Securing affordable car insurance in Florida can feel like navigating a maze. High accident rates and a competitive insurance market contribute to varying costs. This guide demystifies the process, providing insights into factors influencing premiums, strategies for finding the best deals, and understanding your policy. We’ll explore how your driving history, credit score, and even the type of car you drive impact your insurance costs.

Understanding Florida’s unique insurance landscape is crucial. We’ll delve into the state’s minimum coverage requirements, compare average costs across major cities, and offer practical tips to help you save money without sacrificing necessary protection. From bundling policies to improving your driving habits, we’ll cover a range of strategies to help you secure affordable and comprehensive car insurance.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is unique and often more expensive than in many other states. Several factors contribute to the high cost, creating a complex landscape for drivers seeking affordable coverage. Understanding these factors is crucial for making informed decisions about your insurance needs.

Florida’s high insurance costs are a result of several interconnected factors. The state has a high number of uninsured drivers, leading to more claims paid by insured drivers. Furthermore, Florida’s warm climate and high population density contribute to a higher frequency of accidents. The prevalence of costly lawsuits and a high number of fraudulent claims also drive up premiums. Finally, the state’s regulatory environment plays a role, influencing the competitiveness of the insurance market.

Factors Influencing Car Insurance Costs in Florida

Several key factors significantly influence the cost of car insurance in Florida. These include your driving record (accidents and tickets), age and driving experience, the type of vehicle you drive (make, model, and safety features), your location (urban areas generally have higher rates), and the coverage levels you choose. Credit history can also be a factor in determining your premium. For example, a driver with multiple speeding tickets and a history of accidents will typically pay more than a driver with a clean record. Similarly, insuring a high-performance sports car will be more expensive than insuring a compact sedan.

Common Car Insurance Coverage Types in Florida

Florida offers a variety of car insurance coverage options. Liability coverage is the most basic type, legally required in the state, and pays for damages or injuries you cause to others. Personal Injury Protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Collision coverage pays for damage to your vehicle in an accident, regardless of fault, while comprehensive coverage covers damage from events other than collisions, such as theft, vandalism, or hail. Choosing the right combination of coverages is essential for protecting yourself financially.

Florida’s Minimum Insurance Requirements

Florida mandates minimum liability coverage of $10,000 for bodily injury or death per person, $20,000 for bodily injury or death per accident, and $10,000 for property damage. While meeting the minimum requirements is legally sufficient, it may not provide adequate protection in the event of a serious accident. Many drivers opt for higher liability limits to safeguard against significant financial losses. Furthermore, PIP coverage is also mandatory in Florida, with a minimum coverage of $10,000.

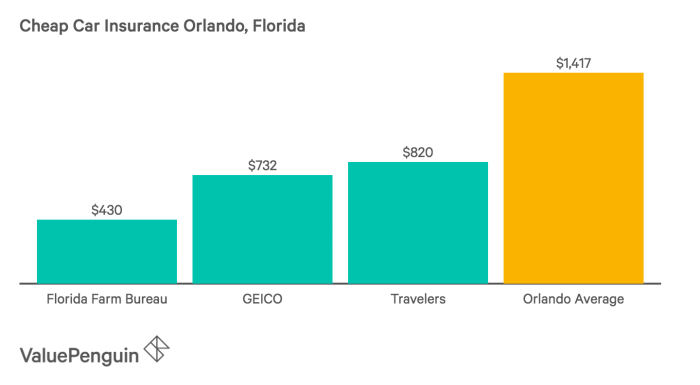

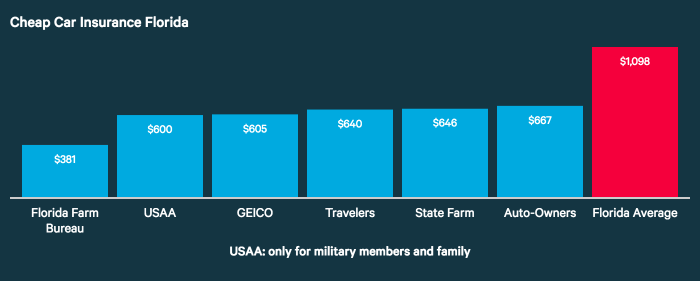

Average Car Insurance Costs in Major Florida Cities

The following table presents estimated average annual car insurance costs for different coverage levels across several major Florida cities. These are averages and individual costs can vary significantly based on the factors mentioned previously. It’s crucial to obtain personalized quotes from multiple insurers for accurate pricing.

