Understanding your insurance policy is crucial, and the declaration page serves as its concise summary. This vital document Artikels key details, providing a quick reference for policyholders. It’s your snapshot of coverage, clarifying essential information at a glance, from policy numbers to coverage specifics. This guide will illuminate the importance and practical applications of this often-overlooked document.

We’ll explore the key elements found on a declaration page across various insurance types, highlighting the significance of accurate information and the potential legal ramifications of inaccuracies. We’ll also delve into how to interpret this document, use it for claims, and compare it to the full policy document. Ultimately, understanding your declaration page empowers you to navigate your insurance coverage confidently.

Defining the Insurance Policy Declaration Page

The insurance policy declaration page serves as a concise summary of the key details of your insurance coverage. It’s essentially a snapshot of your policy, providing readily accessible information crucial for both you and your insurer. This page is not the entire policy document, but rather a vital component, acting as a quick reference guide.

The declaration page’s function is multifaceted. It confirms the agreement between you and the insurance provider, outlining the specifics of your coverage. It also aids in claims processing, allowing for swift verification of your policy details. Finally, it serves as a record of your policy’s essential elements, allowing for easy tracking of changes or updates over time.

Key Information Found on a Declaration Page

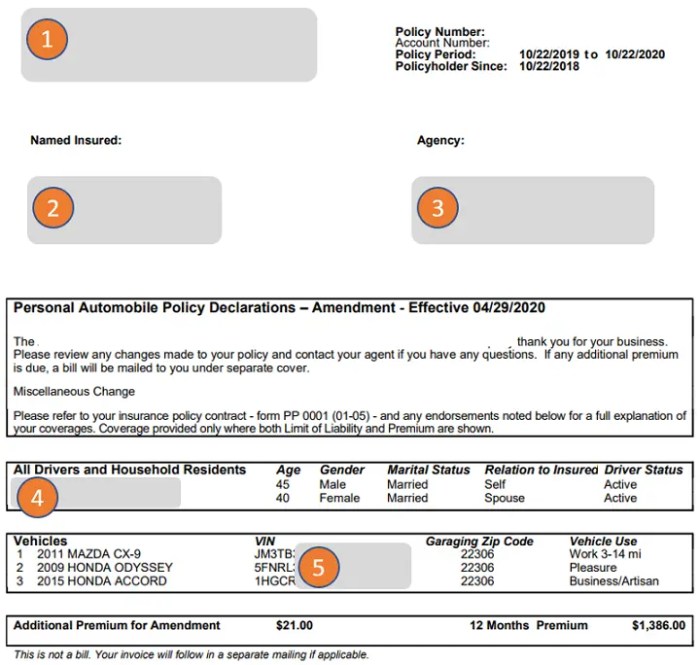

A typical declaration page includes several key pieces of information. This information varies slightly depending on the type of insurance, but common elements include the policyholder’s name and address, policy number, effective dates (inception and expiration), coverage amounts, premiums, and any applicable deductibles. Specific details related to the insured item (vehicle, property, etc.) are also usually included. For example, in auto insurance, this might include the vehicle’s make, model, and year. In homeowners insurance, it would detail the property’s address and coverage limits.

Examples of Declaration Page Elements Across Different Insurance Types

Different insurance policies necessitate different information on their declaration pages. Consider the following examples:

- Auto Insurance: The declaration page for an auto insurance policy would include details like the insured vehicle’s identification number (VIN), coverage limits (liability, collision, comprehensive), and the named insured driver’s information. It might also specify any additional drivers listed on the policy and any discounts applied.

- Homeowners Insurance: A homeowners insurance declaration page would list the property’s address, coverage amounts for dwelling, personal property, and liability, as well as the deductible. It would also specify any endorsements or riders added to the policy, such as flood or earthquake coverage.

- Health Insurance: A health insurance declaration page might detail the plan’s name, effective dates, premium amount, and the names of covered individuals. It might also include information on the plan’s deductible, copay, and coinsurance amounts. Specific details regarding covered services and exclusions would be found in the full policy document, not necessarily on the declaration page itself.

