Protecting your business from potential liabilities is crucial for long-term success. Unexpected incidents, from customer injuries to property damage, can lead to significant financial burdens. Affordable business liability insurance acts as a safety net, mitigating these risks and providing peace of mind. This guide explores how businesses can find and understand cost-effective liability coverage tailored to their specific needs.

We will delve into the various factors that influence insurance costs, explore strategies to lower premiums, and clarify the key features to consider when selecting a policy. Understanding your business’s risk profile and implementing effective risk management techniques are equally important aspects we will cover. Ultimately, this guide aims to empower you to make informed decisions about protecting your business’s financial future.

Defining “Affordable Business Liability Insurance”

Affordable business liability insurance refers to policies that provide adequate protection against financial losses from lawsuits related to business operations, at a price point that aligns with a company’s budget. The definition of “affordable” is subjective and depends heavily on the specific business, its risk profile, and its financial resources. It’s less about finding the absolute cheapest policy and more about finding the best balance between coverage and cost.

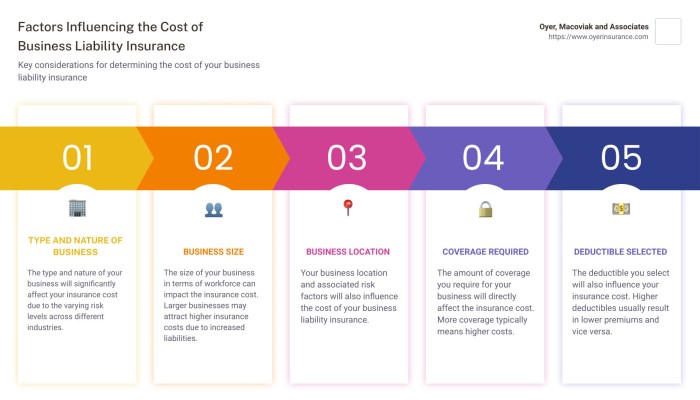

Factors Influencing the Cost of Business Liability Insurance

Several factors significantly influence the premium cost of business liability insurance. These include the type of business, its location, the number of employees, the business’s revenue, its claims history, and the level of coverage selected. Higher-risk businesses, such as those in construction or healthcare, generally pay more than lower-risk businesses, such as those in retail or administrative services. Geographic location also plays a role, as premiums may be higher in areas with higher litigation rates. A business with a history of claims will typically face higher premiums due to increased risk. Finally, the extent of coverage selected directly impacts the cost; more comprehensive coverage means a higher premium.

Types of Business Liability Insurance and Typical Price Ranges

Several types of liability insurance cater to different business needs. General liability insurance, protecting against bodily injury or property damage caused by business operations, typically costs between $500 and $1,500 annually for small businesses. Professional liability insurance (errors and omissions insurance), safeguarding against claims of negligence or mistakes in professional services, can range from $500 to $5,000 annually, depending on the profession and risk level. Product liability insurance, covering damages caused by defective products, is highly variable and depends on the nature of the products and the potential for harm. Prices for this type of insurance can vary widely. Commercial auto insurance, covering vehicles used for business purposes, typically costs between $1,000 and $5,000 annually, influenced by factors such as vehicle type, driver history, and mileage. These are just examples, and actual costs can vary significantly.

Key Features to Consider When Comparing Policies

When comparing business liability insurance policies, businesses should prioritize several key features. The policy’s coverage limits are crucial; they determine the maximum amount the insurer will pay for a claim. Businesses should ensure these limits are sufficient to cover potential losses. The policy’s exclusions are equally important; these are specific situations or types of claims that are not covered. Understanding these exclusions is essential to avoid gaps in coverage. The insurer’s financial stability and reputation should also be considered; a financially sound insurer is more likely to be able to pay out claims. Finally, the policy’s deductible, the amount the business must pay before the insurance coverage kicks in, should be carefully evaluated to find a balance between cost and out-of-pocket expense.

