Securing the right home insurance in California can feel like navigating a complex maze. The Golden State’s unique geographical challenges, from wildfires to earthquakes, significantly impact insurance costs. This guide unravels the intricacies of obtaining California home insurance quotes, empowering you to make informed decisions and find the best coverage for your needs and budget. We’ll explore the factors influencing premiums, compare different providers and policy types, and equip you with the knowledge to confidently navigate the process.

From understanding the various coverage options available to learning how to compare quotes effectively, we aim to demystify the world of California home insurance. Whether you’re a first-time homebuyer or a seasoned homeowner looking to review your policy, this resource offers valuable insights and practical advice to help you secure comprehensive protection for your most valuable asset.

Factors Affecting Quote Prices

Getting a home insurance quote in California involves understanding several key factors that significantly influence the final price. These factors interact in complex ways, so it’s crucial to understand their individual impact to make informed decisions about your coverage and budget.

Location

Your home’s location is a primary determinant of your insurance premium. Areas prone to wildfires, earthquakes, floods, or mudslides will command higher premiums due to the increased risk. For example, homes situated in coastal areas vulnerable to erosion or high winds will generally be more expensive to insure than those in inland, less hazardous zones. The specific zip code is often a key factor in determining risk assessment.

Home Value

The higher the value of your home, the more expensive it will be to insure. This is because the insurer’s potential payout in case of damage or loss is directly proportional to the property’s worth. A comprehensive rebuild of a larger, more luxurious home would cost significantly more than a smaller, more modest one, hence the higher premium.

Coverage Level

The level of coverage you choose directly affects your premium. Higher coverage limits mean greater protection against losses but also result in higher premiums. Choosing a higher deductible can lower your premium, but this means you’ll pay more out-of-pocket in the event of a claim.

Credit Score

In many states, including California, your credit score can influence your insurance premium. Insurers often use credit-based insurance scores to assess risk. A higher credit score generally indicates better financial responsibility and, therefore, a lower risk to the insurer, potentially resulting in lower premiums.

Natural Disaster Risk

California’s susceptibility to various natural disasters significantly impacts home insurance costs. Homes in areas with high wildfire risk, for instance, face substantially higher premiums than those in areas with lower risk. Similarly, proximity to fault lines increases earthquake insurance costs, while coastal properties may face higher premiums due to flood risk. Insurance companies use sophisticated models to assess these risks and adjust premiums accordingly. For example, a home in a designated high-fire-risk zone might see premiums double or even triple compared to a similar home in a low-risk area.

Home Security Features

Installing home security features can positively influence your insurance premium. Features such as security systems with alarms, fire sprinklers, and deadbolt locks can demonstrate a reduced risk of theft or fire damage, leading to potential discounts. The specific features and their effectiveness in mitigating risk will influence the discount amount. For instance, a professionally monitored security system might earn a larger discount than a basic alarm system.

Impact of Different Coverage Levels on Premium Costs

The following table illustrates how different coverage levels can affect your premium costs. Note that these are illustrative examples and actual costs will vary based on other factors.

| Coverage Level | Annual Premium (Example) | Deductible |

|---|---|---|

| Basic Coverage | $1,200 | $1,000 |

| Standard Coverage | $1,500 | $500 |

| Comprehensive Coverage | $2,000 | $250 |

Ways to Reduce Insurance Premiums

Homeowners can explore several strategies to potentially lower their insurance premiums. These include improving home security, increasing their deductible (though this increases out-of-pocket expenses in case of a claim), bundling home and auto insurance, and maintaining a good credit score. Regular home maintenance and upgrades that mitigate risk, such as upgrading electrical systems or replacing outdated roofing, can also positively impact premiums. Shopping around and comparing quotes from multiple insurers is also crucial for securing the most competitive rate.

Ultimate Conclusion

Obtaining the right California home insurance quote requires careful consideration of several factors, from your home’s location and value to your desired coverage level and personal financial situation. By understanding the nuances of the California insurance market, comparing quotes from multiple providers, and carefully reviewing policy details, you can secure comprehensive protection that offers peace of mind. Remember, proactive planning and informed decision-making are key to finding the best home insurance policy for your individual circumstances.

FAQ Guide

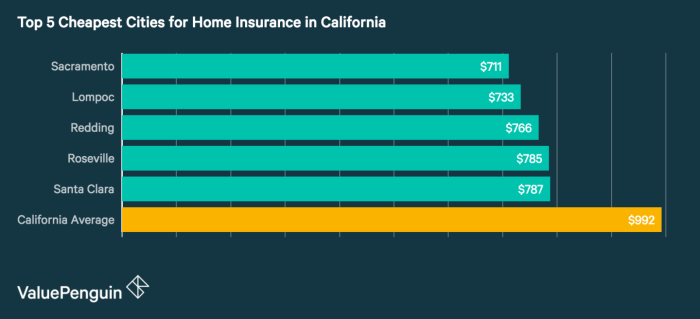

What is the average cost of home insurance in California?

The average cost varies greatly depending on location, home value, coverage, and individual risk factors. It’s best to obtain quotes from multiple insurers to determine your specific cost.

How long does it take to get a home insurance quote?

Online quotes can be generated instantly, while quotes from insurance agents may take a few days depending on the complexity of your request and the agent’s availability.

Can I get home insurance quotes without providing my Social Security Number (SSN)?

While some initial information gathering may be possible without an SSN, insurers will require it to complete your application and finalize a quote.

What happens if I make a claim after obtaining a quote but before the policy starts?

Coverage typically begins on the policy’s effective date. Events occurring before that date are generally not covered.

What is the difference between dwelling coverage and personal property coverage?

Dwelling coverage protects the physical structure of your home, while personal property coverage protects your belongings inside.