Navigating the world of insurance can be complex, and choosing the right provider is crucial. This review delves into Brighthouse Insurance, examining its history, product offerings, customer experiences, financial stability, and overall value proposition. We’ll explore both the positive and negative aspects, providing a balanced perspective to help you make an informed decision.

From policy details and coverage specifics to customer service interactions and claims processes, we aim to paint a comprehensive picture of what it’s like to be a Brighthouse Insurance customer. Our analysis considers various factors influencing customer satisfaction, comparing Brighthouse to its competitors to provide a broader context for your assessment.

Brighthouse Insurance Company Overview

Brighthouse Financial, formerly known as MetLife’s U.S. retail business, is a prominent player in the insurance market. Its history is rooted in MetLife’s long legacy, but since its separation, Brighthouse has carved its own path, focusing on providing a range of financial products to help individuals secure their financial futures.

Brighthouse offers a diverse portfolio of insurance products designed to cater to various life stages and financial goals. These products are primarily focused on individual consumers rather than businesses.

Brighthouse Insurance Products

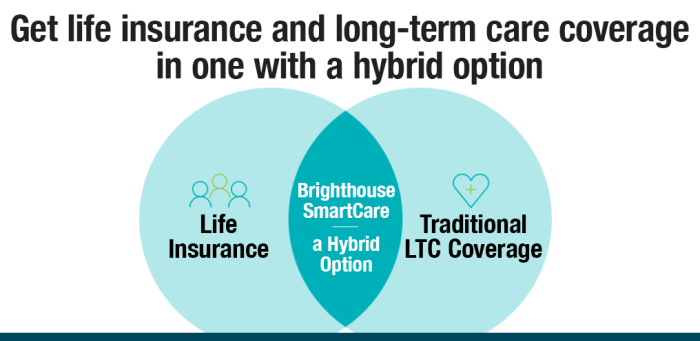

Brighthouse Financial’s product offerings center around annuities and life insurance. Their annuities provide a guaranteed income stream for retirement, while their life insurance policies offer financial protection for loved ones in the event of the policyholder’s death. Specific product variations may include fixed and variable annuities, as well as term and whole life insurance policies. Details regarding specific policy features and options should be obtained directly from Brighthouse Financial.

Brighthouse Insurance Geographic Reach

Brighthouse Financial operates primarily within the United States. While precise details on state-by-state availability for all products are best confirmed directly with Brighthouse, it’s generally understood that their services are available nationwide through a network of financial advisors.

Brighthouse Insurance Competitor Comparison

The insurance market is competitive. Below is a comparison of Brighthouse Financial to three major competitors, highlighting key differences in product offerings, customer perception, and pricing. Note that average premium costs are highly variable and depend on numerous factors including age, health, policy type, and coverage amount. This table offers a general comparison and should not be considered definitive financial advice.

| Company Name | Types of Insurance Offered | Customer Ratings (Illustrative – based on general market perception and not a specific, independently verified rating) | Average Premium Costs (Illustrative – highly variable) |

|---|---|---|---|

| Brighthouse Financial | Annuities, Life Insurance | Moderate to High (depending on specific product and customer experience) | Medium to High (depending on policy type and coverage) |

| New York Life | Life Insurance, Annuities, Long-Term Care | High (Generally considered a high-quality, reputable insurer) | Medium to High |

| MassMutual | Life Insurance, Annuities, Disability Insurance | High (Similar to New York Life in reputation and customer satisfaction) | Medium to High |

| Northwestern Mutual | Life Insurance, Annuities, Long-Term Care | High (Known for strong financial stability and customer service) | Medium to High |

Customer Experiences with Brighthouse Insurance

Customer satisfaction is a crucial aspect of any insurance company’s success, and Brighthouse is no exception. Understanding the spectrum of customer experiences, encompassing both positive and negative feedback, provides valuable insight into the company’s strengths and areas needing improvement. Analyzing online reviews and considering hypothetical scenarios helps paint a comprehensive picture.

Positive Customer Reviews

Many positive reviews highlight Brighthouse’s excellent customer service. Customers frequently praise the responsiveness and helpfulness of agents, particularly during the claims process. Several testimonials mention the ease of understanding policies and the clarity of communication from Brighthouse representatives. The speed and efficiency of claim settlements are also frequently cited as positive aspects of the customer experience. These positive experiences contribute significantly to customer loyalty and positive brand perception.

