Navigating the world of insurance can feel overwhelming, especially when considering both your car and your home. Understanding the nuances of car home insurance quotes is crucial for securing the best coverage at a price that fits your budget. This guide delves into the process, offering insights into factors influencing your premium, comparing different providers, and ultimately empowering you to make informed decisions.

From understanding the search intent behind “car home insurance quote” to analyzing competitor websites and identifying key factors impacting pricing, we’ll explore every aspect of this vital financial decision. We’ll also equip you with the knowledge to navigate the complexities of insurance, allowing you to confidently compare options and secure the most suitable policy.

Understanding “Car Home Insurance Quote” Search Intent

The search phrase “car home insurance quote” reveals a user seeking bundled insurance coverage for both their vehicle and their home. Understanding the nuances behind this search requires examining the diverse needs and motivations driving such inquiries. This analysis will explore the various insurance types, the demographic profile of users, and create a representative user persona.

The primary need driving this search is the desire for convenience and potential cost savings. Users are likely looking to simplify their insurance management by obtaining quotes for both their car and home insurance from a single provider. This approach streamlines the process, reducing the administrative burden of dealing with multiple insurers and potentially leading to lower overall premiums through bundled discounts.

Types of Insurance Coverage Sought

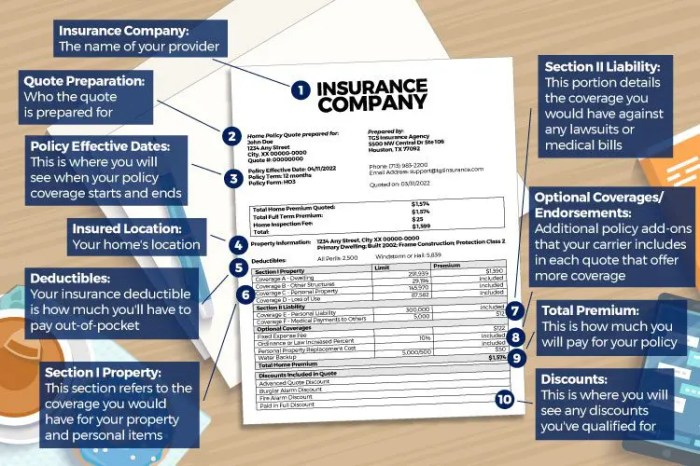

Users searching for “car home insurance quote” are interested in a range of insurance coverages for their car and home. For car insurance, this might include liability coverage (protecting against injuries or damages caused to others), collision coverage (repairing or replacing the user’s car after an accident), comprehensive coverage (covering damage from events other than collisions, such as theft or hail), and uninsured/underinsured motorist coverage (protecting the user if involved in an accident with an uninsured driver). Home insurance coverage sought typically includes dwelling coverage (protecting the structure of the home), liability coverage (protecting against lawsuits resulting from accidents on the property), personal property coverage (protecting belongings within the home), and additional living expenses coverage (covering temporary housing costs if the home becomes uninhabitable). The specific coverages sought will depend on individual needs and risk assessments.

Demographics of Users

The demographic profile of users searching for “car home insurance quote” is relatively broad, but certain patterns are likely. Homeowners, particularly those in the 25-55 age range, are a key demographic. This age group often represents individuals who have established themselves financially, own a home and a car, and are actively managing their household insurance needs. Families with children are also likely to be prominent among those searching for bundled quotes, as they are often concerned with comprehensive coverage for both their property and vehicles. Furthermore, individuals who are new homeowners or have recently purchased a new car may also frequently use this search phrase as they establish their insurance needs.

User Persona: Sarah Miller

Sarah Miller is a 32-year-old marketing professional who recently purchased her first home and a new car. She’s busy with her career and family and wants to simplify her insurance needs. Sarah values convenience and cost-effectiveness and is looking for a single provider that can offer competitive rates for both her home and car insurance. She is primarily interested in liability, collision, and comprehensive coverage for her car and dwelling, liability, and personal property coverage for her home. She prioritizes online quotes and clear, easy-to-understand policy information. Sarah is tech-savvy and comfortable managing her insurance online.

Competitor Analysis of Insurance Quote Websites

Understanding the user experience across different insurance quote websites is crucial for identifying best practices and areas for improvement. This analysis compares three major players in the online car and home insurance market, focusing on their user interfaces, features, and data handling processes. The goal is to highlight strengths and weaknesses to provide a comprehensive overview.

