Securing your Florida home requires careful consideration of insurance options. AAA, a well-known name in roadside assistance, also offers a range of home insurance policies tailored to the unique challenges of Florida’s climate and risk profile. This guide delves into the specifics of AAA home insurance in Florida, examining coverage options, premium factors, claims processes, customer service, and potential cost savings through bundling.

Understanding the nuances of Florida home insurance is crucial for homeowners. Factors like location, home features, and the prevalence of hurricanes and flooding significantly impact premiums. This guide aims to clarify these factors and empower you to make informed decisions about protecting your most valuable asset.

Understanding AAA Home Insurance in Florida

AAA provides home insurance in Florida, offering various policy types designed to cater to diverse homeowner needs and risk profiles. Understanding the nuances of these policies is crucial for securing adequate protection for your property and belongings. This section will detail the different policy options, coverage specifics, and a comparison to other major insurers in the state.

AAA Home Insurance Policy Types in Florida

AAA likely offers several standard home insurance policy types in Florida, including but not limited to, basic homeowners insurance, comprehensive homeowners insurance, and possibly specialized policies tailored to specific property types (e.g., condos, townhouses). Basic policies provide fundamental coverage, while comprehensive policies offer broader protection against a wider range of perils. Specialized policies often address the unique risks associated with certain property types. It’s important to directly contact AAA for the most up-to-date and precise details on their current policy offerings.

Coverage Options Under Each AAA Policy Type

Coverage options vary significantly depending on the specific policy chosen. Generally, basic policies cover damage caused by specific named perils such as fire, windstorm, and hail. Comprehensive policies typically expand coverage to include additional perils, potentially offering protection against events like water damage, theft, and vandalism. Further, many policies allow for add-ons such as liability coverage, which protects against lawsuits stemming from accidents on your property, and personal property coverage, which covers your belongings in the event of damage or loss. Specific coverage amounts and limits are determined at the time of policy purchase and vary based on individual risk assessments.

Comparison of AAA Home Insurance with Other Major Providers in Florida

Direct comparison requires access to current pricing and policy details from various insurers, which is beyond the scope of this document. However, a general comparison can be made by considering factors such as coverage options, customer service reputation, claims handling processes, and pricing. Consumers should compare quotes from multiple providers, including AAA, to determine the best value for their specific needs. Factors like your credit score, location, and the age and condition of your home will significantly influence the premiums offered by different companies.

Comparison of Three AAA Home Insurance Plans

The following table provides a hypothetical comparison of three different AAA home insurance plans. Note that these are examples and may not reflect actual AAA offerings. Always consult AAA directly for current rates and coverage details.

| Plan Name | Coverage Limit (Dwelling) | Deductible | Additional Coverages |

|---|---|---|---|

| Basic Homeowner | $250,000 | $1,000 | Liability ($100,000), Personal Property (50% of Dwelling) |

| Comprehensive Homeowner | $500,000 | $2,500 | Liability ($300,000), Personal Property (75% of Dwelling), Flood (Optional Add-on) |

| Premium Homeowner | $750,000 | $5,000 | Liability ($500,000), Personal Property (100% of Dwelling), Flood (Included), Replacement Cost Coverage |

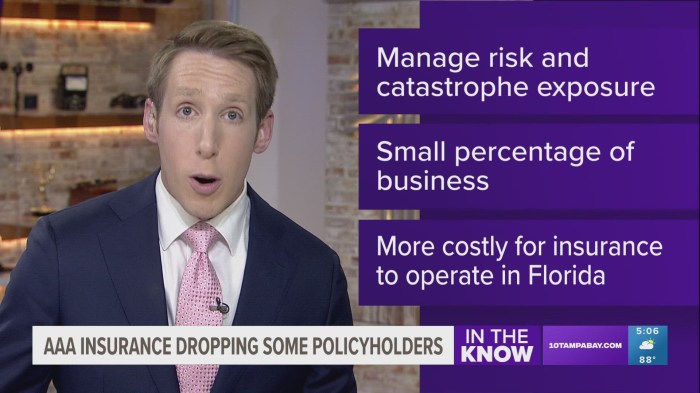

Factors Affecting AAA Home Insurance Premiums in Florida

Several key factors influence the cost of AAA home insurance premiums in Florida. Understanding these factors can help homeowners better understand their premiums and potentially take steps to reduce them. These factors are interconnected and often considered together by insurance companies to assess risk.

