Navigating the complexities of homeownership often involves understanding the often-overlooked yet crucial aspect of home mortgage insurance rates. These rates, significantly impacting your monthly mortgage payments, are influenced by a variety of factors, from your creditworthiness to the type of loan you secure. This guide provides a clear and concise overview of these factors, helping you make informed decisions throughout your home-buying journey.

Understanding home mortgage insurance is key to budgeting effectively for your new home. This guide will demystify the process, explaining how various elements influence your premiums and offering strategies to potentially lower your costs. We’ll explore different loan types, highlight the importance of your credit score and down payment, and offer practical tips to navigate this essential aspect of home financing.

Factors Influencing Home Mortgage Insurance Rates

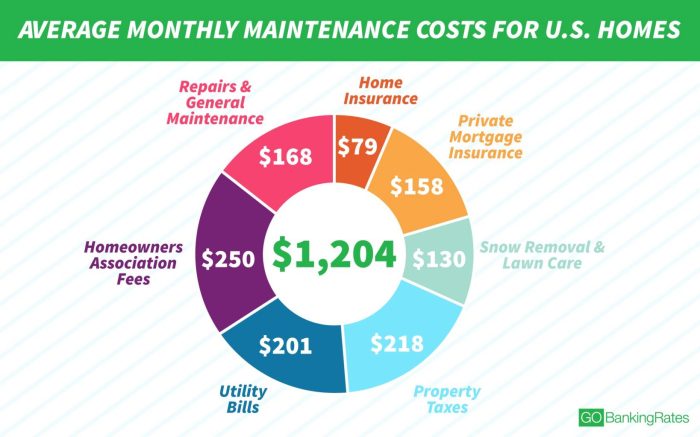

Securing a home mortgage often involves Private Mortgage Insurance (PMI) or other forms of insurance, depending on the loan type and down payment. The cost of this insurance can significantly impact your overall monthly payment and the total cost of your home. Several key factors determine the premium you’ll pay. Understanding these factors can help you make informed decisions about your mortgage.

Credit Score and Home Mortgage Insurance Premiums

Your credit score is a crucial factor influencing your home mortgage insurance rates. Lenders view a higher credit score as an indicator of lower risk. Borrowers with excellent credit scores (typically 760 and above) are generally considered less likely to default on their loan, resulting in lower premiums. Conversely, borrowers with lower credit scores face higher premiums due to the perceived increased risk. A difference of even a few points can impact the rate, highlighting the importance of maintaining good credit.

Down Payment Size and Home Mortgage Insurance Cost

The size of your down payment directly affects the cost of your mortgage insurance. A larger down payment reduces the loan-to-value (LTV) ratio, which is the loan amount divided by the home’s value. A lower LTV ratio signifies less risk for the lender, leading to lower or even eliminated PMI premiums. For example, a 20% down payment on a conventional loan typically eliminates the need for PMI, while smaller down payments will necessitate insurance.

Comparison of Insurance Rates for Different Loan Types

Different loan types have varying insurance requirements and rate structures. FHA loans, backed by the Federal Housing Administration, typically require mortgage insurance premiums (MIP) throughout the loan term, even with a down payment exceeding 20%. VA loans, guaranteed by the Department of Veterans Affairs, usually don’t require PMI but may have funding fees. Conventional loans often require PMI for loans with less than a 20% down payment, but this insurance can be canceled once the LTV ratio reaches 80%. Each loan type has its own set of rules and associated costs.

Loan-to-Value Ratio and Premium Calculation

The loan-to-value (LTV) ratio is a significant determinant of your mortgage insurance premium. As mentioned earlier, a lower LTV ratio (meaning a larger down payment) indicates less risk, resulting in lower premiums. Lenders use the LTV ratio to assess the risk of default; a higher LTV ratio suggests a greater risk and thus higher premiums. For instance, a loan with an 80% LTV ratio will generally have a higher PMI than a loan with a 70% LTV ratio.

