Navigating the world of car rental insurance can be confusing, especially with the added layer of premium credit card benefits. This guide delves into the specifics of Amex Premium Car Rental Insurance, providing a clear understanding of its coverage, limitations, and the claims process. We’ll compare it to other similar offerings and help you determine if it’s the right choice for your travel needs. Understanding the nuances of this insurance can save you significant financial headaches in case of unexpected incidents during your rental period.

From eligibility requirements and cost analysis to real-world scenarios illustrating both successful claims and denials, we aim to equip you with the knowledge to make informed decisions about your car rental insurance. We’ll explore the value proposition against purchasing insurance directly from a rental agency and highlight scenarios where this Amex benefit shines—and where it might fall short. This comprehensive overview will clarify the complexities and empower you to choose the best protection for your next trip.

Amex Premium Car Rental Insurance

Amex Premium Car Rental Insurance offers supplemental coverage for your car rentals, providing peace of mind while traveling. It’s designed to bridge the gap between basic rental company insurance and comprehensive personal auto coverage, offering broader protection against potential incidents. Understanding its specifics, limitations, and comparisons to other options is crucial before relying on it for your next trip.

Amex Premium Car Rental Insurance: Coverage Details

Amex Premium Car Rental Insurance typically covers collision damage, theft, and liability, often with higher coverage limits than standard rental insurance. This means that if your rental car is damaged or stolen, or if you’re involved in an accident causing damage to another vehicle or property, the insurance can help cover the associated costs. Specific coverage details vary depending on your Amex card and the terms and conditions at the time of rental. Always refer to your card’s benefits guide and the rental agreement for the most up-to-date information. The coverage usually applies to vehicles rented in the United States and some other countries.

Limitations and Exclusions of Amex Premium Car Rental Insurance

Like any insurance policy, Amex Premium Car Rental Insurance has limitations and exclusions. These might include, but are not limited to, damage caused by driving under the influence of alcohol or drugs, exceeding the permitted mileage, or using the vehicle for unauthorized purposes (e.g., off-road driving). Additionally, there may be deductibles or co-pays you are responsible for. Wear and tear, and damage from certain events like floods or earthquakes may also be excluded. Pre-existing damage to the vehicle is another common exclusion. It’s essential to carefully review the policy details to understand what is and isn’t covered before relying on the insurance.

Comparison to Standard Car Rental Insurance

Standard car rental insurance, often offered by the rental agency, typically provides basic liability coverage and collision damage waiver (CDW). However, these policies often have limitations, high deductibles, and may not cover all potential damages or losses. Amex Premium Car Rental Insurance typically offers higher coverage limits, lower deductibles, and broader protection than standard rental insurance, reducing your out-of-pocket expenses in case of an incident. It acts as a supplementary layer of protection, providing more comprehensive coverage than the basic options offered by rental companies.

Comparison to Other Premium Credit Card Rental Insurance Options

The coverage and cost of premium car rental insurance vary significantly between different credit card providers. The following table provides a general comparison; it is not exhaustive and specific details are subject to change. Always check the terms and conditions of your specific card for the most accurate information.

| Provider | Coverage Highlights | Exclusions | Price Range |

|---|---|---|---|

| American Express (Premium Cards) | Collision damage, theft, liability; potentially higher coverage limits | Driving under the influence, unauthorized use, pre-existing damage, wear and tear | Included with card membership (no additional cost) |

| Chase Sapphire Reserve | Similar to Amex, often with primary coverage | Similar to Amex, specific exclusions vary | Included with card membership (no additional cost) |

| Capital One Venture X Rewards Credit Card | Comprehensive coverage, potentially including roadside assistance | Similar to Amex and Chase, specific exclusions vary | Included with card membership (no additional cost) |

| Citi Prestige® Card | Collision damage, theft, liability; may have specific rental restrictions | Similar to Amex, specific exclusions vary | Included with card membership (no additional cost) |

Amex Premium Car Rental Insurance

Amex Premium Car Rental Insurance provides valuable coverage for unexpected events while renting a vehicle. Understanding the claim process is crucial to ensure a smooth experience should you need to file a claim. This section details the steps involved, provides examples of approved and denied claims, and offers advice on gathering necessary documentation.

