Securing affordable and comprehensive insurance is a key concern for many, especially as we age. AARP, the American Association of Retired Persons, offers a range of insurance products designed to meet the specific needs of its members. This guide explores the AARP insurance quote process, highlighting factors influencing premiums, policy features, customer experiences, and how AARP insurance integrates into broader financial planning.

We’ll delve into the details of obtaining a quote, comparing AARP’s offerings to competitors, and examining the impact of various factors like age, health, and lifestyle choices on premium costs. Understanding these aspects empowers you to make informed decisions about your insurance needs and secure the best possible coverage.

Understanding AARP Insurance Offerings

AARP, the American Association of Retired Persons, offers a range of insurance products designed to meet the needs of its members, primarily those aged 50 and older. These offerings leverage partnerships with reputable insurance companies to provide competitive rates and comprehensive coverage options. Understanding the specifics of these plans is crucial for making informed decisions about your financial security in retirement.

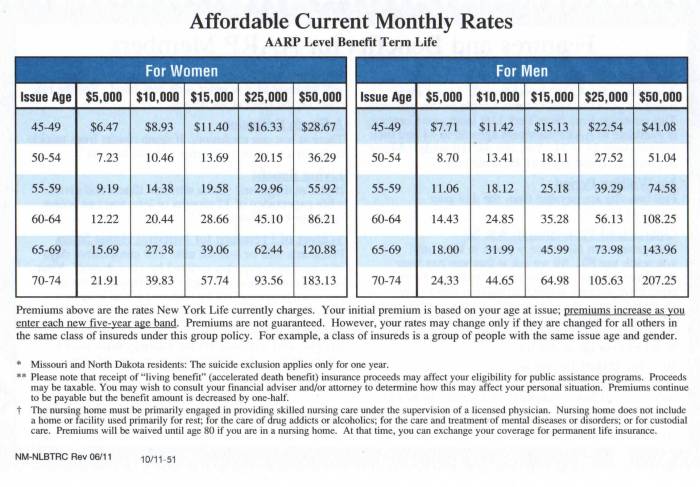

AARP’s insurance portfolio includes Medicare Supplement plans (Medigap), which help cover out-of-pocket costs associated with Original Medicare; Part D prescription drug plans; and various other supplemental health insurance plans designed to address gaps in coverage. They also offer life insurance options, designed to provide financial security for loved ones after death. These plans vary in coverage amounts and premium costs, catering to diverse financial situations and risk tolerances. The specific features and benefits will depend on the individual plan chosen and the insurer involved in the partnership.

AARP Insurance Products Compared to Other Providers

AARP insurance plans, while competitive, should be compared to offerings from other major insurance providers serving a similar demographic. Direct comparisons are difficult without specifying the exact AARP plan and its counterpart from another provider, as coverage details, premiums, and benefits vary significantly. However, a general comparison reveals that AARP often emphasizes value and member benefits, sometimes resulting in competitive pricing and convenient access to customer service. Other providers might offer more extensive coverage options or specialized features but may come with higher premiums. Consumers should compare quotes from multiple sources, including AARP and other established insurers, to determine the best value for their specific needs. Factors like pre-existing conditions, health status, and desired coverage levels will significantly influence the best choice.

Benefits and Drawbacks of AARP Insurance by Age and Health

The suitability of AARP insurance varies considerably depending on individual circumstances. For example, a healthy 55-year-old might find AARP’s Medigap plans an excellent way to supplement Original Medicare, providing peace of mind at a potentially competitive price. However, an individual with pre-existing conditions might find that a plan from another provider offers better coverage or more favorable terms, even if the premium is slightly higher. Similarly, older individuals (70+) with complex health needs might benefit more from plans with broader coverage, potentially requiring a deeper examination of options beyond just AARP offerings. AARP’s life insurance options, while potentially affordable for some, may not offer the same level of coverage as some standalone life insurance providers, particularly for individuals with higher risk profiles. Therefore, careful consideration of individual health status, age, and financial goals is essential before selecting any AARP insurance plan. Consulting with an independent insurance agent can be beneficial in navigating these complexities.