Debt-to-Income Ratio and Insurance Rates

Your debt-to-income (DTI) ratio, which is the percentage of your gross monthly income dedicated to debt payments, also influences your mortgage insurance rates. A high DTI ratio indicates a greater financial burden, suggesting a higher risk of default. Lenders will scrutinize your DTI ratio and may charge higher premiums if it’s too high, reflecting the increased risk associated with your financial situation. Maintaining a manageable DTI ratio is beneficial in securing favorable mortgage insurance rates.

Typical Rate Ranges for Various Credit Scores and Loan-to-Value Ratios

| Credit Score | LTV Ratio 80% | LTV Ratio 90% | LTV Ratio 95% |

|---|---|---|---|

| 660-679 | 0.8% – 1.2% | 1.0% – 1.5% | 1.3% – 2.0% |

| 680-719 | 0.6% – 0.9% | 0.8% – 1.2% | 1.0% – 1.5% |

| 720-759 | 0.5% – 0.7% | 0.6% – 0.9% | 0.8% – 1.2% |

| 760+ | 0.4% – 0.6% | 0.5% – 0.8% | 0.6% – 1.0% |

*Note: These are illustrative ranges and actual rates may vary depending on the lender, loan type, and other factors. These percentages represent annual premiums, typically added to your monthly mortgage payment.

Understanding Home Mortgage Insurance Premiums

Home mortgage insurance (PMI) premiums are a crucial aspect of securing a mortgage, significantly impacting the overall cost of homeownership. Understanding how these premiums are calculated, the different types of premiums available, and common misconceptions surrounding them is vital for prospective homeowners. This section will clarify these aspects, providing a clearer picture of PMI costs and how they vary among lenders.

Home Mortgage Insurance Premium Calculation Methods

Lenders employ various methods to calculate PMI premiums, primarily focusing on the Loan-to-Value ratio (LTV). The LTV is the percentage of the home’s value that is financed through the mortgage. A higher LTV generally translates to a higher PMI premium because it represents a greater risk for the lender. For example, a borrower with a 20% down payment (80% LTV) will typically pay a lower PMI premium than a borrower with a 10% down payment (90% LTV). Specific calculation formulas vary by lender and insurance provider, often incorporating factors such as credit score, loan type (fixed-rate or adjustable-rate), and the type of property. Some lenders might use a tiered system, where premiums decrease as the LTV decreases, reflecting the reduced risk. Others might use a more complex model incorporating multiple risk factors.

Upfront Versus Annual Premiums

Two primary types of PMI premiums exist: upfront and annual. Upfront premiums are a single, lump-sum payment made at closing, typically ranging from 0.5% to 2% of the loan amount. This payment covers a portion of the insurance for the loan’s life. Annual premiums, on the other hand, are paid monthly along with the mortgage payment. These payments are typically a small percentage of the loan amount, spread over the loan’s term. The choice between upfront and annual premiums depends on individual financial circumstances and preferences. Borrowers with more readily available funds might opt for the upfront premium to avoid ongoing monthly payments. Conversely, those with tighter budgets might prefer the smaller monthly payments associated with annual premiums, even though the total cost over the loan term may be slightly higher.

Common Misconceptions About Home Mortgage Insurance

Several misconceptions surround PMI. One common misconception is that PMI is only for high-risk borrowers. In reality, PMI is often required even for borrowers with excellent credit scores if their down payment is less than 20% of the home’s value. Another misconception is that PMI is optional. While some lenders might offer alternatives, PMI is typically mandatory for conventional loans with LTVs exceeding 80%. Finally, some believe that PMI is a permanent cost. This is untrue; once the borrower’s equity reaches 20% of the home’s value (typically through paying down the principal), the lender is usually required to cancel the PMI.

