Navigating the world of contracting can be challenging, but securing the right business insurance is paramount. This guide delves into the essential types of insurance contractors need, exploring factors influencing costs and providing practical strategies for obtaining and managing policies. We’ll cover everything from general liability and workers’ compensation to the nuances of claim processes and contract negotiations, ensuring you’re well-prepared to protect your business and its future.

Understanding your insurance needs is crucial for both financial stability and legal compliance. This guide aims to clarify the often-complex landscape of contractor insurance, empowering you to make informed decisions that safeguard your assets and reputation. We’ll examine various scenarios, providing real-world examples and practical advice to help you navigate the complexities of insurance in the contracting industry.

Types of Business Insurance for Contractors

Protecting your contracting business requires a multifaceted approach to risk management. Understanding the various types of insurance available is crucial for mitigating potential financial losses and ensuring the continued success of your operations. Failing to secure adequate coverage can leave you personally liable for significant expenses in the event of accidents, injuries, or legal disputes.

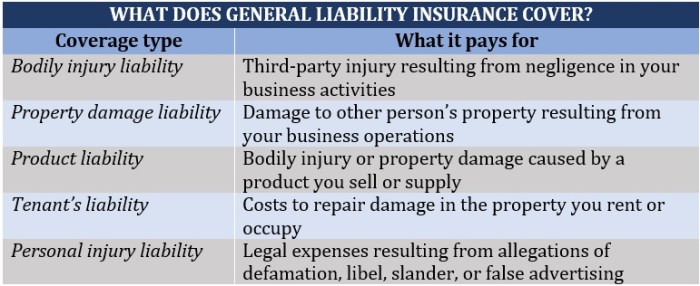

General Liability Insurance

General liability insurance protects your business from financial losses arising from bodily injury or property damage caused by your operations or employees. This is a fundamental policy for most contractors, covering claims related to accidents on job sites, damage to clients’ property, and advertising injuries. For instance, if a client trips and falls on your job site due to your negligence, general liability insurance would cover the resulting medical expenses and potential legal costs. The coverage amount varies depending on your specific needs and risk assessment. Higher coverage limits provide greater protection but also come with higher premiums.

Workers’ Compensation Insurance

Workers’ compensation insurance is legally mandated in most states for businesses with employees. This policy covers medical expenses and lost wages for employees injured on the job, regardless of fault. It protects you from potentially crippling lawsuits and ensures your employees receive necessary medical care and financial support during their recovery. Failure to secure workers’ compensation insurance can result in significant fines and legal repercussions. The premiums are typically calculated based on factors such as the number of employees, the type of work performed, and the company’s past claims history.

Commercial Auto Insurance

If you or your employees use vehicles for business purposes, commercial auto insurance is essential. This policy covers damages and injuries resulting from accidents involving company vehicles. It extends beyond standard personal auto insurance, providing broader coverage for business-related activities. For example, if an employee is involved in a car accident while transporting tools or materials to a job site, commercial auto insurance would cover the resulting damages and liabilities. The specific coverage options, such as collision and liability, can be tailored to your business needs.

Professional Liability Insurance (Errors and Omissions Insurance)

Professional liability insurance, often called errors and omissions (E&O) insurance, protects contractors from claims of negligence or mistakes in their professional services. This is particularly relevant for contractors who provide specialized services, such as architects, engineers, or designers. If a client alleges that your work was faulty or caused them financial losses, E&O insurance would cover the costs of defending against the claim and any resulting settlements or judgments. The coverage limit and premium depend on the complexity of your work and the potential for errors.