Location’s Impact on Premiums

The location of a home significantly impacts insurance premiums. Coastal properties are considerably more expensive to insure than inland properties. This is primarily due to the increased risk of damage from hurricanes, storm surges, and flooding. Homes located in designated high-risk flood zones will face substantially higher premiums, sometimes requiring separate flood insurance policies. Conversely, homes situated further inland, away from the immediate threat of coastal hazards, typically enjoy lower premiums. For example, a home in Orlando might have significantly lower premiums than an equivalent home in Miami Beach. The specific distance from the coast and the elevation of the property are also crucial factors.

Home Features and Premium Costs

The characteristics of a home itself play a crucial role in determining insurance costs. The age of the home, its construction materials, and the presence of security systems all contribute to the overall risk assessment. Older homes, particularly those with outdated plumbing or electrical systems, may be considered higher risk due to increased potential for damage or failure. Homes constructed with more durable materials, such as reinforced concrete or impact-resistant windows, generally receive lower premiums than those built with less resilient materials. Similarly, the presence of security features, such as alarm systems, fire sprinklers, and impact-resistant doors and windows, can lead to lower premiums as they mitigate the risk of theft and damage. A newly constructed home with hurricane-resistant features will likely have a lower premium than an older home with outdated features in the same location.

Risk Factors and Premium Calculations

Various risk factors influence the calculation of insurance premiums. These factors go beyond location and home features to include the homeowner’s claims history, the presence of pools or trampolines, and even the type of roofing material. A homeowner with a history of filing multiple claims will likely face higher premiums than one with a clean record. Features like swimming pools or trampolines increase the risk of accidents and therefore higher premiums. Similarly, certain roofing materials, such as wood shingles, are more susceptible to damage from high winds and hurricanes compared to more resilient options like tile or metal roofs. For instance, a homeowner with a pool and a history of previous claims might see a significant increase in their premium compared to a homeowner with a similar home but without these risk factors.

Filing a Claim with AAA Home Insurance in Florida

Filing a claim with AAA Home Insurance in Florida involves a straightforward process designed to help policyholders navigate the complexities of insurance after a covered incident. Understanding the steps involved, required documentation, and expected timeline will ensure a smoother experience. This section Artikels the process to facilitate a successful claim resolution.

Steps Involved in Filing a Home Insurance Claim

Promptly reporting your claim is crucial. Delaying notification can impact your claim’s processing. AAA aims to process claims efficiently and fairly. The specific steps may vary slightly depending on the nature of the damage, but the overall process remains consistent.

- Report the incident: Immediately contact AAA’s claims department by phone at the number listed on your policy documents. This initial contact starts the claims process.

- Provide initial information: Be prepared to provide details about the incident, including the date, time, and location, along with a brief description of the damage.

- Schedule an inspection: AAA will likely schedule an inspection of the damaged property by a claims adjuster. Cooperate fully with the adjuster during this inspection.

- Submit supporting documentation: Provide all necessary documentation as requested by the adjuster (detailed below).

- Review the claim: Once the adjuster completes their assessment, they will review your claim and determine the extent of coverage.

- Receive payment or denial: AAA will notify you of their decision regarding your claim, including the amount of compensation (if approved) or reasons for denial.

Required Documentation to Support a Claim

Providing complete and accurate documentation is vital for a smooth and efficient claims process. The necessary documentation will depend on the nature of the damage, but generally includes the following:

- Proof of Loss Form: This form is typically provided by AAA and requires detailed information about the incident and the resulting damage.

- Photographs and Videos: High-quality photos and videos documenting the damage from multiple angles are essential. These should clearly show the extent of the damage.

- Police Report (if applicable): If the damage resulted from a crime, a police report is necessary.

- Repair Estimates: Obtain written estimates from qualified contractors for the repair or replacement of damaged property.

- Inventory of Damaged Property: Create a detailed list of damaged or destroyed items, including their value and purchase date (if possible).

- Copies of Relevant Documents: This may include your insurance policy, proof of ownership of the property, and any other pertinent documentation.

Claim Processing Timeline and Policyholder Expectations

The claim processing timeline varies based on the complexity of the claim and the availability of necessary information. Simple claims may be processed relatively quickly, while more complex claims may take longer. Policyholders should expect clear communication from AAA throughout the process.

- Initial Claim Report: Within 24-48 hours of reporting the claim, you should receive confirmation and instructions from AAA.

- Inspection: The inspection should be scheduled within a reasonable timeframe, depending on the adjuster’s availability and the nature of the damage.

- Claim Review and Decision: The review process may take several days to several weeks, depending on the complexity of the claim and the availability of documentation.

- Payment: If approved, payment will be issued according to the terms of your policy.

Step-by-Step Guide for Filing a Claim

This guide provides a clear, step-by-step process for filing a claim. Remember to always refer to your policy for specific details and requirements.

- Contact AAA’s Claims Department: Call the phone number listed on your policy documents immediately after the incident. Be prepared to provide basic information about the incident.

