Navigating the world of healthcare can be complex, and understanding your insurance coverage is crucial. Basic medical expense insurance, while less comprehensive than other plans, offers a foundation of protection against unexpected medical costs. This guide provides a clear overview of what basic medical expense insurance entails, covering its benefits, limitations, and how to choose a plan that best suits your individual needs and budget.

We’ll explore the key features of these plans, including the types of medical services covered, typical reimbursement structures, and common cost factors. We’ll also compare basic plans to more comprehensive options, helping you make an informed decision about your healthcare coverage. Understanding the nuances of basic medical expense insurance empowers you to take control of your healthcare finances and make responsible choices for your well-being.

Definition and Scope of Basic Medical Expense Insurance

Basic medical expense insurance, often referred to as a “basic plan,” provides fundamental coverage for medical expenses. It acts as a foundational layer of protection, offering assistance with the costs associated with common medical services, but with significant limitations compared to more comprehensive health insurance options. Understanding its scope and limitations is crucial for making informed decisions about health insurance coverage.

Basic medical expense insurance primarily covers the costs of hospital stays, surgery, and physician services. These core components form the basis of the policy, but the specifics of what is included and the extent of coverage can vary considerably between providers and plans. The goal is to offer a safety net against substantial medical bills, particularly for unexpected events.

Core Components of Basic Medical Expense Insurance

Basic plans typically include coverage for hospital room and board, meaning the cost of your hospital stay. They also usually cover a portion of the fees charged by surgeons for procedures and the fees of the physicians who provide care during your hospitalization. Some plans may also offer limited coverage for diagnostic tests conducted during your hospital stay. The amount covered, however, is usually capped at a specific dollar amount or percentage of the total expenses. For example, a plan might cover up to $5,000 for hospital room and board and $10,000 for surgery, regardless of the actual cost.

Coverage Limitations of Basic Plans

A key characteristic of basic medical expense insurance is its limited coverage. These plans typically have low coverage limits, meaning the maximum amount the insurer will pay for covered expenses is relatively low. This can leave individuals with significant out-of-pocket expenses if their medical bills exceed these limits. Furthermore, many basic plans have high deductibles, which is the amount you must pay out-of-pocket before the insurance coverage kicks in. This means that you may have to pay a substantial sum before the insurance company starts contributing towards your medical bills. Co-payments, which are fixed amounts you pay for each medical service, are also common features of basic plans, adding to the out-of-pocket costs.

Common Exclusions in Basic Medical Expense Insurance Policies

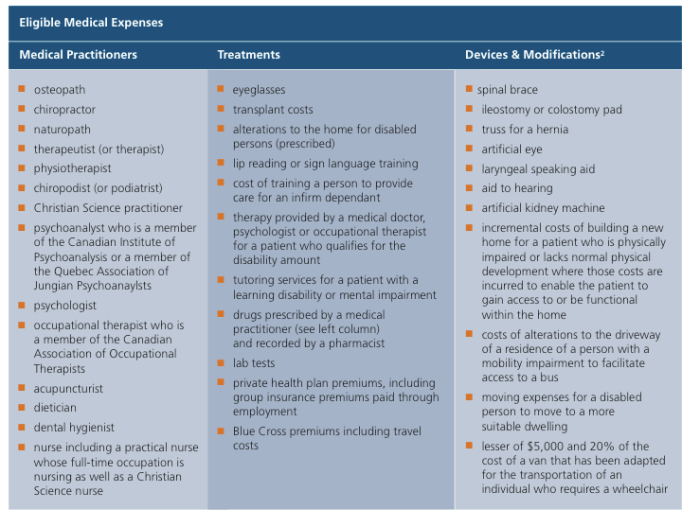

Basic medical expense insurance policies often exclude a wide range of medical services and conditions. Common exclusions include pre-existing conditions (health issues you had before the policy started), routine check-ups and preventative care, long-term care, mental health services beyond a limited scope, and experimental treatments. Furthermore, many basic plans have limitations on coverage for certain types of medical treatments or procedures, or may place restrictions on the choice of healthcare providers. For instance, a basic plan may not cover treatment for chronic illnesses like diabetes or high blood pressure, except for emergency treatment.

