Securing affordable and comprehensive renters insurance is a crucial step for apartment dwellers. Understanding the factors influencing cost, from location and credit score to coverage choices, empowers renters to make informed decisions about their financial protection. This guide navigates the complexities of renters insurance, offering insights into policy types, cost-saving strategies, and the overall value of this essential coverage.

This exploration delves into the various aspects of apartment renters insurance, providing a clear understanding of how costs are determined and how to find the best policy for your individual needs and budget. We’ll examine different coverage options, explore ways to lower premiums, and highlight the importance of thoroughly reviewing your policy before signing.

Factors Influencing Apartment Renters Insurance Costs

Several key factors interact to determine the price of renters insurance. Understanding these elements allows you to make informed decisions when choosing a policy and potentially save money. These factors range from your personal circumstances to the characteristics of your apartment and its location.

Coverage Amounts

The amount of coverage you choose significantly impacts your premium. Higher coverage limits, meaning more financial protection for your belongings in case of theft or damage, will naturally result in higher premiums. Conversely, lower coverage limits mean lower premiums, but also less financial protection if a significant loss occurs. It’s crucial to strike a balance between affordability and adequate protection. Consider the value of your possessions – electronics, furniture, clothing – to determine the appropriate coverage level. For example, someone with a high-value collection of electronics will require a higher coverage amount than someone with more modest possessions, leading to a higher premium.

Location

Your apartment’s location is a major factor in determining your renters insurance cost. Areas with higher crime rates or a greater risk of natural disasters (hurricanes, earthquakes, wildfires) will generally have higher premiums. Insurance companies assess the risk associated with each location and adjust premiums accordingly. For instance, an apartment in a high-crime urban area will likely cost more to insure than a similar apartment in a quiet suburban neighborhood.

Credit Score

In many states, insurance companies use your credit score as a factor in determining your renters insurance premium. A higher credit score generally indicates a lower risk to the insurer, leading to lower premiums. Conversely, a lower credit score might result in higher premiums. This is because individuals with poor credit history are statistically more likely to file claims. The impact of credit score on premiums varies by state and insurer.

Claims History

Your past claims history, both for renters insurance and other types of insurance, can significantly affect your premiums. A history of filing frequent claims can lead to higher premiums, as it suggests a higher risk profile. Conversely, a clean claims history can lead to lower premiums, rewarding responsible policyholders. Insurance companies use this information to assess the likelihood of future claims.

Deductibles

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible will lower your premium, as you’re taking on more financial responsibility. Conversely, a lower deductible will result in a higher premium but less out-of-pocket expense in the event of a claim. For example, a $500 deductible will typically result in a lower premium than a $1000 deductible, but you will have to pay $500 more out-of-pocket if you file a claim. The optimal deductible depends on your risk tolerance and financial situation.

Liability Coverage

Liability coverage protects you if someone is injured or their property is damaged on your premises. Higher liability coverage limits offer greater protection but result in higher premiums. For instance, a policy with $100,000 in liability coverage will typically cost more than a policy with $300,000 in liability coverage. Choosing the appropriate liability coverage level depends on your individual circumstances and risk assessment.

Average Renters Insurance Costs in Major US Cities

| City | Average Cost | Factors Affecting Cost | Coverage Details |

|---|---|---|---|

| New York, NY | $200 – $300 | High cost of living, high crime rates | $30,000 personal property, $100,000 liability |

| Los Angeles, CA | $150 – $250 | Earthquake risk, high property values | $25,000 personal property, $300,000 liability |

| Chicago, IL | $100 – $200 | Moderate crime rates, varying property values | $20,000 personal property, $100,000 liability |

| Houston, TX | $120 – $220 | Hurricane risk, fluctuating property values | $25,000 personal property, $100,000 liability |

Types of Apartment Renters Insurance Coverage

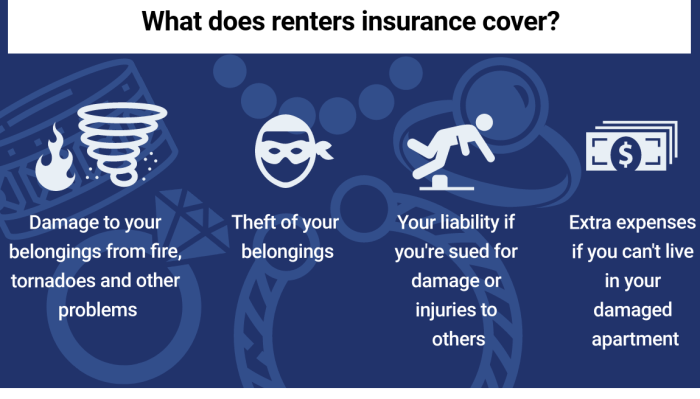

Renters insurance offers crucial protection for your belongings and personal liability. Understanding the different types of coverage available is essential to selecting a policy that meets your individual needs and budget. This section details the common coverage options, helping you make an informed decision.

