Navigating the world of business often requires understanding complex legal and financial documents. One such document, crucial for risk mitigation and contractual agreements, is the Business Certificate of Insurance (COI). This guide provides a clear and concise overview of COIs, exploring their purpose, types, acquisition, interpretation, and legal implications. We’ll demystify the process, equipping you with the knowledge to confidently manage COIs and protect your business interests.

From defining a COI and outlining its key components to detailing the steps involved in obtaining one, this guide covers the essential aspects of this vital business tool. We’ll examine different COI types, highlighting their specific coverages and exclusions, and discuss the potential pitfalls of inaccurate or outdated certificates. Furthermore, we’ll explore best practices for managing COIs to ensure compliance and minimize risk.

What is a Business Certificate of Insurance?

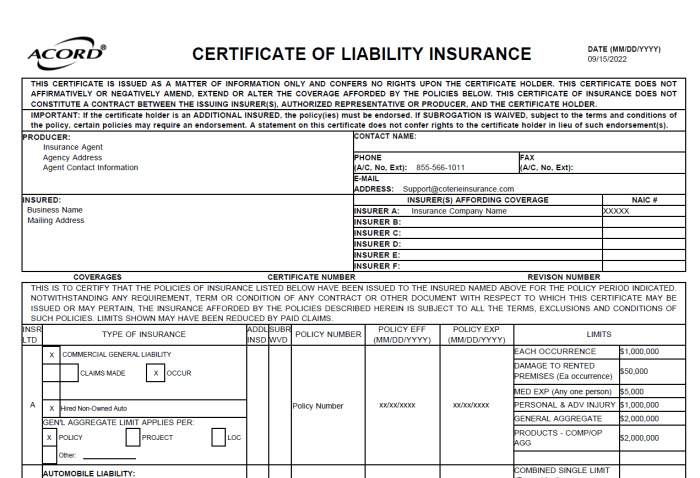

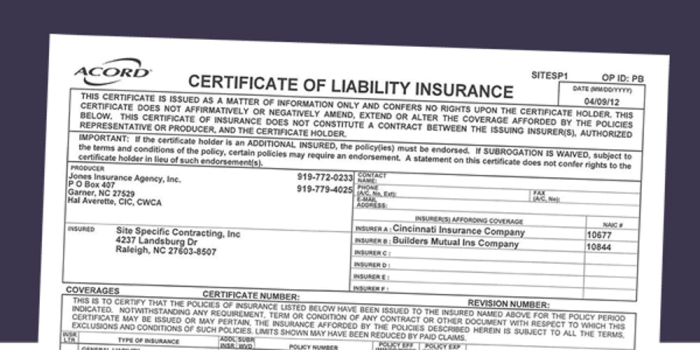

A business certificate of insurance (COI) is essentially a snapshot of your company’s insurance coverage. It’s a concise summary, not a complete policy, providing key details about your insurance policies to third parties. This document helps demonstrate that you have the necessary insurance protection to mitigate potential risks associated with your business operations.

A COI serves a crucial purpose in various business transactions by providing assurance to others that you have adequate insurance coverage to protect them from potential liabilities. This helps to build trust and confidence, and often is a requirement for entering into contracts or business relationships. It’s a way to demonstrate your responsible business practices and minimize potential financial losses for all parties involved.

Key Information Included in a COI

A standard COI typically includes information such as the policyholder’s name and address, the insurance company’s name and contact information, the policy number, the types of coverage (e.g., general liability, workers’ compensation, auto liability), the policy effective and expiration dates, and the limits of liability for each coverage type. This information allows potential clients, partners, or landlords to quickly assess the adequacy of your insurance protection. Missing even one crucial piece of information could render the COI insufficient for its purpose.

Examples of Situations Requiring a COI

Several scenarios commonly necessitate the provision of a COI. For example, many commercial leases require tenants to maintain adequate liability insurance and provide proof thereof via a COI to the landlord. Similarly, many contractors are required to provide a COI to clients before commencing work, demonstrating they are adequately insured against potential accidents or damages on the job site. Furthermore, companies often request COIs from vendors or subcontractors to protect themselves from potential liabilities arising from the vendor’s or subcontractor’s operations. Finally, many professional organizations or associations may require members to carry specific insurance coverages, with proof provided via a COI.

