Securing the right auto insurance is crucial, and understanding full coverage quotes is the first step towards peace of mind. This comprehensive guide navigates the complexities of full coverage, helping you compare options, understand influencing factors, and ultimately, make an informed decision that best suits your needs and budget. We’ll explore the components of a full coverage policy, the factors that impact its cost, and strategies to find the best possible deal.

From exploring the nuances of different policy types and coverage levels to deciphering the impact of your driving history, age, and location, we aim to demystify the process. We’ll also delve into practical tips for comparing quotes effectively, avoiding potential pitfalls, and leveraging strategies to potentially save money on your premiums.

Understanding “Auto Insurance Full Coverage Quotes”

Obtaining a full coverage auto insurance quote involves understanding the various components of the policy and the factors that influence its cost. This ensures you’re adequately protected and paying a fair price. This section will break down the key aspects of full coverage auto insurance.

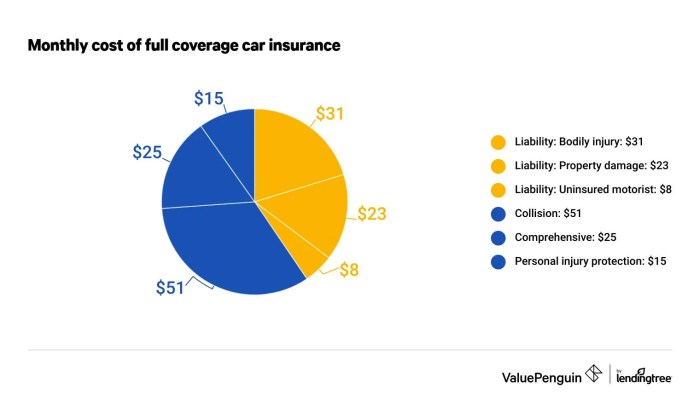

Components of a Full Coverage Auto Insurance Policy

A full coverage auto insurance policy typically includes several key components: liability coverage (bodily injury and property damage), collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Liability coverage protects you financially if you cause an accident resulting in injuries or property damage to others. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or weather-related incidents. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured. Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of fault. The specific limits and deductibles for each coverage type are customizable and will affect the overall cost of your policy.

Factors Influencing the Cost of Full Coverage Auto Insurance

Several factors influence the cost of a full coverage auto insurance policy. These include your driving record (accidents, tickets, and violations), your age and driving experience, your vehicle’s make, model, and year (as newer or more expensive vehicles tend to have higher repair costs), your location (areas with higher accident rates typically have higher premiums), your credit history (in some states), and the amount of coverage you choose (higher coverage limits generally mean higher premiums). For example, a young driver with a poor driving record living in a high-risk area will likely pay significantly more than an older driver with a clean record living in a low-risk area driving an older, less expensive vehicle.

Comparison of Different Types of Full Coverage Policies

While the core components of full coverage remain consistent, different insurance providers may offer varying policy options and add-ons. Some insurers may offer discounts for bundling auto and home insurance or for safe driving habits. Others might include roadside assistance or rental car reimbursement as part of their full coverage package. The specific terms and conditions, coverage limits, and exclusions can vary significantly, emphasizing the importance of comparing quotes from multiple providers. It is crucial to carefully review the policy documents to understand the nuances of each policy before making a decision.

Situations Where Full Coverage is Beneficial

Full coverage insurance provides comprehensive protection in various scenarios. For instance, if your vehicle is stolen or severely damaged in an accident, full coverage will cover the repair or replacement costs. If you are at fault in an accident causing significant injury or property damage to others, liability coverage will protect you from substantial financial liability. Even minor accidents can result in costly repairs, and comprehensive coverage can safeguard you from unexpected expenses due to events like hailstorms or vandalism. The peace of mind that full coverage offers is often worth the added cost, especially for newer or more expensive vehicles.

Comparison of Coverage Provided by Different Insurance Providers

| Insurance Provider | Liability Coverage | Collision Coverage | Comprehensive Coverage | Uninsured/Underinsured Motorist |

|---|---|---|---|---|

| Provider A | $100,000/$300,000/$50,000 | $500 deductible | $500 deductible | $100,000/$300,000 |

| Provider B | $250,000/$500,000/$100,000 | $1000 deductible | $1000 deductible | $250,000/$500,000 |

| Provider C | $100,000/$300,000/$50,000 | $0 deductible | $0 deductible | $100,000/$300,000 |

| Provider D | $50,000/$100,000/$25,000 | $500 deductible | $500 deductible | $50,000/$100,000 |

