Finding the right home and car insurance can feel like navigating a maze. Juggling coverage options, premiums, and deductibles across multiple providers is time-consuming and often confusing. This guide simplifies the process by providing a clear understanding of home and car insurance comparison tools, helping you make informed decisions and secure the best possible coverage at the most competitive price.

We’ll explore the key features of leading comparison websites, discuss effective strategies for presenting complex insurance information, and delve into the legal and regulatory aspects of this crucial financial decision. Ultimately, our aim is to empower you with the knowledge and resources needed to confidently compare and choose the insurance package that best suits your needs.

Understanding the Search Intent

Understanding the reasons behind a user’s search for “home car insurance comparison” is crucial for providing relevant and effective information. This search query reveals a user actively seeking to find the best insurance options, balancing cost and coverage. The motivations are multifaceted and depend heavily on the individual’s circumstances.

People search for “home car insurance comparison” for a variety of reasons, all stemming from a desire for optimal value and protection. This search signifies a proactive approach to managing personal finances and risk.

User Needs and Motivations

The primary need driving this search is the desire to find the most affordable home and car insurance policy that adequately meets their needs. Secondary motivations often include simplifying the insurance-buying process, finding better coverage options, or switching providers to secure more favorable terms. Users may also be motivated by a recent life event, such as a new home purchase, a new car, or a change in family status.

Types of Users

Several distinct user types employ this search term. These include first-time insurance buyers navigating a complex market, existing policyholders seeking better deals, and those who have recently experienced a claim and are dissatisfied with their current provider. Additionally, price-conscious consumers, those prioritizing specific coverage features, and users seeking bundled home and auto insurance packages all utilize this search.

User Scenarios and Search Intent

Consider these scenarios:

* Scenario 1: A young couple recently purchased their first home and car. Their search intent is to find affordable yet comprehensive coverage that protects their new assets. They are likely comparing policies based on price and basic coverage levels.

* Scenario 2: A homeowner with a long-standing policy is facing a premium increase. Their search intent is to identify more competitive offers that provide similar coverage at a lower cost. They are likely comparing quotes from multiple insurers, focusing on price and policy details.

* Scenario 3: A driver involved in a minor accident is dissatisfied with their current insurer’s claim handling process. Their search intent is to find a more responsive and customer-friendly provider with a better reputation for claim settlements. They are likely comparing insurers based on customer reviews and claim handling procedures.

* Scenario 4: A family is downsizing and selling their larger home and car, intending to purchase smaller, more affordable replacements. Their search intent is to find insurance that accurately reflects their reduced risk profile and lower asset value, resulting in lower premiums. They will compare policies based on coverage limits and pricing tailored to their new circumstances.

Competitor Analysis

The home car insurance comparison market is fiercely competitive, with numerous websites vying for consumer attention. Understanding the strengths and weaknesses of leading platforms is crucial for developing a successful comparison tool. This analysis focuses on key features, ease of use, and data presentation to identify best practices and areas for improvement.

