Navigating the world of boat insurance can feel like charting unfamiliar waters. Finding affordable coverage shouldn’t be a stressful endeavor, however. This guide unravels the complexities of boat insurance, offering insights into securing comprehensive protection without breaking the bank. We’ll explore various coverage options, strategies for securing competitive quotes, and crucial factors influencing your premiums.

Understanding the nuances of boat insurance is key to making informed decisions. From the type of vessel you own to your boating experience and location, numerous factors impact the cost. This guide equips you with the knowledge to compare policies effectively, negotiate favorable rates, and ultimately, enjoy peace of mind on the water.

Defining “Affordable Boat Insurance”

Affordable boat insurance isn’t simply about finding the cheapest policy; it’s about securing adequate coverage at a price that fits your budget without compromising necessary protection. This involves carefully considering your needs, the risks involved in owning and operating your boat, and the various coverage options available. Finding the right balance between cost and coverage is key to responsible boat ownership.

Several factors influence the affordability of boat insurance. The premium you pay isn’t just a single number; it’s a reflection of your specific circumstances and the level of risk associated with your boat and its use. Understanding these factors allows you to make informed decisions and potentially save money without sacrificing crucial protection.

Types of Boat Insurance Coverage and Costs

Boat insurance policies offer various levels of coverage, each with a corresponding price tag. Basic liability coverage protects you against claims from third parties for injuries or property damage caused by your boat. This is usually a legal requirement and forms the foundation of most policies. However, adding comprehensive coverage provides broader protection, including damage to your own boat from accidents, theft, or other incidents. Hull insurance, a significant component of comprehensive coverage, can be expensive, particularly for larger or more valuable vessels. Uninsured boater coverage protects you if you are involved in an accident with an uninsured boater. The cost of each type of coverage varies significantly depending on factors detailed below.

Factors Influencing Boat Insurance Costs

Several factors play a crucial role in determining the cost of your boat insurance. These include the type and size of your boat; larger, more powerful boats generally command higher premiums. The frequency and type of use also influence costs; boats used frequently for watersports or in high-traffic areas will typically cost more to insure than those used infrequently for leisurely cruising. Your location matters as well; areas with higher rates of accidents or theft will usually result in higher premiums. Your boating experience and claims history also factor into the equation; experienced boaters with clean records often qualify for lower rates. Finally, the deductible you choose affects the premium; a higher deductible generally leads to a lower premium.

Comparison of Boat Insurance Coverage Options

| Coverage Type | Description | Typical Annual Cost Range | Example |

|---|---|---|---|

| Liability Only | Covers damage or injury caused to others. | $200 – $500 | Covers medical bills and property damage if you accidentally hit another boat. |

| Liability + Hull | Liability plus coverage for damage to your own boat. | $500 – $1500 | Covers repairs to your boat after a storm or collision. |

| Comprehensive | Liability, hull, and other coverage (theft, fire, etc.). | $1000 – $3000+ | Covers total loss of your boat due to fire or theft. |

Note: These are just example ranges and actual costs will vary greatly depending on the factors mentioned above. It’s crucial to obtain quotes from multiple insurers to find the best price for your specific needs.

Finding Affordable Boat Insurance Options

Securing affordable boat insurance requires a proactive approach and a thorough understanding of the market. By employing effective strategies and leveraging available resources, boat owners can significantly reduce their insurance premiums without compromising necessary coverage. This section Artikels key steps to help you find the best value for your boat insurance needs.

Finding the most competitive boat insurance rates involves more than simply searching online. A multifaceted approach, combining online research with direct engagement with insurance providers, yields the best results. This includes carefully considering your coverage needs, comparing quotes from multiple insurers, and exploring potential discounts.

Comparing Quotes from Multiple Insurers

Obtaining quotes from several insurers is crucial for identifying the most competitive rates. Different companies utilize varying algorithms and risk assessment methods, resulting in significant price differences for similar coverage. Failing to compare quotes could mean paying substantially more than necessary. It’s recommended to get at least three to five quotes from a mix of large national insurers and smaller, regional companies. This broader approach maximizes your chances of discovering a surprisingly low premium. For instance, a smaller, regional insurer might specialize in a particular type of boat and offer lower rates for that specific category.