*Note: These are illustrative examples only. Actual coverage limits and deductibles will vary depending on the provider and the specific policy. Always check the policy details for accurate information.*

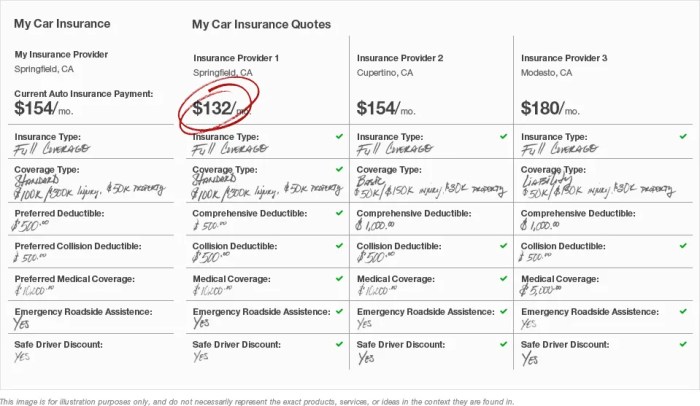

Obtaining Quotes

Securing the best auto insurance full coverage quote involves more than just clicking a few buttons. It requires a strategic approach to ensure you’re comparing apples to apples and finding the most suitable policy for your needs and budget. This section will guide you through the process of obtaining and comparing multiple quotes effectively.

Obtaining multiple auto insurance quotes online is a relatively straightforward process. Most major insurance companies have user-friendly websites that allow you to receive instant quotes. The process generally involves providing basic information about yourself, your vehicle, and your driving history. However, remember that the accuracy of the quote depends heavily on the accuracy of the information you provide.

Online Quote Acquisition Process

To obtain multiple quotes efficiently, begin by visiting the websites of several reputable insurance providers. Each site will have a quote request form. Complete these forms honestly and completely, ensuring consistency across all applications. Note that providing inaccurate information could lead to a policy being cancelled later. After submitting your information, you’ll receive a quote almost immediately. Repeat this process for several different companies to get a range of options.

Accurate Comparison of Auto Insurance Quotes

Comparing auto insurance quotes requires careful attention to detail. Don’t solely focus on the premium amount. Instead, consider the coverage limits, deductibles, and any additional features included in each policy. For instance, a lower premium might come with lower liability limits, leaving you vulnerable in case of a serious accident. Pay close attention to the specific details of each policy’s coverage to ensure it adequately protects your assets. Creating a simple comparison table can be invaluable in this process.

Policy Details Review Before Purchase

Before committing to a policy, meticulously review the policy documents. Understand the terms and conditions, including exclusions, limitations, and any specific requirements. Don’t hesitate to contact the insurance company directly if anything is unclear. A thorough understanding of your policy protects you from unexpected expenses or disputes later on. For example, understand what constitutes a covered accident and what types of damages are excluded.

Potential Pitfalls to Avoid

Several pitfalls can affect the accuracy and effectiveness of your quote comparison. One common mistake is providing inconsistent information to different insurers. Another is focusing solely on the price without considering the coverage offered. Failing to read the policy details thoroughly before purchase is another significant pitfall, potentially leading to unexpected costs or inadequate protection. Finally, relying solely on online quotes without contacting an insurance agent can limit your understanding of available options and personalized advice.

Step-by-Step Guide for Comparing Quotes

- Gather necessary information: Compile details about your vehicle, driving history, and desired coverage levels.

- Visit multiple insurer websites: Obtain quotes from at least three to five different insurance companies.

- Maintain consistency: Provide the same information to each insurer to ensure accurate comparisons.

- Compare coverage details: Analyze coverage limits, deductibles, and included features beyond the premium price.

- Review policy documents carefully: Thoroughly examine the terms and conditions of each policy before making a decision.

- Contact insurers with questions: Don’t hesitate to clarify any uncertainties before committing to a policy.

- Choose the best policy for your needs: Select the policy that offers the most comprehensive coverage at a price you can afford.

Factors Affecting Quote Prices

Several key factors influence the price you’ll pay for full coverage auto insurance. Understanding these factors can help you shop for the best rates and make informed decisions about your coverage. These factors interact in complex ways, so it’s important to consider them holistically.

Driving History

Your driving record significantly impacts your insurance premiums. A clean driving record, free of accidents and traffic violations, will typically result in lower premiums. Conversely, accidents, speeding tickets, and other moving violations can substantially increase your rates. The severity and frequency of incidents are key factors; a single minor accident might have less impact than multiple serious accidents or a DUI. Insurance companies use a points system to assess risk based on your driving history. More points generally translate to higher premiums. For example, a driver with multiple speeding tickets within a year might see a premium increase of 20-30% compared to a driver with a clean record.