| City | Minimum Coverage (Liability + PIP) | Liability + PIP + UM/UIM | Full Coverage (Including Collision & Comprehensive) |

|---|---|---|---|

| Miami | $1500 | $2000 | $3000 |

| Orlando | $1400 | $1800 | $2800 |

| Tampa | $1350 | $1750 | $2700 |

| Jacksonville | $1250 | $1600 | $2500 |

Finding Affordable Car Insurance Options

Securing affordable car insurance in Florida requires a strategic approach. Understanding the market and employing effective strategies can significantly reduce your premiums. This section Artikels key strategies, compares pricing models, and details the influence of driving history and credit scores on your insurance costs. We will also provide a practical guide to comparing quotes from multiple providers.

Key Strategies for Affordable Car Insurance

Finding the most affordable car insurance policy involves more than just comparing prices. Several factors are within your control and can significantly impact your premium. These strategies can help you save money.

- Bundle your insurance policies: Many insurers offer discounts when you bundle your auto insurance with other policies, such as homeowners or renters insurance. This often results in substantial savings compared to purchasing each policy separately.

- Maintain a good driving record: A clean driving record is a significant factor in determining your premium. Avoiding accidents and traffic violations demonstrates responsible driving and can lead to lower rates. For example, a driver with no accidents in five years may qualify for a significant discount compared to a driver with multiple at-fault accidents.

- Shop around and compare quotes: Don’t settle for the first quote you receive. Compare quotes from multiple insurance providers to find the best rates. Use online comparison tools or contact insurers directly to obtain quotes.

Comparison of Insurance Provider Pricing Models

Florida’s car insurance market features a variety of providers, each employing different pricing models. While specific rates vary based on individual risk profiles, general trends can be observed. For instance, some insurers may prioritize low base premiums but charge more for add-ons, while others may have higher base premiums but offer more comprehensive coverage at a potentially lower overall cost. Direct insurers often offer lower premiums by minimizing overhead, while traditional insurers may provide more personalized service and broader coverage options. It’s crucial to compare the total cost of coverage, including any add-ons, rather than focusing solely on the base premium.

Impact of Driving History and Credit Score

Your driving history and credit score are significant factors influencing your car insurance premiums. Insurance companies view a clean driving record (free of accidents and violations) as a lower risk, resulting in lower premiums. Conversely, a history of accidents or traffic violations can significantly increase your premiums. Similarly, a good credit score is often correlated with responsible financial behavior, leading insurers to perceive you as a lower risk and offer more favorable rates. A poor credit score, on the other hand, can lead to higher premiums. For example, a driver with multiple speeding tickets may see their premium increase by 20-30% compared to a driver with a clean record. Similarly, a driver with a low credit score may face higher premiums than a driver with excellent credit.

Step-by-Step Guide for Comparing Insurance Quotes

Comparing quotes is crucial to finding the best car insurance deal. Follow these steps to ensure a thorough comparison:

- Gather your information: Collect necessary information such as your driver’s license number, vehicle information (make, model, year), and driving history.

- Obtain quotes from multiple providers: Use online comparison tools or contact insurance companies directly to request quotes. Be sure to provide consistent information across all quotes for accurate comparison.

- Compare coverage options and premiums: Carefully review the coverage details and premiums from each provider. Consider factors like deductibles and limits to find the best balance of coverage and cost.

- Review policy details: Before making a decision, carefully read the policy documents from your top choices to fully understand the coverage and terms.

- Choose the best policy: Select the policy that offers the best combination of coverage and price, considering your individual needs and risk tolerance.