Comparison of Declaration Page Elements Across Insurance Types

The following table compares the typical declaration page elements for three common insurance types: auto, home, and health.

| Element | Auto Insurance | Homeowners Insurance | Health Insurance |

|---|---|---|---|

| Policy Number | Yes | Yes | Yes |

| Policyholder Name & Address | Yes | Yes | Yes |

| Effective Dates | Yes | Yes | Yes |

| Premium Amount | Yes | Yes | Yes |

| Coverage Amounts/Limits | (Liability, Collision, Comprehensive) | (Dwelling, Personal Property, Liability) | (Deductible, Copay, Coinsurance) |

| Deductible | Yes (for Collision and Comprehensive) | Yes | Yes |

| Vehicle Information (VIN, Make, Model) | Yes | No | No |

| Property Address | No | Yes | No |

| Covered Individuals | (Drivers) | (Named Insured and Household Members) | Yes |

Understanding Key Terms and Concepts

The insurance policy declaration page, while seemingly straightforward, contains crucial terminology defining the policy’s scope and participants. Understanding these terms is vital for ensuring you’re adequately covered and aware of your rights and responsibilities. This section clarifies key concepts and their relevance to the declaration page.

Policyholder, Insured, and Beneficiary

The policyholder, insured, and beneficiary are distinct roles, though sometimes one person fills multiple roles. The policyholder is the individual or entity that purchases the insurance policy and is legally responsible for paying premiums. The insured is the person or entity covered by the policy, whose risk the insurer is assuming. The beneficiary is the person or entity who receives the policy’s benefits in the event of a covered loss or death. For example, in a life insurance policy, the policyholder might be the spouse, the insured the deceased, and the beneficiary their children. On the declaration page, these individuals will be clearly identified, and any discrepancies between them must be noted.

Visual Representation of Policyholder, Insured, and Beneficiary Relationships

Imagine a simple diagram. A large circle represents the insurance policy. Inside this circle are three smaller, interconnected circles. One circle is labeled “Policyholder,” another “Insured,” and the third “Beneficiary.” Arrows might connect the circles to illustrate the flow of responsibility (policyholder paying premiums) and benefits (from the policy to the beneficiary, often contingent on the insured’s situation). In some cases, the Policyholder and Insured circles might overlap, indicating the same individual, while the Beneficiary remains separate. In other cases, all three circles may be distinct and separate.

Policy Number, Effective Date, and Expiration Date

The policy number uniquely identifies the specific insurance policy. It’s crucial for all communication with the insurance company and acts as a reference point for all policy-related documentation. The effective date marks the policy’s commencement, indicating when coverage begins. The expiration date signifies the end of the policy’s coverage period. These dates are prominently displayed on the declaration page and are essential for determining coverage during a claim. Failure to renew a policy before its expiration date results in the lapse of coverage.

Policy Endorsements and Their Impact

Policy endorsements are additions or modifications to the original insurance policy. They alter the policy’s terms, conditions, or coverage. For example, an endorsement might add coverage for a specific item, increase liability limits, or exclude certain risks. These endorsements are often referenced on the declaration page, either through a specific notation or by incorporating the changes directly into the policy details. A common example is adding an earthquake endorsement to a homeowner’s insurance policy. This endorsement, once added, would be reflected on the updated declaration page.

Legal and Regulatory Aspects

The insurance declaration page, while seemingly straightforward, carries significant legal weight. Its accuracy and completeness are crucial for both the insurer and the policyholder, impacting the validity and enforceability of the insurance contract. Inaccuracies or omissions can lead to disputes, legal challenges, and potentially significant financial consequences.

The legal implications of errors on the declaration page are far-reaching. This section will explore the potential consequences for both parties involved and examine how regulatory requirements vary across different jurisdictions.