Comparison of Contractor Insurance Types

| Insurance Type | Key Features | Benefits | Approximate Annual Cost (USD) |

|---|---|---|---|

| General Liability | Covers bodily injury and property damage caused by your business | Protects against lawsuits and financial losses from accidents | $500 – $2,000+ |

| Workers’ Compensation | Covers medical expenses and lost wages for injured employees | Complies with legal requirements and protects against employee lawsuits | Varies greatly based on payroll and risk; can be several thousand dollars annually |

| Commercial Auto | Covers accidents involving company vehicles used for business purposes | Protects against liability and damages related to business vehicle accidents | $500 – $2,000+ |

| Professional Liability (E&O) | Covers claims of negligence or mistakes in professional services | Protects against lawsuits and financial losses from professional errors | $500 – $2,000+ |

Insurance Needs by Contractor Specialty

The specific types of insurance necessary vary significantly depending on the contractor’s specialty. For example, a general contractor will likely need general liability, workers’ compensation (if employing others), and commercial auto insurance. An electrician might also need general liability and workers’ compensation, potentially adding professional liability insurance if they design electrical systems. A plumber might have similar needs, focusing on general liability and workers’ compensation. Specialized contractors like structural engineers or architects would almost certainly require professional liability insurance in addition to general liability and possibly workers’ compensation. The level of risk inherent in each specialty dictates the specific coverage requirements. It’s always best to consult with an insurance professional to determine the appropriate coverage for your specific business.

Factors Affecting Insurance Costs

Securing the right business insurance is crucial for contractors, but understanding the factors that influence premiums is equally important. Knowing these factors empowers contractors to make informed decisions and potentially reduce their insurance costs. This section Artikels the key elements insurance companies consider when assessing risk and setting premiums.

Several interconnected factors determine the cost of contractor insurance. Insurance companies carefully analyze these elements to assess the level of risk associated with insuring a particular contractor. A higher perceived risk translates to higher premiums, while a lower risk profile often results in more affordable coverage.

Contractor Experience and History

Experience significantly impacts insurance premiums. New contractors with limited project history are generally considered higher risk than established businesses with a proven track record. Insurance companies often look at the number of years in business, the types of projects completed, and the overall success rate. A consistent history of successfully completed projects with minimal incidents or claims significantly reduces premiums. Conversely, a history of accidents or claims can lead to higher premiums or even difficulty securing insurance. For instance, a contractor with five years of experience and a clean safety record will likely secure lower premiums than a newly established contractor.

Project Size and Scope

The size and complexity of projects undertaken directly influence insurance costs. Larger, more complex projects inherently involve greater risk, increasing the likelihood of accidents or injuries. High-rise construction, for example, carries a higher risk profile than smaller residential renovations. Insurance companies consider the total project value, the number of workers involved, and the potential for liability claims when determining premiums. A multi-million-dollar construction project will undoubtedly command a higher premium than a smaller-scale residential remodeling job.

Location and Geographic Factors

The geographical location of the contractor’s operations plays a significant role in premium calculations. Areas with higher crime rates, severe weather conditions (like hurricanes or earthquakes), or a history of construction-related accidents may lead to higher premiums. Insurance companies analyze local statistics on accident rates, worker compensation claims, and property damage to assess the overall risk in specific locations. A contractor operating in a high-risk area will typically pay more for insurance than one working in a lower-risk region.

Claims History and Safety Records

A contractor’s claims history is a critical factor in determining insurance premiums. A history of frequent claims, especially those resulting from negligence or safety violations, will significantly increase insurance costs. Insurance companies carefully review past claims, investigating the circumstances and assigning responsibility. Maintaining a strong safety record, through proactive measures and adherence to safety regulations, is crucial for reducing premiums. Investing in safety training programs and implementing robust safety protocols can demonstrably lower insurance costs. For example, a contractor with a documented safety program and regular safety training for employees will likely receive a lower premium than one without such initiatives.

Strategies to Lower Insurance Costs

Contractors can employ several strategies to reduce their insurance premiums. These include investing in comprehensive safety training programs for employees, implementing rigorous safety protocols on job sites, maintaining detailed records of projects and safety procedures, and building a strong reputation for reliability and safety. Working with an experienced insurance broker to compare quotes from multiple insurers can also lead to significant savings. Regularly reviewing and updating insurance coverage to ensure it aligns with current needs and risk profiles can also help optimize insurance costs. Negotiating with insurers and demonstrating a commitment to risk mitigation can often result in lower premiums.

Obtaining and Managing Insurance Policies

Securing the right business insurance is crucial for contractors. The process involves several steps, from obtaining quotes to understanding the policy’s fine print. Careful planning and comparison shopping are essential to ensure you find the best coverage at a competitive price.

