Securing your family’s financial future is paramount, and understanding life insurance options is crucial. This guide delves into the intricacies of life insurance in New York, exploring various policy types, cost factors, and regulatory considerations. We’ll navigate the process of finding a suitable agent and selecting the right coverage to meet your specific needs, providing a clear and informative overview for New York residents.

From term life insurance’s temporary coverage to the lifelong protection of whole life policies, we’ll dissect the nuances of each option. Understanding factors like age, health, and lifestyle’s impact on premiums is key to making an informed decision. We’ll also examine New York’s specific regulations and the role of the Department of Financial Services in protecting consumers. This comprehensive guide aims to empower you with the knowledge to make the best choice for your circumstances.

Types of Life Insurance in New York

Choosing the right life insurance policy is a crucial financial decision. Understanding the various types available is key to making an informed choice that best suits your individual needs and circumstances. This section will Artikel the primary types of life insurance offered in New York, highlighting their key features and differences.

Term Life Insurance

Term life insurance provides coverage for a specific period, or “term,” such as 10, 20, or 30 years. If the insured dies within the term, the beneficiaries receive the death benefit. If the insured survives the term, the policy expires, and there is no cash value. Term life insurance is generally the most affordable option, making it a popular choice for those seeking temporary coverage, such as during periods of high financial responsibility like raising a family or paying off a mortgage. Premiums are typically fixed for the duration of the term.

Whole Life Insurance

Whole life insurance provides lifelong coverage, meaning the death benefit is paid out whenever the insured dies, regardless of when that occurs. Unlike term life, whole life policies build cash value over time, which grows tax-deferred. Policyholders can borrow against this cash value or withdraw it, though this will reduce the death benefit. Whole life insurance is more expensive than term life insurance due to the lifelong coverage and cash value component. It’s often seen as a long-term investment and estate planning tool.

Universal Life Insurance

Universal life insurance combines lifelong coverage with a flexible premium payment structure. Policyholders can adjust their premium payments within certain limits, and the cash value grows tax-deferred based on the interest rate credited to the policy. Unlike whole life insurance, the interest rate credited to the cash value can fluctuate, impacting the growth of the cash value. This flexibility offers some advantages, but it also introduces more complexity and potential risks compared to whole life insurance.

Variable Life Insurance

Variable life insurance also provides lifelong coverage, but the cash value grows based on the performance of underlying investment options chosen by the policyholder. This offers the potential for higher returns compared to whole life or universal life insurance, but it also carries greater investment risk. Policyholders bear the investment risk, and the cash value can fluctuate depending on market conditions. The death benefit can also vary, depending on the performance of the underlying investments. This type of policy requires a higher degree of investment knowledge and risk tolerance.

| Feature | Term Life | Whole Life | Universal Life | Variable Life |

|---|---|---|---|---|

| Coverage Period | Specific Term (e.g., 10, 20, 30 years) | Lifelong | Lifelong | Lifelong |

| Premiums | Fixed | Fixed | Flexible | Flexible |

| Cash Value | None | Yes, grows tax-deferred | Yes, grows tax-deferred (interest rate varies) | Yes, grows based on investment performance |

| Death Benefit | Fixed | Fixed (can be reduced by withdrawals) | Variable (can be reduced by withdrawals) | Variable (based on investment performance) |

| Cost | Generally Lower | Generally Higher | Moderate to High | Moderate to High |

| Risk | Low | Low | Moderate | High |

Factors Affecting Life Insurance Premiums in New York

Several key factors determine the cost of life insurance premiums in New York. Understanding these factors can help you make informed decisions when purchasing a policy. Insurers use a complex actuarial process to assess risk and price premiums accordingly. This assessment considers a variety of personal characteristics and policy choices.

The primary factors influencing premium costs are age, health, lifestyle, smoking habits, and the type of policy chosen. Each of these contributes to the overall risk assessment undertaken by the insurance company. A higher perceived risk translates to higher premiums, as the insurer needs to account for a greater chance of having to pay out a death benefit.

Age

Age is a significant factor because the probability of death increases with age. Younger individuals generally qualify for lower premiums than older individuals due to their statistically lower risk of mortality. This is a fundamental principle of life insurance pricing. For example, a 25-year-old will typically pay significantly less for the same coverage than a 55-year-old.

Health

An applicant’s health status heavily influences premium rates. Individuals with pre-existing conditions or a history of health problems generally face higher premiums. Insurers carefully review medical records and may require additional medical examinations to assess the level of risk involved. This is because individuals with pre-existing conditions are statistically more likely to require a payout from the life insurance policy sooner.

