Securing affordable and comprehensive auto insurance is a crucial step for responsible drivers. This guide delves into the specifics of obtaining a State Farm auto insurance quote, exploring the factors that influence pricing, the various coverage options available, and the overall customer experience. We’ll navigate the online quoting process, compare State Farm’s offerings to competitors, and uncover strategies to maximize your savings.

From understanding the nuances of liability, collision, and comprehensive coverage to leveraging discounts and utilizing State Farm’s digital tools, we aim to equip you with the knowledge to make informed decisions about your auto insurance needs. We’ll also examine the claims process and customer service aspects, ensuring a holistic understanding of what State Farm offers.

State Farm Auto Insurance Overview

State Farm is one of the largest and most well-known auto insurance providers in the United States, offering a comprehensive range of coverage options and services designed to meet diverse customer needs. They are known for their strong customer service reputation and extensive agent network. Their offerings are designed to provide financial protection and peace of mind to drivers across the country.

State Farm provides a variety of auto insurance coverages to protect drivers and their vehicles. These coverages are designed to address different potential risks and financial liabilities associated with owning and operating a vehicle.

Types of Auto Insurance Coverage Offered by State Farm

State Farm offers a standard suite of auto insurance coverages, including liability coverage (bodily injury and property damage), collision coverage (damage to your vehicle from accidents), comprehensive coverage (damage to your vehicle from non-accident events like theft or hail), uninsured/underinsured motorist coverage (protection if you’re hit by an uninsured driver), medical payments coverage (medical bills for you and your passengers), and personal injury protection (PIP, which covers medical bills and lost wages regardless of fault). They also offer additional optional coverages such as rental reimbursement and roadside assistance. The specific availability and details of each coverage may vary by state and individual policy.

Key Features and Benefits of State Farm Auto Insurance

State Farm differentiates itself from competitors through several key features and benefits. Their extensive agent network provides personalized service and convenient access to assistance. Many policyholders value the ease of working with a local agent for policy adjustments and claims. State Farm also offers a range of discounts, such as good driver discounts, multi-policy discounts (bundling auto and home insurance), and safe driver discounts based on telematics programs. Their strong financial stability and high ratings from independent rating agencies provide customers with confidence in their ability to pay claims. Additionally, State Farm offers various digital tools and resources, making managing your policy and filing claims easier.

Comparison of State Farm and Geico Auto Insurance Coverages

The following table compares State Farm’s coverage options with those offered by Geico, another major auto insurance provider. Note that specific pricing and coverage details will vary depending on individual factors such as driving history, location, and the specific vehicle being insured. This is a general comparison for illustrative purposes only.

| Coverage Type | State Farm | Geico | Notes |

|---|---|---|---|

| Liability | Bodily Injury & Property Damage; customizable limits | Bodily Injury & Property Damage; customizable limits | Both offer standard liability coverage, with varying limit options. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault | Covers damage to your vehicle in an accident, regardless of fault | Both offer collision coverage, potentially with deductibles. |

| Comprehensive | Covers damage to your vehicle from non-accident events (theft, fire, hail, etc.) | Covers damage to your vehicle from non-accident events (theft, fire, hail, etc.) | Both offer comprehensive coverage, with deductibles often applying. |

| Uninsured/Underinsured Motorist | Protects you if hit by an uninsured or underinsured driver | Protects you if hit by an uninsured or underinsured driver | This coverage is crucial for financial protection in certain accident scenarios. |

Obtaining a State Farm Auto Insurance Quote

Getting an auto insurance quote from State Farm is a straightforward process, designed to provide you with a personalized estimate of your potential premiums. Whether you prefer the convenience of online tools or the personalized service of a local agent, State Farm offers multiple avenues to explore your coverage options and pricing. This section focuses on obtaining a quote through their website.

The online quote process is user-friendly and generally quick. State Farm’s website guides you through a series of questions designed to accurately assess your risk profile. This information is crucial for generating a precise and relevant quote. Providing accurate and complete information is key to receiving a quote that truly reflects your individual circumstances.

Information Required for an Accurate Quote

State Farm will require specific information to calculate your insurance premium. This data allows them to accurately assess your risk and provide a fair and competitive quote. Providing incomplete or inaccurate information may result in an inaccurate quote or even delays in processing your application.