Obtaining a Business Insurance Quote

The process of obtaining a business insurance quote for contractors typically begins with contacting insurance providers directly or using online comparison tools. You’ll need to provide detailed information about your business, including the types of work you perform, your annual revenue, the number of employees, and the location of your operations. Insurance providers will then use this information to assess your risk profile and generate a quote. This quote will Artikel the coverage offered, the premium amount, and any applicable deductibles. Some providers offer instant quotes online, while others may require a more in-depth consultation.

Comparing Insurance Quotes

Once you have several quotes, comparing them effectively is vital. A systematic approach ensures you don’t overlook crucial details. First, carefully review the coverage offered by each provider. Make sure the policy adequately protects your business against potential liabilities. Then, compare the premium amounts. Remember that the lowest premium isn’t always the best option; consider the level of coverage provided. Finally, examine the policy’s terms and conditions, including deductibles, exclusions, and claims procedures. Using a spreadsheet to organize this information can greatly simplify the comparison process. For example, create columns for provider name, premium cost, coverage details, deductible amounts, and any other important features.

Reviewing Policy Terms and Conditions

Thoroughly reviewing and understanding your policy’s terms and conditions is paramount. This section Artikels your rights and responsibilities as a policyholder, detailing the scope of coverage, exclusions, and limitations. Failing to understand these terms could leave you vulnerable to unexpected costs in the event of a claim. Pay close attention to the definitions of covered perils, the claims process, and any specific exclusions. Don’t hesitate to contact the insurance provider for clarification on any unclear aspects of the policy. For example, understanding the specific wording regarding “Acts of God” or the limits on professional liability coverage is vital for protecting your business.

Checklist of Documents Needed for Contractor’s Insurance Application

Preparing the necessary documents beforehand streamlines the application process. This avoids delays and ensures a smoother experience.

- Business License and Registration

- Proof of Business Address

- Details of all employees (names, roles, and employment dates)

- Description of business operations and services offered

- Detailed financial information (annual revenue, profit and loss statements)

- Workers’ Compensation Insurance (if applicable)

- Previous insurance policy details (if applicable)

- Information about any past claims or incidents

Having all these documents readily available will significantly speed up the application process and improve your chances of securing favorable terms.

Common Contractor Insurance Claims

Contractor insurance, while designed to protect your business, is only as effective as your understanding of its coverage and how to utilize it. Knowing the common types of claims and how to navigate the claims process is crucial for minimizing financial and operational disruptions. This section Artikels common claim scenarios, best practices for filing a claim, and the critical role of accurate record-keeping.

Contractor insurance claims often stem from incidents involving property damage, bodily injury, or professional negligence. Understanding these common scenarios helps contractors proactively mitigate risks and prepare for potential claims.

Types of Contractor Insurance Claims

A wide range of situations can lead to insurance claims. These are often categorized by the type of loss incurred. Careful documentation of each project and its associated risks is vital in navigating the claims process effectively.

- Property Damage: This encompasses damage to the contractor’s own equipment, materials, or the client’s property during a project. Examples include damage to a building during demolition, a damaged piece of machinery due to misuse, or accidental damage to a client’s landscaping.

- Bodily Injury: This covers injuries sustained by employees, subcontractors, clients, or members of the public on a job site. This could range from minor injuries requiring first aid to severe injuries resulting in extended medical treatment and potential lawsuits.

- Professional Negligence (Errors and Omissions): This covers claims arising from mistakes or omissions in the contractor’s professional services. Examples include faulty workmanship leading to structural problems, incorrect calculations causing project delays, or failure to meet contract specifications.

- Vehicle Accidents: If a contractor uses company vehicles for business purposes, accidents involving those vehicles can lead to claims for property damage and bodily injury.

Filing an Insurance Claim

The process of filing a claim typically involves several key steps. Prompt and accurate reporting is essential to ensure a smooth and efficient claims process. Failure to follow the correct procedure may jeopardize the claim’s outcome.

