Securing the right auto liability insurance is crucial for responsible drivers. Understanding the nuances of liability coverage, from policy components to influencing factors like driving history and vehicle type, empowers you to make informed decisions. This guide navigates the complexities of obtaining quotes, comparing providers, and ultimately, finding the best fit for your needs and budget. We’ll explore the process from initial quote requests to analyzing policy details and strategies for saving money.

This exploration will cover various aspects, including the different types of liability coverage, how to effectively compare quotes from multiple insurers, and the significant impact of personal information accuracy on your quote. We will also delve into strategies to reduce premiums and uncover potential hidden costs, equipping you with the knowledge to navigate the world of auto insurance confidently.

Understanding Auto Liability Insurance Quotes

Obtaining an auto liability insurance quote can seem daunting, but understanding its components and influencing factors empowers you to make informed decisions. This section will clarify the key aspects of liability insurance quotes, helping you navigate the process with confidence.

Components of an Auto Liability Insurance Quote

An auto liability insurance quote is a detailed breakdown of the estimated cost of your insurance coverage. Several key components contribute to the final price. These typically include the premium, which is the amount you pay for the coverage, and any applicable taxes or fees. The premium itself is calculated based on a number of factors, which we will explore further. Additionally, some quotes may include details about payment plans or discounts available.

Factors Influencing Quote Variations

Several factors significantly influence the variation in quotes from different providers. These factors are assessed by insurance companies to determine your risk profile. Key factors include your driving history (accidents, tickets), age and driving experience, the type and age of your vehicle, your location (crime rates, accident frequency), and your credit history (in some states). For example, a driver with multiple speeding tickets will likely receive a higher quote than a driver with a clean record. Similarly, a newer, more expensive car will typically command a higher premium than an older, less valuable vehicle.

Types of Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Several types of liability coverage are commonly included in quotes. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers the cost of repairing or replacing the other person’s vehicle or property. Uninsured/underinsured motorist bodily injury protection covers your medical bills and other expenses if you are injured by an uninsured or underinsured driver. The specific limits of liability (e.g., $100,000/$300,000) are crucial and influence the overall cost of the quote.

Liability-Only vs. Comprehensive Auto Insurance

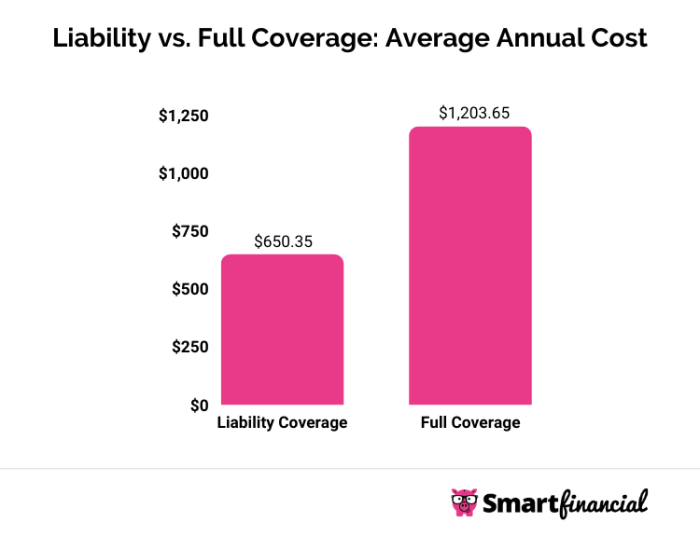

The following table compares key features of liability-only and comprehensive auto insurance quotes.

| Feature | Liability-Only | Comprehensive |

|---|---|---|

| Coverage | Covers damages and injuries you cause to others | Covers damages and injuries you cause to others, plus damage to your own vehicle from various events (collisions, theft, fire, vandalism, etc.) |

| Cost | Generally less expensive | Generally more expensive |

| Risk Protection | Protects against lawsuits from accidents you cause | Protects against lawsuits and damage to your own vehicle from a wider range of incidents |

| Recommendation | Suitable for drivers with older vehicles or limited budgets | Recommended for drivers who want broader protection and own newer vehicles |

Obtaining Auto Liability Insurance Quotes

Securing the best auto liability insurance quote involves a strategic approach, encompassing online methods, effective comparison techniques, and accurate information provision. Understanding these aspects is crucial for obtaining affordable and comprehensive coverage.

