Securing affordable and comprehensive insurance for your home and car is a crucial aspect of financial planning. The digital age has revolutionized this process, offering convenient access to home and car insurance quotes online. This guide delves into the intricacies of navigating online platforms, comparing providers, understanding pricing factors, and ensuring data security, ultimately empowering you to make informed decisions.

From understanding your search intent to exploring the various features of different online platforms, we’ll cover everything you need to know to confidently obtain the best insurance quotes. We’ll examine the influence of factors like location, credit score, and driving history on your premiums, providing you with actionable strategies to secure competitive rates. We’ll also address crucial concerns about data privacy and security, ensuring you navigate the online landscape safely and effectively.

Understanding Consumer Search Intent

Consumers searching for “home and car insurance quotes online” are driven by a desire for convenience, cost savings, and comparison shopping. This search reflects a proactive approach to managing their financial responsibilities and securing adequate protection. The underlying motivation is to find the best possible insurance coverage at the most competitive price, minimizing time and effort in the process.

The diversity of users searching this term is significant. The search query encompasses a broad range of individuals at different stages of their insurance journey.

User Segmentation

Understanding the different types of users is crucial for tailoring online experiences. First-time buyers, for example, are typically seeking basic information about coverage options and policy features. They may be overwhelmed by the sheer volume of choices and require clear, concise explanations. Conversely, those switching providers are often motivated by dissatisfaction with their current insurer, such as higher premiums or poor customer service. They are likely to be more informed and focused on specific features and price comparisons. Finally, existing customers renewing their policies may be simply looking for better rates or to bundle their home and auto insurance for potential discounts. Their search reflects a more transactional approach, focused on efficiency and value.

User Expectations

Users expect the search results to provide quick and easy access to multiple insurance quotes. They anticipate a straightforward and user-friendly interface that allows for efficient comparison of coverage options, premiums, and policy features. Transparency and clarity regarding policy terms and conditions are also highly valued. Accuracy and reliability of the information presented are paramount, as users are making significant financial decisions based on the data they find. The expectation is to find a credible and trustworthy platform to facilitate their insurance needs. Many users expect to be able to obtain quotes without providing extensive personal information upfront.

Stages of the User Journey

The user journey for obtaining home and car insurance quotes online typically unfolds in several distinct stages. It begins with the initial search, driven by a need or desire for insurance. This is followed by a comparison phase, where users evaluate various quotes based on price, coverage, and other factors. Next comes the selection phase, where the user chooses a policy that best suits their needs and budget. Finally, the purchase phase involves completing the application process and securing the insurance policy. Throughout this journey, users may engage in additional research, contact customer service for clarification, or revisit comparison sites to ensure they’ve made the best decision. A smooth and efficient user experience across all these stages is critical to converting potential customers into paying clients.

Comparison of Online Quote Platforms

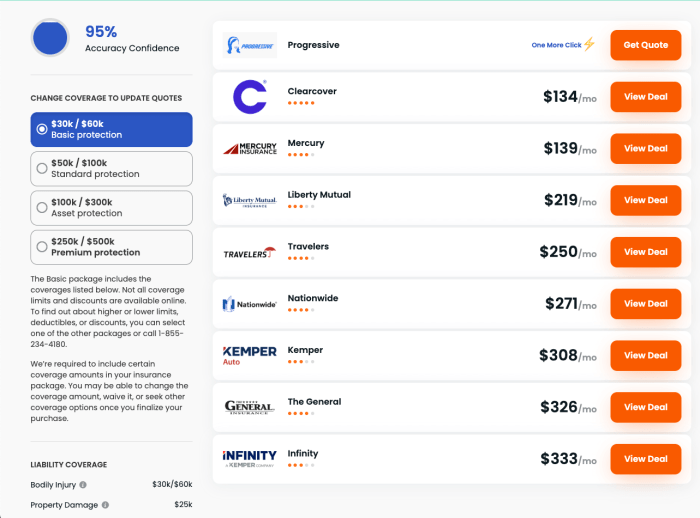

Choosing the right online platform for home and car insurance quotes can significantly impact your experience and the final price you pay. This section compares three major platforms, highlighting their strengths and weaknesses to aid in your decision-making process. We will analyze features, user experience, insurance offerings, and website design aspects.

Online Quote Platform Comparison Table

The following table summarizes key features, advantages, and disadvantages of three popular online insurance quote platforms. Note that specific features and offerings may vary by location and individual circumstances.

| Platform Name | Features | Pros | Cons |

|---|---|---|---|

| Progressive | Name Your Price® tool, bundled discounts, various coverage options (home, auto, motorcycle, etc.), 24/7 customer service, mobile app | User-friendly interface, innovative pricing tool, comprehensive coverage options, strong mobile presence. | Some users report difficulty understanding certain policy details, potentially limited customization options compared to others. |

| Geico | Quick quote process, various discounts (good driver, multi-policy), online policy management, 24/7 customer service, extensive online resources | Fast and efficient quote process, clear and concise information, strong brand reputation, multiple discount opportunities. | Limited customization options for certain coverage types, fewer bundled options compared to some competitors. |

| State Farm | Wide range of insurance products (home, auto, life, health), online and offline options, local agents, various discounts, mobile app | Extensive coverage options, strong customer support network (both online and offline), established reputation and reliability. | The online quote process may not be as streamlined as other platforms, potential for higher prices depending on location and risk profile. |

