Planning for long-term health care is a crucial yet often overlooked aspect of financial security. The prospect of needing extensive medical assistance in later life can be daunting, both emotionally and financially. AARP, a well-known organization dedicated to the well-being of older Americans, offers a range of long-term care insurance plans designed to alleviate some of this burden. This guide explores the intricacies of AARP long-term health insurance, examining its features, benefits, costs, and alternatives.

Understanding the nuances of long-term care insurance is paramount. This involves comprehending the various types of care available, such as home healthcare, assisted living facilities, and nursing homes, and the significant financial implications associated with each. We’ll delve into the specifics of AARP’s offerings, comparing them to other providers and helping you determine if such a policy aligns with your individual needs and circumstances. We will also discuss crucial aspects like eligibility requirements, application processes, and cost factors.

AARP’s Role in Long-Term Health Insurance

AARP, the American Association of Retired Persons, plays a significant role in the long-term care insurance market by partnering with insurance providers to offer plans specifically designed for their members. This partnership leverages AARP’s extensive network and brand recognition to provide access to potentially more affordable and comprehensive coverage options for seniors. Their involvement aims to address the growing need for long-term care solutions among the aging population.

AARP does not underwrite or sell insurance policies directly. Instead, they collaborate with reputable insurance companies to develop and market plans tailored to the needs and financial capabilities of their members. This collaborative approach allows AARP to focus on advocacy and member education while leaving the complexities of insurance underwriting and claims processing to the partnered insurance providers.

Types of Long-Term Care Insurance Plans Offered Through AARP

AARP-affiliated plans typically include a range of long-term care insurance options, often encompassing various coverage levels and benefit structures. These plans may cover a spectrum of care needs, including home health care, assisted living, and nursing home care. The specific benefits and limitations will vary depending on the chosen plan and the insurance provider. For example, some plans might offer a daily benefit amount for a specified duration, while others might provide a lump-sum payment upon the need for long-term care. The plans often include options for inflation protection to adjust benefits over time to account for rising healthcare costs.

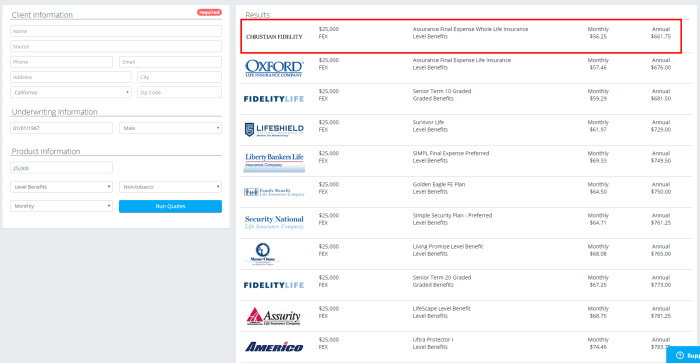

Comparison of AARP-Affiliated Plans with Other Major Providers

Comparing AARP-affiliated plans with other major long-term care insurance providers requires careful consideration of several factors. These factors include premium costs, benefit levels, policy features (such as inflation protection and benefit periods), and the financial stability of the insurance company. While AARP plans may offer competitive pricing and benefits for their members, it’s crucial to compare them to offerings from other established insurers to ensure you are selecting the most suitable policy based on your individual circumstances and financial situation. Independent comparisons from reputable financial websites and consumer advocacy groups can be helpful in this process.

Benefits and Limitations of AARP Long-Term Care Insurance Options

AARP-affiliated long-term care insurance plans offer several potential benefits, including access to a potentially wider range of coverage options, competitive pricing due to the bulk purchasing power of AARP’s membership, and the familiarity and trust associated with the AARP brand. However, limitations exist. Specific benefits and limitations are dependent on the chosen plan and the insurance company. For example, pre-existing conditions may impact eligibility, and waiting periods before benefits commence are common. Furthermore, premium costs can increase over time, and the financial stability of the insurance provider should always be a primary concern. It is crucial to carefully review the policy details and seek professional financial advice before making a purchasing decision.

Understanding Long-Term Care Needs

Planning for long-term care is a crucial aspect of securing your financial and personal well-being as you age. Understanding the various types of care available, their associated costs, and the resources accessible to help you navigate this process is essential for making informed decisions. This section will explore these vital elements to assist you in preparing for potential long-term care needs.

Types of Long-Term Care Services

Long-term care encompasses a range of services designed to assist individuals who require ongoing support due to age, illness, or disability. These services cater to varying levels of need and preference. The three most common types are home health care, assisted living, and nursing homes.

