Navigating the world of auto insurance in Michigan can feel overwhelming, with its unique no-fault system and a wide array of coverage options. Understanding the factors that influence your premium, from driving history to vehicle type, is crucial to securing the best possible rate. This guide provides a clear and concise overview of Michigan auto insurance, empowering you to make informed decisions and find the right coverage at the right price.

We’ll delve into the specifics of Michigan’s mandatory coverage requirements, explore various coverage types, and offer practical tips for comparing quotes and securing discounts. Learn how factors like your driving record, age, and even your credit score can impact your premiums, and discover strategies to minimize your costs while ensuring adequate protection.

Understanding Michigan Auto Insurance Requirements

Choosing the right auto insurance in Michigan can seem daunting, but understanding the state’s requirements is the first step to securing adequate protection. This information will clarify the mandatory coverages and help you determine the appropriate level of protection for your needs. Failing to meet minimum requirements can result in significant penalties.

Michigan has a unique auto insurance system, requiring drivers to carry specific types of coverage. The state mandates no-fault insurance, meaning your own insurance company will cover your medical expenses and lost wages regardless of who caused the accident. However, this doesn’t absolve you from responsibility for damages you cause to others.

Mandatory Coverage Types in Michigan

Michigan law mandates several types of auto insurance coverage. These coverages are designed to protect you and others involved in an accident. Understanding the differences between them is crucial for making informed decisions about your insurance policy.

Minimum vs. Recommended Coverage Levels

While minimum coverage fulfills the legal requirements, it may not provide sufficient protection in the event of a serious accident. The minimum coverage often leaves significant gaps in financial protection, especially when dealing with substantial medical bills or property damage. Therefore, opting for higher coverage limits is strongly recommended.

Liability Limits and Their Implications

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party. Liability limits are expressed as three numbers (e.g., 25/50/10), representing bodily injury per person, bodily injury per accident, and property damage per accident, respectively. Lower limits mean you are personally liable for any costs exceeding those limits. For example, a 25/50/10 policy means your insurance will cover up to $25,000 for injuries to one person, $50,000 for injuries to multiple people in a single accident, and $10,000 for property damage. A higher limit, such as 100/300/100, provides significantly more protection.

Michigan Auto Insurance Coverage Comparison

| Coverage Type | Minimum Requirement | Recommended Amount | Explanation |

|---|---|---|---|

| Bodily Injury Liability | 20/40 | 100/300 or higher | Covers injuries to others in an accident you caused. |

| Property Damage Liability | 10,000 | 100,000 or higher | Covers damage to others’ property in an accident you caused. |

| Uninsured/Underinsured Motorist | 20/40/10 | Match your liability limits or higher | Covers injuries and damages caused by an uninsured or underinsured driver. |

| Personal Injury Protection (PIP) | Required, but amounts vary | Unlimited or high coverage recommended | Covers your medical bills and lost wages regardless of fault. |

Factors Affecting Michigan Auto Insurance Quotes

Obtaining affordable auto insurance in Michigan requires understanding the various factors that influence your premium. Several key elements contribute to the final cost, and it’s crucial to be aware of these to make informed decisions about your coverage. This section details the significant factors impacting your Michigan auto insurance quote.

Driving History’s Impact on Premiums

Your driving record significantly affects your auto insurance rates in Michigan. Insurance companies assess risk based on your past driving behavior. Accidents and traffic violations, such as speeding tickets or DUIs, are major factors. Multiple accidents or serious violations will generally result in substantially higher premiums. Conversely, a clean driving record with no accidents or tickets will often lead to lower rates. The severity and frequency of incidents are key considerations; a single minor fender bender will have a less dramatic impact than multiple accidents involving significant property damage or injuries. Maintaining a safe driving record is essential for keeping your insurance costs manageable.