Bundling Boat Insurance with Other Policies

Bundling your boat insurance with other policies, such as homeowners or auto insurance, can often lead to significant savings. Many insurance companies offer discounts for bundling multiple policies with them. This is because the insurer can streamline administrative processes and reduce overall risk assessment costs. However, bundling isn’t always advantageous. Carefully weigh the potential discounts against the necessity of the bundled policies. If bundling forces you to purchase unnecessary coverage, the overall cost could increase. For example, if you already have comprehensive homeowners insurance and bundling adds only a small discount, it may not be financially beneficial.

Common Discounts Available for Boat Insurance

Several discounts can significantly reduce your boat insurance premiums. Taking advantage of these discounts is a straightforward way to lower your overall cost. These discounts frequently reflect a reduced risk profile based on factors under your control.

- Safe Boating Courses: Completing a certified safe boating course demonstrates your commitment to safe boating practices, often resulting in a discount. Many insurers offer discounts of 5-10% for completing an approved course.

- Multiple-Boat Ownership: Insuring multiple boats with the same insurer frequently qualifies for a multi-policy discount. The discount percentage varies by insurer but can be substantial, often ranging from 10-20%.

- Boat Storage: Storing your boat in a secure location, such as a locked garage or a guarded marina, often qualifies for a discount. This reflects the reduced risk of theft or damage.

- Anti-theft Devices: Installing and maintaining anti-theft devices, such as a GPS tracking system or alarm, can significantly reduce your premiums. The discount offered will depend on the type and quality of the device.

- Claim-Free History: Maintaining a consistent claim-free history with your insurer often leads to loyalty discounts. These discounts can increase over time with continued safe boating and responsible insurance practices.

Understanding Policy Details and Coverage

Securing affordable boat insurance is only half the battle; understanding the specifics of your policy is crucial to ensure you’re adequately protected. This section clarifies key policy details, common exclusions, and the various types of liability coverage available. Failing to grasp these aspects could leave you financially vulnerable in the event of an accident or loss.

Essential Questions Addressed Before Policy Purchase

Before committing to a boat insurance policy, several key aspects require clarification. A thorough understanding of these points ensures the policy aligns with your needs and expectations, preventing future misunderstandings or disputes.

- The policy’s coverage limits for liability, medical payments, and damage to your boat are clearly defined and sufficient for your needs.

- The deductible amount is carefully considered and affordable in case of a claim.

- Specific exclusions and limitations of the policy, such as coverage for water sports or specific geographical areas, are understood and acceptable.

- The claims process is straightforward and efficient, with clear instructions on how to file a claim and what documentation is required.

- The policy’s renewal process and any potential changes in premium are transparently explained.

Typical Exclusions and Limitations in Boat Insurance Policies

Boat insurance policies, while comprehensive, typically exclude certain events or circumstances. Understanding these exclusions is vital to avoid surprises during a claim.

- Wear and Tear: Normal wear and tear on your boat’s components are usually not covered.

- Mechanical Breakdown: Engine failure or other mechanical issues are often excluded unless specified as part of a separate coverage option.

- Acts of God: Damage caused by hurricanes, tornadoes, or other natural disasters may have limitations or exclusions depending on the specific policy and endorsements.

- Negligence: Damage caused by intentional actions or gross negligence may not be covered.

- Unlicensed Operation: Operating the boat without the proper license or certification can void coverage.

Key Elements of a Standard Boat Insurance Policy

A standard boat insurance policy typically includes several key components. These elements work together to provide comprehensive protection against various risks.

- Liability Coverage: This protects you financially if you cause injury or damage to another person or their property.

- Hull Coverage: This covers damage to your boat itself, from accidents or other covered perils.

- Medical Payments Coverage: This covers medical expenses for injuries sustained by you or your passengers, regardless of fault.

- Uninsured Boater Coverage: This protects you if you are involved in an accident with an uninsured boater.

- Towing and Assistance: Coverage for towing and other emergency assistance services.

Types of Liability Coverage and Their Implications

Liability coverage is a crucial aspect of boat insurance. Understanding the different types ensures you have adequate protection.

- Bodily Injury Liability: This covers medical bills, lost wages, and pain and suffering for injuries you cause to others.