The types of information typically requested include:

- Driver Information: This includes your age, driving history (including accidents, tickets, and DUI convictions), driving experience, and your address. State Farm uses this information to assess your risk as a driver.

- Vehicle Information: Details about your vehicle(s) are essential, including the year, make, model, and VIN. The vehicle’s value and safety features influence the premium.

- Coverage Preferences: You will need to specify the type and level of coverage you desire (liability, collision, comprehensive, etc.). Choosing higher coverage limits will typically result in a higher premium, but also greater financial protection.

- Location: Your address is a critical factor, as insurance rates vary significantly by location due to factors like accident rates and theft statistics.

Factors Influencing the Cost of a State Farm Auto Insurance Quote

Several factors contribute to the final cost of your State Farm auto insurance quote. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your premiums.

Key factors influencing the cost include:

- Driving History: A clean driving record with no accidents or tickets will generally result in lower premiums. Conversely, a history of accidents or violations will significantly increase your rates.

- Vehicle Type: The make, model, and year of your vehicle play a significant role. Expensive cars or those with a history of theft or accidents will usually have higher premiums.

- Coverage Levels: Choosing higher coverage limits will increase your premium, but provides greater financial protection in case of an accident.

- Location: Your geographic location impacts your rates due to varying accident rates and crime statistics. Areas with higher accident rates typically have higher premiums.

- Age and Gender: Statistical data shows that age and gender can influence risk assessment and thus, insurance premiums.

- Discounts: State Farm offers various discounts, such as good student discounts, multi-car discounts, and safe driver discounts, which can significantly lower your premium. Taking advantage of these can result in substantial savings.

Comparing Quotes from Different Insurance Providers

Comparing quotes from multiple insurance providers is crucial to finding the best coverage at the most competitive price. This allows you to evaluate different coverage options and pricing structures to make an informed decision.

A step-by-step guide for comparing quotes:

- Gather Necessary Information: Collect all the information needed for each quote (driving history, vehicle details, etc.). This will streamline the process.

- Obtain Quotes Online: Visit the websites of several insurance providers, including State Farm, and use their online quote tools. Ensure you are providing consistent information across all quotes.

- Compare Coverage Options: Carefully review the coverage details of each quote, paying close attention to the limits of liability, collision, and comprehensive coverage.

- Analyze Premiums: Compare the total annual premiums for each quote. Remember to consider the overall value you receive for the price.

- Read the Fine Print: Before making a decision, carefully review the policy documents of each provider to understand the terms and conditions.

- Contact Agents (Optional): If you have questions or require clarification, contact agents from the different companies to discuss your options.

Factors Affecting State Farm Auto Insurance Premiums

Several key factors influence the cost of your State Farm auto insurance premium. Understanding these factors can help you make informed decisions and potentially lower your costs. These factors are assessed individually and then combined to determine your final premium. It’s a complex calculation, but understanding the components makes the process more transparent.

Your driving history, vehicle characteristics, and location are among the most significant factors determining your State Farm auto insurance rate. State Farm, like other insurance companies, uses actuarial data to assess risk and price policies accordingly. This means they analyze historical data to predict the likelihood of accidents and claims based on various characteristics of the insured and their vehicle.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance premium. Accidents and traffic violations increase your risk profile, leading to higher premiums. A clean driving record, on the other hand, reflects lower risk and often results in lower premiums. For example, a driver with multiple at-fault accidents in the past three years will likely pay substantially more than a driver with a spotless record. Similarly, accumulating speeding tickets or other moving violations will also increase your premium. The severity of the accident or violation also plays a role; a serious accident will have a greater impact than a minor fender bender. State Farm uses a points system, assigning points for different infractions. The more points accumulated, the higher the premium.

Vehicle Type and Characteristics

The type of vehicle you insure significantly influences your premium. Generally, newer vehicles, particularly those with advanced safety features, are associated with lower premiums than older models. This is because newer cars often have better safety ratings and are less prone to mechanical failures that could lead to accidents. Sports cars and other high-performance vehicles typically command higher premiums due to their higher risk profile, as they are often involved in more accidents. Factors such as the vehicle’s make, model, year, and safety features all play a role in determining your premium. A high-value vehicle may also result in a higher premium due to the increased cost of repairs or replacement.

