and DUI convictions. Defensive driving courses can help improve your driving skills and potentially lower your rates.

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Compare rates from multiple insurers to find the best deal. Online comparison tools can streamline this process.

- Increase Your Deductible: Choosing a higher deductible reduces your monthly premium, but you’ll pay more out-of-pocket if you have an accident. Carefully weigh the trade-off between premium savings and potential out-of-pocket expenses.

- Bundle Your Insurance: Combining your car insurance with homeowners or renters insurance can often result in significant discounts. This is a common strategy offered by many insurers.

- Consider Usage-Based Insurance: Some insurers offer programs that track your driving habits using telematics devices. Safe driving can lead to premium reductions.

Benefits and Drawbacks of Bundling Insurance

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is a popular way to save money.

- Benefits: Bundling often leads to significant discounts, simplifying your insurance management, and potentially providing more comprehensive coverage.

- Drawbacks: You may be locked into a single insurer, potentially missing out on better rates for a specific type of insurance if offered by a different company. Also, changing one policy might necessitate changes to the other, potentially creating inconvenience.

Comparing Insurance Providers

Choosing the right car insurance provider in Georgia can significantly impact your budget and peace of mind. A thorough comparison of different providers is crucial to finding the best coverage at the most affordable price. This involves understanding not only the price but also the scope of coverage, customer service reputation, and financial stability of the company.

Georgia Car Insurance Provider Comparison

The Georgia car insurance market is competitive, with numerous companies offering a range of policies. Below is a comparison of five major providers, highlighting their strengths and weaknesses. Note that rates vary based on individual factors like driving history, location, and the type of vehicle. This table provides a general overview and should not be considered exhaustive or a substitute for obtaining personalized quotes.

| Provider | Strengths | Weaknesses | Average Customer Rating (Example) |

|---|---|---|---|

| State Farm | Extensive agent network, wide range of coverage options, strong financial stability. | Can be more expensive than some competitors, claims process may be slow in some cases. | 4.5 out of 5 stars |

| GEICO | Competitive pricing, easy online quote process, strong brand recognition. | Limited agent support, fewer customization options compared to some competitors. | 4.2 out of 5 stars |

| Progressive | Name-Your-Price® Tool allows for customized coverage selection, strong online presence. | Customer service can be inconsistent, some policies may have limitations. | 4.0 out of 5 stars |

| Allstate | Wide range of coverage options, strong financial stability, good customer service reputation in some areas. | Pricing can be higher than competitors, may not offer the most flexible options. | 4.3 out of 5 stars |

| Farmers Insurance | Local agents provide personalized service, strong focus on customer relationships. | Pricing may be higher than online-only providers, fewer digital tools compared to competitors. | 4.1 out of 5 stars |

Importance of Carefully Reading Policy Details

Before committing to a car insurance policy, thoroughly reviewing the policy documents is paramount. Understanding the specific coverages, exclusions, deductibles, and premiums is crucial to avoid unexpected costs or insufficient protection. Paying attention to details like the definition of “accident,” the process for filing a claim, and the cancellation policy can prevent future misunderstandings. A common oversight is failing to understand the difference between liability and collision coverage.

Obtaining Quotes from Multiple Providers

Getting quotes from multiple insurance providers is a straightforward process, significantly increasing the likelihood of finding the best deal. Most providers offer online quote tools, allowing for quick comparisons based on your specific information. Contacting insurance agents directly can also provide valuable insights and personalized recommendations. By comparing quotes side-by-side, you can easily identify the most cost-effective options while ensuring adequate coverage.

Checklist of Questions to Ask Insurance Providers

A prepared list of questions helps ensure you obtain all necessary information before making a decision. This includes asking about specific coverage details, the claims process, discounts, and customer service availability.

| Question Area | Example Questions |

|---|---|

| Coverage | What does your liability coverage include? What is your deductible for collision and comprehensive coverage? Does your policy cover rental car reimbursement? |

| Claims Process | How do I file a claim? What documents will I need? How long does it typically take to process a claim? |

| Discounts | What discounts are available? Do you offer discounts for bundling policies, safe driving records, or anti-theft devices? |

| Customer Service | How can I contact customer service? What are your customer service hours? What is your process for handling complaints? |

Discounts and Savings Opportunities

Securing affordable car insurance in Georgia often hinges on understanding and utilizing the various discounts and savings opportunities available. Many insurers offer a range of discounts designed to reward safe driving habits and responsible choices, potentially significantly reducing your premiums. By actively seeking these discounts and employing smart strategies, you can substantially lower your overall cost of car insurance.