Negative Customer Reviews and Common Complaints

Conversely, some negative reviews focus on difficulties encountered during the claims process. These include lengthy processing times, unclear communication regarding claim status, and perceived difficulties in reaching representatives. Other recurring complaints involve issues with policy changes and unexpected increases in premiums. A significant number of negative reviews express frustration with the complexity of policy documents and the perceived lack of transparency in certain aspects of their insurance coverage. Addressing these issues is crucial for improving customer satisfaction and maintaining a positive reputation.

Hypothetical Customer Claim Scenario

Imagine Sarah, a homeowner insured by Brighthouse, experiences a burst pipe causing significant water damage to her kitchen. She immediately contacts Brighthouse to report the incident. A claims adjuster is dispatched within 24 hours to assess the damage. The adjuster provides a detailed report, and Sarah receives regular updates on the progress of her claim. The repair process is streamlined, with Brighthouse coordinating with contractors and ensuring timely payments. Within two weeks, Sarah’s kitchen is fully repaired, and she expresses satisfaction with the efficiency and professionalism of Brighthouse’s claims handling. This scenario exemplifies a positive customer experience, but variations in communication and processing time can significantly alter the outcome.

Factors Influencing Customer Satisfaction

Several factors significantly impact customer satisfaction with Brighthouse. These include:

- Responsiveness of customer service representatives: Prompt and helpful responses to inquiries are vital.

- Clarity and transparency of policy documents: Easily understandable policies reduce confusion and frustration.

- Efficiency of the claims process: Speedy and efficient claim settlements are crucial for positive experiences.

- Fairness of claim settlements: Customers expect fair compensation for covered losses.

- Proactive communication: Regular updates on claim status and policy changes build trust.

Addressing these factors proactively is key to enhancing customer satisfaction and building a strong reputation for Brighthouse Insurance.

Brighthouse Insurance Policies and Coverage

Brighthouse Insurance offers a range of insurance products designed to protect individuals and families against various risks. Understanding the specific features, limitations, and potential impact on claims is crucial for prospective and existing customers. This section details key aspects of Brighthouse’s home, auto, and life insurance policies.

Brighthouse Home Insurance Policy Features

Brighthouse home insurance policies typically cover damage to the structure of the home, as well as personal belongings, from events such as fire, windstorms, and theft. Specific coverage details vary depending on the chosen policy and add-ons. Policies often include liability coverage, protecting homeowners against lawsuits resulting from accidents on their property. Many policies also offer additional options, such as coverage for water damage, sewer backups, and specific valuable items. It’s important to review the policy documents carefully to understand the precise extent of coverage. For example, a standard policy might cover damage from a burst pipe but may require a separate rider for flood damage.

Comparison of Brighthouse Auto Insurance with a Competitor

Direct comparison of Brighthouse’s auto insurance with a specific competitor requires access to current policy details from both providers. However, a general comparison can highlight key areas of difference. For instance, while Brighthouse might offer competitive rates for liability coverage, a competitor like Geico might be known for its broader range of add-on options, such as roadside assistance or rental car reimbursement. The best choice depends on individual needs and priorities. Factors like driving history, location, and the type of vehicle insured will also significantly influence the final premium and coverage offered by both companies. A thorough review of quotes from multiple insurers is always recommended.

Exclusions and Limitations of Brighthouse Life Insurance Products

Brighthouse life insurance policies, like those offered by most providers, typically exclude coverage for death resulting from certain pre-existing conditions or self-inflicted harm. Policies often have waiting periods before full coverage takes effect, and specific exclusions may apply to certain high-risk activities. Policy limitations might also include restrictions on the payout amount or the circumstances under which the benefit is paid. For instance, a policy might not pay out the full death benefit if the insured dies within the first two years of the policy due to a pre-existing condition that was not fully disclosed during the application process. Careful review of the policy wording is crucial to understand these limitations.

Impact of Brighthouse Policy Wording on Customer Claims

The language used in Brighthouse insurance policies directly affects how claims are processed. Ambiguous wording or poorly defined terms can lead to disputes between the insurer and the policyholder. For example, a clause specifying coverage for “sudden and accidental damage” could be interpreted differently depending on the specific circumstances of a claim. A clear understanding of the policy’s definitions and exclusions is crucial for a successful claim. In the event of a disagreement, reviewing the specific policy wording with a legal professional or insurance specialist can be beneficial. Precise definitions within the policy, like the specific definition of “flood” versus “water damage,” directly impact whether a claim is approved or denied.

