Securing your family’s future through life insurance is a crucial financial decision. Understanding the complexities of life insurance rates, however, can be daunting. This guide delves into AAA life insurance rates, providing a clear and concise overview of the factors that influence costs, the various policy options available, and how to obtain the most competitive quotes. We’ll explore the nuances of AAA’s offerings and compare them to industry standards, empowering you to make informed choices.

From the impact of age and health to the different types of policies and their associated premiums, we aim to demystify the process of securing life insurance coverage. We will examine how factors like smoking, family history, and occupation affect your rates, and offer practical advice on comparing quotes and negotiating premiums. Ultimately, our goal is to equip you with the knowledge needed to find the best life insurance plan for your individual needs and budget.

Understanding AAA Life Insurance Rates

AAA offers life insurance products, and understanding their rates is crucial for making informed decisions. Several factors influence the cost of your policy, and it’s important to compare AAA’s offerings with other major providers to ensure you’re getting the best value. This section will detail these factors, outlining different policy types and rate structures.

Factors Influencing AAA Life Insurance Rate Variations

Several key factors determine the cost of AAA life insurance. These include age, health status, smoking habits, policy type, and the amount of coverage desired. Younger, healthier, non-smoking individuals generally qualify for lower premiums. Conversely, older individuals with pre-existing health conditions or who smoke will typically pay higher premiums. The type of policy—term life, whole life, or universal life—also significantly impacts the cost, with term life usually being the most affordable option. Finally, the amount of coverage you choose directly affects your premium; higher coverage amounts naturally result in higher premiums.

Types of Life Insurance Offered by AAA and Their Associated Rate Structures

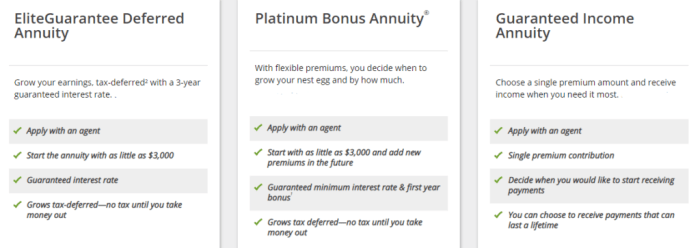

AAA offers a range of life insurance products to cater to diverse needs and budgets. Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years), offering relatively low premiums. Whole life insurance offers lifelong coverage and builds cash value, but premiums are generally higher than term life. Universal life insurance provides flexible premiums and coverage amounts, offering a balance between affordability and long-term coverage. The rate structure for each varies; term life has a fixed premium for the policy term, while whole and universal life policies can have fluctuating premiums depending on factors like interest rates and the policy’s cash value.

Comparison of AAA Life Insurance Rates with Other Major Providers

Direct comparison of AAA life insurance rates with other major providers requires specific quotes based on individual circumstances. However, a general observation is that AAA aims for competitive pricing within the market. Factors like policy type, coverage amount, and individual health profiles significantly influence premium costs. To accurately compare, it’s recommended to obtain personalized quotes from multiple insurers, including AAA and competitors like State Farm, Northwestern Mutual, or Prudential, using online comparison tools or contacting individual companies directly.

Comparison of AAA Life Insurance Rates for Different Age Groups and Policy Types

The following table provides a hypothetical comparison of annual premiums for different age groups and policy types. Note that these are illustrative examples only and actual rates will vary depending on individual factors. Always obtain personalized quotes for accurate pricing.

| Age | 10-Year Term Life | 20-Year Term Life | Whole Life |

|---|---|---|---|

| 30 | $250 | $350 | $700 |

| 40 | $400 | $600 | $900 |

| 50 | $700 | $1000 | $1200 |

Factors Affecting AAA Life Insurance Premiums

Several key factors influence the cost of AAA life insurance premiums. Understanding these factors allows individuals to better anticipate their premium amounts and make informed decisions about their coverage. These factors are primarily assessed during the underwriting process, a crucial step in determining your eligibility and premium rate.

The primary factors considered are age, health status, and lifestyle choices. These elements significantly impact an individual’s life expectancy and, consequently, the insurer’s risk assessment.

Age

Age is a major determinant of life insurance premiums. Statistically, older individuals have a higher mortality risk than younger individuals. Therefore, AAA, like other insurers, charges higher premiums for older applicants. This reflects the increased probability of a claim being filed within the policy’s duration. For example, a 30-year-old applicant will generally receive a significantly lower premium than a 60-year-old applicant, assuming all other factors are equal.

Health and Lifestyle

An applicant’s overall health and lifestyle choices play a crucial role in premium calculations. AAA’s underwriting process involves a thorough review of medical history, including pre-existing conditions, current health status, and lifestyle habits. A healthier individual with a clean bill of health will typically qualify for lower premiums than someone with chronic illnesses or risky lifestyle choices.

