Navigating the world of auto insurance can be daunting, but understanding your options is crucial for securing the right protection. This guide delves into Allianz auto insurance, providing a detailed examination of its coverage options, pricing structure, claims process, customer service, and digital tools. We aim to equip you with the knowledge needed to make informed decisions about your auto insurance needs.

From comparing coverage levels and exploring optional add-ons to understanding the factors influencing premiums and navigating the claims process, we cover all the essential aspects of Allianz auto insurance. We’ll also compare Allianz to its competitors, examining customer reviews and digital features to provide a well-rounded perspective.

Allianz Auto Insurance

Choosing the right auto insurance policy can feel overwhelming, but understanding your coverage options is key to protecting yourself and your vehicle. Allianz offers a range of plans designed to meet diverse needs and budgets, balancing comprehensive protection with affordability. This section will detail the various coverage levels available, along with optional add-ons to further customize your policy.

Allianz Auto Insurance Coverage Levels

Allianz offers various coverage levels, each providing a different degree of protection. The key differences lie in the liability limits, collision deductible options, and the extent of comprehensive coverage. The following table summarizes these differences:

| Coverage Level | Liability Limits | Collision Deductible Options | Comprehensive Coverage Details |

|---|---|---|---|

| Basic | State Minimum | $500, $1000, $2500 | Limited coverage for events outside of collisions, such as theft or vandalism. |

| Standard | $100,000/$300,000 Bodily Injury, $50,000 Property Damage | $500, $1000, $2500, $5000 | Covers damage from events like fire, theft, and weather-related incidents. |

| Premium | $250,000/$500,000 Bodily Injury, $100,000 Property Damage | $500, $1000 | Comprehensive coverage with higher limits and lower deductible options. |

*Note: Specific coverage limits and deductible options may vary depending on your location and individual circumstances. Contact Allianz directly for precise details.*

Optional Add-ons

Allianz offers several valuable optional add-ons to enhance your policy’s protection. These additions provide peace of mind and can be tailored to individual needs.

Adding these optional coverages can significantly improve the overall protection of your policy. Consider your individual driving habits and lifestyle to determine which add-ons are most beneficial for you.

- Roadside Assistance: Provides coverage for towing, flat tire changes, jump starts, and lockout assistance.

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident covered by your policy.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects you if you are involved in an accident with an uninsured or underinsured driver.

Scenario-Based Examples

Let’s illustrate how different coverage levels might handle various accident scenarios.

Understanding how different coverage levels respond to different accident types is crucial for making an informed decision. The examples below highlight the potential financial implications of choosing various coverage options.

- Scenario 1: Minor Fender Bender – A minor fender bender causing $1,500 in damage to your vehicle. With a $500 collision deductible, a Standard coverage policy would require a $500 out-of-pocket payment, while the remaining $1000 would be covered by insurance. A Basic policy would have similar out-of-pocket costs, provided the damage is covered under collision.

- Scenario 2: Significant Collision with Property Damage – A collision causing $10,000 in damage to your vehicle and $5,000 in damage to a property. With a Premium policy and a $500 deductible, you would pay $500 for your vehicle repair, while the remaining damages would be handled by the liability coverage, assuming you are not at fault. Liability coverage for the property damage would also apply. A Standard policy would likely function similarly for your vehicle, but liability limits may impact the coverage for the property damage.

Allianz Auto Insurance

Allianz is a well-established name in the insurance industry, offering a range of auto insurance products. Understanding their pricing structure and the factors that influence premiums is crucial for consumers seeking the best value. This section will delve into the key components of Allianz auto insurance pricing.

Factors Influencing Allianz Auto Insurance Premiums

Several factors contribute to the final cost of your Allianz auto insurance premium. These factors are carefully assessed to provide a personalized rate reflecting your individual risk profile. A thorough understanding of these factors can help you manage your insurance costs effectively.

- Driving History: Your driving record plays a significant role. Accidents, traffic violations, and even the number of years you’ve been driving will influence your premium. A clean driving record typically results in lower premiums.

- Vehicle Type: The make, model, and year of your vehicle significantly impact your insurance cost. Generally, newer, more expensive vehicles command higher premiums due to higher repair costs and potential theft risk.