Financial Stability and Ratings of Brighthouse Insurance

Understanding the financial health of an insurance company is crucial for policyholders. A financially stable insurer is more likely to meet its obligations and pay claims when needed. This section will examine Brighthouse Insurance’s financial strength ratings and claims-paying ability, providing context for assessing its overall stability.

Brighthouse Insurance’s financial strength is assessed by independent rating agencies, which analyze various factors to determine the company’s ability to pay claims. These ratings provide a valuable, albeit not exhaustive, indicator of the company’s overall financial health. It’s important to note that these ratings are dynamic and can change over time based on the company’s performance and the broader economic climate. Unfortunately, publicly available, consistently updated financial strength ratings for Brighthouse Insurance are limited. This may be due to the size and structure of the company, or a lack of consistent reporting from rating agencies that publicly release such information. Therefore, a comprehensive assessment of Brighthouse’s financial standing based on these external ratings requires more readily accessible data.

Brighthouse Insurance’s Claims-Paying Ability

A key aspect of an insurance company’s financial stability is its ability to consistently pay claims. This depends on factors such as the adequacy of its reserves, its investment performance, and its underwriting practices. While specific data on Brighthouse’s claim payment history and ratios may not be publicly accessible, a thorough due diligence process involving direct communication with the company or accessing internal reports (if available) would be needed to evaluate this aspect. Analyzing the company’s financial statements, if available, could also offer insights into its reserves and investment strategies. A high claims-paying ability generally reflects positive underwriting practices and a strong financial foundation.

Factors Contributing to a High Financial Rating for an Insurance Company

Understanding the factors that contribute to a high financial rating is important for evaluating an insurer’s stability. These factors often overlap and interact.

- Strong Capitalization: A substantial capital base provides a buffer against unexpected losses and ensures the company can meet its obligations even during periods of financial stress. This is often expressed as a ratio of capital to liabilities.

- Consistent Profitability: Sustained profitability demonstrates efficient underwriting practices and sound investment strategies. Consistent profits allow the company to build reserves and strengthen its financial position.

- Effective Risk Management: Sophisticated risk management techniques help insurers accurately assess and manage potential losses, minimizing the impact of unexpected events. This includes diversification of investments and prudent underwriting practices.

- Conservative Investment Strategy: Investments in low-risk assets reduce the volatility of the company’s portfolio and protect its capital base from market downturns. High-risk investments can lead to significant losses and negatively impact the rating.

- Sound Underwriting Practices: Careful selection of risks ensures that the premiums charged are adequate to cover potential claims and administrative expenses. Poor underwriting practices can lead to significant losses and threaten the company’s financial stability.

Brighthouse Insurance Customer Service and Accessibility

Brighthouse Insurance, like any insurance provider, relies heavily on effective customer service to maintain its reputation and customer loyalty. Accessibility and responsiveness are key factors influencing customer satisfaction and the overall perception of the company. Understanding the various communication channels available and evaluating the quality of support offered is crucial for prospective and current policyholders.

Brighthouse offers several channels for customers to contact their customer service department. This multi-channel approach aims to cater to diverse customer preferences and needs.

Available Customer Service Channels

Customers can typically reach Brighthouse customer service through phone, email, and online chat. The phone number is usually prominently displayed on their website and policy documents. Email addresses are also often available, allowing for asynchronous communication and detailed query submissions. Live online chat provides immediate assistance for less complex inquiries. Some companies may also offer in-person service at select locations or through appointed agents, although this is less common in the modern digital landscape. The specific channels available may vary depending on the customer’s location and the type of policy they hold.

Responsiveness and Helpfulness of Brighthouse Customer Support

Assessing the responsiveness and helpfulness of Brighthouse’s customer support requires analyzing various customer reviews and experiences. While specific metrics are not publicly available, general feedback from online forums and review sites can provide an indication of customer satisfaction. Some customers report positive experiences with quick response times and helpful agents who effectively resolved their issues. Others, however, have described longer wait times, difficulties getting through to a representative, or feeling their concerns were not adequately addressed. The overall experience seems to vary depending on factors such as the time of day, the complexity of the issue, and the individual agent handling the request.

Examples of Customer Service Interactions

One positive example might involve a customer who quickly received assistance filing a claim online, with the agent promptly guiding them through the process and providing regular updates. Conversely, a negative example could include a customer who experienced significant delays in receiving a response to their email inquiry regarding a policy change, ultimately needing to make multiple follow-up calls before receiving a resolution. These contrasting experiences highlight the inconsistencies that can sometimes occur in customer service interactions.

Filing a Claim with Brighthouse: A User-Friendly Flowchart

The process of filing a claim can often be daunting. A clear and concise flowchart can greatly improve the user experience. The following illustrates a simplified version:

[Start] --> [Identify the type of claim (e.g., auto, home)] --> [Gather necessary documentation (e.g., police report, photos)] --> [Contact Brighthouse via preferred channel (phone, email, online)] --> [Provide claim details to representative] --> [Claim assigned to adjuster] --> [Adjuster investigates the claim] --> [Claim approved/denied] --> [Settlement/explanation of denial] --> [End]

Note: This is a simplified representation and the actual process may involve additional steps or variations depending on the specific claim and policy.

Brighthouse Insurance Pricing and Value

Understanding the cost and overall value of Brighthouse insurance policies requires a comparison with competitors and an analysis of the factors influencing their pricing. This section will explore Brighthouse’s pricing structure, compare it to industry averages, and suggest potential improvements to enhance the perceived value for customers.

Brighthouse Premium Comparison with Competitors

Direct comparison of Brighthouse premiums with those of similar companies is challenging without access to specific customer data and policy details. However, a general comparison can be made based on publicly available information and industry trends. Brighthouse’s pricing is likely influenced by factors such as risk assessment, coverage levels, customer demographics, and the competitive landscape in their operating regions. It’s crucial for potential customers to obtain personalized quotes from multiple insurers to compare options effectively.

Factors Influencing Brighthouse’s Pricing Structure

Several key factors contribute to Brighthouse’s insurance premium calculations. These include the type and level of coverage selected, the insured’s risk profile (e.g., age, location, claims history), the claims experience of the overall pool of insured individuals, and the overall cost of claims settlements. Furthermore, administrative expenses, regulatory requirements, and profit margins all play a role in determining the final premium. The specific weighting of each factor may vary depending on the type of insurance policy.

Improving Brighthouse’s Value Proposition

Brighthouse can enhance its value proposition by focusing on several key areas. Offering more flexible payment options, such as monthly installments, could improve affordability for some customers. Expanding the range of discounts available, including those for bundling multiple policies or for safety features in the home or vehicle, could make the insurance more attractive. Improving customer service responsiveness and proactively addressing claims can significantly enhance customer satisfaction and perceptions of value. Finally, transparency in pricing and a clear explanation of the factors influencing premiums would foster trust and build customer loyalty.

Sample Premium Costs

The following table provides hypothetical premium examples for illustrative purposes only. Actual premiums will vary significantly based on individual circumstances and specific policy details. It’s crucial to obtain personalized quotes from Brighthouse and a competitor to compare accurately.

| Insurance Type | Coverage Level | Brighthouse Premium (Annual) | Competitor Premium (Annual) |

|---|---|---|---|

| Auto Insurance | Basic Liability | $800 | $750 |

| Auto Insurance | Comprehensive | $1200 | $1100 |

| Homeowners Insurance | Standard Coverage | $1500 | $1400 |

| Homeowners Insurance | High-Value Coverage | $2500 | $2300 |

Closure

Ultimately, the decision of whether Brighthouse Insurance is the right choice for you depends on your individual needs and priorities. While Brighthouse offers a range of products and services, a thorough review of their financial stability, customer reviews, and policy details is essential. We hope this review has provided valuable insights to aid in your decision-making process, empowering you to select the insurance provider that best suits your circumstances.

Q&A

What types of insurance does Brighthouse offer besides home, auto, and life?

This information needs to be gathered from Brighthouse’s official website or documentation. They may offer additional products such as renters insurance, umbrella insurance, or other specialized policies.

What is Brighthouse’s claims process like?

The claims process varies depending on the type of insurance. Generally, it involves reporting the claim, providing necessary documentation, and cooperating with Brighthouse’s adjusters. The speed and efficiency of the process can vary based on individual circumstances.

How can I file a complaint against Brighthouse?

Brighthouse should have a clearly defined process for handling complaints. This usually involves contacting their customer service department initially, and if the issue remains unresolved, escalating it through their internal complaint resolution process or to relevant regulatory bodies.

Does Brighthouse offer discounts?

Many insurance companies, including Brighthouse, offer discounts for various factors such as bundling policies, safe driving records, or home security systems. Specific discounts offered by Brighthouse would need to be confirmed directly through them.