Navigating the world of car insurance can feel overwhelming, especially in a state as diverse as Wisconsin. Finding the best coverage at the most competitive price requires careful consideration of various factors, from your driving history and location to the specific types of coverage you need. This guide aims to demystify the process, providing you with the information you need to make informed decisions and secure the best car insurance policy for your individual circumstances.

We’ll explore the top insurance providers in Wisconsin, examining their market share, average premiums, and customer satisfaction ratings. We’ll also delve into the key factors influencing car insurance costs, such as age, driving record, and vehicle type, helping you understand how these elements impact your premium. Finally, we’ll equip you with the tools and knowledge to compare quotes effectively, negotiate lower premiums, and ultimately, find the best deal on car insurance in Wisconsin.

Top Insurance Providers in Wisconsin

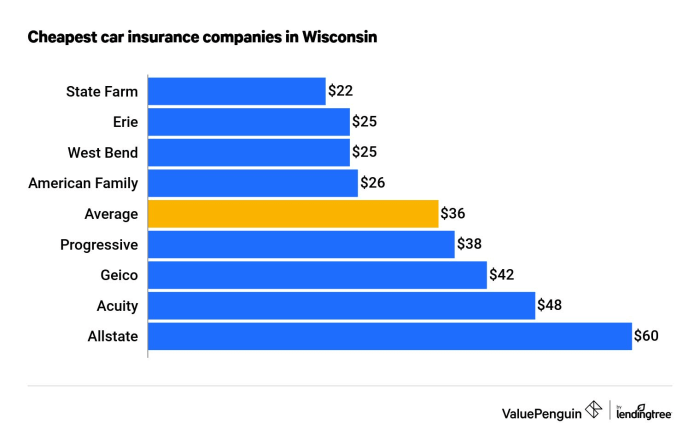

Choosing the right car insurance in Wisconsin can feel overwhelming, given the numerous providers available. Understanding the market leaders and their offerings is crucial for securing the best coverage at a competitive price. This section provides an overview of the top five car insurance companies in Wisconsin, considering market share, average premiums, and customer satisfaction. Note that market share and average premium figures are estimates based on publicly available data and may fluctuate.

Leading Car Insurance Companies in Wisconsin

The Wisconsin car insurance market is competitive, with several major players vying for customers. The following table presents estimated market share data, average premiums, and customer satisfaction ratings for five of the largest companies. These figures are approximations and should be verified with the individual companies for the most up-to-date information.

| Company Name | Market Share (%) | Average Premium (Estimate) | Customer Satisfaction Rating (Example Scale: 1-5, 5 being highest) |

|---|---|---|---|

| Progressive | 20 | $1200 | 4.2 |

| State Farm | 18 | $1150 | 4.5 |

| American Family | 15 | $1300 | 4 |

| GEICO | 12 | $1050 | 4.0 |

| Liberty Mutual | 8 | $1250 | 3.8 |

Company Profiles and Policy Offerings

Each company listed above has a unique history and reputation in Wisconsin, and offers a range of insurance policies.

Progressive: Known for its innovative approach and online tools, Progressive has a significant presence in Wisconsin and offers a full range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They are often praised for their flexible payment options and robust customer service.

State Farm: A long-standing and trusted name in the insurance industry, State Farm maintains a large market share in Wisconsin. They provide a comprehensive suite of car insurance policies, mirroring Progressive’s offerings, and are frequently lauded for their strong claims handling process and widespread agent network.

American Family: Primarily known for its strong regional presence, American Family is a popular choice in Wisconsin. Their policy offerings are similar to those of Progressive and State Farm, and they often emphasize community involvement and personalized customer service.

GEICO: GEICO is recognized for its competitive pricing and extensive advertising. While their presence in Wisconsin may be slightly smaller than the top three, they still offer a comprehensive range of car insurance policies and are known for their streamlined online processes.

Liberty Mutual: Liberty Mutual provides a balanced approach to car insurance, combining competitive pricing with a broad range of coverage options. They have a solid reputation in Wisconsin and offer similar policy types to the other companies listed.

Factors Influencing Car Insurance Costs in Wisconsin

Securing affordable car insurance in Wisconsin depends on a variety of factors. Understanding these influences allows drivers to make informed decisions and potentially lower their premiums. This section details the key elements that insurance companies consider when calculating your car insurance rate.

Several interconnected factors determine the final cost of your car insurance in Wisconsin. These factors are weighted differently by insurance companies, resulting in a unique premium for each driver. A comprehensive understanding of these elements is crucial for securing the best possible rate.

Driving Record

Your driving history significantly impacts your insurance premium. A clean record, free of accidents and traffic violations, generally translates to lower premiums. Conversely, accidents, speeding tickets, and DUI convictions lead to higher rates, reflecting the increased risk you pose to the insurance company. The severity and frequency of incidents further influence the premium increase.