Comparison to More Comprehensive Plans

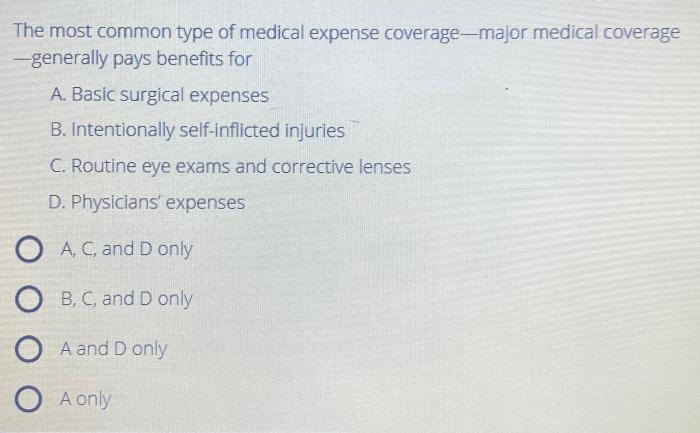

Compared to more comprehensive plans like HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations), basic medical expense insurance offers significantly less coverage. Comprehensive plans typically cover a wider range of medical services, have lower deductibles and co-payments, and offer broader access to healthcare providers. They often include preventative care, mental health services, and coverage for prescription drugs. While basic plans might be cheaper in terms of premiums, the potential for substantial out-of-pocket expenses makes them less attractive for individuals who anticipate needing significant medical care. For example, a comprehensive plan might cover 80% of the cost of a major surgery, while a basic plan might only cover 50%, leaving the individual responsible for a much larger portion of the bill.

Coverage Details

Basic medical expense insurance offers coverage for a range of healthcare services, but the specifics vary depending on the policy and insurer. Understanding what’s included, how reimbursements work, and the associated costs is crucial for choosing the right plan. This section details the typical coverage aspects of a basic medical expense insurance policy.

Basic medical expense insurance policies generally cover a core set of medical services designed to address common healthcare needs. The extent of coverage, however, can differ significantly between plans.

Covered Medical Services

The following is a list of medical services typically included in basic medical expense insurance plans. Remember to always check your specific policy document for precise details as coverage can vary.

- Doctor visits (including specialist consultations): This usually covers the cost of consultations with general practitioners and specialists, although there may be limitations on the number of visits covered annually.

- Hospitalization: Basic plans typically cover inpatient hospital stays, including room and board, but the length of stay may be limited. Specific procedures and services provided during hospitalization may also have separate coverage limits.

- Surgical procedures: Coverage for surgical procedures is common, but the plan might only cover specific procedures, and the amount reimbursed may be capped.

- Diagnostic tests: Many basic plans cover the costs of essential diagnostic tests, such as X-rays, blood tests, and other laboratory services, but again, there might be limits on the frequency or types of tests covered.

- Emergency room visits: Most basic plans include coverage for emergency room visits, though the specific services covered and the reimbursement amounts might vary.

Reimbursement Structure

Basic medical expense insurance typically operates on a reimbursement basis. This means that you pay for the medical services upfront, and then submit claims to the insurance company for reimbursement. The insurer will then process the claim and pay a portion of the costs, based on the terms of your policy. The exact percentage reimbursed varies depending on the plan and the specific service.

Limitations on Coverage Amounts

Basic medical expense insurance plans often have limitations on the maximum amount they will pay for specific procedures or services. For example, there might be a limit on the number of days covered for hospitalization, a cap on the total amount reimbursed for surgical procedures, or restrictions on the cost of certain diagnostic tests. These limits are Artikeld in the policy document.

For instance, a policy might cover only up to $5,000 for a specific surgical procedure, regardless of the actual cost. If the procedure costs $8,000, you would be responsible for the remaining $3,000. It’s crucial to review these limitations carefully before selecting a plan.

Deductibles and Co-pays

Most basic medical expense insurance plans involve deductibles and co-pays. Understanding these cost-sharing mechanisms is essential.

- Deductible: This is the amount you must pay out-of-pocket for covered medical expenses before the insurance company starts paying. For example, a $500 deductible means you pay the first $500 of your medical bills yourself.

- Co-pay: A co-pay is a fixed amount you pay each time you receive a covered medical service, such as a doctor’s visit. This is typically a smaller amount than the full cost of the service. A common example is a $25 co-pay for a doctor’s visit.