Finding the best deals requires a proactive approach. It’s not just about finding the cheapest initial quote; it’s about identifying the insurer that offers the most relevant discounts and best suits your individual circumstances.

Common Car Insurance Discounts in Georgia

Georgia insurers offer a variety of discounts to incentivize safe driving and responsible behavior. These discounts can significantly reduce your premiums, making car insurance more affordable. Common discounts include good driver discounts, which reward drivers with clean driving records, and safe driver discounts, often based on telematics programs that monitor driving habits. Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, from the same provider often results in a substantial discount. Other discounts may be available for specific groups, such as students with good grades, or for vehicles equipped with anti-theft devices.

Leveraging Online Tools and Comparison Websites

Online comparison websites and tools are invaluable resources for finding the best car insurance deals in Georgia. These platforms allow you to input your information once and receive multiple quotes from different insurers simultaneously. This simplifies the comparison process, enabling you to identify the insurer offering the most comprehensive coverage at the most competitive price, considering available discounts. Remember to carefully review the coverage details of each quote before making a decision. For example, a site like [Illustrative Example: Imagine a website displaying quotes from five different insurers, each with varying premiums and coverage levels, clearly showing the discounts applied to each quote] would help you compare the offers. Note that the specific discounts offered may vary between insurers.

Lifestyle Choices and Insurance Premiums

Your lifestyle choices can significantly influence your car insurance premiums. For example, drivers who commute long distances daily typically pay more than those with shorter commutes, as they are statistically more likely to be involved in accidents. Similarly, the type of vehicle you drive impacts your premiums; sports cars and luxury vehicles generally cost more to insure than economy cars due to higher repair costs and a higher risk of theft. Maintaining a good credit score can also lead to lower premiums, as insurers often use credit history as a factor in assessing risk. A driver with a history of multiple speeding tickets will likely pay more than a driver with a clean record.

Ways to Save Money on Car Insurance Without Compromising Coverage

Several strategies can help you save money on car insurance without sacrificing essential coverage.

- Maintain a clean driving record: Avoiding accidents and traffic violations is the most effective way to keep your premiums low.

- Shop around and compare quotes annually: Insurance rates fluctuate, so regularly comparing quotes from different insurers is crucial.

- Increase your deductible: A higher deductible means lower premiums, but it also means you’ll pay more out-of-pocket if you have an accident.

- Bundle your insurance policies: Combining your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant discounts.

- Consider usage-based insurance: Some insurers offer programs that track your driving habits and reward safe driving with lower premiums.

- Take advantage of available discounts: Explore all available discounts, such as good student discounts, anti-theft device discounts, and multiple-car discounts.

Understanding Policy Details and Claims

Navigating the complexities of your car insurance policy is crucial for a smooth experience should you need to file a claim. Understanding your policy’s details, including exclusions and limitations, can prevent unexpected costs and delays. This section clarifies the claims process in Georgia and emphasizes the importance of preparedness.

The Georgia Car Insurance Claims Process

Filing a car insurance claim in Georgia generally involves contacting your insurance provider as soon as possible after an accident. You’ll typically provide details of the incident, including the date, time, location, and parties involved. Your insurer will then guide you through the necessary steps, which may include providing a police report, medical records, and repair estimates. The claim process can vary depending on the specifics of the accident and the type of coverage you have. For example, a claim involving injuries might require more extensive documentation and investigation than a simple property damage claim. It’s important to be patient and cooperative throughout the process, providing all requested information promptly and accurately.

Policy Exclusions and Limitations

Every car insurance policy contains exclusions and limitations that define what is and isn’t covered. Understanding these is critical to avoiding disappointment. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Limitations might involve caps on the amount of coverage for specific types of damage or incidents. For example, your policy might have a specific limit on the amount it will pay for repairs to your vehicle, or for medical expenses resulting from an accident. Carefully reviewing your policy documents, especially the section outlining exclusions and limitations, is essential before an accident occurs.