Standard renters insurance policies typically include several key coverage areas. These are designed to protect you against various unforeseen circumstances that could lead to financial losses. Understanding these components is vital for ensuring adequate protection.

Personal Belongings Coverage

This coverage protects your personal property from damage or loss due to covered perils, such as fire, theft, or vandalism. It typically covers items like furniture, electronics, clothing, and jewelry. The policy will usually have a limit on the total amount it will pay out for your belongings, and this limit is something you should carefully consider when choosing your policy. For example, a policy might cover up to $30,000 worth of personal belongings. It’s important to note that this coverage often has deductibles, meaning you’ll pay a certain amount out-of-pocket before the insurance company begins to pay. It’s wise to create a detailed home inventory, including receipts and photos, to aid in claims processing.

Liability Coverage

Liability coverage protects you from financial responsibility if someone is injured or their property is damaged on your premises, and you are deemed legally responsible. For example, if a guest trips and falls in your apartment, injuring themselves, liability coverage would help pay for their medical expenses and any legal fees associated with a lawsuit. The amount of liability coverage is another important factor to consider, and policies often offer varying limits, ranging from $100,000 to $300,000 or more. Higher limits offer greater protection but usually come at a higher premium.

Additional Living Expenses Coverage

This coverage helps pay for temporary housing, food, and other essential living expenses if your apartment becomes uninhabitable due to a covered peril, such as a fire or burst pipe. For instance, if a fire forces you to evacuate, this coverage could help cover the cost of a hotel room and meals while your apartment is being repaired. The amount of coverage varies depending on the policy, but it’s a crucial aspect to consider, especially if you live in an area prone to natural disasters. This coverage is designed to mitigate the financial strain of displacement during a difficult time.

Endorsements and Riders

Adding endorsements or riders to your basic renters insurance policy can enhance your coverage. These additions provide protection for specific items or situations not covered under the standard policy. For example, you might add a rider for valuable jewelry or a specific piece of art, providing higher coverage than the standard policy would offer for those items. While endorsements and riders typically increase the premium, the added protection can be worthwhile for high-value possessions or specific risks. The increased cost should be weighed against the potential financial losses if those items are damaged or lost without additional coverage.

The decision of whether or not to add endorsements depends heavily on your individual circumstances and the value of your possessions. A consultation with an insurance agent can help determine the appropriate level of coverage.

Actual Cash Value vs. Replacement Cost Coverage

Understanding the difference between actual cash value (ACV) and replacement cost coverage is crucial for choosing the right level of protection for your personal property. Both types of coverage reimburse you for damaged or lost items, but they differ significantly in how the reimbursement is calculated.

- Actual Cash Value (ACV): ACV coverage pays you the current market value of your belongings, minus depreciation. This means that the older an item is, the less you’ll receive for it. For example, if your five-year-old television is damaged, the insurance company will consider its age and condition when determining the payout, resulting in a lower reimbursement than the original purchase price.

- Replacement Cost Coverage: Replacement cost coverage pays you the cost of replacing your damaged or lost belongings with new, similar items, without deducting for depreciation. Using the same television example, replacement cost coverage would pay for a new television of comparable quality, regardless of the age of the damaged one. This option offers greater financial protection, especially for newer items.

Finding Affordable Apartment Renters Insurance

Securing affordable renters insurance doesn’t require sacrificing essential coverage. By employing strategic planning and comparison shopping, you can find a policy that fits your budget without compromising your protection. Understanding the factors that influence premiums and actively engaging in the selection process are key to achieving cost-effective renters insurance.

Finding the right balance between comprehensive coverage and affordable premiums is achievable through several key strategies. These include comparing quotes from multiple insurers, exploring discounts, and carefully considering the level of coverage needed. Bundling insurance policies can also lead to significant savings.

Strategies for Securing Competitive Rates

Several methods can help secure competitive renters insurance rates. Thorough research is crucial, comparing quotes from different insurers is essential, and taking advantage of discounts offered by insurers can significantly reduce the overall cost. Consider increasing your deductible to lower your premium; however, weigh this against your ability to afford a higher out-of-pocket expense in the event of a claim.