Comparison of Coverage Levels

The following table compares three different levels of general liability insurance coverage: basic, standard, and comprehensive. These are illustrative examples, and actual prices and features will vary depending on the insurer and specific circumstances.

| Coverage Level | Annual Premium (Estimate) | Coverage Limits | Key Features |

|---|---|---|---|

| Basic | $500 – $750 | $1,000,000 per occurrence | Covers bodily injury and property damage; limited additional coverage. |

| Standard | $750 – $1,250 | $2,000,000 per occurrence | Includes broader coverage for advertising injury and personal injury; higher coverage limits. |

| Comprehensive | $1,250 – $2,000+ | $5,000,000 per occurrence | Extensive coverage, including broader definitions of injury and damage, additional insured options, and higher limits. |

Finding Affordable Options

Securing affordable business liability insurance is crucial for protecting your business’s financial health. Several strategies can significantly reduce premiums and ensure you have the coverage you need without breaking the bank. Understanding these strategies and employing them effectively can lead to substantial savings over the life of your policy.

Finding the right balance between cost and coverage requires careful planning and research. This section will explore several key approaches to help businesses navigate the process and find affordable liability insurance options.

Strategies for Reducing Insurance Premiums

Implementing proactive risk management measures can dramatically reduce your insurance premiums. Insurance companies assess risk based on various factors, and demonstrating a commitment to safety and preventative measures can lead to lower rates.

- Improve Safety Procedures: Implementing robust safety protocols, providing employee training, and regularly inspecting your premises can significantly reduce the likelihood of accidents and resulting claims. This demonstrable commitment to safety is a key factor in lower premiums.

- Invest in Security Measures: Installing security systems, such as alarm systems and surveillance cameras, can deter theft and vandalism, leading to fewer claims and lower premiums. The investment in these measures often pays for itself in reduced insurance costs.

- Maintain Accurate Records: Keeping detailed records of all business activities, including safety training, maintenance logs, and incident reports, demonstrates responsible business practices and can influence the insurer’s risk assessment positively.

- Consider Risk Mitigation Measures: Implementing measures to reduce potential risks, such as using safer equipment or modifying your work processes, directly demonstrates a proactive approach to risk management, leading to lower premiums. For example, a bakery investing in anti-slip flooring to reduce the risk of slips and falls demonstrates this proactive approach.

Impact of Claims History on Insurance Costs

Your business’s claims history is a major factor influencing insurance costs. A history of claims, especially significant ones, will almost certainly lead to higher premiums. Conversely, a clean claims history can result in significant discounts and more favorable rates.

A clean claims history is a powerful tool in negotiating lower premiums.

Insurance companies use statistical models to assess risk based on past claims data. A single large claim can significantly increase your premiums for several years. Therefore, preventing accidents and effectively managing incidents are critical for maintaining affordable insurance. For example, a restaurant with multiple reported food poisoning incidents will likely face substantially higher premiums than a restaurant with a clean record.

Benefits of Bundling Insurance Policies

Bundling multiple insurance policies, such as liability insurance, property insurance, and workers’ compensation, with the same insurer can often lead to significant discounts. Insurers frequently offer bundled packages at reduced rates compared to purchasing each policy individually.

This strategy simplifies administration, provides a consolidated billing process, and often results in lower overall costs. The specific savings will vary depending on the insurer and the policies bundled, but the potential for cost savings is significant.

Step-by-Step Guide to Shopping for Affordable Liability Insurance

Finding affordable liability insurance involves a systematic approach. The following steps can guide businesses in their search:

- Assess Your Needs: Determine the specific type and amount of liability coverage required for your business. Consider your industry, size, and potential risks.

- Obtain Multiple Quotes: Contact several insurance providers and obtain detailed quotes, comparing coverage, premiums, and policy terms.

- Review Policy Details Carefully: Thoroughly examine each policy’s terms and conditions, including exclusions and limitations. Understand what is and isn’t covered.

