Navigating the world of auto insurance in Oklahoma can feel overwhelming. With numerous providers offering diverse coverage options and varying price points, finding the best auto insurance quote requires careful planning and research. This guide simplifies the process, providing insights into Oklahoma’s unique insurance market, helping you compare quotes effectively, and ultimately securing the most suitable and affordable coverage for your needs.

Understanding the factors that influence your premium—from your driving history and vehicle type to the specific coverage you choose—is crucial. We’ll explore these factors in detail, offering practical tips and strategies to help you save money without compromising on essential protection. Whether you’re a seasoned driver or a new motorist, this comprehensive resource empowers you to make informed decisions about your auto insurance in Oklahoma.

Understanding Oklahoma’s Auto Insurance Market

Oklahoma’s auto insurance market, like many others, is a complex interplay of factors affecting both insurers and consumers. Understanding these dynamics is crucial for securing affordable and adequate coverage. The state’s regulatory environment, the demographics of its drivers, and the frequency of accidents all contribute to the overall landscape.

Key Characteristics of Oklahoma’s Auto Insurance Market

Oklahoma is a state with a relatively high rate of uninsured drivers. This contributes to higher insurance premiums for insured drivers, as insurers must account for the increased risk of accidents involving uninsured motorists. The state also experiences a range of weather conditions, from severe thunderstorms to ice storms, which can lead to increased accident rates and subsequent claims. Competition among insurance providers varies across different regions of the state, leading to fluctuations in pricing and available coverage options. The market also reflects national trends, such as rising repair costs and the increasing use of advanced driver-assistance systems (ADAS).

Types of Auto Insurance Coverage in Oklahoma

Oklahoma, like most states, mandates minimum liability coverage. This typically includes bodily injury liability and property damage liability. Beyond the minimum requirements, drivers can purchase additional coverage options to enhance their protection. Common supplemental coverages include collision coverage (which pays for damage to your vehicle regardless of fault), comprehensive coverage (covering damage from events other than collisions, such as theft or hail), uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with an uninsured or underinsured driver), medical payments coverage (covering medical expenses for you and your passengers regardless of fault), and personal injury protection (PIP) coverage (covering medical expenses and lost wages for you and your passengers).

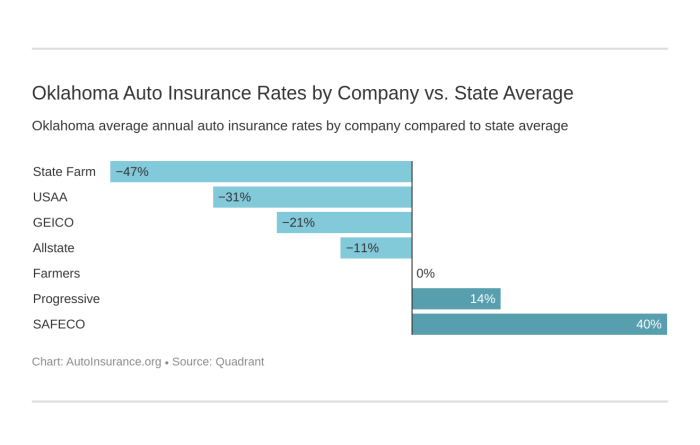

Pricing Structures of Different Insurers in Oklahoma

Insurance companies in Oklahoma utilize different rating methodologies to determine premiums. Factors such as driving history, age, credit score, and the type of vehicle are commonly considered. Some insurers may emphasize specific factors more heavily than others, leading to variations in pricing. For example, one insurer might prioritize credit score while another might focus more heavily on driving history. Direct-to-consumer insurers, often operating primarily online, may offer more competitive pricing compared to traditional brick-and-mortar agencies, but their customer service options might differ. The best way to find the most suitable and affordable coverage is to compare quotes from multiple insurers.

Factors Influencing Auto Insurance Premiums in Oklahoma

The cost of auto insurance in Oklahoma is influenced by several interacting factors. Understanding these factors can help drivers make informed decisions about their coverage.

| Factor | Impact on Premium | Explanation | Example |

|---|---|---|---|

| Driving History | Significant Impact | Accidents and traffic violations increase premiums due to higher risk. | A driver with two at-fault accidents will likely pay significantly more than a driver with a clean record. |

| Age and Gender | Moderate Impact | Younger drivers and males generally pay more due to statistically higher accident rates. | A 16-year-old male driver will typically pay more than a 40-year-old female driver. |

| Credit Score | Moderate Impact | Insurers often use credit scores as an indicator of risk. Higher scores generally lead to lower premiums. | A driver with an excellent credit score may qualify for discounts compared to someone with a poor credit score. |

| Vehicle Type | Moderate Impact | The make, model, and year of the vehicle affect repair costs and theft risk. | A high-performance sports car will typically have higher premiums than a fuel-efficient sedan. |

Finding the Best Auto Insurance Quotes

Securing the best auto insurance quote in Oklahoma requires a strategic approach. By understanding the process and employing effective comparison techniques, you can significantly reduce your premiums and find a policy that suits your needs. This involves leveraging online tools, understanding your coverage options, and knowing what information insurers require.