Legal Implications of Inaccurate or Incomplete Information

Inaccurate or incomplete information provided on the declaration page can render the insurance policy voidable or even void, depending on the nature and materiality of the inaccuracies. For instance, if a policyholder misrepresents the value of insured property, the insurer may be able to deny a claim based on underinsurance. Conversely, if the insurer fails to accurately reflect the coverage details on the declaration page, the policyholder may have grounds to challenge the insurer’s interpretation of the policy terms. This underscores the importance of meticulous accuracy in completing and verifying the information on the declaration page. The burden of proof often lies with the policyholder to demonstrate the accuracy of the information provided.

Consequences for Insurers and Policyholders

Discrepancies on the declaration page can result in significant consequences for both insurers and policyholders. For insurers, inaccurate information can lead to increased claims payouts due to underinsurance or coverage disputes. It may also result in legal challenges and reputational damage. Policyholders, on the other hand, face the risk of claims being denied, leading to substantial financial losses. In cases of intentional misrepresentation, policyholders may face legal action, including potential fraud charges. In the case of unintentional errors, rectifying the information may require amendments to the policy and could potentially affect premiums.

Variations in Declaration Page Requirements Across Jurisdictions

Regulatory bodies worldwide impose varying requirements regarding the content and format of insurance declaration pages. For example, some jurisdictions may mandate specific disclosures related to policy exclusions or cancellation terms, while others may have stricter rules concerning the use of standardized forms. These variations reflect differing legal frameworks and consumer protection standards. A policy issued in one jurisdiction might not necessarily meet the requirements of another. Navigating these differences requires careful attention to local regulations and legal advice when dealing with international insurance policies.

Potential Legal Challenges Arising from Declaration Page Errors

The following list Artikels some potential legal challenges stemming from errors on the insurance declaration page:

- Claims denials based on misrepresentation or omission of material facts.

- Breach of contract lawsuits due to discrepancies between the declaration page and the policy wording.

- Fraudulent claims investigations triggered by discrepancies.

- Legal disputes over the interpretation of policy terms as a result of unclear or ambiguous language on the declaration page.

- Regulatory fines and penalties for insurers who fail to comply with declaration page requirements.

Practical Applications and Scenarios

The insurance policy declaration page, seemingly a simple document, serves as a crucial reference point throughout the policy lifecycle. Understanding its contents and knowing how to utilize it effectively is essential for both policyholders and insurance professionals. This section explores practical applications and scenarios highlighting the declaration page’s importance.

This section will illustrate how to extract relevant information from a sample declaration page, verify its accuracy, and demonstrate its role in common insurance processes.

Locating and Interpreting Specific Information

Let’s consider a hypothetical sample declaration page. Assume it includes fields for the policyholder’s name (John Doe), policy number (1234567), effective date (January 1, 2024), coverage type (Homeowners), coverage amount ($500,000), and premium amount ($1,200). Locating the policy number is straightforward; it’s usually prominently displayed. To find the coverage amount, one would look for the section detailing the specifics of the insured property’s coverage. The effective date signifies the policy’s commencement, while the premium amount indicates the cost of the insurance. Interpreting this information means understanding that John Doe has a homeowners insurance policy covering his property for $500,000, effective from January 1, 2024, at an annual cost of $1,200.

Verifying the Accuracy of Information

A step-by-step procedure for verifying the accuracy of a declaration page involves comparing the information presented against supporting documentation. First, carefully review all entries on the declaration page. Second, cross-reference the policy number with any communication received from the insurance company. Third, confirm the policyholder’s name, address, and contact information. Fourth, verify the effective and expiration dates against the policy documents. Fifth, check the coverage details against the original application or policy agreement. Sixth, confirm the premium amount matches the payment records. Discrepancies should be reported to the insurance company immediately. Failure to verify the accuracy could lead to claim denials or other complications.

Common Scenarios Requiring the Declaration Page

The declaration page is indispensable in several scenarios. During a claim filing, the policy number, coverage details, and policyholder information are essential for processing the claim efficiently. When making a policy change, such as increasing coverage or adding a rider, the declaration page helps track the modifications made to the policy. It also serves as proof of insurance, for example, when providing evidence of coverage to a lender or landlord. Finally, during policy renewal, the declaration page can provide a summary of the current policy terms, allowing for comparison against new offers.

