Navigating the insurance claims process can feel overwhelming, especially when dealing with a large provider like Allstate. Understanding how to quickly and efficiently contact Allstate regarding a claim is crucial. This guide provides a clear and concise path to finding the appropriate Allstate insurance phone number for your specific claim type, along with valuable information to streamline the entire process.

From understanding the various claim types and their respective contact methods to troubleshooting common issues and exploring alternative contact options, we aim to equip you with the knowledge and resources necessary for a smooth and successful claims experience. We’ll cover everything from finding the right number to understanding the steps involved in filing a claim, addressing after-hours emergencies, and utilizing accessibility features. Let’s delve into the details and demystify the Allstate claims process.

Finding the Allstate Claims Phone Number

Locating the appropriate Allstate claims phone number is crucial for quickly reporting an incident and initiating the claims process. Several convenient methods exist to access this information, ensuring a streamlined experience for policyholders. The following details Artikel the various ways to find the necessary contact information.

Methods for Locating the Allstate Claims Phone Number

Finding the Allstate claims phone number is straightforward using several readily available resources. The following list details these methods and the steps involved.

- Allstate Website: The Allstate website provides a dedicated section for claims reporting, usually accessible through a prominent link on the homepage. Navigate to the “Claims” or “Report a Claim” section. You’ll typically find a phone number displayed prominently on this page, or a form to submit your claim online, potentially prompting a call back. If a direct number isn’t immediately visible, look for a contact us section or a live chat option.

- Allstate Mobile App: The Allstate mobile app (available for both iOS and Android devices) usually features a direct link to report a claim. Open the app and look for a button or tab labeled “Claims,” “Report Claim,” or something similar. The claims phone number is often readily available within the claims reporting section of the app. In some cases, the app may allow you to file a claim directly through the app, eliminating the need to call.

- Policy Documents: Your Allstate insurance policy documents, whether physical or digital, contain your policy number and contact information, including the claims phone number. Check your policy booklet or the digital version of your policy for a dedicated claims contact section.

Comparison of Methods for Finding the Allstate Claims Phone Number

The table below summarizes the ease and speed of each method for finding the Allstate claims phone number.

| Method | Ease of Use (1-5) | Speed (Fast, Moderate, Slow) | Additional Information Needed |

|---|---|---|---|

| Allstate Website | 4 | Fast | Internet access |

| Allstate Mobile App | 5 | Fast | Smartphone with app installed |

| Policy Documents | 3 | Moderate | Access to physical or digital policy |

Understanding Allstate’s Claims Process

Filing a claim with Allstate can seem daunting, but understanding the process can significantly ease the experience. This section Artikels the typical steps involved, the necessary information, and a detailed example to illustrate the procedure from start to finish. Remember, while this is a general guide, specific circumstances may require variations in the process.

The Allstate claims process generally follows a structured path, ensuring efficient handling of your claim. Accurate and timely information is crucial for a smooth resolution.

Steps Involved in Filing an Allstate Claim

Filing a claim with Allstate typically involves these key steps. The speed of the process can vary depending on the complexity of the claim and the availability of necessary information.

- Report the Claim: Immediately contact Allstate’s claims department via phone or their mobile app to report the incident. Provide initial details about the event, including date, time, and location.

- Provide Necessary Information: Allstate will request specific information to process your claim. This might include policy details, driver’s license information, vehicle information (if applicable), and details about the incident itself (witnesses, police reports, etc.).

- Claim Investigation: Allstate will investigate the claim, potentially contacting witnesses, reviewing police reports, and assessing the damage. This may involve an adjuster inspecting the property or vehicle.

- Claim Evaluation and Settlement: Once the investigation is complete, Allstate will evaluate the claim and determine the amount they will pay. This may involve negotiations, especially in cases of disputed liability.

- Payment and Claim Closure: After agreeing on a settlement, Allstate will process the payment. This could be directly deposited into your account or issued as a check. Once payment is received, the claim is officially closed.

Information Needed to Report a Claim

Providing accurate and complete information from the outset is vital for a smooth claims process. Missing or inaccurate information can delay the settlement of your claim.

- Your Allstate policy number

- Your contact information (phone number, email address)

- Details about the incident: date, time, location, and a description of what happened

- Information about involved parties (names, contact information, insurance details)

- If applicable, details about any witnesses to the incident

- If applicable, the police report number

- Photos or videos of the damage

Example of a Typical Claim Process

Let’s consider a scenario where a homeowner’s property is damaged by a fallen tree during a storm. This example will illustrate the process, including potential complications and solutions.

Scenario: A homeowner, let’s call her Sarah, experiences significant damage to her roof and backyard fence due to a large tree falling during a severe thunderstorm. She has a comprehensive homeowners insurance policy with Allstate.