Obtaining Auto Insurance Quotes Online

The internet offers a streamlined way to compare auto insurance quotes. Most major insurance providers have user-friendly websites where you can input your information and receive instant quotes. The process typically involves completing an online form with details about your vehicle, driving history, and desired coverage. After submitting the form, the system generates a quote based on your profile and the insurer’s pricing algorithms. Remember to carefully review the quote details, including coverage limits, deductibles, and any exclusions. Many sites allow you to compare quotes from multiple providers simultaneously, simplifying the comparison process.

Comparing Auto Insurance Quotes

Comparing quotes from different providers is crucial to finding the best deal. A systematic approach is recommended. First, gather quotes from at least three to five different insurance companies. Next, create a comparison table listing each provider’s name, the premium amount, coverage details (liability, collision, comprehensive, etc.), and any additional features or discounts offered. This organized approach allows for a clear side-by-side comparison, making it easy to identify the most cost-effective and comprehensive options. Pay close attention to the fine print to ensure you understand what each policy covers. Don’t solely focus on the price; consider the level of coverage offered.

Tips for Finding Affordable Auto Insurance in Oklahoma

Several strategies can help you secure affordable auto insurance in Oklahoma. Maintaining a clean driving record is paramount; accidents and traffic violations significantly impact your premiums. Consider increasing your deductible; a higher deductible typically results in lower premiums. Bundle your insurance policies (home and auto) with the same provider to potentially qualify for discounts. Shop around and compare quotes regularly, as rates can change. Explore discounts offered for various factors, such as good student discounts, safe driver discounts, or discounts for anti-theft devices. Lastly, inquire about payment options; some insurers offer discounts for paying premiums annually instead of monthly.

Information Needed for Accurate Quotes

To obtain accurate and relevant auto insurance quotes, you will need to provide certain information. This checklist will ensure a smooth and efficient process.

- Driver Information: Full name, date of birth, driver’s license number, driving history (including accidents and violations), and current address.

- Vehicle Information: Year, make, model, VIN number, and estimated value of the vehicle.

- Coverage Needs: Desired coverage levels (liability, collision, comprehensive, uninsured/underinsured motorist), and deductible amount.

- Address: Your current residential address, as location influences insurance rates.

- Payment Information: Method of payment preferred (credit card, debit card, or electronic funds transfer).

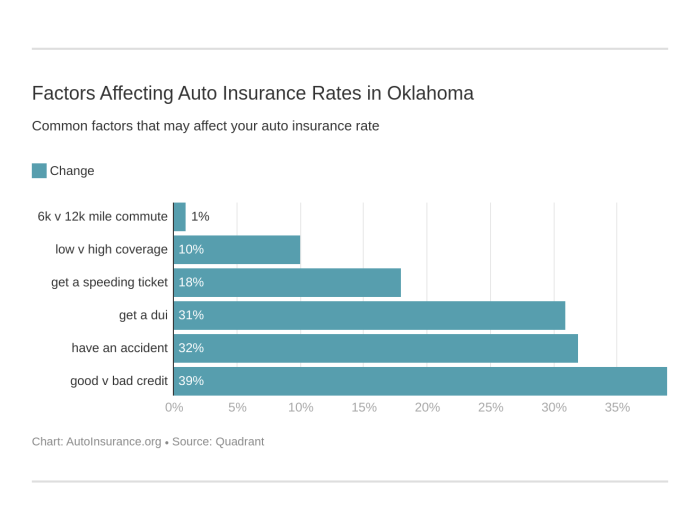

Factors Affecting Auto Insurance Premiums

Several key factors influence the cost of auto insurance in Oklahoma, impacting how much you’ll pay each month or year. Understanding these factors can help you make informed decisions and potentially lower your premiums. These factors work in combination, meaning a positive impact in one area might be offset by a negative one in another.