- Gather Necessary Documentation: Collect all relevant documents as listed above. The more complete your documentation, the faster the process will be.

- Cooperate with the Adjuster: Fully cooperate with the claims adjuster during the inspection and provide any additional information they request.

- Follow Up: If you haven’t heard back within a reasonable timeframe, follow up with AAA’s claims department.

AAA Home Insurance Customer Service and Reviews

AAA Home Insurance’s customer service experiences vary, reflecting the general landscape of the insurance industry. Understanding customer feedback and the accessibility of support channels is crucial for potential policyholders. This section examines available data on customer satisfaction and the effectiveness of AAA’s customer service approaches in Florida.

Customer reviews regarding AAA Home Insurance in Florida are mixed. Online platforms such as Google Reviews, Yelp, and the Better Business Bureau reveal a range of experiences. While some customers praise the company for efficient claims processing and helpful representatives, others express frustration with long wait times, difficulties reaching representatives, and perceived lack of responsiveness to concerns. The overall sentiment appears to be neither overwhelmingly positive nor overwhelmingly negative, suggesting a need for consistent service improvement.

AAA Customer Service Channels and Responsiveness

AAA typically offers several avenues for customer contact, including phone, email, and potentially online chat or a dedicated customer portal. The responsiveness of these channels, however, is a key area of varying customer feedback. Some report swift and helpful responses, particularly for urgent matters, while others describe lengthy hold times, unanswered emails, or difficulty navigating the online resources. The effectiveness of these channels likely depends on factors such as time of day, day of the week, and the complexity of the issue. Anecdotal evidence suggests that phone calls during peak hours may result in longer wait times than emails sent outside of busy periods.

Comparison with Other Major Insurers in Florida

Comparing AAA’s customer service with other major Florida insurers requires a nuanced approach. While objective metrics for customer service quality are scarce, a general comparison can be made based on readily available information. Companies like State Farm, Allstate, and Geico often receive high rankings in customer satisfaction surveys, but these surveys rarely provide a direct comparison to smaller insurers like AAA. Customer reviews on various platforms offer a more direct comparison, albeit subjective. The perception of customer service quality often depends on individual experiences and expectations. AAA may perform favorably compared to some smaller providers, but potentially lags behind established national insurers in terms of consistent, readily available support.

Hypothetical Customer Complaint Scenario

Imagine Mrs. Garcia experiences a roof leak due to a recent storm. She contacts AAA via phone to report the damage and initiate a claim. After a brief hold time, a representative answers, guides Mrs. Garcia through the initial claim process, and schedules an adjuster visit within 48 hours. The adjuster arrives promptly, assesses the damage, and provides a detailed report. However, Mrs. Garcia disagrees with a portion of the adjuster’s assessment. She contacts AAA again, this time via email, to express her concerns and provide additional photographic evidence. Within two business days, a supervisor contacts Mrs. Garcia, reviews the case, and offers a revised claim settlement that addresses her concerns. This scenario depicts a positive customer service experience, where prompt response times, clear communication, and willingness to address concerns contribute to a favorable outcome. However, it is important to note that this is a hypothetical example, and individual experiences may vary.

Specific Coverage Examples under AAA Home Insurance in Florida

AAA Home Insurance in Florida offers various coverage options, and understanding the specifics of these policies is crucial for homeowners. This section details several key coverage areas, providing examples to clarify what is and isn’t included. Remember to always refer to your specific policy documents for complete details.

Hurricane Damage Coverage

Hurricane damage is a significant concern for Florida homeowners. AAA Home Insurance policies typically cover damage caused by wind and rain associated with a hurricane, including damage to the roof, walls, windows, and other structures. However, flood damage is usually a separate coverage and requires a specific flood insurance policy. Coverage limits and deductibles will vary depending on the policy chosen. For example, a homeowner with a $300,000 dwelling coverage and a $5,000 deductible might receive $295,000 in compensation after a hurricane causes $300,000 worth of damage to their home. This assumes the damage is covered under the terms of the policy and that the claim is processed successfully.

Flood Damage Coverage

Given Florida’s vulnerability to flooding, understanding flood insurance is paramount. While standard AAA Home Insurance policies generally do *not* cover flood damage, it is highly recommended to purchase a separate flood insurance policy. Flood insurance is typically offered through the National Flood Insurance Program (NFIP) or private insurers. This separate policy would cover damages caused by flooding, such as water damage to the interior of the house, foundation damage, and damage to personal belongings. The cost of flood insurance varies based on factors like the location of the property and its flood risk assessment. A homeowner in a high-risk flood zone would expect to pay significantly more than someone in a low-risk zone.

