Navigating the world of auto insurance in Chicago can feel like driving through rush hour – challenging but ultimately manageable with the right information. This guide unravels the complexities of Chicago’s auto insurance landscape, offering insights into average costs, influencing factors, coverage options, and the claims process. Whether you’re a seasoned Chicago driver or a newcomer, understanding these nuances is key to securing affordable and comprehensive protection.

From understanding the impact of your driving record and neighborhood on premiums to navigating the intricacies of different coverage types and finding the best deals, we’ll equip you with the knowledge to make informed decisions. We’ll explore the unique challenges presented by Chicago’s traffic and high-value vehicles, and provide actionable steps to help you secure the best possible auto insurance policy for your needs.

Average Auto Insurance Costs in Chicago

Securing affordable auto insurance in Chicago can be a challenge, given the city’s dense population, high traffic volume, and prevalence of accidents. Understanding the factors influencing insurance premiums is crucial for drivers to make informed decisions and find the best coverage at a competitive price. This section provides a detailed overview of average auto insurance costs in Chicago, considering various driver profiles and geographical variations.

Average Annual Premiums for Different Driver Profiles

The cost of auto insurance in Chicago varies significantly based on several factors. The table below illustrates average annual premiums for different driver profiles, providing a general overview. Remember that these are averages, and individual premiums may differ based on specific circumstances.

| Driver Profile | Average Premium | Factors Affecting Cost | Comparison to National Average |

|---|---|---|---|

| 25-year-old with clean driving record, driving a sedan | $1,800 – $2,200 | Age, driving history, vehicle type, location | 15-20% higher than the national average |

| 35-year-old with one at-fault accident, driving an SUV | $2,500 – $3,000 | Age, driving history (accident), vehicle type, location | 25-30% higher than the national average |

| 50-year-old with clean driving record, driving a sports car | $2,200 – $2,800 | Age, driving history, vehicle type (higher risk), location | 20-25% higher than the national average |

| Teenager with no driving history, driving a sedan | $3,500 – $4,500 | Age (high-risk driver), lack of driving history, vehicle type, location | 35-45% higher than the national average |

Neighborhood Variations in Insurance Costs

Insurance costs in Chicago are not uniform across all neighborhoods. Several factors contribute to this variation, including crime rates, accident frequency, and the overall risk profile of the area.

The following points illustrate the variation in insurance costs across different Chicago neighborhoods:

- Areas with higher crime rates and a greater number of vehicle thefts generally have higher insurance premiums.

- Neighborhoods with a high frequency of accidents tend to have higher insurance costs due to increased risk.

- More affluent neighborhoods may have lower premiums due to lower crime rates and a higher proportion of newer, safer vehicles.

- Conversely, some lower-income neighborhoods may see higher premiums due to a higher concentration of older vehicles and potentially a higher frequency of accidents.

Impact of Traffic Violations and Accidents on Premiums

Traffic violations and accidents significantly impact auto insurance premiums in Chicago. Insurance companies consider these events as indicators of risk.

The effect of traffic violations and accidents can be substantial:

- A single speeding ticket might result in a moderate premium increase.

- Multiple violations or serious offenses like DUI (Driving Under the Influence) can lead to significantly higher premiums or even policy cancellation.

- Being at fault in an accident typically results in a much larger premium increase than a traffic violation.

- The severity of the accident also plays a role; a minor fender bender will have a less dramatic impact than a major collision resulting in significant damage or injuries.

Factors Influencing Chicago Auto Insurance Rates

Auto insurance premiums in Chicago, like elsewhere, aren’t arbitrarily set. Numerous factors contribute to the final cost, impacting how much you pay annually. Understanding these factors empowers you to make informed decisions and potentially lower your premiums. This section details the key elements influencing your Chicago auto insurance rate.

Insurance Company Ratings and Financial Stability

The financial strength and reputation of an insurance company significantly affect premiums. Insurers with high ratings from agencies like AM Best, Moody’s, and Standard & Poor’s generally offer more stability and are less likely to face financial difficulties, leading to greater confidence in their ability to pay claims. Companies with robust financial standing can often afford to offer more competitive rates, while those with weaker ratings might charge higher premiums to offset increased risk. Checking an insurer’s ratings before purchasing a policy is a crucial step in ensuring you’re getting a reliable and potentially cost-effective policy.

