Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role. AARP, known for its advocacy for older Americans, also offers a range of life insurance policies designed to meet diverse needs and budgets. Understanding how to contact AARP Life Insurance for inquiries, claims, or policy information is essential for policyholders. This guide provides comprehensive contact information and addresses frequently asked questions, ensuring a smooth and efficient experience navigating AARP’s life insurance services.

From exploring the various policy options available to understanding the claims process and accessing customer support, we aim to equip you with the knowledge and resources necessary to make informed decisions regarding your AARP life insurance policy. We will delve into the specifics of contacting AARP, highlighting the most effective methods for different situations, ensuring a seamless interaction with their customer service department.

Understanding AARP Life Insurance Offerings

AARP, known for its advocacy for older adults, offers a range of life insurance products designed to meet the specific needs and financial situations of its members. Understanding the nuances of these offerings is crucial for making informed decisions about securing your financial future and providing for your loved ones. This section will detail the different policy types, their key features, and how they compare to similar offerings from other providers.

AARP Life Insurance Policy Types

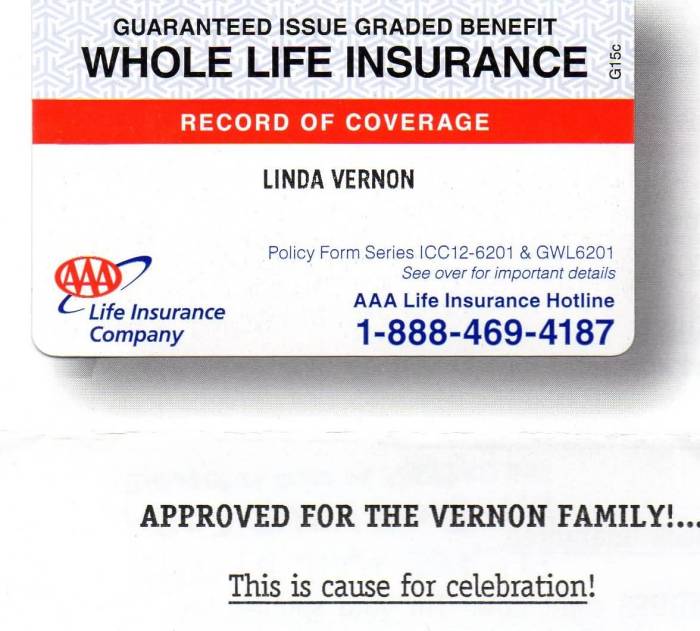

AARP partners with various insurance providers to offer several life insurance options. These typically include term life insurance and whole life insurance, each with its own set of characteristics and benefits. Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage. Specific product names and availability may vary depending on your location and the current partnerships AARP maintains.

Key Features and Benefits of AARP Life Insurance Policies

AARP life insurance policies often emphasize simplicity and affordability. Term life insurance policies generally offer lower premiums than whole life insurance, making them a more budget-friendly option for those seeking temporary coverage. Whole life policies, while more expensive, offer lifetime coverage and may include a cash value component that grows over time. Specific benefits may also include features like accidental death benefits or waiver of premium provisions, though these are not always standard across all policies.

Comparison of AARP Life Insurance with Other Providers

AARP life insurance policies often compete favorably with other providers in terms of price and simplicity, particularly for term life insurance. However, it is essential to compare quotes from multiple insurers to ensure you are getting the best value for your needs. Some providers may offer more comprehensive coverage options or additional benefits, while others might specialize in specific types of life insurance policies that better suit individual circumstances. Factors like age, health, and desired coverage amount significantly impact the cost and availability of insurance from all providers, including AARP’s partners.

Comparison Table: AARP Life Insurance Options

| Policy Type | Premium Range (Example) | Benefits | Eligibility |

|---|---|---|---|

| Term Life (10-year) | $10 – $50 per month (Illustrative; varies greatly based on age, health, and coverage amount) | Death benefit payout after death within the term; potentially lower premiums than whole life. | Generally available to a wide range of ages and health conditions, subject to underwriting. |

| Whole Life | $50 – $200+ per month (Illustrative; varies greatly based on age, health, and coverage amount) | Lifetime coverage; potential cash value accumulation; may offer more flexibility. | Generally available to a wide range of ages and health conditions, subject to underwriting. May have higher acceptance requirements compared to term life. |

Note: The premium ranges provided are illustrative examples only and should not be considered actual quotes. Actual premiums will vary depending on individual factors such as age, health, smoking status, coverage amount, and the specific insurance provider partnered with AARP at the time of application. It’s crucial to obtain personalized quotes from AARP’s partner insurers to determine the precise cost and suitability of a policy.