- Compare quotes from multiple insurers: Obtain quotes from at least three different insurance providers to compare coverage options and pricing. Online comparison tools can simplify this process.

- Explore discounts: Many insurers offer discounts for bundling policies, paying annually instead of monthly, or having security systems installed in your apartment.

- Consider a higher deductible: A higher deductible will generally result in a lower premium. Carefully assess your financial situation to determine the deductible amount you can comfortably afford.

- Maintain a good credit score: Insurers often use credit scores to assess risk, and a good credit score can lead to lower premiums.

Benefits of Bundling Renters Insurance

Bundling renters insurance with other insurance policies, such as auto insurance, can often result in significant cost savings. Insurance companies frequently offer discounts for bundling multiple policies with them, rewarding customer loyalty and simplifying the insurance management process. This strategy reduces administrative overhead for the insurer, leading to potential savings for the policyholder.

For example, a hypothetical scenario could involve an individual paying $300 annually for renters insurance and $600 annually for auto insurance. By bundling both with the same insurer, they might receive a 10% discount, saving $90 annually ($300 + $600 = $900, 10% of $900 = $90). This illustrates the potential financial benefits of bundling policies.

Step-by-Step Guide to Comparing Quotes

Comparing quotes from different insurers requires a systematic approach to ensure a thorough and efficient process. This involves gathering information, utilizing online tools, and carefully analyzing the quotes received. Focusing on key features and understanding the implications of coverage levels is crucial to making an informed decision.

- Gather necessary information: Compile details about your apartment, possessions, and desired coverage levels.

- Use online comparison tools: Several websites allow you to compare quotes from multiple insurers simultaneously.

- Request quotes directly from insurers: Contact insurers directly to obtain quotes and clarify any questions.

- Analyze quotes carefully: Compare coverage options, premiums, deductibles, and other relevant factors.

- Choose the best policy: Select the policy that offers the best balance of coverage and affordability.

Tips for Negotiating Lower Premiums

Negotiating lower premiums can be successful by demonstrating your commitment to risk mitigation and responsible insurance practices. This might involve highlighting safety features in your apartment or demonstrating a consistent history of responsible insurance behavior. A polite and informed approach can often lead to positive results.

- Highlight safety features: Mention any security systems or safety measures in your apartment that reduce risk.

- Demonstrate responsible insurance history: If you have a history of claims-free insurance, highlight this to the insurer.

- Inquire about discounts: Ask about any available discounts, such as those for bundling policies or paying annually.

- Negotiate politely and professionally: Approach the negotiation process with a polite and respectful attitude.

Understanding Your Policy

Renter’s insurance, while seemingly straightforward, requires careful examination of the policy document to ensure you understand your coverage and limitations. Failing to do so could leave you financially vulnerable in the event of an unforeseen incident. A thorough review before signing is crucial for protecting your belongings and financial well-being.

Reviewing your policy isn’t just about skimming the surface; it involves understanding the specific terms, conditions, and limitations of your coverage. This includes knowing what events are covered, the limits of liability, and the claims process. This proactive approach ensures you’re prepared for any unexpected events and can avoid costly surprises later.

Filing a Claim

The claims process typically begins by contacting your insurance provider immediately after an incident. You will need to provide specific details about the event, including the date, time, location, and a description of the damages. Accurate and complete information is vital for a smooth and efficient claims process. You’ll likely need to provide supporting documentation such as photos of the damage, police reports (if applicable), and receipts for any damaged items. The insurer will then investigate the claim, potentially sending an adjuster to assess the damage. Once the investigation is complete, they will determine the extent of your coverage and the amount you’ll receive. The entire process can take several weeks, depending on the complexity of the claim and the insurance company’s processing times.

Policy Exclusions and Limitations

Most renter’s insurance policies have exclusions and limitations. Common exclusions include damage caused by floods, earthquakes, and acts of war. Limitations often involve specific dollar amounts for certain types of losses, such as the maximum payout for personal property or liability coverage. For example, a policy might cap the amount it will pay for stolen electronics or limit the amount it will pay for liability claims resulting from injuries to others in your apartment. Carefully reviewing these sections will help you understand what is and isn’t covered under your policy. Consider purchasing supplemental coverage if there are specific concerns or high-value items not adequately protected.

Claim Process Flowchart

Imagine a flowchart:

Step 1: Incident Occurs (e.g., fire, theft, water damage).