The AARP Insurance Quote Process

Getting an insurance quote is a crucial first step in securing the right coverage for your needs. AARP offers a range of insurance products, and understanding their quote process is key to finding the best fit for you. This section details how to obtain an AARP insurance quote, highlighting the simplicity and convenience of the process.

The process of obtaining an AARP insurance quote is designed to be straightforward and user-friendly, regardless of your chosen method. Whether you prefer the convenience of online tools, the personalized assistance of a phone call, or the formality of a mailed request, AARP aims to make the process as smooth as possible.

Obtaining an AARP Insurance Quote Online

The online quote process offers a quick and easy way to explore your options. Following these steps will guide you through obtaining a personalized quote:

- Visit the AARP insurance website. Navigate to the specific insurance type you’re interested in (e.g., auto, health, life).

- Select your state of residence. This is essential for accurate rate calculations based on your location.

- Provide the necessary information. This typically includes details about your age, the type of coverage desired, and other relevant specifics depending on the insurance type. For example, auto insurance might require information about your vehicle and driving history.

- Review your quote. Once you’ve submitted your information, the system will generate a personalized quote. Carefully review the details, including coverage amounts and premiums.

- Compare options. If applicable, you can adjust your coverage options to find the best balance between cost and protection. This iterative process helps you fine-tune your insurance needs.

- Contact an agent (optional). If you have questions or need further assistance, you can contact an AARP-affiliated insurance agent.

A Flowchart Illustrating the Quote Process

The following description illustrates a flowchart depicting the various paths to obtaining an AARP insurance quote. The flowchart visually represents the decision points and actions involved in the process.

The flowchart would begin with a central node labeled “Obtain AARP Insurance Quote.” From this node, three branches would extend: “Online Quote,” “Phone Quote,” and “Mail Quote.” Each branch would lead to a series of subsequent steps specific to that method. For example, the “Online Quote” branch would show steps like “Visit Website,” “Enter Information,” “Receive Quote,” and “Review/Adjust.” Similarly, the “Phone Quote” branch would illustrate steps such as “Call AARP,” “Speak with Agent,” “Provide Information,” “Receive Quote.” Finally, the “Mail Quote” branch would show steps like “Request Quote Form,” “Complete Form,” “Mail Form,” and “Receive Quote.” All three branches would ultimately converge at a final node labeled “Quote Received.”

Comparison of AARP’s Quote Process with Competitors

While specific competitor processes vary, AARP generally strives for a user-friendly experience. Many competitors offer similar online quote processes, but AARP’s focus on its members often leads to personalized support and potentially simplified forms. Phone and mail options are also generally comparable across insurers. However, the ease of use can depend on individual preferences and technological comfort levels. Some competitors might offer more advanced features like instant online chat support or detailed comparison tools, while others might prioritize a simpler, more streamlined approach. The best method ultimately depends on individual needs and preferences.

Factors Affecting AARP Insurance Premiums

Understanding the factors that influence your AARP insurance premiums is crucial for making informed decisions about your coverage. Several key elements contribute to the final cost, and being aware of them can help you anticipate and potentially manage your expenses. This section details those factors and their impact.

Key Factors Influencing AARP Insurance Premiums

Several factors interact to determine your AARP insurance premium. The following table Artikels these key elements, their effect on your premium, and provides illustrative examples.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | Your age is a significant factor in determining risk assessment. | Generally increases with age, reflecting higher likelihood of needing care. | A 65-year-old will typically pay more than a 55-year-old for the same coverage. |

| Health Status | Pre-existing conditions and current health significantly influence premium calculations. | Pre-existing conditions generally lead to higher premiums, reflecting increased risk. | Someone with a history of heart disease will likely pay more than someone with no such history. |

| Location | Geographic location impacts the cost of healthcare services and claims processing. | Premiums can vary based on the cost of living and healthcare access in your area. | Living in a high-cost area like New York City might result in higher premiums compared to a rural area. |

| Coverage Type and Amount | The type and level of coverage you select directly impact the cost. | Higher coverage amounts and comprehensive plans generally lead to higher premiums. | A comprehensive plan with high coverage limits for hospital stays will be more expensive than a basic plan. |

| Tobacco Use | Smoking and tobacco use are significant health risk factors. | Smokers generally pay higher premiums due to increased health risks. | Individuals who smoke will typically pay significantly more than non-smokers. |