Age, Gender, and Credit Score Influence

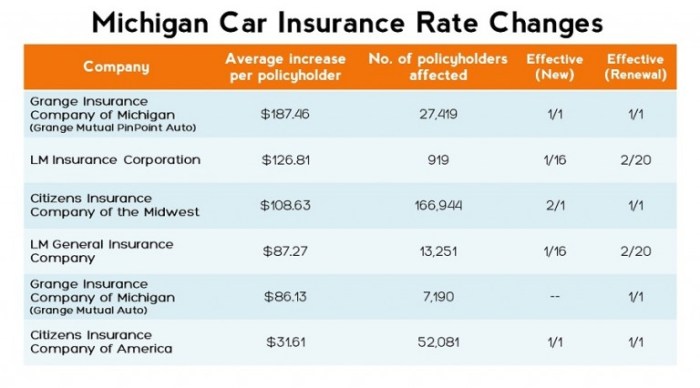

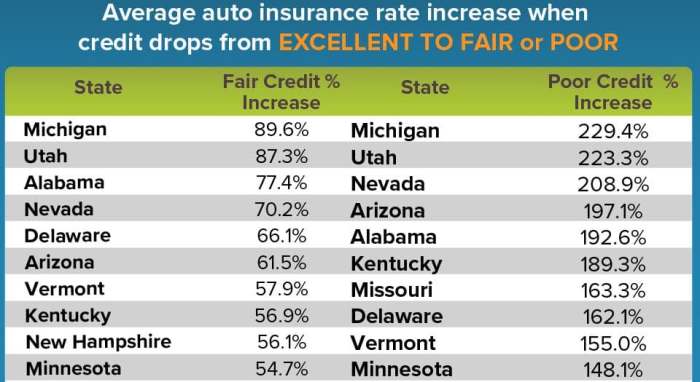

Age and gender play a role in determining auto insurance rates, reflecting statistical trends in accident frequency and severity. Younger drivers, particularly those under 25, often pay higher premiums due to increased risk. Insurance companies use actuarial data to assess risk profiles for different age groups. Similarly, gender can also be a factor in some insurance calculations, although this is becoming increasingly regulated and less prevalent. Your credit score also surprisingly influences your insurance rates in Michigan. Insurers often use credit-based insurance scores, believing that those with poor credit are more likely to file claims. Improving your credit score can potentially lead to lower insurance premiums.

Vehicle Type and Safety Features

The type of vehicle you drive significantly impacts your insurance costs. Higher-performance vehicles, sports cars, and luxury cars often command higher premiums due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles typically have lower insurance rates. A vehicle’s safety rating also plays a role. Cars with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, tend to have lower premiums because they are statistically associated with fewer accidents and less severe injuries. The vehicle’s make, model, and year are also considered in assessing risk and determining premiums.

Summary of Factors Affecting Michigan Auto Insurance Quotes

The following list summarizes how each factor impacts your final auto insurance quote:

- Driving History: Accidents and tickets increase premiums; a clean record lowers them.

- Age: Younger drivers generally pay more due to higher risk profiles.

- Gender: While less significant now, gender may still be a minor factor in some calculations.

- Credit Score: A higher credit score can lead to lower premiums.

- Vehicle Type: Expensive, high-performance cars generally have higher rates than less expensive vehicles.

- Vehicle Safety Ratings: Cars with advanced safety features often result in lower premiums.

Types of Auto Insurance Coverage in Michigan

Choosing the right auto insurance coverage in Michigan is crucial for protecting yourself financially in the event of an accident. Understanding the different types of coverage available will help you make informed decisions and ensure you have adequate protection. This section details the common types of coverage, their benefits, limitations, and examples of when they would be useful.