User Experience and Navigation

The user experience across these platforms varies. Progressive’s Name Your Price® tool, while innovative, can be initially confusing for some users. Geico prioritizes speed and simplicity, making it easy to obtain a quick quote. However, the limited customization options may frustrate users seeking specific coverage details. State Farm’s online presence balances ease of use with access to local agents, catering to different user preferences. However, the site can feel less streamlined than dedicated online-only platforms. Information clarity is generally good across all platforms, though Progressive’s detailed explanations could benefit from clearer visual organization.

Types of Insurance Offered

Each platform offers a core set of home and auto insurance products. However, differences exist in the breadth of additional coverage options. Progressive offers more niche options like motorcycle insurance, while State Farm’s portfolio extends beyond home and auto to encompass life and health insurance. Geico largely focuses on auto and home insurance with fewer supplementary offerings.

Effective and Ineffective Website Design Elements

Effective design elements include Geico’s clean layout and straightforward navigation. Progressive’s use of interactive tools, like the Name Your Price® tool, is innovative but requires careful design to ensure user comprehension. Ineffective elements include instances where State Farm’s website can feel cluttered or overwhelming with information, potentially distracting users from completing the quote process. Clear call-to-action buttons and concise policy summaries are generally well-implemented across all three platforms.

Data Privacy and Security Concerns

Obtaining insurance quotes online requires sharing personal information, raising legitimate concerns about data privacy and security. Understanding the potential risks and implementing protective measures is crucial for safeguarding your sensitive data. This section Artikels the privacy implications, security measures to consider, potential risks, and best practices for protecting your information during your online insurance quote search.

Privacy Implications of Sharing Personal Information

Providing personal information, such as your address, driving history, and financial details, to online insurance quote platforms exposes you to potential privacy risks. This data is valuable to insurance companies for risk assessment and pricing, but its misuse could lead to identity theft, fraud, or unwanted marketing communications. Companies are legally obligated to protect this data under various privacy laws, but the potential for breaches remains. Consider the breadth of data requested – the more information you provide, the greater the potential risk. For example, providing your social security number, while sometimes required, increases the severity of potential damage if a breach occurs.

Security Measures to Look For in Online Quote Platforms

Consumers should prioritize using platforms with robust security measures. Look for indicators of secure websites, such as HTTPS in the URL (the padlock icon in the address bar), and clear privacy policies that Artikel how your data is collected, used, and protected. Verifying the company’s reputation and checking independent reviews for security incidents can also be helpful. Consider whether the platform uses encryption to protect data transmitted between your computer and their servers. A lack of these measures signals a potentially higher risk of data breaches and unauthorized access.

Potential Risks Associated with Sharing Sensitive Data Online

The risks associated with sharing sensitive data online include identity theft, where your personal information is used fraudulently to open accounts or make purchases; financial fraud, involving unauthorized access to your bank accounts or credit cards; and unwanted marketing communications, such as spam emails or phone calls. In the worst-case scenario, a data breach could expose your personal and financial information to malicious actors, leading to significant financial and emotional distress. For example, a publicized data breach at a major insurance provider could result in thousands of individuals experiencing identity theft and needing to take extensive steps to rectify the situation.

Best Practices for Protecting Personal Information

To mitigate risks, only use reputable and well-established online quote platforms. Carefully review privacy policies before submitting any information. Limit the amount of personal information you provide to what is absolutely necessary. Consider using a strong, unique password and enabling two-factor authentication where available. Regularly monitor your credit report for any suspicious activity. Furthermore, be wary of phishing attempts; legitimate insurance companies will never request sensitive information via unsolicited emails or text messages. Always verify the authenticity of any communication before responding or clicking any links.

Wrap-Up

Obtaining home and car insurance quotes online has become the preferred method for many, offering unparalleled convenience and price transparency. By carefully comparing platforms, understanding the factors influencing premiums, and prioritizing data security, you can confidently secure the best coverage at the most competitive price. Remember to leverage the resources available, including online comparison tools and customer reviews, to make an informed decision that best suits your individual needs and budget.

FAQ Compilation

What information do I need to provide to get a quote?

Typically, you’ll need basic personal information (name, address, date of birth), details about your home (address, type, value), and information about your car (make, model, year). Specific requirements vary by provider.

Are online quotes binding?

No, online quotes are generally not binding. They provide an estimate of the cost; the final price may vary after a full application review.

How long are online quotes valid for?

Validity periods vary by provider, but often range from a few days to a few weeks. Check the specific terms of the quote.

Can I bundle my home and auto insurance online?

Yes, many online platforms allow you to bundle your home and auto insurance for potential discounts.

What if I have a poor driving record or low credit score?

These factors can impact your premiums. However, some insurers may offer programs to help mitigate the effect of a less-than-perfect record.