Lifestyle Choices and Insurance Premiums

Lifestyle choices play a considerable role in determining your insurance premiums. Engaging in healthy habits can potentially lower your premiums, while unhealthy choices may increase them. Insurance companies assess risk based on lifestyle factors to accurately reflect the likelihood of future claims. For instance, regular exercise, a balanced diet, and avoiding tobacco use are all viewed favorably, potentially resulting in lower premiums. Conversely, unhealthy habits such as smoking, excessive alcohol consumption, or a sedentary lifestyle may lead to higher premiums. This is because these factors increase the risk of developing health problems requiring medical intervention.

Pre-existing Conditions and Insurance Costs

Pre-existing conditions, meaning health issues you had before obtaining insurance, can influence your AARP insurance premiums. Insurance companies consider pre-existing conditions during the underwriting process, as they represent a higher risk of needing medical care. The impact of pre-existing conditions varies depending on the severity and type of condition. While AARP plans may not exclude coverage for pre-existing conditions, they may result in higher premiums or adjusted coverage terms. It’s crucial to disclose all pre-existing conditions accurately during the application process to avoid potential issues later.

AARP Insurance Policy Features and Benefits

AARP insurance policies, offered through various reputable insurance providers, are designed to cater to the specific needs and financial situations of individuals aged 50 and over. These policies often include a range of features and benefits that go beyond standard offerings, providing comprehensive coverage and peace of mind. Understanding these features is crucial for making informed decisions about your insurance needs.

The specific features and benefits vary depending on the type of insurance policy (auto, home, life, health, etc.) and the chosen provider. However, several common advantages are frequently found across AARP-endorsed plans.

Key Features and Benefits of AARP Insurance Policies

AARP insurance policies often emphasize value and ease of use, incorporating features designed to simplify the insurance process and maximize benefits for policyholders. The following points highlight some common features.

- Competitive Pricing: AARP leverages its large membership base to negotiate favorable rates with insurance providers, often resulting in lower premiums compared to similar policies from other companies. This allows members to access quality coverage without breaking the bank.

- Bundling Options: Many AARP-affiliated insurers offer discounts for bundling multiple insurance policies, such as auto and home insurance. This can lead to significant savings compared to purchasing each policy separately.

- Strong Customer Service: AARP-endorsed providers generally prioritize customer satisfaction and offer responsive, accessible customer service channels, ensuring policyholders can easily resolve issues or access support when needed. This often includes 24/7 access to customer service representatives.

- Flexible Payment Options: Many plans offer flexible payment options, such as monthly installments, making it easier to manage insurance costs and fit them within a budget.

- Specialized Coverage Options: Some AARP insurance plans offer specialized coverage tailored to the needs of older adults, such as supplemental health insurance or long-term care insurance options.

Real-Life Scenarios Illustrating AARP Insurance Benefits

The value of AARP insurance becomes particularly apparent in various real-life scenarios. These examples demonstrate how the features and benefits translate into tangible advantages for policyholders.

- Scenario 1: Unexpected Medical Expenses: AARP supplemental health insurance can significantly reduce out-of-pocket costs associated with unexpected medical emergencies or long-term health conditions, helping to mitigate the financial burden of healthcare expenses.

- Scenario 2: Auto Accident: AARP auto insurance with comprehensive coverage can provide financial protection in case of an accident, covering repair costs, medical bills, and potential legal expenses. The strong customer service support can also be invaluable during a stressful time.

- Scenario 3: Home Damage: AARP home insurance can protect against financial losses due to damage from natural disasters, theft, or other unforeseen events. The competitive pricing can ensure adequate coverage without excessive premiums.

Comparison with Competing Insurance Policies

While AARP insurance policies often offer competitive pricing and benefits, it’s crucial to compare them with similar offerings from other companies. Direct comparison requires reviewing specific policy details, including coverage limits, deductibles, and exclusions. Factors such as individual needs, location, and driving history also influence the optimal choice.