Driving History

Your driving record is arguably the most significant factor determining your auto insurance premium. Insurance companies meticulously review your history for accidents, traffic violations, and even the number of claims filed. A clean driving record with no accidents or tickets within a specified period (typically three to five years) will result in lower premiums. Conversely, accidents, particularly those deemed your fault, will significantly increase your premiums. Multiple accidents or serious violations like DUI convictions can lead to substantial increases or even policy cancellations. The severity of the accident, such as the amount of damage or injuries involved, also influences the impact on your rates. For example, a minor fender bender will have less impact than a serious collision causing significant property damage or injury.

Age and Gender

Statistically, age and gender correlate with accident risk. Younger drivers, particularly those under 25, generally pay higher premiums due to their higher accident rates. Insurance companies perceive them as higher-risk drivers. As drivers age and gain experience, their premiums tend to decrease. Gender also plays a role, although the impact varies among insurance companies and states. Historically, males have faced higher premiums than females in some areas, again reflecting statistical differences in accident rates. However, this gap is narrowing in many regions as driving habits and accident statistics evolve.

Type of Vehicle

The type of vehicle you drive significantly impacts your insurance costs. Insurance companies assess the vehicle’s make, model, year, safety features, and repair costs. Luxury vehicles, sports cars, and vehicles with a history of theft or high repair costs generally command higher premiums due to their increased risk profile. Conversely, smaller, less expensive vehicles with good safety ratings typically have lower premiums. For instance, a new, fuel-efficient compact car with advanced safety features will usually be cheaper to insure than a used luxury SUV. The vehicle’s safety rating, as determined by organizations like the IIHS (Insurance Institute for Highway Safety), is also a key factor; vehicles with higher safety ratings often attract lower premiums.

Ways to Improve Insurance Rates

Improving your insurance rates involves proactive steps to reduce your perceived risk. Here are some effective strategies:

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Take a defensive driving course: Completing a certified course can demonstrate responsible driving habits and potentially earn you a discount.

- Bundle your insurance: Combining auto insurance with other types of insurance, such as homeowners or renters insurance, from the same company often results in discounts.

- Increase your deductible: Choosing a higher deductible reduces your premium, but you’ll pay more out-of-pocket in the event of a claim.

- Shop around and compare quotes: Different insurance companies use varying algorithms and assess risk differently, so comparing quotes from multiple providers is crucial.

- Maintain good credit: Your credit score can influence your insurance rates in some states, including Oklahoma. Good credit often translates to lower premiums.

- Install anti-theft devices: Adding anti-theft devices to your vehicle can demonstrate your commitment to vehicle security, potentially lowering your premiums.

Types of Auto Insurance Coverage

Choosing the right auto insurance coverage in Oklahoma is crucial for protecting yourself financially in the event of an accident. Understanding the different types of coverage available will help you make an informed decision that best suits your needs and budget. This section will Artikel the key types of coverage and their respective benefits.

Liability Insurance

Liability insurance covers damages and injuries you cause to others in an accident. This is typically the most important type of coverage, as it protects you from potentially devastating financial consequences. It usually includes bodily injury liability, which covers medical expenses and other damages to people injured in an accident you caused, and property damage liability, which covers repairs or replacement costs for damaged property belonging to others. The amounts of coverage are usually expressed as limits, such as 25/50/25, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage. It’s important to choose limits that reflect your potential liability.

Collision and Comprehensive Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects. While these are optional coverages, they offer significant peace of mind and financial protection, especially for newer or more valuable vehicles. For example, if a tree falls on your car during a storm, comprehensive coverage would handle the repairs. If you’re involved in an accident where you’re at fault, collision coverage would cover the damage to your vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. This is vital because many drivers operate without sufficient insurance. UM coverage protects you and your passengers if the at-fault driver lacks insurance. UIM coverage steps in if the at-fault driver’s insurance limits are insufficient to cover your medical bills and other damages. This coverage can help prevent significant out-of-pocket expenses in such situations. For instance, if an uninsured driver causes an accident resulting in substantial medical bills, your UM coverage will help pay for these expenses.

| Coverage Type | Description | Benefits |

|---|---|---|

| Liability Insurance | Covers damages and injuries you cause to others. Includes bodily injury and property damage liability. | Protects you from significant financial responsibility if you cause an accident. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Pays for repairs or replacement of your vehicle after a collision. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions (theft, vandalism, weather, etc.). | Protects your vehicle from various non-collision related damages. |

| Uninsured/Underinsured Motorist Coverage | Protects you if involved in an accident with an uninsured or underinsured driver. | Covers medical bills and other damages when the at-fault driver lacks sufficient insurance. |

Choosing the Right Insurance Provider

Selecting the right auto insurance provider in Oklahoma is crucial for securing adequate coverage at a competitive price. This decision involves careful consideration of several factors beyond just the premium amount, including the insurer’s reputation, financial stability, customer service, and the specific features offered within their policies. A thorough evaluation process ensures you find a provider that aligns with your individual needs and risk profile.

