Securing affordable and comprehensive car insurance as a young adult can feel like navigating a complex maze. Premiums are often higher for younger drivers due to perceived higher risk, but understanding the factors influencing these costs empowers you to make informed decisions and potentially save money. This guide explores the key elements of car insurance for young adults, from understanding coverage types to finding the best deals and practicing safe driving habits.

We’ll delve into the specifics of different coverage options, highlighting the importance of understanding liability, collision, and comprehensive insurance. We’ll also examine how factors like driving history, vehicle type, location, and even credit score can impact your premiums. Furthermore, we’ll provide practical strategies for finding affordable insurance, including leveraging discounts and negotiating rates.

Factors Influencing Car Insurance Costs for Young Adults

Securing affordable car insurance as a young adult can feel like navigating a maze. Numerous factors contribute to the final premium, and understanding these elements is crucial for making informed decisions. This section details the key influences on your car insurance costs.

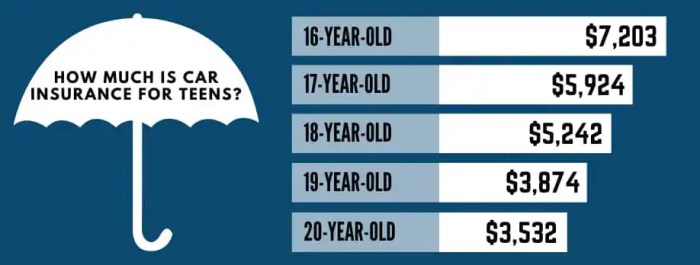

Age and Insurance Premiums

Insurance companies consider age a significant factor because younger drivers statistically have higher accident rates. Inexperience behind the wheel translates to a greater risk for insurers. As drivers gain experience and reach their mid-twenties, their accident rates typically decrease, leading to lower premiums. This is reflected in most insurance policies which show a steady decline in cost as age increases within the younger driver demographic. For example, a 16-year-old might pay significantly more than a 25-year-old with a similar driving record.

Driving History’s Impact on Rates

Your driving history is a major determinant of your insurance cost. Accidents and traffic violations dramatically increase premiums. A single at-fault accident can raise your rates considerably, while multiple accidents or serious offenses can lead to significantly higher costs or even policy cancellation. Similarly, speeding tickets, reckless driving citations, and DUI convictions significantly impact your premium. Insurance companies use a points system to track these infractions, leading to higher risk assessments and consequently higher premiums. For instance, a driver with two speeding tickets in a year might see their premiums increase by 20-30% or more, compared to a driver with a clean record.

Car Type and Features’ Influence on Insurance Costs

The type of vehicle you drive directly affects your insurance cost. Sports cars, luxury vehicles, and high-performance models are generally more expensive to insure due to their higher repair costs and greater potential for theft. Safety features, however, can influence premiums. Cars equipped with advanced safety technologies like anti-lock brakes, airbags, and electronic stability control may qualify for discounts because they reduce the risk of accidents and injuries. A new, expensive sports car will cost significantly more to insure than a used, economical sedan with standard safety features.

Location’s Role in Determining Premiums

Where you live significantly influences your insurance rates. Urban areas tend to have higher accident rates and higher rates of vehicle theft compared to rural areas. This increased risk translates to higher premiums for drivers in cities and densely populated suburbs. Insurance companies analyze accident statistics and crime rates in specific zip codes to determine risk levels. A driver living in a high-crime, densely populated city will likely pay more than a driver in a rural area with lower accident rates.

Other Factors Affecting Insurance Costs

Beyond the factors already discussed, other elements contribute to your insurance premium. Your credit score can be a factor for some insurers, with better credit often correlating to lower premiums. Your educational level can also play a role, with some insurers offering discounts to college graduates. Factors such as your marital status and the number of drivers on your policy can also affect your overall cost.