Key Factors Considered by Insurers When Setting Rates

Insurers use a complex algorithm to calculate premiums, considering various factors. Understanding these factors helps you anticipate your rate and potentially take steps to reduce it.

| Factor | Impact on Premium | Explanation | Mitigation Strategies |

|---|---|---|---|

| Credit Score | Significant Impact | Many insurers believe that a good credit score correlates with responsible behavior, including responsible driving. A higher credit score often translates to lower premiums. | Improve your credit score by paying bills on time, reducing debt, and monitoring your credit report for errors. |

| Driving Record | Significant Impact | Accidents, tickets, and DUIs significantly increase premiums. A clean driving record is crucial for lower rates. | Defensive driving, avoiding speeding tickets, and maintaining a safe driving record are key. Consider taking a defensive driving course to potentially reduce points on your license. |

| Vehicle Type | Moderate to Significant Impact | The make, model, year, and safety features of your vehicle affect premiums. Expensive cars, sports cars, and vehicles with a history of theft or accidents tend to cost more to insure. | Consider insuring a less expensive, safer vehicle. Installing anti-theft devices can also reduce premiums. |

| Location | Significant Impact | Your address influences premiums due to factors like crime rates, accident frequency, and the cost of repairs in your area. High-risk areas generally have higher premiums. | This factor is largely outside your control, but you may be able to find insurers who offer more competitive rates in your specific area. |

| Age and Gender | Moderate Impact | Statistically, younger drivers and certain gender groups are involved in more accidents, leading to higher premiums. | Maintaining a clean driving record and bundling policies can help mitigate the impact. |

| Coverage Levels | Significant Impact | Choosing higher coverage limits (liability, collision, comprehensive) will increase your premiums. | Carefully evaluate your needs and choose coverage levels that offer adequate protection without unnecessary expense. |

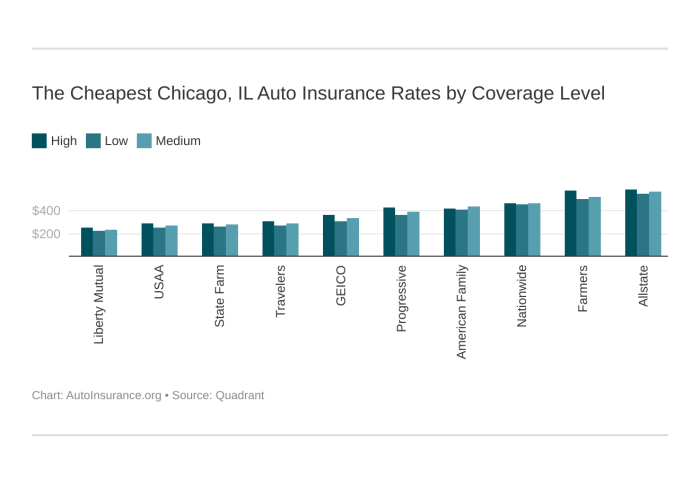

Comparison of Insurance Rate Structures Across Providers

Major insurance providers in Chicago, such as State Farm, Allstate, Geico, Progressive, and others, utilize different algorithms and rating factors. While they all consider the factors mentioned above, the weight given to each factor and the overall rate structure can vary significantly. For example, one insurer might heavily weigh credit score, while another might prioritize driving history. Direct comparison of rates from multiple providers is crucial before settling on a policy. It’s recommended to obtain quotes from several insurers to find the best rate for your specific circumstances. Remember that the cheapest option isn’t always the best if it compromises on coverage or financial stability.

Types of Auto Insurance Coverage in Chicago

Choosing the right auto insurance coverage is crucial for protecting yourself and your finances in the event of an accident. Understanding the different types of coverage available and Illinois’ minimum requirements is essential for all drivers in Chicago. This section details the various coverage options and their implications.

Illinois Minimum Insurance Requirements

Illinois mandates minimum liability coverage for all drivers. This means you are legally required to carry a specific amount of insurance to cover damages you cause to others. Failing to maintain this minimum coverage can result in significant penalties, including fines and suspension of your driver’s license. The state’s minimum requirements are $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $20,000 property damage liability. This means your insurance company would pay a maximum of $25,000 for injuries to one person, $50,000 for injuries to multiple people in a single accident, and $20,000 for damage to another person’s vehicle or property. It’s important to note that these minimums may not be sufficient to cover significant damages in a serious accident.