- Location: Your geographic location influences your premium because of varying crime rates and accident statistics. Areas with higher rates of theft or accidents typically have higher insurance premiums.

- Age: Insurance companies often consider age as a factor, as younger drivers statistically have higher accident rates than more experienced drivers. Older drivers might benefit from lower rates due to their lower accident risk, though this can vary depending on other factors.

- Coverage Level: The type and amount of coverage you choose will also influence your premium. Comprehensive and collision coverage typically costs more than liability-only coverage.

Comparison of Allianz Auto Insurance Pricing

To provide context, let’s compare Allianz’s pricing structure with that of two other major auto insurance providers. The following table presents average premium estimates and key features, though actual premiums will vary based on individual circumstances. Customer ratings are based on aggregated reviews from reputable sources. Please note that these are estimates and may not reflect current pricing.

| Provider | Average Premium (Annual Estimate) | Key Features | Customer Ratings (Example) |

|---|---|---|---|

| Allianz | $1200 | Accident forgiveness, roadside assistance, various discounts | 4.2 stars |

| Geico | $1100 | Easy online management, strong customer service reputation | 4.5 stars |

| State Farm | $1300 | Wide agent network, comprehensive coverage options | 4.0 stars |

Impact of Discounts on Allianz Auto Insurance Costs

Allianz, like other insurers, offers various discounts to incentivize safe driving and customer loyalty. These discounts can significantly reduce your overall premium.

- Safe Driver Discount: Maintaining a clean driving record for a specified period often qualifies you for a substantial discount.

- Multi-Car Discount: Insuring multiple vehicles under one Allianz policy usually results in a discount on each vehicle’s premium.

- Bundling Discount: Combining your auto insurance with other Allianz insurance products, such as home or renters insurance, often leads to a significant discount.

- Good Student Discount: Students with good grades may qualify for a discount, reflecting their lower risk profile.

Allianz Auto Insurance

Choosing the right auto insurance is a significant decision, impacting your financial well-being in the event of an accident. Allianz Auto Insurance offers comprehensive coverage and a streamlined claims process designed to minimize stress during challenging times. Understanding this process is key to a smooth and efficient resolution should you need to file a claim.

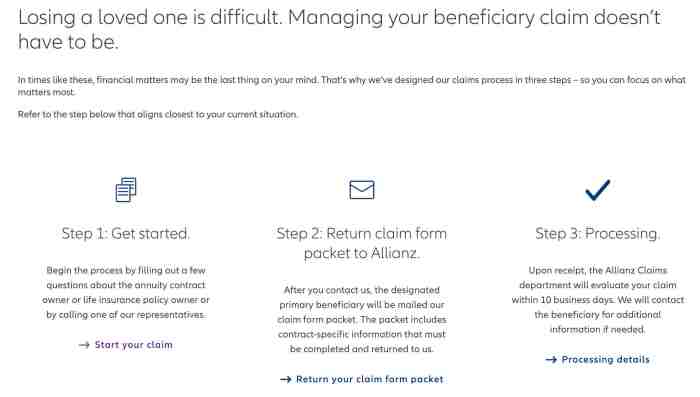

Allianz Auto Insurance Claims Process

The Allianz auto insurance claims process is designed to be straightforward and supportive. It involves several key steps, from initial notification to final settlement. A clear understanding of these steps can significantly ease the process.

- Report the Accident: Immediately after an accident, contact Allianz to report the incident. This is typically done via phone, but online reporting options may also be available. Provide as much detail as possible, including the date, time, location, and circumstances of the accident.

- File a Claim: Following the initial report, you will need to formally file a claim. This usually involves completing a claim form, either online or via mail. Be prepared to provide further details about the accident and involved parties.

- Investigation and Assessment: Allianz will investigate the claim, potentially involving contacting witnesses, reviewing police reports, and assessing the damage to your vehicle. This may involve an adjuster inspecting the vehicle.

- Damage Repair or Replacement: Once the claim is assessed, Allianz will determine the appropriate course of action. This may involve authorizing repairs at a preferred repair shop or offering a settlement for vehicle replacement.

- Settlement and Payment: Upon completion of repairs or agreement on a settlement, Allianz will process the payment. This may be directly to the repair shop or to you, depending on the specifics of your claim.