For example, a 65-year-old individual in Florida might find AARP’s home insurance more affordable than a competitor’s due to AARP’s negotiated rates and specific coverage options for hurricane-prone areas. However, a younger individual in a different state might find another provider offers better coverage for their specific needs at a comparable or lower price. Therefore, a thorough comparison is always recommended before selecting a policy.

Customer Reviews and Experiences with AARP Insurance

Customer feedback provides valuable insights into the strengths and weaknesses of AARP insurance products. Analyzing these reviews allows for a comprehensive understanding of customer satisfaction and areas where improvements might be needed. This section summarizes common themes found in online reviews and testimonials.

Understanding the range of customer experiences is crucial for prospective buyers. While many are satisfied, others have reported negative experiences. Examining both positive and negative feedback paints a complete picture.

Summary of Customer Reviews

A review of various online platforms reveals a mixed bag of experiences with AARP insurance. While some customers praise the company for its competitive pricing, excellent customer service, and comprehensive coverage options, others express concerns about claims processing delays, confusing policy details, and difficulties in contacting customer support. The following bulleted list summarizes common themes:

- Positive Feedback: Many customers highlight AARP’s competitive pricing, particularly for those over 50. Several reviews mention the ease of obtaining quotes and the helpfulness of AARP’s customer service representatives during the purchase process. Some also appreciate the range of coverage options available.

- Negative Feedback: A recurring negative theme is the perceived difficulty in filing claims. Some customers report extended wait times and confusing claim procedures. Other complaints include difficulties reaching customer service representatives by phone, and a lack of clarity in policy documents.

Common Themes in Customer Feedback

Several patterns emerge from analyzing customer reviews. The most prevalent themes include pricing, customer service responsiveness, and the claims process. Positive feedback often centers on the affordability of AARP insurance compared to competitors, especially for the target demographic. Conversely, negative feedback frequently points to difficulties navigating the claims process and slow response times from customer service. These experiences highlight the need for ongoing improvements in communication and efficiency.

AARP’s Response to Customer Concerns

AARP actively addresses customer concerns and complaints through various channels. While specific responses to individual complaints are not publicly available for privacy reasons, AARP’s website includes a dedicated section for contacting customer service and submitting feedback. Furthermore, the company regularly updates its policies and procedures based on customer feedback, aiming to improve its services and address common issues. While not explicitly stated in public forums, the frequency of updates suggests an ongoing effort to address customer concerns and enhance the overall customer experience.

AARP Insurance and Financial Planning

AARP insurance products can play a significant role in a comprehensive financial plan designed for retirement. By integrating these insurance options into a broader strategy, individuals can effectively manage the financial risks associated with aging and ensure greater financial security during their later years. This involves understanding how insurance complements other crucial retirement planning elements such as savings, investments, and Social Security benefits.

AARP insurance helps mitigate several key financial risks inherent in aging. These risks include unexpected medical expenses, long-term care needs, and the potential loss of income due to disability or death. By providing financial protection against these unforeseen events, AARP insurance can significantly reduce the financial burden on individuals and their families, ensuring a more stable and secure retirement. The various AARP insurance options, such as health, life, and long-term care insurance, are designed to address these specific risks, offering different levels of coverage to suit individual needs and budgets.

The Role of AARP Insurance in Retirement Financial Planning

AARP insurance is a valuable component of a well-rounded retirement financial plan. It works in conjunction with other financial instruments to create a comprehensive safety net. For instance, while savings and investments provide a source of income, insurance safeguards against unforeseen events that could deplete those savings. Consider a scenario where an individual has diligently saved for retirement, but a sudden, unexpected illness leads to substantial medical bills. AARP health insurance could help mitigate the financial impact of such an event, preserving the individual’s retirement savings.

Sample Financial Plan Incorporating AARP Insurance

A hypothetical 65-year-old retiree, John, might structure his financial plan as follows:

* Retirement Savings: $500,000 in a combination of 401(k) and IRA accounts, generating estimated annual income of $25,000.

* Social Security: Monthly income of $1,500.

* AARP Health Insurance: Comprehensive plan covering medical expenses, reducing the risk of significant out-of-pocket costs.

* AARP Long-Term Care Insurance: Policy providing coverage for potential long-term care needs, minimizing the financial strain on family and savings.