User Interface Comparison

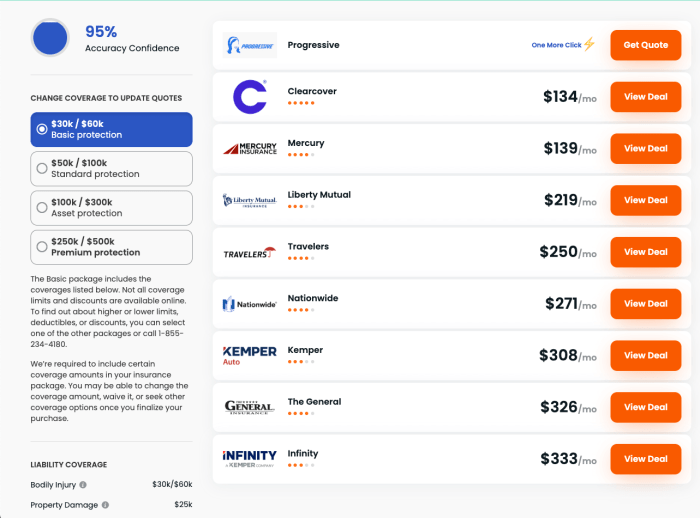

This section details the user interface characteristics of three leading online insurance providers: Progressive, Geico, and State Farm. Each platform offers a unique approach to navigating the quote process, impacting overall user experience.

| Feature | Progressive | Geico | State Farm |

|---|---|---|---|

| Quote Speed | Relatively fast, typically under 5 minutes. | Very fast, often providing a quote within seconds. | Moderately fast, averaging around 7-10 minutes. |

| Ease of Use | Intuitive navigation, clear instructions. | Simple and straightforward interface, minimal distractions. | Can feel slightly cluttered, requiring more navigation steps. |

| Information Clarity | Provides comprehensive details about coverage options. | Clearly presents key information; some details require further exploration. | Information is available but may require more effort to locate specific details. |

| Mobile Responsiveness | Excellent mobile experience; seamlessly adapts to various screen sizes. | Highly responsive mobile design, ensuring a smooth user experience on all devices. | Good mobile responsiveness, but some features may require zooming or scrolling. |

Customer Information Input

The method of collecting customer data varies significantly across these platforms. Progressive utilizes a step-by-step approach, guiding users through each piece of information required. Geico employs a more streamlined process, often pre-filling data based on limited information provided. State Farm’s process tends to be more thorough, requesting a broader range of details. All three platforms prioritize data security, employing encryption and secure protocols. However, the amount of information requested and the method of input differ, impacting user perception of privacy and convenience.

Insurance Package Offerings

The range and types of insurance packages available differ among these providers. Progressive offers a wide selection of customizable options, allowing users to tailor their coverage to their specific needs. Geico focuses on providing comprehensive coverage at competitive prices, with a more limited selection of add-ons. State Farm provides a balance between comprehensive coverage and customization, offering a variety of packages with different levels of coverage. The differences in offerings reflect each company’s market strategy and target customer demographics. For example, Progressive might cater to younger drivers seeking customizable options, while Geico might appeal to budget-conscious individuals. State Farm often presents itself as a comprehensive option for a wide range of customer profiles.

Improving the User Experience for Obtaining Quotes

A streamlined and user-friendly quote process is crucial for converting potential customers into paying clients. Clear communication, efficient navigation, and a strong focus on data privacy are key components of a positive user experience. By implementing best practices, insurance providers can significantly improve customer satisfaction and increase conversion rates.

A well-designed quote process should minimize the number of steps required to obtain a quote, using clear and concise language throughout. The use of intuitive design elements, such as progress bars and clear call-to-actions, can further enhance the user experience. Prioritizing data security and transparency builds trust and encourages customers to provide the necessary information.

Streamlined Quote Process Design

The ideal quote process should be quick, intuitive, and require minimal user input. This can be achieved by employing a modular design, allowing users to selectively provide information relevant to their needs. For example, a user seeking only car insurance shouldn’t be forced to provide home insurance details. Pre-filling forms with data already provided (where permitted and with user consent) can significantly reduce the time and effort required. The use of dropdown menus and pre-populated fields for common data points (e.g., vehicle make and model) can also expedite the process. A multi-step approach with clear progress indicators helps users track their progress and reduces the feeling of being overwhelmed.

Clear and Concise Language in the Quote Process

Using jargon-free language is paramount. Avoid technical insurance terms and opt for plain English. Each question should be clearly phrased and easy to understand. For instance, instead of asking “What is the year, make, and model of your primary vehicle?”, a simpler phrasing could be “Tell us about your car.” This approach reduces cognitive load on the user and ensures a smoother experience. Furthermore, the use of visual aids, such as icons and short text snippets, can help clarify complex information. Consider using bullet points to highlight key information or requirements.

