Navigating the world of auto insurance can be daunting, especially in a city like Joliet, Illinois. This guide aims to simplify the process by providing a comprehensive overview of auto insurance options, costs, and procedures specific to Joliet. We’ll explore the top providers, average costs, strategies for finding affordable coverage, and essential information on filing claims. Understanding your insurance needs is crucial for peace of mind on the road, and this resource is designed to empower you with the knowledge to make informed decisions.

From understanding the factors influencing premiums—such as local crime rates and traffic patterns—to learning how to effectively compare quotes and negotiate lower rates, this guide offers practical advice tailored to the Joliet area. We’ll also delve into specific coverage needs, emphasizing the importance of crucial protections like uninsured/underinsured motorist coverage in a city with its unique driving challenges. By the end, you’ll be better equipped to secure the right auto insurance policy for your needs and budget.

Top Auto Insurance Providers in Joliet, IL

Finding the right auto insurance in Joliet can feel overwhelming, given the numerous providers and varying policy options. This section aims to clarify the landscape by highlighting five of the most popular companies and comparing their offerings. Understanding the nuances of pricing and coverage is crucial for making an informed decision that best suits your individual needs and budget.

Top Five Auto Insurance Providers in Joliet, IL

Determining precise market share for individual cities like Joliet is difficult due to the proprietary nature of insurance company data. However, based on statewide Illinois data and national presence, five consistently popular providers are State Farm, Geico, Allstate, Progressive, and Farmers Insurance. These companies offer a wide range of coverage options and are readily accessible in Joliet.

Pricing Structures of Top Auto Insurance Providers

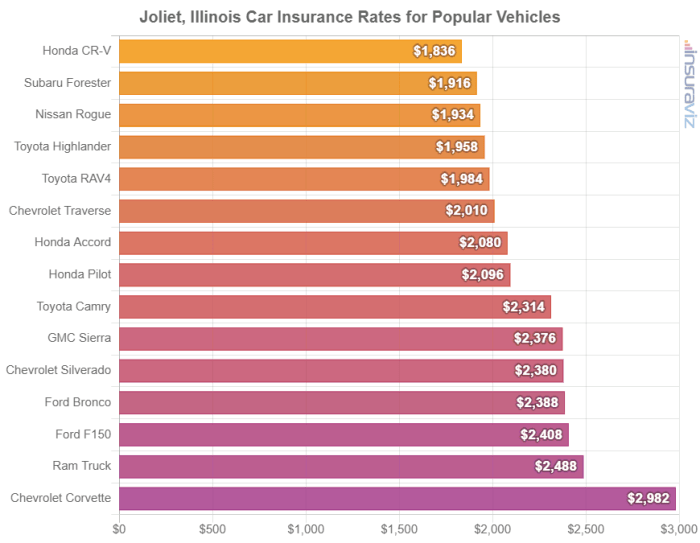

Pricing for auto insurance varies significantly across these providers, and is influenced by several key factors. Age is a major factor, with younger drivers typically paying higher premiums due to higher risk profiles. Driving history plays a crucial role; a clean driving record usually results in lower premiums, while accidents or traffic violations can lead to substantial increases. The type of vehicle also impacts pricing; more expensive or high-performance vehicles generally command higher insurance costs. Finally, coverage levels chosen directly impact the price; higher coverage limits mean higher premiums. While precise pricing is unavailable without individual quotes, it’s safe to say that each of the five companies uses a similar actuarial model, adjusting prices based on these core factors. A younger driver with a poor driving record and a sports car will pay significantly more than an older driver with a clean record and a sedan, regardless of the insurer.

Key Features Comparison of Top Five Providers

The following table summarizes key features of the five providers. Note that specific discounts and coverage options can vary, so it is essential to obtain individual quotes for accurate comparisons. Customer service ratings are based on aggregated online reviews and may vary depending on individual experiences.

| Provider | Discounts | Coverage Options | Customer Service Rating (Example – based on aggregated reviews) |

|---|---|---|---|

| State Farm | Good Driver, Multiple Policy, Safe Driver, etc. | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | 4.2 out of 5 stars |

| Geico | Good Driver, Multiple Policy, Defensive Driving, etc. | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | 4.0 out of 5 stars |

| Allstate | Good Driver, Multiple Policy, Homeowner Bundle, etc. | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | 3.8 out of 5 stars |

| Progressive | Good Driver, Multiple Policy, Safe Driver, etc. | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | 3.9 out of 5 stars |

| Farmers Insurance | Good Driver, Multiple Policy, Safe Driver, etc. | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | 4.1 out of 5 stars |

Average Auto Insurance Costs in Joliet

Understanding the cost of auto insurance in Joliet, Illinois, is crucial for budgeting and financial planning. Several factors influence these costs, making it important to understand the average premiums and the contributing elements. This section provides an overview of average annual auto insurance costs in Joliet, broken down by coverage type, and explores the key factors that impact premiums.