Required Documentation for Filing a Claim

Having the necessary documentation readily available significantly speeds up the claims process. Ensure you gather the following information before contacting Allianz:

- Your Allianz policy number.

- Details of the accident, including date, time, and location.

- Contact information for all parties involved.

- Police report number (if applicable).

- Photos and/or videos of the accident scene and vehicle damage.

- Information about any witnesses.

- Details of any pre-existing damage to your vehicle.

Hypothetical Claims Scenario and Resolution

Imagine Sarah is involved in a minor fender bender. She immediately calls Allianz to report the accident, providing details of the time, location, and other driver’s information. She then files a claim online, uploading photos of the damage to her bumper. An Allianz adjuster contacts Sarah to schedule an inspection of her vehicle. After the inspection, Allianz authorizes repairs at a local repair shop in Sarah’s network. The repair shop completes the work, and Allianz directly pays the shop for the repairs. Sarah receives updates throughout the process via email and phone calls from her assigned claims adjuster. The entire process is completed within two weeks.

Allianz Auto Insurance

Choosing the right auto insurance is a significant decision, impacting your financial security and peace of mind. Understanding a company’s customer service and reputation is crucial in this process. This section focuses on Allianz Auto Insurance, examining customer feedback and support methods to provide a comprehensive overview.

Allianz Auto Insurance Customer Service Feedback

Customer experiences with Allianz Auto Insurance’s customer service are varied, reflecting the complexity of individual claims and interactions. Analyzing both positive and negative feedback helps potential customers make informed decisions.

- Positive feedback frequently highlights the helpfulness and responsiveness of Allianz representatives. Many customers appreciate the clear explanations of policy details and the efficient processing of claims.

- Conversely, some negative feedback points to long wait times on the phone and difficulties reaching a representative. Frustration with navigating the claims process and perceived lack of communication are also common complaints.

- Another recurring theme in customer reviews involves the perceived fairness of claim settlements. While some customers report satisfactory outcomes, others express dissatisfaction with the offered settlements, citing insufficient compensation or protracted negotiation processes.

Allianz Auto Insurance Customer Support Contact Methods

Allianz offers several avenues for customers to access support. Understanding these options is key to resolving issues efficiently.

- Phone Support: Allianz provides a dedicated phone number for customer inquiries and claims reporting. The availability and wait times can vary depending on the time of day and demand.

- Email Support: Customers can submit inquiries and claims information via email. Response times may vary, but email provides a documented record of communication.

- Online Chat: Some Allianz websites offer live chat support, allowing for immediate interaction with a customer service representative. This method is often convenient for quick questions or initial inquiries.

- Online Portal: Many Allianz customers can access their policy information, manage their accounts, and submit claims through a secure online portal. This self-service option offers convenience and 24/7 accessibility.

Summary of Customer Reviews from Reputable Sources

Analyzing reviews from independent review sites reveals several recurring themes. While experiences are subjective, these aggregated insights offer a valuable perspective.

Generally, reviews reveal a mixed bag. While many praise the ease of online access and the helpfulness of some representatives, a significant portion express concerns about claim processing times and communication. The fairness of claim settlements is also a point of contention, with some customers reporting positive experiences while others feel undervalued. The overall sentiment suggests that while Allianz provides adequate services, improvements in communication and claim processing efficiency could enhance customer satisfaction.

Allianz Auto Insurance

Allianz offers a comprehensive auto insurance package, and a key component of their service is the suite of digital tools designed to simplify policy management and enhance customer experience. These tools are intended to make interacting with your insurance straightforward and efficient, allowing you to focus on what matters most.

Digital Tools and Features for Policy Management

Access to your Allianz auto insurance policy is readily available through various digital channels, designed for maximum convenience. These tools empower you to manage your insurance needs quickly and easily, from anywhere with an internet connection.

- Online Account Access: A secure online portal provides 24/7 access to your policy details, including coverage information, payment history, and claims status. You can easily update your personal information, make payments, and view your policy documents all in one place.

- Mobile App Functionality: The Allianz mobile app extends these capabilities to your smartphone or tablet. Features often include the ability to file claims directly through the app, access digital ID cards, locate nearby repair shops, and receive real-time notifications regarding your policy.