Types of Business Certificates of Insurance

Business Certificates of Insurance (COIs) aren’t one-size-fits-all; they vary significantly depending on the specific risks a business faces and the legal requirements of its industry. Understanding the different types of COIs is crucial for both businesses seeking coverage and those requiring proof of insurance from their vendors or contractors. This section will explore several common types of COIs and their key features.

General Liability Certificates of Insurance

General liability insurance protects businesses from financial losses due to bodily injury or property damage caused by their operations or employees. A general liability COI confirms the existence and extent of this coverage. This type of insurance is extremely common and often a requirement for businesses operating in various sectors. Specific coverage details usually include bodily injury liability, property damage liability, and personal and advertising injury liability. This means the policy covers medical expenses, legal fees, and settlements arising from accidents or incidents on the business premises or related to the business’s operations. The policy limits (the maximum amount the insurer will pay for a claim) are clearly stated on the COI.

Workers’ Compensation Certificates of Insurance

Workers’ compensation insurance is legally mandated in most jurisdictions to protect employees injured on the job. A workers’ compensation COI verifies that a business carries adequate coverage to meet these legal obligations. Coverage details typically include medical expenses, lost wages, and rehabilitation costs for employees injured while performing their job duties. The COI will specify the policy’s effective dates and the state or jurisdiction where the coverage applies. Importantly, it doesn’t cover injuries caused by an employee’s willful misconduct or those occurring outside the scope of employment.

Professional Liability Certificates of Insurance (Errors and Omissions Insurance)

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals from claims of negligence or mistakes in their professional services. A professional liability COI demonstrates that a business has this crucial coverage. This is particularly important for professionals like doctors, lawyers, consultants, and engineers. Coverage details typically include legal defense costs and settlements for claims arising from professional errors or omissions that cause financial harm to clients. Exclusions often include intentional acts, fraudulent behavior, and claims arising from work performed before the policy’s inception.

| COI Type | Coverage Details | Exclusions | Common Industries |

|---|---|---|---|

| General Liability | Bodily injury, property damage, personal & advertising injury | Intentional acts, employee injuries (covered by workers’ compensation), contractual liability (often) | Retail, restaurants, construction, manufacturing, offices |

| Workers’ Compensation | Medical expenses, lost wages, rehabilitation for work-related injuries | Injuries from willful misconduct, injuries outside work scope, pre-existing conditions | Construction, manufacturing, healthcare, hospitality, any business with employees |

| Professional Liability (E&O) | Legal defense costs, settlements for professional negligence or errors | Intentional acts, fraud, claims related to work done before policy inception | Law, medicine, engineering, consulting, finance |

Obtaining a Business Certificate of Insurance

Securing a Certificate of Insurance (COI) is a crucial step for many businesses, often required by clients, landlords, or other stakeholders to demonstrate proof of liability coverage. The process itself can vary slightly depending on your insurance provider, but generally involves a straightforward request. Understanding the steps involved and the information needed will streamline the process and minimize potential delays.

Necessary Information for a COI Request

To successfully request a COI, your insurance provider will need specific information to accurately generate the certificate. This typically includes your business’s legal name and address, the policy number, the effective and expiration dates of your insurance policy, and the name and address of the recipient who requires the COI. Providing accurate and complete information upfront will prevent delays and ensure the COI is issued correctly. In some cases, you may also need to provide details about specific types of coverage, such as general liability or workers’ compensation, depending on the recipient’s requirements. Incorrect or incomplete information will likely result in delays or the need for revisions.

Steps Involved in Obtaining a COI from an Insurance Provider

The process of obtaining a COI is generally straightforward. Most insurance providers offer online portals or allow requests via phone or email. Typically, you will need to identify yourself as the policyholder, provide the necessary policy information (mentioned above), and specify the recipient of the COI. The insurance provider will then generate and send the COI electronically or via mail, depending on their procedures and your preferences. Some insurers may charge a small fee for issuing a COI, while others provide this service at no cost.

Potential Challenges and Delays in Obtaining a COI

While obtaining a COI is usually a quick process, several factors can cause delays. Incorrect or incomplete information, as mentioned previously, is a common culprit. High volumes of requests during peak periods can also lead to processing delays. Additionally, if your insurance policy is nearing expiration or has lapsed, obtaining a COI might be delayed until the policy is renewed or reinstated. In some cases, the recipient of the COI may request specific endorsements or additional information that needs to be added to the certificate, which will require further processing time. Finally, technical issues with the insurance provider’s systems can also cause unforeseen delays.