Collision Coverage

Collision coverage pays for damage to your vehicle caused by a collision with another vehicle or object, regardless of fault. This means that even if you cause the accident, your insurance will cover the repairs or replacement of your car. However, there’s usually a deductible you’ll need to pay before the insurance company covers the rest. For example, if you hit a deer, or if you rear-end another car, collision coverage would help pay for the repairs to your vehicle. The amount of coverage is typically limited to the actual cash value (ACV) of your vehicle at the time of the accident, or the cost of repairs, whichever is less.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail, and damage from animals. Like collision coverage, there’s usually a deductible. Imagine a tree falling on your car during a storm, or someone keying your vehicle; comprehensive coverage would step in to cover the repairs. It’s important to note that comprehensive coverage does not cover damage caused by collisions.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. This is particularly important in Michigan, where a significant number of drivers may not carry sufficient liability insurance. If the at-fault driver doesn’t have enough insurance to cover your medical bills and vehicle repairs, your UM/UIM coverage will help fill the gap. For instance, if you’re seriously injured in an accident caused by an uninsured driver, this coverage could pay for your medical expenses and lost wages. It’s often offered in bodily injury and property damage options.

Liability Coverage

Liability coverage pays for the injuries and damages you cause to others in an accident if you are at fault. This is legally required in Michigan. It covers the medical expenses, lost wages, and property damage of the other person(s) involved. For example, if you cause an accident that injures another driver and damages their car, your liability coverage would help pay for their medical bills and car repairs. The amount of coverage is typically expressed as two numbers (e.g., 25/50/10), representing bodily injury per person, bodily injury per accident, and property damage.

Personal Injury Protection (PIP)

PIP coverage in Michigan is mandatory and pays for your medical bills and lost wages, regardless of fault. This includes expenses for you, your passengers, and even family members in your vehicle. It also covers expenses for funeral costs. Even if you cause the accident, your PIP coverage will help cover your medical expenses. For example, if you’re injured in a car accident, PIP will cover your medical bills, regardless of who was at fault. It is important to understand that PIP benefits are subject to specific limits and may require a co-pay or deductible.

Table Comparing Auto Insurance Coverages in Michigan

| Coverage Type | Benefits | Limitations | Typical Cost (Estimate) |

|---|---|---|---|

| Collision | Covers damage to your vehicle in a collision, regardless of fault. | Deductible applies; typically covers only the ACV or repair costs. | Varies widely based on factors such as vehicle type, driving history, and location; expect to pay more for higher coverage limits and lower deductibles. |

| Comprehensive | Covers damage to your vehicle from events other than collisions (theft, fire, vandalism, etc.). | Deductible applies; excludes collision damage. | Generally less expensive than collision coverage; cost varies based on similar factors. |

| Uninsured/Underinsured Motorist | Covers injuries and damages caused by an uninsured or underinsured driver. | Coverage limits apply; may not fully cover all losses. | Cost varies based on coverage limits and other factors. |

| Liability | Covers injuries and damages you cause to others. | Does not cover your own injuries or vehicle damage. | Legally required; cost varies significantly based on coverage limits and driving record. |

| Personal Injury Protection (PIP) | Covers medical bills and lost wages for you and your passengers, regardless of fault. | Coverage limits and deductibles apply; benefits are subject to specific requirements and limitations. | Mandatory in Michigan; cost varies based on coverage limits. |

Finding and Comparing Auto Insurance Quotes in Michigan

Securing the best auto insurance in Michigan involves more than just finding the cheapest quote. A thorough comparison of various insurers and policies is crucial to ensure you receive adequate coverage at a competitive price. This process requires a systematic approach, careful consideration of your needs, and a discerning eye for value.

Obtaining Quotes from Different Insurers

Gathering quotes from multiple insurance providers is the first step towards finding the right policy. This allows for a direct comparison of prices and coverage options. A simple online search can reveal many insurers operating in Michigan. You can then visit their websites, use online comparison tools, or contact them directly via phone or email to request a quote. Remember to provide accurate and complete information to each insurer to ensure the quotes are accurate reflections of your risk profile.

