Navigating the San Diego car insurance market can feel like driving through rush hour traffic – overwhelming and potentially expensive. But finding affordable coverage doesn’t have to be a stressful experience. This guide delves into the factors influencing car insurance costs in San Diego, providing practical strategies and resources to help you secure the best possible rates. We’ll explore various coverage options, compare insurers, and offer tips for lowering your premiums, ultimately empowering you to make informed decisions about your auto insurance.

From understanding the impact of your driving record and credit score to leveraging discounts and negotiating with insurers, we’ll equip you with the knowledge and tools necessary to secure affordable and comprehensive car insurance protection in San Diego. We’ll also address common misconceptions and provide clear, concise answers to frequently asked questions, ensuring you feel confident in your choices.

Understanding the San Diego Car Insurance Market

San Diego’s car insurance market is influenced by a variety of factors, resulting in a diverse range of premiums and coverage options. Understanding these factors is crucial for securing affordable and adequate insurance. This section will explore the key elements that shape the cost of car insurance in this vibrant coastal city.

Factors Influencing Car Insurance Costs in San Diego

Several factors contribute to the cost of car insurance in San Diego. These include the driver’s age and driving history (younger drivers and those with accidents or violations typically pay more), the type and value of the vehicle (luxury cars and high-performance vehicles are more expensive to insure), the location of residence within San Diego (areas with higher crime rates or accident frequencies may have higher premiums), and the level of coverage selected (more comprehensive coverage naturally costs more). Additionally, credit history and the driver’s insurance score can also significantly impact premiums. For example, a driver with a history of speeding tickets will likely pay more than a driver with a clean record. Similarly, a driver residing in a high-risk area like downtown San Diego may face higher premiums than someone living in a quieter suburban neighborhood.

Types of Car Insurance Coverage Available in San Diego

San Diego residents have access to various car insurance coverage options, each offering different levels of protection. Liability coverage is legally required in California and protects against financial losses incurred if you cause an accident that injures someone or damages their property. Collision coverage pays for damage to your car in an accident, regardless of fault. Comprehensive coverage protects your vehicle against damage from events like theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage safeguards you if you’re involved in an accident with a driver who lacks sufficient insurance. Medical payments coverage helps cover medical expenses for you and your passengers after an accident, regardless of fault. Personal injury protection (PIP) offers similar coverage but may also cover lost wages and other expenses. Choosing the right coverage depends on individual needs and risk tolerance.

Comparison of Average Insurance Premiums Across Various Demographics in San Diego

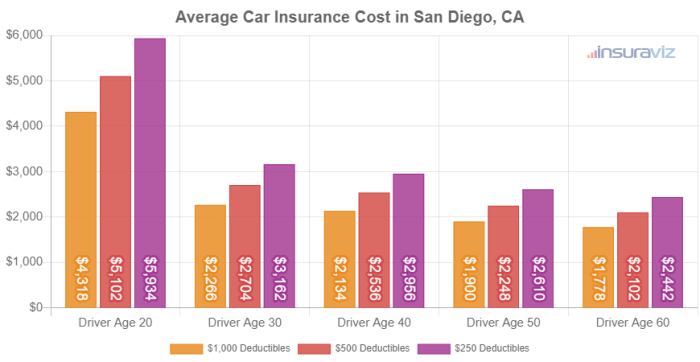

Average car insurance premiums in San Diego vary significantly across different demographics. Generally, younger drivers (under 25) tend to pay substantially more than older, more experienced drivers. Drivers with poor credit scores often face higher premiums than those with good credit. Men, on average, tend to pay slightly more than women, reflecting higher accident rates historically reported for this demographic. The specific premium amount depends on many factors, but these demographic trends are generally observed. It is important to note that these are averages, and individual premiums can vary widely based on other factors such as driving history and vehicle type. Precise figures require accessing data from multiple insurance providers.