Step-by-Step Guide to Requesting a COI

To ensure a smooth and efficient process, follow these steps:

- Gather Necessary Information: Collect your business’s legal name and address, policy number, policy effective and expiration dates, and the recipient’s name and address. Also, determine if the recipient requires specific types of coverage to be included.

- Contact Your Insurance Provider: Contact your insurance provider through their preferred method (online portal, phone, or email). Clearly state that you need a COI.

- Provide Required Information: Accurately provide all the necessary information to your insurance provider. Double-check for any errors before submitting.

- Specify the Recipient: Clearly identify the individual or organization that requires the COI, including their complete name and address.

- Review and Confirm: Once the COI is generated, review it carefully to ensure all the information is accurate and complete. If there are any discrepancies, immediately contact your insurance provider to correct them.

Necessary documents for this process typically include proof of your business’s legal status (e.g., articles of incorporation, business license) and your insurance policy details. In some cases, you may need to provide additional documentation to support specific coverage requests.

Understanding the Information on a COI

A Certificate of Insurance (COI) is more than just a piece of paper; it’s a critical document that Artikels the insurance coverage a business holds. Understanding the information presented is crucial for both the issuing and receiving parties to ensure adequate protection and compliance. Misinterpretations or oversights can lead to significant financial and legal ramifications.

A thorough review of the COI is essential to verify that the coverage aligns with the specific needs and requirements of the involved parties. This includes confirming the accuracy of the policy details, the extent of coverage provided, and the validity period of the insurance. Paying close attention to detail prevents potential disputes and ensures that all parties are adequately protected.

Key Terms and Phrases on a COI

Several key terms and phrases regularly appear on a COI. Understanding their meaning is paramount to interpreting the document accurately. For instance, the “named insured” clearly identifies the business covered by the policy. The “policy period” specifies the duration of the coverage, and the “policy number” serves as a unique identifier for the specific insurance policy. The “limits of liability” define the maximum amount the insurer will pay for covered losses. Crucially, “additional insureds” indicate parties who are also protected under the policy, while “exceptions” and “exclusions” clearly state what is not covered. Failure to understand these terms can lead to misunderstandings about the extent of protection offered.

Importance of Careful Review

Before accepting a COI, a thorough and critical review is essential. This involves not only understanding the individual terms but also assessing the overall coverage in relation to the specific risks involved. For example, a construction company requiring a COI from a subcontractor should carefully verify that the subcontractor’s liability coverage is sufficient to cover potential damages or injuries arising from their work. Overlooking crucial details can leave a business vulnerable to significant financial losses in case of an incident. A simple mistake in the policy number or the expiry date can render the entire COI invalid.

Potential Discrepancies and Errors

Several potential discrepancies or errors should be carefully watched for. These include incorrect policy numbers, inaccurate dates (policy effective and expiration dates), mismatched addresses, or discrepancies between the listed coverage and the required coverage. For instance, a COI might show lower liability limits than what was agreed upon, or it might incorrectly identify the additional insured. Missing endorsements or inaccurate descriptions of the insured’s operations are further potential issues. Identifying such discrepancies before work commences is critical for preventing future disputes and financial liabilities.

Common Abbreviations on a COI

Understanding common abbreviations is crucial for efficiently interpreting a COI. Many abbreviations are used to concisely represent various aspects of the insurance policy. A quick reference can save time and prevent misunderstandings.

- CGL: Commercial General Liability

- GL: General Liability

- AU: Automobile

- WC: Workers’ Compensation

- UM: Uninsured Motorist

- BI: Bodily Injury

- PD: Property Damage

- ISO: Insurance Services Office

Legal and Contractual Implications of COIs

Certificates of Insurance (COIs) play a crucial role in managing risk and fulfilling contractual obligations. Misunderstandings or inaccuracies within a COI can have significant legal and financial repercussions for all parties involved. This section will explore the legal ramifications of COIs in business transactions.

