Navigating the world of auto insurance in New Jersey can feel overwhelming, especially when seeking affordable options. Finding the right balance between comprehensive coverage and manageable premiums requires understanding the state’s regulations, various coverage types, and the factors that influence your rates. This guide unravels the complexities, offering practical advice and strategies to secure cheap auto insurance in NJ without compromising your protection.

From understanding mandatory coverages and penalties for driving uninsured to exploring discounts and effective negotiation techniques, we’ll equip you with the knowledge to make informed decisions. We’ll also delve into the impact of your driving record, credit score, and vehicle type on your premiums, helping you identify areas for potential savings.

Understanding NJ Auto Insurance Requirements

Securing the right auto insurance in New Jersey is crucial for responsible driving. Understanding the state’s requirements protects you from significant financial and legal consequences should an accident occur. This section details the minimum coverage levels, penalties for non-compliance, and mandatory coverages included in a standard policy.

Minimum Liability Coverage Requirements in New Jersey

New Jersey mandates minimum liability insurance coverage to protect others involved in accidents you cause. This coverage pays for the injuries and property damage you inflict on others. The minimum requirements are $15,000 for bodily injury to one person, $30,000 for bodily injury to multiple people in a single accident, and $5,000 for property damage. This means that if you cause an accident resulting in injuries exceeding these limits, you are personally liable for the remaining costs. It’s important to note that these are minimums; higher coverage limits are strongly recommended to provide adequate protection.

Penalties for Driving Without Insurance in NJ

Driving without insurance in New Jersey is illegal and carries severe penalties. These penalties can include substantial fines, license suspension, vehicle impoundment, and even jail time. The specific penalties vary depending on the circumstances and the number of offenses, but they can quickly become very costly. Furthermore, an uninsured driver is fully responsible for all damages and injuries resulting from an accident they cause. This financial burden can be crippling.

Mandatory Coverages in a Standard NJ Auto Insurance Policy

A standard New Jersey auto insurance policy includes several mandatory coverages designed to protect both you and others. These coverages are legally required and cannot be omitted. Understanding what each one covers is vital for responsible car ownership.

Types of Auto Insurance Coverage

The following table compares different types of auto insurance coverage commonly available in New Jersey. Choosing the right coverage levels is a personal decision based on your risk tolerance and financial situation. It is advisable to consult with an insurance professional to determine the best coverage for your needs.

| Coverage Type | What it Covers | Minimum Requirement (NJ) | Optional Enhancements |

|---|---|---|---|

| Liability | Injuries and property damage you cause to others. | 15/30/5 ($15,000/$30,000/$5,000) | Higher limits (e.g., 100/300/100) |

| Collision | Damage to your vehicle from accidents, regardless of fault. | Not Required | Deductible options |

| Comprehensive | Damage to your vehicle from non-accident events (e.g., theft, vandalism, weather). | Not Required | Deductible options |

| Uninsured/Underinsured Motorist | Injuries caused by an uninsured or underinsured driver. | Required, but limits are often lower than liability. | Higher limits to match or exceed your liability coverage. |

Factors Affecting Auto Insurance Costs in NJ

Securing affordable auto insurance in New Jersey involves understanding the various factors that influence your premium. Insurance companies use a complex formula to assess risk, and your individual circumstances significantly impact the final cost. This section will detail the key elements contributing to your auto insurance rate.

Driver’s Age and Driving Record

Age is a significant factor in determining insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher insurance costs. Conversely, older drivers with a clean record often receive lower rates due to their reduced risk profile. Your driving record plays an equally crucial role. Accidents, speeding tickets, and DUI convictions will substantially increase your premiums. The severity and frequency of these incidents directly correlate to higher insurance costs. For example, a single DUI conviction can lead to a significant premium increase for several years, while multiple speeding tickets can also result in higher rates. Maintaining a clean driving record is paramount to keeping your insurance costs down.

Type of Vehicle

The type of vehicle you drive heavily influences your insurance premium. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. Factors like the vehicle’s safety rating, anti-theft features, and repair history also contribute to the cost. A vehicle with advanced safety features may qualify for a discount, while a vehicle with a history of frequent repairs will likely result in a higher premium.

Location

Your geographic location significantly impacts your auto insurance rates. Insurance companies consider the crime rate, accident frequency, and the overall risk associated with your area. Areas with high rates of theft or accidents will typically have higher insurance premiums than areas with lower risk profiles. For instance, living in a densely populated urban area with high traffic volume may result in a higher premium compared to living in a rural area with lower traffic density.