Cost of Insurance for Different Car Makes and Models in San Diego

The cost of car insurance is also heavily influenced by the type of vehicle. Generally, higher-value vehicles and those with a history of theft or accidents command higher premiums. Sports cars and luxury vehicles often fall into this category. Conversely, smaller, less expensive cars tend to have lower insurance costs. The table below provides a general comparison, keeping in mind that actual costs can fluctuate based on other factors mentioned previously. This data is illustrative and should not be considered definitive pricing.

| Car Make and Model | Estimated Annual Premium (Low) | Estimated Annual Premium (Average) | Estimated Annual Premium (High) |

|---|---|---|---|

| Honda Civic | $800 | $1200 | $1800 |

| Toyota Camry | $900 | $1300 | $2000 |

| Ford F-150 | $1100 | $1600 | $2500 |

| BMW 3 Series | $1500 | $2200 | $3500 |

Finding Affordable Car Insurance Options

Securing affordable car insurance in San Diego requires a strategic approach. The cost of insurance can vary significantly based on several factors, including your driving history, the type of vehicle you drive, and the coverage you choose. Understanding these factors and utilizing available resources can help you find a policy that fits your budget without compromising necessary protection.

Finding the best car insurance rate often involves comparing quotes from multiple providers and understanding the different policy options available. This process can be simplified by leveraging online tools and understanding how various factors influence your premium.

Utilizing Resources for Affordable Car Insurance

Several resources can assist San Diego residents in finding affordable car insurance. Comparison websites, such as The Zebra, NerdWallet, and Insurance.com, allow you to enter your information once and receive quotes from multiple insurers simultaneously. This streamlined approach saves time and effort. Independent insurance agents also act as valuable resources. They can compare policies from various companies, often accessing options not readily available online, and providing personalized advice based on your individual needs. Their expertise can be particularly helpful for those navigating complex insurance situations.

Strategies for Lowering Car Insurance Premiums

Several strategies can significantly reduce your car insurance premiums in San Diego. Maintaining a clean driving record is paramount; many insurers offer substantial discounts for drivers with no accidents or traffic violations. Bundling your car insurance with other policies, such as homeowners or renters insurance, from the same provider often results in significant savings through bundled discounts. Choosing a car with favorable safety ratings can also impact your premiums; insurers often reward drivers of safer vehicles with lower rates. Increasing your deductible can lower your monthly premium, but remember this means you’ll pay more out-of-pocket in the event of a claim. Consider opting for higher deductibles if you have sufficient savings to cover potential expenses. Finally, exploring discounts for good students, mature drivers, and those who complete defensive driving courses can further reduce your costs.

Benefits and Drawbacks of Different Insurance Policy Types

Different types of car insurance policies offer varying levels of coverage and, consequently, different price points. Liability-only coverage is the most basic and affordable option, covering damages to others’ property or injuries sustained by others in an accident you cause. However, it doesn’t cover damage to your own vehicle. Collision coverage pays for repairs to your car regardless of fault, while comprehensive coverage protects against damage from events like theft, vandalism, or natural disasters. These additional coverages increase the premium but provide greater financial protection. Understanding your individual needs and risk tolerance is crucial in determining the appropriate level of coverage and balancing affordability with comprehensive protection. For instance, a newer, more expensive vehicle might justify the higher cost of comprehensive coverage, while an older car might only require liability insurance.

Obtaining Quotes from Multiple Insurers: A Step-by-Step Guide

1. Gather Necessary Information: Compile your driver’s license information, vehicle information (year, make, model), and details about your driving history (accidents, violations).

2. Use Online Comparison Tools: Visit comparison websites and input your information to receive quotes from multiple insurers.

3. Contact Independent Agents: Reach out to independent insurance agents to discuss your needs and obtain additional quotes.

4. Review Policy Details: Carefully compare the coverage offered by each insurer, paying attention to deductibles, premiums, and policy limitations.

5. Choose the Best Policy: Select the policy that best balances affordability with the level of coverage you require. Remember to consider the long-term costs, factoring in potential deductibles and out-of-pocket expenses.

6. Purchase Your Policy: Once you’ve selected a policy, complete the purchase process through the chosen insurer or agent.