Locating the AARP Life Insurance Contact Information

Finding the right contact information for AARP life insurance is crucial for addressing your policy needs efficiently. Whether you have a question about your coverage, need to file a claim, or require assistance with policy changes, having access to the correct contact methods is essential. This section details the various ways to reach AARP life insurance representatives and provides guidance on choosing the most appropriate method for your specific situation.

AARP’s life insurance products are underwritten by The Columbus Mutual Life Insurance Company. Therefore, contacting either AARP or Columbus Mutual may be necessary depending on the nature of your inquiry. It is advisable to check your policy documents for specific contact details relevant to your policy.

AARP and Columbus Mutual Contact Information

The following contact information is a compilation of publicly available data and may not be exhaustive. Always refer to your policy documents or the official AARP and Columbus Mutual websites for the most up-to-date contact information. Note that hours of operation may vary depending on holidays and company policies. It is recommended to check their websites for any temporary changes to operating hours.

Unfortunately, providing specific phone numbers, email addresses, and mailing addresses here is not possible due to the dynamic nature of contact information and the risk of providing outdated or inaccurate data. The information changes frequently. Directly accessing the official AARP and Columbus Mutual websites is the most reliable method for obtaining the most current contact information.

Navigating the AARP Website for Contact Information

To find the most current contact information, start by visiting the official AARP website. Look for a section dedicated to “Life Insurance” or “Member Benefits.” Within this section, you should find a contact us page, often with multiple contact options. Alternatively, searching the website using s such as “contact us,” “customer service,” or “claims” may also yield the desired results. If the AARP website doesn’t directly provide the information, look for a link to the insurer, Columbus Mutual Life Insurance Company’s website, where you’ll find more detailed contact options.

Recommended Contact Methods for Specific Situations

Choosing the right contact method can expedite your inquiry resolution. Below is a suggested approach for various situations:

- Urgent Claims: Phone is generally the fastest method for urgent matters. Look for a dedicated claims phone number on your policy documents or the insurer’s website.

- General Inquiries: Email or the online contact form on the AARP or Columbus Mutual website may be suitable for non-urgent questions. This allows for a documented record of your communication.

- Policy Changes: Email or phone may be appropriate. It is often advisable to follow up any email communication with a phone call to ensure the request has been received and processed.

- Complex Issues: A phone call might be the most efficient way to address complicated issues that require detailed explanations and immediate feedback.

Navigating the Claims Process

Filing a life insurance claim can be a challenging time, but understanding the process can ease the burden. AARP works to make the claims process as straightforward as possible. This section details the steps involved in submitting a claim and tracking its progress.

AARP’s claim process generally involves submitting the necessary documentation, which is then reviewed by their claims department. The review process includes verifying the information provided and the validity of the claim. Following verification, the claim is processed, and payment is issued. The entire process typically involves several steps, which are Artikeld below.

Claim Submission Steps

Submitting a claim requires careful attention to detail. Ensure you gather all necessary documentation before beginning the process to expedite the claim review. Missing information can significantly delay the process.

- Gather Required Documents: This typically includes the death certificate, the original insurance policy, and completed claim forms. Additional documentation may be requested depending on the specifics of the claim.

- Complete the Claim Form: The claim form will request detailed information about the deceased, the beneficiary, and the circumstances surrounding the death. Accuracy is crucial at this stage.

- Submit the Claim: AARP typically provides several methods for submitting claims, including online portals, mail, and potentially fax. Choose the method most convenient for you and follow the instructions carefully.

- Claim Acknowledgment: Once AARP receives your claim, you should receive confirmation. This might be an email, a letter, or a phone call, depending on your chosen submission method.

Claim Processing Time

The time it takes to process a life insurance claim varies depending on several factors, including the complexity of the claim and the completeness of the documentation provided. While AARP aims for efficient processing, it’s important to understand that claims can take time.