Lifestyle

Lifestyle choices also play a role. Factors like diet, exercise, and participation in risky activities (e.g., extreme sports) can impact premiums. Insurers consider these factors because they can influence an individual’s overall health and longevity. A healthy lifestyle generally leads to lower premiums, reflecting a lower risk profile.

Smoking Habits

Smoking significantly increases the risk of various health problems, including heart disease and cancer. As a result, smokers typically pay considerably higher premiums than non-smokers. This difference reflects the increased likelihood of an early death due to smoking-related illnesses. The premium increase can be substantial, sometimes doubling or even tripling the cost for a similar policy.

Policy Type

The type of life insurance policy chosen also affects the premium. Term life insurance, which provides coverage for a specific period, generally has lower premiums than permanent life insurance, which offers lifelong coverage. Within permanent insurance, whole life policies tend to have higher premiums than universal life policies due to the cash value component.

Impact of Pre-existing Conditions

Pre-existing conditions can significantly impact premium rates. Conditions such as diabetes, heart disease, or cancer can lead to substantially higher premiums or even policy denial. The severity and management of the condition will influence the level of increased cost. For instance, a well-managed condition might result in a moderate premium increase, while a poorly managed or severe condition could lead to a significant increase or refusal of coverage.

Flowchart: Determining Life Insurance Premiums

The process of determining life insurance premiums involves several steps. The following flowchart illustrates this process:

[Imagine a flowchart here. The flowchart would begin with “Application Received,” branching to “Medical Information Gathering” (including medical history, lifestyle questionnaires, and potentially medical exams). This would then lead to “Risk Assessment” (evaluating age, health, lifestyle, smoking status, and policy type). The “Risk Assessment” box would feed into “Premium Calculation” (using actuarial tables and risk models). Finally, the process would end with “Premium Quote Provided”.]

Finding a Life Insurance Agent in New York

Securing the right life insurance policy is a significant financial decision. Finding a trustworthy and knowledgeable agent is crucial to ensuring you understand your options and choose a policy that meets your needs and budget. This section provides guidance on locating a qualified life insurance agent in New York and asking the right questions to make an informed decision.

Choosing the right life insurance agent can significantly impact your experience and the suitability of your policy. A competent agent will guide you through the complexities of various policy types, explain the fine print, and help you choose a plan that aligns with your financial goals and risk tolerance. They’ll also assist with the application process and ensure your coverage is properly in place.

Resources for Finding Licensed Agents in New York

The New York State Department of Financial Services (NYDFS) is the primary resource for verifying the licensing and legitimacy of insurance agents. Their website provides a searchable database allowing consumers to check an agent’s license status, confirm their registration, and identify any disciplinary actions taken against them. Additionally, professional organizations such as the National Association of Insurance and Financial Advisors (NAIFA) and the Million Dollar Round Table (MDRT) offer directories of their members, many of whom are experienced life insurance agents. These organizations often have standards of professional conduct that their members are expected to uphold. Referrals from trusted sources, such as friends, family, or financial advisors, can also be valuable in identifying reputable agents.

Questions to Ask Potential Life Insurance Agents

Before committing to a policy, it’s essential to thoroughly vet potential agents. Asking specific questions demonstrates your due diligence and helps you assess their expertise and suitability.

Consider asking questions related to their experience, licensing, and the specific products they offer. Inquire about their commission structure to understand potential conflicts of interest. Discuss your specific needs and goals, and evaluate how well the agent addresses your concerns and provides tailored recommendations. Finally, request references and check their reviews to gain a broader understanding of their reputation and client experiences.

Examples of specific questions include: How long have you been selling life insurance in New York? Are you licensed by the NYDFS? What types of life insurance policies do you specialize in? What are your commission rates? Can you provide references from previous clients? Can you explain the various policy riders and their implications? What is your approach to helping clients manage their life insurance needs over time? What continuing education have you completed in the last year?

New York State Regulations for Life Insurance

Purchasing life insurance in New York is governed by a comprehensive set of regulations designed to protect consumers and ensure the solvency of insurance companies. These regulations, primarily enforced by the New York State Department of Financial Services (NYDFS), cover various aspects of the industry, from the licensing of agents to the types of policies that can be sold. Understanding these regulations is crucial for both consumers making purchasing decisions and insurance companies operating within the state.

The New York State Department of Financial Services plays a central role in overseeing the life insurance industry within the state. Its responsibilities include licensing and regulating insurance companies, agents, and brokers; reviewing and approving policy forms; investigating consumer complaints; and enforcing state insurance laws. The NYDFS aims to maintain a stable and competitive insurance market while protecting consumers from unfair or deceptive practices. They achieve this through regular audits, investigations, and enforcement actions against companies and individuals who violate state regulations. The department’s website provides a wealth of information regarding insurance regulations and consumer resources.