Home health care provides assistance with daily living activities such as bathing, dressing, and medication management within the comfort of one’s home. This option offers greater independence and familiarity, but the level of care may be limited depending on the individual’s needs and the availability of caregivers.

Assisted living facilities offer a more structured environment with 24-hour supervision and assistance with daily tasks. Residents typically live in private or semi-private apartments and have access to communal areas and amenities. Assisted living is a good option for individuals who require more support than home health care can provide but do not need the intensive medical care offered in a nursing home.

Nursing homes provide the highest level of medical care and support for individuals with significant health challenges. Residents typically have private or semi-private rooms and access to medical professionals around the clock. Nursing homes are often the most expensive option and are usually reserved for individuals with complex medical needs that cannot be met in other settings.

Financial Implications of Long-Term Care

The cost of long-term care can be substantial and vary significantly depending on the type of care needed, the location, and the level of services required. Home health care is generally the least expensive option, while nursing home care is the most expensive. The average annual cost of a nursing home can range from tens of thousands to over one hundred thousand dollars, depending on the facility and location. Even assisted living facilities can incur significant costs, often exceeding the annual cost of many people’s housing. These costs can quickly deplete personal savings and assets, placing a considerable financial burden on individuals and their families.

Resources for Planning Long-Term Care Costs

Several resources can assist individuals in planning for long-term care costs. These include financial advisors specializing in long-term care planning, who can help develop a personalized financial strategy that incorporates long-term care expenses. Insurance professionals can explain various long-term care insurance options and help determine the best coverage for individual needs and budgets. Government agencies, such as the Centers for Medicare & Medicaid Services (CMS), provide valuable information on long-term care options and eligibility requirements for government assistance programs. Finally, many non-profit organizations offer counseling and support services to individuals and families facing long-term care challenges.

Hypothetical Long-Term Care Budget

Let’s consider a hypothetical scenario for a 70-year-old individual requiring assisted living care. Assume an annual cost of $60,000 for assisted living, including rent, meals, and personal care. This excludes additional expenses like medical care, transportation, and personal items. If this individual has $200,000 in savings, this could cover approximately 3.3 years of care. To extend this coverage, they might consider long-term care insurance, reducing the financial strain on their savings and family. This example highlights the importance of planning ahead and understanding the potential financial implications of long-term care needs. The specific costs will vary greatly based on location, level of care, and individual circumstances.

Policy Features and Coverage

Choosing a long-term care insurance policy requires careful consideration of various features and their impact on your future needs. Understanding the specifics of your policy is crucial to ensure it aligns with your financial capabilities and long-term care expectations. This section will delve into key policy features, comparing different options and highlighting important considerations.

Policy Feature Comparisons: Inflation Protection, Benefit Periods, and Waiting Periods

Long-term care insurance policies offer varying levels of protection, primarily differentiated by inflation protection, benefit periods, and waiting periods. Inflation protection safeguards the purchasing power of your benefits over time, as healthcare costs tend to rise. Benefit periods specify the maximum length of time the policy will pay benefits, ranging from a few years to lifetime coverage. Waiting periods represent the time you must wait after needing care before benefits begin. Policies with higher inflation protection, longer benefit periods, and shorter waiting periods generally come with higher premiums. For example, a policy with 5% annual inflation protection will increase its daily benefit amount by 5% each year, helping to offset rising healthcare costs. A policy with a 90-day waiting period requires you to cover your care costs for the first 90 days before benefits are activated. Conversely, a policy with a shorter waiting period, say 30 days, offers quicker access to benefits but may have a higher premium. A lifetime benefit period provides the most comprehensive coverage, while shorter benefit periods, such as 3 or 5 years, are less expensive but offer less long-term security.

Understanding Policy Exclusions and Limitations

It’s equally vital to understand what your policy *doesn’t* cover. Most long-term care policies have exclusions and limitations. Common exclusions might include coverage for pre-existing conditions, experimental treatments, or care received outside of a licensed facility. Limitations could include caps on daily or total benefits, restrictions on the types of care covered, or requirements for specific medical evaluations. Carefully reviewing the policy document is essential to avoid unexpected costs and ensure the policy meets your needs. For instance, a policy might exclude coverage for care received in a foreign country or for certain types of mental health conditions. Understanding these limitations allows for informed decision-making and prevents future disappointments.