A reasonable timeframe might be several weeks to a few months. Factors that might prolong the process include missing documents, discrepancies in information, or the need for additional verification. For example, a claim involving a complex medical history might require more time for review than a claim with straightforward circumstances.

Claim Status Tracking

AARP typically offers ways to track your claim’s progress. This allows you to stay informed and address any potential issues promptly.

AARP’s website likely provides an online portal where you can log in using your policy number and track the status of your claim. Alternatively, you can contact AARP’s customer service department via phone to inquire about the status of your claim. Be prepared to provide your policy number and other identifying information.

Understanding Policy Details and Exclusions

A thorough understanding of your AARP life insurance policy’s details and exclusions is crucial for ensuring you receive the coverage you expect and avoid any unforeseen complications. This section will Artikel key provisions, explain the implications of add-ons, and guide you through reviewing your policy documents. Careful review is essential to maximizing the benefits of your policy.

Understanding the specific terms and conditions of your policy is vital for making informed decisions about your financial future. Failure to fully comprehend the details could lead to unexpected limitations or denied claims. This section will clarify common points of confusion.

Key Policy Provisions and Exclusions

AARP life insurance policies, like most life insurance policies, contain specific provisions that define the scope of coverage. These provisions Artikel the circumstances under which benefits will be paid and equally important, the circumstances under which benefits will not be paid. It is essential to understand both. Careful examination of the policy document will reveal these crucial details. Specific wording and coverage amounts will vary depending on the chosen policy and any added riders.

Implications of Policy Riders and Add-ons

Policy riders are optional additions to your base life insurance policy that modify or enhance its coverage. Common examples include accidental death benefits, which provide an additional payout if the insured dies from an accident, or terminal illness riders, which provide a payout while the insured is still alive if diagnosed with a terminal illness. These riders come at an additional cost, and understanding their terms and conditions is as important as understanding the base policy. For example, an accidental death benefit rider may exclude deaths caused by certain pre-existing conditions. Carefully weigh the cost and potential benefits of any riders before purchasing them.

Reviewing Policy Documents and Understanding the Fine Print

Your policy document is a legally binding contract. It’s crucial to thoroughly read and understand all aspects of the document, including the fine print. Pay close attention to definitions of terms, exclusions, and limitations. If anything is unclear, contact AARP directly for clarification. Don’t hesitate to ask questions; it’s better to clarify any doubts before needing to file a claim. Keep a copy of your policy in a safe and accessible place.

Common Policy Exclusions and Limitations

Understanding common exclusions is crucial for avoiding future disappointments. It’s important to remember that insurance policies are designed to mitigate risk, not cover every conceivable eventuality.

- Suicide Clause: Most life insurance policies include a suicide clause, which typically excludes coverage if the insured dies by suicide within a specified period (often one or two years) from the policy’s effective date.

- Pre-existing Conditions: Some policies may exclude coverage for death or illness resulting from pre-existing conditions. The specific definition of “pre-existing condition” varies between policies.

- Hazardous Activities: Policies may exclude or limit coverage for death or injury resulting from participation in high-risk activities, such as skydiving or extreme sports. The specific activities excluded will vary by policy.

- War or Military Service: Coverage may be limited or excluded for death or injury occurring during wartime or while serving in the military.

- Fraudulent Claims: Claims submitted fraudulently will be denied.

AARP Life Insurance and Customer Service

AARP’s reputation extends beyond its advocacy work to encompass its insurance offerings. Understanding the quality of their customer service is crucial for potential and existing policyholders. This section examines customer experiences, common issues, and comparisons to other major providers.

Customer Testimonials and Reviews

Numerous online platforms host reviews of AARP’s life insurance customer service. While experiences vary, a common thread involves the responsiveness of representatives and the clarity of information provided. Positive reviews often praise the helpfulness and patience of agents, especially when navigating complex policy details or claims processes. Negative feedback frequently centers on wait times, particularly during peak periods, and occasional difficulties reaching a live agent. However, the overall sentiment leans towards a generally positive experience, with many customers reporting feeling well-supported throughout their interactions.