Licensing and Qualification Requirements for Insurance Agents and Brokers

The NYDFS sets stringent licensing and continuing education requirements for insurance agents and brokers operating in New York. Agents must pass examinations demonstrating their knowledge of insurance principles and regulations, and they must maintain their licenses through ongoing continuing education courses. These requirements ensure that agents possess the necessary expertise to advise consumers appropriately and sell suitable insurance products. Failure to meet these requirements can result in license suspension or revocation. The licensing process includes background checks to protect consumers from individuals with a history of fraudulent or unethical behavior.

Consumer Protections Under New York Life Insurance Laws

New York’s life insurance laws incorporate several key consumer protections. For example, there are regulations regarding policy disclosures, ensuring consumers receive clear and understandable information about the terms and conditions of their policies before purchasing them. These regulations dictate the specific information that must be included in policy summaries and prospectuses, making it easier for consumers to compare different policies and make informed decisions. Furthermore, the state prohibits unfair or deceptive trade practices, protecting consumers from misleading sales tactics or misrepresentations by insurance agents. The NYDFS actively investigates and addresses consumer complaints, providing a mechanism for redress if consumers believe they have been treated unfairly. Specific examples of consumer protection include regulations against twisting (inducing a policyholder to replace an existing policy with a new one without valid reason), and churning (excessive policy replacements for the agent’s benefit).

Regulation of Insurance Company Solvency

To protect policyholders, New York State actively regulates the financial stability of insurance companies operating within its borders. The NYDFS monitors the financial health of these companies through regular reviews of their financial statements and risk assessments. Companies must maintain adequate reserves to ensure they can meet their obligations to policyholders, even in the event of unforeseen circumstances. If a company’s financial condition deteriorates to a point where its ability to pay claims is threatened, the NYDFS can intervene to protect policyholders’ interests, potentially through rehabilitation or liquidation of the company. This ensures that policyholders are not left without coverage due to the insolvency of their insurer.

Life Insurance Riders and Add-ons in New York

Purchasing life insurance in New York offers the opportunity to customize your policy with various riders and add-ons. These additions provide enhanced coverage and flexibility, tailoring the policy to your specific needs and circumstances. Understanding the available options and their implications is crucial for making informed decisions.

Adding riders typically increases your premium, but the potential benefits can outweigh the added cost, depending on your individual risk profile and financial goals. It’s important to carefully weigh the costs and benefits of each rider before making a decision.

Accidental Death Benefit Rider

This rider provides an additional death benefit payment if the insured dies as a result of an accident. The payout amount is usually a multiple of the policy’s face value, often doubling or tripling it. For example, a $500,000 policy with a double indemnity accidental death benefit rider would pay out $1,000,000 in the event of an accidental death. The cost of this rider varies depending on factors such as the insured’s age, health, and the specific terms of the rider. The benefit is a significant financial safety net for families who rely on the insured’s income.

Long-Term Care Rider

A long-term care rider provides funds to cover the costs of long-term care services, such as nursing home care or in-home assistance, should the insured become chronically ill or disabled. The rider typically pays a daily or monthly benefit for a specified period, helping to offset the potentially high costs of long-term care. The cost of this rider depends on factors like the insured’s age, health, and the benefit amount chosen. The benefit can provide peace of mind, knowing that long-term care expenses are covered, preventing a financial strain on the family.

Disability Waiver of Premium Rider

This rider waives future premium payments if the insured becomes totally and permanently disabled. This means that the policy remains in force without requiring further premium payments, even if the insured is unable to work. The cost of this rider is relatively modest compared to the potential financial relief it provides. The benefit ensures that the policy continues to provide coverage even during periods of financial hardship caused by disability.

Guaranteed Insurability Rider

This rider allows the insured to purchase additional life insurance coverage at predetermined intervals without undergoing a medical examination. This is particularly beneficial if the insured’s health deteriorates over time, making it more difficult or expensive to obtain additional coverage later. The cost of this rider is usually relatively low, particularly when compared to the potential cost of obtaining additional coverage at a later date when health might be compromised. The advantage lies in the ability to lock in coverage at younger, healthier ages, ensuring coverage is available regardless of future health changes.

Return of Premium Rider

This rider guarantees that all or a portion of the premiums paid will be returned to the beneficiary if the insured dies within a specified period, or if the policy is surrendered before the end of the policy term. The cost of this rider is significantly higher than a standard policy, as it effectively adds an investment component to the life insurance. The benefit is a potential return of the premiums paid, offering a degree of financial security even if the death benefit is not triggered.