Filing a Claim Using the Declaration Page

A flowchart illustrating the process of using the declaration page to file a claim would look like this:

Start -> Locate policy number and other relevant information on the declaration page -> Contact the insurance company (phone, email, or online portal) -> Provide the declaration page information along with details of the incident -> Insurance company verifies the information -> Claim is processed (investigation, assessment, and payment). End.

Comparison with Other Policy Documents

The insurance policy declaration page, while a crucial component, presents only a summary of the overall insurance contract. Understanding its relationship to the complete policy document is vital for policyholders to fully grasp their coverage. This section will clarify the differences and highlight when each document is most relevant.

The declaration page provides a concise overview, acting as a snapshot of the key details of your insurance policy. In contrast, the full policy document contains the comprehensive terms, conditions, exclusions, and definitions that govern the insurance agreement. Think of the declaration page as the cover letter, and the full policy document as the detailed contract itself.

Key Differences Between the Declaration Page and the Policy’s Terms and Conditions

The declaration page primarily focuses on identifying information, such as the policyholder’s name, address, policy number, effective dates, and the covered property or individual. It also summarizes key coverage amounts. The full policy document, on the other hand, elaborates on the specifics of coverage, including definitions of covered perils, exclusions, limitations, procedures for filing claims, and the insurer’s responsibilities. It’s the legal agreement that Artikels the rights and obligations of both parties.

Situations Requiring the Declaration Page Versus the Full Policy Document

Referring to the declaration page is usually sufficient for verifying basic policy information, such as the policy number, coverage start and end dates, or the insured’s name and address. It is also useful for quickly checking the main coverage amounts. However, understanding the nuances of your coverage, determining whether a specific event is covered, or navigating the claims process necessitates reviewing the full policy document. For instance, the declaration page might state the liability coverage amount, but the full policy would detail the specific circumstances under which that coverage applies and any exclusions that might limit it. Similarly, the full policy document Artikels the steps involved in making a claim, something not explicitly detailed on the declaration page.

Comparison of Information in the Declaration Page and Full Policy Document

| Information | Declaration Page | Full Policy Document |

|---|---|---|

| Policyholder Information | Name, Address, Contact Information | Name, Address, Contact Information (potentially more detailed) |

| Policy Number | Clearly displayed | Referenced throughout the document |

| Policy Effective Dates | Start and End Dates | Start and End Dates, with potential for renewal information |

| Coverage Amounts | Summary of key coverage limits | Detailed breakdown of coverage limits, with specific conditions and exclusions |

| Covered Property/Individual | Brief description | Detailed description, potentially including specific addresses, details of covered items, etc. |

| Premium Information | Total premium amount | Detailed breakdown of premium components, payment schedule, etc. |

| Exclusions and Limitations | Generally not included | Comprehensive list of exclusions and limitations to coverage |

| Claims Procedures | Usually not included | Detailed instructions on how to file a claim, required documentation, and timelines |

Summary

The insurance policy declaration page, though seemingly simple, acts as a cornerstone of your insurance coverage. Its concise summary of key policy details empowers you to quickly access crucial information, verify accuracy, and smoothly navigate claims processes. By understanding its components and legal implications, you can ensure your protection and avoid potential pitfalls. Mastering your declaration page is a key step towards confident insurance management.

General Inquiries

What happens if information on my declaration page is incorrect?

Inaccurate information can lead to claim denials or disputes. It’s crucial to report any discrepancies to your insurer immediately.

Can I get a replacement declaration page if I lose mine?

Yes, contact your insurance provider; they can usually issue a replacement.

Is the declaration page legally binding?

Yes, it’s a legally binding part of your insurance contract. Information on it is considered part of the agreement.

Where can I find definitions of terms used on my declaration page?

Your full policy document usually contains a glossary of terms, or you can contact your insurer for clarification.