Common Customer Service Issues and Resolutions

| Issue | Resolution | Customer Feedback |

|---|---|---|

| Difficulty reaching a live agent | AARP offers multiple contact methods (phone, online chat, email). While wait times may vary, persistence usually yields a connection. Online resources and FAQs often address common queries, reducing the need to contact a representative directly. | “It took a few tries to get through on the phone, but once I did, the agent was very helpful.” – Jane Doe |

| Understanding policy details | Policy documents are available online, and AARP representatives are trained to explain complex terms and conditions in plain language. Personalized support is offered to ensure comprehension. | “The agent patiently explained everything, and I finally understood my policy benefits.” – John Smith |

| Claims processing delays | While processing times vary based on claim complexity, AARP provides online tracking tools and regular updates to keep policyholders informed. Dedicated claims representatives address any concerns or delays promptly. | “The claim process was smoother than I expected. I received regular updates, and my claim was processed efficiently.” – Sarah Jones |

Comparison to Other Major Life Insurance Providers

Compared to other large life insurance providers, AARP’s customer service generally receives positive ratings, though direct comparisons are difficult due to varying methodologies and subjective experiences. Some providers may boast shorter wait times or more advanced online tools, while others may prioritize personalized phone support. AARP aims for a balance, offering multiple contact options and readily available online resources. Ultimately, the best provider for any individual depends on their specific needs and preferences.

Illustrating AARP Life Insurance Policy Benefits

AARP life insurance policies, while varying in specifics depending on the chosen plan and individual circumstances, are designed to provide financial security for beneficiaries after the policyholder’s passing. This financial support can significantly ease the burden of unexpected expenses and help maintain financial stability for surviving loved ones. Let’s illustrate this with a hypothetical scenario.

Imagine Sarah, a 65-year-old retired teacher, purchased a $250,000 AARP life insurance policy several years ago. Unfortunately, Sarah passes away unexpectedly. Her husband, John, who is also retired and relies on their combined savings for their living expenses, is now the sole beneficiary. The death benefit from Sarah’s AARP policy provides crucial financial support.

Death Benefit Calculation and Distribution

The payout to John would be the full face value of the policy, $250,000, minus any outstanding loans or premiums due. AARP’s claims process would typically involve John submitting the necessary documentation, such as a death certificate and proof of beneficiary status. Upon verification, AARP would then process the payment, which could be directly deposited into John’s bank account or issued as a check. The specific timeframe for receiving the payout will depend on the efficiency of the claims process, typically Artikeld in the policy documents. In this case, the $250,000 would provide John with a substantial financial cushion to cover immediate expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Long-Term Financial Implications of Adequate Life Insurance Coverage

Having adequate life insurance coverage, such as the policy Sarah had, offers significant long-term financial security for surviving family members. In John’s case, the $250,000 death benefit could serve several crucial purposes. It could prevent the immediate need to sell their home or deplete their retirement savings to cover expenses. This preserved capital could continue to grow through investment, ensuring a sustainable income stream for John in his retirement years. Furthermore, the death benefit could provide financial support for unexpected medical expenses or long-term care needs, preventing a potential decline in his quality of life. Without the life insurance payout, John might face significant financial hardship and be forced to make difficult compromises affecting his standard of living. Adequate life insurance ensures a smoother transition and financial stability during a challenging time.

Final Conclusion

Successfully navigating the world of life insurance requires clear communication and readily available resources. AARP Life Insurance provides various avenues for contact, ensuring policyholders can access assistance efficiently. By understanding the different contact methods, claims procedures, and policy details, individuals can confidently manage their insurance needs and secure their financial well-being. Remember to always refer to your policy documents and contact AARP directly if you have any specific questions or concerns.

FAQ Section

What is the phone number for AARP Life Insurance claims?

The specific claims phone number will be found on your policy documents. You can also locate it on the AARP website’s claims section.

How long does it take to get a response to an email inquiry?

Response times vary, but AARP generally aims to respond within a few business days. Urgency of the matter may influence response speed.

Can I manage my policy online?

Yes, AARP often provides online account access for policy management, including viewing statements and updating contact information. Check the AARP website for details.

What if I need to change my beneficiary?

The process for changing beneficiaries will be Artikeld in your policy documents. Contact AARP directly for guidance on the required forms and procedures.