Factors Affecting Insurance Costs

Several key factors influence the cost of car insurance in San Diego, impacting premiums significantly. Understanding these factors allows drivers to make informed decisions and potentially reduce their insurance expenses. These factors interact in complex ways, and a seemingly small change in one area can affect your overall premium.

Insurance companies utilize sophisticated algorithms to assess risk, and these algorithms consider a wide range of data points. While the exact formulas are proprietary, understanding the key contributing factors provides valuable insight into how to manage your insurance costs.

Driving Record

Your driving history is a primary determinant of your insurance premium. A clean driving record with no accidents or violations results in lower premiums. Conversely, accidents and violations lead to significantly higher rates. The severity of the violation also plays a role; a speeding ticket will generally have less impact than a DUI or reckless driving conviction. For example, a single at-fault accident could increase your premium by 30-40% or more, depending on the extent of the damage and injuries involved. A DUI conviction could result in even more substantial increases, sometimes leading to policy cancellations. Insurance companies view these as high-risk behaviors, and therefore adjust premiums accordingly.

Age and Driving Experience

Younger drivers, particularly those under 25, generally pay higher insurance premiums due to statistically higher accident rates within this demographic. Lack of driving experience is a major contributing factor. As drivers gain experience and age, premiums typically decrease, reflecting a lower perceived risk. For instance, a 16-year-old driver will likely pay substantially more than a 40-year-old driver with a clean record. This is because insurance companies use actuarial data that shows younger drivers are more likely to be involved in accidents.

Location

Your address plays a role in determining your insurance rates. Areas with higher crime rates, more accidents, and higher vehicle theft rates tend to have higher insurance premiums. San Diego’s diverse neighborhoods have varying risk profiles, impacting insurance costs. Living in a high-risk area may lead to significantly higher premiums than residing in a lower-risk area, even if all other factors remain the same. Insurance companies analyze claims data from specific zip codes to assess risk levels.

Credit Score

In many states, including California, insurance companies use credit-based insurance scores to assess risk. A higher credit score generally correlates with lower insurance premiums. The reasoning behind this is that individuals with good credit are statistically less likely to file fraudulent claims or fail to pay their premiums. A poor credit score can lead to significantly higher premiums. This is a controversial practice, but it is legal and widely used in the industry. The impact can be substantial; a lower credit score might increase your premium by 20% or more.

Type of Vehicle

The type of vehicle you drive is another significant factor. Sports cars and luxury vehicles are often associated with higher insurance premiums due to their higher repair costs and the perceived risk of higher-speed driving. The vehicle’s safety features also play a role; cars with advanced safety technology may qualify for discounts. For example, insuring a high-performance sports car will cost considerably more than insuring a fuel-efficient compact car.

Bulleted List of Most Impactful Factors

The following list summarizes the most impactful factors affecting San Diego car insurance costs:

- Driving Record (accidents, violations)

- Age and Driving Experience

- Location (zip code)

- Credit Score

- Type of Vehicle

Insurance Company Comparisons

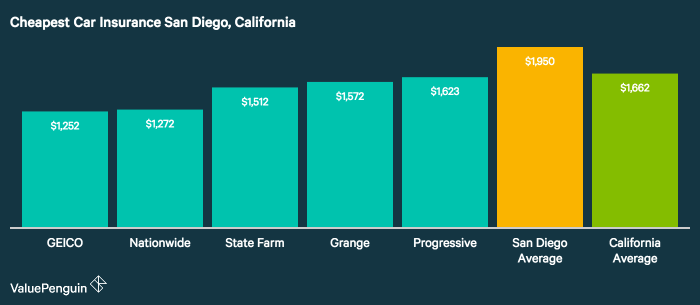

Choosing the right car insurance provider in San Diego can significantly impact your budget. This section compares three major insurers, highlighting their strengths and weaknesses regarding affordability, customer service, and coverage options. Remember that rates vary based on individual factors, so these comparisons offer a general overview.