Credit Score Impact

In New Jersey, as in many other states, your credit score can influence your auto insurance premium. While the exact relationship between credit score and insurance rates varies by insurer, a lower credit score generally translates to higher premiums. Insurance companies use credit scores as an indicator of risk, suggesting that individuals with lower credit scores may be more likely to file claims. It’s important to note that this is not always a direct correlation, and some insurers place less emphasis on credit scores than others. Improving your credit score can positively affect your insurance rates over time.

Discounts and Savings Opportunities

Several discounts can lower your auto insurance premiums. Good student discounts are available for students who maintain a certain GPA. Safe driver discounts reward drivers with clean driving records who demonstrate responsible driving habits. Multi-vehicle discounts are offered to individuals insuring multiple vehicles under the same policy. Other potential discounts include bundling your auto insurance with other types of insurance, such as homeowners or renters insurance. Taking advantage of these discounts can significantly reduce your overall insurance costs. It’s advisable to inquire with your insurance provider about available discounts to determine your eligibility.

Finding Affordable Auto Insurance Options in NJ

Securing affordable auto insurance in New Jersey requires a proactive approach. By understanding your options and employing effective comparison strategies, you can significantly reduce your premiums without compromising necessary coverage. This section Artikels methods to find the best rates and suitable policies for your needs.

Comparing Auto Insurance Quotes

Comparing quotes from multiple providers is crucial for finding the most affordable auto insurance. Several online comparison tools allow you to input your information once and receive quotes from various insurers simultaneously. This saves significant time and effort. Remember to compare not only price but also coverage options and customer service ratings before making a decision. Pay attention to deductibles and policy limits as these significantly impact the overall cost. It’s also wise to contact insurers directly to discuss specific needs or to clarify any aspects of the online quotes.

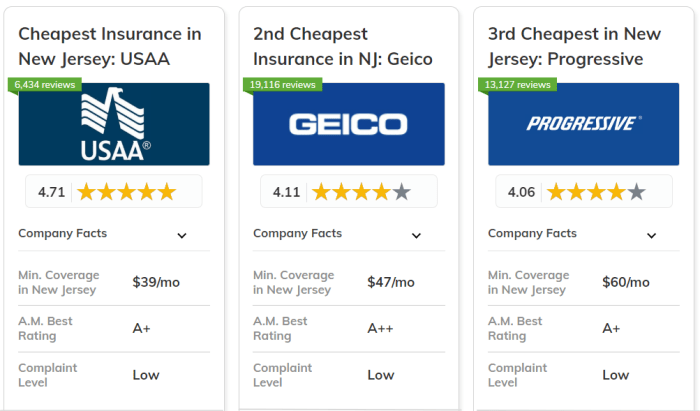

Reputable Insurance Companies in New Jersey

Many reputable insurance companies operate in New Jersey, each offering varying levels of coverage and pricing. Choosing a company with a strong financial rating and positive customer reviews is essential. Some well-known providers include, but are not limited to, State Farm, Geico, Allstate, Progressive, and Liberty Mutual. This list is not exhaustive, and other reputable companies may be available depending on your location and specific needs.

Comparison of Auto Insurance Providers

The following table provides a sample comparison of three major insurers in New Jersey. Note that these are average rates and can vary significantly based on individual factors like driving history, vehicle type, and location. Always obtain a personalized quote for the most accurate pricing.

| Insurer | Average Annual Rate (Estimate) | Coverage Options | Customer Review Summary |

|---|---|---|---|

| State Farm | $1200 – $1800 | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection (PIP), medical payments | Generally positive, known for strong customer service and broad coverage options. |

| Geico | $1000 – $1500 | Similar to State Farm, known for competitive pricing and online convenience. | Mixed reviews, some praise low cost, others cite difficulties with claims processing. |

| Progressive | $1100 – $1700 | Offers a wide range of coverage options, including specialized policies. | Generally positive, appreciated for their online tools and personalized options. |

Obtaining an Online Insurance Quote

Obtaining an online quote is generally straightforward. Most major insurers have user-friendly websites. Typically, you’ll need to provide information such as your driving history, vehicle details (year, make, model), address, and desired coverage levels. The system will then generate a personalized quote based on your risk profile. Remember to review the quote carefully and compare it to quotes from other providers before making a decision. It is crucial to accurately provide all information to ensure the quote’s accuracy and avoid discrepancies later. If you have any questions or require clarification, contacting the insurer directly is recommended.

Specific Coverage Considerations for NJ Drivers

Choosing the right auto insurance coverage in New Jersey involves understanding your specific needs and risk factors. While minimum coverage requirements exist, selecting additional coverage can offer significant protection and peace of mind. This section explores key coverage options and considerations for New Jersey drivers.