Claim Process Steps

Filing a claim with Amex Premium Car Rental Insurance involves several key steps. First, report the incident to the rental car company immediately, obtaining a police report if necessary. Then, contact Amex directly to initiate your claim. You will need to provide details about the incident, including the date, time, location, and a description of the damage or theft. Amex will then guide you through the next steps, which may involve providing additional documentation or arranging for repairs. Finally, Amex will review your claim and determine the amount of coverage.

Examples of Approved and Denied Claims

Claims for damage resulting from accidents, such as collisions with another vehicle or objects, are generally approved, provided the cardholder was not at fault or acted negligently. Conversely, claims resulting from intentional damage or violations of the rental agreement, such as driving under the influence of alcohol or drugs, are typically denied. Theft of the rental vehicle is usually covered, provided the cardholder reports the theft promptly to the authorities and Amex. However, claims for damage caused by normal wear and tear or pre-existing conditions are usually rejected. For example, a claim for a scratched bumper due to a minor parking incident might be approved if it’s a new scratch, but a claim for a pre-existing scratch might be denied.

Gathering Necessary Documentation

Thorough documentation is vital for a successful claim. This includes the rental agreement, police report (if applicable), photographs of the damage or stolen vehicle, repair estimates, and any communication with the rental company and Amex. Keep all receipts related to the incident, such as towing fees or temporary transportation costs. Accurate and complete documentation significantly increases the chances of a successful claim resolution. The more detailed the information provided, the smoother and faster the claim process will be.

Claim Process Flowchart

Imagine a flowchart with four distinct boxes connected by arrows.

Box 1: Incident Occurs: This box depicts the initial event, such as an accident or theft. An arrow points to the next box.

Box 2: Report to Rental Company & Authorities: This box represents the immediate reporting to the rental company and obtaining a police report if necessary. An arrow points to the next box.

Box 3: Contact Amex & Provide Details: This box illustrates contacting Amex and providing all relevant details about the incident. An arrow points to the next box.

Box 4: Amex Review & Claim Resolution: This box represents Amex’s review of the claim and the final determination of coverage. This box could branch into two smaller boxes: “Claim Approved” and “Claim Denied,” each with a description of the next steps involved.

This flowchart visually represents the sequential steps involved in filing a claim with Amex Premium Car Rental Insurance.

Amex Premium Car Rental Insurance

Amex Premium Car Rental Insurance provides supplemental coverage for eligible cardholders renting vehicles. It’s designed to offer peace of mind by helping to cover potential costs associated with damage or theft of a rental car, often exceeding the limitations of standard rental agency insurance. Understanding the eligibility criteria and specific requirements is crucial before relying on this benefit.

Eligibility Criteria for Amex Premium Car Rental Insurance

To determine your eligibility for Amex Premium Car Rental Insurance, several factors are considered. It’s important to note that specific terms and conditions may vary slightly depending on your Amex card type and location. Always refer to your card’s benefits guide for the most up-to-date and accurate information.

- Primary Cardholder Status: You must be the primary cardholder of an eligible American Express card. Supplementary cardholders generally are not covered.

- Rental Car Booking: The rental car must be booked directly with a participating rental agency, using your eligible Amex card. Bookings made through third-party websites may not be covered.

- Card Usage: The rental car charges must be fully paid using your eligible Amex card. Partial payments or alternative payment methods may invalidate coverage.

- Specific Card Eligibility: Not all American Express cards offer this benefit. Check your card’s terms and conditions or contact Amex customer service to verify eligibility.

Requirements for Using Amex Premium Car Rental Insurance

Before using the insurance, you need to fulfill certain requirements to ensure your claim is processed smoothly. Failure to comply with these requirements may lead to claim denial.

- Report the Incident: Immediately report any accident or theft to the local authorities and the rental car agency. Obtain a police report if necessary.

- Complete Claim Forms: Thoroughly complete all necessary claim forms and provide all supporting documentation, such as the police report, rental agreement, and photographic evidence of the damage.

- Cooperate with Amex: Fully cooperate with Amex’s investigation of the claim. Failure to provide required information or follow instructions may delay or prevent claim settlement.