Five Common Life Insurance Riders and Their Implications

Below is a list summarizing five common life insurance riders and their implications:

- Accidental Death Benefit: Pays extra if death is accidental. Increases payout, adds cost.

- Long-Term Care Rider: Covers long-term care expenses. Provides financial security for long-term care, adds cost.

- Disability Waiver of Premium: Waives premiums if disabled. Protects policy during disability, adds cost.

- Guaranteed Insurability Rider: Allows for increased coverage later without medical exams. Secures future insurability, adds cost.

- Return of Premium Rider: Returns premiums paid under certain conditions. Offers premium return, adds significant cost.

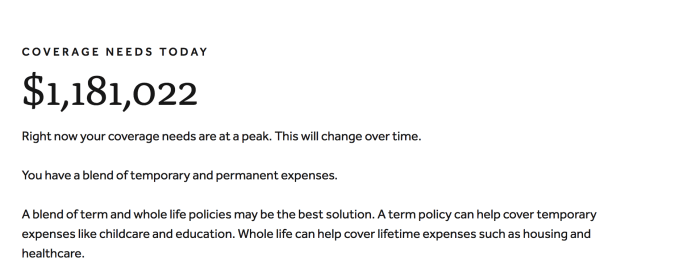

Illustrative Example: Life Insurance Needs for a New York Family

This example demonstrates how to calculate the appropriate life insurance coverage for a hypothetical family in New York, considering various financial obligations. We will use a common approach, focusing on replacing lost income and covering significant expenses. Remember, this is a simplified illustration and individual needs may vary significantly.

The Smith family, residing in New York, consists of John (age 35), a software engineer earning $150,000 annually, Mary (age 32), a teacher earning $75,000 annually, and two children, ages 5 and 2. They own a home with a $500,000 mortgage, have $50,000 in outstanding student loan debt, and aim to save for their children’s college education.

Calculating Life Insurance Needs

To determine the appropriate life insurance coverage for John, we will consider several key factors. First, we estimate the amount needed to replace his lost income for a specified period. We’ll use a common approach: replacing income for 10 years to account for the time it might take for the family to adjust financially.

Lost Income Replacement: $150,000 (annual income) x 10 (years) = $1,500,000

Next, we add the outstanding mortgage and student loan debt.

Debt Coverage: $500,000 (mortgage) + $50,000 (student loans) = $550,000

Finally, we factor in the estimated cost of college education for their two children. Assuming $25,000 per year per child for a four-year degree, this totals $200,000.

Children’s Education: $25,000/child/year x 4 years/child x 2 children = $200,000

Total Life Insurance Needs

Summing up these components gives a preliminary estimate of John’s necessary life insurance coverage.

Total Estimated Need: $1,500,000 (lost income) + $550,000 (debt) + $200,000 (education) = $2,250,000

This calculation provides a starting point. Additional expenses such as funeral costs, estate taxes, and unforeseen circumstances should be considered. A financial advisor can help refine this calculation to account for specific circumstances and risk tolerance. For Mary’s coverage, a similar calculation, though smaller, should be undertaken based on her income and the family’s remaining financial obligations after John’s death.

Visual Representation of Financial Needs

A simple bar chart could visually represent these calculations. The chart would have three bars representing lost income, debt, and children’s education. Each bar’s height would correspond to the calculated dollar amount. A fourth bar would represent the total life insurance needs, which would be the sum of the three previous bars. This visual would clearly illustrate how life insurance helps cover the significant financial burdens the family would face in the event of John’s death. The total height of the bars would visually represent the $2,250,000 total life insurance need, clearly showing how the different financial obligations contribute to the overall sum.

Last Word

Navigating the world of life insurance can feel overwhelming, but with the right information, the process becomes significantly clearer. This guide has provided a foundational understanding of life insurance in New York, covering policy types, cost influences, agent selection, regulations, and additional riders. Remember to carefully consider your individual needs and consult with a qualified agent to determine the most suitable policy for your family’s financial security. Proactive planning ensures peace of mind knowing your loved ones are protected.

FAQ Guide

What is the average cost of life insurance in New York?

The cost varies significantly based on factors like age, health, coverage amount, and policy type. It’s impossible to give an average without specific details. Obtaining quotes from multiple insurers is recommended.

How long does it take to get approved for life insurance in New York?

Approval times vary depending on the insurer and the complexity of the application. Simple applications might be approved within days, while more complex cases could take several weeks.

Can I get life insurance if I have a pre-existing condition?

Yes, but it may affect your premiums. Insurers will assess your health history and may offer coverage with higher premiums or exclusions.

What happens to my life insurance policy if I move out of New York?

Generally, your policy remains valid, but it’s advisable to notify your insurer of your address change. State regulations may vary slightly, so check your policy details.