Methods for Obtaining Auto Liability Insurance Quotes Online

Many insurance providers offer convenient online quote tools. These typically involve filling out a form with basic information about yourself, your vehicle, and your driving history. Some companies allow you to instantly compare quotes from multiple insurers on their platforms. Others direct you to a separate page to complete the process with the individual insurer. Websites dedicated to insurance comparisons aggregate quotes from various providers, simplifying the process of side-by-side evaluation. Remember to check the reputation and licensing of any comparison website before using it.

Tips for Comparing Quotes from Different Insurance Providers Effectively

Comparing quotes effectively requires a systematic approach. Don’t just focus on the premium amount; consider the coverage details. Pay close attention to policy limits for bodily injury and property damage liability. Check for deductibles, which represent the amount you’ll pay out-of-pocket before your insurance coverage kicks in. Look for any additional benefits or discounts offered, such as accident forgiveness or safe driver discounts. Also, compare the insurers’ financial stability ratings to ensure they can meet their obligations if you need to file a claim. A lower premium isn’t always the best deal if the coverage is insufficient or the insurer is financially unstable.

Importance of Accurately Providing Personal Information When Requesting Quotes

Providing accurate personal information is paramount when obtaining auto liability insurance quotes. Inaccurate information can lead to inaccurate quotes, potentially resulting in insufficient coverage or even policy cancellation. Insurance companies use the information you provide to assess your risk profile, which directly impacts your premium. For example, misrepresenting your driving history or the details of your vehicle can lead to higher premiums or even denial of coverage. Be truthful and thorough in completing the quote request forms.

Step-by-Step Guide for Obtaining the Best Auto Liability Insurance Quote

- Gather Necessary Information: Compile details about your vehicle (make, model, year), driving history (including accidents and violations), and personal information (address, date of birth, etc.).

- Use Online Quote Tools: Utilize online quote tools from multiple insurance providers and comparison websites. Be sure to use the same information across all platforms for consistent comparisons.

- Compare Quotes Carefully: Analyze the quotes received, paying attention to coverage limits, deductibles, and additional benefits. Don’t solely focus on the premium; prioritize comprehensive coverage.

- Verify Insurer’s Financial Stability: Check the financial strength rating of each insurer to ensure they are financially sound and can fulfill their obligations.

- Review Policy Documents: Before purchasing a policy, carefully review the policy documents to fully understand the terms and conditions.

- Contact Insurers Directly: If you have questions or require clarification on any aspect of a quote, contact the insurer directly to discuss your options.

Factors Affecting Auto Liability Insurance Quote Prices

Several interconnected factors influence the price you’ll pay for auto liability insurance. Understanding these factors can help you make informed decisions and potentially secure more favorable rates. This section details the key elements that insurance companies consider when calculating your premium.

Demographic Factors

Demographic information plays a significant role in determining your auto insurance quote. Insurers use statistical data to assess risk profiles. Age, gender, and marital status are frequently considered. Younger drivers, statistically, have higher accident rates, leading to higher premiums. Similarly, insurers may use data showing that certain gender groups may have slightly different accident or claim patterns, impacting rates. Marital status can sometimes be a factor, with some insurers offering slightly lower rates to married individuals, reflecting potential differences in driving habits or risk assessment. It’s important to note that these differences are based on statistical averages and do not reflect individual driving skills or behaviors.

Driving History

Your driving history is arguably the most influential factor in determining your auto liability insurance quote. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents, especially those resulting in injuries or significant property damage, will substantially increase your premiums. The severity and frequency of incidents directly impact the perceived risk associated with insuring you. Even minor infractions like speeding tickets can lead to higher premiums, as they indicate a higher propensity for risky driving behaviors. Maintaining a spotless driving record is crucial for securing affordable auto insurance.

Vehicle Type and Location

The type of vehicle you drive significantly impacts your insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased potential for accidents. Conversely, smaller, less powerful vehicles often attract lower premiums. Your location also plays a critical role. Areas with high crime rates, frequent accidents, or severe weather conditions typically have higher insurance premiums due to the increased risk of claims. Urban areas often have higher rates than rural areas because of increased traffic density and the greater likelihood of collisions. Insurers carefully analyze accident statistics and crime rates in specific geographic locations to adjust their premiums accordingly.

Prioritized List of Factors

The following list prioritizes the factors discussed above based on their typical impact on auto insurance quote costs:

- Driving History: This is generally the most significant factor, with a clean record leading to the lowest premiums and accidents significantly increasing costs.

- Vehicle Type: The type of vehicle, particularly its value, repair costs, and safety features, significantly influences premiums.

- Location: Your geographic location, including its accident and crime rates, plays a substantial role in determining your rates.

- Demographic Factors: Age, gender, and marital status are typically less influential than the other factors but still play a role in the overall calculation.

Analyzing Auto Liability Insurance Quote Details

Understanding the details within your auto liability insurance quote is crucial to ensuring you have adequate coverage at a fair price. This involves familiarizing yourself with common terminology, coverage limits, and potential additional costs. By carefully reviewing your quote, you can make informed decisions about your insurance needs.

Common Terms and Conditions

Auto liability insurance quotes often include various terms and conditions that can be confusing. Key terms to understand include bodily injury liability, property damage liability, uninsured/underinsured motorist coverage, and the policy’s deductibles. Bodily injury liability covers medical expenses and other damages for injuries you cause to others in an accident. Property damage liability covers the cost of repairing or replacing damaged property belonging to others. Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who lacks sufficient insurance or is uninsured. Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. The policy will also specify the length of coverage (typically a year), and may include details about cancellation policies and dispute resolution processes. Careful review of these terms is essential before accepting a quote.

Understanding Coverage Limits

Coverage limits are expressed as numerical values, typically in the format of “X/Y/Z”. For example, a 25/50/25 liability limit means: $25,000 for bodily injury per person injured in an accident; $50,000 total for all bodily injuries sustained by multiple people in one accident; and $25,000 for property damage. These limits dictate the maximum amount the insurance company will pay out in the event of a claim. Higher limits offer greater protection but typically result in higher premiums. Choosing appropriate coverage limits depends on individual circumstances, including assets and risk tolerance. For instance, someone with significant assets might opt for higher limits to protect those assets.

Liability Insurance Scenarios

Liability insurance becomes essential in various accident scenarios. Consider these examples: You rear-end another car causing significant damage and injuries requiring extensive medical treatment. Your liability insurance would cover the medical bills and vehicle repairs for the other driver. Or, you are involved in a multi-vehicle accident at an intersection, resulting in injuries to multiple individuals and substantial property damage to several vehicles. Your liability coverage would help to compensate those affected. A final example is a situation where you accidentally hit a pedestrian while driving, leading to serious injuries and substantial medical expenses. Liability insurance would help cover these costs. Without sufficient liability insurance, you could face significant financial responsibility for damages and injuries.

Potential Hidden Costs and Additional Fees

It’s important to be aware of potential hidden costs that may not be immediately apparent in the initial quote.

- Administrative Fees: Some insurers may charge administrative fees for processing your application or making changes to your policy.

- Policy Processing Fees: These fees cover the insurer’s costs associated with setting up your policy.

- Late Payment Fees: Penalties for failing to make timely payments on your premiums.

- Cancellation Fees: Charges for canceling your policy before its expiration date.

- Reinstatement Fees: Fees for reinstating a lapsed policy.

Understanding these potential additional costs helps in accurately budgeting for your auto insurance expenses. A thorough review of the policy documents will clarify these potential fees.

Saving Money on Auto Liability Insurance Quotes

Securing affordable auto liability insurance is a priority for most drivers. Understanding the various factors that influence your premium and employing effective strategies can significantly reduce your overall cost. This section Artikels several key approaches to achieving lower premiums while maintaining adequate coverage.

Maintaining a Good Driving Record

A clean driving record is arguably the most significant factor in determining your auto insurance premiums. Insurance companies view drivers with a history of accidents, traffic violations, or DUI convictions as higher risks. Consequently, they charge higher premiums to offset the increased likelihood of claims. Conversely, maintaining a spotless driving record demonstrates responsible driving behavior, leading to lower premiums. For example, a driver with no accidents or violations in five years might qualify for significant discounts compared to a driver with multiple incidents. The financial benefits of safe driving extend beyond avoiding accidents; they directly translate into lower insurance costs.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple insurance policies, such as auto and homeowners or renters insurance. This practice leverages the principle of risk diversification for the insurer, resulting in lower premiums for the policyholder. By insuring multiple assets with the same company, you demonstrate loyalty and reduce the administrative costs associated with managing separate policies. The discount amount varies depending on the insurer and the specific policies bundled, but it can represent a substantial savings overall. For instance, a hypothetical bundled policy could offer a 15% discount compared to purchasing auto and home insurance separately.

Leveraging Insurance Company Discounts

Insurance companies frequently offer various discounts to attract and retain customers. These discounts can be based on factors such as vehicle safety features, completing a defensive driving course, being a good student (for younger drivers), or even belonging to specific professional organizations. Proactively researching and inquiring about available discounts is crucial. For example, installing anti-theft devices in your car or opting for a car with advanced safety features like automatic emergency braking might qualify you for a discount. Similarly, completing a defensive driving course demonstrates your commitment to safe driving practices, potentially resulting in a reduced premium. It’s worthwhile to contact multiple insurers and compare their discount offerings.

Illustrating Key Concepts

Understanding the practical application of auto liability insurance is crucial. Let’s explore scenarios to solidify your comprehension of how it works in real-world situations and the impact of different coverage limits.

A car accident can happen unexpectedly, leaving you facing significant financial burdens. Liability insurance is designed to protect you in such situations by covering the costs associated with injuries and damages you cause to others.

Scenario: A Car Accident and Liability Insurance Coverage

Imagine Sarah, driving her sedan, is distracted by her phone and accidentally runs a red light, colliding with John’s pickup truck. The impact is significant. John suffers a broken leg requiring extensive medical treatment, and his truck sustains considerable damage, needing extensive repairs. Sarah’s car also has substantial damage. John’s medical bills reach $50,000, and the repairs to his truck cost $20,000. Without liability insurance, Sarah would be personally responsible for these $70,000 in damages. However, because she carries liability insurance with $100,000 in bodily injury liability coverage and $50,000 in property damage liability coverage, her insurance company will cover these costs. The insurance company will negotiate with John and his insurance company (if he has collision coverage) to settle the claims. The fact that Sarah’s car was also damaged is irrelevant to her liability insurance coverage; that would be handled through her collision coverage (if she has it).

Visual Representation of Coverage Limits and Payout Amounts

The amount your insurance company pays out depends directly on your chosen coverage limits. Consider this simplified text-based illustration:

Scenario: Accident resulting in $80,000 in damages.

Coverage Limit: $50,000 Bodily Injury & $25,000 Property Damage

Payout: Insurance pays $50,000 (Bodily Injury limit reached) + $25,000 (Property Damage limit reached) = $75,000. You are responsible for the remaining $5,000.

Coverage Limit: $100,000 Bodily Injury & $50,000 Property Damage

Payout: Insurance pays the full $80,000.

Coverage Limit: $25,000 Bodily Injury & $10,000 Property Damage

Payout: Insurance pays $25,000 (Bodily Injury limit reached) + $10,000 (Property Damage limit reached) = $35,000. You are responsible for the remaining $45,000.

This clearly demonstrates how higher coverage limits offer greater protection and reduce your personal financial risk in the event of an accident. Choosing appropriate coverage limits is a crucial part of responsible insurance planning.

Conclusive Thoughts

Obtaining the best auto liability insurance quote involves careful consideration of multiple factors and a proactive approach to comparison and analysis. By understanding the components of a quote, the influence of your driving history and vehicle, and the strategies for saving money, you can secure comprehensive protection at a price that suits your budget. Remember, accurate information is key, and comparing quotes from multiple providers is crucial for securing the best possible coverage.

Quick FAQs

What is the difference between liability-only and comprehensive auto insurance?

Liability-only covers damages you cause to others; comprehensive covers damages to your vehicle and other incidents.

How long does it take to get an auto insurance quote?

Online quotes are often instantaneous; others may take a few hours or days depending on the insurer.

Can I get a quote without providing my driving history?

No, your driving history significantly impacts your premium; insurers require this information.

What happens if I don’t have auto liability insurance?

Driving without liability insurance is illegal in most places and can lead to significant fines and legal repercussions if involved in an accident.