- Maintain Records: Keep records of all communication, documents, and expenses related to the incident and claim process.

Limitations of Amex Premium Car Rental Insurance

While Amex Premium Car Rental Insurance offers valuable protection, certain limitations apply. It is essential to understand these limitations before relying on the insurance.

- Specific Car Types: Coverage may be limited or excluded for certain types of vehicles, such as luxury cars, specialty vehicles, or vehicles rented for commercial use. Review your policy details for specifics.

- Geographic Restrictions: Coverage may not extend to all geographical locations. Certain countries or regions may be excluded from the insurance policy. Check the policy for details on covered areas.

- Deductibles: There may be a deductible amount that you are responsible for paying in the event of a claim. The amount of the deductible varies depending on the specific card and the nature of the claim.

- Pre-existing Damage: Pre-existing damage to the rental car is generally not covered. It is crucial to document the condition of the vehicle before commencing your rental.

Amex Premium Car Rental Insurance

Amex Premium Car Rental Insurance offers supplemental coverage for car rentals, potentially saving you significant costs in the event of an accident or damage. Understanding the cost and value proposition is crucial to determining if this insurance is right for you. This section will compare the cost of Amex’s insurance to purchasing coverage directly from a rental agency and analyze its value in various scenarios.

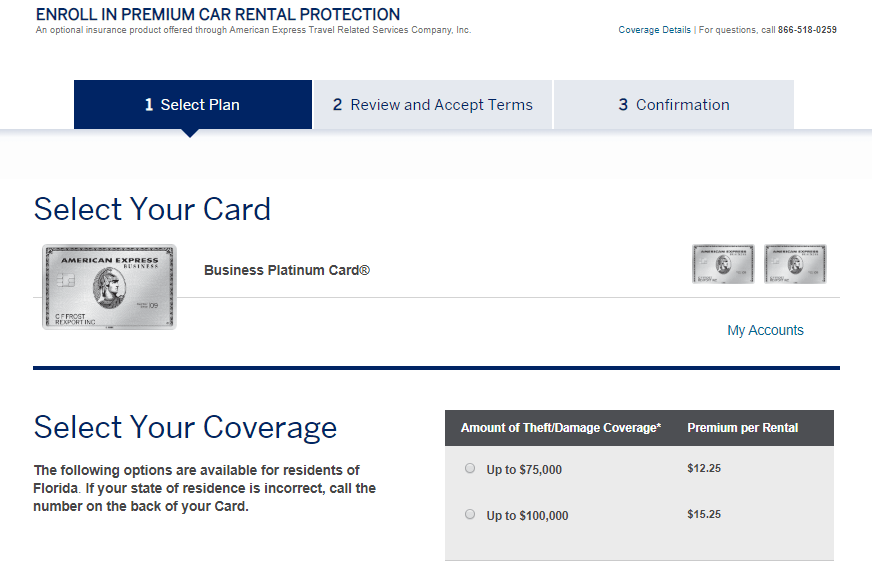

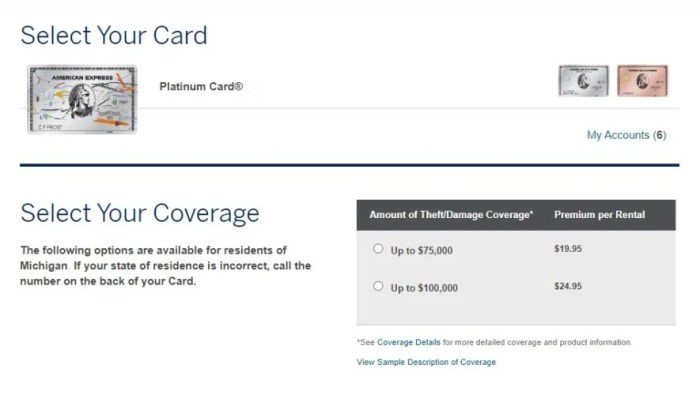

Cost Comparison: Amex vs. Rental Agency Insurance

The cost of Amex Premium Car Rental Insurance varies depending on your Amex card type and the rental period. Generally, it’s a flat daily fee, often significantly less than purchasing comparable insurance directly from a rental company. Rental agency insurance typically charges a higher daily rate and can vary greatly based on vehicle type and location. For example, a week-long rental in a popular tourist destination might see the rental agency charge $20-$30 per day for their insurance, while the Amex Premium Car Rental Insurance might only cost $10-$15 per day, resulting in substantial savings over the rental period. It’s essential to compare the specific costs for your planned rental before making a decision.