Uninsured/Underinsured Motorist Coverage in New Jersey

Uninsured/underinsured motorist (UM/UIM) coverage is crucial in New Jersey, a state with a relatively high number of uninsured drivers. This coverage protects you and your passengers if you’re involved in an accident caused by an uninsured or underinsured driver. Without UM/UIM coverage, you would be responsible for your medical bills, lost wages, and vehicle repairs, even if the accident wasn’t your fault. The minimum UM/UIM coverage in New Jersey is $15,000 per person and $30,000 per accident, but it’s highly recommended to purchase higher limits to adequately protect yourself against significant losses. For example, if you are injured in an accident caused by an uninsured driver whose liability limits are insufficient to cover your medical expenses and lost wages, UM/UIM coverage steps in to compensate you for the difference.

Roadside Assistance Coverage Benefits

Adding roadside assistance to your auto insurance policy provides valuable convenience and peace of mind. This coverage typically includes services such as towing, flat tire changes, jump starts, and lockout assistance. While not strictly required, roadside assistance can save you time, money, and stress in the event of a breakdown or unexpected car trouble. For instance, imagine being stranded on a busy highway late at night; roadside assistance can quickly dispatch a tow truck to get you and your vehicle to safety. The cost of roadside assistance is relatively low compared to the potential costs associated with unexpected car repairs or towing.

Coverage Options for Older Vehicles

Insuring older vehicles can present unique challenges. While comprehensive and collision coverage may be less cost-effective for older vehicles due to their lower value, liability coverage remains essential. Consider adjusting your coverage limits to reflect the actual cash value of your vehicle. For example, if your older car is worth only a few thousand dollars, it may not be financially prudent to carry full collision coverage, but liability coverage is still vital to protect you from potential lawsuits. You might opt for a higher deductible to lower your premiums.

Frequently Asked Questions about NJ Auto Insurance

Understanding the nuances of New Jersey auto insurance can be complex. The following frequently asked questions address common concerns:

- Q: What is the minimum auto insurance coverage required in New Jersey?

A: New Jersey requires a minimum of 15/30/5 coverage: $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, and $5,000 property damage liability. - Q: How can I lower my auto insurance premiums?

A: Several factors can influence your premiums, including your driving record, age, vehicle type, and location. Maintaining a clean driving record, choosing a safer vehicle, and taking advantage of discounts offered by insurers can help lower your costs. - Q: What is the difference between liability and collision coverage?

A: Liability coverage protects you if you cause an accident, while collision coverage protects your vehicle in an accident regardless of fault. - Q: Can I get a discount for bundling my auto and home insurance?

A: Yes, many insurance companies offer discounts for bundling your auto and home insurance policies. - Q: What should I do if I’m involved in a car accident?

A: Call the police, exchange information with the other driver, take photos of the damage, and contact your insurance company as soon as possible.

Saving Money on NJ Auto Insurance

Securing affordable auto insurance in New Jersey requires a proactive approach. By implementing several strategies, drivers can significantly reduce their premiums and maintain adequate coverage. This section Artikels practical methods to achieve substantial savings on your New Jersey auto insurance.

Defensive Driving and Premium Reduction

Participating in a state-approved defensive driving course can lead to significant discounts on your insurance premiums. Many insurance companies offer substantial reductions for completing these courses, which teach safer driving techniques and help reduce the likelihood of accidents. These courses typically cover topics such as hazard perception, safe following distances, and proper lane positioning. The completion certificate serves as proof to your insurer, triggering the promised discount. For example, a driver with a clean record might see a 10% reduction in their premium after completing a state-approved course.

Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with the same provider is a common and effective way to save money. Insurance companies often offer discounts for customers who bundle their policies, recognizing the reduced risk associated with insuring multiple assets with a single company. The discount percentage varies depending on the insurer and the specific policies, but it can range from 5% to 20% or more. For instance, a homeowner who bundles their home and auto insurance might save an average of $150 annually compared to purchasing separate policies.

Maintaining a Good Driving Record

A clean driving record is paramount for maintaining low insurance premiums. Avoiding accidents, traffic violations, and DUI convictions is crucial. Each incident negatively impacts your insurance score, resulting in higher premiums. For example, a single at-fault accident can increase premiums by 30% or more, depending on the severity of the accident and the insurer. Conversely, maintaining a spotless record for several years can qualify you for discounts designed to reward safe driving. Many insurers offer “good driver” discounts to those with several years of accident-free driving.

