Securing affordable and comprehensive auto insurance in New Jersey can feel overwhelming. Navigating the complexities of coverage options, understanding the factors influencing premiums, and finding the best deal requires careful consideration. This guide provides a clear and concise overview of the New Jersey auto insurance landscape, empowering you to make informed decisions and find the right policy for your needs.

From understanding mandatory coverage requirements and potential penalties for driving uninsured to exploring various coverage types and identifying cost-saving strategies, we’ll equip you with the knowledge to confidently navigate the process. We’ll delve into the key factors impacting your quote, such as driving history, vehicle type, and location, and provide practical tips for securing the most competitive rates. This guide aims to simplify the often-daunting task of obtaining auto insurance in New Jersey.

Understanding NJ Auto Insurance Requirements

Driving in New Jersey requires you to carry auto insurance that meets the state’s minimum requirements. Failing to do so can result in significant penalties, impacting your driving privileges and finances. This section will clarify New Jersey’s auto insurance mandates and the various coverage options available to drivers.

Mandatory Auto Insurance Coverage in New Jersey

New Jersey is a no-fault state, meaning that regardless of who caused an accident, your own insurance company will initially cover your medical bills and lost wages. However, this doesn’t eliminate the need for liability coverage, which protects you if you cause an accident resulting in injuries or property damage to others. The state mandates minimum liability coverage of $15,000 for injuries to one person, $30,000 for injuries to multiple people in a single accident, and $5,000 for property damage. These are the bare minimums, and higher coverage limits are strongly recommended.

Penalties for Driving Without Insurance in New Jersey

Driving without insurance in New Jersey is a serious offense. Penalties can include significant fines, license suspension, vehicle registration suspension, and even potential jail time. The fines can be substantial, and the impact on your driving record can make it difficult to obtain insurance in the future, leading to higher premiums if you eventually do secure coverage. Furthermore, if you cause an accident without insurance, you could face substantial financial liability for damages.

Types of Auto Insurance Coverage Available in NJ

Several types of auto insurance coverage are available in New Jersey, beyond the mandatory liability coverage. Understanding these options allows you to tailor your policy to your specific needs and risk tolerance.

Liability Coverage: As mentioned, this covers injuries and damages you cause to others. It’s crucial to have adequate liability coverage to protect yourself from potentially devastating financial consequences. The minimums are often insufficient in serious accidents.

Collision Coverage: This pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. While not mandatory, it’s highly recommended to protect your investment.

Comprehensive Coverage: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, fire, or hail. It provides broader protection than collision coverage alone.

Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It’s essential given the prevalence of uninsured drivers on the road.

Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault. It can supplement your health insurance and expedite medical bill payments.

Personal Injury Protection (PIP): In New Jersey’s no-fault system, PIP coverage pays for your medical bills and lost wages, regardless of fault. It’s often included in policies, but the coverage limits can be adjusted.

Minimum vs. Recommended Auto Insurance Coverage in NJ

The following table compares the minimum required coverage with recommended levels:

| Coverage Type | Minimum Required | Recommended | Notes |

|---|---|---|---|

| Bodily Injury Liability (per person) | $15,000 | $100,000 or more | Consider your assets and potential liability. |

| Bodily Injury Liability (per accident) | $30,000 | $300,000 or more | Covers multiple injured parties in one accident. |

| Property Damage Liability | $5,000 | $25,000 or more | Covers damage to other vehicles or property. |

| Uninsured/Underinsured Motorist | $15,000/$30,000 | At least your liability limits | Crucial protection against uninsured drivers. |

Factors Affecting Auto Insurance Quotes in NJ

Several key factors influence the cost of auto insurance in New Jersey. Insurance companies use a complex algorithm considering your individual circumstances to determine your premium. Understanding these factors can help you make informed decisions and potentially save money.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance rates. A clean driving record, free of accidents and traffic violations, will result in lower premiums. Conversely, accidents, speeding tickets, and especially DUI convictions, substantially increase your premiums. The severity of the incident also matters; a minor fender bender will have less impact than a serious accident causing significant damage or injuries. Multiple incidents within a short period will likely lead to even higher increases. For example, a driver with two speeding tickets and an at-fault accident in the past three years will likely pay considerably more than a driver with a spotless record. Insurance companies often use a points system to assess risk, with each violation adding points that increase your premium.