Other Factors Affecting Premiums

Beyond driving history and vehicle type, several other factors contribute to your State Farm auto insurance premium. These factors are often considered in combination to create a comprehensive risk assessment.

- Location: Your address influences premiums due to varying accident rates and theft risks in different areas. Higher-crime areas or areas with more frequent accidents generally lead to higher premiums.

- Age and Gender: Statistically, younger drivers and males tend to have higher accident rates, resulting in higher premiums. This is a broad generalization, and individual driving records are also taken into account.

- Coverage Levels: The amount of coverage you choose (liability, collision, comprehensive) directly impacts your premium. Higher coverage limits typically result in higher premiums.

- Credit Score: In many states, your credit score is a factor in determining your insurance rates. A higher credit score often correlates with lower premiums.

- Discounts: State Farm offers various discounts that can lower your premiums, such as discounts for bundling insurance policies, having a good student record, or installing anti-theft devices in your vehicle.

State Farm’s Customer Service and Claims Process

State Farm, one of the nation’s largest insurance providers, offers a multi-faceted approach to customer service and claims handling. Understanding their various channels and the claims process can significantly improve your experience should you need to utilize their services. This section details State Farm’s customer service options and provides a step-by-step guide to navigating the claims process.

State Farm’s Customer Service Channels

State Farm provides multiple avenues for customers to access support and information. These channels are designed to cater to diverse preferences and levels of technological comfort.

Customer Service Contact Methods

Customers can reach State Farm through various channels: phone calls to their dedicated customer service lines, online interactions through their website’s portal, and in-person visits to local State Farm agent offices. The phone line offers immediate assistance, the website provides self-service options and access to account information, and in-person visits allow for more personalized interactions. The responsiveness and helpfulness of State Farm’s customer service vary depending on the channel and the specific agent or representative. While many customers report positive experiences, some have noted longer wait times or difficulties reaching a live agent, particularly during peak periods. Online reviews often highlight both positive and negative experiences, emphasizing the importance of patience and persistence when seeking assistance.

State Farm Claims Process

Filing a claim with State Farm generally involves several key steps, from initial notification to final settlement. The exact process may vary depending on the type of claim (auto, home, etc.), but the fundamental steps remain consistent. Prompt and accurate reporting is crucial to expedite the process.

Filing a Claim with State Farm

The claims process begins with reporting the incident. This can be done through their website, mobile app, or by calling their claims line. Following the initial report, State Farm will assign a claims adjuster who will investigate the incident, gather evidence, and assess the damages. This investigation might include taking statements, reviewing police reports, and inspecting the damaged property or vehicle. Once the investigation is complete, the adjuster will determine the extent of coverage and the amount of the settlement. The settlement may be paid directly to the insured or to the repair facility, depending on the agreement and the nature of the damages. Throughout the process, State Farm provides updates to the policyholder on the progress of their claim.

State Farm Claims Process Flowchart

Report the incident (phone, online, app)

Claims adjuster assigned

Investigation and evidence gathering (statements, police reports, inspections)

Damage assessment and coverage determination

Settlement offer and payment

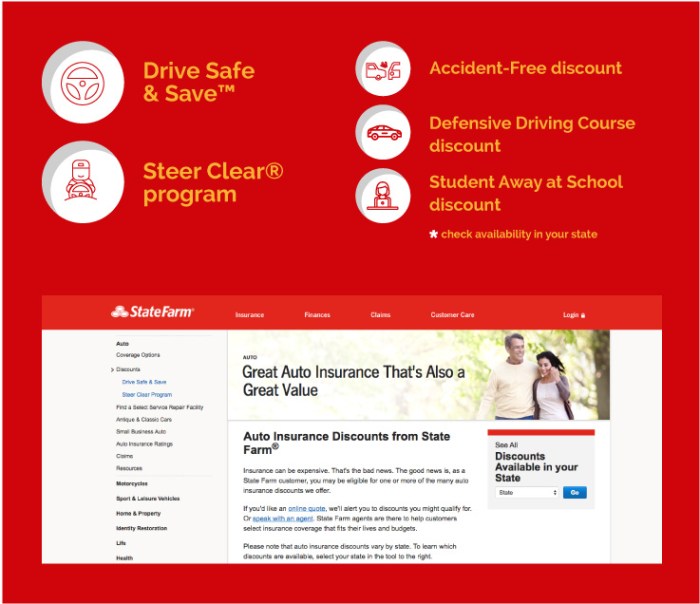

State Farm’s Discounts and Savings Programs

State Farm offers a wide array of discounts designed to reward safe driving habits and responsible insurance practices. These discounts can significantly reduce your premium, making State Farm a potentially cost-effective choice for many drivers. Understanding the available discounts and their eligibility requirements is crucial for maximizing your savings.