Negotiating with Insurance Companies

Don’t hesitate to negotiate with your insurance company. Shop around and compare quotes from multiple providers. This competitive approach can reveal better rates. Armed with competing quotes, you can leverage this information to negotiate a lower premium with your current insurer. Be prepared to discuss your driving history, the features of your vehicle, and any safety features it possesses. Clearly articulate your desire for a lower premium and highlight your commitment to safe driving. For example, you might say, “I’ve received a quote from another company that is 15% lower. Could you match or beat that offer?”

Understanding NJ’s Insurance Fraud Laws

Insurance fraud is a serious crime in New Jersey, carrying significant legal and financial consequences. Understanding the state’s laws regarding insurance fraud is crucial for both policyholders and insurance companies. This section Artikels the various types of insurance fraud, their penalties, and the process for reporting suspected fraudulent activity.

Consequences of Committing Insurance Fraud in New Jersey

Committing insurance fraud in New Jersey can lead to severe penalties, including hefty fines, imprisonment, and a criminal record. The severity of the punishment depends on the nature and extent of the fraudulent activity. For example, a minor infraction might result in a fine, while more serious cases could involve lengthy prison sentences. Beyond legal ramifications, individuals convicted of insurance fraud may face difficulty obtaining insurance in the future and suffer reputational damage. The state takes a firm stance against insurance fraud to protect both the integrity of the insurance system and the financial well-being of its citizens.

Types of Insurance Fraud and Examples

Insurance fraud encompasses a wide range of deceptive practices aimed at illegally obtaining insurance benefits. Several common types exist:

- Staged Accidents: Individuals intentionally cause or feign accidents to file fraudulent claims. For example, two individuals might deliberately crash their cars to collect insurance payouts.

- False Claims: This involves submitting a claim for damages or losses that did not occur or exaggerating the extent of actual damage. An example would be claiming a stolen item that was never owned or inflating the value of damaged property.

- Arson: Intentionally setting fire to property to collect insurance money is a serious crime with severe penalties. This could involve burning down a home or business to claim the insurance payout for the loss.

- Fraudulent Medical Claims: Submitting false medical bills or exaggerating medical expenses to inflate insurance claims is another common form of fraud. This might involve billing for treatments that were not received or claiming injuries that did not occur.

- Premium Fraud: This involves providing false information to obtain lower premiums. Examples include misrepresenting driving history, vehicle usage, or the number of drivers in a household.

Reporting Suspected Insurance Fraud

Suspected insurance fraud should be reported immediately to the appropriate authorities. This can include contacting your insurance company’s fraud department, the New Jersey Department of Banking and Insurance (DOBI), or law enforcement agencies. Providing detailed information about the suspected fraudulent activity is crucial for a thorough investigation. The process generally involves filing a report with supporting documentation, such as photographs, receipts, and witness statements. The authorities will then investigate the claim and take appropriate action if fraud is confirmed.

A Typical Insurance Claim Process

The following steps illustrate a typical insurance claim process:

- Incident Occurs: A car accident, theft, or other insured event takes place.

- Report to Insurance Company: The policyholder promptly notifies their insurance company of the incident.

- Claim Filed: The policyholder files a formal claim with the insurance company, providing necessary details and documentation.

- Investigation: The insurance company investigates the claim, potentially including an adjuster visiting the scene or reviewing evidence.

- Claim Evaluation: The insurance company assesses the validity and extent of the claim based on policy coverage and evidence.

- Settlement or Denial: The insurance company either approves and settles the claim or denies it if insufficient evidence or policy violations exist.

- Payment (if approved): If the claim is approved, the insurance company pays the policyholder according to the terms of the policy.

Wrap-Up

Securing cheap auto insurance in New Jersey doesn’t mean sacrificing essential protection. By understanding the factors influencing your premiums, actively comparing quotes from different insurers, and employing smart strategies, you can find affordable coverage that meets your needs. Remember, responsible driving habits, maintaining a clean record, and exploring available discounts can significantly contribute to lowering your insurance costs over time. Take control of your auto insurance and drive confidently knowing you’re well-protected.

Quick FAQs

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility required by the state after certain driving violations. You’ll need it if mandated by the court or DMV.

Can I pay my insurance monthly?

Most insurance companies offer monthly payment plans, though there may be a small additional fee.

How often can I get a new quote?

You can request a new quote as often as you like, especially if your circumstances change (e.g., new car, improved driving record).

What happens if I get into an accident and don’t have enough coverage?

You could be personally liable for any costs exceeding your policy limits, potentially leading to significant financial hardship.