Navigating the world of car insurance can feel overwhelming, but understanding your options is key to securing the best coverage at the right price. Automobile association car insurance offers a unique approach, leveraging the collective strength of a membership base to provide competitive rates and potentially valuable added benefits. This guide delves into the specifics of this type of insurance, exploring its history, policy features, pricing structures, claims processes, and ultimately, how it compares to traditional insurance providers.

From the historical context of automobile associations branching into insurance to a detailed comparison against independent insurers, we aim to provide a clear and comprehensive understanding. We’ll examine the advantages and disadvantages, highlighting key factors such as coverage options, customer service experiences, and the overall value proposition. This information will empower you to make an informed decision about whether automobile association car insurance is the right choice for your needs.

Automobile Association Car Insurance

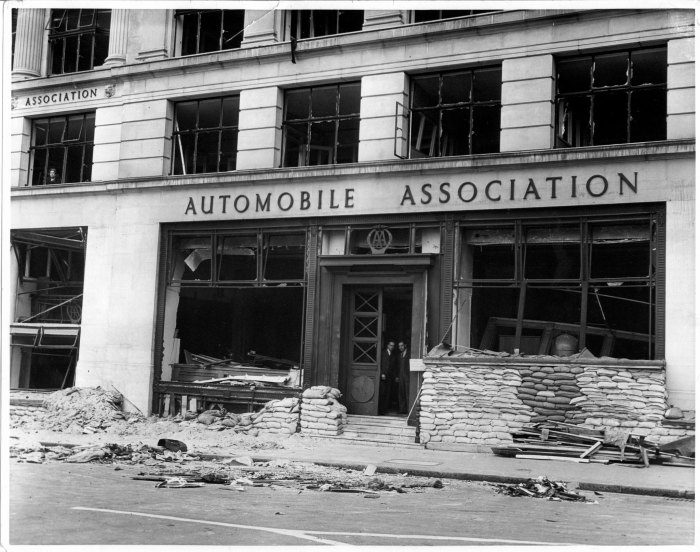

Automobile associations (AAs) have a long history of providing services to motorists, and car insurance is a natural extension of their core mission of advocating for and supporting drivers. Initially focused on roadside assistance and advocacy, many AAs expanded their offerings to include insurance products to provide comprehensive protection to their members. This diversification allows them to offer bundled services and potentially more competitive pricing.

Automobile Association Car Insurance Policies

Automobile associations typically offer a range of car insurance policies to cater to diverse needs and budgets. Common policy types include liability coverage (protecting against injury or damage caused to others), collision coverage (repairing damage to your own vehicle in an accident), comprehensive coverage (covering damage from events like theft or vandalism), and uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with a driver who lacks sufficient insurance). Some AAs also offer specialized policies tailored to specific vehicle types or driver profiles, such as classic car insurance or young driver programs. Policy details and available coverage options vary significantly between associations and even within the same association depending on location and individual risk assessment.

Financial Stability and Customer Ratings of Automobile Association Insurers

Assessing the financial stability of an automobile association insurer is crucial before purchasing a policy. Factors to consider include the insurer’s claims-paying ability, its financial strength ratings from independent agencies like AM Best or Moody’s, and its history of solvency. Customer ratings, often found on review websites or through independent surveys, provide insights into the insurer’s customer service quality, claims handling efficiency, and overall customer satisfaction. A strong financial rating combined with positive customer reviews indicates a reliable and trustworthy insurer. It’s important to note that financial stability and customer satisfaction can fluctuate, so it’s recommended to regularly review these aspects.

Comparison of Automobile Associations

The following table compares four hypothetical automobile associations (names are for illustrative purposes only). Actual coverage, pricing, and ratings will vary based on location, specific policy details, and individual circumstances. Always check directly with the insurance provider for the most up-to-date information.

| Automobile Association | Coverage Options | Pricing Structure (Example Premium) | Customer Service Rating (Hypothetical) |

|---|---|---|---|

| AutoAssist Alliance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $800/year (example) | 4.5 stars |

| RoadSafe Group | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Specialty Vehicle Coverage | $950/year (example) | 4.2 stars |

| Motorist Mutual | Liability, Collision, Comprehensive | $750/year (example) | 4 stars |

| DriveSecure Federation | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Roadside Assistance (bundled) | $850/year (example) | 4.3 stars |

Policy Features and Benefits

Automobile Association car insurance policies typically offer a comprehensive range of features designed to provide drivers with peace of mind and financial protection. These features vary depending on the specific policy and chosen coverage level, but generally include a strong emphasis on customer service and potentially unique benefits not always found with other insurers.