Several factors influence the specific discounts available to you. These include your driving history, the type of vehicle you insure, and the features of your vehicle. It’s important to contact your State Farm agent to determine your eligibility for each discount and to calculate your personalized premium.

Discounts Offered by State Farm

State Farm provides a variety of discounts, and the availability of each may vary depending on your location and specific circumstances. It’s advisable to contact your local agent for the most up-to-date information. However, some commonly offered discounts include:

- Safe Driver Discount: This discount rewards drivers with clean driving records, typically free of accidents and traffic violations for a specified period. Eligibility requires a proven history of safe driving, demonstrated through your driving record.

- Multi-Car Discount: Insuring multiple vehicles under one State Farm policy often qualifies you for a significant discount. The more vehicles you insure, the greater the potential savings.

- Bundling Discount: Combining your auto insurance with other State Farm insurance products, such as homeowners or renters insurance, typically results in a substantial discount. This is because State Farm rewards customers who consolidate their insurance needs with them.

- Defensive Driving Course Discount: Completing an approved defensive driving course can often lead to a discount. Eligibility depends on successful completion of a course recognized by State Farm.

- Good Student Discount: Students maintaining a certain grade point average (GPA) may qualify for this discount. Eligibility criteria vary by state and educational level, usually requiring a high GPA and full-time enrollment.

- Vehicle Safety Features Discount: Vehicles equipped with certain safety features, such as anti-theft devices or advanced driver-assistance systems (ADAS), may qualify for a discount. This recognizes the reduced risk associated with these features.

Calculating Potential Savings

Let’s illustrate how these discounts can combine to lower your premium. Assume a hypothetical base premium of $1200 per year.

| Discount | Discount Percentage | Savings |

|---|---|---|

| Safe Driver | 10% | $120 |

| Multi-Car | 5% | $60 |

| Bundling | 15% | $180 |

In this example, the total savings would be $120 + $60 + $180 = $360. This would reduce the annual premium to $1200 – $360 = $840. This is a significant reduction, highlighting the value of combining multiple discounts.

The actual savings will vary depending on your specific circumstances and the discounts you qualify for. Contact your State Farm agent for a personalized quote.

State Farm’s Digital Tools and Resources

State Farm offers a robust suite of digital tools and resources designed to enhance policyholder convenience and accessibility. These tools allow for streamlined management of insurance policies, simplified claims processes, and proactive engagement with State Farm services, all from the comfort of your home or on the go. The availability and specific features of these tools may vary depending on your policy and location.

State Farm’s digital presence is centered around its mobile application and online account management system. Both platforms provide a user-friendly interface to manage various aspects of your insurance policy, providing a significant improvement over traditional methods. The integration between these platforms allows for a seamless and consistent experience regardless of the device used.

State Farm Mobile App Functionality

The State Farm mobile app is a comprehensive tool designed to provide policyholders with quick and easy access to their insurance information and services. Key features include the ability to view policy details, make payments, report claims, find nearby State Farm agents, and access roadside assistance. The app also offers personalized alerts and notifications, keeping you informed about important policy updates or potential issues. For example, the app might send a notification reminding you of an upcoming payment due date or alert you to potential severe weather in your area that could impact your driving. The intuitive design makes navigating the app simple, even for those less familiar with mobile technology. The app also incorporates features like ID cards, providing quick access to your policy information in case of an emergency.

State Farm Online Account Management System Benefits

Managing your State Farm insurance policy online offers numerous advantages. The online account management system provides a centralized location to access and manage all aspects of your policy, including viewing your coverage details, updating your personal information, making payments, reviewing your claims history, and exploring available discounts. This centralized approach simplifies policy management and eliminates the need for phone calls or visits to a local agent for routine tasks. The system is designed for ease of use, with a clear and intuitive layout that makes finding the information you need straightforward. The ability to access your policy information anytime, anywhere, offers significant convenience and peace of mind. For example, quickly checking your policy’s deductible amount before deciding whether to file a small claim is made significantly easier through this online portal.