Geico

Geico is known for its competitive pricing and straightforward online processes. Their strength lies in their user-friendly website and mobile app, making it easy to obtain quotes, manage policies, and file claims. However, their customer service can sometimes be challenging to reach, particularly during peak hours. Geico offers a standard range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Their value proposition focuses on ease of use and competitive pricing, prioritizing digital interaction over extensive personal service.

State Farm

State Farm boasts a strong reputation for reliable customer service and a wide network of local agents. While their premiums may not always be the absolute lowest, their extensive agent network offers personalized support and convenient in-person assistance. This personal touch can be valuable for those who prefer face-to-face interaction. State Farm provides a comprehensive suite of coverage options, often including specialized endorsements for unique needs. Their value proposition centers on personalized service and a wide range of coverage choices, emphasizing human interaction and tailored solutions.

Progressive

Progressive is recognized for its innovative features, such as its Name Your Price® Tool, which allows customers to specify their desired premium and then see which coverage options fit within that budget. This approach empowers consumers to control their spending. While their online tools are robust, some customers have reported inconsistencies in customer service responsiveness. Progressive offers a broad selection of coverage options, often including unique add-ons such as roadside assistance and rental car reimbursement. Their value proposition focuses on consumer control and customized options, prioritizing technological innovation and flexible coverage choices.

Comparison Table

| Feature | Geico | State Farm | Progressive |

|---|---|---|---|

| Affordability | Generally competitive | Moderately priced | Variable, depends on Name Your Price® selection |

| Customer Service | Can be difficult to reach | Strong local agent network | Mixed reviews, online tools are strong |

| Coverage Options | Standard range | Comprehensive, with specialized endorsements | Broad selection, unique add-ons |

| Value Proposition | Ease of use and competitive pricing | Personalized service and comprehensive coverage | Consumer control and customized options |

Tips for Saving Money

Securing affordable car insurance in San Diego requires a proactive approach. By understanding the factors influencing your premiums and implementing smart strategies, you can significantly reduce your annual costs without sacrificing necessary coverage. This section Artikels practical steps to achieve substantial savings.

Lowering your car insurance premiums involves a multifaceted strategy encompassing several key areas. Careful consideration of your deductible, driving habits, and insurance coverage selection, combined with effective negotiation, can lead to significant long-term savings.

Increasing Deductibles

Raising your deductible—the amount you pay out-of-pocket before your insurance coverage kicks in—is a common method to lower your premiums. A higher deductible means lower monthly payments, as the insurance company assumes less risk. However, it’s crucial to weigh this against your ability to afford a larger upfront payment in case of an accident. For example, increasing your deductible from $500 to $1000 could result in a noticeable reduction in your premium, but you’ll need to be prepared to cover $1000 yourself if you file a claim. Carefully assess your financial situation to determine the optimal balance between affordability and risk.

Improving Driving Habits

Maintaining a clean driving record is paramount for securing lower premiums. Insurance companies heavily weigh driving history when calculating rates. Avoid speeding tickets, accidents, and traffic violations, as these incidents significantly increase your premiums. Defensive driving courses can also demonstrate your commitment to safe driving and potentially earn you discounts. For instance, successfully completing a certified defensive driving course could result in a 5-10% discount depending on the insurer and your location. Safe driving practices translate directly into lower insurance costs.

Negotiating Lower Premiums

Don’t hesitate to negotiate with your insurance provider. Shop around and compare quotes from multiple companies. Armed with competing offers, you can leverage this information to negotiate a lower rate with your current insurer. Explain your commitment to safe driving and highlight any discounts you’re eligible for. Many insurers are willing to negotiate, especially if you’ve been a loyal customer with a clean driving record. For example, if a competitor offers a rate 15% lower, presenting this information to your current provider might incentivize them to match or even slightly undercut the offer.

Choosing the Right Coverage

Carefully review your coverage options to ensure you have adequate protection without paying for unnecessary extras. While comprehensive and collision coverage offer valuable protection, they can significantly increase your premiums. If your car is older and has a lower value, you might consider dropping collision and comprehensive coverage, opting for liability coverage instead. This can lead to considerable savings, but it’s vital to weigh the potential financial risk of not having comprehensive coverage in case of an accident. For example, if your car is worth less than your deductible, the cost of comprehensive coverage might outweigh its benefits.