Steps: Sarah immediately calls Allstate to report the claim. She provides her policy number, contact information, details of the storm, and a description of the damage. She also takes numerous photos and videos of the damage. Allstate assigns a claims adjuster who visits Sarah’s property to assess the damage. The adjuster confirms the damage is covered under her policy. Allstate provides Sarah with a contractor list to help with repairs. After the repairs are completed, Sarah submits the receipts and invoices to Allstate, and they process the payment for the covered damages.

Potential Complication: A dispute arises regarding the cost of the repairs. The contractor’s estimate is higher than Allstate’s initial assessment. Sarah provides additional documentation supporting the higher cost. Allstate reviews the documentation and agrees to the increased amount, issuing a revised payment.

Solution: Open communication and providing sufficient supporting documentation were key to resolving the dispute and ensuring a fair settlement. This illustrates that patience and proactive communication are essential throughout the claims process.

Different Claim Types and Contact Information

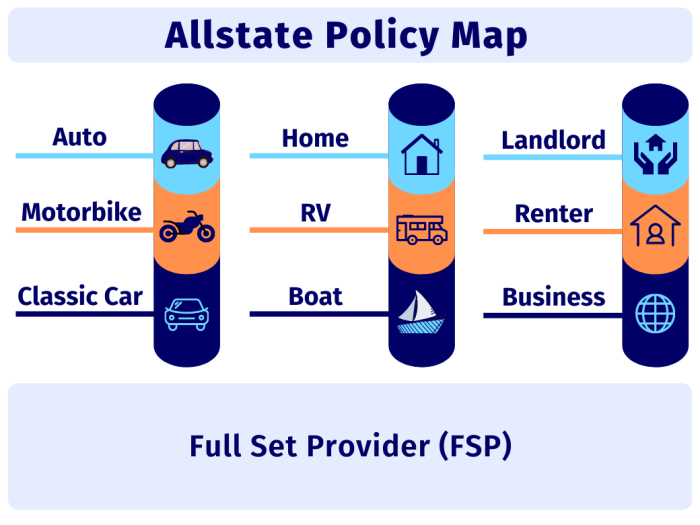

Allstate handles a variety of insurance claims, each with its own specific requirements and, in some cases, dedicated contact methods. Understanding the differences ensures a smoother claims process. This section Artikels the various claim types and the appropriate ways to contact Allstate for assistance.

Auto Claims

Filing an auto insurance claim with Allstate typically involves reporting the accident, providing details about the incident, and cooperating with the claims adjuster. Information needed includes policy details, driver’s license and vehicle information, details of the accident (date, time, location, other parties involved), and photos of the damage.

| Claim Type | Phone Number | Website Link | Additional Contact Information |

|---|---|---|---|

| Auto | (800) 344-0101 (This is a general number, specific numbers may be provided after initial contact) | www.allstate.com/claims | You may be able to file a claim online via the website; a claims adjuster will contact you to schedule an inspection. |

Homeowners Claims

Homeowners insurance claims cover damage to your property or its contents. To file a claim, you will need your policy information, details about the damage (date, time, cause, extent of damage), and any supporting documentation such as photos or videos. It is beneficial to document the damage thoroughly.

| Claim Type | Phone Number | Website Link | Additional Contact Information |

|---|---|---|---|

| Homeowners | (800) 344-0101 (This is a general number, specific numbers may be provided after initial contact) | www.allstate.com/claims | Similar to auto claims, online filing may be an option; a claims adjuster will likely visit the property to assess the damage. |

Renters Claims

Renters insurance claims cover your personal belongings in case of damage or loss. The information required is similar to homeowners claims, focusing on the damaged or lost items, their value, and the cause of the loss. Accurate documentation of your belongings, including receipts or photos, will be helpful in the claims process.

| Claim Type | Phone Number | Website Link | Additional Contact Information |

|---|---|---|---|

| Renters | (800) 344-0101 (This is a general number, specific numbers may be provided after initial contact) | www.allstate.com/claims | Online filing options may be available; a claims adjuster may contact you to discuss the details. |

After-Hours and Emergency Claims

Filing an Allstate insurance claim outside of regular business hours or in an emergency situation requires a slightly different approach than during standard operating hours. The key difference lies in the immediate need for assistance in emergency situations versus the less urgent nature of non-emergency claims. While both types of claims ultimately follow similar reporting procedures, the speed and priority of handling differ significantly.

The process for filing a claim outside of normal business hours or in an emergency generally involves contacting Allstate’s 24/7 claims hotline. This dedicated line ensures immediate access to a claims adjuster who can assess the situation and begin the claims process, regardless of the time of day. For urgent situations, such as accidents resulting in injuries or significant property damage, immediate reporting is crucial to initiate prompt assistance and documentation. Non-urgent claims, like minor damage that can wait until business hours, can be reported later, though prompt reporting is still recommended to expedite the process.