Legal Implications of Inaccurate or Incomplete COIs

Providing or receiving an inaccurate or incomplete COI can lead to serious legal consequences. If a COI falsely represents the coverage a business possesses, and a claim arises that is not covered due to this misrepresentation, the business providing the inaccurate COI could face legal action for breach of contract or even fraud. Similarly, a business relying on an inaccurate COI might find itself uninsured when a loss occurs, leading to significant financial burdens and potential legal disputes with the party who provided the faulty certificate. The severity of the consequences depends on the nature and extent of the inaccuracies, the jurisdiction, and the specific contractual agreements in place. For example, a missing endorsement on a COI could invalidate the entire certificate in the eyes of the court.

The Role of a COI in Contractual Agreements

A COI frequently serves as a critical component of contractual agreements, particularly in situations involving construction, leasing, or events. Many contracts explicitly require the submission of a COI as a condition precedent to the commencement of work or the fulfillment of the agreement. This demonstrates a clear intention by the contracting parties to ensure adequate insurance coverage exists to mitigate potential risks. The COI provides evidence that a party maintains the necessary insurance policies, safeguarding the other party from potential financial losses resulting from accidents or incidents caused by the insured party. Failure to provide a valid COI, or a COI that doesn’t meet the contract’s specifications, could be grounds for contract breach, leading to potential legal disputes and financial penalties.

How a COI Can Protect Businesses from Liability

A correctly issued and accurate COI can offer significant protection against liability. By demonstrating that a business maintains adequate insurance coverage, a COI can deter potential lawsuits and limit the financial exposure in case of an incident. For instance, a contractor working on a construction project might require a COI from its subcontractors to protect itself from liability should an accident occur on the job site. If a subcontractor causes damage or injury, the general contractor can rely on the subcontractor’s insurance coverage to cover the costs, reducing the general contractor’s own liability. This protective mechanism extends beyond direct contractual relationships; it can also reassure third parties about the insured party’s responsibility and financial stability.

Legal Ramifications of Using a COI versus Not Having One

The legal ramifications of using a COI versus not having one in a business transaction are starkly different. Having a valid and accurate COI provides a degree of protection and demonstrates adherence to contractual obligations. In contrast, the absence of a required COI can lead to significant legal and financial vulnerabilities. A business that fails to provide a COI as stipulated in a contract may face breach of contract claims, potential loss of business opportunities, and damage to its reputation. Furthermore, if an incident occurs, the business could be held solely responsible for all related costs and damages, potentially leading to substantial financial losses and legal battles. The presence of a COI, therefore, provides a clear advantage in protecting a business’s interests and mitigating legal risks.

Best Practices for Managing Business COIs

Effective management of Certificates of Insurance (COIs) is crucial for maintaining compliance, mitigating risk, and ensuring smooth business operations. A well-structured system for handling COIs safeguards your organization from potential liabilities and simplifies the process of verifying insurance coverage from vendors and contractors. This section Artikels best practices for managing your business’s COIs.

Storing and Managing COIs for Compliance and Record-Keeping

A centralized, easily accessible system is vital for efficient COI management. This could involve a dedicated file folder (physical or digital), a database, or a specialized insurance management software. Regardless of the method chosen, a clear naming convention (e.g., Vendor Name_Date_Policy Number) is essential for quick retrieval. Regular backups are crucial to protect against data loss. Consider the security implications of your chosen storage method, particularly for sensitive information contained within the COIs. For example, if using a cloud-based solution, ensure it complies with relevant data privacy regulations.

Ensuring COI Currency and Accuracy

Maintaining up-to-date COIs is paramount. Many COIs have expiration dates; it’s essential to track these meticulously. Establish a system for requesting updated COIs well in advance of expiration. This could involve automated reminders sent to vendors or a regular review process. Verification of the information on the COI against the insurer’s records may be necessary to confirm accuracy and validity. This could involve directly contacting the insurance provider. Consider using a system that automatically flags expiring or soon-to-expire certificates.

Regular Review and Update of COIs

Regular review of COIs is not just about expiration dates. Changes in coverage limits, policy amendments, or even changes in the insured entity require updated COIs. A schedule for regular review (e.g., quarterly or annually) should be implemented and consistently followed. This process should involve comparing the existing COI with the most recent policy information to identify any discrepancies. This proactive approach helps ensure that your organization is adequately protected at all times.