- Property Damage Liability: This covers the cost of repairing or replacing another person’s property that you damage.

- Umbrella Liability Coverage: This provides additional liability protection beyond the limits of your primary boat insurance policy. This is particularly beneficial for high-value assets or those who frequently operate their boat in high-traffic areas.

Factors Affecting Boat Insurance Premiums

Several key factors influence the cost of your boat insurance premiums. Understanding these elements allows you to make informed decisions and potentially secure more affordable coverage. This section will explore the primary drivers of premium costs.

Boating Experience

Your experience as a boater significantly impacts your insurance premium. Insurers consider your boating history, including the number of years you’ve been operating boats of similar size and type, and any formal boating certifications you hold. A seasoned boater with a clean record will typically qualify for lower premiums than a novice. For example, a seasoned captain with 15 years of experience and a US Coast Guard Captain’s license might receive a substantially lower rate compared to someone who just purchased their first small motorboat. This is because experienced boaters demonstrate a lower risk profile.

Claims History

Your claims history is a critical factor in determining your insurance premiums. Filing claims, even for minor incidents, can lead to higher premiums in the future. Insurers view claims as indicators of risk. Multiple claims or significant claims within a short period will almost certainly result in a rate increase. Conversely, maintaining a clean claims history can lead to discounts and lower premiums over time. A driver with no claims for five years might be eligible for a significant discount compared to someone who has filed multiple claims.

Boat Type

Different types of boats carry varying levels of risk, directly impacting insurance costs. Powerboats, particularly those with high horsepower engines, are generally considered higher risk than sailboats due to their greater speed and potential for more severe accidents. Larger, more expensive boats will also command higher premiums than smaller, less expensive vessels. For example, insuring a high-performance powerboat will likely be more expensive than insuring a small, used sailboat. The inherent risk and potential repair costs associated with each type are key considerations.

Geographical Location

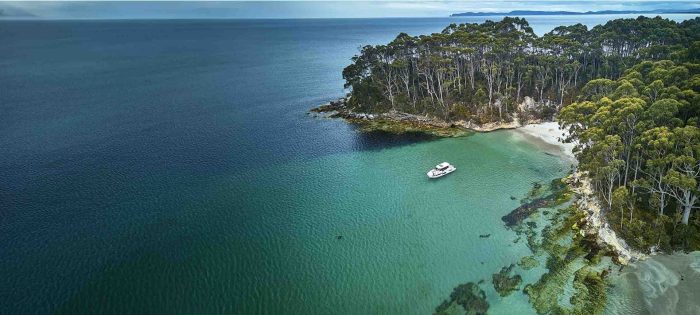

The location where your boat is primarily kept and used plays a significant role in determining your insurance premium. Areas prone to severe weather, such as those frequently hit by hurricanes or experiencing significant wave action, will typically have higher insurance rates due to the increased risk of damage or loss. Similarly, areas with high rates of boat theft will also result in higher premiums. For instance, a boat kept in a hurricane-prone coastal region will likely cost more to insure than a similar boat stored in a calm inland lake. The statistical likelihood of various types of damage influences the premium calculation.

Tips for Reducing Boat Insurance Costs

Securing affordable boat insurance involves proactive steps beyond simply comparing quotes. By implementing strategic measures and demonstrating responsible boating practices, you can significantly reduce your premiums and enjoy peace of mind. This section Artikels practical strategies for lowering your insurance costs.

Maintaining a Safe Boating Record

A clean boating record is a significant factor in determining your insurance premiums. Insurance companies view a history of accidents, violations, or claims as indicators of higher risk. Therefore, adhering to safe boating practices is crucial for keeping your premiums low. This includes responsible operation, proper navigation, and adherence to all boating regulations. For instance, avoiding alcohol consumption while operating a boat, maintaining a safe speed, and always wearing a life jacket can substantially reduce the likelihood of incidents. A consistent record of safe boating will translate into lower insurance costs over time.