Comparison of Key AARP Long-Term Care Insurance Plan Features

The following table compares three hypothetical AARP long-term care insurance plans to illustrate the range of options available. Note that specific plan details and availability can vary based on location and underwriting criteria. Always consult an AARP representative or insurance professional for the most up-to-date and accurate information.

| Plan Name | Inflation Protection | Benefit Period | Waiting Period |

|---|---|---|---|

| Plan A | 3% Compound | 5 Years | 90 Days |

| Plan B | 5% Compound | 10 Years | 30 Days |

| Plan C | 0% (No Inflation Protection) | Lifetime | 90 Days |

Benefit Payment Procedures under an AARP Long-Term Care Insurance Policy

Benefits are typically paid out on a daily or monthly basis, depending on the specific policy terms. To receive benefits, you’ll generally need to submit documentation demonstrating your need for long-term care, such as a physician’s assessment or a care facility’s certification. The insurance company will then review the claim and, if approved, begin making payments directly to the care provider or to you, depending on your policy’s provisions. Payment amounts are usually based on the daily or monthly benefit amount stated in your policy, adjusted for inflation protection if included. The process involves submitting necessary paperwork, potentially undergoing an assessment by the insurance company’s medical professional, and adhering to the policy’s terms and conditions for claim approval and subsequent benefit payments. The exact procedure may vary slightly depending on the specific plan and the insurance company.

Eligibility and Application Process

Securing AARP long-term care insurance involves understanding the eligibility criteria and navigating the application process. This section Artikels the requirements, steps involved, potential influencing factors, and examples of reasons for application denial. It’s important to remember that specific eligibility and application details can vary depending on the specific policy and your state of residence. Always refer to the most current information from the insurer directly.

Eligibility Requirements for AARP Long-Term Care Insurance

Eligibility for AARP long-term care insurance policies generally centers around age, health status, and residency. Applicants usually need to be within a specific age range, typically starting in their 50s or 60s, though this varies depending on the specific policy and the insurer. Pre-existing conditions may impact eligibility or premium costs, and the application process will include a health assessment. Finally, residency requirements usually limit coverage to residents of specific states.

Application Steps

The application process typically involves several key steps. First, you’ll complete an application form providing personal information, health history, and desired coverage level. Next, you’ll undergo a medical evaluation which might include a physical examination, medical records review, and potentially cognitive assessments. This is crucial for the insurer to assess your health risk. After the medical evaluation, the insurer will review your application and medical information to determine eligibility and premium cost. Finally, upon approval, you’ll receive a policy and begin coverage.

Factors Affecting Approval and Premium Costs

Several factors can influence both the approval of your application and the cost of your premiums. Your age significantly impacts premium costs; younger applicants generally receive lower premiums. Your health status, including pre-existing conditions and current health, plays a substantial role in both eligibility and premium determination. Higher health risks lead to higher premiums or even potential denial. The type and level of coverage you select also affect your premium; more extensive coverage naturally results in higher premiums. Finally, your smoking status is another significant factor considered by insurers when calculating your premium.

Examples of Application Denial Reasons

Applications for long-term care insurance can be denied for several reasons. Pre-existing conditions that are considered high-risk, such as advanced-stage Alzheimer’s disease or severe heart failure, might lead to denial. Applicants who fail to disclose relevant medical history during the application process may also face denial. In some cases, an applicant’s current health status might be deemed too precarious to provide coverage. Additionally, providing false or misleading information on the application will almost certainly result in denial. It’s crucial to provide accurate and complete information throughout the application process.

Cost and Affordability

Choosing long-term care insurance involves careful consideration of its cost and whether it aligns with your financial situation. Several factors influence the premium you’ll pay, and understanding these factors is crucial for making an informed decision. This section will explore these factors, payment options, and illustrate how to assess the potential return on your investment.

Factors Influencing Premium Costs

A variety of factors contribute to the cost of AARP long-term care insurance premiums. These factors are often assessed during the application process and directly impact the final price. The most significant factors include the applicant’s age, health status, policy benefits (such as the daily benefit amount and benefit period), and the chosen payment structure. For example, a younger applicant with excellent health will generally receive a lower premium than an older applicant with pre-existing conditions. Similarly, a policy with a higher daily benefit and longer benefit period will naturally command a higher premium. The policy’s inflation protection feature also plays a significant role, as it protects against the rising cost of care over time. Policies offering this protection will generally have higher premiums but offer greater financial security.