Standard features commonly found in AA car insurance policies often include liability coverage (protecting you financially if you cause an accident), collision coverage (covering damage to your vehicle in an accident regardless of fault), comprehensive coverage (covering damage from events other than collisions, such as theft or vandalism), uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with an uninsured driver), and medical payments coverage (covering medical expenses for you and your passengers).

Unique Benefits and Add-on Options

Beyond the standard features, many Automobile Associations offer unique benefits and add-on options to enhance their car insurance policies. These can significantly differentiate their offerings from those of traditional insurance providers. For example, some associations provide roadside assistance as a standard inclusion or as an affordable add-on. This can be invaluable in the event of a breakdown, flat tire, or lockout. Other unique benefits might include discounts for safe driving, accident forgiveness programs, or specialized coverage for classic or modified vehicles. Add-on options could include rental car reimbursement, gap insurance (covering the difference between your car’s value and what your loan or lease is worth after an accident), or new car replacement coverage.

Advantages and Disadvantages of Bundling Services

Many Automobile Associations offer the opportunity to bundle car insurance with other services, such as roadside assistance, travel insurance, or home insurance. Bundling can often lead to significant cost savings through discounts offered for combining multiple policies. This convenience is a major advantage. However, a disadvantage could be a lack of flexibility. If you are unhappy with one service, you may be less inclined to switch providers if it means losing the discount on your other bundled services. It’s crucial to carefully compare the individual costs of each service bundled together versus purchasing them separately to ensure that bundling actually saves money and aligns with your specific needs.

Comparison of Automobile Association Car Insurance with Other Providers

| Feature | Automobile Association | Other Providers | Advantage |

|---|---|---|---|

| Roadside Assistance | Often included or offered at a discounted rate | Usually a separate purchase | Convenience and cost savings |

| Member Discounts | Available to members, often substantial | Limited or less frequent | Significant cost reduction for members |

| Customer Service | Often highly rated for member support | Varied levels of customer service | Improved responsiveness and personalized attention |

| Specialized Coverage Options | May offer unique coverage for classic cars or other niche vehicles | Potentially limited options for specialized vehicles | Better protection for specific vehicle types |

Pricing and Affordability

Understanding the cost of car insurance is crucial for making informed decisions. Several factors contribute to the final price you pay, and Automobile Association (AA) car insurance, like other providers, uses a risk assessment model to determine premiums. This means that your individual circumstances significantly influence your quote.

Factors influencing the cost of AA car insurance are multifaceted and include your driving history (accidents, convictions), the type of vehicle you drive (make, model, age, safety features), your location (riskier areas may have higher premiums), your age and driving experience, and the level of coverage you choose (comprehensive, third-party, etc.). The more risk the insurer perceives, the higher the premium will likely be.

Factors Affecting Insurance Costs

Several key elements contribute to your insurance premium. Your driving record is a significant factor; a clean record typically results in lower premiums, while accidents or speeding tickets can lead to increases. The type of car you drive also plays a crucial role; high-performance vehicles or those with a history of theft are often more expensive to insure. Your location influences your premium due to varying levels of crime and accident rates in different areas. Finally, the level of coverage you select directly impacts the cost; comprehensive coverage is typically more expensive than third-party only. Age and experience also factor in, with younger, less experienced drivers often facing higher premiums.

Discounts and Savings for Members

The AA offers various discounts to its members to make car insurance more affordable. These may include multi-car discounts if you insure multiple vehicles through the AA, discounts for safe driving, or loyalty discounts for long-standing members. Specific discounts offered can vary, so it’s essential to check the AA website or contact them directly for the most up-to-date information on available savings. Some AA members may also qualify for additional discounts based on their occupation or affiliations. For example, certain professions might be eligible for reduced premiums due to lower perceived risk.

Comparison with Other Major Insurers

Direct comparison of average costs across insurers requires careful consideration. Average costs vary significantly based on individual circumstances. However, general market analysis often reveals that AA car insurance is competitively priced compared to other major insurers. To get the most accurate comparison, it’s recommended to obtain quotes from multiple insurers, including the AA, inputting your specific details for a personalized price assessment. Remember that the “cheapest” insurer isn’t always the best; consider the level of coverage and customer service alongside price.

Tips for Obtaining the Most Affordable Car Insurance

Before purchasing, understanding the factors that influence your premium can save you money.

- Maintain a clean driving record: Avoid accidents and speeding tickets.