Effectively Comparing Quotes and Identifying the Best Value

Once you’ve gathered several quotes, comparing them effectively requires more than simply looking at the price. Consider the coverage levels offered by each policy. A lower premium might come with reduced coverage, potentially leaving you vulnerable in the event of an accident. Compare deductibles, liability limits, and other crucial aspects of each policy. Look for any hidden fees or additional charges. Prioritize policies that offer comprehensive coverage that aligns with your needs and financial capacity. Creating a simple table comparing premiums, deductibles, and coverage limits can significantly aid this process. For example, comparing a $1,000 deductible policy with a $500 deductible policy, even if the latter has a slightly higher premium, might be more financially beneficial in the long run, depending on your risk tolerance.

Reading Policy Details Carefully Before Making a Decision

Before committing to any policy, thoroughly review the policy documents. Don’t just skim the highlights; read the fine print. Pay close attention to exclusions, limitations, and specific definitions of coverage. Understanding these details will prevent unexpected surprises and ensure you’re fully aware of what is and isn’t covered under the policy. For example, some policies might exclude coverage for certain types of accidents or driving conditions. Understanding these nuances is critical to making an informed decision.

Questions to Ask Insurance Providers Before Selecting a Policy

Asking the right questions can clarify any uncertainties and ensure you’re making an informed decision. A prepared list of questions can guide your conversations with insurers. For example, inquire about the claims process, customer service availability, and the insurer’s financial stability rating. Understanding their claims process, including how long it typically takes to settle a claim, is crucial. Asking about discounts for safe driving, bundling policies, or other potential savings can also lead to significant cost reductions. Finally, inquire about the insurer’s reputation and customer reviews. Checking independent rating agencies for their financial strength and customer satisfaction ratings can provide valuable insights.

Michigan’s No-Fault System and its Impact on Quotes

Michigan’s unique no-fault auto insurance system significantly impacts the cost and structure of car insurance premiums. Understanding its mechanics is crucial for anyone seeking auto insurance in the state. This system, while aiming to streamline accident claims, has resulted in some of the highest auto insurance rates in the nation.

Michigan’s no-fault system means that after a car accident, your own insurance company covers your medical bills and lost wages, regardless of who caused the accident. This contrasts with at-fault systems, where the at-fault driver’s insurance pays for the other party’s damages. The system aims to reduce litigation and provide quicker compensation to injured individuals.

How the No-Fault System Affects Insurance Costs

The no-fault system’s impact on insurance costs is multifaceted. The unlimited medical benefits coverage mandated under the system is a primary driver of high premiums. The sheer volume of claims, coupled with the potential for extensive medical expenses to be covered, increases the financial burden on insurance companies, which is ultimately passed on to consumers through higher premiums. Furthermore, the ability to sue for pain and suffering is limited under the no-fault system, although exceptions exist for serious injuries. This limitation, while intended to reduce litigation costs, hasn’t entirely eliminated lawsuits and their associated expenses. The combination of unlimited medical coverage and the potential for legal action, even if restricted, contributes significantly to the high cost of Michigan auto insurance.

Benefits of Michigan’s No-Fault System

One perceived benefit is the swift access to medical care and financial assistance following an accident. Injured individuals can begin receiving compensation for their medical bills and lost wages without lengthy legal battles to determine fault. This can provide crucial financial stability during recovery. Furthermore, the system aims to reduce the number of lawsuits related to car accidents, potentially easing the burden on the court system.

Drawbacks of Michigan’s No-Fault System

The most significant drawback is the extraordinarily high cost of insurance premiums. Michigan consistently ranks among the states with the highest auto insurance rates, largely due to the unlimited medical benefits provision in the no-fault system. This high cost disproportionately affects low-income individuals and families. Another concern is the potential for fraud and abuse within the system. The unlimited medical benefit coverage can incentivize unnecessary or inflated medical treatments, further driving up costs. The complexity of the system also makes it challenging for individuals to navigate and understand their rights and responsibilities.