- Report the Incident Immediately: Contact your insurance provider as soon as possible after the incident occurs. Provide a concise summary of the event and any injuries or damages.

- Gather Evidence: Collect all relevant documentation, including photographs, videos, police reports (if applicable), witness statements, and any contracts or agreements related to the project.

- Complete the Claim Form: Your insurance provider will provide a claim form that requires detailed information about the incident, damages, and involved parties.

- Cooperate with the Investigation: The insurance company may conduct an investigation to determine liability and the extent of the damages. Full cooperation is crucial for a successful claim.

- Maintain Open Communication: Stay in contact with your insurance adjuster throughout the claims process. Promptly respond to requests for information or clarification.

Importance of Accurate Record-Keeping

Meticulous record-keeping is paramount in successfully navigating insurance claims. Comprehensive documentation strengthens your claim and minimizes potential disputes.

Maintaining detailed records of all aspects of your projects, including contracts, permits, invoices, safety procedures, and communication with clients, will greatly aid in the claims process. These records serve as irrefutable evidence supporting your claim.

Examples of Successful and Unsuccessful Insurance Claims

The success of an insurance claim often hinges on the thoroughness of the documentation and the adherence to the claims process. Below are examples illustrating these differences.

- Successful Claim: A contractor experienced a fire on a construction site that damaged their equipment. They promptly reported the incident, provided photos of the damage, detailed invoices for the equipment, and a comprehensive report outlining the safety procedures in place. The claim was processed swiftly and the contractor received full compensation for the damaged equipment.

- Unsuccessful Claim: A contractor failed to meet contract specifications, leading to structural problems in a newly built home. The client filed a claim against the contractor’s insurance, but the contractor lacked proper documentation of the project and failed to respond promptly to the insurance company’s requests. The claim was denied due to insufficient evidence and lack of cooperation.

The Role of Insurance in Contractor Bidding and Contracts

Insurance is a critical component of the contractor-client relationship, influencing bidding processes and forming the bedrock of contractual agreements. A comprehensive insurance policy protects both the contractor and the client from financial losses stemming from accidents, injuries, or property damage during a project. This section explores how insurance requirements are integrated into contracts, the consequences of inadequate coverage, and the various approaches to managing insurance in collaborative projects.

Insurance requirements are typically incorporated into contracts through specific clauses that Artikel the types and amounts of coverage the contractor must maintain. These clauses usually specify the minimum liability limits, the types of insurance required (such as general liability, workers’ compensation, and commercial auto insurance), and the names of the insurers. The client may also require the contractor to provide certificates of insurance as proof of coverage. This ensures the client’s protection and reduces their potential financial risk associated with the project.

Insurance Requirements in Contracts

Sample clauses might include stipulations such as: “Contractor shall maintain, at its own expense, general liability insurance with a minimum coverage of $1,000,000 per occurrence and $2,000,000 aggregate, naming Client as an additional insured.” Another clause could state: “Contractor shall maintain workers’ compensation insurance in accordance with all applicable state and federal laws.” The specific wording will vary depending on the project’s complexity, location, and the client’s risk tolerance. It is crucial for both parties to consult with legal and insurance professionals to ensure the clauses are comprehensive and legally sound.

Implications of Inadequate Insurance Coverage

Insufficient insurance coverage can have severe consequences for both contractors and clients. For contractors, it can lead to significant financial losses in the event of an accident or incident. They could face lawsuits, medical expenses, property damage costs, and potential business closure. For clients, inadequate contractor insurance leaves them vulnerable to liability claims if something goes wrong on the project site. They may have to cover expenses themselves, potentially incurring substantial costs and facing legal challenges. A real-world example would be a contractor without adequate liability insurance causing damage to a client’s property during construction; the client would be responsible for the repair costs if the contractor’s insurance was insufficient.