Types of Auto Insurance Coverage

Several types of auto insurance coverage are available, each designed to protect you in different situations. Understanding these options helps you make informed decisions about your insurance policy.

| Coverage Type | Purpose | Typical Cost (Estimate) |

|---|---|---|

| Liability | Covers bodily injury and property damage you cause to others in an accident. | Varies greatly based on factors like driving record and vehicle type; can range from $300-$1000 annually. |

| Collision | Covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. | Moderately expensive; can range from $300-$800 annually depending on vehicle type and deductible. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or weather damage. | Varies depending on vehicle value and deductible; generally less expensive than collision. |

| Uninsured/Underinsured Motorist | Protects you if you’re injured by an uninsured or underinsured driver. | Relatively inexpensive, often included as part of a standard package; usually around $100-$300 annually. |

Note: These cost estimates are approximate and vary widely depending on several factors, including your driving history, age, location, the type of vehicle you drive, and the amount of coverage you choose.

Optional Coverage Options

Beyond the standard coverage types, several optional additions can enhance your policy’s protection.

Adding these optional coverages provides extra peace of mind and can be invaluable in unexpected situations. The cost will vary based on your insurer and chosen options.

- Roadside Assistance: Covers towing, flat tire changes, jump starts, and lockout services.

- Rental Car Reimbursement: Helps cover the cost of a rental car while your vehicle is being repaired after an accident or other covered event.

- Medical Payments Coverage (Med-Pay): Pays for medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): Covers medical bills and lost wages for you and your passengers, regardless of fault. In some states, including Illinois, PIP is mandatory.

Finding and Choosing Auto Insurance in Chicago

Securing the right auto insurance in Chicago can feel overwhelming given the numerous providers and policy options. This section provides a practical guide to navigate the process effectively, from obtaining quotes to making informed decisions. Understanding the steps involved and employing smart strategies will help you find affordable and comprehensive coverage.

Obtaining Auto Insurance Quotes

To obtain auto insurance quotes, follow these steps: First, gather necessary information, including your driver’s license, vehicle information (make, model, year), and driving history. Then, visit the websites of various insurance companies, or contact them directly by phone. Many online comparison tools are available, allowing you to input your information and receive quotes from multiple providers simultaneously. Remember to be accurate and thorough when providing your information to ensure you receive the most accurate quotes. Finally, carefully review each quote, paying attention to coverage details and premium costs before making a decision.

Negotiating Lower Premiums

Negotiating lower premiums is achievable. Start by comparing quotes from at least three different providers. This provides leverage when discussing prices. Highlight any safe driving records, such as accident-free years or completion of defensive driving courses. Consider bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, as many companies offer discounts for bundled policies. Inquire about discounts for features like anti-theft devices or safety features in your vehicle. Finally, don’t hesitate to ask about payment options; paying in full annually might lead to a lower overall cost.

Comparing Insurance Policies

Comparing insurance policies is crucial for making an informed decision. Before committing to a policy, carefully examine several key aspects.

- Coverage Levels: Compare the liability limits, collision, comprehensive, and uninsured/underinsured motorist coverage offered by different providers. Ensure the coverage levels align with your needs and risk tolerance.

- Premium Costs: Compare the total annual premium cost from each provider. Consider the cost relative to the coverage provided. A slightly higher premium might be worthwhile if it offers significantly better coverage.

- Deductibles: Analyze the deductible amounts for different types of claims. Higher deductibles generally lead to lower premiums, but you’ll pay more out-of-pocket in case of an accident.

- Customer Service Ratings: Research the customer service reputation of each company. Look for reviews and ratings from independent sources to gauge their responsiveness and helpfulness in handling claims.

- Financial Stability: Check the financial strength ratings of insurance companies. This ensures the company can pay out claims if needed. Independent rating agencies like A.M. Best provide these ratings.

Dealing with Auto Insurance Claims in Chicago

Navigating the auto insurance claims process in Chicago can be complex, but understanding the steps involved can significantly ease the burden after an accident. This section Artikels the process from initial reporting to potential claim denial resolution.

Filing a claim typically begins with promptly reporting the accident to your insurance company. This often involves contacting your insurer’s claims department by phone, providing details of the accident, including date, time, location, and involved parties. You’ll likely be asked to provide information about the other driver(s) and any witnesses. It’s crucial to obtain contact information from all parties involved, including names, addresses, phone numbers, insurance information, and license plate numbers. Furthermore, documenting the accident scene with photographs or videos can be invaluable.

The Role of a Claims Adjuster

Following the initial report, a claims adjuster will be assigned to your case. The claims adjuster’s role is to investigate the accident, gather evidence, and determine liability. They will review police reports (if any), witness statements, and your provided documentation. The adjuster will then assess the damages to your vehicle and any medical expenses incurred. They will communicate with you throughout the process, requesting additional information as needed. Effective communication with the adjuster is key to a smooth claims process. Remember, maintaining a clear and concise record of all communications is essential.

