Navigating the world of insurance can feel like deciphering a complex code. Many homeowners and car owners grapple with the decision of bundling their home and auto insurance or purchasing separate policies. This guide aims to illuminate the advantages and disadvantages of each approach, providing you with the knowledge to make an informed decision that best suits your needs and budget. We’ll delve into cost comparisons, coverage options, and the process of finding the best bundled insurance deal.

Understanding the nuances of bundled insurance policies requires careful consideration of several factors. From comparing prices across different providers to analyzing coverage details and understanding policy terms, the journey to finding the optimal insurance solution can be simplified with the right information. This comprehensive guide will equip you with the tools and knowledge to confidently navigate this process, ensuring you secure the most appropriate and cost-effective coverage.

Bundled vs. Separate Policies

Choosing between bundled and separate home and auto insurance policies often comes down to cost. While the convenience of a single bill is appealing, the true savings potential needs careful examination. Understanding the factors influencing price differences can empower you to make an informed decision.

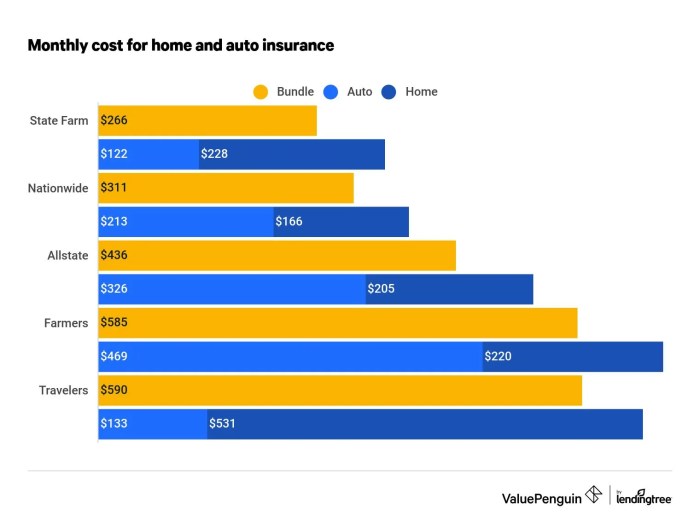

Bundled vs. Separate Policy Cost Comparison

The cost of bundled versus separate home and auto insurance policies varies significantly depending on several factors, including your location, coverage needs, and the insurance provider. While a bundled policy often offers discounts, it’s not always the cheapest option. Below is a hypothetical comparison based on average prices from various hypothetical insurance providers (Note: These prices are for illustrative purposes only and do not reflect actual quotes from specific insurers. Actual quotes should be obtained directly from insurance providers.).

| Provider | Bundled Price (Annual) | Separate Home Price (Annual) | Separate Auto Price (Annual) |

|---|---|---|---|

| Insurer A | $1800 | $1200 | $700 |

| Insurer B | $1500 | $900 | $600 |

| Insurer C | $2000 | $1300 | $800 |

Factors Influencing Price Differences and Discounts

Several factors influence the cost difference between bundled and separate policies. Insurance companies offer bundled discounts as an incentive to attract customers who purchase multiple policies. These discounts can range from 5% to 25% or more, depending on the insurer and the specific policies. However, the overall cost savings depend on your individual risk profile and the premiums for each policy. For example, a driver with a history of accidents may see a smaller discount, or even no discount, when bundling. Similarly, homeowners with high-value properties might see less significant savings, as the home insurance portion of the premium will remain high.

Hypothetical Cost Savings Scenarios

Let’s consider two hypothetical scenarios to illustrate the cost savings (or lack thereof) of bundled policies:

Scenario 1: A young driver (22 years old) with a basic auto policy and a modest home. In this case, the bundled discount might offset the higher auto insurance premiums, resulting in overall savings. For example, if the separate policies cost $1000 (auto) and $700 (home), a 15% bundle discount on a total of $1700 could reduce the cost to $1445.