Comparison of Home Mortgage Insurance Costs from Different Lenders

The cost of PMI can vary significantly among lenders. The following table illustrates potential differences, emphasizing that these are examples and actual costs depend on individual circumstances:

| Lender | Annual Premium (as % of loan amount) | Upfront Premium (as % of loan amount) | Average Annual Cost (on a $300,000 loan) |

|---|---|---|---|

| Lender A | 0.5% | 1.0% | $1,500 |

| Lender B | 0.6% | 1.2% | $1,800 |

| Lender C | 0.4% | 0.8% | $1,200 |

| Lender D | 0.7% | 1.4% | $2,100 |

Obtaining a Home Mortgage Insurance Quote

Obtaining a PMI quote is relatively straightforward. Most lenders provide online quote tools that allow borrowers to input relevant information, such as loan amount, down payment, credit score, and property type, to receive an immediate estimate. Alternatively, borrowers can contact lenders directly to discuss their options and receive personalized quotes. It’s advisable to compare quotes from multiple lenders to secure the most competitive rate. Be sure to ask about all fees and charges associated with the PMI, including upfront and annual premiums, and any additional administrative fees.

Strategies to Reduce Home Mortgage Insurance Costs

Minimizing the cost of home mortgage insurance (PMI) is a key concern for many homebuyers. Several strategies can significantly reduce or even eliminate these premiums, ultimately saving you considerable money over the life of your loan. These strategies focus on improving your financial standing and strategically managing your mortgage.

Improving Credit Scores to Lower Insurance Premiums

A higher credit score is directly correlated with lower PMI rates. Lenders perceive borrowers with excellent credit as less risky, leading to reduced premiums. Improving your credit score involves consistent and responsible financial management. This includes paying all bills on time, keeping credit utilization low (ideally below 30% of your available credit), and avoiding opening numerous new credit accounts in a short period. Regularly checking your credit report for errors and disputing any inaccuracies is also crucial. A consistent effort over several months can result in a noticeable credit score improvement, leading to lower PMI rates or even eligibility for a lower rate from a different lender. For example, a borrower who raises their credit score from 660 to 760 could see a significant reduction in their monthly PMI payment, potentially saving hundreds of dollars annually.

Increasing Down Payment Amounts to Reduce or Eliminate Insurance

One of the most effective ways to avoid PMI is to make a larger down payment. Generally, a down payment of 20% or more eliminates the need for PMI on conventional loans. Increasing your down payment requires careful saving and planning. Strategies include increasing your savings rate, reducing unnecessary expenses, and exploring additional income streams. For example, a buyer aiming for a $300,000 home could save $60,000 for a 20% down payment, eliminating the need for PMI altogether. This can significantly reduce the overall cost of homeownership.

Comparison of Different Types of Home Mortgage Insurance

Several types of mortgage insurance exist, each with its own benefits and drawbacks. Private Mortgage Insurance (PMI) is the most common type, typically required for loans with less than 20% down payment. Federal Housing Administration (FHA) insurance is another option, often preferred by borrowers with lower credit scores or smaller down payments. While FHA insurance offers more lenient requirements, it usually comes with higher upfront and annual premiums compared to PMI. Choosing the right type of insurance depends on individual financial circumstances and risk tolerance. A careful comparison of premiums and requirements is essential before making a decision.

Step-by-Step Guide for Negotiating Lower Home Mortgage Insurance Rates

Negotiating lower PMI rates might be possible, though it’s not always guaranteed. The process involves researching different lenders, comparing their rates and terms, and presenting a strong financial profile.

- Research and Compare: Obtain quotes from multiple lenders, highlighting your strong credit score and financial stability.

- Highlight Positive Financial Aspects: Emphasize factors like a consistent employment history, significant savings, and low debt-to-income ratio.

- Negotiate: Politely discuss your options and explore the possibility of a lower rate based on your financial strength.

- Consider Alternatives: If negotiation fails, consider exploring alternative mortgage options or lenders.

- Review the Contract Carefully: Before signing any agreement, thoroughly review all terms and conditions, including the PMI rate and payment schedule.