Emergency Claim Reporting Procedure

The steps involved in filing an emergency claim are designed for speed and efficiency. Following these steps helps ensure that you receive the necessary immediate assistance and begin the claims process quickly.

- Contact Allstate’s 24/7 Claims Hotline: Immediately call the number provided on your insurance card or found on the Allstate website. Provide the necessary information to the representative, including your policy number, the date and time of the incident, and a brief description of the event.

- Provide Details of the Incident: Clearly and concisely describe the circumstances surrounding the emergency, including the location, any injuries involved, and the extent of the damage. Be prepared to answer questions from the claims adjuster.

- Obtain a Claim Number: The representative will assign you a claim number. Keep this number readily available for future reference and communication with Allstate.

- Follow Instructions from the Adjuster: The claims adjuster may provide additional instructions, such as taking photos of the damage or seeking immediate medical attention. Follow these instructions carefully to ensure a smooth claims process.

- Document Everything: Thoroughly document the incident. This includes taking photographs or videos of the damage, gathering contact information from witnesses, and keeping records of any medical treatment received.

Urgent vs. Non-Urgent Claim Differences

The primary difference between urgent and non-urgent claims lies in the immediacy of the situation and the need for prompt action. Urgent claims involve situations requiring immediate attention, such as accidents resulting in injuries or significant property damage that poses a safety risk. Non-urgent claims involve less critical situations, such as minor damage that does not pose an immediate safety threat. The speed of response and the priority given to the claim will vary accordingly. While Allstate aims to process all claims efficiently, urgent claims will always receive priority handling.

Emergency Claim Flowchart

Imagine a flowchart with four distinct boxes connected by arrows.

Box 1: Incident Occurs (Emergency) – This box depicts a car accident with damage, for example.

Arrow pointing right: Call Allstate 24/7 Claims Hotline – This arrow shows the next step.

Box 2: Report Details to Adjuster – This box displays a phone call being made.

Arrow pointing right: Receive Claim Number & Instructions – This arrow shows receiving instructions and a claim number.

Box 3: Follow Instructions (Photos, Medical Attention, etc.) – This box depicts taking photos of the damage and seeking medical attention.

Arrow pointing right: Documentation & Further Communication – This box displays paperwork and a phone being used to communicate.

Alternative Contact Methods

Filing a claim with Allstate doesn’t always require a phone call. The company offers several alternative methods to report and manage your claim, each with its own set of advantages and disadvantages. Choosing the right method depends on your specific circumstances and personal preferences. Consider the urgency of your situation, the complexity of your claim, and your comfort level with technology when making your selection.

Allstate provides various digital avenues for initiating and tracking claims, offering convenience and flexibility for policyholders. These methods can be particularly useful for less urgent situations or for simple claims that don’t require immediate phone assistance. However, it’s important to understand the limitations of each method before using them.

Email Communication

Email can be a useful method for less urgent inquiries or to provide supplemental documentation related to an existing claim. For instance, you might use email to send photos of damage to your vehicle after an accident, supplementing information already provided via phone.

- Advantages: Provides a written record of communication, allows for attaching supporting documents, convenient for non-urgent matters.

- Disadvantages: Slower response time compared to phone calls, may not be suitable for urgent situations, lack of immediate interaction.

For example, submitting a simple claim for a minor property damage might be well-suited to email, while a serious car accident necessitating immediate medical attention would require a phone call.

Online Forms and Portals

Allstate’s website typically features online forms for reporting claims, allowing you to input relevant information directly. These portals often allow for claim tracking and updates as well.

- Advantages: Convenient and accessible 24/7, provides a record of your claim submission, often allows for immediate claim number generation.

- Disadvantages: May not be suitable for complex claims requiring immediate human interaction, technical difficulties may arise, less personal interaction.

Using the online portal to report a minor hail damage to your roof might be preferable to calling, while a major house fire would warrant a direct phone call for immediate assistance and dispatch of emergency services.

Social Media

While not a primary method for filing claims, Allstate’s social media presence can be used for general inquiries or to escalate issues if you’ve experienced difficulty through other channels. This method is generally not ideal for reporting initial claims.

- Advantages: Public forum for voicing concerns, potentially faster response for simple questions or escalating existing problems.

- Disadvantages: Not a secure method for sharing sensitive information, response times can vary widely, not designed for formal claim reporting.

Social media might be useful if you are experiencing delays in processing an existing claim and need to escalate the issue for attention, but it is not recommended for initially reporting a claim.

Accessibility Features for Claim Reporting

Allstate recognizes the importance of ensuring equal access to its services for all customers, including those with disabilities. They offer a variety of accessibility features to make reporting a claim as straightforward and convenient as possible, regardless of individual needs. These features aim to remove barriers and provide a seamless claims experience for everyone.