Choosing an insurance provider requires a multifaceted approach. Understanding an insurer’s reputation and financial strength is paramount to ensuring your claims will be handled efficiently and effectively. Similarly, examining customer service experiences and policy features helps determine which provider best fits your needs. Finally, evaluating reviews and ratings provides an external perspective on the insurer’s performance.

Reputation and Financial Stability of Oklahoma Insurance Providers

Several major insurance providers operate within Oklahoma, each with varying reputations and financial standings. It’s important to research the financial strength ratings of these companies, often provided by agencies like A.M. Best. A high rating indicates a greater likelihood of the company being able to pay claims in the event of an accident. For example, a company with an A+ rating from A.M. Best demonstrates superior financial strength compared to one with a lower rating. Consumers should consult these ratings before making a decision. Furthermore, researching online reviews and news articles can provide insights into the company’s history of handling claims and customer disputes. A consistent pattern of positive reviews suggests a reliable and trustworthy provider.

Customer Service Experiences Reported by Policyholders

Customer service is a critical factor when choosing an insurance provider. Negative experiences, such as lengthy wait times, unhelpful representatives, or difficulties filing claims, can significantly impact the overall satisfaction with an insurer. Policyholders frequently share their experiences through online reviews on sites like Yelp, Google Reviews, and the Better Business Bureau. Analyzing these reviews helps gauge the responsiveness and helpfulness of the customer service teams. For example, consistently positive feedback regarding claim processing speed and the professionalism of representatives suggests a positive customer service experience. Conversely, a preponderance of negative reviews might indicate potential issues with the provider’s customer service.

Key Features and Benefits Offered by Different Insurance Companies

Different insurance companies offer various features and benefits that cater to diverse customer needs. Some companies might specialize in accident forgiveness programs, while others may offer discounts for bundling insurance policies or for maintaining a clean driving record. Features like roadside assistance, rental car reimbursement, and uninsured/underinsured motorist coverage are also important considerations. A comparison of these features across multiple providers is essential to identify the best fit for individual requirements. For instance, a driver who frequently travels long distances might prioritize roadside assistance, while a driver with a spotless driving record might focus on insurers offering significant discounts for safe driving.

Evaluating Insurance Company Reviews and Ratings

Review and rating websites offer valuable insights into the overall performance of insurance companies. Websites like J.D. Power and A.M. Best provide ratings based on various factors, including customer satisfaction, financial strength, and claims handling efficiency. It’s important to consider both the overall rating and the specific details within the reviews. For example, a high overall rating accompanied by several negative reviews regarding claim processing might suggest inconsistencies in the company’s performance. A comprehensive review of multiple sources is crucial to gain a balanced perspective. Focusing solely on one rating or review platform could lead to a skewed understanding of the insurance provider’s strengths and weaknesses.

Understanding Policy Details and Fine Print

Carefully reviewing your auto insurance policy is crucial to understanding your coverage and avoiding unexpected surprises. The fine print contains vital information that can significantly impact your ability to file a successful claim. Failing to understand these details could lead to denied claims or insufficient coverage in the event of an accident.

Understanding the specific terms and conditions Artikeld in your policy is essential for maximizing its benefits. This includes being aware of any limitations or exclusions that might affect your coverage.

Common Exclusions and Limitations

Auto insurance policies often contain exclusions, which are specific events or circumstances not covered by the policy. Limitations define the extent of coverage provided. For example, many policies exclude coverage for damage caused by wear and tear, or damage resulting from driving under the influence of alcohol or drugs. Limitations might include a maximum payout for certain types of damages, such as a specific dollar amount for collision repairs. Furthermore, policies might contain clauses that restrict coverage if you fail to report an accident promptly or if you violate the terms of your policy, such as driving a vehicle not listed on your policy. These exclusions and limitations are usually clearly stated in the policy document, often in a section dedicated to “exclusions” or “limitations.”

Examples of Denied Claims

Several scenarios could result in an insurance claim denial. For instance, if you are involved in an accident while driving a vehicle not listed on your policy, your claim might be denied. Similarly, if you fail to cooperate with the insurance company’s investigation following an accident, or if you provide false information, your claim is likely to be denied. Claims for damage caused by wear and tear, or for damage caused by events specifically excluded in your policy, such as flood damage in areas not prone to flooding (unless you have specific flood coverage), would also be denied. Another example is driving without a valid driver’s license; this violation can invalidate your coverage. Finally, claims exceeding the policy’s coverage limits, such as exceeding the liability limit, will result in the insured being responsible for the excess amount.