- Negotiate Premiums: Don’t hesitate to negotiate with insurers to secure the best possible rates. Highlight your risk mitigation strategies and clean claims history (if applicable).

- Compare and Choose: Compare the quotes, considering both price and coverage, and select the policy that best suits your business’s needs and budget.

Understanding Coverage

Choosing the right business liability insurance involves understanding exactly what types of liabilities are covered. A clear grasp of your policy’s scope is crucial to ensure you’re adequately protected against potential financial losses. This section will clarify common coverages, policy limits and deductibles, and highlight typical exclusions.

Types of Liabilities Covered

Standard business liability insurance policies typically cover several key areas. General liability insurance, for example, protects against bodily injury or property damage caused by your business operations. This could range from a customer slipping on a wet floor in your store to damage caused by a faulty product. Professional liability insurance (also known as errors and omissions insurance) safeguards professionals against claims of negligence or mistakes in their services. For instance, a consultant might be sued for providing incorrect advice. Product liability insurance covers claims arising from injuries or damages caused by your products. Commercial auto insurance covers accidents involving company vehicles. Finally, many policies include advertising injury coverage, protecting against claims related to libel, slander, or copyright infringement in your marketing materials. The specific coverages offered will vary depending on the policy and the insurer.

Policy Limits and Deductibles

Policy limits represent the maximum amount your insurance company will pay for covered claims. These limits are usually expressed as a per-occurrence limit (the maximum paid for a single incident) and an aggregate limit (the maximum paid over the entire policy period). For example, a policy might have a $1 million per-occurrence limit and a $2 million aggregate limit. A higher limit offers greater protection but typically comes with a higher premium.

Deductibles are the amount you must pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means a lower premium, but it also means you’ll bear more of the financial burden in the event of a claim. Businesses should carefully weigh the cost of a higher deductible against the potential savings in premiums. Consider your business’s financial capacity to absorb a deductible payment in the event of a claim.

Adequate Coverage Amounts for Different Business Sizes and Risks

The appropriate coverage amount depends heavily on the size and risk profile of your business. A small, low-risk business might find adequate coverage with lower limits, while a larger, higher-risk business will require significantly higher limits. For example, a small bakery might be adequately covered with a $500,000 general liability limit, whereas a large construction company might need $5 million or more. Factors like the number of employees, the nature of your operations, and your potential exposure to lawsuits should all be considered when determining the appropriate coverage amount. It’s advisable to consult with an insurance professional to assess your specific needs.

Common Exclusions in Business Liability Insurance Policies

It’s crucial to understand what your policy *doesn’t* cover. Most policies exclude coverage for intentional acts, employee dishonesty, pollution, and damage caused by faulty workmanship. Specific exclusions can vary greatly depending on the insurer and the type of policy. For example, a policy might exclude coverage for claims related to environmental damage or intellectual property infringement. Carefully reviewing the policy documents and asking clarifying questions to your insurance provider is essential to ensure you’re aware of all limitations. Many policies also have exclusions related to specific types of activities or locations.

The Role of Risk Management

Effective risk management is crucial for any business, but it’s especially vital for small businesses operating on tighter budgets. Implementing robust risk management strategies isn’t just about preventing accidents; it’s a proactive approach that can significantly reduce the likelihood of costly claims and, consequently, lower your business liability insurance premiums. Insurance providers recognize this and often reward businesses with demonstrably lower risk profiles with discounted rates.

Implementing effective risk management strategies directly impacts insurance premiums. Insurance companies assess risk based on a business’s history of claims and the likelihood of future incidents. By proactively identifying and mitigating potential risks, businesses demonstrate a lower risk profile, making them more attractive to insurers and leading to lower premiums. This translates to significant cost savings over the long term, making insurance more affordable and freeing up resources for other business needs.