Leading Comparison Website Features

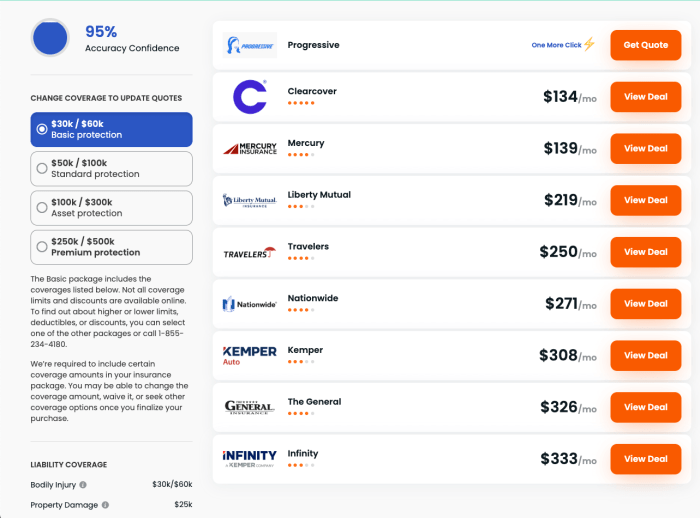

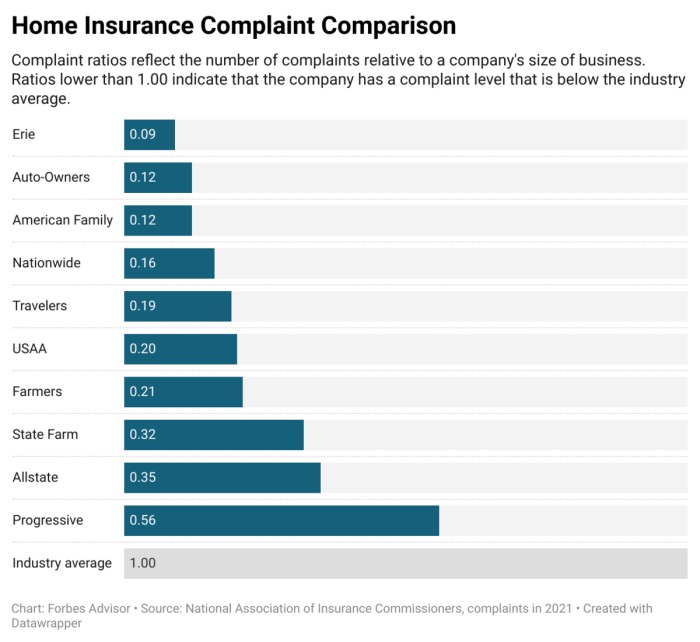

Several websites dominate the home car insurance comparison landscape. These platforms typically offer similar core functionalities, but differ in their user experience and the breadth of their data. Key features often include a comprehensive database of insurers, customizable search filters (allowing users to refine results based on specific needs), clear and concise policy comparisons, and often direct links to insurer websites for quote requests or policy purchases. Some advanced features might include customer reviews, financial strength ratings of insurers, and personalized recommendations.

Strengths and Weaknesses of Comparison Platforms

Each platform presents a unique blend of strengths and weaknesses. For example, some platforms excel in their user-friendly interface, offering a streamlined and intuitive experience. However, they might lack the depth of data offered by competitors. Conversely, platforms boasting extensive data may have a less user-friendly interface, potentially overwhelming users with information. The accuracy and timeliness of the data presented is another critical factor; outdated information can lead to inaccurate comparisons and misinformed decisions. Some platforms may also prioritize certain insurers based on affiliation or advertising revenue, potentially biasing results.

Comparison of Three Leading Websites

| Website Name | Ease of Use (1-5) | Features Offered | Data Presentation Clarity |

|---|---|---|---|

| Website A (Example: A hypothetical leading platform) | 4 | Comprehensive insurer database, customizable search filters, policy comparison tool, direct insurer links, customer reviews. | Excellent; clear and concise presentation of key policy details. |

| Website B (Example: Another hypothetical platform with slightly different strengths) | 3 | Large insurer database, basic search filters, policy comparison tool, direct insurer links, financial strength ratings. | Good; some data points could be presented more clearly. |

| Website C (Example: A third hypothetical platform focusing on a different aspect) | 5 | Smaller, curated insurer database, highly intuitive interface, simplified policy comparison, integrated quote request system. | Excellent; focuses on key information, easy to understand. |

Information Architecture and User Experience

Creating a user-friendly and efficient car insurance comparison website requires careful consideration of information architecture and user experience (UX) design. A well-structured site simplifies the comparison process, leading to higher user satisfaction and increased conversions. This section details the design elements crucial for achieving this goal.

User Flow Design

A streamlined user flow is essential for a positive user experience. The ideal flow begins with a clear and concise entry point, allowing users to quickly input their necessary details. This might involve a simple form requesting basic information such as location, vehicle type, and desired coverage. Following data submission, the system should efficiently compare available insurance options based on the provided criteria, presenting the results in a clear and easily digestible format. Users should then be able to easily drill down into specific quotes, compare features side-by-side, and ultimately purchase a policy directly through the platform or be redirected to the insurer’s website. Each step should be intuitive and require minimal user effort.

Optimal Information Organization

Effective organization of information is key to ease of navigation. The website should be logically structured, with clear headings, subheadings, and a consistent layout. Information should be presented in a hierarchical manner, allowing users to easily find what they need. For example, a prominent search bar should be present, allowing users to quickly locate specific insurance providers or coverage types. Furthermore, categories like “coverage options,” “price comparisons,” and “provider details” should be clearly delineated and easily accessible from the main navigation. A FAQ section addressing common questions and concerns should also be readily available.

Key Elements for a Positive User Experience

Several key elements contribute to a positive user experience. These include: clear and concise language, avoiding jargon; a visually appealing and uncluttered design; fast loading times; responsive design adaptable to various devices; and robust search functionality. Furthermore, providing tools that allow users to easily compare quotes side-by-side is critical. Interactive elements such as charts and graphs can further enhance understanding and engagement. Finally, a secure and reliable platform that protects user data is paramount.

Best Practices for User-Friendly Interface Design

Designing a user-friendly interface involves several best practices. This includes utilizing a clean and intuitive layout, with a focus on clear visual hierarchy and easy navigation. The use of consistent branding and design elements across the website creates a cohesive and professional feel. The inclusion of progress indicators during the quote comparison process helps to keep users informed and engaged. Providing multiple filtering and sorting options allows users to tailor their search results to their specific needs. Finally, integrating user feedback mechanisms enables continuous improvement and refinement of the user experience. For instance, incorporating A/B testing can identify the most effective design elements and user flows. Examples of successful implementation of these principles can be found on websites like NerdWallet and The Zebra, which have intuitive interfaces and easy-to-understand comparison tools.

Content Strategy and Presentation

Presenting car insurance comparison data effectively requires a strategic approach that prioritizes clarity, conciseness, and user-friendliness. The goal is to empower users to make informed decisions by readily understanding complex insurance concepts. This involves careful selection and organization of information, coupled with intuitive visual aids.

Essential Information for a Home Car Insurance Comparison Tool

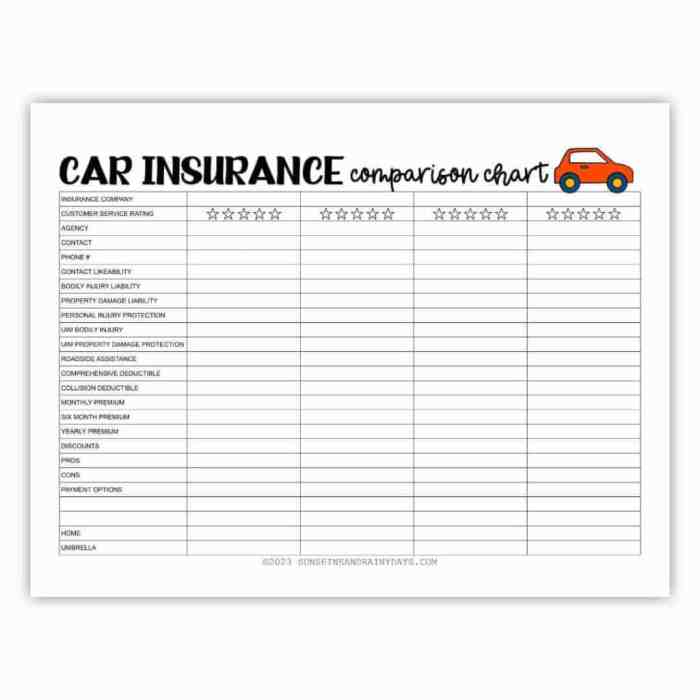

A comprehensive car insurance comparison tool should provide users with all the necessary information to make an informed choice. This includes detailed coverage options, cost breakdowns, and policy features. Users need to easily compare different providers and find the best fit for their needs and budget.

- Coverage Types: Liability (bodily injury and property damage), Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Personal Injury Protection (PIP).

- Deductibles: Explanation of deductibles and their impact on premiums. Options for different deductible amounts and their corresponding premium changes should be clearly displayed.

- Premiums: Monthly and annual premium costs for each policy option, clearly broken down by coverage type.

- Policy Limits: Maximum payout amounts for each coverage type (e.g., $100,000 bodily injury liability).

- Discounts: Available discounts (e.g., safe driver, multi-car, bundling with home insurance).

- Provider Details: Company name, customer ratings, and contact information.

- Policy Features: Additional features offered by each provider (e.g., roadside assistance, rental car reimbursement).

Presenting Complex Insurance Information Clearly and Concisely

Complex insurance information can be simplified through the use of clear language, visual aids, and well-structured data presentation. Avoid jargon and technical terms; instead, use plain language that is easily understandable for everyone.

- Coverage Types Explanation: Instead of saying “Bodily Injury Liability,” use “Covers injuries you cause to others in an accident.” For Collision, use “Covers damage to your car from accidents, regardless of fault.” For Comprehensive, use “Covers damage to your car from events other than accidents, such as theft or hail damage.”

- Deductible Explanation: Present deductibles as “The amount you pay out-of-pocket before your insurance coverage kicks in.” Use a simple example: “A $500 deductible means you pay the first $500 of repair costs after an accident; your insurance pays the rest.”

- Premium Presentation: Display premiums clearly as monthly and annual costs, side-by-side for easy comparison. Use charts or graphs to visually represent premium differences based on coverage levels and deductibles.

Illustrative Descriptions of Car Insurance Coverage Types

- Liability Coverage Illustration: The illustration depicts two cars colliding. One car (yours) is clearly labeled “Your Car,” and the other is labeled “Other Car.” Arrows point from your car to the other car, indicating liability for damages. Text explains that this coverage pays for injuries and property damage you cause to others. The illustration uses simple shapes and colors to avoid clutter.

- Collision Coverage Illustration: This illustration shows a single car with damage from a collision. The damage is highlighted, and text explains that this coverage pays for repairs to your car, regardless of who caused the accident. The illustration focuses on the damaged car, with simple visual cues to show the impact.

- Comprehensive Coverage Illustration: The illustration shows a car damaged by a tree falling on it. The tree and damage are clearly shown, and text explains that this coverage pays for damage to your car from events other than collisions, such as weather events, theft, or vandalism. The focus is on the unexpected nature of the damage.

Last Word

Choosing the right home and car insurance is a significant financial commitment. By leveraging online comparison tools and understanding the factors discussed in this guide, you can significantly streamline the process, ensuring you secure comprehensive coverage at a competitive price. Remember to carefully review policy details and compare quotes from multiple providers before making your final decision. Empowered with knowledge, you can navigate the insurance landscape with confidence and secure the best protection for your home and vehicle.

User Queries

What factors should I prioritize when comparing home and car insurance?

Prioritize coverage limits, deductibles, premiums, and customer reviews. Consider discounts for bundling policies, safety features, or good driving records.

How often should I review my home and car insurance policies?

Annually, or whenever significant life changes occur (e.g., moving, new car purchase, marriage).

Can I compare insurance quotes without providing personal information?

Many comparison websites offer preliminary quote estimations without requiring extensive personal details. However, full quotes necessitate more information.

What are the potential consequences of inadequate insurance coverage?

Inadequate coverage can lead to substantial out-of-pocket expenses in the event of an accident or loss. It could also impact your credit score and financial stability.