Comparative Impact of Factors on Premium Costs

| Factor | Low Impact | Medium Impact | High Impact |

|---|---|---|---|

| Age | 25+ years | 18-24 years | Under 18 years |

| Driving History | Clean record | 1 minor accident/ticket | Multiple accidents/serious offenses |

| Car Type | Economical sedan | Mid-size SUV | High-performance sports car |

| Location | Rural area | Suburban area | Urban area with high crime rates |

Types of Car Insurance Coverage for Young Drivers

Choosing the right car insurance as a young driver can feel overwhelming, but understanding the different types of coverage available is crucial for protecting yourself and your vehicle. This section Artikels the key coverage options, their benefits and drawbacks, and helps you determine what’s essential for your needs.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the medical bills and property repairs of the other party, not your own. For young drivers, who may be more prone to accidents due to inexperience, this is arguably the most important type of coverage. The amount of liability coverage you carry is typically expressed as a three-number limit, such as 25/50/25, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage. Higher limits offer greater protection. For example, if a young driver causes an accident resulting in $30,000 in medical bills for one person, they would be personally liable for the extra $5,000 if they only carried 25/50/25 coverage.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is particularly beneficial for young drivers, who are statistically more likely to be involved in collisions. The drawback is that it typically comes with a deductible, the amount you pay out-of-pocket before the insurance kicks in. For instance, if a young driver crashes into a parked car, causing $2,000 in damage and having a $500 deductible, the insurance would cover $1,500. Without collision coverage, the entire repair cost would fall on the driver.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or weather events. While not as crucial as liability or collision, it provides valuable protection against unexpected incidents. For example, if a young driver’s car is damaged by a falling tree branch or is stolen, comprehensive coverage would help cover the repairs or replacement cost (again, subject to a deductible). The benefits outweigh the costs, particularly if the car is new or represents a significant financial investment.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured altogether. This is extremely important, as a significant number of drivers operate without adequate insurance. It covers your medical bills and vehicle repairs if the at-fault driver’s insurance is insufficient to cover your losses. For instance, if a young driver is hit by an uninsured driver, this coverage would pay for their medical expenses and vehicle damage, preventing significant financial hardship.

Essential Coverage for Young Drivers: A Guide

Choosing the right insurance can be complex, but prioritizing certain coverages is crucial. For young drivers, liability coverage is non-negotiable; it’s a legal requirement in most jurisdictions and protects others from your potential mistakes. Collision coverage is highly recommended, given the higher accident risk for new drivers. Comprehensive coverage offers additional protection, but the level of importance depends on the value of the vehicle and the driver’s financial situation. Uninsured/underinsured motorist coverage should also be considered essential, providing a crucial safety net in the event of an accident with an at-fault driver who is inadequately insured. The specific coverage amounts should be chosen based on individual financial circumstances and risk tolerance. Consulting with an insurance professional can help determine the best coverage levels and premiums.

Finding Affordable Car Insurance for Young Adults

Securing affordable car insurance as a young adult can feel like navigating a maze, but with the right strategies and knowledge, it’s entirely achievable. Understanding how insurers assess risk and leveraging available options can significantly lower your premiums. This section Artikels effective methods to find and maintain affordable car insurance.

Strategies for Reducing Insurance Premiums

Several proactive steps can substantially reduce your car insurance costs. Maintaining a good academic record often qualifies you for good student discounts, which many insurers offer. Completing a defensive driving course demonstrates your commitment to safe driving practices, often resulting in lower premiums. Choosing a car with favorable safety ratings and a lower theft risk can also impact your rates. Furthermore, maintaining a clean driving record is paramount; accidents and traffic violations significantly increase premiums. Consider increasing your deductible; a higher deductible means lower premiums, but you’ll pay more out-of-pocket in case of an accident.

Comparison of Insurance Companies and Their Offerings

Different insurance companies cater to various risk profiles, and their offerings for young drivers vary considerably. Some companies specialize in providing competitive rates for young adults, while others may prioritize comprehensive coverage. It’s crucial to compare quotes from multiple insurers, considering factors beyond just the premium price. Examine the coverage details, customer service ratings, and claims processing procedures. For instance, a company with a lower premium might have a lengthy claims process or limited coverage options. Direct comparison websites can streamline this process, allowing you to see various options side-by-side.

Negotiating Lower Rates with Insurance Providers

Don’t hesitate to negotiate your insurance rates. Armed with quotes from competing insurers, you can leverage this information to negotiate a lower premium with your current provider or a new one. Highlight your good driving record, completion of safety courses, or any other factors that demonstrate your low-risk profile. Be polite but firm in your request, and be prepared to switch providers if a satisfactory agreement cannot be reached. Remember, loyalty doesn’t always equate to the best deal.