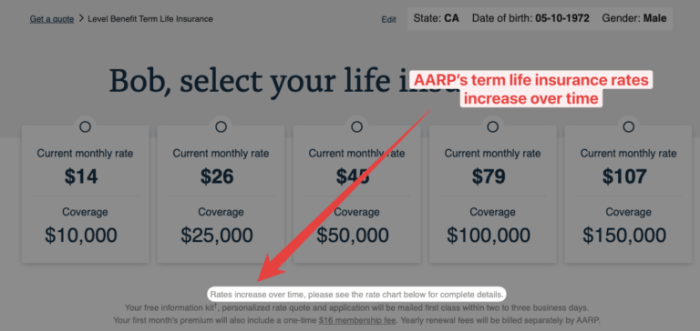

Payment Options and Premium Structures

AARP long-term care insurance offers various payment options to cater to individual financial situations. These include level premiums, which remain constant throughout the policy’s term, and increasing premiums, which rise annually. Level premiums offer predictability but might lead to higher overall costs compared to increasing premiums, which are lower initially but increase over time. Many policies also allow for premium payments through monthly, quarterly, semi-annual, or annual installments. Choosing the appropriate payment option depends on individual financial planning and risk tolerance. For example, someone with a stable income might prefer level premiums for predictable budgeting, while someone expecting income growth might find increasing premiums more manageable.

Premium Cost Comparison Across Age Groups and Health Conditions

Premium costs vary significantly depending on age and health. Generally, younger applicants enjoy lower premiums due to their lower risk of needing long-term care. However, this also means they pay premiums for a longer period. Conversely, older applicants face higher premiums due to the increased probability of requiring long-term care. Pre-existing health conditions further influence premium costs, with individuals having more serious conditions generally paying more. Illustrative examples could show a 50-year-old in good health paying significantly less than a 70-year-old with a chronic illness. It’s crucial to remember that these are just examples, and actual costs will vary based on the specific policy details and the insurer’s underwriting guidelines. Specific cost data should be obtained directly from AARP or a licensed insurance agent.

Calculating Potential Return on Investment

Calculating the potential return on investment (ROI) for long-term care insurance requires careful consideration of several factors. The formula for a simplified ROI calculation is:

(Total Benefits Received – Total Premiums Paid) / Total Premiums Paid * 100% = ROI

This formula provides a basic understanding, but a comprehensive analysis needs to factor in the time value of money, inflation, and the probability of actually needing long-term care. For instance, consider a scenario where an individual pays $50,000 in premiums over 20 years and receives $150,000 in benefits. The simplified ROI would be 200%. However, this calculation ignores inflation and the possibility that the individual might not require long-term care, which would result in a negative ROI. Consulting with a financial advisor is strongly recommended for a comprehensive ROI analysis.

Alternatives to AARP Long-Term Care Insurance

Planning for long-term care is crucial, and while AARP long-term care insurance offers a valuable option, it’s important to understand the alternatives available to ensure you choose the best solution for your individual circumstances and financial situation. Exploring other avenues for financing long-term care can provide a more comprehensive approach to planning.

Medicaid as a Long-Term Care Financing Option

Medicaid, a joint federal and state program, provides healthcare coverage to low-income individuals and families. While not designed specifically for long-term care, Medicaid can significantly contribute to covering these costs under certain circumstances. Eligibility is determined by income and asset levels, which vary by state. Generally, individuals must deplete most of their assets before qualifying for Medicaid assistance with long-term care. This process, often referred to as “Medicaid spend-down,” can be complex and require careful financial planning. The advantages include substantial financial assistance for those who qualify, but the disadvantages are the stringent eligibility requirements and the potential need to significantly reduce personal assets.

Medicare’s Role in Long-Term Care Coverage

Medicare, the federal health insurance program for those 65 and older or with certain disabilities, has limited coverage for long-term care. Medicare primarily covers short-term rehabilitation services following a hospital stay. It does not typically cover custodial care, which is the type of ongoing assistance most people need for long-term care. Therefore, relying solely on Medicare for long-term care is generally unrealistic. While Medicare offers some benefits post-hospitalization, it’s crucial to recognize its limitations in providing long-term care support. This highlights the need for alternative financial planning strategies.

Utilizing Personal Savings and Investments for Long-Term Care

Many individuals rely on their personal savings and investments to finance long-term care. This approach offers flexibility and control but requires careful financial planning and a significant level of personal savings. The advantages include avoiding the complexities of government programs and maintaining personal autonomy. However, the disadvantages are the potential for depleting savings rapidly, especially considering the high cost of long-term care. A well-defined financial plan, including life insurance, annuities, or other investment vehicles, is critical to mitigate this risk. It’s advisable to estimate the potential costs of long-term care and ensure sufficient savings to cover these expenses. For example, a family might estimate the cost of assisted living in their area and factor this into their retirement savings plan.

Government Programs and Resources for Long-Term Care

Several government programs and resources can assist with long-term care planning and financing. These resources often provide information, counseling, and support services to help individuals navigate the complexities of long-term care. State agencies on aging, for example, can provide valuable information and referrals to local resources. The Administration on Aging, a federal agency, also offers numerous resources and publications on long-term care. These resources can be invaluable in understanding the various options available and making informed decisions.