Factors Affecting Insurance Premiums

Several interconnected factors influence the cost of car insurance in Florida. Understanding these factors can help you make informed decisions to potentially lower your premiums. This section details the key elements affecting your insurance rate, from your personal characteristics to your vehicle’s features and your driving history.

Age and Gender

Insurance companies consider age and gender when assessing risk. Statistically, younger drivers, particularly those under 25, are involved in more accidents than older drivers. This higher risk translates to higher premiums. Similarly, historical data often shows differences in accident rates between genders, although this is a complex issue with ongoing debate about its relevance. These differences are reflected in the pricing structures used by insurance providers. For example, a 20-year-old driver will typically pay significantly more than a 40-year-old driver with a similar driving record. Gender-based differences, where present, are subject to legal and regulatory scrutiny and vary by state and insurance company.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premium. Sports cars, luxury vehicles, and high-performance vehicles generally cost more to insure than economy cars or sedans. This is because these vehicles are often more expensive to repair or replace, and they are statistically more likely to be involved in accidents due to their higher speeds and performance capabilities. For instance, insuring a high-powered sports car will be considerably more expensive than insuring a fuel-efficient compact car. The cost of parts and the likelihood of theft are also major factors in determining premiums.

Driving Habits and Safety Features

Your driving record is a crucial factor in determining your insurance premium. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions will significantly increase your premiums. Furthermore, the presence of safety features in your vehicle can affect your rates. Features like anti-lock brakes (ABS), airbags, and electronic stability control (ESC) can reduce the severity of accidents and, therefore, lower your insurance costs. Many insurance companies offer discounts for vehicles equipped with these safety technologies. For example, a driver with multiple speeding tickets will likely pay more than a driver with a spotless record, even if they drive the same vehicle.

Hierarchical Structure of Factors Influencing Premiums

The most significant factor influencing your car insurance premium is your driving history. Accidents and violations significantly increase your risk profile. Following this, the type of vehicle you drive plays a substantial role. Age and gender are influential factors, although their impact varies depending on the insurance company and state regulations. Finally, safety features influence premiums, although their effect is generally less impactful than driving history and vehicle type.

Discounts Available

Many insurance companies offer various discounts to lower your premiums. These can include:

- Good student discounts for students maintaining a high GPA.

- Safe driver discounts for maintaining a clean driving record for a specified period.

- Multi-car discounts for insuring multiple vehicles with the same company.

- Bundling discounts for combining auto insurance with other types of insurance, such as homeowners or renters insurance.

- Anti-theft device discounts for vehicles equipped with anti-theft systems.

Taking advantage of these discounts can significantly reduce your overall insurance costs. For example, a good student discount could save hundreds of dollars annually.

Saving Money on Car Insurance

Securing affordable car insurance in Florida requires a proactive approach. By understanding the various factors influencing your premiums and implementing strategic cost-saving measures, you can significantly reduce your expenses without compromising essential coverage. This section Artikels practical strategies to help you achieve substantial savings.

Finding ways to lower your car insurance costs can feel overwhelming, but many simple steps can make a significant difference. From smart policy choices to responsible driving habits, there are numerous avenues to explore. Let’s examine some effective methods to reduce your premiums.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, is a common and effective way to save money. Insurance companies often offer discounts for bundling because it simplifies their administrative processes and reduces the risk of losing a customer. For example, a customer who bundles their car insurance with their homeowners insurance might receive a discount of 10-15%, depending on the insurer and specific policies. This discount translates directly into lower premiums, making bundling a financially attractive option.

Improving Driving Habits

Safe driving habits are not only crucial for your safety and the safety of others, but they also directly impact your car insurance premiums. Insurance companies reward responsible drivers with lower rates. By avoiding accidents and traffic violations, you demonstrate a lower risk profile, making you a more attractive customer. Consistent safe driving, such as maintaining a safe following distance, adhering to speed limits, and avoiding aggressive driving maneuvers, significantly reduces the likelihood of accidents and, consequently, your insurance premiums.

Maintaining a Good Driving Record

A clean driving record is arguably the most significant factor in determining your car insurance rates. A history of accidents or traffic violations will invariably increase your premiums. Conversely, a spotless record signifies a low-risk driver, resulting in lower insurance costs. Even minor infractions can lead to premium increases, so it’s essential to prioritize safe driving and avoid any avoidable violations. The longer you maintain a clean record, the more you will benefit from lower premiums over time. Many insurers offer discounts for drivers with several years of accident-free driving.

Ways to Reduce Car Insurance Costs Without Compromising Coverage

Careful consideration of several factors can lead to lower premiums. It is important to remember that cost savings should never come at the expense of adequate coverage.

- Shop around and compare quotes from multiple insurers. Different companies have different pricing structures.

- Consider increasing your deductible. A higher deductible means lower premiums, but you’ll pay more out-of-pocket in case of an accident.

- Maintain a good credit score. Many insurers use credit scores as a factor in determining premiums. A higher credit score often translates to lower rates.

- Explore discounts offered by your insurer. Many companies offer discounts for things like good student status, completing a defensive driving course, or installing anti-theft devices in your vehicle.

- Review your coverage annually. Your insurance needs may change over time. Regularly review your policy to ensure you have the right coverage at the most competitive price.

Understanding Insurance Policies

Your car insurance policy is a legally binding contract outlining the terms and conditions of your coverage. Understanding its contents is crucial to ensuring you have the appropriate protection and know how to utilize it in the event of an accident or other covered incident. A thorough review of your policy will help you avoid unexpected costs and ensure a smoother claims process.

Policy Sections

A typical car insurance policy is organized into several key sections. These sections clearly define your coverage, responsibilities, and the insurer’s obligations. Common sections include a declarations page summarizing your coverage details, a description of covered perils (what events are covered), specific policy exclusions (what is not covered), and information regarding your premium payments and cancellation procedures. The policy will also detail the claims process, explaining how to report an accident and what documentation is required. Finally, it will contain the insurer’s contact information and any relevant legal disclaimers.

Common Insurance Terms

Several key terms are frequently used in car insurance policies. Understanding these terms is essential for making informed decisions about your coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, a $500 deductible on collision coverage means you’ll pay the first $500 of repair costs after an accident. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical bills and property damage up to your policy’s limits. Uninsured/Underinsured motorist coverage protects you if you’re involved in an accident caused by a driver without insurance or with insufficient coverage. This coverage can help pay for your medical bills and vehicle repairs. Comprehensive coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, or hail damage. Collision coverage protects your vehicle from damage resulting from a collision with another vehicle or object.

Filing a Claim

The claims process typically begins with promptly reporting the accident to your insurance company. You will need to provide details about the accident, including the date, time, location, and the other parties involved. You’ll likely be asked to provide police reports, witness statements, and photos of the damage. Your insurer will then investigate the claim to determine liability and the extent of the damages. After the investigation, they will determine the amount they will pay towards your claim, taking into account your deductible and policy limits. You should maintain thorough records throughout the entire claims process.

Visual Representation of Coverage

Imagine a circle representing your vehicle. Inside this circle, several smaller, overlapping circles represent different coverage types. The largest circle, encompassing the entire vehicle circle, represents liability coverage. A smaller circle overlapping partially with the vehicle circle represents collision coverage; it only protects against damage caused by a collision. Another smaller circle, also partially overlapping, represents comprehensive coverage, protecting against non-collision damages. A smaller circle, partially overlapping the liability circle, represents uninsured/underinsured motorist coverage, offering protection when the other driver is at fault but lacks sufficient insurance. The areas where circles overlap indicate instances where multiple coverages might apply to a single incident. The area outside all circles represents events or damages not covered by your policy. The size of each circle could vary depending on the policy limits purchased, visually demonstrating the extent of protection offered by each coverage type.

Resources for Finding Affordable Insurance

Finding the best and most affordable car insurance in Florida can feel overwhelming, but several resources are available to help you navigate the process. By understanding where to look for quotes, how to address potential issues, and leveraging the expertise of professionals, you can significantly improve your chances of securing a policy that fits both your needs and your budget. This section details key resources to aid in your search for affordable car insurance.

Reputable Online Resources for Comparing Car Insurance Quotes

Many reputable websites allow you to compare car insurance quotes from multiple providers simultaneously. These platforms typically use algorithms to search across a wide range of insurers, saving you the time and effort of contacting each company individually. It’s important to use several different comparison sites, as the selection of insurers and the quotes presented can vary. Remember to input accurate and complete information to ensure you receive the most accurate quotes. Examples of such websites include but are not limited to: The Zebra, NerdWallet, and Insurance.com. These sites provide a convenient way to compare prices, coverage options, and customer reviews, enabling informed decision-making.

Consumer Protection Agencies Assisting with Insurance-Related Issues

Facing challenges with your car insurance provider? Several agencies exist to protect consumers’ rights and resolve insurance-related disputes. The Florida Department of Financial Services (DFS) is the primary regulatory agency overseeing the insurance industry in the state. They handle consumer complaints, investigate insurance fraud, and provide educational resources on insurance policies and regulations. The DFS website offers valuable information, complaint filing options, and contact details for assistance. Additionally, organizations like the Better Business Bureau (BBB) can provide information on insurer reputation and help mediate disputes. Remember to document all interactions with your insurer, including correspondence and phone calls.

The Role of Independent Insurance Agents in Securing Affordable Coverage

Independent insurance agents act as intermediaries, representing multiple insurance companies rather than just one. This allows them to compare policies from various providers and present you with options that best suit your needs and budget. They can often access discounts and special offers not readily available to consumers who apply directly to insurers. Their expertise in navigating the complexities of insurance policies can be invaluable, especially for those unfamiliar with the industry’s terminology and regulations. Working with an independent agent can save you significant time and effort in your search for affordable coverage. It is advisable to interview several agents to find one whose approach and expertise best aligns with your requirements.

Frequently Asked Questions Regarding Affordable Car Insurance in Florida

- What factors influence car insurance premiums in Florida?

- Several factors impact premiums, including driving history, age, location, vehicle type, and credit score. Higher risk profiles generally result in higher premiums.

- How can I lower my car insurance costs?

- Consider increasing your deductible, bundling insurance policies (home and auto), maintaining a good driving record, and exploring discounts for safety features or good student status. Shop around and compare quotes from multiple insurers.

- What is the minimum required car insurance coverage in Florida?

- Florida mandates a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). However, carrying higher liability limits is strongly recommended for comprehensive protection.

- What should I do if I have a dispute with my insurance company?

- First, attempt to resolve the issue directly with your insurer. If unsuccessful, contact the Florida Department of Financial Services to file a complaint. You can also seek assistance from a consumer protection agency or legal counsel.

- Are there any discounts available for senior citizens?

- Some insurers offer discounts for senior citizens based on their driving experience and reduced risk profile. Check with individual companies for specific eligibility criteria.

End of Discussion

Finding affordable car insurance in Florida requires careful planning and comparison shopping. By understanding the factors that influence premiums and employing the strategies Artikeld in this guide, you can significantly reduce your costs. Remember to always compare quotes from multiple providers, leverage available discounts, and maintain a good driving record. Taking proactive steps to manage your risk and understand your policy ensures you’re adequately protected while keeping your premiums manageable.

FAQ

What is the minimum car insurance coverage required in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

Can I get car insurance without a credit check?

Some insurers offer policies that don’t heavily rely on credit scores, but it’s less common. It’s best to contact multiple providers directly to inquire about their specific requirements.

How often can I expect my insurance rates to change?

Rates can change annually, or even more frequently depending on your driving record, claims history, and other factors. It’s important to review your policy regularly and shop around for better rates.

What is SR-22 insurance?

SR-22 insurance is proof of financial responsibility required by the state after certain driving violations, like DUI or multiple accidents. It certifies that you have the minimum required insurance coverage.