Addressing Claim Denials

If your insurance company denies your claim, understanding your recourse is vital. Reasons for denial can vary, from insufficient evidence of the other driver’s fault to discrepancies in your account of the accident. If you believe the denial is unwarranted, you have several options. First, carefully review the denial letter to understand the specific reasons provided. Gather any additional evidence that might support your claim, such as additional witness statements, photos, or medical records. You may wish to consult with an attorney specializing in insurance claims to review the denial and discuss your legal options. An attorney can advise you on whether to appeal the denial or pursue other legal avenues to obtain compensation for your damages. Appealing a claim typically involves submitting a formal appeal letter to the insurance company, outlining the reasons why you believe the denial was incorrect and providing any new supporting evidence. Remember to keep meticulous records of all correspondence throughout this process.

Unique Challenges of Auto Insurance in Chicago

Auto insurance in Chicago presents unique challenges compared to other cities, largely due to a combination of high population density, significant traffic congestion, and a high value of vehicles often found within the city limits. These factors interact to create a complex insurance landscape that significantly impacts premiums and claims processes.

High traffic volume and congestion directly contribute to a higher frequency of accidents. The sheer number of vehicles on the road, coupled with stop-and-go traffic patterns, increases the likelihood of collisions, fender benders, and more serious incidents. This increased accident rate translates directly into higher insurance premiums for drivers in Chicago. Insurance companies factor in the statistical probability of accidents in their rate calculations, and Chicago’s traffic patterns inevitably lead to higher costs for consumers.

Impact of High Traffic Volume and Congestion on Insurance Rates

The relationship between traffic congestion and insurance rates is straightforward: more accidents equal higher premiums. Chicago’s notorious traffic jams, particularly during peak hours, create conditions ripe for accidents. Rear-end collisions are particularly common in stop-and-go traffic. Insurance companies analyze accident data from various sources, including police reports and their own claims data, to assess risk. Areas with high accident rates, like certain congested stretches of Chicago roadways, will generally result in higher insurance premiums for drivers in those areas. This is often reflected in geographic-based rate adjustments. For example, drivers in densely populated downtown areas might pay more than those in less congested suburban areas.

Challenges of Insuring High-Value Vehicles in Chicago

Chicago is home to a significant number of high-value vehicles, ranging from luxury cars and SUVs to classic automobiles. Insuring these vehicles presents unique challenges for insurance companies due to the higher repair costs associated with damage. Replacing or repairing a luxury car after an accident can be significantly more expensive than repairing a more common vehicle. This increased cost of repair translates into higher premiums for owners of high-value vehicles. Furthermore, the risk of theft is also a significant factor, especially for high-end models. Insurance companies must factor in the cost of theft and related losses, leading to even higher premiums. For instance, a luxury SUV might cost significantly more to insure than a compact car, even if both drivers have similar driving records.

Specific Legal Considerations and Regulations Related to Auto Insurance in Chicago

Illinois, where Chicago is located, has specific legal requirements regarding auto insurance. Drivers are required to carry a minimum amount of liability insurance, which covers damages to others in the event of an accident. Failure to carry the legally mandated insurance can result in significant penalties, including fines and license suspension. Furthermore, the state has regulations concerning uninsured/underinsured motorist coverage, which protects drivers in the event of an accident with an uninsured or underinsured driver. Understanding these legal requirements is crucial for all Chicago drivers. The specific minimum liability coverage limits are defined by state law and are subject to change, so drivers should always consult the most up-to-date information from the Illinois Department of Insurance. Understanding these regulations helps drivers make informed decisions about their insurance coverage and avoid legal consequences.

Ultimate Conclusion

Securing the right auto insurance in Chicago requires careful consideration of various factors, from your driving history and vehicle type to the specific coverage options available. By understanding the average costs, influencing factors, and the claims process, you can navigate the complexities of the market and find a policy that offers both comprehensive protection and affordability. Remember to compare quotes, negotiate premiums, and carefully review policy details before making a decision. Driving safely and maintaining a clean driving record are also crucial steps in managing your insurance costs effectively.

FAQ Section

What is the minimum auto insurance coverage required in Illinois?

Illinois requires minimum liability coverage of $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in one accident, and $20,000 for property damage.

How does my credit score affect my auto insurance rates?

In many states, including Illinois, insurers use credit-based insurance scores to assess risk. A higher credit score generally translates to lower premiums.

Can I bundle my auto and home insurance for a discount?

Yes, many insurance companies offer discounts for bundling auto and home insurance policies.

What should I do if my insurance claim is denied?

Review the denial reason carefully, gather supporting documentation, and contact your insurer to appeal the decision. If necessary, consult with an attorney.