Impact of Smoking, Family History, and Occupation

Smoking significantly increases the risk of various health problems, leading to higher premiums. Similarly, a family history of specific diseases (like heart disease or cancer) can also elevate premium costs due to increased genetic predisposition. Certain high-risk occupations, such as those involving dangerous machinery or hazardous materials, may also result in higher premiums as the likelihood of accidental death or injury increases.

Underwriting Processes and Their Effect on Rates

AAA utilizes various underwriting processes to assess risk. These may include reviewing medical records, requiring medical examinations, and assessing lifestyle factors. A more rigorous underwriting process, potentially involving extensive medical testing, might be necessary for applicants with pre-existing conditions or those applying for higher coverage amounts. This more thorough assessment can lead to either higher premiums or even denial of coverage in some cases. A simplified underwriting process, on the other hand, might be available for applicants with excellent health and lower coverage needs, potentially resulting in lower premiums.

Examples of Health Conditions Influencing Premium Costs

Several health conditions can impact premium costs. For example, individuals with diabetes, heart disease, or cancer may face significantly higher premiums compared to those without these conditions. The severity and management of these conditions further influence the premium amount. An applicant with well-controlled diabetes might receive a more favorable rate than someone with poorly managed diabetes. Similarly, a history of cancer that is in remission might still lead to higher premiums than an applicant with no history of cancer.

Policy Options and Rate Structures within AAA

AAA offers a range of life insurance policies to cater to diverse needs and budgets. Understanding the differences between these options and the factors influencing their costs is crucial for making an informed decision. This section will detail the available policy types, premium payment structures, optional riders, and how these elements affect your overall insurance premiums.

AAA Life Insurance Policy Types

AAA typically provides three main types of life insurance: term life, whole life, and universal life. Term life insurance offers coverage for a specific period (term), typically ranging from 10 to 30 years. Whole life insurance provides lifelong coverage, accumulating cash value that grows tax-deferred. Universal life insurance combines aspects of both, offering flexible premiums and adjustable death benefits. The choice depends on individual financial goals and risk tolerance. For example, a young family might prioritize affordable term life coverage, while someone seeking long-term financial security and wealth accumulation might opt for whole life.

Premium Payment Options at AAA

AAA offers flexibility in how you pay your life insurance premiums. Common options include monthly, quarterly, semi-annual, and annual payments. While monthly payments offer convenience, they generally result in slightly higher overall costs due to accumulated interest charges. Annual payments, conversely, usually offer a slight discount. The choice depends on personal budgeting preferences and financial capabilities. Consider your cash flow and choose the option that best fits your financial situation.

Optional Riders and Their Cost Impact

Several optional riders can be added to your AAA life insurance policy to enhance coverage. These riders provide additional benefits but increase the overall premium. Examples include accidental death benefit riders (paying an extra benefit in case of accidental death), waiver of premium riders (waiving future premiums if you become disabled), and long-term care riders (providing coverage for long-term care expenses). The cost of each rider varies based on factors such as age, health, and the specific terms of the rider. Carefully consider the potential benefits against the added cost before selecting any riders.

Policy Benefits and Rate Adjustments

The following table illustrates how different policy benefits and choices can influence your AAA life insurance rates. Note that these are illustrative examples and actual rates will vary based on individual circumstances.

| Policy Type | Benefit | Rate Adjustment Factor (Illustrative Example) | Notes |

|---|---|---|---|

| Term Life (20-year) | $500,000 Death Benefit | Low | Generally the most affordable option |

| Whole Life | $500,000 Death Benefit + Cash Value Accumulation | Medium-High | Higher premiums due to lifelong coverage and cash value component |

| Universal Life | $500,000 Adjustable Death Benefit + Flexible Premiums | Medium | Premiums can be adjusted, but flexibility comes at a cost |

| Term Life (20-year) + Accidental Death Benefit Rider | $500,000 Death Benefit + Additional Benefit for Accidental Death | Low-Medium | Adds a significant increase to the premium but offers extra protection |

Obtaining and Comparing AAA Life Insurance Quotes

Securing the best life insurance coverage often involves obtaining and comparing quotes from multiple providers, including AAA. This process ensures you find a policy that meets your needs at a competitive price. Understanding how to navigate this process efficiently can save you significant money and time.

Obtaining a Personalized AAA Life Insurance Quote

To obtain a personalized quote from AAA, you’ll typically need to provide some personal information. This usually includes your age, health status (including any pre-existing conditions), desired coverage amount, and the type of policy you’re interested in (term life, whole life, etc.). AAA may ask for details about your lifestyle, such as smoking habits, occupation, and family medical history. The more accurate and complete the information you provide, the more precise the quote will be. You can usually initiate this process online through AAA’s website, by phone, or through a local AAA agent. Expect the process to take some time, as the underwriter will need to review your information.