Refinancing and its Effect on Home Mortgage Insurance Costs

Refinancing your mortgage can impact your PMI costs. If your home has appreciated significantly in value, refinancing to a lower loan-to-value ratio (LTV) might allow you to eliminate PMI. However, refinancing involves closing costs, and the overall savings need to outweigh these expenses. For example, if a homeowner refinances from an 80% LTV to a 70% LTV, they might be able to cancel their PMI. However, they need to carefully weigh the refinancing costs against the potential long-term savings from eliminating PMI.

Home Mortgage Insurance and the Home Buying Process

Home mortgage insurance (PMI) plays a significant role in the home buying process, particularly for borrowers who put down less than 20% of the home’s purchase price. Understanding its function and implications is crucial for navigating this complex transaction successfully. This section will detail how PMI integrates into the home buying process, its purpose in protecting lenders, when it’s required, and the options available for its cancellation.

PMI’s integration into the home-buying process begins with the loan application. Lenders use it to mitigate risk associated with loans where the down payment is less than 20% of the home’s value. The presence or absence of PMI affects the loan approval process, the overall cost of the mortgage, and the borrower’s monthly payment. Its inclusion in the closing costs and monthly mortgage payment is standard practice, and its removal depends on achieving sufficient home equity.

The Role of Home Mortgage Insurance in Protecting Lenders

Home mortgage insurance primarily protects lenders against losses if a borrower defaults on their mortgage loan. If a borrower defaults and the home is sold through foreclosure, and the sale proceeds don’t fully cover the outstanding loan amount, PMI covers the difference up to a certain limit. This protects the lender’s financial investment and encourages them to offer mortgages to borrowers with smaller down payments, expanding access to homeownership. For example, if a borrower defaults on a $300,000 loan and the foreclosure sale only yields $250,000, the PMI policy would compensate the lender for the $50,000 shortfall (subject to policy limits).

When Home Mortgage Insurance is Typically Required

Home mortgage insurance is typically required when a borrower’s down payment is less than 20% of the home’s purchase price. This is because a smaller down payment increases the lender’s risk of loss in case of default. The requirement for PMI is a standard practice for conventional loans (loans not backed by government agencies like FHA or VA). However, lenders may waive PMI requirements even with a down payment less than 20% if the borrower meets specific criteria, such as exceptional credit scores and a demonstrated history of responsible financial management.

Home Mortgage Insurance Cancellation Options

There are several ways to cancel PMI, primarily revolving around achieving sufficient equity in the home. One common method is to reach a loan-to-value (LTV) ratio of 80% or less. This means that the borrower’s home equity (the difference between the home’s value and the outstanding loan amount) reaches at least 20% of the home’s value. At this point, many lenders automatically cancel PMI. Borrowers can also request cancellation once the 80% LTV ratio is reached, although the lender might have specific procedures for this. In some cases, borrowers may be able to refinance their mortgage to eliminate PMI, provided they meet the lender’s refinancing criteria. Alternatively, some lenders offer policies with automatic cancellation provisions at specific milestones, like after a certain number of years of consistent on-time payments.

The Process of Removing Home Mortgage Insurance

The process of removing PMI once the equity requirements are met involves providing the lender with documentation demonstrating the increased home equity. This usually involves an appraisal to determine the current market value of the home. Once the appraisal confirms that the LTV ratio has fallen below 80%, the lender will typically cancel the PMI. The lender might require specific paperwork and a formal request from the borrower to initiate the cancellation. The process timeframe can vary depending on the lender’s policies and procedures. It’s crucial to actively monitor the LTV ratio and initiate the PMI cancellation process once the threshold is reached to avoid paying unnecessary premiums. Failure to actively pursue cancellation could result in continued PMI payments for longer than necessary.

Illustrative Examples of Home Mortgage Insurance Scenarios

Understanding the cost of mortgage insurance can be complex, varying significantly based on individual circumstances. The following scenarios illustrate how different factors influence premiums, providing a clearer picture of what homebuyers might expect. Remember that these are examples, and actual rates will depend on the specific lender and current market conditions.

The examples below showcase three distinct homebuyer profiles, highlighting the impact of credit score, down payment percentage, and loan amount on the total cost of mortgage insurance.