The combination of deductibles and co-pays means that you will likely incur some out-of-pocket expenses even with insurance coverage. The specific amounts for deductibles and co-pays will be clearly stated in your policy.

Cost and Affordability

Understanding the cost of basic medical expense insurance is crucial for making an informed decision. Premiums vary significantly based on several factors, and comparing the cost to more comprehensive plans helps determine the best value for individual needs.

The affordability of basic medical expense insurance is a key consideration for many individuals. While it offers a foundation of coverage, it’s essential to weigh the cost against the level of protection provided. This section will explore the various factors influencing cost and help you understand potential savings compared to more comprehensive plans.

Average Premiums Across Age Groups

The table below illustrates how average monthly premiums for basic medical expense insurance can vary depending on age. These figures are illustrative and may differ based on location, insurer, and specific plan details. It’s important to obtain quotes from multiple insurers for accurate pricing.

| Age Group | Average Premium | Deductible | Copay |

|---|---|---|---|

| 18-35 | $50 | $500 | $25 |

| 36-50 | $75 | $750 | $30 |

| 51-65 | $125 | $1000 | $40 |

| 65+ | $175 | $1500 | $50 |

Factors Influencing Cost

Several factors contribute to the overall cost of basic medical expense insurance premiums. Understanding these factors can help you make more informed choices and potentially find more affordable options.

Age is a significant factor, as older individuals generally have higher premiums due to a statistically increased risk of health issues. Geographic location also plays a role, with premiums often higher in areas with higher healthcare costs. The chosen deductible and copay amounts directly impact the premium; higher deductibles and copays typically result in lower premiums, but higher out-of-pocket expenses. Finally, the insurer’s administrative costs and profit margins contribute to the overall premium.

Cost Savings Compared to Comprehensive Plans

Basic medical expense insurance is generally less expensive than comprehensive plans. However, this lower cost comes with reduced coverage. While comprehensive plans cover a broader range of medical expenses, including hospitalization, surgery, and chronic illness management, basic plans often only cover specific services and have higher out-of-pocket costs. For individuals with limited budgets and a lower risk tolerance for high medical expenses, a basic plan might be a more financially viable option, even if it offers less comprehensive coverage.

For example, a family might choose a basic plan to cover routine doctor visits and minor illnesses, relying on savings or other financial resources for more significant medical events. This approach balances affordability with a degree of financial protection.

Individual Health Factors and Premium Costs

Pre-existing conditions and current health status can significantly influence premium costs. Insurers assess the risk associated with insuring individuals, and those with pre-existing conditions or a history of significant health issues may face higher premiums. A thorough health assessment is typically part of the application process. Lifestyle choices, such as smoking or lack of physical activity, can also affect premium costs, as these factors are associated with increased health risks.

For instance, an individual with a history of heart disease may be offered a higher premium compared to a healthy individual of the same age and location. This reflects the increased likelihood of needing medical care for this condition.

Choosing a Basic Medical Expense Insurance Plan

Selecting the right basic medical expense insurance plan can feel overwhelming, given the variety of options available. Understanding your needs and carefully comparing plans is crucial to finding affordable and adequate coverage. This section provides guidance to help you navigate this process effectively.

Factors to Consider When Selecting a Basic Medical Expense Insurance Plan

A comprehensive checklist helps ensure you consider all relevant aspects before committing to a plan. Failing to do so could lead to inadequate coverage or unexpected expenses.

- Premium Cost: The monthly or annual cost of the plan. Consider this in relation to your budget and the coverage provided.

- Deductible: The amount you pay out-of-pocket before the insurance begins to cover expenses. Lower deductibles generally mean higher premiums.

- Copay: The fixed amount you pay for covered services, such as doctor visits.

- Coinsurance: The percentage of costs you share with the insurer after meeting your deductible.

- Out-of-Pocket Maximum: The maximum amount you’ll pay out-of-pocket in a year. Once this limit is reached, the insurance company covers 100% of eligible expenses.

- Network of Providers: The doctors, hospitals, and other healthcare providers included in the plan’s network. In-network care is usually less expensive.

- Covered Services: The specific medical services covered by the plan. Compare this list carefully to ensure it aligns with your healthcare needs.

- Pre-existing Conditions: Check the plan’s policy on pre-existing conditions to understand any limitations or exclusions.

