Securing your financial future in retirement is paramount, and life insurance plays a crucial role. For seniors, navigating the complexities of life insurance plans can be challenging. This guide provides a clear and concise overview of AARP life insurance options for seniors, exploring various plan types, cost factors, and application processes. We’ll compare AARP-endorsed plans with other senior-specific options, helping you make informed decisions about your coverage.

Understanding the nuances of term life insurance versus whole life insurance, and how factors like age and health influence premiums, is essential for making the right choice. We will also address common misconceptions and concerns surrounding senior life insurance, empowering you to confidently navigate this important aspect of retirement planning.

AARP’s Role in Senior Life Insurance

AARP, the American Association of Retired Persons, doesn’t directly sell life insurance. Instead, it leverages its large membership base and reputation for advocating for seniors’ interests to partner with insurance providers, offering members access to potentially more affordable and suitable life insurance plans. This partnership model allows AARP to influence the market and provide its members with options tailored to their specific needs and financial situations.

AARP’s involvement in the senior life insurance market primarily focuses on providing access to plans designed with seniors in mind. This means consideration of factors like health conditions, age, and budget constraints that are often significant barriers to securing affordable life insurance for older adults. Their goal is to simplify the process and offer competitive options, making it easier for seniors to secure the coverage they need.

AARP’s Partnerships with Insurance Providers

AARP collaborates with various reputable insurance companies to offer life insurance products to its members. These partnerships allow AARP to negotiate favorable terms and conditions, potentially resulting in lower premiums or more comprehensive coverage for its members compared to policies available on the open market. The specific companies AARP partners with may vary by location and over time, so it’s important to check the AARP website for the most up-to-date information. The partnership structure ensures that the insurance products offered are vetted to some degree, providing an additional layer of assurance for AARP members. For example, AARP might partner with a company known for its strong financial stability and positive customer reviews.

Comparison of AARP-Endorsed Plans and Other Senior Life Insurance Options

AARP-endorsed plans often compete favorably with other senior life insurance options. The key advantages frequently cited include potentially lower premiums, simplified application processes, and coverage tailored to the specific needs of older adults. However, it’s crucial to remember that “better” is subjective and depends on individual circumstances. AARP plans might not always be the absolute cheapest or most comprehensive available; instead, they aim to provide a balance of affordability, accessibility, and appropriate coverage. Before making a decision, comparing AARP-endorsed plans with other options from independent insurers is essential to ensure you are selecting the best policy for your individual needs and financial situation. Factors such as pre-existing health conditions, desired death benefit amount, and policy term length will heavily influence which option proves most beneficial. For example, a senior with significant health concerns might find that an AARP plan offers a more accessible route to securing coverage than policies from some other providers.

Types of Life Insurance for Seniors Offered Through or Endorsed by AARP

AARP partners with several insurance providers to offer life insurance options tailored to the needs of its members. Understanding the different types of plans available is crucial for seniors to make informed decisions about securing their financial legacy and protecting their loved ones. The specific plans offered may vary over time, so it’s essential to check directly with AARP or the partnered insurance provider for the most up-to-date information.

Several life insurance plan types are commonly available through AARP-endorsed programs. Each plan offers a unique set of features and benefits, making it vital to carefully consider individual circumstances before making a selection. Factors like budget, health, and desired coverage amount all play a significant role in determining the most suitable option.

Term Life Insurance

Term life insurance provides coverage for a specific period, or “term,” such as 10, 20, or 30 years. If the insured dies within the term, the death benefit is paid to the beneficiaries. If the insured survives the term, the policy expires. For seniors, term life insurance can be a cost-effective way to provide a death benefit for a defined period, particularly if they need coverage for a specific purpose, such as paying off a mortgage or providing for final expenses. The premiums are generally lower than those for permanent life insurance, but the coverage ends at the end of the term.

Whole Life Insurance

Whole life insurance offers lifelong coverage, meaning the death benefit is paid whenever the insured dies, regardless of when that occurs. It also builds a cash value component that grows tax-deferred over time. Seniors may find the cash value feature attractive, as it can be borrowed against or withdrawn, providing a potential source of funds in retirement. However, whole life insurance premiums are generally higher than term life insurance premiums. The cash value growth is usually slow and depends on the insurance company’s performance.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance offering lifelong coverage. Unlike whole life insurance, it features flexible premiums and death benefits. Policyholders can adjust their premium payments within certain limits, and the death benefit can often be increased or decreased. This flexibility can be appealing to seniors whose financial circumstances might change over time. However, the cash value growth is not guaranteed and depends on the investment performance of the underlying accounts, which carries some risk.