Risk Assessment for Small Businesses

Conducting a thorough risk assessment involves a systematic process of identifying potential hazards, analyzing their likelihood and potential impact, and determining appropriate control measures. For a small business, this might start with a simple brainstorming session involving all key personnel. Consider all aspects of the business, from physical premises and equipment to customer interactions and online operations. Document each identified risk, assigning a severity level based on the potential financial and reputational consequences. This process should be repeated periodically, ideally annually, or whenever significant changes occur within the business. The results of this assessment will directly inform the development of your risk mitigation strategies.

Risk Mitigation Strategies

A comprehensive risk management plan requires a variety of mitigation strategies tailored to specific risks. The following list categorizes common risks and Artikels practical mitigation approaches.

- Property Damage:

- Regular maintenance of equipment and facilities to prevent breakdowns and accidents.

- Implementing security measures such as alarms, surveillance systems, and secure storage for valuable assets.

- Ensuring adequate insurance coverage for property damage, including buildings, equipment, and inventory.

- Customer Injury:

- Regular safety inspections to identify and address potential hazards, such as slips, trips, and falls.

- Providing adequate training to employees on safety procedures and customer service protocols.

- Maintaining clear signage and warnings to alert customers to potential hazards.

- Implementing a comprehensive incident reporting and investigation system.

- Professional Errors/Omissions:

- Implementing quality control measures to minimize errors in services or products provided.

- Maintaining detailed records and documentation to support work performed.

- Seeking professional advice and expertise when needed.

- Purchasing professional liability insurance to cover potential claims arising from errors or omissions.

- Data Breaches (for businesses handling sensitive data):

- Implementing robust cybersecurity measures, including firewalls, antivirus software, and employee training on data security best practices.

- Regularly updating software and systems to patch vulnerabilities.

- Developing a comprehensive data breach response plan.

- Purchasing cyber liability insurance to cover costs associated with data breaches.

Working with Insurance Providers

Choosing the right insurance provider is only half the battle; effectively interacting with them is crucial for securing and utilizing your coverage. Open communication and a thorough understanding of your policy are key to a positive experience. This section details best practices for interacting with insurance providers and navigating the claims process.

Effective communication with your insurance broker or agent is paramount. A strong working relationship built on trust and clear communication can significantly simplify the process of obtaining and managing your liability insurance.

Effective Communication with Insurance Brokers and Agents

Maintaining clear and consistent communication is vital for a smooth insurance experience. This involves promptly responding to inquiries, providing accurate information, and clearly articulating your needs and concerns. Regular check-ins, especially before policy renewal, allow for proactive adjustments based on your business’s evolving needs. For example, if your business expands or changes its operations significantly, informing your broker promptly allows them to adjust your coverage accordingly, preventing potential gaps in protection. Keeping detailed records of all communications, including emails and phone calls, is also recommended for your protection.

Careful Review of Policy Documents

Thoroughly reviewing your policy documents is not merely advisable; it’s essential. Understanding the specifics of your coverage, including exclusions and limitations, will help you avoid costly surprises down the line. Pay close attention to the definition of covered incidents, the claims process, and the limits of your liability. Many policies contain complex legal jargon, so don’t hesitate to ask your broker for clarification on anything you don’t understand. Consider seeking independent legal advice if you have significant concerns about the policy’s terms. A clear understanding of your policy terms empowers you to make informed decisions and manage your risks effectively.

Filing a Claim

The claims process can be stressful, but understanding the steps involved will help you navigate it more effectively. Most insurers have a dedicated claims department, often reachable by phone or online portal. When filing a claim, promptly report the incident, providing accurate details and any relevant documentation, such as police reports or witness statements. Cooperate fully with the insurer’s investigation and provide any requested information in a timely manner. Failure to comply with the insurer’s requirements could delay or even jeopardize your claim. Keep records of all communications and documentation related to your claim.