Questions to Ask Your Insurance Provider

Before purchasing an auto insurance policy, it is vital to clarify several key aspects with your provider. This proactive approach ensures you fully understand your coverage and avoid potential misunderstandings.

- What specific events or situations are excluded from my coverage?

- What are the limitations on my coverage amounts for different types of claims (e.g., liability, collision, comprehensive)?

- What is the process for filing a claim, and what documentation will I need to provide?

- What is the deductible amount for different types of coverage?

- Are there any specific conditions or requirements I must meet to maintain my coverage?

- What are the consequences of failing to report an accident promptly or provide accurate information?

- What is the procedure for appealing a denied claim?

- Does the policy cover rental car expenses following an accident?

- Does the policy offer any roadside assistance services?

- What is the policy’s grace period for payments, and what are the consequences of late payment?

Saving Money on Auto Insurance

Saving money on your auto insurance in Oklahoma is achievable through several strategic approaches. By understanding the factors influencing your premiums and proactively implementing cost-saving measures, you can significantly reduce your annual expenses without compromising essential coverage. This section Artikels effective strategies to help you achieve lower premiums.

Strategies for Reducing Auto Insurance Premiums

Several actions can directly impact your insurance premiums. Maintaining a good driving record is paramount; accidents and traffic violations significantly increase costs. Choosing a vehicle with favorable safety ratings and a lower theft risk can also lead to lower premiums. Consider your vehicle’s usage; those who drive less often generally qualify for lower rates. Finally, exploring different coverage options and deductibles can also result in savings. Higher deductibles mean lower premiums, but you’ll pay more out-of-pocket in case of an accident. Carefully weigh the trade-offs to find the balance that best suits your needs and budget.

Benefits of Bundling Insurance Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, often results in significant discounts. Insurance companies frequently offer bundled packages at a reduced overall price, reflecting the reduced administrative costs associated with managing multiple policies for a single customer. For example, a homeowner might find that bundling their home and auto insurance with the same company results in a 10-15% discount, translating to substantial savings over the policy term. This is a simple and effective way to save money.

Impact of Safe Driving Habits on Insurance Costs

Safe driving habits directly correlate with lower insurance premiums. Insurance companies reward drivers with clean records by offering lower rates. This reflects the reduced risk associated with experienced, responsible drivers. For instance, a driver with a spotless record for five years might qualify for a “good driver” discount, potentially reducing their premium by 10% or more. Conversely, accidents and traffic violations lead to higher premiums due to the increased risk of future claims. Maintaining a safe driving record is not only crucial for personal safety but also a key factor in controlling insurance costs.

Potential Savings Through Discounts and Programs

Many insurance companies offer various discounts and programs designed to reward responsible drivers and promote safety. These include discounts for good students, mature drivers (those over a certain age), and those who complete defensive driving courses. Some companies also offer discounts for installing anti-theft devices or for bundling multiple policies, as previously discussed. For example, a good student discount could reduce premiums by 15-20%, while a mature driver discount might offer a 5-10% reduction. These discounts can add up to substantial savings over time. It’s worthwhile to inquire about all available discounts when obtaining quotes from different insurers.

Concluding Remarks

Securing the right auto insurance in Oklahoma involves a thoughtful approach. By understanding the market dynamics, comparing quotes effectively, and considering the various factors influencing premiums, you can confidently choose a policy that balances comprehensive coverage with affordability. Remember to thoroughly review policy details and ask questions to ensure complete understanding before committing to a provider. With careful planning and the information provided in this guide, you can navigate the Oklahoma auto insurance landscape with ease and secure the best possible protection for yourself and your vehicle.

Commonly Asked Questions

What is SR-22 insurance and do I need it in Oklahoma?

SR-22 insurance is proof of financial responsibility required by the state after certain driving offenses (like DUI). You’ll need it if mandated by the Oklahoma Department of Public Safety.

Can I get auto insurance if I have a DUI on my record?

Yes, but it will likely be more expensive. Companies consider your driving history, and a DUI significantly impacts your premiums. You may need to shop around for specialized high-risk insurers.

How often can I change my auto insurance provider?

You can generally switch providers whenever your current policy renews. There’s usually no penalty for switching, but you might need to pay a pro-rated premium for the remaining time on your current policy.

What is the minimum liability coverage required in Oklahoma?

Oklahoma’s minimum liability coverage is 25/50/25, meaning $25,000 for injury per person, $50,000 for total injury per accident, and $25,000 for property damage.