Navigating the complex world of business in Chicago necessitates a thorough understanding of liability insurance. From bustling downtown streets to quiet neighborhood shops, every enterprise faces potential risks. This guide unravels the intricacies of liability insurance in Chicago, empowering businesses to make informed decisions and protect their future.

We’ll explore the various types of liability coverage available, the factors influencing premiums, and the crucial steps involved in selecting a provider and handling claims. Understanding these elements is paramount for mitigating financial exposure and ensuring business continuity in the face of unforeseen events.

Types of Liability Insurance in Chicago

Navigating the complexities of business in Chicago requires a thorough understanding of risk management. Liability insurance plays a crucial role in protecting your business from financial ruin stemming from accidents, injuries, or property damage caused by your operations. This section will explore the various types of liability insurance commonly available in Chicago, highlighting their coverage, exclusions, and ideal applications.

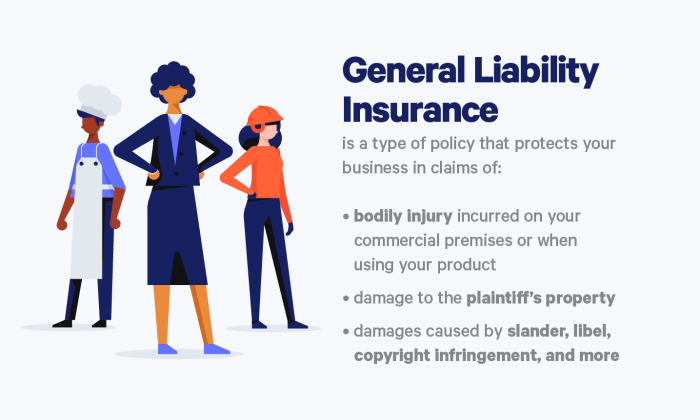

General Liability Insurance

General liability insurance is a foundational policy for many businesses. It protects against financial losses resulting from bodily injury or property damage caused by your business operations, as well as advertising injury (such as libel or slander). This coverage extends to accidents occurring on your premises, at a client’s location, or even at a trade show. A Chicago-based restaurant, for example, would benefit from general liability insurance to cover potential lawsuits arising from a customer slipping and falling, or a foodborne illness outbreak. Similarly, a retail store would be protected against claims related to customer injuries on their premises.

Professional Liability Insurance (Errors and Omissions Insurance)

Professional liability insurance, often called errors and omissions (E&O) insurance, safeguards professionals against claims of negligence or mistakes in their professional services. This is particularly crucial for businesses offering advice, consulting, or specialized services. A Chicago law firm, for instance, would need professional liability insurance to cover potential claims related to legal malpractice. Similarly, a Chicago-based architect would benefit from this coverage to protect against claims resulting from design flaws.

Commercial Auto Liability Insurance

Commercial auto liability insurance protects businesses against financial losses arising from accidents involving company vehicles. This coverage extends to injuries or property damage caused by your employees while driving company cars, trucks, or other vehicles for business purposes. A Chicago-based delivery service, for example, needs comprehensive commercial auto liability insurance to cover accidents involving their delivery vans. A construction company using company trucks for transporting materials would also require this type of insurance to protect against liability arising from traffic accidents.

Comparison of Liability Insurance Types

Understanding the nuances between different types of liability insurance is crucial for effective risk management. The following table compares key features of three common types:

| Feature | General Liability | Professional Liability (E&O) | Commercial Auto Liability |

|---|---|---|---|

| Coverage | Bodily injury, property damage, advertising injury | Negligence or mistakes in professional services | Bodily injury and property damage caused by company vehicles |

| Exclusions | Intentional acts, employee injuries (covered by workers’ compensation), contractual liability (often) | Claims related to intentional misconduct, breach of contract (often) | Damage to the insured vehicle, injuries to the insured’s employees (often covered by workers’ compensation) |

| Cost Factors | Business size, industry, location, claims history | Professional services offered, years of experience, claims history | Number of vehicles, driver history, type of vehicles, mileage |

Factors Affecting Liability Insurance Costs in Chicago

Securing affordable and adequate liability insurance in Chicago is crucial for businesses of all sizes. The cost of this insurance, however, is not uniform and depends on a variety of interconnected factors. Understanding these factors can empower businesses to make informed decisions and potentially reduce their insurance premiums.

Several key elements significantly influence the price of liability insurance in the city. These factors interact in complex ways, meaning a change in one area can ripple through and affect the overall cost. It’s a dynamic process, and understanding these nuances is key to effective risk management.

Industry Type

The industry in which a business operates is a primary determinant of its liability insurance costs. High-risk industries, such as construction or manufacturing, typically face higher premiums due to the inherent dangers associated with their operations. Conversely, businesses in lower-risk sectors, like retail or office administration, might enjoy lower premiums. This reflects the increased likelihood of accidents or injuries occurring in certain lines of work. For instance, a construction company will pay significantly more than a bakery due to the inherent higher risk of workplace accidents and potential lawsuits.