User Flow Diagram for Obtaining a Quote

Imagine a user flow diagram as a visual representation of the quote process. It would begin with a landing page featuring a prominent “Get a Quote” button. Clicking this initiates a multi-step process. Step 1: Selection of insurance type (car, home, or both). Step 2: Inputting basic information (name, address, email). Step 3: Providing details specific to the chosen insurance type (car details, home address and value). Step 4: Review and submission. Step 5: Quote presentation and next steps (policy purchase). Each step is clearly defined, with a progress bar indicating the user’s advancement. Error handling and clear feedback mechanisms are crucial for a smooth user experience. For example, if a user inputs incorrect data, the system should provide specific guidance on how to correct it.

Best Practices for Handling User Data and Maintaining Privacy

Protecting user data is crucial. Compliance with relevant data protection regulations (such as GDPR or CCPA) is non-negotiable. Transparency is key; users should clearly understand how their data will be used and protected. A clear privacy policy, easily accessible on the website, is essential. Data encryption and secure storage practices are crucial for preventing unauthorized access. Users should have the ability to access, modify, or delete their data at any time. Regular security audits and updates to security protocols are necessary to maintain a high level of data protection. Providing users with control over their data, such as opting out of marketing communications, further strengthens trust and demonstrates a commitment to privacy.

Visual Representation of Insurance Data

Understanding the cost of car insurance can be complex, influenced by numerous factors. Visual representations, such as charts and graphs, can significantly improve comprehension of this data. By presenting the information in a clear and concise manner, we can better understand trends and make informed decisions.

Visual aids help to quickly grasp key insights about insurance pricing, allowing for easier comparison of different policies and providers. This section will present illustrative examples of how data related to car and home insurance costs can be visually presented.

Average Car Insurance Costs by State

The following bar chart illustrates the average annual cost of car insurance across several states. Note that these figures are hypothetical examples for illustrative purposes and may not reflect actual current premiums. Real-world data would need to be sourced from reputable insurance comparison websites or industry reports.

Hypothetical Bar Chart: The horizontal axis (x-axis) would list various states (e.g., California, Texas, Florida, New York, Illinois). The vertical axis (y-axis) would represent the average annual cost of car insurance in dollars. Bars of varying heights would represent each state’s average cost. For example, California might have a tall bar indicating a higher average cost, while a state like Illinois might have a shorter bar representing a lower average cost. The chart would include a clear title, axis labels, and a legend if necessary.

Bundled vs. Separate Car and Home Insurance Costs

This line graph compares the total cost of insuring a home and car together (bundled) versus purchasing separate policies for each. This comparison highlights the potential cost savings of bundling.

Hypothetical Line Graph: The horizontal axis (x-axis) represents different policy coverage levels (e.g., basic, standard, comprehensive). The vertical axis (y-axis) displays the total annual cost in dollars. Two lines would be plotted: one representing the total cost of bundled home and car insurance and another representing the sum of separate home and car insurance policies for each coverage level. The graph would clearly show if the bundled option consistently offers a lower total cost across different coverage levels. A key would distinguish between bundled and separate policy costs. The graph would also include a title and axis labels.

Factors Influencing Insurance Premiums

Several factors significantly impact the cost of car and home insurance premiums. Understanding these factors can help individuals make informed decisions to potentially lower their costs.

- Driving Record: Accidents and traffic violations increase premiums. A clean driving record usually results in lower premiums.

- Age and Gender: Younger drivers and certain gender demographics often face higher premiums due to statistically higher risk.

- Vehicle Type and Value: Expensive or high-performance vehicles generally cost more to insure due to higher repair costs and theft risk.

- Location: Insurance rates vary significantly by location, reflecting factors like crime rates and accident frequency.

- Credit Score: In many states, credit scores are used to assess risk, with lower scores often leading to higher premiums.

- Coverage Level: Higher coverage limits (liability, collision, comprehensive) result in higher premiums, but offer greater protection.

- Home Security Features: For home insurance, features like security systems and fire alarms can lower premiums.

Last Point

Obtaining a car home insurance quote shouldn’t be a daunting task. By understanding the factors that influence pricing, comparing different providers, and leveraging the resources and tips Artikeld in this guide, you can confidently secure comprehensive coverage for your home and vehicle. Remember, a little research goes a long way in protecting your valuable assets and securing peace of mind.

Essential FAQs

What is bundled car and home insurance?

Bundled insurance combines your car and home insurance policies under a single provider, often resulting in discounts.

How often should I review my insurance quotes?

It’s recommended to review your insurance quotes annually, or whenever there’s a significant life change (e.g., moving, new car).

Can I get a quote without providing my driving history?

While some providers might offer preliminary quotes without full driving history, accurate information is crucial for obtaining an accurate final quote.

What if I have a poor credit score? Will this affect my quote?

Yes, in many jurisdictions, credit scores can influence insurance premiums. A poor credit score might lead to higher rates.

What happens if I need to file a claim after receiving a quote?

The claims process varies by provider. Contact your insurance company immediately after an accident or incident to begin the claims process.