- Claims Process: Understand how to file a claim and the typical processing time. A straightforward claims process can save you time and frustration.

Pros and Cons of Basic vs. Comprehensive Plans

Weighing the advantages and disadvantages of different plan types is essential for making an informed decision. A basic plan offers lower premiums but less coverage, while a comprehensive plan offers broader coverage at a higher cost.

| Feature | Basic Plan | Comprehensive Plan |

|---|---|---|

| Premium Cost | Lower | Higher |

| Deductible | Higher | Lower |

| Copay/Coinsurance | Higher | Lower |

| Coverage | Limited | Extensive |

| Out-of-Pocket Maximum | Higher | Lower |

Step-by-Step Guide for Comparing Basic Medical Expense Insurance Policies

A structured approach ensures a thorough comparison of different policies. This systematic process minimizes the risk of overlooking crucial details.

- Gather Information: Obtain detailed information, including policy documents, from several insurance providers.

- Identify Key Features: Create a comparison chart highlighting premium costs, deductibles, copays, coinsurance, out-of-pocket maximums, and covered services.

- Analyze Coverage: Evaluate the extent of coverage offered by each plan, focusing on services you are most likely to need.

- Assess Affordability: Determine which plan best fits your budget while providing adequate coverage.

- Compare Claims Processes: Review the claims procedures of different insurers and choose a plan with a user-friendly process.

- Review Provider Networks: Check if your preferred doctors and hospitals are included in the plan’s network.

- Make a Decision: Based on your analysis, select the plan that offers the best balance of cost and coverage.

Evaluating the Value Proposition of Different Basic Plans Based on Individual Needs

The best plan depends entirely on individual circumstances and healthcare requirements. Consider your health history, anticipated healthcare needs, and financial situation when making your choice.

A plan that is excellent for one person may be inadequate or unaffordable for another. Prioritize the features that best align with your specific needs and budget.

For example, a young, healthy individual might prioritize a low-premium plan with a high deductible, knowing they are unlikely to require frequent medical care. Conversely, someone with a pre-existing condition might prefer a plan with lower out-of-pocket costs, even if the premiums are higher.

Limitations and Alternatives

Basic medical expense insurance, while offering a foundational level of coverage, possesses inherent limitations. Understanding these limitations and exploring alternative financing options is crucial for ensuring comprehensive healthcare protection. This section will Artikel scenarios where basic plans fall short, detail potential out-of-pocket costs, and examine supplementary healthcare financing strategies.

Insufficient Coverage Situations

Basic medical expense insurance typically covers only essential medical services, leaving significant gaps in coverage for more extensive or specialized care. For instance, pre-existing conditions might be excluded, or coverage for chronic illnesses might be limited. Major illnesses requiring extensive hospitalization, specialized treatments like organ transplants, or long-term rehabilitation could easily exceed the coverage limits of a basic plan, resulting in substantial personal financial burdens. Similarly, expensive diagnostic tests, advanced medical technologies, or prescription drugs might not be fully covered, leaving individuals to shoulder considerable out-of-pocket expenses.

Potential Out-of-Pocket Expenses

Even with basic medical expense insurance, substantial out-of-pocket expenses can arise. These include deductibles, co-pays, and coinsurance. The deductible represents the amount an insured individual must pay before the insurance company begins to cover expenses. Co-pays are fixed amounts paid at the time of service, while coinsurance is the percentage of costs the insured shares after the deductible is met. For example, a $5,000 deductible coupled with a 20% coinsurance could lead to significant costs, especially for expensive procedures or prolonged hospital stays. Furthermore, many basic plans exclude coverage for certain services, such as vision, dental, and mental health care, leading to additional out-of-pocket costs.

Alternative Healthcare Financing Options

Several alternative healthcare financing options can supplement basic medical expense insurance. Health Savings Accounts (HSAs) allow individuals to contribute pre-tax dollars to a dedicated account for medical expenses. These funds can be used to pay for deductibles, co-pays, and other eligible healthcare costs. Flexible Spending Accounts (FSAs) are employer-sponsored plans that allow pre-tax contributions for medical expenses, offering similar benefits to HSAs. Catastrophic health insurance plans offer coverage for major medical events, providing a safety net for high-cost medical situations. These plans often have high deductibles but lower premiums compared to comprehensive plans. Finally, exploring options like crowdfunding platforms can provide financial assistance during unexpected medical emergencies.