Business Size

The size of a business also plays a crucial role. Larger businesses, with more employees and a wider operational scope, generally face higher premiums. This is because larger operations often have a greater potential for incidents and resulting claims. A small boutique, for example, will likely have lower insurance costs compared to a large manufacturing plant employing hundreds of workers. The increased exposure to risk directly translates to higher premiums.

Claims History

A business’s claims history is a critical factor. A history of frequent or substantial claims will inevitably lead to higher premiums. Insurers view a history of claims as an indicator of higher risk, and they adjust premiums accordingly to offset potential future payouts. Conversely, a clean claims history can result in significant premium discounts, reflecting the insurer’s assessment of lower risk.

Location within Chicago

The specific location of a business within Chicago can significantly influence its insurance costs. Areas with higher crime rates or a greater frequency of accidents tend to have higher premiums. Insurance companies conduct detailed risk assessments based on location data, considering factors like proximity to high-traffic areas, crime statistics, and the overall safety of the neighborhood. A business located in a high-crime area might pay considerably more than one in a safer, less congested neighborhood.

Risk Assessment

Insurance companies employ rigorous risk assessment methodologies to determine premiums. These assessments consider various factors, including the nature of the business, its safety protocols, employee training, and the overall risk profile. A business that demonstrates a proactive approach to safety, such as implementing robust safety measures and providing thorough employee training, might receive a lower premium due to the reduced risk profile. Conversely, a lack of safety protocols and a history of safety violations could lead to higher premiums.

Hypothetical Scenario

Let’s consider a hypothetical scenario: Two restaurants, “A” and “B,” both operate in Chicago. Restaurant “A” is a small, family-owned Italian restaurant in a quiet residential neighborhood with a spotless safety record and no prior claims. Restaurant “B” is a large, bustling steakhouse located in a busy downtown area with a history of minor slip-and-fall incidents. Restaurant “A” will likely enjoy significantly lower liability insurance premiums due to its lower risk profile (smaller size, safe location, clean claims history), whereas Restaurant “B” will face higher premiums due to its location, size, and claims history. This illustrates how various factors interact to determine the final cost.

Finding and Choosing a Liability Insurance Provider in Chicago

Securing the right liability insurance in Chicago is crucial for protecting your personal or business assets. Navigating the options available can feel overwhelming, but a systematic approach simplifies the process. This section details how to locate reputable providers, obtain competitive quotes, and compare policies effectively to make an informed decision.

Finding a suitable liability insurance provider involves utilizing various resources and understanding the quote comparison process. This ensures you secure the best coverage at a fair price.

Resources for Finding Reputable Liability Insurance Providers

Several avenues exist for locating reputable liability insurance providers in Chicago. Online directories, such as those maintained by the Illinois Department of Insurance or independent review sites, offer a starting point. These platforms often allow you to filter by coverage type, location, and customer ratings. Working with an independent insurance broker is another effective strategy. Brokers represent numerous insurance companies, allowing them to compare policies and find the best fit for your needs. They often possess specialized knowledge of the Chicago insurance market and can navigate the complexities of policy selection. Directly contacting insurance companies is also an option; however, this approach requires more independent research and comparison across multiple providers.

Obtaining Quotes from Multiple Insurance Providers

Once you’ve identified potential providers, obtaining quotes is the next step. Most companies offer online quote request forms, simplifying the process. Be prepared to provide detailed information about your circumstances, including the type of liability coverage you need, the location of your business or property, and your risk profile. For more complex situations or specialized coverage, a phone call or in-person meeting with an agent might be necessary. Remember to request quotes from at least three to five different providers to ensure you’re comparing a range of options. This competitive comparison is essential for securing the most favorable terms.

Comparing Policy Details Before Selecting a Provider

Comparing quotes isn’t just about price; it’s about understanding the policy details. A lower premium might come with reduced coverage or higher deductibles. Thoroughly reviewing each policy’s terms and conditions is vital. Pay close attention to the coverage limits, exclusions, and any specific conditions that might affect your claims process. Look for clarity in the policy language – a well-written policy will be easy to understand. Also, check the provider’s financial stability rating, ensuring they can meet their obligations if a claim arises. Consumer reviews and ratings can provide valuable insights into the provider’s reputation for claims handling and customer service.

Key Aspects to Consider When Comparing Insurance Quotes

Before making a decision, carefully consider the following:

- Premium Cost: The total annual cost of the policy.

- Coverage Limits: The maximum amount the insurer will pay for a covered claim.

- Deductible: The amount you pay out-of-pocket before the insurance coverage kicks in.

- Exclusions: Specific situations or events not covered by the policy.

- Policy Period: The duration of the insurance coverage (usually one year).

- Claims Process: The procedure for filing and processing a claim.

- Customer Service: The insurer’s reputation for responsiveness and helpfulness.

- Financial Stability Rating: An indicator of the insurer’s financial strength and ability to pay claims.

By carefully considering these factors, you can choose a liability insurance provider that offers comprehensive coverage at a price you can afford, minimizing your financial risk.

Liability Insurance Claims Process in Chicago

Filing a liability insurance claim in Chicago, like in any other city, involves a structured process designed to assess the validity of a claim and determine the appropriate compensation. Understanding this process can significantly reduce stress and improve the chances of a successful outcome. The process generally begins with reporting the incident and culminates in a settlement or denial of the claim.

Steps Involved in Filing a Liability Insurance Claim

The process typically starts with promptly notifying your insurance provider about the incident. This should include detailed information about the event, including date, time, location, and involved parties. Next, you’ll likely need to complete a claim form providing comprehensive details of the incident and any resulting damages or injuries. Your insurer will then assign an adjuster to investigate the claim. This investigation involves gathering evidence, interviewing witnesses, and reviewing relevant documentation. The adjuster will assess liability and determine the amount of compensation, if any. Finally, the insurance company will make a decision regarding the claim, offering a settlement or denying the claim, based on their investigation and policy terms. Disputes may necessitate further negotiations or legal action.

Common Liability Claims for Chicago Businesses

Chicago businesses face a variety of liability risks. Common claims include slip and fall accidents on business premises, injuries caused by defective products sold by the business, property damage caused by the business’s operations, and allegations of professional negligence, such as medical malpractice for a clinic or legal malpractice for a law firm. Another significant area involves automobile accidents involving company vehicles. Claims arising from advertising injury (such as false advertising or libel) and employment practices liability (such as wrongful termination or discrimination lawsuits) are also prevalent.

Role of an Insurance Adjuster

The insurance adjuster plays a critical role in the claims process. They are responsible for investigating the claim, gathering evidence, and assessing liability. This involves interviewing witnesses, reviewing police reports (if applicable), inspecting damaged property, and reviewing medical records (in cases involving injuries). The adjuster evaluates the validity of the claim based on the policy’s terms and conditions, applicable laws, and the evidence gathered. They determine the amount of compensation to be paid, negotiating settlements with claimants or their legal representatives. Essentially, the adjuster acts as the intermediary between the insured and the insurance company, ensuring a fair and efficient resolution.

Typical Claim Scenario

Imagine a coffee shop in Chicago where a customer slips on a wet floor and sustains injuries. The customer (claimant) contacts the coffee shop (insured), and the incident is reported to the coffee shop’s liability insurance company. The insurance company assigns an adjuster who visits the coffee shop, interviews witnesses, reviews security footage (if available), and examines the area where the incident occurred. The adjuster also reviews the customer’s medical records and assesses the extent of their injuries. Based on their investigation, the adjuster determines the coffee shop’s liability and negotiates a settlement with the customer or their attorney. This settlement might cover medical expenses, lost wages, and pain and suffering. The settlement amount will depend on the severity of the injuries, the coffee shop’s level of negligence, and the terms of their insurance policy.

Legal Considerations for Liability Insurance in Chicago

Navigating the legal landscape of liability insurance in Chicago requires understanding the specific requirements for various businesses and the potential consequences of inadequate coverage. This section will explore the legal ramifications of liability insurance, common disputes, and a hypothetical case to illustrate the complexities involved.

Legal Requirements for Liability Insurance in Chicago

Chicago, like many other cities, has specific regulations regarding liability insurance for certain businesses. These requirements often depend on the industry, size, and the nature of the business operations. For example, contractors often need to demonstrate proof of liability insurance to secure permits and work on city projects. Similarly, certain professions, such as healthcare providers, may face stricter regulations and higher minimum coverage requirements. Failure to meet these mandated insurance levels can result in significant penalties, including fines, suspension of licenses, and legal action. Businesses should consult with legal counsel and relevant city agencies to determine their specific liability insurance obligations.

Implications of Inadequate Liability Insurance

The absence of adequate liability insurance can expose businesses to substantial financial risk. If a business is found liable for damages or injuries, it could be forced to pay significant sums out of its own pockets to cover settlements, judgments, and legal fees. This can lead to bankruptcy or severely impact the business’s financial stability. Beyond the financial consequences, a lack of insurance can also damage a business’s reputation and lead to loss of customers and future business opportunities. Furthermore, inadequate coverage can create significant personal liability for business owners, potentially putting their personal assets at risk.