Value Proposition: Weighing Costs and Potential Losses

The value of Amex Premium Car Rental Insurance hinges on the potential costs associated with accidents or damage. Without insurance, you could face significant expenses including collision damage waivers, liability claims, and repair costs. These costs can easily reach thousands of dollars, especially for higher-end vehicles. Amex’s insurance provides a safety net, limiting your out-of-pocket expenses and reducing the financial burden of unexpected incidents. The relatively small daily cost of the Amex insurance becomes a worthwhile investment when considering the potential for substantial financial loss.

Financial Benefits in Different Scenarios

The financial benefits of Amex Premium Car Rental Insurance become evident in various scenarios. Consider a minor fender bender: with Amex insurance, your out-of-pocket expenses might be limited to a small deductible. Without it, you could be responsible for the full cost of repairs. In a more severe accident, involving significant damage or injuries, the savings are even more dramatic. The cost of repairs, medical bills, and legal fees could easily exceed the cost of the Amex insurance many times over. Even a small incident like a flat tire or a minor scratch can be costly without supplemental insurance.

Cost-Benefit Analysis

The following table illustrates a cost-benefit analysis for various scenarios, assuming a 7-day rental with a daily Amex insurance cost of $12 and a rental agency insurance cost of $25 per day. These figures are illustrative and may vary.

| Scenario | Cost with Amex Insurance | Cost without Amex Insurance | Net Savings/Loss |

|---|---|---|---|

| No Damage | $84 (7 days x $12) | $0 (No insurance purchased) | -$84 (Cost of Amex Insurance) |

| Minor Scratch (Rental Agency Estimate: $500 Repair) | $584 ($84 + $500 deductible) | $500 | -$84 (Amex insurance cost offset by deductible) |

| Moderate Damage (Rental Agency Estimate: $2000 Repair) | $2084 ($84 + $2000 deductible) | $2000 | -$84 (Amex insurance cost offset by deductible) |

| Major Accident (Rental Agency Estimate: $10,000 Damage) | $10,084 ($84 + $10,000 deductible) | $10,000 | -$84 (Amex insurance cost offset by deductible) |

Amex Premium Car Rental Insurance

Amex Premium Car Rental Insurance offers valuable coverage for car rentals, but it’s crucial to understand its limitations and compare it to alternative options to determine if it’s the best choice for your specific needs. This section will examine alternatives and provide a comparison to help you make an informed decision.

Amex Premium Car Rental Insurance Compared to Other Travel Insurance Options

Amex Premium Car Rental Insurance primarily covers damage to or theft of the rental vehicle. Other travel insurance policies often include broader coverage, encompassing trip cancellations, medical emergencies, lost luggage, and other unforeseen circumstances. While Amex’s offering is convenient for its integration with the card, a comprehensive travel insurance policy might offer more extensive protection for a wider range of travel-related risks. For example, a comprehensive policy might reimburse you for a non-refundable flight if a sudden illness prevents you from traveling, a risk not covered by Amex’s car rental insurance.

Advantages and Disadvantages of Amex Premium Car Rental Insurance versus Separate Insurance

Using Amex Premium Car Rental Insurance offers convenience and simplicity. It’s readily available if you already possess an eligible Amex card, requiring no additional paperwork or separate purchase. However, its coverage is limited to the rental car itself. Purchasing separate car rental insurance provides potentially broader coverage, such as liability protection for accidents involving third parties, which is often not included in the Amex offering. Additionally, separate insurance policies might offer better coverage amounts or deductibles tailored to your individual needs. The disadvantage of separate insurance is the added cost and administrative burden of purchasing a separate policy.