Resources for Further Information on Long-Term Care Planning

Planning for long-term care involves careful consideration of various factors. Here is a list of resources that can help you gather more information and make informed decisions:

- The Administration on Aging (AoA): Provides information and resources on aging and long-term care services.

- Your State’s Aging Agency: Offers localized information and services related to long-term care.

- The National Council on Aging (NCOA): Provides educational materials and resources on aging issues.

- Long-Term Care Insurance Companies: Provide information on their specific long-term care insurance policies.

- Financial Advisors: Can help you develop a comprehensive financial plan that incorporates long-term care costs.

Illustrative Scenarios

Understanding the potential benefits and drawbacks of AARP long-term care insurance requires considering various scenarios. These examples illustrate situations where the insurance could prove invaluable and others where it might be less crucial, highlighting the financial and emotional implications of long-term care needs.

Scenario: AARP Long-Term Care Insurance is Beneficial

Consider Sarah, a 60-year-old retired teacher who recently experienced a stroke, leaving her with significant mobility limitations. She requires 24-hour care, including assistance with bathing, dressing, and eating. Without long-term care insurance, the cost of a nursing home or in-home care could quickly deplete her savings. However, with her AARP policy, a significant portion of her care expenses are covered, allowing her to maintain a reasonable quality of life and avoid placing a substantial financial burden on her family. This scenario underscores the peace of mind and financial security that AARP long-term care insurance provides.

Scenario: AARP Long-Term Care Insurance Might Not Be Necessary

John, a 65-year-old healthy retiree with substantial savings and a supportive family network, might not find AARP long-term care insurance as crucial. He has children who are willing and able to provide assistance should the need arise, and his financial resources are sufficient to cover potential long-term care costs. While insurance offers a safety net, in this case, John’s personal resources and family support might make the premium cost less justifiable.

Potential Financial Impact of Serious Illness Requiring Long-Term Care

The financial impact of a serious illness requiring long-term care can be devastating. Consider the cost of a nursing home, which can range from $7,000 to $10,000 per month or more, depending on location and the level of care required. Even in-home care can be expensive, averaging several thousand dollars per month. Without insurance, these costs can quickly exhaust savings, deplete retirement funds, and potentially lead to financial ruin. For example, three years of nursing home care at $8,000 per month would cost $288,000. With AARP long-term care insurance, a significant portion, if not all, of these expenses could be covered, protecting the individual’s financial well-being.

Emotional and Social Aspects of Needing Long-Term Care

The need for long-term care can significantly impact an individual’s emotional and social well-being. Loss of independence, a decline in physical and cognitive abilities, and the need to rely on others for basic daily tasks can lead to feelings of frustration, depression, and isolation. The social aspects are also affected, as individuals may withdraw from their usual social circles due to physical limitations or a sense of embarrassment. Family caregivers can also experience emotional strain, including feelings of stress, guilt, and resentment. Maintaining social connections and a sense of purpose during this challenging period is crucial for both the individual receiving care and their family members. AARP long-term care insurance, by alleviating some of the financial burden, can help create a more supportive and less stressful environment for everyone involved.

Ending Remarks

Securing your future health and financial well-being requires careful consideration of long-term care options. While AARP long-term health insurance provides a valuable solution for many, it’s essential to weigh its features against your personal circumstances and available alternatives. This guide has aimed to provide a clear and comprehensive overview, empowering you to make informed decisions about this vital aspect of retirement planning. Remember to consult with a financial advisor to tailor a strategy that best suits your unique needs and financial situation.

Query Resolution

What is the waiting period for benefits with AARP long-term care insurance?

Waiting periods vary depending on the specific plan chosen, typically ranging from 30 to 90 days. This means benefits won’t begin until after a specified period of needing care.

Can I change my AARP long-term care insurance plan later?

The possibility of changing plans depends on the specific policy and the insurer’s rules. Some plans allow for modifications, while others may have stricter limitations. It’s best to review your policy documents or contact the insurer directly.

What happens if I cancel my AARP long-term care insurance policy?

Cancelling a policy may result in the loss of coverage. The specific consequences depend on the policy terms and the reason for cancellation. You may receive a refund of any unearned premiums, but this is subject to policy conditions.

Does AARP long-term care insurance cover assisted living facilities?

Coverage for assisted living facilities varies depending on the specific plan selected. Some plans may offer coverage, while others may not. Review the policy details carefully to determine the extent of coverage.