Comparison of AARP-Related Life Insurance Plans

The following table provides a simplified comparison. Actual policy details and costs will vary depending on the insurer, individual health, age, and other factors. It is crucial to obtain specific quotes from AARP-endorsed providers.

| Plan Type | Premiums | Death Benefit | Cash Value |

|---|---|---|---|

| Term Life (Example) | Relatively Low | Fixed Amount | None |

| Whole Life (Example) | Relatively High | Fixed Amount | Grows Tax-Deferred |

| Universal Life (Example) | Flexible | Adjustable | Variable, Based on Investment Performance |

Factors Affecting Life Insurance Costs for Seniors

Securing affordable life insurance as a senior requires understanding the key factors influencing premiums. Several elements, some controllable and others not, significantly impact the cost of your policy. This section will explore these factors, providing clarity on how they affect your insurance options.

Age, health status, and lifestyle choices are the most prominent factors determining life insurance premiums for seniors. Insurance companies assess the risk associated with insuring an individual based on these elements. A higher perceived risk translates to higher premiums. Understanding this risk assessment process is crucial for seniors seeking cost-effective coverage.

Age’s Impact on Life Insurance Premiums

As age increases, so does the likelihood of needing life insurance benefits. This increased risk is reflected in higher premiums. A 65-year-old will generally pay significantly more than a 55-year-old for the same coverage amount. This is because statistically, older individuals have a shorter life expectancy, increasing the insurer’s payout probability.

Health and Lifestyle’s Influence on Premiums

An individual’s health history and current lifestyle significantly influence premium calculations. Insurers carefully review medical records, considering pre-existing conditions and current health status. Lifestyle factors such as smoking, excessive alcohol consumption, and lack of physical activity also impact risk assessment and, consequently, premiums. A healthier lifestyle generally leads to lower premiums.

Pre-existing Conditions and Life Insurance Eligibility

Pre-existing conditions, such as diabetes, heart disease, or cancer, can significantly affect both eligibility for life insurance and the cost of premiums. Insurers may require additional medical examinations or decline coverage altogether for individuals with severe pre-existing conditions. Even if coverage is granted, premiums will likely be higher to compensate for the increased risk. For example, someone with a history of heart disease might find it difficult to secure a policy or face significantly higher premiums compared to a healthy individual of the same age.

Factors Seniors Can Control to Lower Premiums

While some factors are beyond an individual’s control, several lifestyle choices can positively influence insurance costs. By making proactive changes, seniors can potentially lower their premiums and secure more affordable coverage.

- Maintain a healthy lifestyle: Regular exercise, a balanced diet, and avoiding smoking and excessive alcohol consumption can significantly reduce the perceived risk and, consequently, the premium.

- Improve health conditions: Actively managing pre-existing conditions through medication, lifestyle changes, and regular checkups can demonstrate improved health and potentially lead to lower premiums over time. This might involve providing updated medical information to the insurer to reflect positive health changes.

- Shop around for the best rates: Comparing quotes from multiple insurers is essential to finding the most competitive rates. Different companies use varying risk assessment models, resulting in diverse premium offers.

- Consider a shorter policy term: A shorter policy term, such as a 10-year term life insurance policy, generally comes with lower premiums than a whole life policy, although it offers coverage for a limited period.

- Reduce the death benefit: Lowering the death benefit amount reduces the insurer’s potential payout, leading to lower premiums. This is a viable strategy if the need for a large death benefit is less pressing.

Applying for and Understanding AARP Life Insurance Policies

Applying for AARP-endorsed life insurance is generally a straightforward process, but understanding the policy details is crucial. This section Artikels the application procedure, clarifies typical waiting periods and exclusions, and provides guidance on interpreting your policy documents. Remember that specific requirements and procedures may vary slightly depending on the insurance provider offering the AARP-endorsed plan.

The application process usually begins with contacting the insurance company directly or visiting their website. You’ll likely be presented with several options depending on your needs and budget.

The Application Process

The application process typically involves completing a detailed application form. This form will request personal information, including your age, health history, smoking status, and desired coverage amount. You’ll also need to provide identifying information, such as your Social Security number and driver’s license. In many cases, the insurer will require a medical examination to assess your health risk. This exam might involve blood tests, urine tests, and a physical examination by a physician. The insurer will use this information to determine your eligibility and premium rate. Following submission of the completed application and any necessary medical documentation, the insurer will review your application and make a decision.

Waiting Periods and Exclusions

Most life insurance policies include a waiting period, typically two years, before full coverage takes effect. This means that if you die during the waiting period, the payout may be reduced or limited to the return of premiums paid. Furthermore, policies often have exclusions, which are specific events or conditions that are not covered by the policy. Common exclusions might include death resulting from pre-existing conditions that were not disclosed during the application process, or death caused by engaging in high-risk activities such as skydiving. It’s vital to carefully review the policy documents to understand any exclusions that apply to your specific policy. Understanding these limitations is critical to ensure you’re adequately protected.