Filing a Claim Under Michigan’s No-Fault System

Following a car accident, promptly notify your insurance company. Provide them with all relevant information, including the date, time, location of the accident, and details of the other involved parties. You should also seek medical attention immediately, even if injuries seem minor. Your insurance company will then handle the processing of your medical bills and lost wage claims. Documentation is critical throughout the process. Keep records of all medical bills, doctor visits, therapy sessions, and lost wages. If your injuries meet the threshold for a lawsuit, you will need to consult with an attorney. The specifics of the claim process will depend on the nature and severity of your injuries and the circumstances of the accident.

Discounts and Savings on Michigan Auto Insurance

Securing affordable auto insurance in Michigan is a priority for many drivers. Fortunately, several discounts are available to help lower your premiums. Understanding these discounts and how to qualify for them can significantly reduce your overall insurance costs. This section Artikels common discounts and strategies for maximizing your savings.

Common Auto Insurance Discounts in Michigan

Many Michigan auto insurance providers offer a range of discounts to reward safe driving habits and responsible vehicle ownership. These discounts can substantially reduce your premiums, making insurance more manageable.

- Good Driver Discount: This discount is awarded to drivers with clean driving records, typically free of accidents and moving violations for a specified period (often three to five years). The specific requirements vary by insurer. Maintaining a spotless driving record is key to qualifying.

- Safe Vehicle Discount: Insurers often offer discounts for vehicles equipped with advanced safety features, such as anti-lock brakes (ABS), electronic stability control (ESC), and airbags. Some insurers may also consider the vehicle’s safety rating from organizations like the IIHS (Insurance Institute for Highway Safety).

- Bundling Discount: Many insurance companies offer discounts when you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance. This is often a significant savings opportunity, as insurers reward loyalty and consolidated business.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can often result in a discount. These courses teach safe driving techniques and can demonstrate your commitment to responsible driving to your insurer.

- Good Student Discount: Students with high grade point averages (GPAs) may qualify for discounts, reflecting the lower risk associated with responsible, academically successful young drivers. The specific GPA requirements vary by insurer.

- Multi-Car Discount: Insuring multiple vehicles under the same policy with the same insurer often leads to a discount. This reflects the reduced administrative overhead for the insurer.

- Payment Plan Discount: Some insurers offer discounts for paying your premiums in full upfront, rather than opting for monthly installments. This reflects reduced administrative costs.

Strategies for Maximizing Auto Insurance Savings

Beyond simply qualifying for individual discounts, proactive strategies can further enhance your savings.

Actively comparing quotes from multiple insurers is crucial. Don’t settle for the first quote you receive. Use online comparison tools or contact insurers directly to obtain a range of quotes. This allows you to identify the most competitive pricing and coverage options.

Review your coverage needs annually. As your circumstances change (e.g., purchasing a new car, changing your driving habits), your insurance needs may also evolve. Regularly reviewing your policy can help ensure you’re not overpaying for unnecessary coverage.

Maintain a clean driving record. This is perhaps the most impactful strategy. Avoiding accidents and traffic violations not only qualifies you for discounts but also keeps your premiums lower overall. Defensive driving practices are essential in achieving this.

Consider increasing your deductible. A higher deductible means a lower premium, but it also means you’ll pay more out-of-pocket in the event of a claim. Carefully weigh the trade-off between premium savings and potential out-of-pocket expenses.

Illustrative Example: Comparing Quotes for Different Driver Profiles

Understanding how your personal characteristics influence your auto insurance premium is crucial for securing the best possible rate. This example illustrates how quotes can vary significantly based on different driver profiles in Michigan. We’ll examine three distinct profiles: a young, inexperienced driver; an experienced driver with a clean record; and a driver with a history of accidents. These hypothetical examples are for illustrative purposes only and actual quotes will vary depending on the specific insurer and other factors.