Precise figures for average annual auto insurance costs in Joliet fluctuate based on data collection periods and the specific insurance providers involved. However, we can offer general estimations based on industry trends and publicly available data from sources like the National Association of Insurance Commissioners (NAIC) and independent insurance comparison websites. Keep in mind these are estimates and your individual premium will vary significantly.

Average Annual Auto Insurance Costs by Coverage Type

The cost of auto insurance in Joliet varies considerably depending on the level of coverage selected. Liability insurance is generally the most affordable, while comprehensive and collision coverage add to the overall premium. Below is a representative illustration of potential average annual costs, though actual figures may differ based on individual circumstances.

Illustrative Bar Graph: Average Annual Auto Insurance Costs in Joliet (Estimated)

Imagine a bar graph with the x-axis representing coverage types and the y-axis representing the average annual cost in dollars. The bars would show the following approximate relationships: Liability insurance would have the shortest bar, representing the lowest cost (perhaps around $500-$700 annually). Liability plus Uninsured/Underinsured Motorist coverage would be slightly taller. Adding collision coverage would result in a significantly taller bar (perhaps $1000-$1500 annually), and the tallest bar would represent comprehensive coverage, including collision, indicating the highest annual cost (perhaps $1200-$1800 annually or more). These are rough estimations, and the actual heights of the bars would depend on the specific data used.

Factors Influencing Auto Insurance Premiums in Joliet

Several factors contribute to the variation in auto insurance premiums within Joliet. These factors are considered by insurance companies when calculating individual rates.

Crime rates, traffic congestion, and the average value of vehicles in the area all play a significant role. Higher crime rates lead to increased theft and accident claims, driving up premiums. Heavy traffic congestion increases the likelihood of accidents, also impacting costs. Finally, the average value of vehicles in Joliet influences the cost of collision and comprehensive coverage, as repairs or replacements for more expensive vehicles are more costly.

Beyond these factors, individual driver characteristics significantly influence premiums. These include driving history (accidents, tickets), age, credit score, and the type of vehicle driven. A driver with a history of accidents or traffic violations will generally pay more than a driver with a clean record. Younger drivers often face higher premiums due to statistically higher accident rates. Credit score can also be a factor for some insurers, and the make, model, and year of the vehicle will affect the cost of collision and comprehensive coverage.

Finding Affordable Auto Insurance in Joliet

Securing affordable auto insurance in Joliet requires a proactive approach, combining smart shopping strategies with an understanding of how insurers determine premiums. By carefully considering various factors and utilizing available resources, drivers can significantly reduce their insurance costs.

Finding the best rate involves more than just picking the first insurer you see. Several strategies can help you secure the most competitive price for your auto insurance needs in Joliet.

Comparison Shopping Techniques

Effective comparison shopping is crucial for finding affordable auto insurance. Don’t rely solely on online comparison websites; contact insurers directly to obtain personalized quotes. This allows you to discuss specific details about your driving history and vehicle, ensuring a more accurate assessment of your risk profile. Remember to compare not only price but also the coverage offered. A slightly higher premium might be worthwhile if it provides significantly better protection. Consider using a spreadsheet to organize quotes, comparing coverage levels, deductibles, and premiums side-by-side for easy comparison.

Discounts and Savings Opportunities

Many insurance companies offer various discounts that can significantly lower your premiums. These discounts frequently overlap, allowing for substantial savings. Common discounts include those for good driving records (accident-free periods), completing defensive driving courses, bundling insurance policies (home and auto), paying in full, and installing anti-theft devices. Some insurers also offer discounts for students with good grades or those who are members of specific organizations. Inquire about all available discounts when obtaining quotes.

Obtaining Quotes from Multiple Providers

The process of obtaining quotes is straightforward. Most insurers have online quote tools that allow you to quickly input your information and receive an estimate. However, calling insurers directly often yields more accurate and personalized quotes. Be prepared to provide information about your vehicle, driving history (including accidents and violations), and desired coverage levels. Keep detailed records of all quotes you receive, including the date, insurer, and specific coverage details. Remember to compare apples to apples; ensure all quotes are for the same coverage levels before making a comparison.

Negotiating Lower Premiums

Once you have several quotes, you’re in a stronger position to negotiate. If you find a lower quote from a competitor, present it to your current insurer or a preferred insurer. Explain that you’re considering switching unless they can match or beat the offer. Highlight your good driving record and any discounts you qualify for. Be polite but firm in your negotiation. Sometimes, simply inquiring about a lower premium can lead to a discount, even without a competing offer. Remember to document all communication and agreements in writing.

Specific Coverage Needs in Joliet

Choosing the right auto insurance coverage in Joliet requires understanding the local driving environment and its potential risks. Factors such as weather patterns, traffic congestion, and the overall accident rate influence the types and levels of coverage that are most appropriate for drivers in the area. This section will Artikel specific coverage considerations for Joliet residents.

Joliet’s weather presents specific challenges for drivers. The region experiences harsh winters with snow and ice, increasing the likelihood of accidents due to slippery roads and reduced visibility. Similarly, summer thunderstorms can cause flash flooding and sudden downpours, impacting road conditions and driver safety. These weather-related incidents highlight the need for comprehensive coverage, including collision and comprehensive insurance, to protect against damage caused by unforeseen events. Furthermore, higher deductibles might be considered to lower premiums, but drivers should carefully weigh the financial implications of a higher out-of-pocket expense in the event of an accident.