* AARP Life Insurance: Policy providing a death benefit to protect his spouse and ensuring financial stability for her after his passing.

This plan demonstrates how AARP insurance complements other income sources and safeguards against significant financial risks. The insurance components protect John’s savings from being depleted by unexpected health events or long-term care expenses, thereby ensuring a more secure and comfortable retirement. The specific amounts and types of insurance would, of course, vary depending on individual circumstances, risk tolerance, and financial goals.

Financial Risk Mitigation with AARP Insurance

The primary benefit of incorporating AARP insurance into a retirement financial plan lies in its ability to mitigate various financial risks. The potential for unexpected medical bills, especially in later life, is a significant concern. AARP health insurance can help cover these costs, preventing the depletion of retirement savings. Similarly, the need for long-term care can be incredibly expensive. AARP long-term care insurance can offer crucial financial protection, preventing individuals and their families from facing catastrophic financial burdens. Finally, AARP life insurance can provide a financial safety net for surviving family members, ensuring their financial stability after the death of a loved one. By addressing these key risks, AARP insurance provides a crucial layer of security within a broader retirement financial strategy.

Accessibility and Customer Service

AARP prioritizes providing accessible and responsive customer service to its members. Understanding how to reach them and the quality of support offered is crucial for potential and existing policyholders. This section details the various channels available for accessing information and support, describes the typical customer service experience, and compares AARP’s approach with industry standards.

AARP offers a multi-channel approach to customer service, ensuring accessibility for a wide range of individuals. This includes various methods of contact, each designed to cater to different preferences and needs. The goal is to provide prompt and helpful assistance, resolving inquiries efficiently.

AARP’s Customer Service Channels

AARP provides multiple avenues for accessing information and support. These options aim to make assistance readily available regardless of individual preferences or technological capabilities.

- Phone Support: A dedicated phone number provides direct access to trained representatives who can answer questions, process requests, and offer assistance with policy management.

- Website: The AARP website features a comprehensive FAQ section, online policy management tools, and a secure messaging system for contacting customer service.

- Mail: For those who prefer traditional methods, AARP offers a mailing address for written inquiries and correspondence.

- Email: Email support allows for asynchronous communication, enabling members to submit questions and receive responses at their convenience.

Customer Service Response Times and Accessibility Options

AARP aims for prompt response times across all channels. While specific wait times can vary depending on factors such as call volume and complexity of the issue, the company strives to resolve most inquiries efficiently. Accessibility features include options for those with visual or auditory impairments, such as large print materials and phone support for the hearing impaired. The website also incorporates accessibility features to meet WCAG guidelines.

Comparison with Other Insurance Providers

Comparing AARP’s customer service with other providers requires considering multiple factors, including response times, channel availability, and accessibility features. While some competitors may offer similar options, AARP’s focus on its large senior member base influences its approach to accessibility and communication. For example, AARP might provide more comprehensive materials in large print or offer more readily available phone support than some other providers who might rely more heavily on online self-service portals. Specific comparisons would require in-depth analysis of individual providers’ practices.

Final Summary

Navigating the world of insurance can be complex, but understanding your options is crucial for securing your financial future. AARP insurance provides a valuable resource for many, offering a range of coverage options and a streamlined quote process. By carefully considering the factors influencing premiums and understanding the policy features, you can make an informed decision that best suits your individual circumstances. Remember to compare AARP’s offerings with those of other providers to ensure you find the most comprehensive and cost-effective coverage.

Questions Often Asked

What types of insurance does AARP offer?

AARP offers a variety of insurance products, including health, life, auto, and home insurance. Specific offerings may vary by location.

How long does it take to get an AARP insurance quote?

The time it takes to receive a quote varies depending on the method used (online, phone, mail) and the complexity of the application. Online quotes are typically the fastest.

Can I get an AARP insurance quote if I’m not an AARP member?

Eligibility for AARP insurance may vary depending on the specific product. While some plans may be available to non-members, membership often provides additional benefits and discounts.

What if I have pre-existing conditions?

Pre-existing conditions will be considered during the underwriting process. This may impact the premium or eligibility for certain plans. It’s important to disclose all relevant health information accurately.