Scenario 2: A homeowner (45 years old) with a high-value property and a clean driving record. The high home insurance premium might outweigh the bundled discount. If separate policies cost $2500 (home) and $500 (auto), a 10% discount on $3000 would only reduce the cost to $2700, resulting in minimal savings compared to purchasing the policies separately.

Coverage Options and Features in Bundled Policies

Bundling your home and auto insurance offers several advantages, primarily cost savings, but also simplifies policy management. Understanding the coverage options and features available within a bundled package is crucial to ensuring you have the right protection. This section details the typical coverage components, available add-ons, and the flexibility offered in bundled plans compared to separate policies.

Bundled home and auto insurance policies generally include standard coverages for both your home and vehicles. For home insurance, this typically includes dwelling coverage (damage to your house), personal liability (protection against lawsuits), and personal property coverage (protection for your belongings). Auto insurance within the bundle usually encompasses liability coverage (protecting others in accidents), collision coverage (damage to your vehicle in an accident), and comprehensive coverage (damage from non-accidents like theft or hail). The specific coverage limits for each component are variable and can be adjusted based on your needs and risk assessment, although the degree of customization might be more limited than with separate policies. Higher coverage limits naturally lead to higher premiums.

Standard Coverage Levels in Bundled Policies

Standard coverage levels in bundled policies vary by insurer and the specific package chosen. For instance, dwelling coverage might range from $100,000 to $1,000,000 or more, depending on the value of your home. Liability coverage for auto insurance can range from the state-mandated minimum to much higher limits, providing greater protection against significant financial losses from accidents. Personal property coverage usually offers a percentage of the dwelling coverage, for example, 50% or 70%, allowing for flexibility in protection levels for personal belongings. These levels are customizable within a range set by the insurance company, and selecting higher limits usually increases the premium.

Add-on Features in Bundled Policies

Many insurers offer valuable add-on features with bundled policies that enhance protection and convenience. These add-ons often come at an additional cost but can be worthwhile depending on your individual circumstances.

- Identity Theft Protection: This covers expenses related to recovering from identity theft, including legal fees and credit monitoring services. It can offer significant peace of mind in an increasingly digital world.

- Flood Insurance: While not always included in standard home insurance, flood insurance is a crucial add-on, especially in flood-prone areas. This provides coverage for damage caused by flooding, which is often excluded from standard policies.

- Equipment Breakdown Coverage (Home): This covers the repair or replacement of major home appliances and systems that malfunction due to mechanical or electrical failure. This can save you significant expenses on costly repairs.

- Roadside Assistance (Auto): This provides assistance in case of breakdowns, flat tires, or lockouts, offering convenience and potentially saving you money on towing and other roadside services.

- Umbrella Liability Coverage: This extends your liability coverage beyond the limits of your home and auto policies, offering additional protection against significant lawsuits.

Customization Options in Bundled vs. Separate Policies

While bundled policies offer convenience and potential savings, they may have limitations regarding coverage customization compared to purchasing separate policies. With separate policies, you have greater control over choosing specific coverage levels for each aspect of your home and auto insurance needs. Bundled policies might offer less flexibility in fine-tuning coverage amounts, possibly limiting your ability to select extremely high or low coverage levels for individual components. For example, you might not be able to secure significantly higher liability coverage for your auto insurance without also increasing other coverages within the bundle, impacting the overall cost. Conversely, if you only need minimal coverage for one aspect, you might be paying for more coverage than necessary within the bundled package.

Illustrative Examples of Bundled Policies

Choosing a bundled home and auto insurance policy can offer significant savings compared to purchasing separate policies. Understanding the different coverage levels and how they apply to various scenarios is crucial for making an informed decision. The following examples illustrate the variety of bundled options available and their potential impact on your finances.