- Choose a car with good safety features and a lower insurance group rating.

- Consider a higher excess: A higher excess (the amount you pay before the insurer covers the rest) can lower your premiums.

- Bundle your insurance: Consider combining your car insurance with other insurance policies (home, travel) for potential discounts.

- Shop around and compare quotes: Obtain quotes from multiple insurers to find the best deal.

- Take advantage of all available discounts: Check for discounts offered by the AA and other insurers.

- Review your coverage regularly: Ensure your coverage is appropriate for your needs and adjust as necessary to minimize costs.

Claims Process and Customer Service

Navigating the claims process after a car accident or incident can be stressful. Understanding the steps involved and knowing what to expect from your insurer’s customer service is crucial for a smooth and efficient resolution. Automobile Association prioritizes a straightforward and supportive claims experience for its members.

The Automobile Association’s claims process is designed to be as simple as possible. First, report the incident promptly. This usually involves contacting the Association’s dedicated claims line, either by phone or through their online portal. You will then need to provide detailed information about the accident, including date, time, location, and the other parties involved. Supporting documentation such as police reports, photos of the damage, and witness statements should also be provided. The Association will then assign a claims adjuster who will assess the damage and determine the extent of coverage under your policy. Once the assessment is complete, you will receive a settlement offer. The entire process, from initial report to final settlement, typically takes several weeks, though this can vary depending on the complexity of the claim.

Claim Filing Steps

The claim filing process involves several key steps. First, the member reports the accident via phone or online. Next, the Association gathers information from the member and possibly investigates the accident. Then, an adjuster assesses the damage and coverage. Following this, a settlement offer is made to the member. Finally, the settlement is processed and payment is released. Clear communication throughout this process is essential.

Customer Experience Examples

Positive experiences often involve prompt responses, clear communication from adjusters, and efficient processing of claims. For instance, one member reported receiving a prompt call back from their adjuster, who guided them through the entire process with patience and understanding, resulting in a swift resolution and fair settlement. Negative experiences, on the other hand, frequently involve delays in communication, difficulty reaching customer service representatives, and protracted claim processing times. For example, another member reported a significant delay in receiving an update on their claim, leading to frustration and increased stress. Inconsistent experiences highlight the need for standardized procedures and improved training for customer service staff.

Customer Service Channels

The Automobile Association offers various customer service channels to facilitate communication and support. These include a 24/7 telephone hotline, an online portal for managing claims and accessing policy information, and email support. The availability and accessibility of these channels are crucial in providing timely assistance and resolving member queries effectively. However, some members have reported difficulties reaching representatives via phone during peak hours, highlighting the need for improved resource allocation to ensure consistent responsiveness.

Recommendations for Improvement

To enhance the claims process and customer service experience, several recommendations are suggested:

- Implement a more robust online claims portal with real-time tracking capabilities.

- Increase staffing levels in the customer service department to reduce wait times.

- Provide more comprehensive training to claims adjusters on effective communication and empathy.

- Develop a standardized claims processing timeline with clear expectations for each step.

- Proactively communicate with members throughout the claims process, providing regular updates.

Comparison with Other Insurers

Choosing car insurance can feel overwhelming, with numerous companies offering a wide range of policies. Understanding the differences between Automobile Association (AA) insurance and policies from independent insurers is crucial for making an informed decision. This comparison highlights key aspects of coverage, pricing, and customer service to help you determine which type of insurer best suits your needs.

AA insurance, often associated with a strong brand reputation and extensive roadside assistance services, typically competes with a diverse market of independent insurance companies. These independent companies range from large national providers to smaller, regional insurers, each with its unique strengths and weaknesses.

Coverage Differences

While both AA and independent insurers offer various coverage options (liability, collision, comprehensive, etc.), the specific details and limits can vary significantly. For example, AA might offer enhanced roadside assistance as part of its standard package, a feature less common or requiring an add-on with some independent insurers. Conversely, an independent insurer might offer more customizable options, allowing drivers to tailor their coverage to their specific needs and risk profiles, potentially resulting in lower premiums if less coverage is desired. Some independent insurers may specialize in niche markets (e.g., classic cars, high-performance vehicles), offering more tailored coverage than a generalist like the AA.

Pricing and Affordability

Pricing is a major factor in choosing car insurance. AA’s pricing strategy is likely to be competitive, leveraging its brand recognition and large customer base. However, independent insurers often offer a wider range of pricing options due to their varied policy structures and risk assessments. A driver with a clean driving record might find a better deal with an independent insurer, while a driver with a less-than-perfect record might find the AA’s broader acceptance more appealing. Comparing quotes from multiple providers, including both AA and several independent insurers, is essential to determine the most affordable option for individual circumstances.

Customer Service and Claims Process

Customer service experiences can differ considerably between AA and independent insurers. AA often boasts a large, well-established customer service network, potentially offering quicker response times and more readily available support. Independent insurers may vary greatly in their customer service quality, with some providing excellent service while others struggle to match the resources and infrastructure of a larger organization like the AA. Similarly, the claims process can vary; AA may have streamlined processes due to its scale, while independent insurers might offer more personalized attention during claims handling, depending on the size and structure of the company.

Comparison Table

| Feature | Automobile Association Insurance | Independent Insurance Companies |

|---|---|---|

| Coverage Options | Comprehensive range, often including enhanced roadside assistance | Wide range, varying greatly by company; potential for highly customized policies |

| Pricing | Generally competitive, leveraging brand recognition | Highly variable; can be more or less expensive depending on the insurer and the driver’s profile |

| Customer Service | Typically large, well-established network; potentially quicker response times | Variable quality, depending on the specific insurer; may offer more personalized attention |

| Claims Process | Often streamlined due to scale and experience | Variable; can range from highly efficient to less efficient depending on the insurer |

Illustrative Scenarios

Understanding when Automobile Association car insurance is the most beneficial requires considering various factors beyond just price. The right insurance policy depends heavily on individual circumstances and driving habits. Let’s examine scenarios highlighting the strengths of AA car insurance and situations where other options might be more suitable.

Scenario Favoring Automobile Association Car Insurance

Imagine Sarah, a long-time member of the Automobile Association. She’s a responsible driver with a clean record, regularly utilizing AA roadside assistance services. She values the peace of mind that comes with knowing she has a trusted organization handling both her breakdown needs and her insurance. In this case, the bundled services and potentially preferential rates offered by the AA make their car insurance a highly attractive option. The comprehensive coverage, coupled with the existing membership benefits, offers significant value and convenience. The potential discounts available to existing members, coupled with the seamless integration of roadside assistance, significantly outweigh the cost compared to other insurers.

Scenario Favoring Alternative Car Insurance

Conversely, consider Mark, a young driver with a less-than-perfect driving record. He’s involved in a lot of short trips in busy city centers, and his driving style is considered high-risk by many insurance providers. While the AA offers insurance, other insurers specializing in high-risk drivers might offer more competitive premiums despite lacking the bundled roadside assistance. These insurers may have specialized programs designed to manage the risks associated with young or inexperienced drivers, offering more affordable options tailored to his specific needs. Their focus on risk assessment and tailored pricing structures provides a better fit for his circumstances.

Illustrative Automobile Association Member and Insurance Needs

Picture David, a 45-year-old architect who commutes daily to work and enjoys weekend trips with his family. He’s been an AA member for over 15 years, relying on their roadside assistance several times for minor issues like flat tires and jump starts. David values reliability and convenience. He owns a family-sized SUV, and his primary insurance needs center around comprehensive coverage for his vehicle and liability protection for his family in case of accidents. The peace of mind that comes with AA’s established reputation and integrated roadside assistance service perfectly aligns with his needs and lifestyle. His history as a responsible driver and long-standing membership would likely qualify him for preferential rates and additional benefits within the AA’s insurance program, making it the ideal choice for him.

Ending Remarks

Ultimately, the decision of whether to choose automobile association car insurance rests on individual circumstances and priorities. While the potential for cost savings and added member benefits is attractive, careful consideration of coverage specifics and comparison with other providers is crucial. By weighing the advantages and disadvantages Artikeld in this guide, and by actively engaging with potential providers, you can confidently select a car insurance policy that best protects you and your vehicle.

Commonly Asked Questions

What types of discounts are typically offered by automobile associations?

Discounts often include safe driving records, bundling insurance policies (home, auto), multi-car discounts, and membership-specific savings.

How does the claims process differ from other insurers?

The process may vary, but generally involves reporting the claim through designated channels, potentially online or via phone. Associations may have dedicated claims adjusters and potentially faster processing times due to established member relationships.

What happens if I’m not a member of the automobile association?

Most associations offer insurance to non-members, but membership often leads to better rates and additional benefits. Check directly with the association for their specific non-member policies.

Can I customize my coverage with an automobile association?

Yes, most associations allow customization to a degree, offering various coverage levels and add-on options to tailor the policy to your specific needs and budget.