Comparison with Other Health Insurance Plans

Basic medical expense insurance differs significantly from other health insurance plans. Comprehensive plans offer broader coverage, including hospitalization, surgery, major illnesses, and often preventive care. Managed care plans, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), emphasize cost control and preventive care through a network of providers. These plans generally offer greater coverage and lower out-of-pocket costs compared to basic plans, although premiums might be higher. Medicare and Medicaid are government-sponsored programs offering health insurance to specific populations, providing a comprehensive alternative to private insurance options. The choice of insurance plan depends heavily on individual needs, financial capabilities, and health status.

Illustrative Example

Let’s consider a hypothetical scenario to illustrate how a basic medical expense insurance policy might work in practice. We’ll follow the experience of Sarah, a 30-year-old who recently purchased a basic medical expense insurance plan.

Sarah’s policy has a $5,000 annual maximum benefit, a $500 deductible, and a 20% coinsurance rate after the deductible is met. This means she’ll pay the first $500 of her medical expenses herself. After that, the insurance company will cover 80% of the remaining costs, up to the $5,000 limit.

Sarah’s Medical Event and Claim Process

Sarah experienced a sudden illness requiring hospitalization. Her total medical bills amounted to $7,000. This includes $2,000 for hospital room charges, $3,000 for medical procedures, and $2,000 for medication and other related expenses.

First, Sarah met her deductible of $500. Then, the insurance company covered 80% of the remaining $6,500 ($7,000 – $500 = $6,500). This means the insurance paid 80% of $6,500, which is $5,200. Sarah’s out-of-pocket expense was the deductible ($500) plus 20% of the remaining amount ($1,300 – 20% of $6,500), totaling $1,800.

Typical Policy Document Key Sections

A typical basic medical expense insurance policy document includes several key sections. These sections provide crucial information about coverage, limitations, and procedures.

The first section usually details the policy’s coverage, outlining what medical expenses are included and any exclusions. This often includes a list of covered services (such as doctor visits, hospital stays, and surgery) and specific conditions or treatments that are not covered.

The second key section specifies the policy’s limits and exclusions. This clearly defines the maximum amount the insurer will pay out during a policy year and lists any specific circumstances or pre-existing conditions that are not covered. This section also often explains the deductible and coinsurance amounts.

Another important section Artikels the claims process. It details the steps involved in submitting a claim, the required documentation (such as medical bills and receipts), and the timeframe for processing claims. This section often includes contact information for customer service and claim processing departments. Finally, the policy usually contains definitions of key terms used throughout the document, ensuring clarity and understanding.

Filing a Claim: Sarah’s Experience

To file her claim, Sarah submitted a completed claim form, along with copies of her medical bills and receipts. She sent these documents to the insurance company via mail. The insurer reviewed her claim, verifying the medical expenses and confirming her eligibility for coverage under the policy terms. After a few weeks, Sarah received a payment from the insurance company for $5,200, the amount covered under her policy. She then paid the remaining $1,800 directly to the healthcare providers.

Final Thoughts

Ultimately, the decision of whether basic medical expense insurance is right for you depends on your individual circumstances, risk tolerance, and financial situation. While it offers a cost-effective entry point into health insurance, it’s essential to carefully weigh the coverage limitations against your potential healthcare needs. By understanding the details Artikeld in this guide, you can confidently assess your options and choose a plan that provides the appropriate level of protection without unnecessary financial burden. Remember to carefully review policy documents and seek professional advice when necessary.

Key Questions Answered

What is the difference between a deductible and a copay?

A deductible is the amount you pay out-of-pocket before your insurance coverage begins. A copay is a fixed amount you pay for each doctor’s visit or service, even after meeting your deductible.

Can I use my basic medical expense insurance for preventative care?

Coverage for preventative care varies widely depending on the specific policy. Some basic plans may offer limited coverage, while others may exclude it entirely. Review your policy details carefully.

What happens if I need a procedure not covered by my basic plan?

You would be responsible for the full cost of the uncovered procedure. Consider supplemental health savings accounts (HSAs) or other options to help manage these expenses.

How do I file a claim with my basic medical expense insurance?

The claims process varies by insurance provider. Your policy documents will Artikel the necessary steps, often involving submitting forms and supporting documentation.