Scenario 1: High Credit Score, Low Down Payment

This scenario depicts a buyer with an excellent credit score but a smaller down payment. Let’s assume a buyer with a 780 credit score, purchasing a $400,000 home with a 5% down payment ($20,000). This leaves a loan amount of $380,000. Due to the lower down payment, private mortgage insurance (PMI) is required. Assuming a current average annual PMI rate of 0.5% of the loan amount, the annual PMI cost would be $1,900 ($380,000 x 0.005). This translates to a monthly PMI payment of approximately $158.33 ($1,900 / 12).

Scenario 2: Average Credit Score, Higher Down Payment

Here, we consider a buyer with a more average credit score and a larger down payment. This buyer has a credit score of 700, purchasing a $350,000 home with a 10% down payment ($35,000). The loan amount is $315,000. With a higher down payment, the PMI rate may be lower or potentially eliminated entirely depending on the lender’s requirements. Let’s assume a slightly higher annual PMI rate of 0.7% due to the lower credit score, resulting in an annual cost of $2,205 ($315,000 x 0.007). The monthly PMI payment would be approximately $183.75 ($2,205 / 12).

Scenario 3: Lower Credit Score, Larger Down Payment

This scenario presents a buyer with a lower credit score but a substantial down payment. The buyer has a credit score of 660 and purchases a $300,000 home with a 20% down payment ($60,000). The loan amount is $240,000. With a 20% down payment, PMI is typically not required. Therefore, there are no additional monthly PMI payments in this scenario.

Impact of Different Factors on Monthly Mortgage Payments

The following points illustrate how various factors interact to determine total monthly mortgage costs, including insurance.

- Credit Score: A higher credit score generally leads to lower interest rates and potentially lower PMI rates, resulting in lower monthly payments. A lower credit score can significantly increase both interest rates and PMI costs.

- Down Payment: A larger down payment reduces the loan amount, potentially eliminating the need for PMI and leading to lower monthly payments. Smaller down payments increase the loan amount and often necessitate PMI, increasing monthly costs.

- Loan Amount: A larger loan amount increases both the principal and interest payments and may increase the PMI cost, resulting in higher monthly payments. Conversely, smaller loan amounts lead to lower monthly payments.

- Interest Rate: Higher interest rates increase the monthly principal and interest payments, regardless of the down payment or PMI. Lower interest rates result in lower monthly payments.

- Loan Term: A longer loan term (e.g., 30 years) results in lower monthly payments but higher total interest paid over the life of the loan. Shorter loan terms (e.g., 15 years) result in higher monthly payments but significantly lower total interest paid.

Epilogue

Securing a mortgage and understanding the associated insurance costs are critical steps in responsible homeownership. By carefully considering the factors discussed – credit score, down payment, loan type, and debt-to-income ratio – you can gain a clearer picture of your potential home mortgage insurance rates. Remember, proactive planning and a thorough understanding of these rates can empower you to make financially sound decisions, leading to a smoother and more manageable home-buying experience. This guide serves as a starting point; further research and consultation with financial professionals are recommended for personalized advice.

Quick FAQs

What happens to my PMI after I reach 20% equity?

Most conventional loans require PMI until you reach 20% equity. At that point, you can usually request cancellation from your lender. However, the process and requirements may vary depending on your lender and loan terms.

Can I shop around for home mortgage insurance?

While you typically don’t directly “shop” for PMI like you do for car insurance, your lender may offer different options or you can explore different loan products with varying insurance requirements. Comparing lenders and their offerings is crucial for finding the best rates.

Is home mortgage insurance tax deductible?

The deductibility of home mortgage insurance depends on your specific circumstances and the type of loan you have. Consult a tax professional for personalized advice, as rules can change.

What’s the difference between PMI and MIP?

PMI (Private Mortgage Insurance) is required on conventional loans with less than 20% down payment. MIP (Mortgage Insurance Premium) is required on FHA loans, regardless of the down payment.