- Digital ID Cards: Eliminate the need for a physical insurance card. Your digital ID card is always accessible through your online account or mobile app, providing immediate proof of insurance when needed.

- Automated Payment Options: Set up automatic payments to ensure timely premium payments and avoid late fees. You can also easily manage payment methods and view your payment schedule.

Enhanced Customer Convenience and Efficiency

The digital tools offered by Allianz significantly improve customer convenience and efficiency by reducing the need for phone calls, paperwork, and visits to physical offices. This translates to saved time and reduced hassle for policyholders. For instance, filing a claim through the mobile app can be significantly faster than traditional methods, often involving simply taking photos of the damage and submitting them through the app. Similarly, accessing policy documents online eliminates the need to wait for mailed copies.

Comparison with Competitor Offerings

While many competitors offer online account access and mobile apps, Allianz distinguishes itself through its user-friendly interface and comprehensive range of features within those platforms. Features such as integrated repair shop locators and real-time claim status updates are not always standard across all providers. A direct comparison would require analyzing the specific features and functionality of each competitor’s platform, but Allianz consistently aims for a seamless and intuitive digital experience. The level of integration between online and mobile platforms also contributes to a more streamlined experience compared to some competitors who may have less cohesive digital offerings.

Allianz Auto Insurance

Managing your Allianz auto insurance policy is designed to be straightforward and convenient. Whether you need to make a payment, update your information, or renew your coverage, Allianz provides several accessible methods to ensure a smooth experience. This section details the online policy management process, the renewal procedure, and the steps involved in canceling your policy.

Online Policy Management

The Allianz online customer portal provides a centralized location for managing your policy details. Access is typically available through the Allianz website, requiring your policy number and other identifying information. Once logged in, you can view your policy details, including coverage specifics, payment history, and upcoming renewal dates. Payments can be made securely online using various methods, such as credit cards, debit cards, and electronic bank transfers. You can also update your personal information, such as your address, phone number, or email address, directly through the portal. This ensures your policy information remains accurate and up-to-date. Any changes made are usually reflected immediately in your policy record.

Policy Renewal Process

Allianz typically sends renewal notices well in advance of your policy’s expiration date. These notices Artikel the renewal premium and any changes to coverage or rates. You can review your policy details online and choose to renew your coverage with the existing terms or modify your coverage as needed. This might include adjusting your liability limits, adding optional coverages, or changing your payment plan. Allianz may offer various payment options, such as a single lump-sum payment or installment payments. Choosing an installment plan may involve a slightly higher overall cost due to financing charges. Confirming your renewal online usually requires accepting the terms and conditions and authorizing the payment method.

Policy Cancellation

To cancel your Allianz auto insurance policy, you must typically submit a written cancellation request. This can often be done through the online portal or by contacting Allianz customer service directly. The request should clearly state your policy number, the reason for cancellation, and the desired cancellation date. Allianz may require you to provide additional information or documentation, depending on your circumstances. There may be penalties or fees associated with canceling your policy early, so it’s crucial to understand the terms and conditions Artikeld in your policy documents. It’s advisable to obtain written confirmation from Allianz once the cancellation request has been processed. This documentation serves as proof of cancellation and protects you from any potential future claims or charges.

Ending Remarks

Choosing the right auto insurance is a significant financial decision. This comprehensive guide has explored Allianz auto insurance in detail, highlighting its strengths and weaknesses. By understanding its coverage options, pricing, claims process, and customer service, you can confidently assess whether Allianz aligns with your individual needs and budget. Remember to always compare quotes from multiple providers before making a final decision to ensure you’re getting the best value for your money.

FAQs

What types of vehicles does Allianz insure?

Allianz typically insures a wide range of vehicles, including cars, trucks, motorcycles, and sometimes even RVs. Specific eligibility may vary by location and policy.

How long does it take to get a quote from Allianz?

Getting a quote online is usually quick, often taking only a few minutes to complete the application. However, processing times for a final quote might vary.

Does Allianz offer discounts for good driving records?

Yes, Allianz, like many insurers, offers discounts for drivers with clean driving records, often reflecting a lower risk profile.

Can I pay my Allianz premium monthly?

Payment options often include monthly installments, but specific options and any associated fees should be confirmed directly with Allianz.