Sample Claim Scenario

Imagine a small bakery, “Sweet Surrender,” suffers a slip-and-fall incident where a customer is injured due to a spilled liquid on the floor. The customer sustains injuries requiring medical attention and files a claim against Sweet Surrender. The owner of Sweet Surrender immediately reports the incident to their insurance provider, providing details of the accident, including witness statements, photos of the spill, and the customer’s medical records. The insurer then investigates the claim, reviewing the provided documentation and potentially conducting its own investigation. Sweet Surrender cooperates fully, providing any additional information requested. Based on the investigation, the insurer determines the extent of their liability and settles the claim with the injured customer, covering medical expenses and potentially legal fees. The prompt reporting and cooperation of Sweet Surrender played a crucial role in a smooth and successful claims process.

Illustrative Examples

Understanding the cost and type of business liability insurance needed varies greatly depending on the size and nature of your business. The following examples illustrate typical scenarios for small and medium-sized businesses. Remember, these are estimates, and actual costs will depend on several factors, including location, coverage limits, and the insurer.

Liability Insurance for a Small Bakery

A small, owner-operated bakery with a few employees might need a General Liability policy covering bodily injury and property damage. For example, a customer slipping on a wet floor or a delivery driver damaging a customer’s property could trigger a claim. This policy might cost between $500 and $1500 annually for a $1 million liability limit. Depending on the bakery’s specific operations (e.g., using specialized equipment, selling food products), additional coverage like product liability insurance might be necessary. This would protect the business against claims related to foodborne illnesses or other issues stemming from the bakery’s products. This could add another $300-$800 annually to the total cost.

Liability Insurance for a Medium-Sized Retail Store

A medium-sized retail store with 10-20 employees would likely need a more comprehensive policy. This could include General Liability, covering incidents like customer injuries or property damage, as well as Employers Liability insurance to protect against workplace accidents involving employees. The cost for a retail store could range from $1500 to $5000 annually, depending on factors such as the store’s size, location, and the number of employees. A larger store with more foot traffic would typically require higher coverage limits and therefore a higher premium. Commercial Auto insurance might also be needed if the business uses vehicles for deliveries or other purposes.

Hypothetical Scenario Illustrating the Value of Business Liability Insurance

Imagine a busy restaurant, “The Cozy Corner,” serving a popular lunch crowd. A customer trips over a loose floorboard, falls, and breaks their arm. Medical bills, lost wages, and potential legal fees quickly accumulate, reaching $50,000. Without business liability insurance, The Cozy Corner would be responsible for covering these costs, potentially leading to significant financial hardship or even closure. However, with a suitable liability insurance policy in place, The Cozy Corner files a claim, and the insurance company covers the costs, protecting the restaurant’s financial stability and allowing it to continue operations without major disruption. This scenario highlights the critical role business liability insurance plays in mitigating risk and safeguarding a business’s financial future.

Last Word

Securing affordable business liability insurance is not merely about finding the cheapest policy; it’s about finding the right coverage for your specific risks. By understanding the factors influencing cost, implementing effective risk management strategies, and carefully comparing policy options, businesses can significantly reduce their exposure to financial liabilities. Proactive planning and a thorough understanding of your insurance policy are key to protecting your business’s hard-earned success.

Essential Questionnaire

What types of businesses need liability insurance?

Virtually any business, regardless of size, can benefit from liability insurance. The specific type and amount of coverage will vary depending on the nature of the business and its associated risks.

How do I find a reputable insurance provider?

Seek recommendations from other businesses, check online reviews, and verify the provider’s licensing and financial stability. Consider working with an independent insurance agent who can compare quotes from multiple insurers.

Can I cancel my liability insurance policy early?

Generally, you can cancel a policy, but there may be penalties or fees depending on the terms of your contract. Review your policy documents carefully for details on cancellation procedures.

What happens if I make a claim?

The claims process varies depending on the insurer, but generally involves reporting the incident promptly, providing necessary documentation, and cooperating with the insurer’s investigation. Your policy will Artikel the specific steps involved.