Understanding Policy Details

Before committing to a car insurance policy, thoroughly understanding its terms and conditions is crucial. This ensures you’re adequately protected and avoid unexpected costs or coverage gaps. Failing to understand your policy can lead to financial hardship in the event of an accident or claim.

Policy terms and conditions are legally binding agreements between you and the insurance company. A clear understanding protects your rights and ensures you receive the coverage you paid for. Neglecting this step could leave you vulnerable to unforeseen expenses and disputes.

Common Policy Exclusions and Limitations

Car insurance policies typically exclude certain events or circumstances from coverage. These exclusions and limitations are designed to manage risk for the insurance company and prevent fraudulent claims. Familiarizing yourself with these provisions is essential to avoid disappointment when you need to file a claim.

Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Limitations might include restrictions on the amount of coverage for specific types of damage or the number of claims you can file within a specific period. For example, a policy might have a specific limit on the amount it will pay for repairs to your car after an accident, or it might exclude coverage for damage to your car caused by a natural disaster if you live in a high-risk area. Another common limitation is the deductible, which is the amount you pay out-of-pocket before your insurance coverage kicks in.

Reading and Interpreting an Insurance Policy Document

Insurance policies are often dense and legally complex documents. However, understanding the key components is achievable with a systematic approach. Start by carefully reading the policy’s declaration page, which summarizes key information like your coverage limits, premium, and policy period. Then, review the sections detailing your specific coverages (liability, collision, comprehensive, etc.), carefully noting any limitations or exclusions. Look for definitions of key terms, as insurance policies often use specialized jargon. If any section is unclear, contact your insurance agent or company for clarification.

Consider using a highlighter or making notes to identify crucial information. Pay particular attention to the sections describing how to file a claim, what documentation is required, and the claims process timeline. Understanding these procedures will streamline the process should you need to make a claim.

Sample Policy Document Clauses

The following table provides a simplified representation of essential clauses often found in a car insurance policy. Note that the specific wording and coverage details will vary depending on the insurer and the policy purchased.

| Clause | Description | Example |

|---|---|---|

| Liability Coverage | Covers bodily injury and property damage caused to others in an accident you are at fault for. | $100,000 bodily injury liability per person, $300,000 per accident; $50,000 property damage liability. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Covers damage to your vehicle resulting from a collision with another vehicle or object, subject to your deductible. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. | Covers damage to your vehicle from fire, hail, or theft, subject to your deductible. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with an uninsured or underinsured driver. | Covers medical bills and property damage if you’re injured by an uninsured driver. |

| Deductible | The amount you pay out-of-pocket before your insurance coverage begins. | $500 deductible for collision and comprehensive coverage. |

Final Conclusion

Securing affordable car insurance in San Diego requires careful planning and a proactive approach. By understanding the factors influencing premiums, utilizing available resources, and employing effective negotiation strategies, you can significantly reduce your insurance costs without compromising essential coverage. Remember, comparing quotes, maintaining a clean driving record, and bundling policies are key steps towards achieving significant savings. Take control of your insurance costs and drive confidently knowing you’ve found the best possible protection at a price that fits your budget.

FAQs

What is the average cost of car insurance in San Diego?

The average cost varies greatly depending on factors like age, driving history, vehicle type, and coverage level. It’s best to obtain personalized quotes from multiple insurers for an accurate estimate.

Can I get car insurance without a driver’s license?

Generally, no. Most insurers require a valid driver’s license to issue a car insurance policy. However, some limited coverage options might exist in specific circumstances; it’s best to contact insurers directly to inquire.

How often can I expect my car insurance rates to change?

Rates can change annually, or even more frequently, depending on your driving record, claims history, and changes in the insurance market. Review your policy regularly and consider shopping for new rates periodically.

What happens if I get into an accident while my insurance is expired?

Driving without insurance is illegal and can result in significant fines and penalties. In the event of an accident, you would be responsible for all costs associated with damages and injuries, regardless of fault.