Step 2: Contact your Insurer Immediately. Provide initial details of the event.

Step 3: Documentation Gathering. Gather photos, receipts, police reports (if applicable).

Step 4: Insurer Investigation. This may involve an adjuster visiting your apartment to assess the damage.

Step 5: Claim Assessment. The insurer determines the extent of your coverage and the payout amount.

Step 6: Payment. You receive payment for covered losses. This can take several weeks or longer depending on the claim’s complexity.

For example, if a fire damages your apartment, you would immediately contact your insurance company, provide details and photos, and cooperate with their investigation. They would then assess the damage and determine the payout based on your policy’s coverage limits and the actual cost of repairs or replacement of your belongings. The process could take several weeks as they verify the claim and process the payment.

The Value of Renters Insurance

Renters insurance is often overlooked, but it provides a crucial safety net against unforeseen circumstances that can significantly impact your financial well-being. The relatively low cost of a policy pales in comparison to the potential financial devastation that can occur without it. Understanding the value of renters insurance is key to protecting your assets and peace of mind.

Renters, unlike homeowners, are not typically responsible for the building structure itself. However, they are responsible for their personal belongings and, in some cases, for damage they cause to the property. Without insurance, the financial burden of replacing these items after a loss can be overwhelming, potentially leading to significant debt.

Financial Risks Faced by Renters Without Insurance

The absence of renters insurance exposes renters to substantial financial risks. Consider the cost of replacing all your furniture, electronics, clothing, and other personal possessions after a fire, theft, or other covered event. These costs can easily reach tens of thousands of dollars, a sum many renters could not afford to replace out of pocket. Further, liability coverage is essential; if you accidentally cause damage to your apartment building, you could be held financially responsible for repairs.

Scenarios Highlighting the Importance of Renters Insurance

Several scenarios demonstrate the critical role of renters insurance. A fire, even a small one, can quickly destroy valuable possessions. A burglary can leave you without your electronics, jewelry, and other irreplaceable items. Water damage from a burst pipe or a neighbor’s flooding apartment can ruin furniture and belongings. Liability coverage becomes vital if a guest is injured in your apartment, resulting in medical bills and potential lawsuits. Finally, even temporary displacement due to an uninhabitable apartment necessitates additional living expenses that renters insurance can cover.

Long-Term Benefits of Renters Insurance

The benefits of renters insurance extend beyond immediate protection. Having a policy provides peace of mind, knowing you are financially protected against unexpected events. This can reduce stress and anxiety, allowing you to focus on other aspects of your life. Furthermore, maintaining consistent insurance coverage can positively impact your credit score in the long run, as it demonstrates responsible financial management. Finally, the relatively low premium cost represents a small investment compared to the potential cost of replacing your belongings and facing liability claims without insurance.

Scenario: Fire and Theft

Imagine a scenario where a fire breaks out in your apartment building, damaging your apartment and destroying many of your belongings. Simultaneously, during the chaos of the evacuation, thieves target the building, stealing items from unoccupied apartments. Without renters insurance, you would face the immense cost of replacing your lost possessions, potentially including furniture, electronics, clothing, and personal documents. Your renters insurance policy, however, would cover the replacement cost of your belongings up to your policy limits, as well as providing temporary housing and living expenses while your apartment is being repaired. In addition, if items were stolen from your apartment during the fire, those losses would also be covered. This demonstrates the comprehensive financial protection renters insurance provides in a single event.

Final Summary

Ultimately, understanding apartment renters insurance cost is about more than just the price tag; it’s about securing peace of mind. By carefully considering the factors that influence premiums, comparing quotes from multiple providers, and choosing coverage that aligns with your needs, you can protect your belongings and financial well-being. Remember, the cost of renters insurance is a small price to pay for the significant protection it offers.

Top FAQs

What is the average cost of renters insurance?

The average cost varies significantly based on location, coverage level, and individual factors. Expect to pay anywhere from $15 to $30 per month, but this is just a broad estimate.

Can I get renters insurance without a credit check?

Some insurers offer renters insurance without a credit check, but it may result in higher premiums. It’s best to shop around and compare quotes from different providers.

What happens if I file a claim and my deductible is high?

You will be responsible for paying your deductible before the insurance company covers the remaining costs of your claim. A higher deductible typically results in lower premiums.

How long does it take to get a renters insurance claim processed?

Processing times vary depending on the insurer and the complexity of the claim. Expect a timeframe ranging from a few days to several weeks.