Liability Coverage for Accidents on Insured Property

AAA Home Insurance policies typically include liability coverage, protecting you against financial responsibility for accidents or injuries that occur on your property. This coverage would pay for medical expenses, legal fees, and settlements arising from such incidents. For example, if a guest slips and falls on your icy driveway and sustains injuries, your liability coverage would help cover their medical bills and any legal costs associated with a lawsuit. The extent of liability coverage varies depending on the policy; higher coverage limits provide greater protection. It’s crucial to understand the limits of your liability coverage to avoid unexpected out-of-pocket expenses in case of a significant incident.

Example Claim Process: Wind Damage to Roof

Imagine a scenario where a strong windstorm causes significant damage to a homeowner’s roof, tearing off shingles and causing water damage to the interior ceiling. The homeowner, holding an AAA Home Insurance policy, immediately contacts AAA to report the damage. AAA sends an adjuster to inspect the property and assess the damage. The adjuster documents the damage with photographs and a detailed report. The homeowner then submits all required documentation, including photos, receipts for temporary repairs, and the adjuster’s report. AAA reviews the claim, determines the extent of coverage based on the policy terms and the adjuster’s assessment, and then issues a payment to cover the cost of repairs, minus any applicable deductible. The homeowner can then proceed with repairs using the funds received from AAA.

AAA Home Insurance Discounts and Bundling Options in Florida

AAA offers a range of discounts and bundling options to help Florida residents save money on their home insurance premiums. Understanding these options can significantly impact the overall cost of your insurance coverage. This section details the available discounts and the advantages and disadvantages of bundling your home and auto insurance policies with AAA.

Available Discounts

AAA frequently offers various discounts to its home insurance policyholders in Florida. These discounts can vary depending on the specific policy and individual circumstances. While specific discounts change, some commonly offered discounts include those for: home security systems (alarms and monitoring), claims-free history, multiple policies (bundling), and being a AAA member for a specified period. Contacting AAA directly or reviewing their website is crucial to get the most up-to-date information on current discounts. Eligibility criteria for each discount will also be Artikeld in the policy documentation.

Bundling Home and Auto Insurance with AAA

Bundling your home and auto insurance with AAA can often lead to significant cost savings. This is because insurance companies frequently offer reduced premiums when you purchase multiple policies from them. The combined policy administration is more efficient, resulting in cost savings passed on to the customer. However, bundling isn’t always the best option for everyone. A drawback is that if you have a claim on one policy, it could potentially affect your rates on the bundled policies. Also, you might be restricted in choosing providers if you only have bundled policies.

Cost Savings Comparison: Bundled vs. Separate Policies

The cost savings of bundling AAA insurance products can vary considerably depending on your individual circumstances and the specific coverage levels chosen. To illustrate, let’s consider a hypothetical example:

| Policy Type | Separate Premiums (Annual) | Bundled Premiums (Annual) | Savings (Annual) |

|---|---|---|---|

| Home Insurance | $1,500 | $1,350 | $150 |

| Auto Insurance | $1,200 | $1,080 | $120 |

| Total | $2,700 | $2,430 | $270 |

This hypothetical example shows a potential annual savings of $270 by bundling both home and auto insurance. These figures are illustrative only and actual savings may vary. It’s always advisable to obtain personalized quotes from AAA to determine the exact cost savings based on your specific needs and risk profile. Remember that these savings can change based on claims history and coverage levels. A significant claim on either policy could negate the savings of bundling.

Concluding Remarks

Choosing the right home insurance is a significant financial decision. AAA offers a competitive option in the Florida market, providing various coverage levels and potential discounts. By understanding the factors that influence premiums, the claims process, and the quality of customer service, Florida homeowners can confidently select a policy that best suits their needs and budget. This guide serves as a starting point for a more thorough investigation into AAA’s offerings and a comparison with other insurers in the state.

Detailed FAQs

What types of discounts does AAA offer on home insurance in Florida?

AAA may offer discounts for various factors, including bundling home and auto insurance, installing security systems, and having a good claims history. Specific discounts should be confirmed directly with AAA.

How long does it typically take AAA to process a home insurance claim in Florida?

Processing times vary depending on the complexity of the claim. While AAA aims for efficiency, expect some delay, especially for significant events like hurricane damage. Contacting AAA directly will provide the most accurate estimate for your specific situation.

Does AAA cover sinkhole damage in Florida?

Sinkhole coverage is often an add-on to standard policies. Check your policy details or contact AAA directly to confirm if sinkhole coverage is included or available as an option.

What is AAA’s customer service availability?

AAA typically offers multiple channels for customer service, including phone, email, and potentially online chat. Check their website for the most up-to-date contact information and hours of operation.