Checklist of Best Practices for Handling Business COIs

- Establish a centralized system for storing COIs (digital or physical).

- Implement a clear and consistent naming convention for all COI files.

- Regularly back up all COI data to prevent loss.

- Set up a system for tracking COI expiration dates and sending timely reminders.

- Verify the accuracy of COIs by contacting insurers when necessary.

- Develop a schedule for regularly reviewing and updating all COIs (e.g., quarterly).

- Ensure that all COIs meet your organization’s minimum coverage requirements.

- Maintain a record of all communication regarding COIs (e.g., requests, updates).

- Store COIs securely and in compliance with data privacy regulations.

- Consider using insurance management software to automate many of these tasks.

Illustrative Examples of COI Usage

Certificates of Insurance (COIs) are not merely pieces of paper; they are critical risk management tools that protect businesses from significant financial and legal liabilities. Their importance becomes readily apparent when examining real-world scenarios where their absence or inadequacy can lead to severe consequences. The following examples highlight the crucial role COIs play in various business contexts.

Construction Project Risk Mitigation

Consider a large-scale construction project involving multiple contractors and subcontractors. Each entity involved, from the general contractor to the specialized plumbing subcontractor, carries inherent risks. A significant risk is a workplace accident resulting in injury or death. Without COIs from each subcontractor demonstrating adequate workers’ compensation and liability insurance, the general contractor faces potential liability for any accidents occurring on the site, even if caused by a subcontractor’s negligence. The general contractor’s COI, in turn, protects the building owner from similar liability. The COI provides proof of insurance coverage, mitigating the financial burden of potential lawsuits and ensuring the project’s continuity. The specific risks mitigated include: workplace injuries, property damage, and third-party liability claims. The presence of valid COIs from all parties provides a layer of protection, transferring some risk to the insurers.

Protection Against Lawsuits in Client-Vendor Relationships

Imagine a software development company (the vendor) creating a custom application for a large corporation (the client). The contract stipulates that the vendor will indemnify the client against any third-party claims arising from the software’s use. The client, however, requires assurance that the vendor has sufficient liability insurance to cover potential damages. The vendor’s COI provides this assurance. Should the software malfunction and cause the client financial loss, or should a third-party claim arise from the software’s operation, the client can pursue the vendor’s insurance provider, rather than facing the burden of litigation and potentially substantial financial losses directly against the vendor. The COI thus acts as a safeguard against potential lawsuits and protects the client’s financial interests.

Financial Loss Due to Outdated or Inaccurate COI

A commercial property owner (the landlord) rented space to a tenant operating a restaurant. The lease agreement required the tenant to provide a COI demonstrating adequate liability insurance. The tenant provided a COI, but it was outdated; the policy had expired months prior. A customer slipped and fell in the restaurant, sustaining injuries. The customer sued the landlord, and the landlord, relying on the outdated COI, assumed the tenant was adequately insured. However, the lack of valid insurance meant the landlord bore the entire cost of the lawsuit and the resulting settlement. This situation highlights the critical importance of verifying the accuracy and validity of COIs. The outdated COI resulted in significant financial loss for the landlord – not only the settlement costs but also the legal fees incurred in defending the lawsuit. The lack of a valid COI resulted in a complete transfer of risk, leading to substantial financial repercussions for the landlord.

Outcome Summary

Understanding and effectively managing Business Certificates of Insurance is paramount for any business seeking to mitigate risk and maintain strong contractual relationships. This guide has provided a foundational understanding of COIs, from their purpose and acquisition to their legal implications and best practices for management. By diligently reviewing and updating your COIs, and by understanding the critical information they contain, you can significantly reduce your exposure to liability and protect your business’s financial well-being. Remember, a well-managed COI is a cornerstone of responsible business practice.

FAQ Summary

What happens if I provide an inaccurate COI?

Providing an inaccurate COI can lead to legal repercussions, including contract breaches and potential lawsuits. It can also invalidate your insurance coverage.

How long is a COI typically valid for?

The validity period varies depending on the insurer and policy, but it’s often one year. Always check the certificate for the expiration date.

Can I get a COI for a specific project?

Yes, you can often request a COI that specifically covers a particular project or timeframe.

Who should I contact if I have questions about my COI?

Contact your insurance provider or broker; they are the best resource for clarifying any uncertainties.