Age and Location

Age is a significant factor in determining insurance costs. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As drivers age and gain experience, their premiums typically decrease. Location also plays a crucial role. Insurance rates are higher in areas with higher crime rates, more traffic congestion, and a greater frequency of accidents. For instance, urban areas often have higher premiums than rural areas due to increased risk factors.

Vehicle Type

The type of vehicle you drive directly affects your insurance costs. Generally, expensive vehicles, high-performance cars, and vehicles with a history of theft or accidents command higher premiums due to higher repair costs and greater risk. Conversely, less expensive, smaller vehicles often come with lower insurance rates. For example, insuring a luxury SUV will typically cost more than insuring a compact sedan. The vehicle’s safety features also play a role; vehicles with advanced safety technology may qualify for discounts.

Credit Score

In many states, your credit score is a factor in determining your insurance premiums. Insurers often use credit-based insurance scores, which are different from your traditional credit scores, to assess risk. A good credit score typically translates to lower premiums, while a poor credit score can result in significantly higher premiums. This is based on the idea that individuals with good credit are considered less risky. The exact impact of credit score varies by state and insurance company. However, a difference of 100 points in credit score could lead to a substantial difference in insurance premiums.

| Factor | Impact on Insurance Costs | Example | Potential Premium Change |

|---|---|---|---|

| Driving History (Accidents/Violations) | Higher premiums with more incidents | Two accidents in the past three years | +25% to +50% |

| Age (Young Drivers) | Higher premiums for younger drivers | 20-year-old driver vs. 40-year-old driver | +50% to +100% (or more) |

| Location (High-risk area) | Higher premiums in high-risk areas | Urban area vs. rural area | +15% to +30% |

| Vehicle Type (Luxury car) | Higher premiums for expensive vehicles | Luxury SUV vs. compact car | +30% to +75% (or more) |

| Credit Score (Poor Credit) | Higher premiums with poor credit | Credit score below 600 vs. above 750 | +20% to +50% (or more) |

Policy Features and Coverage

Full coverage auto insurance provides a baseline of protection, but many additional features and coverage options can enhance your policy and provide greater peace of mind. Understanding these options allows you to tailor your policy to your specific needs and budget.

Additional Coverage Options

Beyond the standard collision, comprehensive, liability, and uninsured/underinsured motorist coverage included in a typical full coverage policy, several supplementary options exist. These can include rental car reimbursement (covering the cost of a rental vehicle while yours is being repaired), gap insurance (covering the difference between your car’s actual cash value and the outstanding loan amount in case of a total loss), and medical payments coverage (paying for medical expenses for you and your passengers regardless of fault). Adding these options provides broader protection against unforeseen circumstances. For instance, gap insurance is particularly beneficial for newer vehicles with significant loan balances.

Roadside Assistance Benefits and Limitations

Roadside assistance, a common add-on, offers valuable services like towing, flat tire changes, jump starts, and lockout assistance. The benefits are clear: it provides immediate help in emergency situations, minimizing inconvenience and potential costs. However, limitations exist. Coverage typically has geographical restrictions, limits on the number of services per year, and may exclude certain types of assistance or situations (e.g., towing over a certain distance, assistance with mechanical breakdowns not directly related to a flat tire or lockout). It’s crucial to review the specific terms and conditions of your roadside assistance coverage.

Uninsured/Underinsured Motorist Coverage

Accidents involving uninsured or underinsured drivers are unfortunately common. Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are involved in a collision with a driver who lacks sufficient insurance or no insurance at all. This coverage can help pay for medical expenses, lost wages, and vehicle repairs resulting from the accident. The amount of coverage you choose significantly impacts your protection in such situations; higher limits offer greater financial security. For example, a $100,000 UM/UIM policy provides significantly more protection than a $25,000 policy.

Deductible Options

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums. Choosing the right deductible involves balancing affordability with the financial risk you are willing to assume. For example, a $500 deductible will result in a lower premium than a $1000 deductible, but you will have to pay more out-of-pocket in the event of a claim. Consider your financial situation and risk tolerance when selecting a deductible.

Typical Full Coverage Policy Coverage Areas

Collision Coverage: Covers damage to your vehicle caused by a collision with another vehicle or object, regardless of fault.

Comprehensive Coverage: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or weather-related damage.

Liability Coverage: Covers injuries or damages you cause to others in an accident. This includes bodily injury liability and property damage liability.