Common Claim-Triggering Situations

Several situations commonly lead to car insurance claims. These include collisions with other vehicles, single-vehicle accidents (such as hitting a tree or guardrail), vandalism or theft of your vehicle, and injuries sustained in an accident, regardless of fault. Comprehensive coverage can also cover damage from events like hailstorms, flooding, or fire. Understanding which situations are covered by your specific policy is crucial for preparedness. For instance, if you have collision coverage, you’re protected in the event of a collision, but if you only have liability coverage, you are only protected for damages you cause to others.

Steps After a Car Accident

Following a car accident, immediate actions can significantly influence your claim’s success. First, ensure the safety of yourself and others involved. Call emergency services if necessary. Then, gather information from all parties involved, including names, contact details, driver’s license numbers, insurance information, and vehicle details. Take photographs of the accident scene, including vehicle damage, and any visible injuries. If possible, obtain contact information from any witnesses. Report the accident to the police and obtain a copy of the police report. Finally, contact your insurance provider as soon as reasonably possible to initiate the claims process. Following these steps systematically helps streamline the claim process and ensures you have the necessary documentation to support your claim.

Illustrative Examples

Understanding the impact of various factors on your car insurance premiums can be clarified through real-world examples. These scenarios demonstrate how seemingly small choices can significantly affect your overall cost.

Good Driving Record and Premium Savings

A clean driving record translates directly into lower insurance premiums. Consider Sarah, a 30-year-old with a perfect driving history for the past ten years. She drives a mid-sized sedan and lives in a suburban area of Atlanta. With her spotless record, Sarah qualifies for a significant “safe driver” discount. Let’s assume her initial quote without any discounts is $1200 annually. Due to her excellent driving record, her insurer offers a 25% discount, reducing her annual premium to $900. This represents a savings of $300 per year. This savings illustrates the considerable financial benefits of maintaining a safe driving record.

Higher Deductible and Premium/Out-of-Pocket Cost Impact

Choosing a higher deductible can significantly reduce your insurance premiums, but it increases your out-of-pocket expenses in the event of an accident. Let’s examine John, a 45-year-old who owns a pickup truck. He’s considering two options: a $500 deductible and a $1500 deductible. Assume his annual premium with the $500 deductible is $1500. By opting for the $1500 deductible, his annual premium drops to $1200, a $300 savings. However, if he were to have an accident with $5000 in damages, his out-of-pocket expense would be $500 with the lower deductible and $1500 with the higher deductible. The table below summarizes the cost breakdown:

| Deductible | Annual Premium | Out-of-Pocket Expense (with $5000 in damages) |

|---|---|---|

| $500 | $1500 | $500 |

| $1500 | $1200 | $1500 |

This example highlights the trade-off between lower premiums and higher potential out-of-pocket costs. The best choice depends on an individual’s risk tolerance and financial situation. It is crucial to carefully weigh these factors before selecting a deductible.

Last Word

Securing affordable car insurance in Georgia requires careful planning and research. By understanding the factors influencing premiums, comparing providers, and actively seeking discounts, you can significantly reduce your costs without compromising on essential coverage. Remember to carefully review policy details, ask clarifying questions, and leverage online tools to find the best deal. With a proactive approach and the information provided in this guide, you can confidently navigate the Georgia car insurance market and find a policy that offers both protection and affordability.

Questions Often Asked

What is the minimum car insurance coverage required in Georgia?

Georgia requires minimum liability coverage of $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people, and $25,000 for property damage in a single accident.

Can I get car insurance if I have a bad driving record?

Yes, but your premiums will likely be higher. Several insurers specialize in high-risk drivers, though you may need to shop around to find competitive rates.

How often can I change my car insurance provider?

You can generally switch providers at any time, though there may be penalties depending on your policy terms. It’s advisable to give your current provider sufficient notice before switching.

What are some ways to lower my deductible?

Lowering your deductible will result in higher premiums. Consider your risk tolerance and financial capacity when choosing a deductible amount.