Allstate provides several methods for individuals with disabilities to report claims. These options are designed to accommodate a wide range of needs, ensuring inclusivity and ease of access for all.

Accessibility Features for Visual Impairments

Allstate’s website and mobile app incorporate accessibility features designed to benefit users with visual impairments. These features enhance usability and make navigating the claims process easier.

- Screen reader compatibility: Allstate’s online platforms are designed to be compatible with popular screen readers, allowing users to navigate and interact with the website and app through auditory cues.

- Keyboard navigation: The website and app can be fully navigated using only a keyboard, eliminating the need for a mouse for those with limited dexterity or visual impairments.

- High contrast mode: Users can adjust the contrast settings to improve readability and visibility of text and images.

- Alternative text for images: Images on the website and app have alternative text descriptions, providing context for screen reader users.

Accessibility Features for Hearing Impairments

For individuals with hearing impairments, Allstate offers alternative communication methods to facilitate claim reporting. These options ensure effective communication and support throughout the claims process.

- Video Relay Service (VRS): Allstate supports communication through VRS, allowing individuals who are deaf or hard of hearing to communicate with Allstate representatives using sign language interpreted in real-time.

- TTY/TDD: Allstate provides access to TTY/TDD lines, which are text-based telephone systems that enable communication for individuals with hearing impairments.

- Email and online chat: Allstate offers email and online chat support as alternative methods for communicating about claims, providing a written communication channel.

Additional Accessibility Support

Beyond the specific features listed above, Allstate strives to provide a supportive and inclusive environment for all customers. This includes offering assistance to those who may require additional support to navigate the claims process.

- Large print materials: Upon request, Allstate can provide claim-related materials in large print format for individuals with low vision.

- Personalized assistance: Allstate representatives are trained to provide assistance and support to individuals with disabilities who may require additional help navigating the claims process. Customers should not hesitate to request assistance.

Troubleshooting Common Issues

Contacting Allstate to report a claim can sometimes present challenges. Understanding potential problems and their solutions can significantly streamline the process and reduce frustration. This section addresses common difficulties encountered during claim reporting and offers practical solutions.

While Allstate strives for efficient service, various factors can contribute to delays or technical difficulties. These issues often stem from high call volumes, website traffic surges, or unexpected technical glitches. Proactive problem-solving can help you navigate these situations effectively.

Common Contact Problems and Solutions

The following table Artikels frequent problems experienced when contacting Allstate for claims and suggests corresponding solutions.

| Problem | Solution |

|---|---|

| Long wait times on the phone | Consider using Allstate’s online claim reporting system or mobile app. If calling is necessary, try calling during off-peak hours (e.g., early mornings or late evenings). You might also find that using the callback feature, if available, can reduce your wait time. |

| Website or app malfunctions | First, check your internet connection. If the problem persists, try clearing your browser’s cache and cookies. Restarting your device or using a different browser might also resolve temporary glitches. If issues continue, contact Allstate’s customer service via phone or social media to report the technical problem. |

| Difficulty navigating the website or app | Allstate’s website and app usually have a search function. Use s related to your specific need (e.g., “file a claim,” “check claim status”). Look for FAQs or help sections within the app or website. If you’re still having trouble, consider contacting Allstate customer service for assistance. |

| Incorrect or incomplete claim information requested | Carefully review the required information. Gather all necessary documents before starting the process. If you are unsure about what information is needed, refer to Allstate’s website or contact customer service for clarification. Double-check all entries for accuracy before submitting. |

| Inability to upload documents online | Ensure your files are in a compatible format (e.g., JPG, PNG, PDF). Check the file size limits specified by Allstate. If you continue to experience problems, try compressing large files or contacting Allstate customer support for assistance with uploading. |

Closing Summary

Successfully filing an insurance claim involves understanding the process, knowing where to find the necessary information, and utilizing the most efficient contact methods. This guide has Artikeld multiple avenues for reaching Allstate, including phone numbers for various claim types, online resources, and alternative contact options. By utilizing these resources and understanding the steps involved, you can confidently navigate the claims process and obtain the support you need from Allstate.

Helpful Answers

What if I can’t find my Allstate policy number?

Contact Allstate customer service through their general number; they can help locate your policy information.

How long does it typically take for Allstate to process a claim?

Processing times vary depending on the claim type and complexity, but Allstate provides estimated timelines on their website.

What happens if my claim is denied?

Allstate will provide a detailed explanation of the denial. You have the right to appeal the decision, following the procedures Artikeld in your policy.

Can I file a claim online instead of calling?

Yes, Allstate offers online claim filing through their website and mobile app. This is often a faster method for non-emergency situations.