Benefits and Drawbacks of Bundling Insurance Policies

Bundling your car insurance with other policies, such as renters or homeowners insurance, often results in significant discounts. Insurers frequently offer bundled packages at a reduced rate compared to purchasing each policy separately. However, the benefit of bundling depends on your specific circumstances and the insurer’s offerings. Carefully compare the bundled price with the individual policy costs to ensure you’re receiving a genuine discount. The drawback is that you’re tied to a single provider for multiple insurance needs, potentially limiting your flexibility in the future.

Resources for Finding Affordable Insurance

Several resources can assist young adults in finding affordable car insurance. Independent insurance agents can compare quotes from various insurers, saving you the time and effort of doing it yourself. Online comparison websites offer a convenient way to quickly compare premiums and coverage options from multiple companies. Your state’s insurance department website might provide resources and information about consumer protection and available discounts. Finally, consulting with a financial advisor can provide personalized guidance on managing your insurance needs and budget.

Understanding Insurance Policies and Terms

Navigating the world of car insurance can feel overwhelming, especially for young adults. Understanding the key terms and processes involved in your policy is crucial for making informed decisions and ensuring you’re adequately protected. This section will clarify common insurance terminology, outlining the claims process, policy renewal, and potential reasons for policy cancellation.

Common Insurance Terms

Understanding the terminology used in your car insurance policy is the first step to confidently managing your coverage. Three fundamental terms are premiums, deductibles, and coverage limits. Premiums represent the regular payments you make to maintain your insurance coverage. Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in after an accident. Coverage limits define the maximum amount your insurance company will pay for covered losses, such as repairs or medical expenses. For example, a $25,000 bodily injury liability limit means the insurer will pay a maximum of $25,000 for injuries caused to another person in an accident. A higher limit provides greater protection but typically results in a higher premium. A lower deductible means you pay less out-of-pocket, but your premiums will likely be higher.

Filing an Insurance Claim

Filing a claim involves reporting an incident to your insurance company and following their procedures to receive compensation for covered damages. The process typically begins with contacting your insurer immediately after an accident, providing details of the incident, and obtaining a police report if necessary. Your insurer will then guide you through the next steps, which may involve inspections, appraisals, and negotiations with other parties involved. Providing accurate and complete information is vital for a smooth claims process. For instance, if you are involved in a collision, promptly contact your insurer, gather contact information from other drivers and witnesses, and take photos of the damage to your vehicle and the accident scene. Failure to report the accident promptly could jeopardize your claim.

Renewing an Insurance Policy

Renewing your car insurance policy is a straightforward process, typically involving a review of your current coverage and payment of the renewed premium. Most insurers send renewal notices well in advance of the policy expiration date. You may have the opportunity to review and adjust your coverage levels during renewal, reflecting changes in your circumstances, such as a change of address or the addition of a new driver to your policy. It is advisable to compare rates from different insurers before renewing to ensure you are getting the best value for your money. For example, if you’ve had a year of accident-free driving, you may qualify for a discount upon renewal.

Reasons for Policy Cancellation or Non-Renewal

Insurance companies may cancel or choose not to renew your policy for several reasons. These include repeated violations of traffic laws, such as speeding tickets or DUI convictions, failure to pay premiums on time, making fraudulent claims, or significant changes in risk assessment, such as modifications to your vehicle that increase its risk profile. Driving records are a major factor; a history of accidents or violations can lead to higher premiums or even policy cancellation. Similarly, if your insurer determines that your driving habits have increased the risk, such as increased mileage, they may increase your premiums or cancel your policy.

Glossary of Essential Insurance Terms

| Term | Definition | Example |

|---|---|---|

| Premium | The regular payment made to maintain insurance coverage. | A monthly payment of $100 for car insurance. |

| Deductible | The amount you pay out-of-pocket before insurance coverage begins. | A $500 deductible means you pay the first $500 of repair costs. |

| Coverage Limits | The maximum amount the insurer will pay for a covered loss. | A $100,000 liability limit for bodily injury. |

| Liability Coverage | Covers damages or injuries you cause to others. | Paying for another driver’s car repairs after an accident you caused. |

| Collision Coverage | Covers damage to your car in an accident, regardless of fault. | Repairing your car after a collision, even if you were at fault. |

| Comprehensive Coverage | Covers damage to your car from events other than collisions, like theft or vandalism. | Replacing your stolen car. |

Safe Driving Practices for Young Adults

Safe driving is paramount for young adults, significantly impacting insurance costs and, more importantly, personal safety. Adopting defensive driving techniques and avoiding risky behaviors can lead to lower premiums and a greatly reduced risk of accidents. This section Artikels key safe driving practices that can benefit young drivers.