Hypothetical Insurance Quotes Based on Driver Profile

The following table presents hypothetical annual auto insurance premiums for a standard liability policy in Michigan, highlighting the impact of driver experience and driving history. Remember that these are estimates, and your actual quote will be determined by your specific circumstances and the insurance company.

| Driver Profile | Age | Driving History | Estimated Annual Premium |

|---|---|---|---|

| Young, Inexperienced Driver | 18 | No driving history, first-time driver | $3,500 |

| Experienced Driver, Clean Record | 45 | 15+ years of driving experience, no accidents or violations | $1,200 |

| Driver with Accidents | 30 | 5 years of driving experience, two at-fault accidents in the past three years | $2,800 |

Understanding Policy Renewals and Cancellation

Renewing or cancelling your Michigan auto insurance policy involves several key steps and considerations. Understanding these processes can help ensure smooth transitions and avoid potential problems. This section details the renewal process, reasons for cancellation, preventative measures, and steps to take if your policy is cancelled.

Michigan Auto Insurance Policy Renewal

The renewal process for your Michigan auto insurance policy is typically straightforward. Most insurers will send you a renewal notice several weeks before your policy’s expiration date. This notice will Artikel the premium amount for the upcoming term, usually a year, and any changes to your coverage. To renew, you generally need to pay the premium by the due date. Failure to do so may result in your policy lapsing. You can usually renew your policy online, by phone, or by mail, depending on your insurer’s methods. It’s advisable to review your policy details before renewing to ensure the coverage still meets your needs. If you have experienced significant changes, such as a new car or driver, you should contact your insurer to update your policy details before renewal to avoid inaccuracies.

Circumstances Leading to Policy Cancellation

Insurance companies have the right to cancel your policy under specific circumstances. These can include non-payment of premiums, providing false information on your application (such as driving history or vehicle information), or engaging in activities that increase your risk profile significantly, such as multiple at-fault accidents or numerous traffic violations within a short period. Furthermore, if your insurer determines that the risk associated with insuring you has increased substantially, they may choose to not renew your policy. This might be due to changes in your driving record or changes in your vehicle. Fraudulent claims are another major reason for cancellation.

Avoiding Policy Cancellation

Preventing policy cancellation primarily involves maintaining open communication with your insurer and adhering to the terms of your policy. Promptly paying your premiums is crucial. Always be honest and accurate when providing information to your insurer, whether during the application process or when reporting an accident. Maintaining a safe driving record and avoiding traffic violations significantly reduces the likelihood of cancellation. Regularly review your policy to ensure it aligns with your current needs and risk profile. If your circumstances change, notify your insurer promptly to avoid any potential discrepancies.

Handling a Policy Cancellation

If your policy is cancelled, it’s essential to understand your rights and take appropriate action. First, understand the reason for the cancellation. Review your cancellation notice carefully and contact your insurer to clarify any questions or disputes. Explore options for appealing the cancellation if you believe it was unjustified. Second, immediately begin searching for new auto insurance coverage. Having a gap in coverage can lead to legal and financial consequences. Obtain proof of insurance from your new provider as soon as possible to avoid penalties. Finally, understand that your driving record may be affected by a cancellation, potentially leading to higher premiums in the future. Addressing any underlying issues that led to the cancellation will improve your chances of obtaining more favorable rates from other insurers.

Final Wrap-Up

Securing affordable and comprehensive auto insurance in Michigan requires careful planning and understanding of the state’s unique regulations. By thoughtfully considering the factors influencing your premiums and diligently comparing quotes from various insurers, you can confidently choose a policy that aligns with your needs and budget. Remember to thoroughly review policy details and don’t hesitate to ask questions before committing to a plan. Driving safely and maintaining a good driving record remain the best ways to keep your premiums low in the long run.

Common Queries

What is the minimum liability coverage required in Michigan?

Michigan requires a minimum of $20,000 per person/$40,000 per accident for bodily injury liability and $25,000 for property damage liability.

How does my credit score affect my auto insurance rates?

In Michigan, insurers can use your credit score to help determine your rates. A higher credit score generally leads to lower premiums.

Can I bundle my auto and home insurance for a discount?

Yes, many insurers offer discounts for bundling auto and home insurance policies.

What is uninsured/underinsured motorist coverage?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver.