Navigating the world of home insurance can feel overwhelming, especially in a vibrant city like San Antonio. This guide delves into the intricacies of the San Antonio home insurance market, offering insights into finding the right policy to safeguard your valuable asset. We’ll explore the factors influencing premiums, compare leading insurance providers, and equip you with the knowledge to make informed decisions about protecting your home.

From understanding the unique characteristics of San Antonio’s housing market and its susceptibility to specific weather events, to comparing coverage options and navigating the claims process, this guide provides a comprehensive overview. We aim to empower you to secure the best possible home insurance coverage at a price that fits your budget.

Understanding San Antonio’s Home Insurance Market

San Antonio’s dynamic housing market presents a unique landscape for home insurance. Factors like rapid growth, diverse architectural styles, and susceptibility to certain weather events significantly influence the cost and availability of insurance policies. Understanding these nuances is crucial for homeowners seeking adequate protection.

San Antonio’s housing market is characterized by a mix of older, established neighborhoods and newer, rapidly developing suburbs. This diversity impacts insurance premiums due to variations in building codes, infrastructure, and proximity to potential hazards. The prevalence of older homes, some with outdated electrical systems or plumbing, can increase the risk of claims, leading to higher premiums. Conversely, newer homes in well-maintained communities often command lower rates.

Types of Home Insurance Policies in San Antonio

Several types of home insurance policies are commonly offered in San Antonio, each providing varying levels of coverage. The most common include homeowners insurance (HO-3), which offers broad coverage for dwelling, personal property, and liability; renters insurance, which protects renters’ personal belongings and provides liability coverage; and condo insurance, tailored to the specific needs of condominium owners. Other specialized policies may cater to unique situations, such as those with high-value items or those living in areas prone to specific hazards like flooding.

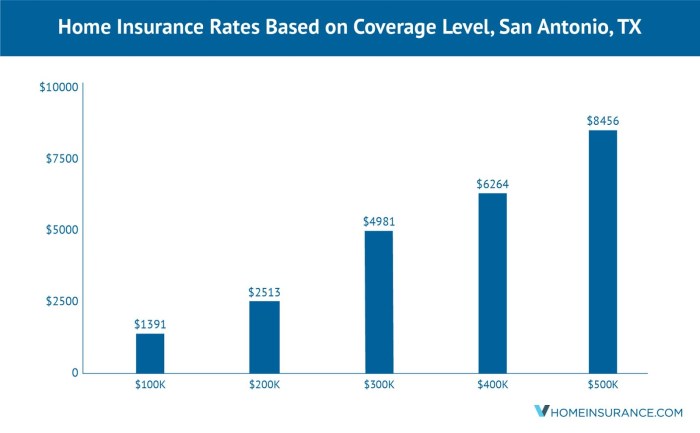

Average Premiums for Various Coverage Levels in San Antonio

Providing exact average premiums is challenging due to the numerous variables influencing cost. However, a general understanding can be gleaned from industry reports and online resources. For example, a basic HO-3 policy with $250,000 dwelling coverage and $100,000 personal property coverage might range from $1,200 to $2,000 annually, while a higher coverage policy with additional features like flood or windstorm coverage could cost significantly more, potentially reaching $3,000 or more. These figures are estimates and vary based on individual circumstances. It’s essential to obtain quotes from multiple insurers to compare prices and coverage options.

Factors Influencing Home Insurance Premiums in San Antonio

Insurance companies in San Antonio consider a variety of factors when determining premiums. These include the location of the property (flood zones, crime rates), the age and condition of the home (building materials, roof condition, updated systems), the coverage amount desired, the homeowner’s claims history, and the presence of security features (alarm systems, fire sprinklers). For example, a home located in a flood-prone area will command higher premiums than one situated on higher ground. Similarly, a home constructed with fire-resistant materials might receive a lower rate than one built with more combustible materials. The age of the home’s roof is also a significant factor, as older roofs are more susceptible to damage. Finally, a homeowner with a history of filing claims is likely to face higher premiums than one with a clean record.

Top Insurance Providers in San Antonio

Choosing the right home insurance provider is crucial for protecting your biggest investment. San Antonio’s market offers a range of options, each with its own strengths and weaknesses. Understanding the key differences between providers can help you make an informed decision that best suits your needs and budget.

Comparison of Top Home Insurance Providers in San Antonio

The following table compares four major home insurance providers commonly found in San Antonio. Note that premiums and ratings can fluctuate, and it’s essential to obtain personalized quotes based on your specific property and coverage needs. Customer satisfaction ratings are based on averages from various reputable review sites and may vary depending on individual experiences.

| Provider | Customer Rating (Average) | Coverage Options | Average Premium Range (Annual) |

|---|---|---|---|

| State Farm | 4.5 stars | Comprehensive coverage, including dwelling, liability, personal property, and additional living expenses; various endorsements available. | $1,200 – $2,500 |

| USAA | 4.7 stars | Wide range of coverage options, strong focus on military members and their families; competitive pricing for eligible members. | $1,000 – $2,200 |

| Farmers Insurance | 4.2 stars | Offers a variety of coverage options; known for its extensive agent network providing personalized service. | $1,300 – $2,600 |

| Allstate | 4.0 stars | Comprehensive coverage options; known for its bundling options (auto and home). | $1,400 – $2,800 |

Customer Service Strengths and Weaknesses

Customer service experiences can vary greatly depending on individual interactions and specific agents. However, general trends can be observed. State Farm generally receives positive feedback for its widespread agent network and accessibility, although some customers report inconsistencies in service quality depending on the local agent. USAA, while highly rated, primarily serves military members and their families, limiting its accessibility to a specific demographic. Farmers Insurance is often praised for its personalized service provided by independent agents, but response times might vary. Allstate’s customer service receives mixed reviews, with some praising its accessibility and others reporting difficulties with claims processing.

Market Share of Top Five Home Insurance Companies in San Antonio

This chart illustrates the estimated market share of the top five home insurance companies in San Antonio. These figures are estimates based on publicly available data and industry reports and may not reflect the precise current market dynamics. The actual market share may fluctuate due to various factors, including competitive pricing, marketing campaigns, and customer preferences.

| Company | Estimated Market Share (%) |

|---|---|

| State Farm | 25 |

| USAA | 20 |

| Farmers Insurance | 15 |

| Allstate | 12 |

| Other | 28 |

Factors Affecting Home Insurance Costs in San Antonio

Several factors influence the cost of home insurance in San Antonio, a city known for its diverse neighborhoods and susceptibility to certain weather events. Understanding these factors can help homeowners make informed decisions about their insurance coverage and potentially reduce their premiums. These factors interact in complex ways to determine your final premium.

Impact of Weather Events on Home Insurance Premiums

San Antonio’s climate exposes homes to various weather risks, significantly impacting insurance costs. Hailstorms are frequent, causing substantial roof damage and leading to higher premiums for homeowners in affected areas. While flooding isn’t as pervasive as in other parts of Texas, localized flash flooding can still cause significant damage, resulting in increased premiums, particularly for homes in flood-prone zones. Insurance companies assess the risk based on historical weather data, proximity to floodplains, and the effectiveness of existing drainage systems. For example, a home located near the San Antonio River with a history of flooding will likely have higher premiums than a home situated on higher ground in a well-drained neighborhood. The increased risk translates directly into higher premiums to cover potential payouts for damage.

Neighborhoods with Highest and Lowest Insurance Rates

Insurance rates vary considerably across San Antonio’s diverse neighborhoods. Generally, areas with higher crime rates, older housing stock, and a history of significant property damage tend to have higher insurance premiums. Conversely, newer neighborhoods with lower crime rates and modern building codes often enjoy lower rates. For instance, some upscale neighborhoods in Northwest San Antonio might have lower rates due to their newer homes and lower crime statistics, compared to certain older neighborhoods in the East Side that may experience higher rates due to a combination of older infrastructure and higher claims frequency. The specific neighborhoods with the highest and lowest rates are subject to change based on ongoing risk assessments performed by insurance companies.

Home Security Features that Reduce Insurance Costs

Many home security features can reduce insurance premiums. Installing a monitored security system, which provides immediate notification to emergency services, is a common example. Other features such as fire alarms, smoke detectors, and security cameras can also contribute to lower premiums. The discounts offered vary by insurance provider, but generally, the more comprehensive the security system, the greater the potential savings. For example, a comprehensive system that includes burglar alarms, fire alarms, and carbon monoxide detectors may result in a more substantial discount than a basic security system with only a burglar alarm. These features demonstrate a commitment to home safety, which translates to lower risk for the insurance company.

Common Home Insurance Claims in San Antonio and Their Associated Costs

Common home insurance claims in San Antonio often involve weather-related damage. Hail damage to roofs is a frequent claim, with costs varying significantly depending on the extent of the damage and the roof’s size and materials. Wind damage, often associated with severe thunderstorms, can also lead to substantial claims. Water damage from plumbing failures or burst pipes is another common claim, with costs depending on the location and extent of the damage. The average cost of these claims can range from a few hundred dollars for minor repairs to tens of thousands of dollars for extensive damage. For example, a minor roof leak might cost a few hundred dollars to repair, whereas a complete roof replacement after a hailstorm could cost tens of thousands of dollars.

Finding the Right Home Insurance Policy

Securing the right home insurance policy in San Antonio is crucial for protecting your most valuable asset. A well-chosen policy offers peace of mind, knowing you’re financially protected against unforeseen events. This section will guide you through the process of comparing quotes, understanding policy details, and filing a claim.

Comparing Home Insurance Quotes in San Antonio

Effectively comparing home insurance quotes requires a systematic approach. Begin by obtaining multiple quotes from different insurers. Consider using online comparison tools to streamline the process, but remember to verify information directly with the insurance companies. Pay close attention to the coverage amounts, deductibles, and premiums offered by each provider. Don’t solely focus on the lowest price; a policy with seemingly lower premiums might lack sufficient coverage. A thorough comparison ensures you find a balance between cost and comprehensive protection.

Understanding Policy Exclusions and Limitations

It’s vital to understand what your home insurance policy *doesn’t* cover. Every policy has exclusions and limitations. Common exclusions might include damage caused by floods, earthquakes, or acts of war. Limitations might specify coverage caps for certain types of losses or impose waiting periods before coverage begins. Carefully review the policy documents, paying particular attention to the exclusions and limitations sections. If anything is unclear, contact the insurance provider for clarification. Ignoring these aspects can lead to significant financial burden in the event of a claim. For example, a policy might cover fire damage but exclude damage caused by a specific type of fire, such as one resulting from faulty wiring if it is deemed not to be properly maintained.

Filing a Home Insurance Claim in San Antonio

Filing a claim involves reporting the incident promptly to your insurance provider. This typically involves a phone call or online submission, followed by providing detailed information about the event, including date, time, and circumstances. You’ll likely need to provide documentation such as photos or videos of the damage. The insurer will then assign an adjuster to assess the damage and determine the extent of coverage. Cooperate fully with the adjuster throughout the process. Remember to keep detailed records of all communication and documentation related to your claim. Delays in reporting or providing necessary information can impact the claim processing time and the final settlement. For instance, if a tree falls on your house during a storm, you should immediately contact your insurance company, then take pictures of the damage before any cleanup is done.

Types of Home Insurance Coverage

Home insurance policies typically include several types of coverage. Liability coverage protects you against financial responsibility for injuries or property damage caused to others on your property. Personal property coverage protects your belongings inside your home from damage or theft. Medical payments coverage helps pay for medical expenses for individuals injured on your property, regardless of fault. Additional living expenses coverage can help cover temporary housing and other costs if your home becomes uninhabitable due to a covered event. Understanding these different coverage options helps you choose a policy that meets your specific needs and risk profile. For example, if you have valuable collections, you might need to increase your personal property coverage to ensure adequate protection.

Protecting Your Home from Common Risks in San Antonio

San Antonio, like any city, faces specific risks that can impact homeowners. Understanding these risks and implementing preventative measures is crucial not only for protecting your property but also for maintaining lower insurance premiums. This section Artikels common hazards and strategies for mitigation, focusing on fire, theft, and water damage—frequent causes of insurance claims in the area. We will also explore home improvements that can enhance your home’s safety and potentially lower your insurance costs.

Effective risk mitigation involves a proactive approach combining preventative measures and smart home improvements. By taking steps to protect your home, you not only reduce the likelihood of damage but also demonstrate responsible homeownership to your insurance provider, potentially leading to lower premiums and a stronger insurance rating.

Fire Safety Measures

Fire is a significant threat to homes in any location, and San Antonio is no exception. Preventing fires requires a multi-faceted approach, combining regular maintenance with smart safety practices.

- Regularly inspect and clean your chimneys and dryer vents to prevent the buildup of flammable materials. A clogged vent can easily ignite and cause a devastating fire.

- Ensure all electrical appliances are properly grounded and in good working order. Overloaded circuits and faulty wiring are common causes of electrical fires.

- Install and maintain smoke detectors on every level of your home, including inside and outside sleeping areas. Test them monthly and replace batteries annually.

- Keep flammable materials like gasoline and propane away from your home and properly store any other potentially hazardous materials.

- Develop and practice a family fire escape plan. Knowing your escape routes and having a designated meeting place can be crucial in an emergency.

Theft Prevention Strategies

Home burglaries are a concern in many urban areas, including San Antonio. Taking proactive steps to deter thieves can significantly reduce your risk.

- Install a robust security system, including motion detectors, door/window sensors, and a loud alarm. Consider professional monitoring for added security.

- Invest in high-quality locks on all exterior doors and windows. Regularly check that they are functioning correctly.

- Keep valuable items out of sight from windows and ensure that landscaping doesn’t provide easy hiding places for potential intruders.

- Maintain good outdoor lighting around your property. Well-lit areas deter criminals.

- Consider using timers for lights and other appliances to create the illusion that someone is home, even when you are away.

Water Damage Mitigation

Water damage, often stemming from plumbing issues or severe weather, is another significant risk. Preventing water damage requires both proactive maintenance and preparedness for unexpected events.

- Regularly inspect your plumbing system for leaks, drips, or signs of corrosion. Address any issues promptly.

- Install water detectors near appliances like washing machines and water heaters to alert you to leaks immediately.

- Ensure your gutters and downspouts are clean and functioning properly to divert rainwater away from your foundation. Clogged gutters can lead to water damage.

- Consider installing a sump pump in your basement or crawlspace to remove excess water in case of flooding.

- Have a plan in place for dealing with burst pipes or other plumbing emergencies, including knowing how to shut off your main water supply.

Home Improvements for Better Insurance Ratings

Certain home improvements can significantly reduce your risk and, consequently, your insurance premiums. These improvements demonstrate a commitment to home maintenance and safety.

- Updated Plumbing: Replacing outdated galvanized pipes with PEX piping reduces the risk of leaks and burst pipes, a common cause of water damage claims.

- New Roof: A new roof, especially one made of impact-resistant materials, protects your home from severe weather and reduces the likelihood of damage from hail or wind.

- Enhanced Security Systems: Installing a monitored security system can significantly lower your premiums as it demonstrates a proactive approach to theft prevention.

- Fire-Resistant Materials: Using fire-resistant materials in construction or renovations can reduce the risk of fire damage and improve your insurance rating.

Supplemental Coverage Options

While standard home insurance covers many risks, supplemental coverage provides additional protection against specific hazards prevalent in San Antonio.

- Flood Insurance: While not typically included in standard policies, flood insurance is crucial in areas prone to flooding, offering protection against water damage from heavy rainfall or overflowing rivers.

- Earthquake Insurance: Depending on your location in San Antonio, earthquake insurance may be a worthwhile investment, offering protection against damage caused by seismic activity.

Outcome Summary

Securing adequate home insurance in San Antonio requires careful consideration of various factors, from your home’s characteristics and location to the specific coverage options offered by different providers. By understanding these elements and utilizing the resources and strategies Artikeld in this guide, you can confidently choose a policy that provides comprehensive protection for your home and peace of mind. Remember, proactive risk mitigation and thorough policy review are key to ensuring your home remains adequately protected.

Commonly Asked Questions

What is the average cost of home insurance in San Antonio?

The average cost varies significantly depending on factors like home value, coverage level, location, and risk profile. It’s best to obtain quotes from multiple insurers for a personalized estimate.

How does hail damage affect my insurance premiums?

San Antonio experiences hailstorms, and significant hail damage can lead to increased premiums. Installing hail-resistant roofing can mitigate this risk.

What are some common exclusions in San Antonio home insurance policies?

Common exclusions can include flood damage (requiring separate flood insurance), earthquake damage, and certain types of wear and tear. Carefully review your policy’s details.

How long does it take to get a home insurance claim settled in San Antonio?

The claims process timeline varies depending on the complexity of the claim and the insurer’s efficiency. It’s advisable to follow up regularly with your insurer.

Can I bundle my home and auto insurance in San Antonio for a discount?

Many insurers offer discounts for bundling home and auto insurance. Inquire with your prospective providers to see if this option is available.