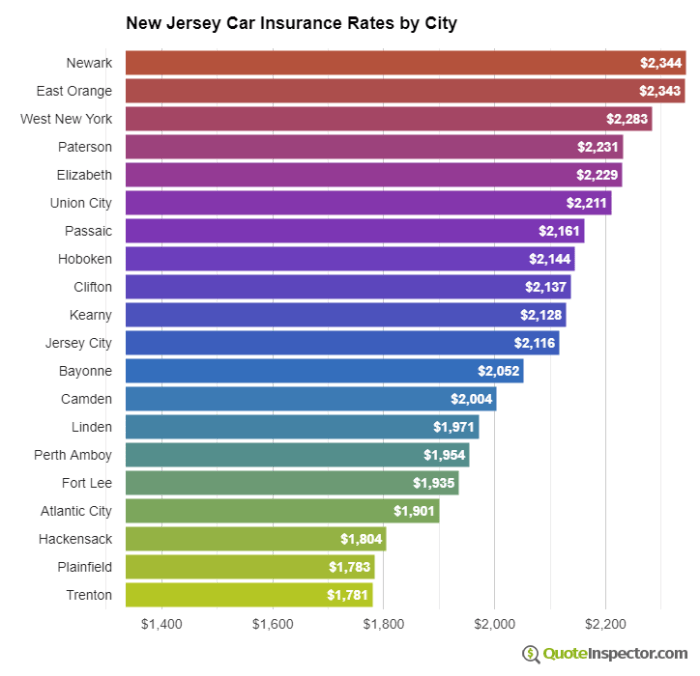

Geographic Location in NJ

Your address in New Jersey plays a significant role in determining your insurance rates. Urban areas generally have higher rates due to increased traffic congestion, higher accident rates, and a greater likelihood of theft or vandalism. Rural areas, with their lower population density and generally safer driving conditions, tend to have lower premiums. For instance, someone living in Newark might pay significantly more than someone living in a rural area like Sussex County, even if all other factors are identical. This is because insurers consider the statistical likelihood of claims in different areas.

Vehicle Type and Insurance Costs

The type of vehicle you drive is another critical factor. Insurance companies categorize vehicles based on factors such as safety features, repair costs, and the vehicle’s propensity for theft. Luxury vehicles and high-performance sports cars typically command higher premiums due to their higher repair costs and increased risk of accidents. Conversely, smaller, less expensive vehicles often have lower insurance rates.

| Vehicle Type | Typical Premium Impact | Reasoning | Example |

|---|---|---|---|

| Luxury Sedan | High | High repair costs, potential for higher speeds | Mercedes-Benz S-Class |

| Economy Car | Low | Lower repair costs, less powerful engine | Honda Civic |

| Sports Car | High | High performance, higher accident risk | Porsche 911 |

| SUV | Moderate | Larger size, potential for higher repair costs | Toyota RAV4 |

Finding and Comparing Auto Insurance Quotes

Securing the best auto insurance rate in New Jersey involves diligent comparison shopping. This process, while initially time-consuming, can lead to significant savings over the life of your policy. Understanding the various methods for obtaining quotes and effectively comparing them is crucial to making an informed decision.

Finding the right auto insurance policy requires a strategic approach. This section will Artikel effective methods for obtaining quotes, guide you through completing online quote forms, and provide a list of reputable insurance companies operating within New Jersey. We will also address key questions to consider when speaking with insurance agents to ensure you receive the most comprehensive and suitable coverage.

Online Quote Acquisition Methods

Several methods exist for obtaining auto insurance quotes online. Many insurance companies have user-friendly websites where you can input your information and receive an instant quote. Comparison websites also aggregate quotes from multiple insurers, allowing you to view various options side-by-side. Directly contacting insurance companies via email or phone can also yield quotes, although this method is generally less efficient for initial comparisons.

Completing Online Quote Request Forms

Accurately completing an online quote request form is essential to receiving an accurate insurance quote. Follow these steps for a smooth process:

- Personal Information: Provide accurate details about yourself, including your name, address, date of birth, and driver’s license information. Inaccuracies can lead to delays or inaccurate quotes.

- Vehicle Information: Enter complete details about your vehicle(s), including the year, make, model, VIN, and mileage. Specify any modifications that might affect your insurance premium.

- Driving History: Be honest and thorough when providing your driving history. This includes details about accidents, tickets, and driving violations. Omitting this information can lead to policy cancellations or higher premiums later.

- Coverage Preferences: Choose the coverage levels that best suit your needs and budget. Understand the differences between liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Review and Submit: Carefully review all entered information before submitting the form. Ensure all details are accurate to prevent delays or discrepancies.

Reputable Auto Insurance Companies in NJ

Several reputable auto insurance companies operate in New Jersey. This is not an exhaustive list, and the best choice will depend on your individual needs and preferences.

- State Farm

- Allstate

- Geico

- Progressive

- Liberty Mutual

- USAA (for military members and their families)

It’s advisable to research each company further to understand their specific offerings and customer reviews.

Questions to Ask Insurance Agents

When comparing quotes, asking clarifying questions is crucial. The following examples represent critical aspects to discuss with insurance agents:

- Details of Coverage: Clarify the specific inclusions and exclusions of each policy to understand the extent of coverage.

- Premium Breakdown: Request a detailed breakdown of your premium to understand the factors contributing to the cost.

- Discounts: Inquire about available discounts, such as safe driver discounts, multi-car discounts, or bundling discounts.

- Claims Process: Understand the claims process, including the required documentation and the typical processing time.

- Customer Service: Inquire about customer service options, including contact methods and response times.

Discounts and Savings on NJ Auto Insurance

Securing affordable auto insurance in New Jersey is achievable through various discounts and savings strategies. Understanding these options and how to qualify for them can significantly reduce your annual premium. This section will explore common discounts, the bundling of insurance policies, and additional strategies to minimize your costs.

Common Auto Insurance Discounts in New Jersey

Many New Jersey auto insurance providers offer a range of discounts to incentivize safe driving and responsible financial habits. These discounts can substantially lower your premiums, making insurance more accessible.

- Good Student Discount: This discount is typically available to students maintaining a high grade point average (GPA). The specific GPA requirement varies by insurer, but generally, a “B” average or higher qualifies. Proof of enrollment and academic records are usually required.

- Safe Driver Discount: Insurers reward drivers with clean driving records, often offering discounts for those who haven’t been involved in accidents or received traffic violations within a specific timeframe (typically 3-5 years). Your driving history is verified through your driving record.

- Multiple Vehicle Discount: Insuring multiple vehicles under one policy with the same provider often results in a discount on the overall premium. This reflects the reduced administrative costs for the insurer.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can demonstrate your commitment to safe driving and often qualifies you for a discount. Proof of course completion is necessary.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can significantly reduce your risk of theft and often earns you a discount. Proof of installation is usually required.

- Bundling Home and Auto Insurance: Insuring both your home and auto with the same company often leads to significant savings due to bundled discounts. This demonstrates loyalty and reduces administrative costs for the insurer.

Qualifying for Auto Insurance Discounts

The process of qualifying for these discounts generally involves providing the necessary documentation to your insurance provider. This may include transcripts for good student discounts, proof of completion for defensive driving courses, or copies of police reports and insurance claims to verify your driving history. It’s crucial to proactively inform your insurer of any qualifying factors to ensure you receive the appropriate discounts.

Bundling Home and Auto Insurance for Savings

Bundling your home and auto insurance policies with the same company is a highly effective way to reduce your overall insurance costs. Many insurers offer substantial discounts for bundling, often exceeding the savings from individual discounts. This is because the insurer streamlines administrative processes and reduces the risk associated with insuring multiple aspects of your life. For example, a family with a home valued at $500,000 and two vehicles might see a combined discount of 15-20% when bundling their policies.

Strategies for Securing the Lowest Possible Premium

To obtain the most competitive auto insurance rates in New Jersey, consider these strategies:

- Shop around and compare quotes: Obtain quotes from multiple insurers to compare coverage and pricing.

- Maintain a clean driving record: Avoid accidents and traffic violations to qualify for safe driver discounts.

- Consider increasing your deductible: A higher deductible can lower your premium, but be sure you can afford the increased out-of-pocket expense in case of an accident.

- Explore different coverage options: Assess your needs and choose the coverage levels that best suit your situation. Higher coverage usually means higher premiums.

- Bundle your insurance policies: Combine your home and auto insurance policies for potential discounts.

- Take advantage of all available discounts: Ensure you’re taking advantage of any discounts you qualify for, such as good student, safe driver, or multiple vehicle discounts.

Understanding Your Policy and Coverage

Choosing the right auto insurance policy in New Jersey involves understanding its terms, conditions, and the claims process. This knowledge empowers you to make informed decisions and navigate potential challenges effectively. A thorough grasp of your policy’s specifics is crucial for ensuring adequate protection and a smooth claims experience.

Standard Auto Insurance Policy Terms and Conditions in NJ

New Jersey’s standard auto insurance policy includes several key coverages. Liability coverage protects you financially if you cause an accident resulting in injuries or property damage to others. Uninsured/Underinsured Motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured. Collision coverage pays for repairs to your vehicle regardless of fault, while Comprehensive coverage covers damage from events like theft, fire, or vandalism. Personal Injury Protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. Medical Payments coverage offers similar benefits, but it’s often more limited. These coverages are defined by specific limits, deductibles, and exclusions Artikeld in your policy documents. Understanding these details is vital to know the extent of your protection. For example, a $100,000 liability limit means the insurance company will pay a maximum of $100,000 for damages caused by you to others.

The Claims Process After an Accident

Following an accident, promptly report the incident to your insurance company. Gather information at the scene, including the other driver’s information, police report details (if applicable), witness contact information, and photographs of the damage. Contact your insurer as soon as possible to initiate the claims process. You’ll likely need to provide a detailed account of the accident, along with supporting documentation. Your insurer will then investigate the claim, assessing liability and the extent of damages. Remember, honesty and accuracy are paramount throughout this process. Providing false information can lead to claim denial. The time it takes to resolve a claim can vary depending on the complexity of the accident and the availability of information.

The Role of an Insurance Adjuster

An insurance adjuster investigates claims, assesses damages, and determines the amount the insurance company will pay. They work for the insurance company and are responsible for evaluating the validity of your claim, determining liability, and negotiating a settlement. Adjusters review police reports, medical records, repair estimates, and witness statements to determine the extent of the damage and who is at fault. They may contact you to ask for additional information or clarification. It’s essential to cooperate fully with the adjuster to ensure a fair and timely resolution. Negotiating with an adjuster requires a calm and factual approach; understanding your policy coverage limits and supporting your claims with solid evidence is crucial.

Situations Where Coverage May Be Denied or Limited

Coverage may be denied or limited for various reasons. Driving under the influence of alcohol or drugs is a common cause for denial. Failing to cooperate with the investigation or providing false information can also result in a denied claim. Driving without a valid license or operating a vehicle not listed on your policy can also lead to limited or denied coverage. If your accident was caused by an intentional act, your claim may be denied. Similarly, if you fail to meet the terms and conditions of your policy, such as failing to notify the insurance company within the required timeframe, your coverage could be impacted. For example, if your policy requires you to report an accident within 24 hours and you fail to do so, the claim might be partially or fully denied.

Illustrating Insurance Policy Features

Understanding the features of your auto insurance policy is crucial for ensuring you have adequate protection in the event of an accident. This section will illustrate key policy features through real-world examples, focusing on liability and uninsured/underinsured motorist coverage.

Liability coverage is designed to protect you financially if you cause an accident that results in injuries or property damage to others. It typically consists of two parts: bodily injury liability and property damage liability. These coverages have separate limits, often expressed as numerical values, such as 100/300/50. This means $100,000 per person for bodily injury, $300,000 total for bodily injury per accident, and $50,000 for property damage per accident.

Liability Coverage in an Accident Scenario

Imagine a scenario where you rear-end another vehicle, causing significant damage and injuring the other driver. Let’s assume your liability coverage is 100/300/50. The other driver’s medical bills total $75,000, and the damage to their vehicle is $40,000. Your insurance company would cover the $75,000 in medical expenses and the full $40,000 in vehicle repairs. If the medical bills exceeded $100,000 for one person, or the total medical bills for all injured parties exceeded $300,000, you would be personally responsible for the excess amount. Similarly, if the property damage exceeded $50,000, you would be responsible for the difference. This illustrates how liability coverage limits protect you from potentially devastating financial consequences.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is a critical protection against drivers who lack sufficient insurance or are uninsured altogether. Consider a situation where you are stopped at a red light and are rear-ended by an uninsured driver. The impact causes significant damage to your vehicle and results in serious injuries requiring extensive medical treatment and physical therapy. Without UM/UIM coverage, you would be responsible for all medical bills, lost wages, and vehicle repair costs. However, with UM/UIM coverage, your own insurance company would step in to cover your losses, up to the limits of your UM/UIM policy. This protection is especially important given the prevalence of uninsured drivers on the roads. The coverage amount is typically set independently of your liability coverage, and it is highly recommended to purchase UM/UIM coverage with limits comparable to your liability limits. For example, if you have 250/500/100 liability coverage, consider purchasing a similar amount for your UM/UIM coverage.

Outcome Summary

Obtaining the best auto insurance quote in New Jersey involves understanding your needs, comparing options from reputable providers, and leveraging available discounts. By carefully considering the factors influencing premiums and actively engaging in the quote comparison process, you can secure a policy that offers comprehensive coverage at a price that fits your budget. Remember to regularly review your policy and explore opportunities for savings to ensure you remain adequately protected while maximizing value.

FAQs

What happens if I’m in an accident and don’t have insurance?

Driving without insurance in NJ results in significant fines, license suspension, and potential legal repercussions. You’ll be responsible for all accident-related costs.

Can I get a quote without providing my personal information?

Most online quote tools require some personal information to provide an accurate estimate, but the level of detail varies. Check the specific requirements of each provider.

How often can I change my auto insurance policy?

You can typically change your policy at any time, but there might be penalties or fees depending on your contract terms. Contact your provider for details.

What is the difference between liability and collision coverage?

Liability covers damages you cause to others, while collision covers damage to your vehicle regardless of fault.