Proper Boat Maintenance and its Impact on Insurance

Regular and meticulous boat maintenance is not just about preserving your vessel’s condition; it’s also about mitigating risks and reducing insurance premiums. Insurance providers consider well-maintained boats less prone to accidents and mechanical failures. Regular servicing, including engine checks, hull inspections, and safety equipment reviews, demonstrates responsible ownership. For example, a boat with properly functioning navigation lights and a well-maintained engine is less likely to be involved in an accident, leading to lower premiums. Conversely, neglecting maintenance can lead to higher premiums due to increased risk. Comprehensive documentation of maintenance activities can be beneficial when dealing with insurance claims.

Choosing a Higher Deductible

Opting for a higher deductible is a common strategy for lowering your boat insurance premiums. The deductible represents the amount you’ll pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible, therefore, reduces the insurer’s financial responsibility and consequently, your premium. For example, choosing a $1000 deductible instead of a $500 deductible might result in a noticeable decrease in your annual premium. However, it’s crucial to carefully consider your financial capacity to cover a higher deductible in case of an incident. Weigh the potential savings against your ability to afford the higher out-of-pocket expense.

Illustrative Examples of Boat Insurance Scenarios

Understanding the nuances of boat insurance often becomes clearer through real-world examples. The following scenarios illustrate how various factors influence the cost and coverage of your policy.

Cost Comparison: Small Fishing Boat vs. Large Yacht

Insuring a small, 16-foot aluminum fishing boat will typically cost significantly less than insuring a 50-foot luxury yacht. The smaller boat presents a lower risk to insurers due to its lower value, simpler mechanics, and generally less extensive use. A basic liability policy for the fishing boat might cost a few hundred dollars annually, while a comprehensive policy for the yacht could easily reach several thousand dollars, or even tens of thousands, depending on its features, value, and the level of coverage desired. This difference reflects the increased potential for damage, liability claims, and the higher repair costs associated with larger, more complex vessels.

Impact of a Boating Accident on Insurance Premiums

Imagine a scenario where a boat owner, while operating their 24-foot powerboat, is involved in a collision resulting in significant damage to both vessels and minor injuries to a passenger. This accident will almost certainly lead to a substantial increase in their insurance premiums. The insurer will consider the severity of the accident, the amount of damages claimed, and the owner’s degree of fault in determining the premium adjustment. Depending on the circumstances, the premium could double or even triple in the following year, reflecting the increased risk associated with the insured. The impact on premiums would be less if the accident was minor and the owner was not at fault.

Coverage Provided in a Typical Boat Insurance Policy

A standard boat insurance policy usually includes several key coverages. For example, liability coverage protects the policyholder against claims for bodily injury or property damage caused to others. Hull insurance covers damage to the insured boat itself, whether caused by collision, fire, or other covered perils. Uninsured boater coverage protects the policyholder if they are involved in an accident with an uninsured or underinsured boater. Additional coverage options may include medical payments coverage for injuries sustained by the insured or their passengers, and wreck removal coverage for the costs of removing a sunken or disabled vessel. The specific coverages and limits will vary depending on the policy and the insurer.

Bundling Home and Boat Insurance for Savings

Many insurance companies offer discounts for bundling home and boat insurance policies. Consider a homeowner with a $300,000 home and a 20-foot sailboat. Purchasing both home and boat insurance separately might cost $1,500 annually for the home and $500 annually for the boat, totaling $2,000. However, bundling these policies with the same insurer could result in a discount of 10-15%, reducing the total annual cost to somewhere between $1,700 and $1,800. This represents a savings of $200-$300 annually, highlighting the financial benefits of bundling policies when available.

Summary

Securing affordable boat insurance involves careful planning and informed decision-making. By understanding the various coverage options, leveraging comparison tools, and adopting proactive risk management strategies, boat owners can find comprehensive protection that aligns with their budget. Remember, prioritizing safety and responsible boating practices not only protects your vessel but also contributes to lower premiums in the long run. Enjoy the open water with confidence!

FAQ

What is the difference between liability and hull insurance?

Liability insurance covers damages you cause to others’ property or injuries you inflict. Hull insurance covers damage to your own boat.

How does my boating experience affect my premiums?

A strong safety record and experience generally lead to lower premiums. Insurance providers often offer discounts for completing boating safety courses.

Can I bundle my boat insurance with other policies?

Yes, bundling your boat insurance with home or auto insurance often results in discounts.

What happens if I make a claim?

Filing a claim will likely increase your premiums in the future. The impact depends on the severity and frequency of claims.