Situations Where One Option Would Be Preferable Over the Other

If you’re on a short trip and primarily concerned about damage to the rental vehicle, Amex Premium Car Rental Insurance might suffice. Its built-in convenience makes it a simple and effective solution. However, for extended trips, international travel, or situations where higher liability coverage is desired, a separate car rental insurance policy, or even a comprehensive travel insurance policy, might be preferable. For instance, if you plan to drive in a region known for high accident rates, a separate policy offering greater liability protection would be advisable. Conversely, for a quick weekend getaway within your own country, the Amex option might be perfectly adequate.

Tips on Choosing the Most Suitable Car Rental Insurance Option

Consider the length and location of your trip. International travel often necessitates broader coverage than domestic trips. Evaluate the level of liability protection offered by each option, as this is crucial in the event of an accident involving third parties. Assess the cost of each option and compare coverage amounts and deductibles. Carefully read the policy details to fully understand the inclusions and exclusions of each insurance offering. Weigh the convenience of Amex’s integrated coverage against the potential for broader protection and higher coverage limits offered by separate policies. Choosing the right insurance depends entirely on the individual’s risk tolerance and the specifics of their travel plans.

Illustrative Scenarios

Amex Premium Car Rental Insurance offers valuable protection, but understanding its coverage limits is crucial. The following scenarios illustrate situations where the insurance proves beneficial and, conversely, where it may not provide coverage. These examples are for illustrative purposes only and should not be considered exhaustive. Specific policy terms and conditions always govern coverage.

Scenario: Amex Premium Car Rental Insurance Proves Invaluable

Imagine you’re on a cross-country road trip, renting a luxury SUV for the journey. While driving through a remote area, you encounter an unexpected severe thunderstorm. A large tree falls, causing significant damage to the rental vehicle – a completely crushed roof and substantial body damage. You immediately contact the rental company and then Amex. Amex’s 24/7 assistance line guides you through the process, providing you with a claim number and instructions for filing a police report (essential for documenting the incident). You provide photos and documentation of the damage, the police report, and the rental agreement to Amex. Within a few business days, Amex confirms coverage and handles the claim directly with the rental company, eliminating the need for you to navigate complex insurance procedures. The outcome is that Amex covers the cost of repairs or replacement of the vehicle, sparing you significant financial burden during your trip.

Scenario: Amex Premium Car Rental Insurance Does Not Cover Damages

You rent a compact car for a weekend getaway. While parking in a crowded city lot, you carelessly scrape the side of the car against a concrete pillar. You fail to report the incident to either the rental company or the authorities. Later, when returning the car, the rental company assesses the damage and charges you for the repairs. In this instance, Amex Premium Car Rental Insurance would likely not cover the damages. The policy typically excludes damage caused by negligence and the failure to report the incident promptly is a critical factor in the denial of the claim. Further, pre-existing damage not reported at the time of rental pick-up is another common reason for denial. The lack of a police report and your failure to report the damage immediately to the rental company are key reasons for the claim’s denial.

Final Wrap-Up

Ultimately, the decision of whether or not to utilize Amex Premium Car Rental Insurance hinges on a careful assessment of your individual risk tolerance, travel habits, and the potential costs associated with car rental damage or theft. By understanding the coverage details, limitations, and claims process, you can make an informed decision that aligns with your needs and budget. Remember to always review your policy details and compare it to other available options before finalizing your car rental arrangements.

FAQ

What types of vehicles are covered under Amex Premium Car Rental Insurance?

Coverage typically extends to most standard rental cars, but specific exclusions may apply to luxury vehicles, oversized vehicles, or specialty vehicles. Always check the policy details for specific vehicle types.

Is there a deductible with Amex Premium Car Rental Insurance?

The existence and amount of a deductible vary depending on your specific Amex card and the terms of your insurance coverage. Check your cardholder agreement for details.

What if I rent a car in a country not covered by my Amex card?

Coverage is typically limited to specific regions. Review your cardholder agreement or contact Amex directly to confirm international coverage.

Can I use Amex Premium Car Rental Insurance if I already have personal auto insurance?

Often, it acts as supplemental coverage, but it’s crucial to understand how your personal and Amex insurance policies interact. Consult with both providers to avoid potential coverage gaps or conflicts.