Understanding Your Policy Documents

Your life insurance policy is a legally binding contract, and it’s essential to understand its terms and conditions. The policy document will Artikel the coverage details, including the death benefit amount, premium payments, and any applicable riders or add-ons. It will also specify the policy’s exclusions, waiting periods, and the procedures for filing a claim. Take your time to read through the entire document carefully, and don’t hesitate to contact the insurance company or a qualified insurance professional if you have any questions or require clarification. Consider keeping a copy of your policy in a safe and easily accessible location, perhaps with other important financial documents. Review your policy periodically to ensure it still meets your needs. If you have difficulty understanding any part of the policy, don’t hesitate to seek professional assistance.

Comparing AARP Life Insurance with Other Senior-Specific Options

Choosing the right life insurance policy can be a complex process, especially for seniors. AARP offers plans, but it’s crucial to compare them against other options available in the market to ensure you’re getting the best value and coverage for your needs. This section will examine AARP life insurance alongside policies from other major providers specializing in senior life insurance, highlighting their advantages and disadvantages regarding cost, benefits, and accessibility.

A thorough comparison requires considering several factors. Cost is paramount, with premiums varying widely based on age, health, and the type of policy. Benefit structures also differ significantly; some policies offer higher payouts, while others may include additional riders or features. Finally, accessibility plays a role; some insurers may have stricter underwriting requirements or limited product availability for older applicants.

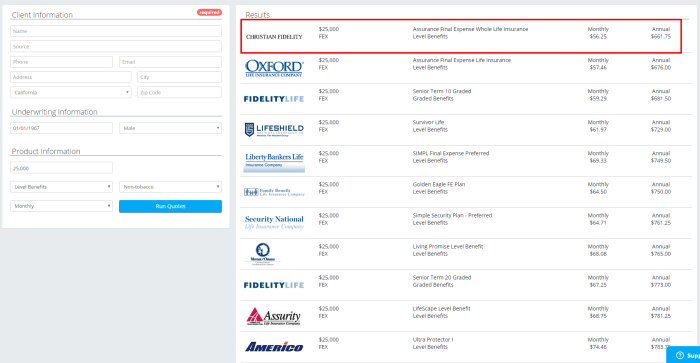

AARP Life Insurance Compared to Other Providers

This comparison considers AARP’s offerings alongside two other major providers known for their senior-specific life insurance plans. The specific policies and their features will vary, and it is essential to obtain current quotes from each provider for accurate information. The table below offers a general overview, highlighting key differences. Remember that individual circumstances will significantly impact the final cost and benefits received.

| Provider | Cost (Example Premium) | Benefits | Accessibility |

|---|---|---|---|

| AARP Life Insurance (Example: AARP-endorsed plan through a partner insurer) | $50/month (Illustrative; depends on age, health, coverage amount) | Term life insurance, potentially simplified underwriting, may offer options for riders (depending on the specific plan). | Generally accessible, simplified application process often available. |

| Provider B (Example: Mutual of Omaha) | $75/month (Illustrative; depends on age, health, coverage amount) | Variety of term and whole life options, potentially higher payout amounts, potentially more riders available. | May have more stringent health requirements for underwriting. |

| Provider C (Example: Colonial Penn) | $30/month (Illustrative; depends on age, health, coverage amount) | Primarily term life insurance, often focused on affordability, simplified application process. | Generally accessible, often designed for simplified underwriting, potentially lower coverage amounts. |

Factors Influencing Cost Comparisons

Several factors heavily influence the final cost of senior life insurance, regardless of the provider. Age is a significant determinant, with older applicants generally paying higher premiums. Health status plays a crucial role, as individuals with pre-existing conditions may face higher costs or even be denied coverage. The type of policy chosen (term vs. whole life) also impacts the cost, with whole life policies typically more expensive but offering lifelong coverage. Finally, the amount of coverage desired will directly influence the premium amount. A higher death benefit will lead to higher premiums. It is recommended to obtain quotes from multiple providers to compare options effectively.

Illustrative Examples of Senior Life Insurance Scenarios

Understanding how life insurance can benefit seniors is best done through real-world examples. The following scenarios illustrate how different types of policies can address specific needs and financial goals in retirement.

Joint Life Insurance Policy for Final Expenses and Estate Planning

Imagine a retired couple, John and Mary, both in their late 70s. They have modest savings and want to ensure their final expenses, such as funeral costs and outstanding medical bills, are covered without burdening their children. A joint life insurance policy provides a single death benefit payable upon the death of either John or Mary. This simplifies estate planning, ensuring sufficient funds are available to settle their affairs and potentially leave a small inheritance for their family. The policy’s death benefit could cover the costs of their funerals, outstanding debts, and potentially provide a financial cushion for their surviving spouse. This approach offers peace of mind, knowing that their legacy will be handled responsibly without placing a financial strain on their loved ones.

Term Life Insurance for Seniors on a Fixed Income

Consider Sarah, a 72-year-old widow living on a fixed income. She wants to ensure her remaining assets are passed to her grandchildren without creating a financial burden on them. A term life insurance policy, offering coverage for a specific period (e.g., 10 or 20 years), might be an affordable option for her. The premiums are generally lower than those for permanent policies, making it suitable for individuals with budget constraints. The policy could provide a death benefit large enough to cover her final expenses and leave a legacy for her grandchildren, all while remaining within her financial means. This illustrates how affordable coverage can still provide significant financial protection.

Whole Life Insurance Policy for Long-Term Financial Security

Let’s examine the case of Robert, a 65-year-old retiree with a substantial estate and concerns about long-term financial security for his family. A whole life insurance policy could offer him a death benefit to protect his family’s financial future while also providing a cash value component that grows over time. This cash value can be accessed for various needs, such as supplemental retirement income or long-term care expenses, without jeopardizing the death benefit. The policy offers a lifelong safety net and a financial tool that can adapt to changing circumstances, ensuring long-term security for both himself and his family. This exemplifies how a permanent policy can provide a comprehensive financial solution.

Addressing Common Concerns and Misconceptions about Senior Life Insurance

Many seniors harbor misconceptions about life insurance, often believing it’s too expensive or unattainable at their age. These misunderstandings can prevent them from securing crucial financial protection for their loved ones. This section clarifies common concerns and provides practical advice on navigating the process.

Affordability and Eligibility for Senior Life Insurance are Key Considerations. The cost of life insurance for seniors varies significantly depending on factors such as age, health, and the type of policy. However, affordable options exist, and eligibility isn’t as restrictive as many believe. Many insurers offer policies specifically designed for seniors, with premiums tailored to their circumstances.

Overcoming Barriers to Obtaining Life Insurance Coverage

Seniors may face challenges in securing life insurance due to age-related health concerns or pre-existing conditions. However, several strategies can help overcome these obstacles. Working with an independent insurance agent who specializes in senior life insurance can be particularly beneficial. These agents have access to a wider range of insurers and policies, increasing the likelihood of finding a suitable and affordable option. Furthermore, carefully comparing quotes from multiple insurers is crucial to finding the best value. Some insurers may offer more favorable terms for seniors with specific health conditions than others. Finally, exploring different types of life insurance, such as simplified issue policies (which require less medical underwriting), can significantly increase the chances of approval.

Communicating Life Insurance Needs with Family and Financial Advisors

Open communication with family members and financial advisors is essential when planning for senior life insurance. Discussing financial goals, estate planning objectives, and potential funeral or end-of-life expenses with family members ensures everyone understands the importance of the policy and its intended beneficiaries. Similarly, consulting a financial advisor can provide valuable insights into how life insurance fits into a comprehensive financial plan, helping seniors make informed decisions based on their overall financial situation and risk tolerance. A financial advisor can also help assess the need for a policy, the appropriate coverage amount, and the most suitable type of policy given the senior’s financial resources and health status. This collaborative approach ensures the chosen policy aligns with the individual’s needs and objectives.

Final Summary

Planning for the future is a cornerstone of responsible financial management, and life insurance forms a vital part of this plan, particularly for seniors. By carefully considering your individual needs and comparing various options, you can select a policy that provides the appropriate level of coverage and peace of mind. This guide has provided a framework for understanding AARP life insurance and other relevant options; however, consulting with a financial advisor is always recommended for personalized guidance.

Answers to Common Questions

What is the age limit for AARP life insurance?

There isn’t a fixed age limit, but eligibility criteria vary depending on the specific plan and insurer. Contact AARP directly or check the insurer’s website for details.

Can I get life insurance if I have pre-existing health conditions?

Yes, but pre-existing conditions may affect your eligibility and premium rates. Disclose all relevant health information during the application process for accurate assessment.

How long does the application process take?

The application process time varies. It typically involves completing an application, undergoing a medical exam (possibly), and waiting for policy approval, which could take several weeks.

What happens if I miss a premium payment?

Your policy may lapse, and coverage could be terminated. Contact your insurer immediately if you anticipate difficulty making a payment to explore available options.