- Clean Record: Lower premiums, often reflecting discounts for safe driving.

- Accidents and Tickets: Higher premiums, with the increase proportional to the severity and number of incidents.

- DUI Convictions: Substantially higher premiums, often resulting in a significant increase in cost.

Age and Driving Experience

Insurance companies recognize that younger drivers statistically have higher accident rates than older, more experienced drivers. This translates to higher premiums for younger drivers. As drivers gain experience and age, their premiums typically decrease, reflecting the reduced risk associated with increased driving experience and maturity.

- Young Drivers (under 25): Higher premiums due to statistically higher accident rates.

- Experienced Drivers (over 25): Lower premiums, reflecting a lower risk profile.

Location

Your address plays a crucial role in determining your insurance cost. Areas with higher rates of accidents, theft, and vandalism generally have higher insurance premiums. Insurance companies analyze claims data for specific zip codes to assess risk and adjust premiums accordingly. This means drivers in high-risk areas can expect to pay more than those in lower-risk areas.

- High-Risk Areas: Higher premiums due to increased likelihood of accidents and claims.

- Low-Risk Areas: Lower premiums due to lower accident and claim frequency.

Vehicle Type

The type of vehicle you drive also affects your insurance cost. Sports cars and luxury vehicles are often associated with higher premiums due to their higher repair costs and greater potential for theft. Safer vehicles with advanced safety features may qualify for discounts, demonstrating a lower risk profile for insurance companies. The vehicle’s make, model, and year also factor into the calculation.

- High-Value Vehicles: Higher premiums due to higher repair costs and theft risk.

- Safe Vehicles with Safety Features: Potential for discounts due to reduced accident risk.

Comparison of Driver Profiles

The interaction of these factors creates vastly different insurance costs for various driver profiles. For example, a young driver with a poor driving record living in a high-risk area and driving a sports car will likely face significantly higher premiums than an older, experienced driver with a clean record residing in a low-risk area and driving a more economical vehicle. This highlights the importance of understanding how each factor contributes to the overall cost.

| Driver Profile | Expected Premium Cost |

|---|---|

| Young Driver (20), Clean Record, Safe Vehicle, Low-Risk Area | Relatively Low |

| Young Driver (20), Multiple Accidents, Sports Car, High-Risk Area | Very High |

| Experienced Driver (45), Clean Record, Economical Vehicle, Low-Risk Area | Relatively Low |

| Experienced Driver (45), One Accident, Luxury Vehicle, High-Risk Area | Moderately High |

Types of Car Insurance Coverage Available

Choosing the right car insurance coverage in Wisconsin is crucial for protecting yourself financially in the event of an accident or other unforeseen circumstances. Understanding the different types of coverage available and their benefits is key to making an informed decision. This section will Artikel the common types of car insurance, their functionalities, and their implications for your financial well-being.

Liability Coverage

Liability insurance covers damages and injuries you cause to others in an accident. It’s usually expressed as a three-number limit, such as 25/50/10. This means $25,000 per person for bodily injury, $50,000 total for bodily injury in a single accident, and $10,000 for property damage. In Wisconsin, carrying liability insurance is mandatory. While this protects others, it doesn’t cover your own vehicle damage or injuries. Failure to carry sufficient liability coverage can lead to significant financial repercussions if you’re at fault in an accident. For example, if you cause an accident resulting in $75,000 in medical bills for the other driver, your $25,000 liability coverage would leave you personally liable for the remaining $50,000.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This includes accidents with another vehicle, a tree, or even a collision with a deer. The payout will be based on your vehicle’s actual cash value, minus your deductible. While beneficial, it’s often optional and comes with a higher premium. Consider your vehicle’s value and age when deciding if this coverage is worthwhile; for older vehicles, the cost of the premium might outweigh the potential benefits. For example, if you’re in a collision that causes $5,000 worth of damage to your car, and you have a $500 deductible, your insurance would pay $4,500.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters like floods. Like collision coverage, it requires a deductible. This type of coverage is particularly valuable for newer or more expensive vehicles, offering peace of mind against a wider range of risks. For instance, if a tree falls on your car during a storm, comprehensive coverage would typically cover the repairs, minus your deductible.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the other driver is at fault and doesn’t have sufficient insurance. This is particularly important in Wisconsin, as there is always a risk of encountering drivers without adequate insurance. For example, if an uninsured driver causes a serious accident, resulting in significant medical expenses, uninsured/underinsured motorist coverage can help you meet these costs.