Common Legal Disputes Related to Liability Insurance Claims in Chicago

Disputes involving liability insurance claims in Chicago often center around issues of coverage, policy interpretation, and the extent of the insured’s liability. Common disagreements include whether a specific incident falls under the policy’s definition of covered events, disagreements over the amount of damages owed, and disputes regarding the insurer’s duty to defend the insured. These disputes can lead to lengthy and costly litigation, requiring businesses to engage legal counsel to protect their interests. Cases involving complex injury claims, multiple parties, or ambiguous policy language often lead to protracted legal battles.

Hypothetical Legal Case: Liability Insurance Claim

Imagine a hypothetical case involving “ABC Construction,” a Chicago-based company. While working on a renovation project, a falling piece of debris injures a pedestrian. The injured pedestrian sues ABC Construction for negligence, seeking significant compensation for medical expenses, lost wages, and pain and suffering. ABC Construction holds a general liability policy with “XYZ Insurance.” XYZ Insurance argues that the incident falls outside the policy’s coverage due to a specific exclusion clause relating to “acts of God.” However, ABC Construction’s legal team counters that the incident was due to the company’s negligence in securing the construction site, not an act of God. The case could go to trial, where a judge or jury would determine ABC Construction’s liability and the extent of damages. Depending on the outcome, XYZ Insurance might be obligated to pay the judgment or settlement, potentially leading to a further dispute over the interpretation of the policy. The ultimate outcome hinges on the specific facts of the case, the policy’s wording, and the persuasiveness of the legal arguments presented by both sides.

Illustrative Examples of Liability Insurance Scenarios in Chicago

Understanding liability insurance is best done through real-world examples. The following scenarios illustrate the diverse situations where liability insurance can be crucial for individuals and businesses in Chicago. Each example highlights the claim process and the potential impact of inadequate coverage.

Small Business Liability Claim: The Coffee Shop Spill

A small coffee shop owner in Wicker Park, operating without adequate liability insurance, accidentally spills a large pot of hot coffee on a customer, causing significant burns requiring medical treatment. The customer files a lawsuit seeking compensation for medical expenses, lost wages, and pain and suffering. The lawsuit proceeds, and despite the owner’s attempts to settle, the court rules in favor of the customer, awarding a judgment exceeding $50,000. This amount far surpasses the owner’s personal savings, potentially leading to bankruptcy and the closure of the business. Had the coffee shop owner secured appropriate liability insurance, the claim would have been handled by the insurance company, protecting the business from significant financial ruin. The insurance company would have covered legal fees, medical expenses, and the settlement amount, up to the policy limits.

Large Corporation Liability Claim: Construction Site Accident

A large construction company undertaking a high-rise project in the Loop experiences a serious accident. A worker falls from a significant height due to a safety lapse, resulting in severe injuries and long-term disability. The worker sues the construction company, alleging negligence and seeking substantial compensation for medical bills, lost income, and pain and suffering. The lawsuit involves extensive legal proceedings, expert witnesses, and significant legal fees. While the construction company has liability insurance, the claim exceeds the initial policy limits. This necessitates additional coverage through an umbrella policy and still results in substantial out-of-pocket expenses for the company due to the magnitude of the damages awarded to the injured worker. The case highlights the importance of securing high coverage limits, particularly for high-risk industries.

Importance of Adequate Coverage: The Dog Bite Incident

A Chicago resident owns a dog known to be aggressive, but they do not have adequate liability insurance coverage. During a walk, the dog bites a child, causing serious injuries requiring extensive medical treatment. The child’s parents sue the dog owner for damages. Even with a relatively small settlement amount, the costs associated with medical expenses and legal fees quickly exceed the dog owner’s personal resources. This scenario underscores the importance of having sufficient liability coverage, even for seemingly minor incidents, as legal and medical costs can escalate rapidly. The lack of adequate coverage could lead to significant personal financial hardship for the dog owner.

Ultimate Conclusion

Securing the right liability insurance is a critical investment for any Chicago business. By carefully considering the factors discussed—from the type of coverage needed to the selection of a reputable provider—businesses can significantly reduce their risk exposure and build a stronger foundation for long-term success. Remember, proactive planning and informed decision-making are key to navigating the complexities of liability in the dynamic Chicago market.

Commonly Asked Questions

What is the average cost of liability insurance in Chicago?

The cost varies greatly depending on factors like business type, size, location, and claims history. It’s best to obtain quotes from multiple providers for accurate pricing.

How long does it take to get a liability insurance policy?

The processing time depends on the insurer and the complexity of the application. Generally, it can range from a few days to a few weeks.

Can I get liability insurance if my business has had previous claims?

Yes, but it might affect your premium. Be transparent about your claims history when applying for insurance.

What happens if I don’t have liability insurance and an incident occurs?

You could face significant financial liability, including lawsuits and legal fees, potentially leading to bankruptcy.