Uninsured/Underinsured Motorist Coverage: Covers injuries or damages you sustain in an accident caused by an uninsured or underinsured driver.

Personal Injury Protection (PIP): (In states where it’s required or optional) Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Saving Money on Auto Insurance

Finding affordable auto insurance is a priority for many drivers. Several strategies can significantly reduce your premiums, allowing you to keep more money in your pocket while maintaining adequate coverage. By understanding these strategies and implementing them, you can effectively manage your insurance costs.

Lowering your auto insurance premiums involves a multi-pronged approach encompassing various lifestyle choices, financial habits, and policy decisions. The following sections detail actionable steps you can take to achieve significant savings.

Strategies for Lowering Auto Insurance Premiums

Numerous factors influence your auto insurance rates. By actively managing these factors, you can potentially lower your premiums considerably. Some strategies are more easily implemented than others, but the potential savings often justify the effort.

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Obtain quotes from multiple insurers to compare prices and coverage options. Online comparison tools can simplify this process.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in the event of a claim, but it also results in lower premiums. Carefully weigh the financial implications before making this decision.

- Maintain a Good Driving Record: Avoid accidents and traffic violations. A clean driving record is a significant factor in determining your insurance rates.

- Consider a Usage-Based Insurance Program: Some insurers offer programs that track your driving habits, rewarding safer drivers with lower premiums. These programs often use telematics devices or smartphone apps.

- Bundle Your Insurance Policies: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

Benefits of Bundling Insurance Policies

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, is a simple yet effective way to save money. Insurance companies often offer discounts for bundling policies, as it simplifies their administration and reduces their risk.

- Reduced Premiums: The most significant benefit is lower overall premiums. The discount offered can vary depending on the insurer and the specific policies bundled.

- Convenience: Managing all your insurance policies with a single provider simplifies billing and communication.

- Potential for Additional Discounts: Some insurers offer additional discounts for bundling multiple policies with them, further enhancing your savings.

Impact of Safe Driving Habits on Insurance Costs

Your driving habits directly impact your insurance premiums. Insurers consider your driving record a key factor when determining your rates. Safe driving not only protects you and others on the road but also saves you money on insurance.

- Fewer Accidents: Avoiding accidents is the most impactful way to keep your premiums low. Accidents significantly increase your insurance rates.

- Reduced Traffic Violations: Traffic violations, such as speeding tickets, also lead to higher premiums. Following traffic laws diligently reduces your risk.

- Defensive Driving: Practicing defensive driving techniques helps prevent accidents and demonstrates responsible driving behavior to insurers.

Improving Your Credit Score to Lower Premiums

In many states, your credit score is a factor in determining your auto insurance rates. A higher credit score generally translates to lower premiums. While this practice is controversial, it’s important to understand how it affects your insurance costs.

- Pay Bills on Time: Consistent on-time payments are crucial for building a good credit history.

- Keep Credit Utilization Low: Avoid maxing out your credit cards. A lower credit utilization ratio improves your credit score.

- Monitor Your Credit Report: Regularly check your credit report for errors and take steps to correct them.

Impact of Different Driving Habits on Insurance Costs: A Hypothetical Example

Let’s consider two hypothetical drivers, Alex and Ben, to illustrate how driving habits affect insurance costs. Both have similar vehicles and coverage.

- Alex: Maintains a clean driving record, avoids speeding, and participates in a usage-based insurance program. His annual premium is $800.

- Ben: Has two speeding tickets and one at-fault accident in the past three years. His annual premium is $1500.

This example demonstrates how significantly safer driving habits can reduce insurance costs. Ben’s less safe driving resulted in a premium that is almost double Alex’s.

Closure

Finding the right auto insurance full coverage quote involves careful consideration of multiple factors. By understanding the components of a full coverage policy, comparing different providers, and employing smart strategies to lower premiums, you can secure comprehensive protection while managing your costs effectively. Remember to thoroughly review policy details before committing to a purchase, ensuring the coverage aligns precisely with your individual requirements and risk profile. Making an informed choice will provide you with the confidence and security you deserve on the road.

FAQ Overview

What is the difference between liability and full coverage?

Liability insurance covers damages you cause to others, while full coverage adds collision and comprehensive coverage for your vehicle, protecting it from accidents and other damage.

How often should I review my auto insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant life change (new car, move, change in driving habits).

Can I get a full coverage quote without providing my driving history?

No, your driving history is a major factor in determining your insurance rates. Insurers use this information to assess your risk.

What happens if I file a claim and my premium increases?

Most insurers increase premiums after a claim, but the extent of the increase depends on the severity of the claim and your insurer’s policy.