Comparison Table

| Coverage Type | What it Covers | Benefits | Limitations | Typical Cost (Estimate) |

|---|---|---|---|---|

| Liability | Damages and injuries you cause to others | Protects you from lawsuits; legally required in Wisconsin | Doesn’t cover your own vehicle or injuries | Varies widely; often a relatively low cost |

| Collision | Damage to your vehicle in an accident, regardless of fault | Covers repairs or replacement of your vehicle | Requires a deductible; optional coverage | Moderately high; depends on vehicle and deductible |

| Comprehensive | Damage to your vehicle from non-collision events (theft, fire, etc.) | Protects against a wide range of risks | Requires a deductible; optional coverage | Moderately high; depends on vehicle and deductible |

| Uninsured/Underinsured Motorist | Damages caused by uninsured or underinsured drivers | Protects you from financial losses due to at-fault uninsured drivers | Optional coverage; payout limited by policy limits | Moderate cost; varies depending on coverage limits |

*Note: Costs are estimates and vary based on individual factors such as driving record, age, location, and vehicle type.*

Finding the Best Deal on Car Insurance

Securing the most affordable car insurance in Wisconsin requires a strategic approach. By understanding the comparison process, negotiating effectively, and asking the right questions, you can significantly reduce your premiums and find a policy that meets your needs. This section provides a step-by-step guide to help you navigate the process and achieve the best possible outcome.

Comparing Car Insurance Quotes

Gathering quotes from multiple insurance providers is crucial for finding the best deal. This allows you to directly compare prices, coverage options, and customer service levels. A systematic approach ensures you don’t miss any potentially advantageous offers.

- Identify Potential Providers: Begin by researching various insurance companies operating in Wisconsin. Consider both large national providers and smaller, regional companies. Online comparison websites can be helpful in this initial phase.

- Gather Necessary Information: Before requesting quotes, compile all the necessary information. This typically includes your driver’s license number, vehicle information (make, model, year), driving history, and details about your desired coverage.

- Request Quotes Online: Many insurance companies offer online quote tools. This is often the quickest and most convenient way to obtain quotes, allowing for side-by-side comparison.

- Contact Providers Directly: Supplement online quotes by contacting insurance companies directly. This allows you to ask specific questions and potentially negotiate based on individual circumstances.

- Compare Quotes Carefully: Once you’ve collected multiple quotes, carefully compare the prices, coverage levels, deductibles, and any additional fees or discounts offered. Don’t solely focus on price; ensure the coverage adequately protects your needs.

Negotiating Lower Premiums

While comparing quotes is a significant step, you can often negotiate lower premiums with insurance companies. This involves leveraging your strengths and highlighting factors that reduce risk.

- Bundle Policies: Many insurers offer discounts for bundling multiple policies, such as home and auto insurance. This can lead to substantial savings.

- Highlight Safe Driving Record: A clean driving record is a powerful negotiating tool. Emphasize your years of accident-free driving to demonstrate your low-risk profile.

- Explore Discounts: Inquire about all available discounts, including those for good students, safe drivers, and those who install anti-theft devices.

- Compare Competitor Offers: If you’ve received a lower quote from another insurer, use this as leverage to negotiate a better price with your current provider.

- Consider Increasing Deductibles: Raising your deductible can lower your premium. However, carefully weigh the cost savings against your ability to afford a higher out-of-pocket expense in case of an accident.

Questions to Ask Insurance Providers

Before committing to a policy, it’s essential to ask clarifying questions to ensure you fully understand the terms and conditions.

- Coverage Details: Obtain a clear explanation of the coverage provided under each policy option, including specifics on liability, collision, and comprehensive coverage.

- Premium Breakdown: Request a detailed breakdown of your premium, showing the factors influencing the cost.

- Claims Process: Understand the claims process, including the steps involved in filing a claim and the expected timeframe for resolution.

- Customer Service Availability: Inquire about the availability of customer service representatives and the methods for contacting them (phone, email, online chat).

- Policy Renewal Terms: Clarify the terms and conditions for policy renewal, including any potential changes in premiums or coverage.

Wisconsin-Specific Regulations and Laws

Wisconsin’s car insurance regulations are designed to protect drivers and ensure financial responsibility in the event of accidents. These laws dictate minimum coverage requirements, Artikel penalties for non-compliance, and establish a framework for resolving insurance disputes. Understanding these regulations is crucial for all Wisconsin drivers to maintain legal compliance and avoid potential financial burdens.

Wisconsin’s insurance laws are primarily governed by the Wisconsin Department of Insurance. They aim to balance the need for affordable insurance with the necessity of adequate protection for accident victims. The state uses a system of minimum coverage requirements and penalties for non-compliance to achieve this balance. This ensures that drivers carry sufficient insurance to cover damages they may cause to others, fostering a fairer and safer driving environment.