Uninsured/Underinsured Motorist Coverage in Joliet

Uninsured/underinsured motorist (UM/UIM) coverage is particularly crucial in Joliet, as in any urban area. The probability of encountering an uninsured or underinsured driver is statistically higher in densely populated regions. UM/UIM coverage protects you and your passengers in the event of an accident caused by a driver who lacks sufficient insurance to cover your damages or injuries. This protection is essential to safeguard against significant financial losses resulting from medical expenses, vehicle repairs, or lost wages. Consider increasing your UM/UIM coverage limits beyond the state minimum to ensure adequate protection in the event of a serious accident involving an uninsured or underinsured driver. For example, if you’re involved in an accident with an uninsured driver who causes significant injuries, UM/UIM coverage could help cover your medical bills and lost wages, even if the other driver is at fault.

Supplemental Coverage Options in Joliet

Adding supplemental coverage options can enhance your overall protection and peace of mind. Roadside assistance, for instance, is a valuable addition, especially considering Joliet’s traffic patterns and potential for breakdowns. Roadside assistance provides services such as towing, flat tire changes, and jump starts, reducing inconvenience and potential costs associated with unexpected vehicle problems. Other beneficial supplemental coverages include rental car reimbursement, which helps cover the cost of a rental car while your vehicle is being repaired after an accident, and gap insurance, which protects you from owing more on your car loan than its actual value after a total loss. These additional coverages offer financial protection beyond the standard policy, providing comprehensive coverage and mitigating potential financial burdens in the event of an accident or unexpected vehicle issues.

Filing a Claim in Joliet

Filing an auto insurance claim in Joliet, like anywhere else, involves a series of steps to ensure your claim is processed efficiently and fairly. Understanding these steps and the necessary documentation can significantly streamline the process and help you receive compensation promptly. Remember to always refer to your specific policy for detailed instructions.

The process generally begins with reporting the accident to your insurance company, followed by providing the necessary documentation, and finally, negotiating a settlement. The speed and efficiency of the process can vary depending on the complexity of the accident and the responsiveness of your insurer.

Reporting the Accident

After an accident, promptly report it to your insurance company. Most insurers have 24/7 claims hotlines. Provide them with the necessary information, including the date, time, and location of the accident, as well as details about the other parties involved and any witnesses. Obtain the other driver’s insurance information, driver’s license number, and license plate number. If possible, take photos of the accident scene, including damage to vehicles and any visible injuries. Accurate and detailed information at this stage is crucial for a smooth claims process.

Required Documentation

Gathering the necessary documentation is essential for a successful claim. This typically includes a completed accident report form provided by your insurer, copies of your driver’s license and vehicle registration, photographs of the accident scene and vehicle damage, a copy of your insurance policy, medical records if injuries occurred, and police reports if applicable. Detailed and accurate documentation minimizes delays and ensures the claim is processed efficiently.

Claims Processes: A Comparison

Let’s compare the claims processes of two hypothetical major insurers in Joliet, “Insurer A” and “Insurer B.” Both insurers require similar initial steps, such as reporting the accident via phone or online portal. However, Insurer A is known for its user-friendly online portal, allowing for easy document uploads and claim tracking. Insurer B, on the other hand, might have a more traditional approach, emphasizing phone calls and physical mail for documentation submission. While both aim for efficient claim processing, the specific timelines and communication styles might differ, reflecting the companies’ individual approaches to customer service. For example, Insurer A might provide regular updates via email, while Insurer B may primarily communicate via phone. The choice between insurers often depends on individual preferences regarding communication and technological accessibility.

Summary

Securing the right auto insurance in Joliet requires careful consideration of several factors, from comparing providers and understanding local conditions to effectively navigating the claims process. This guide has provided a framework for understanding these complexities, empowering you to make informed decisions that protect both your financial well-being and your peace of mind on the roads of Joliet. Remember, proactive planning and comparison shopping are key to finding the best coverage at the most competitive price. By leveraging the information presented here, you can confidently navigate the world of auto insurance and find the perfect policy for your individual needs.

Detailed FAQs

What factors affect my auto insurance rates in Joliet?

Your driving history, age, credit score, the type of vehicle you drive, and your location within Joliet all influence your rates. Local crime rates and accident statistics also play a role.

How often can I shop for new auto insurance rates?

You can shop for new rates as often as you like, especially when your circumstances change (new car, new address, improved driving record). Many insurers offer online tools for quick quote comparisons.

What should I do if I’m involved in an accident in Joliet?

Immediately call the police, exchange information with other drivers, take photos of the damage, and contact your insurance company to report the accident as soon as possible.

Can I bundle my auto and homeowners insurance in Joliet?

Yes, many insurance companies offer discounts for bundling auto and homeowners insurance. This can save you money on your overall premiums.