Comparing Quotes from Multiple Providers

Once you have a quote from AAA, it’s crucial to compare it with quotes from other reputable life insurance companies. This allows you to assess the value and pricing of different policies. Begin by gathering quotes from at least three to five different providers. Pay close attention to the details of each policy, not just the premium cost. Consider factors such as the length of coverage (for term life insurance), the death benefit, any riders or additional features included, and the financial stability of the company.

Negotiating Lower Premiums with AAA

While negotiating life insurance premiums isn’t always straightforward, there are strategies you can employ. If you find a significantly lower quote from a competitor offering comparable coverage, you can present this to AAA as leverage. Highlight the specific features and pricing of the competing policy. Be polite but firm in your request for a price adjustment. Also, consider bundling your life insurance with other AAA services, such as auto or home insurance, as this may lead to a discount. Improving your health, such as quitting smoking, can also potentially lower your premiums over time, though this will require re-evaluation of your policy.

Sample Quote Comparison Chart

A comparison chart helps organize and visualize the differences between quotes. Below is an example, focusing on key features and price differences. Remember, this is a sample, and your actual quotes will vary based on your individual circumstances.

| Provider | Policy Type | Coverage Amount | Annual Premium |

|---|---|---|---|

| AAA | 20-Year Term Life | $500,000 | $1,000 |

| Provider B | 20-Year Term Life | $500,000 | $950 |

| Provider C | 20-Year Term Life | $500,000 | $1,100 |

Illustrative Examples of AAA Life Insurance Rates

Understanding the factors that influence AAA life insurance premiums is crucial for making informed decisions. This section provides concrete examples demonstrating how age, health, smoking status, and policy type interact to determine the final cost. Remember that these are hypothetical examples and actual rates may vary depending on specific circumstances and AAA’s current underwriting guidelines.

The following examples illustrate the interplay of various factors affecting premium costs. We’ll compare different profiles to highlight the impact of age, health, and lifestyle choices on insurance premiums.

Rate Variations Based on Age and Health

Let’s consider two hypothetical individuals applying for a $500,000 20-year term life insurance policy from AAA:

| Applicant | Age | Smoking Status | Health Status | Approximate Monthly Premium |

|---|---|---|---|---|

| Individual A | 35 | Non-smoker | Excellent health | $30 |

| Individual B | 50 | Smoker | Pre-existing condition (high blood pressure) | $100 |

Individual A, a 35-year-old non-smoker in excellent health, enjoys a significantly lower monthly premium compared to Individual B. Individual B’s older age, smoking habit, and pre-existing condition result in a substantially higher premium, reflecting the increased risk to the insurer.

Impact of Different Policy Options on Total Cost

The choice of policy type significantly impacts the overall cost of life insurance. Let’s compare the total cost over 20 years for two different policies with a $500,000 death benefit for a 40-year-old non-smoker in good health.

| Policy Type | Approximate Monthly Premium | Total Premium Paid Over 20 Years |

|---|---|---|

| 20-Year Term Life | $45 | $10,800 |

| Whole Life Insurance | $150 | $36,000 |

While the whole life policy offers lifelong coverage, the significantly higher monthly premiums result in a much greater total cost over 20 years compared to the 20-year term life policy. The choice between these options depends on individual financial circumstances and long-term needs.

Premium Adjustments for Specific Health Conditions

AAA, like other insurers, assesses applicants’ health history to determine risk. Certain conditions can lead to higher premiums or even policy declination. For example, a history of heart disease, cancer, or diabetes would likely increase premiums for a 45-year-old non-smoker compared to someone with no such history. The specific adjustment would depend on the severity and management of the condition.

Note: These examples are for illustrative purposes only and do not represent actual AAA rates. Contact AAA directly for personalized quotes.

Ending Remarks

Choosing the right life insurance policy is a significant financial undertaking. By understanding the factors that influence AAA life insurance rates, comparing options across different providers, and utilizing the strategies Artikeld in this guide, you can confidently select a policy that provides adequate coverage for your loved ones without unnecessary expense. Remember to carefully consider your individual circumstances, long-term financial goals, and seek professional advice when necessary to ensure you make the most informed decision.

Questions Often Asked

What is the difference between term and whole life insurance from AAA?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

Can I change my payment frequency after I purchase a policy?

This depends on the specific policy; some policies allow for changes in payment frequency, while others may not. Check your policy documents or contact AAA directly.

Does AAA offer discounts for bundling insurance products?

AAA may offer discounts for bundling products, but this varies by location and specific offerings. Contact your local AAA office for details.

What happens if I miss a premium payment?

Missing a premium payment can lead to a lapse in coverage. AAA will typically send reminders, but it’s crucial to contact them immediately if you anticipate difficulties making a payment to explore options to avoid lapse.