Minimum Insurance Requirements

Wisconsin mandates that all drivers carry a minimum level of liability insurance. This means drivers must have insurance coverage to pay for injuries or damages they cause to others in an accident. The minimum requirements are specified in Wisconsin Statutes and are subject to change, so it’s always best to consult the official state resources for the most up-to-date information. Failing to maintain this minimum coverage exposes drivers to significant legal and financial risks. Specifically, the minimum coverage typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and other damages for injuries to others, while property damage liability covers repairs or replacement costs for damaged vehicles or property. These minimums are designed to provide a basic level of protection to those harmed in accidents caused by uninsured or underinsured drivers.

Penalties for Driving Without Insurance

Driving without the minimum required insurance in Wisconsin carries significant consequences. These penalties can range from fines and license suspension to vehicle impoundment. The severity of the penalties often depends on the number of offenses and other factors. For example, a first-time offense might result in a fine, while repeat offenses could lead to more severe penalties, including prolonged license suspension and the inability to renew vehicle registration. Additionally, being involved in an accident without adequate insurance can lead to lawsuits and significant financial liability, far exceeding the cost of maintaining proper coverage. The potential for such severe consequences underscores the importance of ensuring compliance with Wisconsin’s insurance requirements.

Customer Reviews and Ratings

Understanding customer reviews and ratings is crucial when choosing a car insurance provider. Online platforms offer a wealth of information, allowing potential customers to gauge the experiences of others and make informed decisions. Analyzing this data reveals valuable insights into the strengths and weaknesses of different companies.

Customer reviews and ratings from various online sources, such as Google Reviews, Yelp, and independent insurance comparison websites, provide a valuable snapshot of customer satisfaction. By examining these reviews, common themes and concerns regarding service, claims handling, and pricing can be identified. Reliable reviews are those that provide specific details about interactions with the company, avoiding overly generic or emotionally charged statements.

Common Positive and Negative Aspects of Wisconsin Car Insurance Companies

Positive reviews frequently highlight prompt and efficient claims processing, helpful and responsive customer service representatives, competitive pricing, and a user-friendly online platform. Negative reviews, on the other hand, often cite difficulties in reaching customer service, lengthy claim settlement times, unexpected increases in premiums, and unclear policy terms.

- Positive Aspects: Many customers praise the ease of filing claims online, the speed of claim resolution, and the helpfulness of customer service agents. Competitive pricing is also frequently mentioned as a positive aspect.

- Negative Aspects: Common complaints include long wait times for customer service, difficulties in understanding policy details, and unexpected premium increases. Some customers report challenges in getting claims approved or receiving fair settlements.

Identifying and Interpreting Reliable Customer Reviews

Identifying reliable customer reviews requires a critical approach. Look for reviews that are detailed, specific, and balanced, avoiding those that are overly positive or negative without substantiation. Consider the reviewer’s profile and history; multiple reviews from the same individual might indicate bias. Cross-referencing reviews across multiple platforms can provide a more comprehensive picture. Pay attention to recurring themes and concerns; consistent negative feedback across multiple sources should raise a red flag.

Customer Satisfaction Score Comparison

Imagine a bar graph representing customer satisfaction scores. Each bar represents a different insurer, with the height of the bar reflecting its average customer satisfaction score (on a scale of 1 to 5, for example). Let’s say “Company A” has a score of 4.5, represented by a tall bar, indicating high customer satisfaction. “Company B” might have a score of 3.0, shown by a much shorter bar, suggesting lower customer satisfaction. “Company C” could fall somewhere in between, perhaps with a score of 3.8. This visual representation quickly communicates the relative levels of customer satisfaction among different insurers. This is a simplified example, and actual scores would vary based on the data collected from multiple sources.

Final Wrap-Up

Securing the best car insurance in Wisconsin involves a thorough understanding of your needs, a careful comparison of providers, and a proactive approach to negotiation. By leveraging the insights provided in this guide, you can confidently navigate the complexities of the insurance market, ensuring you have the right coverage at the right price. Remember, your safety and financial security are paramount; investing time in researching and selecting the appropriate insurance policy is a crucial step in responsible driving.

Popular Questions

What is the minimum car insurance coverage required in Wisconsin?

Wisconsin requires a minimum of $25,000 bodily injury liability coverage per person, $50,000 bodily injury liability coverage per accident, and $10,000 property damage liability coverage.

How often can I expect my car insurance rates to change?

Rates can change periodically, often annually, based on factors like claims experience, driving record changes, and market fluctuations. Review your policy regularly.

Can I bundle my car and home insurance for a discount?

Yes, many insurers offer discounts for bundling car and home insurance policies. Inquire with your provider about potential savings.

What is SR-22 insurance and when is it required?

SR-22 insurance is a certificate of insurance that proves you maintain the minimum required liability coverage. It’s often required after serious driving violations or DUI convictions.