Features and Functionalities of State Farm’s Digital Platforms

The following list summarizes the key features and functionalities available through State Farm’s digital platforms, showcasing the breadth of services offered to policyholders.

- Policy Management: View coverage details, make changes to your policy (subject to availability), and access policy documents.

- Payment Processing: Make payments, schedule automatic payments, and view payment history.

- Claims Reporting: Report claims quickly and easily, track claim status, and communicate with adjusters.

- Roadside Assistance: Access roadside assistance services directly through the app in case of a breakdown or other emergency.

- Agent Locator: Find nearby State Farm agents and schedule appointments.

- Digital ID Cards: Access digital copies of your insurance ID cards.

- Personalized Notifications: Receive alerts and reminders regarding payments, policy updates, and potential risks.

- Document Upload: Upload supporting documents related to claims or policy changes.

- Customer Support: Access online help resources and contact customer support through various channels.

Illustrative Example

This example demonstrates a fictional scenario of obtaining a State Farm auto insurance quote, highlighting the process, the factors considered, and the resulting quote details. We will follow Sarah Miller through her quote process to illustrate a typical experience.

Sarah, a 32-year-old resident of Chicago, Illinois, is looking to insure her new 2023 Honda Civic. She has a clean driving record with no accidents or violations in the past five years. She wishes to obtain a quote through State Farm’s online platform.

Sarah’s Profile and Quote Details

Sarah provides her information, including her age, address, driving history, and vehicle details. The system then calculates her potential premium based on several factors including her location, vehicle type, driving history, and the coverage options she selects. In this example, State Farm’s system generates a quote based on her specific circumstances. The quote includes liability coverage of $100,000/$300,000 bodily injury and $50,000 property damage, collision coverage with a $500 deductible, and comprehensive coverage with a $500 deductible. The final quote, reflecting these choices, comes to $120 per month.

Coverage Options and Costs

The breakdown of Sarah’s quote shows liability coverage costing $60 per month, collision coverage at $40 per month, and comprehensive coverage at $20 per month. These figures are illustrative and vary based on numerous factors. Sarah could have opted for different coverage levels, affecting the final premium. For instance, increasing her liability limits would increase the cost, while choosing higher deductibles would lower it. She could also choose to forgo certain coverages, such as comprehensive, if she felt it wasn’t necessary.

Overall Quote Experience

Sarah found the online quote process to be straightforward and easy to navigate. The website provided clear instructions and readily available information. The system clearly Artikeld each coverage option and its associated cost, allowing Sarah to make informed decisions. The entire process, from entering her information to receiving her quote, took less than 15 minutes. The clarity of information and the ease of use made her experience positive and efficient. The system also provided a detailed summary of the quote, allowing her to review the information before proceeding. There was a clear path to obtaining additional information or contacting a State Farm agent should she have required assistance.

Concluding Remarks

Choosing the right auto insurance provider is a significant financial decision. This guide has provided a detailed overview of State Farm’s auto insurance offerings, empowering you to confidently navigate the quoting process and secure the best coverage for your needs. By understanding the factors affecting premiums, utilizing available discounts, and leveraging State Farm’s digital resources, you can optimize your insurance costs while ensuring comprehensive protection. Remember to compare quotes from multiple providers to find the best fit for your individual circumstances.

FAQ Summary

How long does it take to get a State Farm auto insurance quote?

The online quoting process is typically quick, often taking only a few minutes to complete. However, the time may vary depending on the complexity of your information and the system’s availability.

Can I bundle my home and auto insurance with State Farm?

Yes, State Farm offers significant discounts for bundling home and auto insurance policies. This can lead to substantial savings compared to purchasing separate policies.

What happens if I need to make a change to my State Farm policy after it’s issued?

You can usually make changes to your policy online through your State Farm account, by phone, or by contacting your agent. The specific process and any associated fees will depend on the nature of the change.

Does State Farm offer roadside assistance?

Yes, roadside assistance is often available as an add-on to your State Farm auto insurance policy. Check your policy details or contact State Farm to learn about availability and coverage.