Managing Insurance Responsibilities in Joint Ventures and Subcontracting

In joint ventures and subcontracting arrangements, the management of insurance responsibilities requires careful coordination. Different approaches exist, each with its own advantages and disadvantages. One approach is for the prime contractor to assume primary responsibility for insurance coverage, with subcontractors providing certificates of insurance demonstrating their own coverage. Another approach involves each party maintaining their own insurance policies, with clear contractual agreements specifying the extent of each party’s liability. A third approach might involve a comprehensive joint insurance policy covering all parties involved. The chosen approach should be clearly defined in the contract to avoid confusion and disputes. For instance, a joint venture might opt for a blanket policy to cover all aspects of the project, while a subcontracting agreement might rely on the prime contractor’s policy with the subcontractor carrying additional coverage for their specific work.

Illustrative Scenarios

Real-world examples can best illustrate the value of various contractor insurance policies. Understanding these scenarios helps contractors appreciate the potential financial and legal ramifications of operating without adequate coverage. The following examples highlight the critical role insurance plays in protecting contractors and their businesses.

General Liability Insurance: A Crucial Safety Net

Imagine Sarah, a freelance carpenter, contracted to renovate a kitchen. While installing new cabinets, a dropped tool damages a newly-tiled floor. The homeowner, understandably upset, demands compensation for the damage, estimated at $5,000. Sarah’s general liability insurance policy covers this incident. The homeowner files a claim, and after a brief investigation, the insurance company pays for the floor repairs, preventing Sarah from incurring significant personal financial losses. This incident demonstrates how general liability insurance protects contractors from claims arising from property damage or bodily injury caused by their work or on their worksite, even if the contractor wasn’t directly at fault. The outcome is a positive one for Sarah, who avoided a potentially crippling financial burden due to her proactive insurance coverage.

Visual Representation of Comprehensive Contractor Insurance Coverage

A comprehensive contractor insurance policy typically includes several key coverage areas. Understanding these areas is essential for selecting appropriate coverage. A visual representation might look like this:

* General Liability: This large central circle represents the core coverage, encompassing bodily injury and property damage caused by the contractor’s operations to third parties. It extends beyond the contractor’s premises, covering incidents on client sites.

* Workers’ Compensation: A smaller circle overlapping with the General Liability circle, indicating some overlap in certain scenarios. This covers medical expenses and lost wages for employees injured on the job.

* Commercial Auto: A separate circle representing coverage for vehicles used for business purposes. This includes accidents, damage, and liability arising from the use of company vehicles.

* Professional Liability (Errors & Omissions): A smaller circle, partially overlapping with General Liability, representing coverage for claims related to mistakes or negligence in professional services provided.

* Tools and Equipment: A small circle indicating coverage for damage or theft of tools and equipment used in the business.

Workers’ Compensation: Protecting Contractor and Employee

Mark, a roofing contractor, employed two assistants. During a particularly windy day, one assistant, David, fell from the roof, sustaining a broken leg. Mark’s workers’ compensation insurance covered David’s medical expenses, lost wages, and rehabilitation costs. This coverage not only protected David from financial ruin but also shielded Mark from potential lawsuits and significant financial liability. Workers’ compensation insurance, in this case, fostered a positive relationship between employer and employee, emphasizing Mark’s commitment to employee safety and well-being. Had Mark not had workers’ compensation insurance, he could have faced substantial legal and financial penalties. The insurance company managed the claim, ensuring both David received necessary care and Mark avoided significant legal and financial repercussions.

Closure

Protecting your contracting business requires a proactive approach to insurance. By understanding the different types of coverage, managing costs effectively, and navigating the claims process smoothly, you can significantly reduce risks and ensure long-term success. This guide has provided a foundation for building a robust insurance strategy; remember to consult with an insurance professional to tailor a policy that specifically meets your unique needs and the demands of your contracting projects.

Query Resolution

What if I’m a sole proprietor? Do I still need business insurance?

Yes, even sole proprietors need insurance. General liability is particularly important to protect against claims of property damage or bodily injury.

How often should I review my insurance policy?

Annually, or whenever there’s a significant change in your business, such as expanding services or hiring employees.

Can I get insurance if I have a poor claims history?

It may be more difficult and more expensive, but it’s not impossible. Be upfront about your history and shop around for quotes.

What is the difference between general liability and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions) covers claims of negligence or mistakes in your professional services.