Bundled Policy Examples

The following table presents three hypothetical bundled home and auto insurance policies, showcasing varying coverage levels and their corresponding annual premiums. These are illustrative examples and actual premiums will vary based on numerous factors, including location, coverage specifics, and individual risk profiles.

| Policy Name | Home Coverage | Auto Coverage | Annual Premium |

|---|---|---|---|

| Basic Bundle | $150,000 dwelling coverage, $75,000 liability | $25,000 liability, $5,000 collision, $5,000 comprehensive | $1,200 |

| Standard Bundle | $250,000 dwelling coverage, $125,000 liability | $50,000 liability, $10,000 collision, $10,000 comprehensive, Uninsured/Underinsured Motorist Coverage | $1,800 |

| Premium Bundle | $500,000 dwelling coverage, $250,000 liability, additional coverage for valuable items | $100,000 liability, $20,000 collision, $20,000 comprehensive, Uninsured/Underinsured Motorist Coverage, Rental Car Reimbursement | $3,000 |

Ideal Customer Profiles and Claim Scenarios

Each policy is designed to meet the needs of a specific customer profile. The following sections describe these profiles and how the policies might respond to typical claim scenarios.

Basic Bundle: The Budget-Conscious Consumer

The Basic Bundle is ideal for individuals or young couples with limited assets and a smaller home. They prioritize affordability over extensive coverage.

Claim Scenario 1 (Minor Car Accident): A minor fender bender resulting in $2,000 in damage to the insured’s vehicle would be covered under the collision coverage. The deductible would apply.

Claim Scenario 2 (Water Damage): Minor water damage to the home, costing $3,000 to repair, would be covered, subject to the deductible. More extensive damage could exceed the policy limits.

Standard Bundle: The Average Homeowner

The Standard Bundle caters to the average homeowner with a moderate level of assets. It provides a balance between coverage and affordability.

Claim Scenario 1 (Minor Car Accident): A minor car accident causing $5,000 in damage to the other party’s vehicle would be covered under the liability portion. Damage to the insured’s vehicle would be covered under collision, subject to the deductible.

Claim Scenario 2 (Water Damage): Significant water damage from a burst pipe, costing $10,000 to repair, would be covered, subject to the deductible.

Premium Bundle: The High-Net-Worth Individual

The Premium Bundle is designed for high-net-worth individuals with significant assets and a desire for comprehensive protection. It offers substantial coverage for both home and auto.

Claim Scenario 1 (Minor Car Accident): A minor car accident with damages exceeding the policy limits of a basic or standard plan would be fully covered under the higher liability limit. Rental car reimbursement would also apply.

Claim Scenario 2 (Water Damage): Extensive water damage from a severe storm, costing $50,000 to repair, would be covered, subject to the deductible. The additional coverage for valuable items would protect high-value possessions.

Epilogue

Ultimately, the decision of whether to bundle your home and auto insurance hinges on your individual circumstances and priorities. By carefully weighing the cost savings potential against the specifics of your coverage needs, you can confidently choose the insurance plan that provides the best protection at the most favorable price. Remember to thoroughly compare quotes, understand your policy documents, and ask clarifying questions to ensure you are fully informed before making your final decision. Armed with this knowledge, you can navigate the insurance landscape with greater confidence and secure the best possible coverage for your home and vehicle.

Questions and Answers

What happens if I make a claim on both my home and auto insurance under a bundled policy?

The claims process will generally follow the standard procedures Artikeld in your policy documents. You will likely need to file separate claims for each incident, providing all necessary documentation for both the home and auto claims. However, the insurer handles both claims simultaneously, which can streamline the overall process.

Can I switch insurance providers if I’m unhappy with my bundled policy?

Yes, you can switch providers at any time. However, be aware of any cancellation fees or penalties that might apply. It’s advisable to shop around and compare quotes from different providers before making a switch to ensure you are getting the best value for your money.

Does bundling affect my insurance score?

Bundling your home and auto insurance can sometimes positively impact your insurance score, as it demonstrates responsible financial behavior. However, the impact varies depending on your specific circumstances and the insurer’s scoring model. It’s not a guaranteed factor, but it can be a contributing element.

What if my home and auto are insured with different companies? Can I still bundle later?

Generally, yes. Many insurers offer the option to bundle policies even if your home and auto insurance are currently with different providers. Contact the insurer you wish to bundle with to see if they can consolidate your policies.