Defensive Driving Techniques

Defensive driving involves anticipating potential hazards and reacting proactively to minimize risks. This goes beyond simply following traffic laws; it’s about actively scanning the environment, maintaining a safe following distance, and being prepared for unexpected actions from other drivers or pedestrians. For example, anticipating a potential red-light runner at an intersection requires slowing down and being ready to brake, rather than approaching at full speed and reacting only when the other vehicle is already in the intersection. Similarly, maintaining a three-second following distance allows ample reaction time for sudden braking or lane changes by the vehicle ahead. Practicing defensive driving significantly reduces the likelihood of accidents, directly impacting insurance premiums.

Impact of Distracted Driving on Insurance Rates

Distracted driving, encompassing activities like texting, using a cell phone, or adjusting the radio, drastically increases accident risk. Insurance companies recognize this elevated risk and often penalize drivers with distracted driving violations through higher premiums. A single distracted driving ticket can significantly raise insurance costs for years. Moreover, accidents caused by distracted driving often result in more severe damage and injuries, leading to even higher claims and premium increases. The financial burden of a distracted driving accident can be substantial, encompassing repair costs, medical bills, and increased insurance premiums.

Consequences of Driving Under the Influence

Driving under the influence (DUI) of alcohol or drugs carries severe legal and financial repercussions. Beyond potential jail time, fines, and license suspension, a DUI conviction drastically increases car insurance premiums, often resulting in significantly higher rates for several years, or even leading to policy cancellation. The cost of a DUI extends far beyond the immediate penalties; the long-term impact on insurance, employment prospects, and personal well-being can be devastating. For instance, a first-time DUI offender might see their insurance premiums double or triple, and subsequent offenses can lead to even more drastic increases or policy refusal.

Maintaining a Safe Vehicle

Regular vehicle maintenance is crucial for both safety and insurance costs. A well-maintained vehicle is less likely to experience mechanical failures that could lead to accidents. Simple measures like regularly checking tire pressure, ensuring proper fluid levels (oil, coolant, brake fluid), and replacing worn-out parts can prevent costly repairs and accidents. Neglecting maintenance can lead to breakdowns, which can be dangerous and expensive. For example, failing to change worn-out brake pads can lead to brake failure, resulting in an accident.

Benefits of Regular Vehicle Maintenance on Insurance Costs and Safety

Regular vehicle maintenance not only enhances safety but can also indirectly lower insurance premiums. Insurance companies often reward safe driving habits and responsible vehicle upkeep. While not directly reducing premiums, a clean driving record and well-maintained vehicle can positively influence the insurer’s risk assessment, potentially leading to better rates during renewal. This proactive approach to vehicle maintenance demonstrates a commitment to safety and responsibility, factors that insurance companies value.

Safe Driving Habits That Can Lower Insurance Premiums

Maintaining a clean driving record is crucial for obtaining favorable insurance rates. Here are some safe driving habits that can help achieve this:

- Obeying all traffic laws and speed limits.

- Avoiding aggressive driving behaviors such as tailgating and sudden lane changes.

- Always wearing a seatbelt.

- Never driving under the influence of alcohol or drugs.

- Minimizing distractions while driving, such as avoiding cell phone use.

- Regularly performing vehicle maintenance checks.

- Taking defensive driving courses.

Closure

Finding the best car insurance as a young adult involves a careful consideration of various factors and a proactive approach to securing the most suitable coverage at an affordable price. By understanding the intricacies of insurance policies, employing effective cost-saving strategies, and prioritizing safe driving habits, young adults can navigate the insurance landscape confidently and protect themselves financially while on the road. Remember, responsible driving and informed choices are key to securing both affordability and comprehensive protection.

Questions Often Asked

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident.

How does my credit score affect my insurance rates?

In many states, insurance companies use credit-based insurance scores to assess risk. A higher credit score often correlates with lower premiums.

Can I get my insurance cancelled?

Yes, insurance companies can cancel policies for various reasons, including failure to pay premiums, multiple accidents, or fraudulent claims.

What is uninsured/underinsured motorist coverage?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver.